TIDMHYG

For immediate release 10 July 2019

Seneca Growth Capital VCT Plc

Unaudited Half-Yearly Report

For the Six Months Ended 30 June 2019

Financial Headlines

Ordinary Shares

33.6p Net Asset Value per share at 30 June 2019

52.25p Cumulative dividends paid to date

85.85p Total return per share since launch

B Shares

99.5p Net Asset Value per share at 30 June 2019

1.5p Cumulative dividends paid to date

101p Total return per share since launch

Financial Summary

Six months to Six months to Year to Year to

30 June 2019 30 June 2019 Six months to 31 December 2018 31 December 2018

Ordinary Share Pool B Share Pool 30 June 2018 (Ordinary Share Pool only) (Ordinary Share Pool) (B Share Pool)

Net assets

(GBP'000s) 2,728 5,359 5,053 5,282 3,999

Return on

ordinary

activities

after tax

(GBP'000s) (281) 102 (127) 102 (36)

Earnings

per share (3.5p) 2.1p (1.5p) 1.3p (0.9p)

Net asset 33.6p 99.5p 62.3p 65.1p 99.1p

value per

share

Dividends 52.25p 1.5p 24.25p 24.25p -

paid to

date

Total 85.85p 101.0p 86.55p 89.35p 99.1p

return per

share

Dividends 18.0p 1.5p - 10.0p -

declared

for the

period

For further information, please contact:

John Hustler, Seneca Growth Capital VCT Plc at

john.hustler@btconnect.com

https://www.globenewswire.com/Tracker?data=mFLRIPGXYpC5PVnWft47g7VnaK3lVVRJOFao-Mz3OGF3OsJxVj3CkFCApCi19J07mrMeB4xLSWTWSyfcGdtecgBn7H5pQsjQcE1qR1l8yeFkySfEfascg6cXhr52hdPN

Richard Manley, Seneca Growth Capital VCT Plc at

Richard.Manley@senecapartners.co.uk

https://www.globenewswire.com/Tracker?data=UKcjvoAuqCfgo3keo6u2217NM9u5xftvbJgR_z_DMTBkTkemuu75V-a0bEKu_9pfyhykohD2knElgdvwogNJW_AywIqrzsRElmU6JnP78EibB5teeOHO2arD52qBQo-_2imZpaT-kqWyJjeNYl-deg==

Chairman's Statement

I present the unaudited results for the six months ended 30 June 2019.

The Company's net asset values ('NAV') per Ordinary Share and per B

Share at 30 June 2019 were:

-- Per Ordinary Share -- 33.6p compared to 65.1p at 31 December 2018 and

62.3p at 30 June 2018; and

-- Per B Share -- 99.5p compared to 99.1p at 31 December 2018 (No B Shares

were in issue as at 30 June 2018).

Dividends paid during the period were as follows:

-- 2 dividends totalling 28p per Ordinary Share; and

-- 1 dividend of 1.5p per B Share.

The Company's maiden B share offer closed in the period and it was very

pleasing to see that a total of GBP5.5m was raised. It was also

positive to see that the Company's Investment Manager, Seneca Partners

Limited ("Seneca"), added a further 4 new investments to the B Share

pool during the period as noted below:

Company Name Date of Investment Amount Invested

------------------------ ------------------ ---------------

Fabacus Holdings Limited 15 February 2019 GBP500,000

------------------------ ------------------ ---------------

SkinBioTherapeutics Plc 21 February 2019 GBP750,000

------------------------ ------------------ ---------------

Old St Labs Limited 28 March 2019 GBP500,000

------------------------ ------------------ ---------------

Qudini Limited 4 April 2019 GBP500,000

------------------------ ------------------ ---------------

The above investments take the total number of investments in the B

Share portfolio to 5 and further information in relation to each

investee company was included in the 2018 Annual Report and can also be

found on the Company's website

https://www.globenewswire.com/Tracker?data=82KJD4VeS-FmkViGAZpq9zw61a8mWH4QnXPtweQ0jbDScwvzrxYolVJNfE5p_IoUhBXv-IU2rlGPm7WE8ITxbq6h4bRciTExdPt3LZZ7IeE=

www.senecavct.co.uk

Results - Ordinary Shares

The total reduction in NAV per Ordinary Share for the six month period

to 30 June 2019 amounted to 31.5p (June 2018: reduction 1.5p). This

reduction is the result of the combination of dividend payments made in

the period totalling 28p per Ordinary Share and a negative capital

return of 3.5p per Ordinary Share (30 June 2018: negative 0.8p), net of

the corresponding reduction in the accrued performance fee relating to

the Ordinary Share pool: the amount of the performance fee accrued at 30

June 2019 is GBP118,996.

The negative capital return of 3.5p per Ordinary Share noted above is

principally a result of the reduction in the value of the Ordinary Share

pool's AIM portfolio which has seen reductions in the bid prices of the

shares of Omega Diagnostics Group PLC ('Omega') and Scancell Holdings

Plc ('Scancell'), with bid prices of 9.7p and 6.5p respectively. The

value of the Ordinary Share pool's unquoted portfolio remains in line

with the valuations as at 31 December 2018.

Portfolio review -- Ordinary Shares

Following the sale of the Ordinary Share pool's investment in Hallmarq

Veterinary Imaging Limited in December 2018, realising GBP2.9m, we were

very happy to be able to pay dividends totalling 28p per Ordinary Share

during the 6 month period to 30 June 2019. The Total Return in relation

to the Ordinary Shares is now 85.85p comprising cumulative distributions

of 52.25p per Ordinary Share and a residual NAV per Ordinary Share of

33.6p as at 30 June 2019.

The Company's holding in Scancell (13,049,730 shares) continues to

represent approximately one third of the Ordinary Share pool portfolio

value at 30 June 2019 and the shares have been valued at their bid price

of 6.5p as at 30 June 2019 (12.5p per share as at 30 June 2018, and 9.0p

as at 31 December 2018). Whilst this represents a reduction of 27.8%

compared to the bid price as at 31 December 2018 (2018 nil movement), we

are encouraged by the company's progress during the six month period to

30 June 2019 noting in particular:

-- The strengthening of the company's senior team in January 2019 by

appointing Dr Samantha Paston as Head of Research and Dr Adrian Parry as

Head of Manufacturing;

-- The company receiving the necessary regulatory and ethical approvals in

April 2019 to initiate the UK arm of the SCIB1 clinical trial; and

-- Raising gross proceeds of GBP3.9m by the issue of 77.6 million new

ordinary shares to Vulpes Life Sciences Fund in June 2019, following

which, Martin Diggle, Co-Founder and Portfolio Manager of Vulpes

Investment Management, was appointed to the Scancell's Board of Directors

as a Non-Executive Director.

We have reviewed the valuation of the Ordinary Share pool's unquoted

portfolio and do not believe that any revaluations are necessary as at

30 June 2019, and we continue to monitor the portfolio for opportunities

to realise the Ordinary Share pool's investments at appropriate values.

Results -- B Shares

The increase in NAV for the six month period to 30 June 2019 amounted to

0.4p per B Share (June 2018 -- N/A as the first B shares were not issued

until 23 August 2018). This increase is the result of the combination

of the dividend payment of 1.5p per B Share made in the period, a

negative revenue return of 0.7p per B Share (June 2018 -- N/A) and a

positive capital return per B Share of 2.8p (June 2018 -- N/A). The

remaining movement is a function of the increasing number of B Shares in

issue throughout the period, with the return per share being calculated

using a weighted average number of shares.

The positive capital return of 2.8p per B Share noted above is a result

of the increase in the bid price of the B Share pool's AIM quoted

investment in SkinBioTherapeutics Plc, which increased to 19.5p as at 30

June 2019 compared to a cost price of 16p per share. As a result of this

increase in value, the Investment Manager took the opportunity to

realise a small proportion (3.7%) of the B Share pool holding, selling

175,000 shares and realising a gain of GBP14,289 on the disposal. The

value of the B Share pool's unquoted portfolio remains in line with the

values as at 31 December 2018.

Portfolio review -- B Shares

We are pleased with the development of the B Share portfolio and in

particular that the Investment Manager has already made 5 investments,

including one AIM quoted investment. The Investment Manager is currently

exploring a number of further potential investment opportunities for the

B Share pool and we therefore look forward to the continued development

of the B Share portfolio.

Whilst the five investments made by the B Share pool were all made

relatively recently, we were also pleased to note the increase in the

share price of AIM quoted SkinBioTherapeutics Plc during the period.

We have also reviewed the valuation of the B Share pool's unquoted

portfolio comprising four companies as at 30 June 2019 and do not

believe that any revaluations are necessary as at that date.

Fundraising

Having launched the Company's B Share class in 2018 the Board were very

pleased with the GBP5.5m raised under that maiden B Share offer. We

will shortly launch our next offer for B shares to raise a further GBP10

million (with an overallotment facility of an additional GBP10 million)

to enable Seneca to continue to increase the number and diversity of

investments in the B Share pool.

Presentation of half-year report

As previously noted, in order to simplify this report and to reduce

costs, we have omitted details of the Company's objectives and

investment strategy, its Advisers and Registrars and how to buy and sell

shares in the Company. These details are all included in the latest

Annual Report and can be accessed on the Company's website at

https://www.globenewswire.com/Tracker?data=82KJD4VeS-FmkViGAZpq9zw61a8mWH4QnXPtweQ0jbBMuw9eiIxNhaSvkWoQt1tywGmwE--DlEIM3PXffUG8nB1xCLFFPMNrCxUBpvasYr8=

www.senecavct.co.uk

Outlook

After a year of significant developments and change in the Ordinary

Share portfolio, including the successful exit of the Company's largest

investment in December 2018, 2019 is expected to represent a period of

consolidation for the Ordinary Share Pool. We note that 2018/19 was

again a very strong year for VCT fundraising in the UK with more than

GBP700m flowing into VCTs in the period. Against this backdrop, the

Board remain optimistic about the success of the imminent B Share offer

and the continued development of the B Share portfolio.

John Hustler

Chairman

10 July 2019

Investment Portfolio -- Ordinary Shares

Investment Unrealised Carrying value at Movement in the six months to

Unquoted Equity Held at cost profit/(loss) 30 June 2019 30 June 2019

Investments (%) (GBP'000) (GBP'000) (GBP'000) (GBP'000)

-------------- ----------- ---------- ------------- ----------------------- -----------------------------

OR

Productivity

Limited 10.3 765 (101) 664 -

Fuel 3D

Technologies

Limited <1.0 299 (23) 276 -

Arecor Limited 1.3 141 63 205 -

Insense

Limited 4.6 509 (389) 120 -

Microarray

Limited 1.8 132 (65) 67 -

ImmunoBiology

Limited 2.0 868 (868) - -

Exosect

Limited 1.4 270 (270) - -

Total Unquoted

Investments 2,985 (1,653) 1,332 -

Investment Unrealised Movement in the six months to

Quoted at cost profit/(loss) Carrying value at 30 June 2019

Investments Shares Held (GBP'000) (GBP'000) 30 June 2019 (GBP'000) (GBP'000)

-------------- ----------- ---------- ------------- ----------------------- -----------------------------

Scancell plc 13,049,730 789 59 848 (326)

Omega

Diagnostics

plc 2,293,868 328 (105) 223 (64)

Total Quoted

Investments 1,117 (46) 1,071 (390)

-------------- ----------- ---------- ------------- ----------------------- -----------------------------

Total

Investments 4,102 (1,699) 2,403 (390)

-------------- ----------- ---------- ------------- ----------------------- -----------------------------

Investment Portfolio -- B Shares

Investment Unrealised Carrying value at Movement in the six months to

Equity Held at cost profit/(loss) 30 June 2019 30 June 2019

Unquoted Investments (%) (GBP'000) (GBP'000) (GBP'000) (GBP'000)

-------------------- ----------- ---------- ------------- ----------------------- -----------------------------

Silkfred Limited <1.0 500 - 500 -

Fabacus Limited 2.2 500 - 500 -

Old St Labs Limited 3.4 500 - 500 -

Qudini Limited 2.2 500 - 500 -

Total Unquoted

Investments 2,000 - 2,000 -

Investment Unrealised Movement in the six months to

at cost profit/(loss) Carrying value at 30 June 2019

Quoted Investments Shares Held (GBP'000) (GBP'000) 30 June 2019 (GBP'000) (GBP'000)

-------------------- ----------- ---------- ------------- ----------------------- -----------------------------

SkinBioTherapeutics

plc 4,502,107 720 158 878 158

Total Quoted

Investments 720 158 878 158

-------------------- ----------- ---------- ------------- ----------------------- -----------------------------

Total Investments 2,720 158 2,878 158

-------------------- ----------- ---------- ------------- ----------------------- -----------------------------

Responsibility Statement of the Directors in respect of the half-yearly

report

We confirm that to the best of our knowledge:

-- the half-yearly financial statements have been prepared in accordance

with the statement "Interim Financial Reporting" issued by the Financial

Reporting Council;

-- the half-yearly report includes a fair review of the information required

by the Financial Services Authority Disclosure and Transparency Rules,

being:

-- an indication of the important events that have occurred during the first

six months of the financial year and their impact on the condensed set of

financial statements.

-- a description of the principal risks and uncertainties for the remaining

six months of the year.

-- a description of related party transactions that have taken place in the

first six months of the current financial year that may have materially

affected the financial position or performance of the Company during that

period and any changes in the related party transactions described in the

last annual report that could do so.

On behalf of the Board:

John Hustler

Chairman

10 July 2019

Income Statement - Combined

Combined Combined Combined

Six months to 30 June 2019 Six months to 30 June 2018 Year to 31 December 2018

Revenue Capital Total Revenue Capital Total Revenue Capital Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

------------ ------------- ------------- ------------- ------------- ------------- ------------- ------------- ------------- -------------

Gain on

disposal of

fixed asset

investments - 52 52 - 6 6 - 903 903

Loss on

valuation

of fixed

asset

investments - (232) (232) - (108) (108) - (716) (716)

Performance

fee - 71 71 - 32 32 - (26) (26)

Investment

management

fee net of

cost cap 20 (35) (15) - - - 36 (18) 18

Other

expenses (55) - (55) (57) - (57) (113) - (113)

Return on

ordinary

activities

before tax (35) (144) (179) (57) (70) (127) (77) 143 66

Taxation on

return on

ordinary

activities - - - - - - - - -

Return on

ordinary

activities

after tax (35) (109) (179) (57) (70) (127) (77) 143 66

------------ ------------- ------------- ------------- ------------- ------------- ------------- ------------- ------------- -------------

-- The 'Total' column of this statement is the profit and loss account of

the Company; the supplementary Revenue return and Capital return columns

have been prepared under guidance published by the Association of

Investment Companies.

-- All revenue and capital items in the above statement derive from

continuing operations.

-- The accompanying notes are an integral part of the half-yearly report.

-- The Company has only one class of business and derives its income from

investments made in shares and securities and from bank and money market

funds.

-- The Company has no recognised gains or losses other than the results for

the period as set out above. Accordingly a Statement of Comprehensive

Income is not required.

Income Statement -- Ordinary Shares

Ordinary Shares Ordinary Shares Ordinary Shares

Six months to 30 June 2019 Six months to 30 June 2018 Year to 31 December 2018

Revenue Capital Total Revenue Capital Total Revenue Capital Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

------------ ------------- ------------- ------------- ------------- ------------- ------------- ------------- ------------- -------------

Gain on

disposal of

fixed asset

investments - 38 38 - 6 6 - 903 903

Loss on

valuation

of fixed

asset

investments - (390) (390) - (108) (108) - (716) (716)

Performance

fee - 71 71 - 32 32 - (26) (26)

Investment

management

fee net of

cost cap - - - - - - - - -

Other

expenses - - - (57) - (57) (59) - (59)

Return on

ordinary

activities

before tax - (281) (281) (57) (70) (127) (59) 161 102

Taxation on

return on

ordinary

activities - - - - - - - - -

Return on

ordinary

activities

after tax - (281) (281) (57) (70) (127) (59) 161 102

------------ ------------- ------------- ------------- ------------- ------------- ------------- ------------- ------------- -------------

Earnings per

share --

basic and

diluted - (3.5p) (3.5p) (0.7p) (0.8p) (1.5p) (0.7p) 2.0p 1.3p

------------ ------------- ------------- ------------- ------------- ------------- ------------- ------------- ------------- -------------

Income Statement -- B Shares

B Shares B Shares B Shares

Six months to 30 June 2019 Six months to 30 June 2018 Year to 31 December 2018

Revenue Capital Total Revenue Capital Total Revenue Capital Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

------------ ------------- ------------- ------------- ------------- ------------- ------------- ------------- ------------- -------------

Gain on

disposal of

fixed asset

investments - 14 14 - - - - - -

Gain on

valuation

of fixed

asset

investments - 158 158 - - - - - -

Performance

fee - - - - - - - - -

Investment

management

fee net of

cost cap 20 (35) (15) - - - 36 (18) 18

Other

expenses (55) - (55) - - - (54) - (54)

Return on

ordinary

activities

before tax (35) `137 102 (18) (18) (36)

Taxation on

return on

ordinary

activities - - - - - - - - -

Return on

ordinary

activities

after tax (35) 137 102 - - - (18) (18) (36)

------------ ------------- ------------- ------------- ------------- ------------- ------------- ------------- ------------- -------------

Earnings per

share --

basic and

diluted (0.7p) 2.8p 2.1p - - - (0.45p) (0.45p) (0.9p)

------------ ------------- ------------- ------------- ------------- ------------- ------------- ------------- ------------- -------------

Balance Sheet - Combined

Combined Combined Combined

As at 30 June 2019 As at 30 June 2018 As at 31 December 2018

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

---------------- -------- ----------- -------- ----------- ---------- -----------------

Fixed asset

investments* 5,281 5,431 3,293

Current assets:

Cash received

for B shares

not yet

allotted - 1,648 219

Cash at Bank 2,934 7 6,227

Debtors 119 10 23

---------------- -------- ----------- -------- ----------- ---------- -----------------

3,053 1,665 6,469

Creditors:

Amounts falling

due within one

year (128) (63) (72)

Cash received

for B shares

not yet

allotted - (1,648) (219)

Bank Loan - (200) -

---------------- -------- ----------- -------- ----------- ---------- -----------------

(128) (1,911) (291)

Net current

assets 2,925 (246) 6,178

Performance fee

payable (119) (132) (190)

Net assets 8,087 5,053 9,281

---------------- -------- ----------- -------- ----------- ---------- -----------------

Called up equity

share capital 135 4,058 121

Share premium 1,889 - 568

Special

distributable

reserve 8,489 3,397 10,839

Capital

redemption

reserve - 38 -

Capital reserve

--

gains/(losses)

on disposal 1,117 (381) 1,029

-- holding

gains/(losses) (1,541) (113) (1,309)

Revenue reserve (2,002) (1,946) (1,967)

---------------- -------- ----------- -------- ----------- ---------- -----------------

Total equity

shareholders'

funds 8,087 5,053 9,281

---------------- -------- ----------- -------- ----------- ---------- -----------------

*At fair value

through profit

and loss

Balance Sheet -- Ordinary Shares

Ordinary Shares

Ordinary Shares Ordinary Shares As at 31 December

As at 30 June 2019 As at 30 June 2018 2018

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

---------------- -------- ----------- -------- ----------- ------- ------------

Fixed asset

investments* 2,403 5,431 2,793

Current assets:

Cash received

for B Shares

not yet

allotted - 1,648 -

Cash at Bank 476 7 2,738

Debtors - 10 -

---------------- -------- ----------- -------- ----------- ------- ------------

476 1,665 2,738

Creditors:

Amounts falling

due within one

year (32) (63) (59)

Cash received

for B shares

not yet

allotted - (1,648) -

Bank Loan - (200) -

---------------- -------- ----------- -------- ----------- ------- ------------

(32) (1,911) (59)

Net current

assets 444 (246) 2,679

Performance fee

payable (119) (132) (190)

Net assets 2,728 5,053 5,282

---------------- -------- ----------- -------- ----------- ------- ------------

Called up equity

share capital 81 4,058 81

Share premium - - -

Special

distributable

reserve 5,139 3,397 7,412

Capital

redemption

reserve - 38 -

Capital reserve

--

gains/(losses)

on disposal 1,156 (381) 1,047

-- holding

gains/(losses) (1,699) (113) (1,309)

Revenue reserve (1,949) (1,946) (1,949)

---------------- -------- ----------- -------- ----------- ------- ------------

Total equity

shareholders'

funds 2,728 5,053 5,282

---------------- -------- ----------- -------- ----------- ------- ------------

Net asset value 33.6p 62.3p 65.1p

per share

---------------- -------- ----------- -------- ----------- ------- ------------

*At fair value

through profit

and loss

Balance Sheet -- B Shares

B Shares B Shares B Shares

As at 30 June 2019 As at 30 June 2018 As at 31 December 2018

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

---------------- -------- ----------- -------- ----------- ---------- -----------------

Fixed asset

investments* 2,878 - 500

Current assets:

Cash received

for B Shares

not yet

allotted - - 219

Cash at Bank 2,458 - 3,489

Debtors 119 - 23

---------------- -------- ----------- -------- ----------- ---------- -----------------

2,577 - 3,731

Creditors:

Amounts falling

due within one

year (96) - (13)

Cash received

for B Shares

not yet

allotted - - (219)

---------------- -------- ----------- -------- ----------- ---------- -----------------

(96) - (232)

Net current

assets 2,481 - 3,499

Performance fee

payable - - -

Net assets 5,359 - 3,999

---------------- -------- ----------- -------- ----------- ---------- -----------------

Called up equity

share capital 54 - 40

Share premium 1,889 - 568

Special

distributable

reserve 3,350 - 3,427

Capital

redemption

reserve - - -

Capital reserve

--

gains/(losses)

on disposal (39) - (18)

-- holding

gains/(losses) 158 - -

Revenue reserve (53) - (18)

---------------- -------- ----------- -------- ----------- ---------- -----------------

Total equity

shareholders'

funds 5,359 - 3,999

---------------- -------- ----------- -------- ----------- ---------- -----------------

Net asset value 99.5p - 99.1p

per share

---------------- -------- ----------- -------- ----------- ---------- -----------------

*At fair value

through profit

and loss

Statement of Changes in Equity - Combined

Special Capital

Share distributable redemption Capital reserve gains/ Capital reserve holding gains/ Revenue

Capital Share premium GBP'000 reserve reserve (losses) (losses) reserve Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

-------------- ------- ----------------------- ------------- ---------- ---------------------- ------------------------------ ------- -------

As at 1

January 2018 4,058 - 3,397 38 (432) 9 (1,890) 5,180

Revenue return

on ordinary

activities

after tax - - - - - - (57) (57)

Performance

fee allocated

as capital

expenditure - - - - 32 - - 32

Current period

gains on

disposal - - - - 6 - - 6

Current period

losses on

fair value of

investments - - - - - (108) - (108)

Prior years'

unrealised

gains now

realised - - - - 13 (13) - -

-------------- ------- ----------------------- ------------- ---------- ---------------------- ------------------------------ ------- -------

Balance as at

30 June 2018 4,058 - 3,397 38 (381) (112) (1,947) 5,053

As at 1

January 2018 4,058 - 3,397 38 (432) 9 (1,890) 5,180

B Share issue 40 3,995 - - - - - 4,035

Capital

restructuring (3,977) - - 3,977 - - - -

Capital

reduction - (3,427) 7,442 (4,015) - - - -

Revenue return

on ordinary

activities

after tax - - - - - - (77) (77)

Expenses

charged to

capital - - - - (18) - - (18)

Performance

fee allocated

as capital

expenditure - - - - (26) - - (26)

Current period

gains on

disposal - - - - 903 - - 903

Current period

losses on

fair value of

investments - - - - - (716) - (716)

Prior years'

unrealised

losses now

realised - - - - 602 (602) - -

-------------- ------- ----------------------- ------------- ---------- ---------------------- ------------------------------ ------- -------

Balance as at

31 December

2018 121 568 10,839 - 1,029 (1,309) (1,967) 9,281

B Share issue 14 1,321 - - - - - 1,335

Revenue return

on ordinary

activities

after tax - - - - - - (35) (35)

Expenses

charged to

capital - - - - (35) - - (35)

Performance

fee allocated

as capital

expenditure - - - - 71 - - 71

Dividends paid - - (2,350) - - - - (2,350)

Current period

gains on

disposal - - - - 52 - - 52

Current period

losses on

fair value of

investments - - - - - (232) - (232)

Prior years'

unrealised

gains now

realised - - - - - - - -

-------------- ------- ----------------------- ------------- ---------- ---------------------- ------------------------------ ------- -------

Balance as at

30 June 2019 135 1,889 8,489 - 1,117 (1,541) (2,002) 8,087

-------------- ------- ----------------------- ------------- ---------- ---------------------- ------------------------------ ------- -------

Statement of Changes in Equity -- Ordinary Shares

Special Capital

Share distributable redemption Capital reserve gains/ Capital reserve holding gains/ Revenue

Capital Share premium GBP'000 reserve reserve (losses) (losses) reserve Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

-------------- ------- ----------------------- ------------- ---------- ---------------------- ------------------------------ ------- -------

As at 1

January 2018 4,058 - 3,397 38 (432) 9 (1,890) 5,180

Revenue return

on ordinary

activities

after tax - - - - - - (57) (57)

Performance

fee allocated

as capital

expenditure - - - - 32 - - 32

Current period

gains on

disposal - - - - 6 - - 6

Current period

losses on

fair value of

investments - - - - - (108) - (108)

Prior years'

unrealised

gains now

realised - - - - 13 (13) - -

-------------- ------- ----------------------- ------------- ---------- ---------------------- ------------------------------ ------- -------

Balance as at

30 June 2018 4,058 - 3,397 38 (381) (112) (1,947) 5,053

As at 1

January 2018 4,058 - 3,397 38 (432) 9 (1,890) 5,180

Capital

restructuring (3,977) - - 3,977 - - - -

Capital

reduction - - 4,015 (4,015) - - - -

Revenue return

on ordinary

activities

after tax - - - - - - (59) (59)

Expenses

charged to

capital - - - - - - - -

Performance

fee allocated

as capital

expenditure - - - - (26) - - (26)

Current period

gains on

disposal - - - - 903 - - 903

Current period

losses on

fair value of

investments - - - - - (716) - (716)

Prior years'

unrealised

losses now

realised - - - - 602 (602) - -

-------------- ------- ----------------------- ------------- ---------- ---------------------- ------------------------------ ------- -------

Balance as at

31 December

2018 81 - 7,412 - 1,047 (1,309) (1,949) 5,282

Revenue return

on ordinary

activities

after tax - - - - - - - -

Performance

fee allocated

as capital

expenditure - - - - 71 - - 71

Dividends paid - - (2,273) - - - - (2,273)

Current period

gains on

disposal - - - - 38 - - 38

Current period

losses on

fair value of

investments - - - - - (390) - (390)

Prior years'

unrealised

gains now

realised - - - - - - - -

-------------- ------- ----------------------- ------------- ---------- ---------------------- ------------------------------ ------- -------

Balance as at

30 June 2019 81 - 5,139 - 1,156 (1,699) (1,949) 2,728

-------------- ------- ----------------------- ------------- ---------- ---------------------- ------------------------------ ------- -------

Statement of Changes in Equity -- B Shares

Special Capital

Share distributable redemption Capital reserve gains/ Capital reserve holding gains/ Revenue

Capital Share premium GBP'000 reserve reserve (losses) (losses) reserve Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

------------ ------- ----------------------- ------------- ---------- ---------------------- ------------------------------ ------- -------

As at 1

January

2018 - - - - - - - -

Balance as

at 30 June

2018 - - - - - - - -

As at 1

January

2018 - - - - - - - -

B Share

issue 40 3,995 - - - - - 4,035

Capital

reduction (3,427) 3,427 - - - - -

Revenue

return on

ordinary

activities

after tax - - - - - - (18) (18)

Expenses

charged to

capital - - - - (18) - - (18)

Balance as

at 31

December

2018 40 568 3,427 - (18) - (18) 3,999

B Share

issue 14 1,321 - - - - - 1,335

Revenue

return on

ordinary

activities

after tax - - - - - - (35) (35)

Expenses

charged to

capital - - - - (35) - - (35)

Dividends

paid - - (77) - - - - (77)

Current

period

gains on

disposal - - - - 14 - - 14

Current

period

gains on

fair value

of

investments - - - - - 158 - 158

Prior years'

unrealised

gains now

realised - - - - - - - -

------------ ------- ----------------------- ------------- ---------- ---------------------- ------------------------------ ------- -------

Balance as

at 30 June

2019 54 1,889 3,350 - (39) 158 (53) 5,359

------------ ------- ----------------------- ------------- ---------- ---------------------- ------------------------------ ------- -------

Statement of Cash Flows -- Combined

Combined Combined Combined

Six months to 30 June 2019 Six months to 30 June 2018 Year to 31 December 2018

GBP'000 GBP'000 GBP'000

-------------------------- --------------------------- --------------------------- -------------------------

Cash flows from

operating

activities

Return on ordinary

activities before

tax (179) (127) 66

Adjustments for:

Increase in debtors (96) (3) (16)

(Decrease)/increase

in creditors (234) (36) 31

Gain on disposal of

fixed asset

investments (14) (6) (903)

Loss on valuation of

fixed asset

investments 232 108 716

-------------------------- --------------------------- --------------------------- -------------------------

Cash from operations (291) (64) (106)

Income taxes paid - - -

-------------------------- --------------------------- --------------------------- -------------------------

Net cash used in operating

activities (291) (64) (106)

Cash flows from investing

activities

Purchase of fixed asset

investments (2,248) - (500)

Sale of fixed asset

investments 42 31 2,958

-------------------------- --------------------------- --------------------------- -------------------------

Total cash flows from

investing activities (2,206) 31 2,458

Cash flows from financing

activities

Dividends paid (2,350) - -

Issue of B shares 1,335 - 4,035

Cash raised for B shares

not yet allotted - 1,648 219

Bank loan - 200 -

-------------------------- --------------------------- --------------------------- -------------------------

Total cash flows from

financing activities (1,015) 1,848 4,254

Increase in cash and cash

equivalents (3,512) 1,815 6.606

Opening cash and cash

equivalents 6,446 (160) (160)

Closing cash and cash

equivalents 2,934 1,655 6,446

-------------------------- --------------------------- --------------------------- -------------------------

Statement of Cash Flows -- Ordinary Shares

Ordinary Shares Ordinary Shares Ordinary Shares

Six months to 30 June 2019 Six months to 30 June 2018 Year to 31 December 2018

GBP'000 GBP'000 GBP'000

-------------------------- --------------------------- --------------------------- -------------------------

Cash flows from

operating

activities

Return on ordinary

activities before

tax (281) (127) 102

Adjustments for:

(Increase)/decrease

in debtors - (3) 7

(Decrease)/Increase

in creditors (98) (36) 18

Gain on disposal of

fixed asset

investments - (6) (903)

Loss on valuation of

fixed asset

investments 390 108 716

-------------------------- --------------------------- --------------------------- -------------------------

Cash from operations 11 (64) (60)

Income taxes paid - - -

-------------------------- --------------------------- --------------------------- -------------------------

Net cash used in operating

activities 11 (64) (60)

Cash flows from investing

activities

Purchase of fixed asset

investments - - -

Sale of fixed asset

investments - 31 2,958

-------------------------- --------------------------- --------------------------- -------------------------

Total cash flows from

investing activities - 31 2,958

Cash flows from financing

activities

Dividend paid (2,273) - -

Cash raised for B shares

not yet allotted - 1,648 -

Bank loan - 200 -

-------------------------- --------------------------- --------------------------- -------------------------

Total cash flows from

financing activities (2,273) 1,848 -

Increase in cash and cash

equivalents (2,262) 1,815 2,898

Opening cash and cash

equivalents 2,738 (160) (160)

Closing cash and cash

equivalents 476 1,655 2,738

-------------------------- --------------------------- --------------------------- -------------------------

Statement of Cash Flows -- B Shares

B Shares B Shares B Shares

Six months to 30 June 2019 Six months to 30 June 2018 Year to 31 December 2018

GBP'000 GBP'000 GBP'000

-------------------------- --------------------------- --------------------------- -------------------------

Cash flows from

operating

activities

Return on ordinary

activities before

tax 102 - (36)

Adjustments for:

Increase in debtors (96) - (23)

(Decrease)/increase

in creditors (136) - 13

Gain on disposal of

fixed asset

investments (14) - -

Gain on valuation of

fixed asset

investments (158) - -

-------------------------- --------------------------- --------------------------- -------------------------

Cash from operations (302) - (46)

Income taxes paid - -

-------------------------- --------------------------- --------------------------- -------------------------

Net cash used in operating

activities (302) - (46)

Cash flows from investing

activities

Purchase of fixed asset

investments (2,248) - (500)

Sale of fixed asset

investments 42 - -

-------------------------- --------------------------- --------------------------- -------------------------

Total cash flows from

investing activities (2,206) - (500)

Cash flows from financing

activities

Issue of B shares 1,335 - 4,035

Cash raised for B shares

not yet allotted - - 219

Dividends paid (77) - -

Bank loan - - -

-------------------------- --------------------------- --------------------------- -------------------------

Total cash flows from

financing activities 1,258 - 4,254

Increase in cash and cash

equivalents (1,250) - 3,708

Opening cash and cash

equivalents 3,708 - -

Closing cash and cash

equivalents 2,458 - 3,708

-------------------------- --------------------------- --------------------------- -------------------------

Notes to the Half-Yearly Report

1. Basis of preparation

The unaudited half-yearly results which cover the six months to 30 June

2019 have been prepared in accordance with the Financial Reporting

Council's (FRC) Financial Reporting Standard 104 Interim Financial

Reporting ('FRS 104') and the Statement of Recommended Practice (SORP)

for Investment Companies re-issued by the Association of Investment

Companies in November 2014. Details of the accounting policies and

valuation methodologies are included within the Annual Report on Pages

59-71.

2. Publication of non-statutory accounts

The unaudited half-yearly results for the six months ended 30 June 2019

do not constitute statutory accounts within the meaning of Section 415

of the Companies Act 2006. The comparative figures for the year ended 31

December 2018 have been extracted from the audited financial statements

for that year, which have been delivered to the Registrar of Companies.

The independent auditor's report on those financial statements, in

accordance with chapter 3, part 16 of the Companies Act 2006, was

unqualified. This half-yearly report has not been reviewed by the

Company's auditor.

3. Earnings per share

The earnings per Ordinary Share at 30 June 2019 are calculated on the

basis of 8,115,376 shares (31 December 2018: 8,115,376 and 30 June 2018:

8,115,376) being the weighted average number of shares in issue during

the period.

The earnings per B Share at 30 June 2019 are calculated on the basis of

4,783,679 (31 December 2018: 3,412,545 and 30 June 2018: nil) being the

weighted average number of shares in issue during the period.

There are no potentially dilutive capital instruments in issue and,

therefore, no diluted returns per share figures are relevant.

4. Net asset value per share

The net asset value per Ordinary Share is based on net assets as at 30

June 2019 divided by 8,115,376 (31 December 2018: 8,115,376 and 30 June

2018: 8,115,376) shares in issue at that date.

The net asset value per B Share is based on net assets as at 30 June

2019 divided by 5,387,664 (31 December 2018: 4,036,370 and 30 June 2018:

nil) shares in issue at that date.

5. Principal risks and uncertainties

The Company's assets consist of equity and fixed interest investments,

cash and liquid resources. Its principal risks are therefore market risk,

credit risk and liquidity risk. Other risks faced by the Company include

economic, loss of approval as a Venture Capital Trust, investment and

strategic, regulatory, reputational, operational and financial risks.

These risks, and the way in which they are managed, are described in

more detail in the Company's Annual Report and Accounts for the year

ended 31 December 2018. The Company's principal risks and uncertainties

have not changed materially since the date of that report.

6. Related party transactions

Certain Directors are entitled to participate in a performance bonus as

detailed in note 6 of the Annual Report. Those Directors are entitled to

receive a performance incentive fee, of up to 20% of sums returned to

shareholders by way of dividends and capital distributions of whatever

nature, which in aggregate exceeds the sum of 80p per share (including

dividends paid to date, i.e. 52.25p per Ordinary Share, but excluding

any sums returned to shareholders from HMRC in the year of

subscription). Full details are included in the Directors' Remuneration

Report and in Note 5 of the 2018 Annual Report and Accounts, which can

be viewed on the Company's website.

The management fee payable to Seneca is calculated as 2% of the weighted

average net assets of the B share portfolio. As a result, Seneca would

have earned GBP46,712 in management fees in the current period, however

this is reduced to GBP15,420 as a result of the 3% cost cap. No payment

has been made to Seneca, as money is still recoverable from Seneca as a

result of the amounts outstanding from 2018 in line with the cost cap

applied for that period. The remaining balance (GBP2,997) will be

deducted from fees to be paid to Seneca for services in 2019 (31

December 2018: GBP18,417 recoverable from Seneca, 30 June 2018: N/A).

Seneca accrued GBP141,250 (31 December 2018: GBP19,997, 30 June 2018:

GBPnil) in transaction fees, monitoring and directors' fees from

investee companies. Seneca may also become entitled to a performance

fee. See note 3 to the Annual Report for more information on these fees.

As detailed in the offer for subscription document dated 9 May 2018,

Seneca (as promoters of the offer) were entitled to charge the Company

up to 5.5% of investors' subscriptions. A total of GBP18,018 has been

paid to Seneca in the period (31 December 2018: GBP40,596, 30 June 2018:

n/a), based on allotments of GBP1,353,150 in the period.

7. Events after the Balance Sheet Date

There are no post balance sheet events.

8. Copies of this statement are available from the

Registrar's office at Neville House, Steelpark Road, Halesowen, B62 8HD,

and on the company's website -- www.senecavct.co.uk.

(END) Dow Jones Newswires

July 10, 2019 12:20 ET (16:20 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

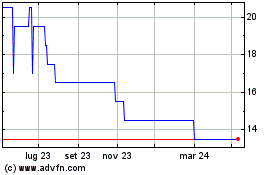

Grafico Azioni Seneca Growth Capital Vct (LSE:HYG)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni Seneca Growth Capital Vct (LSE:HYG)

Storico

Da Apr 2023 a Apr 2024