TIDMIHR

RNS Number : 4034D

Impact Healthcare REIT PLC

28 October 2020

The information contained in this announcement is restricted and

is not for publication, release or distribution in the United

States of America, any member state of the European Economic Area

(other than the United Kingdom, the Republic of Ireland or the

Netherlands), Canada, Australia, Japan or the Republic of South

Africa.

28 October 2020

Impact Healthcare REIT plc

("Impact" or the "Company" or, together with its subsidiaries,

the "Group")

100% RENT COLLECTION YEAR TO DATE, DIVIDEND DECLARATION, NET

ASSET VALUE AND UPDATE

The board of Directors (the "Board") of Impact Healthcare REIT

plc (ticker: IHR), the real estate investment trust which gives

investors exposure to a diversified portfolio of UK healthcare real

estate assets, in particular care homes for the elderly, is pleased

to provide the following update for the quarter ended 30 September

2020.

ROBUST RENT COLLECTION

-- The Company confirms receipt of 100% of the rent due on 1(st)

October for quarterly and monthly rent payments payable in advance.

The Company has received 100% of its contracted rent for 2020 year

to date.

DIVIDEND DECLARATION

-- The Board has today declared the Company's third interim

dividend for the year ending 31 December 2020 of 1.5725 pence per

ordinary share, payable on 27 November 2020 to shareholders on the

register on 6 November 2020. The ex-dividend date will be 5

November 2020.

-- 0.7863 pence per ordinary share will be paid as a property

income distribution dividend ("PID") and 0.7862 pence per ordinary

share will be paid as an ordinary UK dividend ("non-PID").

-- This dividend is in-line with the annual total dividend

target of 6.29 pence per share (1) for the year ending 31 December

2020.

NET ASSET VALUE PROGRESSION

-- Unaudited net asset value ("NAV") (2) as at 30 September 2020

of GBP347.8 million, 109.06 pence per share (NAV as at 30 June

2020: GBP341. 8 million, 107.17 pence per share).

STRONG BALANCE SHEET

-- The Company has deliberately maintained low gearing with a

loan to value ("LTV") ratio of 17.8% as at 30 September 2020. The

LTV ratio will rise to 21.3% if all committed transactions

complete.

-- As at 1 October 2020, the Group had cash of GBP24.8 million

and headroom on its undrawn debt facilities of GBP49.0 million, of

which GBP33.5 million is available immediately.

PROPERTY VALUATION AND PORTFOLIO UPDATE

-- The Group's property portfolio ("Portfolio") was

independently valued (unaudited) at GBP 399.4 million as at 30

September 2020 (at 30 June 2020: GBP346.0 million), an increase of

GBP 53.4 million, or 15.4% in the quarter.

o GBP48.4 million of the increase relates to investments in

acquisitions and GBP0.2 million relates to capital

improvements.

o Net valuation uplifts of GBP5.6 million were recognised in the

quarter, including GBP1.9 million on new acquisitions.

o One non-core property was also sold in the period for GBP0.9

million, a 24% premium to carrying value of GBP0.8 million.

-- In the quarter, the Group welcomed its 11(th) tenant, Holmes

Care, with the completion of the acquisition of nine homes with 649

beds across Scotland. The Group also exchanged contracts on an

additional care home, St Peters House close to Bury St Edmunds,

with 62 single en-suite bedrooms. St Peters House will be leased to

an existing tenant, Welford, on completion and in-line with the

Group's standard lease terms. Completion is awaiting CQC

re-registration.

-- As at 30 September 2020, the Portfolio comprised 102

healthcare properties and one forward funded development under

construction. 101 of these properties are care homes let to 10

tenants on fixed-term leases of 20 to 25 years (no break clauses),

subject to annual upward-only Retail Price Index-linked rent

reviews (with a floor and cap of varying ranges between 1% and 5%

respectively). In addition, the Group owns two healthcare

facilities leased to the NHS. In total, the Group has 11 tenants

across the Portfolio (3) .

-- Weighted average unexpired lease term across the Portfolio of 20.0 years.

-- The Portfolio had an annualised contracted rent roll of

GBP29.9 million as at 30 September 2020.

-- The Investment Manager continues to progress a strong

identified pipeline of investment opportunities and while the

Company remains cautious with the ongoing effects of the pandemic,

it also remains confident in the ongoing long-term outlook for the

sector and the investment and diversification strategy the Group

has set out.

BUSINESS UPDATE

-- The Group's top priority remains the health, welfare and

safety of its tenants' care home residents, healthcare

professionals and wider stakeholders.

-- The Investment Manager continues to be in regular

communication with all the Group's tenants and key service

providers to monitor how the pandemic is affecting them and also,

where appropriate, to share information amongst the tenants.

-- The installation of thermal imaging cameras in the entrances

of the Group's homes provides an added layer of infection control

to support residents and healthcare professionals.

-- Our tenants are in a good position, given the challenges, to

face the challenges which lie ahead. Testing remains critical to

effective infection control measures, with a typical regime of

staff being tested once a week and residents once a month. As at

20(th) October 10 residents living in six homes had tested

positive, and 10 staff working at four homes were positive. All are

now self-isolating. Occupancy was stable across the portfolio

during the third quarter, with home managers reporting good levels

of enquiries. However, new admissions are not expected to rise

substantially until current restrictions on visitors to homes are

eased.

Rupert Barclay, Chairman of Impact Healthcare REIT PLC,

commented:

"The Company's business model remains strong and resilient,

underlined by the Group's collection of 100% of rent due for the

year to date, while our tenants continue to provide good quality

care during an exceptionally challenging period. We continue to

have solid levels of rent cover due to the sustainable and

affordable lease terms we have put in place.

The need remains strong for good quality care from well

maintained, fit for purpose residential care homes with strong

infection controls in place, yet a material undersupply persists.

The Group's tenants provide an essential service to the communities

in which they operate and are playing a critical role in helping to

provide high quality care to vulnerable elderly people during this

pandemic.

We continue to be well positioned, with a strong balance sheet,

modest levels of debt and significant liquidity and headroom. We

will continue responsibly to deliver long-term, sustainable value

to our tenants' residents in the care homes we own, our tenants'

healthcare professionals and our shareholders."

Notes:

(1) This is a target only and not a profit forecast. There can

be no assurance that the target will be met and it should not be

taken as an indicator of the Company's expected or actual

results.

(2) The NAV and other financials reported in this announcement

are unaudited [and subject to change].

(3) Minster and Croftwood (both subsidiaries of Minster Care

Group), Careport, Prestige, Renaissance, Welford, Maria Mallaband

Countrywide Group, NHS Cumbria, Optima, Holmes Care and Silverline

Care.

FOR FURTHER INFORMATION, PLEASE CONTACT:

Impact Health Partners LLP via Maitland/AMO

Mahesh Patel

Andrew Cowley

Winterflood Securities Limited Tel: 020 3100 0000

Joe Winkley

Neil Langford

RBC Capital Markets Tel: 020 7653 4000

Rupert Walford

Matthew Coakes

Maitland/AMO (Communications Adviser) Tel: 020 7379 5151

James Benjamin Email: impacthealth-maitland@maitland.co.uk

The Company's LEI is 213800AX3FHPMJL4IJ53.

Further information on Impact Healthcare REIT is available at

www.impactreit.uk .

NOTES:

Impact Healthcare REIT plc is a real estate investment trust

("REIT") which aims to provide shareholders with an attractive

return, principally in the form of quarterly income distributions

and with the potential for capital and income growth, through

exposure to a diversified portfolio of UK healthcare real estate

opportunities, in particular care homes for the elderly. The

Group's investment policy is to acquire, renovate, extend and

redevelop high quality healthcare real estate assets in the UK and

lease those assets primarily to healthcare operators providing

residential healthcare services under full repairing and insuring

leases.

The Company has a progressive dividend policy with a target to

grow its annual aggregate dividend in line with the

inflation-linked rental uplifts received by the Group under the

terms of the rent review provisions contained in the Group's leases

in the prior financial year.

The Group's Ordinary Shares were admitted to trading on the main

market of the London Stock Exchange, premium segment, on 8 February

2019. The Company is a constituent of the FTSE EPRA/NAREIT

index.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

DIVKKOBDBBDBAKB

(END) Dow Jones Newswires

October 28, 2020 03:00 ET (07:00 GMT)

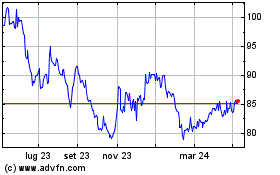

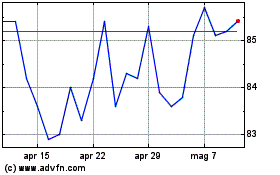

Grafico Azioni Impact Healthcare Reit (LSE:IHR)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni Impact Healthcare Reit (LSE:IHR)

Storico

Da Apr 2023 a Apr 2024