Group revenue down 38.3%(1) in third-quarter

2020, to €1,188 million

Lagardère Publishing revenue up 6.0%(1) to

€704 million, buoyed by the success of its publications and a

market rebound

Lagardère Travel Retail revenue down

66.1%(1) to €393 million, owing to the slump in global air

traffic

Regulatory News:

The Lagardère group (Paris:MMB) saw a year-on-year revenue

decline of 38.3%(1) in the third quarter of 2020, hit hard by the

impacts of the pandemic on its Travel Retail business. This decline

was partly countered by a 6.0%(1) rise in revenue for Lagardère

Publishing over the same period, driven by the success of its

publications.

- Lagardère Publishing: the 6.0% revenue increase was

driven by a good performance in France, which benefited from

advances in General Literature and Illustrated Books, and by

vigorous business growth in the United States and the United

Kingdom spurred by the success of a large number of best-selling

titles and by upbeat trends in digital formats.

- Lagardère Travel Retail: following a slight upturn in

trading observed as from the end of the second quarter through to

mid-August, Lagardère Travel Retail was impacted by the second wave

of Covid-19, reporting a 66.1%(1) drop in revenue in the third

quarter. Tighter travel restrictions introduced as from the end of

August 2020 hit trading in all of the division’s regions with the

exception of mainland China. Lagardère Travel Retail is continuing

its efforts to cut costs in these uncertain times.

I. REVENUE

Revenue (€m)

Change

30 September 2019 (9

months)

30 September 2020 (9

months)

on a consolidated

basis

on a like-for-like

basis

Lagardère Publishing

1,707

1,675

-1.9%

-2.8%

Lagardère Travel Retail

3,147

1,340

-57.4%

-58.8%

Other Activities*

208

164

-21.5%

-21.1%

Target scope

5,062

3,179

-37.2%

-38.3%

Non-retained scope**

187

97

-47.9%

-24.6%

LAGARDÈRE

5,249

3,276

-37.6%

-38.0%

Revenue (€m)

Change

Q3 2019

Q3 2020

on a consolidated

basis

on a like-for-like

basis

Lagardère Publishing

663

704

+6.3%

+6.0%

Lagardère Travel Retail

1,152

393

-65.9%

-66.1%

Other Activities*

63

57

-9.7%

-9.6%

Target scope

1,878

1,154

-38.5%

-38.8%

Non-retained scope**

47

34

-27.7%

-14.4%

LAGARDÈRE

1,925

1,188

-38.3%

-38.3%

* Lagardère News (Paris Match, Le Journal du Dimanche, Europe 1,

Virgin Radio, RFM and the Elle brand licence), the Entertainment

businesses, and the Group Corporate function. ** Assets in the

process of being sold at 30 September 2020. Lagardère Studios. Note

that in 2019, “Other Activities” included TV Channels and other

digital assets.

Revenue for the nine months ended 30 September 2020 totalled

€1,675 million, down 1.9% on a consolidated basis and down 2.8%

like for like, largely eliminating the lag recorded in the first

half of the year. Scope effects added €18 million to revenue

and reflected the acquisition of Le Livre Scolaire, Blackrock Games

and Short Books, while foreign exchange effects reduced revenue by

€3 million.

The health crisis and associated lockdown restrictions put in

place across the division’s regions had a negative like‑for‑like

impact of 8.3% in first-half 2020. The rebound in trading

observed in June was confirmed during the third quarter, which saw

like-for-like revenue growth of 6.0%.

Third-quarter 2020:

Revenue for the division totalled €704 million, up 6.3% on a

consolidated basis and up 6.0% like for like. Scope effects

added €12 million to revenue, while foreign exchange effects

reduced revenue by €11 million.

The figures below are presented on a like-for-like basis.

France reported revenue growth of

4.8% on the back of advances in General Literature and Illustrated

Books, which benefited from the release of Stephenie Meyer’s

Midnight Sun during the quarter. In contrast, Education was down as

expected, with only one level of high school curriculum reform this

year.

Business surged 19.2% in the United

States, spurred by the release of Stephenie Meyer’s Midnight

Sun at Little, Brown Books for Young Readers in August and the

latest title by Nicholas Sparks, The Return, at Grand Central

Publishing in September. Several titles linked to the Black Lives

Matter movement published by Perseus and Little, Brown Books for

Young Readers, also enjoyed success. Digital formats continue to

enjoy bullish growth.

The United Kingdom also saw robust

revenue growth over the quarter, up 15.6% thanks to the release of

Midnight Sun and to a good performance from General Literature, led

by Robert Galbraith’s Troubled Blood, released in September.

Business in the United Kingdom also continued to benefit from

strong momentum in digital sales.

Business in Spain/Latin America was

down by 20.8%, hit hard by less extensive curriculum reform in

Spain and Mexico, and by the impacts of the health crisis.

Partworks revenue was down 7.6%

owing to a lighter release schedule in the first half of 2020

compared with a prior‑year comparison basis that had benefited from

numerous successful launches, notably in France.

E-books as a proportion of total

Lagardère Publishing revenue continued to grow, representing 9.9%

in the third quarter of 2020 versus 7.8% in third-quarter 2019,

while downloadable audiobooks

represented 3.7% of revenue compared to 2.9% one year earlier.

Lagardère Travel Retail revenue for the nine months to 30

September 2020 totalled €1,340 million, down 57.4% on a

consolidated basis and down 58.8% like for like, reflecting the

impacts of the Covid-19 pandemic. The scope impact resulting

mainly from the acquisition of International Duty Free (IDF) in

Belgium added €51 million to revenue, while the foreign exchange

effect reduced revenue by €8 million.

Third-quarter 2020:

Revenue for the division totalled €393 million, down 65.9% on

a consolidated basis (down 66.1% like for like). The scope

impact added €13 million to revenue, while the foreign exchange

effect reduced revenue by €10 million.

In the third quarter, the different regions in which

Lagardère Travel Retail operates were affected by government

measures to restrict travel amid the pandemic’s second wave.

Airport points-of-sale were hit harder than other locations in

which Lagardère Travel Retail operates, such as rail stations and

town centres.

The figures below are presented on a like-for-like

basis.

In France, the division reported a 71.3% fall in

trading, due mainly to the measures restricting international air

traffic. Non-airport trading declined to a lesser extent (down

53.6%), with rail traffic (mainly domestic) less affected by the

travel restrictions.

Revenue for the

EMEA region

(excluding France) fell

61.0%. After increasing slightly at the start of the summer

compared to second-quarter 2020, passenger traffic was down during

August due to the introduction of more stringent travel

restrictions in most countries in the region.

North

America reported a 69.6%

drop in revenue, as passenger traffic remained sluggish due to the

lockdown measures put in place in various states to combat the

pandemic.

Asia-Pacific revenue was down

66.8%, reflecting stark contrasts across the region. Australia and

New Zealand (Pacific region) kept their borders closed during the

period, resulting in virtually zero passenger traffic in these

countries (revenue down 92.5%). This was partly countered by 35.6%

revenue growth in mainland China

spurred by increased domestic travel, new store openings and a good

online and social media sales performance.

Revenue for the nine months ended 30 September 2020 totalled

€164 million, down 21.5% on a consolidated basis (down 21.1% like

for like).

Third-quarter 2020:

Third-quarter 2020 revenue for Other Activities came in at

€57 million, down 9.7% on a consolidated basis and down 9.6% like

for like.

The figures below are presented on a like-for-like basis.

The third-quarter performance at Lagardère News(2) (revenue down

8.7%) was mainly driven by the radio business, which reported 8.5%

revenue growth thanks to advertising slots taken up by announcers

during the summer.

In general however, advertisers have been cutting their press

advertising budgets, which has taken a toll on the press (down

14.5%) and international licensing (down 28.5%) businesses.

Lagardère Live Entertainment revenue fell 58.7% as health

measures severely restricted events at venues.

Revenue for the non-retained scope in the first nine months

of 2020 came in at €97 million, down 47.9% on a consolidated basis

and down 24.6% like for like. The scope impact relating to the

sale of TV Channels in September 2019 and of other digital assets

had a negative €58 million impact on revenue.

Third-quarter 2020:

Third-quarter 2020 revenue for the non-retained scope came in

at €34 million, down 27.7% on a consolidated basis (down 14.4% like

for like).

Lagardère Studios saw its revenue decline 14.4% as a result of

lower production activity levels in 2020 owing to Covid-19-related

health measures.

II. KEY EVENTS SINCE 30 JULY 2020

17 August 2020: Lagardère SCA announced a new strategic roadmap

to adjust to the impacts of the crisis and set up a stabilised and

reinforced governance team to implement it. Arnaud Lagardère was

re-appointed as Managing Partner for a period of four years, and a

Management Board was set up.

31 August 2020: the Supervisory Board of Lagardère SCA co-opted

Valérie Bernis as an independent member.

31 August 2020: the Managing Partners and Supervisory Board

rejected the joint request by Amber Capital and Vivendi to call an

extraordinary general meeting and initiated a dialogue with the

shareholders.

14 October 2020: Lagardère SCA welcomed the decision announced

by the President of the Paris Commercial Court (Tribunal de

Commerce de Paris), rejecting the request by Amber Capital and

Vivendi to call an extraordinary general meeting and reiterated its

desire to engage in a dialogue with the shareholders. Amber Capital

and Vivendi have appealed this decision.

15 October 2020: Sophie Stabile was appointed Chief Financial

Officer of the Lagardère group.

30 October 2020: the Lagardère group finalised the sale of

Lagardère Studios to Mediawan in accordance with the

previously-announced terms and conditions.

4 November 2020: Michel Defer, an employee of the Lagardère

Publishing division, joined the Supervisory Board of Lagardère SCA

as an employee representative member, on appointment by the Group

Employees’ Committee.

III. COVID-19: OUTLOOK AND LIQUIDITY

In light of the uncertain economic environment due to the

pandemic and particularly the difficulty in predicting the

conditions in which air travel will resume, the Group confirms that

it is withdrawing its recurring EBIT guidance published on 27

February 2020, which was suspended indefinitely on 25 March

2020.

The Company intends to pursue the shareholder dialogue initiated

in late August 2020, around the shared aim of ensuring that the

Group weathers this unprecedented crisis as well as possible and

emerges from it strengthened.

The sharp rebound in Lagardère Publishing sales that had been

observed in June 2020 as lockdown measures were eased continued

throughout the third quarter, albeit at a slightly more moderate

pace. This momentum was driven by high-quality publications in the

General Literature and Illustrated Books segments, despite a

downturn in Education and Partworks, thereby confirming the

resilience of Lagardère Publishing’s business model. However, the

Publishing business will be contending with an unfavourable

prior-year comparison basis in fourth-quarter 2020, due to the

absence of Asterix album releases (albums are only released every

other year). The lockdown measures announced recently in several

European countries will also affect sales in France and, to a

lesser extent, the United Kingdom.

In light of envisaged cost reductions and a favourable revenue

mix, Lagardère Publishing expects the adverse impact on full-year

2020 recurring EBIT to be in the region of 20% to 30% of the

decrease in its revenue.

The second wave of the Covid-19 pandemic has considerably

dampened the modest gradual upturn at Lagardère Travel Retail

observed at the start of the summer. Revenue in October 2020 is

expected to be down around 65% year on year. Trading volumes for

the last quarter of the year remain uncertain in light of travel

restrictions recently being strengthened by governments as the

pandemic spreads once again.

The division is continuing to implement cost cutting measures,

with major impacts on rents and payroll costs in particular. These

initiatives enable Lagardère Travel Retail to maintain the

assumption of an adverse impact on full-year 2020 recurring EBIT in

the region of 20% to 25% of the decrease in its 2020 revenue.

Liquidity

At 30 September 2020, the Group’s liquidity stood at €1,387

million, comprising €837 million in cash and cash equivalents and

an undrawn amount of €550 million on the €1,250 million renewable

credit facility granted by a syndicate of the Group’s banking

partners. The decrease of €84 million compared to end-June 2020

mainly results from a €139 million reduction in outstanding

commercial paper.

Note that the Group has been granted a waiver on the covenant

(leverage ratio) applicable to its renewable credit facility in

December 2020.

***

IV. APPENDICES

CHANGES IN SCOPE OF CONSOLIDATION AND EXCHANGE RATES

At 30 September 2020:

The difference between consolidated and like-for-like data is

attributable to a €11 million negative foreign exchange effect

resulting from the depreciation of the Polish zloty, Mexican peso

and Czech koruna, as well as to a €10 million positive scope

effect, breaking down as:

- a €69 million positive impact from acquisitions, carried out at

Lagardère Travel Retail (acquisition of IDF representing a positive

€47 million) and at Lagardère Publishing (mainly the acquisition of

Le Livre Scolaire representing a positive €11 million and of

Blackrock Games representing a positive €4 million);

- a €59 million negative impact from disposals, essentially TV

Channels and digital activities within the scope of the Group’s

strategic refocusing.

Third-quarter 2020:

The difference between consolidated and like-for-like data is

attributable to a €21 million negative foreign exchange effect

resulting from the depreciation of the US dollar and, to a lesser

extent, the Polish zloty, as well as to a €17 million positive

scope effect, breaking down as:

- a €25 million positive impact from acquisitions, carried out

mainly at Lagardère Travel Retail (acquisition of IDF representing

a positive €13 million) and at Lagardère Publishing (acquisition of

Le Livre Scolaire representing a positive €10 million and of

Blackrock Games representing a positive €2 million);

- a €8 million negative impact from disposals, essentially TV

Channels within the scope of the Group’s strategic refocusing.

V. GLOSSARY

Lagardère uses alternative performance measures which serve as

key indicators of the Group’s operating and financial performance.

These indicators are tracked by the Management Board in order to

assess performance and manage the business, as well as by investors

in order to monitor the Group’s operating performance, along with

the financial metrics defined by the IASB. These indicators are

calculated based on accounting items taken from the consolidated

financial statements prepared under IFRS and a reconciliation with

those items is provided in this press release or in the

Third-quarter 2020 Revenue presentation.

Like-for-like revenue is used by the Group to analyse revenue

trends excluding the impact of changes in the scope of

consolidation and in exchange rates.

The like-for-like change in revenue is calculated by

comparing:

- revenue for the period adjusted for

companies consolidated for the first time during the period and

revenue for the prior-year period adjusted for consolidated

companies divested during the period; - revenue for the prior-year

period and revenue for the current period adjusted based on the

exchange rates applicable in the prior-year period.

The scope of consolidation comprises all fully-consolidated

entities. Additions to the scope of consolidation correspond to

business combinations (acquired investments and businesses), and

deconsolidations correspond to entities over which the Group has

relinquished control (full or partial disposals of investments and

businesses, such that the entities concerned are no longer included

in the Group’s financial statements using the full consolidation

method).

The difference between consolidated and like-for-like figures is

explained in section IV - Appendices of this press release.

- Recurring EBIT (Group recurring EBIT)

The Group's main performance indicator is recurring operating

profit of fully consolidated companies (recurring EBIT), which is

calculated as follows:

Profit before finance costs and tax

Excluding:

• Income (loss) from equity-accounted companies before

impairment losses

• Gains (losses) on disposals of assets

• Impairment losses on goodwill, property, plant and equipment,

intangible assets and investments in equity‑accounted companies

• Net restructuring costs

• Items related to business combinations:

- Acquisition-related expenses - Gains and

losses resulting from purchase price adjustments and fair value

adjustments due to changes in control - Amortisation of

acquisition-related intangible assets

• Specific major disputes unrelated to the Group's operating

performance

• Items related to leases and finance sub-leases:

- Cancellation of fixed rental expense* on

concession agreements - Depreciation of right-of-use assets on

concession agreements - Gains and losses on lease modifications

under concession agreements

* Cancellation of fixed rental expense is equal to the repayment

of the lease liability, the associated change in working capital

and interest paid in the statement of cash flows.

Flow through is calculated by dividing the change in recurring

operating profit of fully-consolidated companies (recurring EBIT)

by the change in revenue. This indicator is used by the Group in

the context of the Covid-19 pandemic to measure the effect of the

decline in revenue on recurring EBIT.

***

A live webcast of the third-quarter 2020

revenue presentation will be available today at 10:00 a.m. (CET) on

the Group’s website (www.lagardere.com).

The presentation slides will be made

available at the start of the webcast.

A replay of the webcast will be available

online later in the afternoon.

***

Created in 1992, Lagardère is an international group with

operations in more than 40 countries worldwide. It employs over

30,000 people and generated revenue of €7,211 million in 2019.

In 2018, the Group launched its strategic refocusing around two

priority divisions: Lagardère Publishing (Book and e-Publishing,

Mobile and Board games) and Lagardère Travel Retail (Travel

Essentials, Duty Free & Fashion, Foodservice).

The Group’s operating assets also include Lagardère News and

Lagardère Live Entertainment.

Lagardère shares are listed on Euronext Paris.

www.lagardere.com

Important notice:

Some of the statements contained in this document are not

historical facts but rather are statements of future expectations

and other forward-looking statements that are based on management’s

beliefs. These statements reflect such views and assumptions

prevailing as of the date of the statements and involve known and

unknown risks and uncertainties that could cause future results,

performance or future events to differ materially from those

expressed or implied in such statements.

Please refer to the most recent Universal Registration Document

filed in French by Lagardère SCA with the Autorité des marchés

financiers for additional information in relation to such factors,

risks and uncertainties.

Lagardère SCA has no intention and is under no obligation to

update or review the forward-looking statements referred to above.

Consequently Lagardère SCA accepts no liability for any

consequences arising from the use of any of the above

statements.

1 On a like-for-like basis versus third-quarter 2019. 2 Paris

Match, Le Journal du Dimanche, Europe 1, Virgin Radio, RFM and the

Elle brand licence.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20201104005805/en/

Press Contacts Thierry

Funck-Brentano Tel. +33 1 40 69 16 34 tfb@lagardere.fr

Ramzi Khiroun Tel. +33 1 40 69 16 33 rk@lagardere.fr

Investor Relations Contacts

Emmanuel Rapin Tel. +33 1 40 69 17 45 erapin@lagardere.fr

Alima Lelarge Levy Tel. +33 1 40 69 19 22

alelargelevy@lagardere.fr

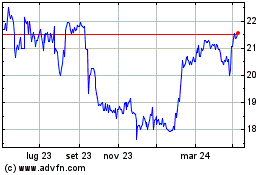

Grafico Azioni Lagardere (EU:MMB)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni Lagardere (EU:MMB)

Storico

Da Apr 2023 a Apr 2024