Imperial Brands 1st Half Pretax Profit Fell; Cuts Dividend by Third

19 Maggio 2020 - 8:58AM

Dow Jones News

By Joe Hoppe

Imperial Brands PLC said Tuesday that pretax profit fell while

revenue increased in the first half of fiscal 2020, and that it has

cut its annual dividend by one-third.

The tobacco company--which houses Davidoff, Gauloises and JPS

among its brands--said that for the six months ended March 31,

pretax profit fell to 785 million pounds ($953.7 billion) compared

with GBP1.02 billion a year earlier.

Revenue for the period was GBP14.7 billion, compared with

GBP14.39 billion the year before. The company said net revenue was

driven by strong growth in its next-generation products and a solid

underlying tobacco performance.

Total tobacco volume fell to 114.6 billion stick equivalents

compared with 115.2 billion stick equivalents in the first half of

the previous fiscal year.

The group said tobacco and next generation product net revenue

fell 0.9% to GBP3.59 billion from GBP3.65 billion.

The company declared an interim dividend of 41.7 pence, a 33.3%

fall on the year before.

Chief Executive Alison Cooper said that while it had delivered

against revised expectations, the company was disappointed with the

results and was focusing on opportunities to improve

performance.

Imperial Brands added that coronavirus had only had a minor hit

to trading, but that it expects a greater hit in the second

half.

Write to Joe Hoppe at joseph.hoppe@wsj.com

(END) Dow Jones Newswires

May 19, 2020 02:43 ET (06:43 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

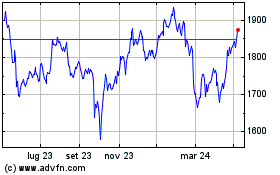

Grafico Azioni Imperial Brands (LSE:IMB)

Storico

Da Mar 2024 a Apr 2024

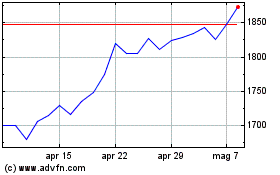

Grafico Azioni Imperial Brands (LSE:IMB)

Storico

Da Apr 2023 a Apr 2024