TIDMIGV

RNS Number : 1466I

Income & Growth VCT (The) PLC

10 December 2020

THE INCOME & GROWTH VCT PLC

LEI: 213800FPC15FNM74YD92

ANNUAL FINANCIAL RESULTS OF THE COMPANY FOR THE YEARED 30 SEPTEMBER

2020

The Income & Growth VCT plc (the "Company") announces the final results

for the year ended 30 September 2020. These results were approved by

the Board of Directors on 9 December 2020.

You may, in due course, view the Annual Report & Financial Statements,

comprising the statutory accounts of the Company by visiting www.incomeandgrowthvct.co.uk

.

FINANCIAL HIGHLIGHTS

As at 30 September 2020:

Net assets: GBP83.13 million

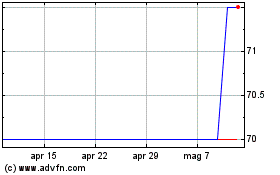

Net asset value ("NAV") per share: 70.06 pence

- Net asset value ("NAV") total return(1) per share was 11.9%.

- Share price total return(1) per share was 3.3%(2) .

- Dividends paid in respect of the year total 14.00 pence per share.

This brings cumulative dividends paid(1) to Shareholders in respect of

the past five years to 57.00 pence per share.

- The Company realised investments totalling GBP17.60 million of cash

proceeds and generated net realised gains in the year of GBP6.42 million.

- GBP8.39 million was invested into five new companies and four follow-on

investments.

1 - Definitions of key terms and alternative performance measures shown

above and throughout this report are provided in the Glossary of terms

within the Annual Report & Financial Statements.

2 - Further details on the share price total return are shown in the

Performance section of the Strategic Report within the Annual Report

& Financial Statements.

PERFORMANCE SUMMARY

The table below shows the recent past performance of the Company's existing

class of shares for each of the last five years.

R Net NA V Share Cumulative Cumulative Dividends

eporting assets per price dividends total paid and

date share 1 paid per return per proposed

share

to

Shareholders

2

share (NA V (Share per share

As at basis) price in

basis) respect of

each year

--------------- ------------- ------------- ---------------- -------------------- -----------------------

30 September (GBPm) (p) (p) (p) (p) (p) (p)

------------- ------------- ---------------- -------------------- -----------------------

201.56 191.

2020 83. 13 70.06 59.50 131.50 00 14. 00

------------- ------------- ---------------- -------------------- -----------------------

75.50 192. 12

2019 81.73 79 .12 3 113. 00 188.50 6. 00

------------- ------------- ---------------- -------------------- -----------------------

186.32 177

2018 82.58 78.32 69.50 108. 00 .50 6. 00

------------- ------------- ---------------- -------------------- -----------------------

183.74

2017 64.35 81.24 73.00 102.50 175.50 21. 00

------------- ------------- ---------------- -------------------- -----------------------

179 . 01

2016 70.84 98.51 88.80 80.50 169 .30 1 0.0 0

------------- ------------- ---------------- -------------------- -----------------------

1 Source: Panmure Gordon & Co (mid-market price).

2 Cumulative total return per share comprises the NAV per share (NAV

basis) or the mid-market price per share (share price basis) plus cumulative

dividends paid since launch of the current share class. The details of

the share price total return per share calculation are shown within the

Annual Report & Financial Statements.

3 The share price at 30 September 2019 has been adjusted to add back

the dividend of 4.50 pence per share paid on 18 October 2019, as the

listed share price was quoted ex this dividend at this year-end.

Detailed performance data for each of the VCT's fundraisings is provided

in the Performance Data Appendix within the Annual Report. The tables,

which give cumulative total return per share information for each allotment

date on both a NAV and share price basis, are also available on the Company's

website at www.incomeandgrowthvct.co.uk where they can be downloaded

by clicking on "table" in "Reviewing the performance of your investment".

CHAIRMAN'S STATEMENT

I am pleased to present the Annual Report of the Company for the financial

year ended 30 September 2020.

Chairman's Introduction

This is my first Statement to Shareholders since succeeding Jonathan

Cartwright as Chairman on 1 July 2020. I would like to thank Jonathan

on your behalf, for the excellent service he provided to Shareholders

during his tenure as a Director and latterly as interim Chairman.

Overview

This year has been a positive one for Shareholders, despite the significant

and exceptional challenges caused by the outbreak of COVID-19 since late

February 2020. Your Company's NAV total return per share increased in

the year by 11.9%.

Before this outbreak, the Company completed a timely and successful fundraising

ensuring the Company remained well-funded. In the same period, performance

had started strongly, as the portfolio made further progress and three

profitable realisations were achieved. One exit was from one of the most

successful investments the Company has made while the two others were

the first profitable exits of growth capital investments (which have

been the only permitted category of investment the VCT can make since

the VCT rule changes in 2015).

Shortly before the mid-point of the Company's year, the COVID-19 pandemic

and the UK Government's lockdown measures provoked substantial uncertainty

and instability. There was a significant decline in consumer and business

confidence and public markets saw a sharp fall in March.

The immediate impact of the COVID-19 crisis for Shareholders was a fall

in portfolio values at the end of March, based on best knowledge at that

uncertain time. These adjustments were partly market related, but mainly

in response to the Investment Adviser's assessment of COVID-19's actual

and potential impact on specific market segments and investee companies.

As the year progressed, greater clarity has emerged. The environment

for most of our investee companies has been less volatile and less uncertain

than initially assumed last March, but critically, also more robust and

favourable trading conditions emerged, such that the valuation of the

portfolio has recovered strongly over the six months to 30 September

from its March low point. Whilst the second lockdown and potential further

restrictions may impact the portfolio going forward, overall, your Board

is pleased with how well so many portfolio companies have been able to

capitalise on opportunities presented and with the performance achieved.

Despite the considerable COVID-19 related restrictions on its ability

to process transactions efficiently, the Company remained an active investor

during the year. Several profitable realisations occurred, being the

primary driver of shareholder value for the year. New and follow-on investment

activity was strong considering the circumstances and resulted in nine

transactions to support further growth in these companies. Both the portfolio

valuation changes and investment movements are discussed in the Investment

Portfolio section below and further details are also provided in the

Investment Adviser's Review.

Performance

The year's key events summarised above saw an overall increase in the

Company's NAV total return per share of 11.9% (2019: 7.4%). This was

due to a strong revenue return, substantial realised gains on disposals

and net gains in portfolio valuations for the year. These factors are

explained in further detail in the Company's Strategic Report and Investment

Adviser's Review.

The Board believes that the Company's performance has demonstrated resilience

in a volatile year and that the valuations at the year-end reflect the

responses to the pandemic and the potential to continue making progress,

despite continued uncertainty in respect of the pandemic's impact.

The share price total return for the year was 3.3% (2019: 15.8%), compared

to the NAV return of 11.9%. This difference arises principally due to

the timing of NAV announcements and is explained more fully in the Strategic

Report within the Annual Report & Financial Statements, under Performance.

At the year-end, your Company was ranked 1st out of 31 Generalist VCTs

over ten years and 16th out of 42 Generalist VCTs over five years, in

the Association of Investment Companies' analysis of NAV Cumulative Total

Return. Shareholders should note that these figures do not reflect the

NAV per share disclosed in this Report. For further details on the performance

of the Company, please refer to the Investment Adviser's Review within

the Annual Report & Financial Statements.

Dividends and Dividend Investment Scheme

A total of 18.50 pence has been paid in dividends during the year although

4.50 pence related to a dividend declared for the previous financial

year. The two interim dividends paid of 3.00 and 11.00 pence per share

in respect of the current year were paid on 10 July and 28 September

2020 respectively.

The Company's Dividend Investment Scheme ("DIS") was re-activated following

the Annual General Meeting ("AGM") held in February 2020 and Shareholders

wishing to take advantage of this seamless method of continuing investment,

and the resultant tax relief, can elect to join the DIS at any time by

instructing the Registrar, Link Asset Services, whose details are contained

within the Annual Report & Financial Statements or by completing the

mandate form available on the Company's website: www. incomeandgrowthvct.co.uk.

Shareholders should note that an election must be registered at least

15 days prior to a dividend payment, for inclusion in the DIS. A total

of 4,277,951 new Ordinary shares were allotted under the DIS scheme,

subject to listing, throughout the year.

The Company's target of paying a dividend of at least six pence per share

in respect of each financial year has been reached or exceeded in each

of the last nine years. As Shareholders have been advised previously,

both the gradual move of the portfolio to younger growth capital investments,

and the realisations of older companies that have provided a good yield,

are likely to make dividends harder to achieve from income and capital

returns alone in any given year. Accordingly, the Board continues to

monitor the sustainability of this target. Also, Shareholders should

note that there may continue to be circumstances where the Company is

required to pay dividends in order to maintain its regulatory status

as a VCT, for example, to stay above the minimum percentage of assets

required to be held in qualifying investments. Such dividends may cause

the Company's NAV per share to reduce by a corresponding amount.

Investment portfolio

In the context of the continuing challenging business environment, the

portfolio has performed strongly. The overall value has increased by

GBP9.85 million (2019: increase of GBP4.93 million), or 19.6% (2019:

increase of 10.0%) on a like-for-like basis, compared to the start of

the year. This increase was comprised of GBP6.42 million in realised

gains over the year and a net unrealised increase in valuations of GBP3.43

million. The portfolio was valued at GBP50.86 million at the year-end

(30 September 2019: GBP50.22 million).

Clearly, COVID-19 has been the dominant influence on the portfolio and

its valuations over the second half of the year. During this unprecedented

time, the Board liaised closely with the Investment Adviser, who ensured

that all practical steps were taken to enable each portfolio company

to trade through the crisis where possible and return to growth in value

thereafter. All investee companies were alerted to, and some utilised,

the available government support packages. The Company has also provided

loan interest payment holidays to some portfolio companies, generating

vital cash headroom for certain companies in the portfolio over the subsequent

half-year.

The sudden imposition of lockdown on UK business created immediate volatility

and uncertainty. However, once the immediate impact subsided, its continuing

influence on business generally and portfolio companies specifically

was able to be far better understood. It is pleasing that this impact

has been far less negative than was initially expected. This, combined

with trading levels achieved by some companies, has caused many valuations

to achieve not just a substantial recovery, but in some cases to reach

higher valuations. Several portfolio companies have greatly benefited

from a structural change in activity, behaviour and consumer purchasing

habits, and are now trading at or above their pre COVID-19 levels. The

majority of the portfolio has demonstrated a strong degree of resilience

with over two-thirds of the portfolio value showing year to date growth

in revenue and/or earnings over the previous year. A further beneficial

factor is the portfolio's relatively limited exposure to the travel and

hospitality sectors with the great majority of the retail sector exposure

being to online business models (of the nine investments in retail, only

the smallest, held at nil value, has a physical presence).

Although quoted markets have also been rallying since March, it is noteworthy

that the principal driver of the rise in valuations over the recent half-year

reflects strong earnings growth at many investee companies. On the other

hand, some companies have clearly struggled, although they are in the

minority and their impact on overall shareholder return is modest.

The portfolio movements across the year were as follows:

GBPm

P ortfolio value at 30 September

2019 50.22

---------

New and follow-on investments 8.39

---------

Disposal proceeds (17. 60)

---------

Net realised gains 6.42

---------

V aluation movements 3.43

---------

Portfolio value at 30 September

2020 50.86

---------

During the year, the Company invested a total of GBP8.39 million (2019:

GBP5.08 million) into five new (2019: three) and four existing (2019:

three) portfolio investments.

The new investments were:

Active Navigation GBP1.54 million

A provider of en t er pri se-

l evel fil e analysis so ft w

ar e

IPV GBP0.95 million

A developer of media asset man

agement so ft w ar e

B leach London GBP0.72 million

Direct to consumer h air care

brand

B ella & Duke GBP0.93 million

A premium fr o z e n raw d og

food provider

Andersen E V GBP 0.32 million

An el ec tri c vehicl e charge

point business

and f o ll ow-o n amounts into

e xisting inv es tments:

Rot ageek GBP0.63 million

A workforce management so ft w

ar e pr ovider

MyTutor GBP 0.98 million

A digital marketplace for school

tutoring

Bust er & Punch GBP1.54 million

A lightin g and interiors brand

Preservica GBP0.78 million

A seller of p ropri e t a r y

digital archi ving so ft w ar

e

These businesses may present opportunities for further investment in

the future as they may require further capital to realise their plans

to expand.

The Company realised investments in Redline, Biosite, Auction Technology

Group, Access IS and Blaze Signs during the year which, combined with

loan repayment and other capital receipts, generated total proceeds of

GBP17.60 million. The first half of the year saw the realisations of

two growth capital investments, Redline Worldwide and Biosite, generating

proceeds of GBP1.53 million and GBP2.65 million respectively, realising

a combined gain in the year of GBP0.98 million. Over the life of these

investments, Redline generated a multiple on cost of 1.7x and an IRR

of 17.7% and Biosite generated a multiple on cost of 1.5x and an IRR

of 21.0%.

In addition, the sale of Auction Technology Group ("ATG") achieved a

substantial gain over cost and represented proceeds of GBP4.19 million

and a gain of GBP1.56 million for the year. Over the life of the investment,

total proceeds of GBP9.04 million have been received, an overall multiple

of over 4.5x original cost and an IRR of 28.9%, an outstanding result

for Shareholders.

The second half of the year saw the realisations of Access IS and Blaze

Signs. Access IS generated cash of GBP8.38 million, a return of 2.5x

and an IRR of 23.4% over the life of the investment and its completion

resulted in a gain of GBP3.00 million in the year. Blaze Signs generated

GBP3.39 million over the life of the investment, a 2.5x return and an

IRR of 13.1% and its completion resulted in a gain of GBP0.13 million.

After the year-end, the sale of Vectair realised cash receipts of GBP1.10

million which over the nearly 15 year life of the investment contributed

to a multiple on cost of 8.3x and an IRR of 22.2%. In isolation, this

would result in an uplift of 0.07 pence per share over the 30 September

2020 NAV of 70.06 pence per share. Further proceeds may be receivable

in due course.

Other loan repayments and other capital proceeds of GBP1.34 million and

net realised gains of GBP0.75 million were principally generated from

Omega Diagnostics, which was partially realised in several phases during

the year.

Revenue account

The results for the year are set out in the Income Statement within the

Financial Statements and show a revenue return (after tax) of 2.07 pence

per share (2019: 1.80 pence per share). The revenue return of GBP2.32

million for the year has increased from last year's comparable figure

of GBP1.87 million. This increase is mainly due to a significant receipt

of loan interest arising from the sale of ATG, partially offset by a

number of provisions against loan interest.

Industry and Regulatory Changes

Although no further changes have emerged in the year, a previous change,

already announced, whereby 80% (previously 70%) of the Company's total

investments must now be in qualifying investments, applied to the Company

from 1 October 2019. The Board has therefore ensured that this requirement

has been met throughout the year under review.

Fundraising

The Board was pleased with the response to the Company's Offer for Subscription

("the Offer") which was launched during this financial year on 25 October

2019. This Offer became fully subscribed within two months and raised

GBP10 million in total, made up of the initial GBP5 million limit, and

the GBP5 million over-allotment facility. In accordance with the Offer's

prospectus, all the shares in the Company were allotted under the Offer

on 8 January 2020. The Board thanks Shareholders for their continued

support and extends a warm welcome to all new investors.

Share buy-backs

During the year, the Company bought back and cancelled 1,858,177 (2019:

2,135,527) of its own shares, representing 1.8 % (2019: 2.0%) of the

shares in issue at the beginning of the year, at a total cost of GBP1.24

million (2019: GBP1.47 million) inclusive of expenses. It is the Company's

policy to cancel all shares bought back in this way. The Board regularly

reviews its buyback policy and currently seeks to maintain the discount

at which the Company's shares trade at no more than 5% below the latest

published NAV.

Liquidity

Following the Company's successful fundraising, the re-introduction of

the DIS and realisation proceeds, cash or near cash resources held by

the Company as at 30 September 2020 were GBP32.19 million or 38.7% of

net assets.

At the date of this report pro forma cash and liquid assets amount to

GBP33.50 million or 40.3% of net assets, following post year-end disposals.

The Board considers the Company to have the advantage of a strong cash

position.

Shareholder communications

May I remind you that the Company has its own website containing useful

information for Shareholders. The Investment Adviser held the annual

Shareholder event on 4 February 2020 and is planning to hold a virtual

event later during 2021. Details will be notified to Shareholders once

finalised and will be shown on the Company's website: www.incomeandgrowthvct.co.uk

.

Fraud Warnings

Boiler Room Fraud

We have been made aware of an increase in the number of Shareholders

being contacted in connection with sophisticated but fraudulent financial

scams which purport to come from the Company or to be authorised by it.

This is often by a phone call or an email usually originating from outside

of the UK, often claiming or appearing to be from a corporate finance

firm offering to buy your VCT shares at an inflated price.

Further information and fraud advice plus details of who to contact,

can be found in the Information for Shareholders section within the Annual

Report & Financial Statements.

Protect against identity fraud

Shareholders are also encouraged to ensure their personal data is always

held securely and that data held by the Registrar of the Company is up

to date, to avoid cases of identity fraud.

Environmental, Social and Governance

Your Board would like to reassure Shareholders that it takes these issues

seriously, and future reporting will cover them in more detail. Further

reporting and procedural requirements for these increasingly important

issues required by current and future regulation should enable the Board

to provide concise information and implement further processes, both

relevant to the Company and, correspondingly, useful to stakeholders.

These objectives do require that regulations are measured, proportionate

and cost-effective to introduce.

Annual General Meeting

The next Annual General Meeting of the Company will be held at 11.00

am on Wednesday, 10 February 2021. Shareholders should note that it is

likely that physical meetings may still not be permitted due to the UK

Government's COVID-19 restrictions and therefore Shareholders would not

be allowed to attend the AGM in person. In planning our AGM we have sought

to prioritise the safety and wellbeing of our Shareholders and all attendees.

In light of the current COVID-19 measures in England, and the legislative

measures that have been proposed to allow companies to hold general meetings

safely, the AGM will, therefore, be held as a closed virtual meeting

with Shareholders able to join the meeting as attendees by electronic

means via MS Teams with the Board and Investment Adviser shown on the

screen. A link to attend the meeting is available on pages 36, 76 and

78 of the Annual Report & Financial Statement and on the Company's website

at www.incomeandgrowthvct.co.uk under the AGM bubble on the front page.

You do not need to download MS Teams or have a MS Teams account to access

the event. The meeting will also be accessible by telephone conference

call for those without a suitable device and/or WiFi connection. Once

the formal business of the meeting is concluded, a presentation by the

Investment Adviser will commence followed by Shareholders' questions.

Shareholders will not be able to vote at the meeting. Voting will be

conducted by way of a poll, by the quorum of members, of all the valid

proxy votes lodged. The Board encourages Shareholders to submit their

vote by proxy either by completing and returning the form enclosed or

proxy votes may also be submitted electronically via the Link Shareholder

portal at: www.signalshares.com . Votes must arrive at the Registrar

48 hours before the meeting to be valid. The Notice of the meeting is

included within the Annual Report & Financial Statements and an explanation

of the resolutions to be proposed can be found in the Directors' Report.

Shareholders can also submit any questions about the resolutions to be

passed at the AGM by using the agm@mobeus.co.uk email address and a response

will be provided prior to the deadline for lodging proxy votes. You can

also register any questions for the AGM using the same email address

or using the question facility during the meeting.

Outlook

The impact of COVID-19 was and will continue to be immediate and wide

reaching. Nevertheless, your Board considers that your Company is well

positioned to continue to respond and adapt in most likely scenarios

in so far as they can presently be foreseen. The successful realisations

and earlier fundraising have given the Company strong liquidity not only

to support the existing portfolio as appropriate, but also to capitalise

on opportunities which may arise for new investment. The portfolio still

retains a foundation of mature investments that are providing an income

return, but also an increasing proportion of younger, growth capital

investments seeking to achieve further scale, higher levels of profitability

and value. The year-end valuations reflect strong performance by many

investees in the second half of the year and a robust and well-funded

portfolio, well equipped to meet an uncertain environment.

The results achieved for the year reflect the growth and valuation increases

across the portfolio, underpinned by the successful realisations. The

Investment Adviser is seeing a good pipeline of interesting new investment

opportunities. Furthermore, as BREXIT negotiations continue unresolved

they cause global market economies to be nervous and volatile. UK and

European businesses in particular will therefore continue to operate

in an uncertain trading environment for the foreseeable future. Although

the degree and frequency of future lockdown and other restrictions to

the UK economy is unclear, both the Investment Adviser and portfolio

companies are well equipped to respond accordingly. On all fronts, we

have cause to be cautiously optimistic.

I would like to take this opportunity once again to thank all Shareholders

for their continued support and hope you and your families remain healthy

and well.

Maurice Helfgott

Chairman

9 December 2020

INVESTMENT POLICY

The Company's policy is to invest primarily in a diverse portfolio of

UK unquoted companies.

Asset Mix and Diversification

The Company will seek to make investments in UK unquoted companies in

accordance with the requirements of prevailing VCT legislation.

Investments are made selectively across a wide variety of sectors, principally

in established companies.

Investments are generally structured as part loan and part equity in

order to receive regular income and to generate capital gain from realisations.

There are a number of conditions within the VCT legislation which need

to be met by I&G and which may change from time to time.

No single investment may represent more than 15% (by VCT tax value) of

the Company's total investments at the date of investment.

Save as set out above, the Company's other investments are held in cash

and liquid funds.

Liquidity

The Company's cash and liquid funds are held in a portfolio of readily

realisable interest-bearing investments, deposit and current accounts,

of varying maturities, subject to the overriding criterion that the risk

of loss of capital be minimised.

Borrowing

The Company's Articles of Association permit borrowing of up to 10% of

the adjusted capital and reserves (as defined therein). However, the

Company has never borrowed and the Board would only consider doing so

in exceptional circumstances.

INVESTMENT ADVISER'S REVIEW

COVID-19 Pandemic

The Company's year started well with strong portfolio performance and

some high-quality realisations being seen. Six months into the year,

in March 2020, the UK Government introduced lockdown and social distancing

measures in response to the COVID-19 pandemic.

These measures had an immediate adverse impact on UK businesses, with

many companies experiencing a significant reduction in consumer and business

demand, restrictions on employees' working practices and disruption to

their supply chains. Global markets fell significantly as a result.

Following the low point in March, there has been a significant and pleasing

bounce-back with recovery in portfolio trading levels. There are still

uncertainties ahead, particularly the second wave of the COVID-19 pandemic

and BREXIT, but the portfolio is in robust shape, following the experience

gained and the opportunities taken over the last six months, to withstand

and respond to these as yet uncertain developments in future.

At all times during the pandemic, the Investment Adviser has reviewed

and evaluated the impact of COVID-19 on each sector exposure and on the

value of the portfolio, and appropriate action taken. Mobeus has and

continues to review the opportunities for new and follow-on investments

and is in a position to capitalise as and when needed via the Company's

relatively high liquidity levels. Over the most recent months, investment

in new opportunities has been relatively low as entrepreneurs temporarily

deferred fundraising but there is now a healthy pipeline of suitable

opportunities which are being evaluated.

The level of portfolio follow-on investment has indicated there are

opportunities to back proven portfolio companies that are achieving strong

relative performance. The realisation activity outlook continues to be

positive with approaches received from trade and financial investors

to several investee companies.

Overall, the portfolio is robust and the Investment Adviser is mindful

of the uncertain future but remains optimistic on the basis of recent

evidence of trading performance and potential growth within the portfolio.

Portfolio review

Prior to the emergence of the COVID-19 pandemic, there was some very

positive progress within the portfolio, particularly with respect to

exits such as Auction Technology Group, Redline Worldwide and Biosite.

At the half-year stage, and at the height of the pandemic uncertainty,

many valuation reductions were applied to the portfolio which reflected

the initial drop in revenues, stock market movements and included COVID-19

specific adjustments given the uncertain outlook. In the second half

of the year, the portfolio experienced a significant bounce-back such

that for the year as a whole the value of the portfolio increased by

GBP9.85 million, comprising an increase of GBP3.43 million in the unrealised

portfolio and gains of GBP6.42 million through realisations.

It is important to note that the usual approach to portfolio valuation

by the Investment Adviser continued to be applied throughout this uncertain

period. The second half-year recovery is attributable to trading improvement

achieved by many portfolio companies, against a backdrop of improved

market sentiment. The removal of unused COVID-19 related adjustments

that were put in place during March, and improved cash generation, were

also contributing factors. Some portfolio companies, often with online

business models, have traded strongly throughout the latter half of the

year. Whilst it is still early to be certain, there is evidence that

a degree of structural change to consumer purchasing habits has occurred,

which should underpin strong performance in future under the "new normal".

The second half of the year, benefited from further valuation increases

and continued a strong run of realisations with further gains generated

from the exits of Access IS and Blaze.

Activity in the year is summarised as follows:

2020 2019

GBPm GBPm

Opening portfolio value 50 .22 49.40

--------------------------------- --------- -------

New and further 8.39 5.08

investments

Disposal proceeds (17. 60) (9.19)

Net realised gains 6.42 3.15

V aluation movements 3.43 1.78

--------------------------------- --------- -------

Portfolio value at 30 September 50.86 50.22

--------------------------------- --------- -------

The Company made new and follow-on investments totalling GBP8.39 million,

which is particularly pleasing given that there was effectively a temporary

pause in new investment going into the summer months. The Company invested

GBP4.46 million into five new growth companies, including one since the

onset of the COVID-19 pandemic. GBP3.93 million was invested into four

existing portfolio companies to allow them to capitalise on further growth

opportunities. The details of these investments are shown within the

Investment Review section of the Annual Report & Financial Statements.

The Company realised its investments in Redline, Biosite, Auction Technology

Group, Access IS and Blaze Signs during the year, receiving a total of

GBP16.25 million in proceeds, and contributing to total receipts of GBP17.60

million during the year. The details are set out below:

In December, the Company realised GBP1.53 million from its first growth

capital investment made under the new VCT rules, Redline Worldwide, generating

a gain of GBP0.98 million in the year. Over the time that this investment

was held, a multiple of proceeds over cost of 1.7x and an IRR of 17.7%

has been achieved to date.

In February, Auction Technology Group was sold and generated proceeds

over the life of the investment of GBP9.04 million compared to an original

cost of GBP2.00 million, a multiple on cost of 4.5x and an IRR of 28.9%

over the 11 1/2 years this investment was held - an exceptional return

for Shareholders.

Also in February, the investment in Biosite was realised, generating

proceeds of GBP2.77 million over the life of the investment, representing

a profit over cost of GBP0.98 million and contributing to a gain over

original cost of 1.5x and an IRR of 21.0%.

In August, the realisation of Access IS provided total proceeds over

the life of the investment of GBP8.38 million representing a profit over

cost of GBP5.06 million and a gain over original cost of 2.5x with an

IRR of 23.4%.

Finally, in September, the Blaze Signs exit contributed to total proceeds

of GBP3.39 million over the life of the holding, contributing to a gain

over cost of GBP2.06 million, representing 2.5x and an IRR of 13.1%.

Following the year-end, the realisation of Vectair contributed to total

proceeds received over the life of the investment of GBP1.79 million,

generating a multiple over cost of 8.3x and an IRR of 22.2%.

Also during the year and following a significant increase in its share

price, the Company received GBP1.05 million from the partial realisations

of its holding in Omega Diagnostics. This represented a realised gain

of GBP0.85 million for the year and contributed to an attractive return

to date of 5.3x multiple on cost and based upon the valuation at the

year-end has achieved an IRR to that date of 19.1%.

This investment has secured a strong positive return to date but maintains

a degree of potential upside through the residual holding.

The investment and divestment activity during the year increased the

proportion of the portfolio regarded as growth capital investments by

value to 74.6% at the year-end (30 September 2019: 59.2%). The portfolio

(including legacy and AIM investments) had decreased from 41 to 40 investments

at the year-end.

The portfolio's contribution to the overall results of the Company is

summarised below:

Investment Portfolio Capital Movement 2020 2019

GBPm GBPm

------------------------------------------- -------- --------

Increase in the value of 10.16 6.69

unrealised investments

------------------------------------------- -------- --------

Decrease in the (6.73) (4.91)

value of unrealised

investments

Net increase in the value of unrealised

investments 3.43 1 .7 8

------------------------------------------- -------- --------

Realised gains 6.53 3 . 1 5

Realised losses (0 .11) -

------------------------------------------- -------- --------

3 . 1

Net realised gains in the year 6.42 5

------------------------------------------- -------- --------

Net investment portfolio capital movement

in the year 9.85 4.93

------------------------------------------- -------- --------

Valuation changes of portfolio investments still held

The strength of the valuation increases in the second half-year was primarily

driven by the Company's growth portfolio, many of which have Direct-to-Consumer

business models that have been ideally suited to the more physically

remote business environment under COVID-19. Mobeus believes that this

has accelerated an existing trend and in many cases the shift in behaviours

will prove permanent. Over this period, some older style MBO portfolio

companies with similar business practices have also benefited.

Despite much of the portfolio performance being positive, a few companies

have struggled in this environment, although in most cases, these businesses

were already struggling pre-COVID-19. While there remains a possibility

such businesses will fail, their value has already been reduced to modest

levels, reducing their risk to future shareholder value. The details

of valuation increases and reductions are explained below.

Within total valuation decreases of GBP(6.73) million, the main reductions

were CGI Creative Graphics International - GBP(1.59) million, Tapas Revolution

- GBP(1.33) million, and Media Business Insight (MBI) - GBP(1.25) million.

These companies saw some of the most significant impact of a sudden decline

in demand for their products or services which, even when restrictions

are eased, may take time for value to recover.

By contrast some investee companies' trading has benefited greatly from

the lockdown. The main valuation increases include Virgin Wines - GBP3.04

million, Active Navigation - GBP1.54 million, Parsley Box - GBP1.24 million

and MPB Group- GBP0.84 million. Virgin Wines, Parsley Box and MPB have

generated record earnings and revenues over the lockdown period and beyond.

All have significantly increased their customer base and there is evidence

that these new customers are continuing to be at least as active and

profitable as their pre-COVID-19 customers. Active Navigation has benefited

from its strong levels of recurring revenues.

The majority of the increase in portfolio value lies in the top 10 companies

which represent nearly 70% of the portfolio by value. Year-on-year growth

by either revenues or earnings has been seen in nine of the top ten companies

and it is pleasing to note that eight of these are from the younger,

growth portfolio. The significant value and performance growth has contributed

to the resilience of the portfolio, reflecting investment by the Company

in strong Direct-to- Customer business models or those that have adapted

to them.

The year also saw portfolio companies, Jablite and Oakheath (formerly

Super Carers) entering voluntary liquidation. These two companies were

struggling before the impact of COVID-19. Valuation reductions for these

companies had already been made, so there has been little impact on shareholder

value from these administration processes.

Investment portfolio yield

During its financial year, the Company received the following amounts

in interest and dividend income:

Investment Portfolio Yield 2020 2019

GBPm GBPm

--------------------------------------- ------ ------

Interest received in the year 2.66 2.64

Dividends received in the year 0 .84 0.26

--------------------------------------- ------ ------

Total portfolio income in the year(1) 3.50 2.90

--------------------------------------- ------ ------

Portfolio value at 30 September 50.86 50.22

--------------------------------------- ------ ------

Portfolio Income Yield (Income as a

% of Portfolio value at

30 September) 6.9% 5.8%

1 Total portfolio income in the year is generated solely from investee

companies within the portfolio. See Note 3 of the Financial Statements

for all income receivable by the Company. The increase in income was

mainly due to interest of GBP1.09 million received on the loan instruments

in Auction Technology Group being paid, as part of the sale transaction,

which had not previously been recognised. Portfolio yield is expected

to fall for the foreseeable future, as the growth portfolio's returns

are likely to be more capital in nature.

Environmental, Social, Governance considerations

The Investment Adviser and the Board have discussed an appropriate framework

within which to assess progress on these matters within the existing

portfolio. The Investment Adviser is encouraging this matter to be a

standing agenda item at investee company board meetings. It will continue

to be an important consideration in our assessment of new investment

opportunities.

Outlook

The portfolio is in a good position with many companies trading well

during lockdown and several at record levels. This gives confidence about

the future prosperity of the portfolio and its ability to cope with other

uncertainties, challenges and opportunities associated with BREXIT and

the second national lockdown. The new investment pipeline is recovering

to levels seen pre-COVID-19 and capital deployment should continue at

an encouraging rate. The Investment Adviser, although cautious in its

approach, is confident that the portfolio is in robust shape to cope

with whatever the short to medium-term holds.

New investments in the year

A total of GBP4.46 million was invested into five new investments during

the year as detailed below:

Company Business Date of Investment Amount of new

investment

(GBPm)

Ac ti ve Nav

igati Data analysis so November 20 1

o n ft w ar e 9 1 . 5 4

------------------- ------------------- -------------------

Data Discovery Solutions (trading as "Active Navigation") is a data

analysis software solution which makes it easier for companies to

clean up network drives, respond to new data protection laws and

dispose of redundant and out-dated documents. Active Navigation's

solution is used by significant blue-chip customers, particularly

those in highly regulated industries such as energy and professional

services, as well as government entities in the USA, Canada, Australia

and the UK. Active Navigation will seek to drive continued growth

from its file analysis platform with the recruitment of experienced

sales and professional services staff. Since 2014 revenues have

grown from GBP1.50 million to GBP6.00 million in its financial year

to 30 June 2019.

M edia asset s

I P V o ft wa r e November 2019 0.95

------------------- ------------------- -------------------

IPV has developed a media asset management software product called

'Curator'. This enables enterprise level customers to retrieve and

search hours of video footage quickly, edit into multiple short

clips and broadcast to online video platforms (such as YouTube)

and company intranets. This enables IPV's impressive list of blue-chip

clients, such as NASA , Sky and Turner Sports to improve efficiency

in managing their video content. The company has built an impressive

senior management team of proven operators and is targeting a media

asset management market in the US and UK, worth an estimated GBP1

billion per annum. The investment will be used to build out a sales

and marketing team and to fund lead generation for new direct and

partner channels as well as supporting the existing partner network.

From 2016 to 2019 recurring revenues grew over 60% annually and

represented approximately 70% of total revenues in 2019.

Direct to consumer

Bleach London hair care brand December 2019 0.72

------------------- ------------------- -------------------

Bleach London Holdings (trading as "Bleach London") is an established

branded, fast growing business which manufactures a range of haircare

and colouring products. Bleach London is regarded as a leading authority

in the hair colourant market, having opened one of the world's first

salons focused on colouring and subsequently launched its first

range of products in 2013. The investment was part of a wider GBP5.60

million investment round alongside trade and angel investors. The

funds will be used to drive continued growth in sales through retailers

as well as capitalise on its strong social media presence whilst

accelerating its growing direct to consumer channel. Bleach London

delivered an impressive three times revenue growth between 2017

and 2019.

Premium frozen

raw dog food

Bella & Duke provider February 2020 0.93

------------------- -------------------- -------------------

Bella & Duke is a direct to consumer subscription service, providing

premium frozen raw dog food to pet owners in the UK. Founded in

2016, the business provides an alternative to standard meal options

for dog owners by focusing on the well documented health benefits

of a raw food diet. This area is a growing niche in the large and

established pet food market and is being driven by the premiumisation

of dog food. The investment will seek to optimise its production

and supply facilities, expand and enhance its team and broaden its

product range. The company has grown revenues over 300% between

2018 and 2019.

Electric vehicle

Andersen EV chargers June 2020 0.32

------------------- -------------------- -------------------

Muller EV Limited (trading as Andersen EV) is a design led manufacturer

of premium electric vehicle (EV) chargers. Incorporated in 2016,

this business has secured high profile partnerships with Porsche

and Jaguar Land Rover, establishing an attractive niche position

in charging points for the high end EV market. The Company's funds

will be used to scale the business through investment in further

products and software, sales and marketing and electric vehicle

manufacturer partnerships. Andersen is well positioned in a nascent

sector experiencing significant growth and has increased sales by

over 350% for its most recent financial year.

Further investments in existing portfolio companies in the year

The Company made further investments totalling GBP3.93 million into four

existing portfolio companies during the year under review, as detailed

below:

Company Business Date of Investment Amount of new

investment (GBPm)

Workforce

management

Rotageek software May 2020 0.63

-------------------- ------------------- -------------------

Rotageek is a provider of cloud-based enterprise software to help

larger retail, leisure and healthcare organisations predict and

meet demand to schedule staff effectively. This investment, alongside

funds from a new VCT investor and existing shareholders, will be

used to capitalise on opportunities that will emerge as the retail

sector recovers from lockdown restrictions. Rotageek will also

be expanding its presence in healthcare to help address the workforce

management issues of a sector that is chronically overburdened

at present. For the year ended 31 December 2019, revenues have

grown over 45% on the prior year.

Digital marketplace

connecting school

pupils seeking

one-to-one online

MyTutor tutoring May 2020 0.98

-------------------- ------------------- -------------------

MyTutorweb (trading as MyTutor) is a digital marketplace that connects

school pupils who are seeking private one-to-one tutoring with

university students. The business is satisfying a growing demand

from both schools and parents to improve pupils' exam results to

enhance their academic and career prospects. This further investment,

alongside other existing shareholders, seeks to build and reinforce

its position as a UK category leader in the online education market

as well as to begin to develop a broader, personalised learning

product offering. MyTutor has performed strongly over the last

18 months with 70% growth in 2019 and in excess of 100% in the

last six months. The company has been chosen as Tutoring Partner

for the National Tuition Programme where they will directly support

30,000 students in catching up on lost learning as a result of

the COVID-19 pandemic.

Lighting and

interiors

Bu s ter & P unch brand September 2020 1 . 5 4

-------------------- ------------------- -------------------

Buster and Punch is a well-established, premium branded, fast growing

business which designs and manufactures a complete range of high-quality

functional fittings (lighting, electrical and hardware and other

accessories) for the home. The Company first invested in 2017 and

since then, the business has delivered consistent high growth across

its ranges, with revenues growing in excess of 65%, and reaching

nearly GBP10 million in 2020. Buster and Punch's products are now

sold in 99 countries via both its highly invested ecommerce platform

and direct services to consumers, trade and retailers across the

world. Buster and Punch also operates flagship showrooms in London,

Stockholm and Los Angeles. The new funding will be used to drive

the global business plans of this fast-growing luxury interior

fashion label with further international expansion into the US

and Asia Pacific markets.

Seller of

proprietary

digital

archiving

Preservica software September 2020 0.78

-------------------- -------------------- -------------------

Preservica is a SaaS software business with blue chip customers

of strong recurring revenues and has developed market leading software

for the long-term preservation of digital records, ensuring that

digital content can remain accessible, irrespective of future changes

in technology. This latest investment is to provide additional

growth capital to finance the further development of the business.

The year to 31 March 2020 saw record bookings growth of 68% and

many key customer wins.

Realisations during the year

The Company realised its investments in Redline Worldwide, Biosite, Auction

Technology Group, Access IS and Blaze Signs, as detailed below:

Company Business Period of investment Total cash proceeds

over the life

of the investment

/ Multiple over

cost

P r ov id er o f Fe bru a r y 2016 GBP 1 . 95

Redline security services to milli

t o the aviation December 2019 on

in dustry and other

sectors 1.7 x cost

-------------------------- --------------------- ----------------------

The Company sold its investment in Redline Worldwide for GBP1.53

million (realised gain in the year of GBP0.98 million including

proceeds received after completion). Since investment in 2016,

the investment has generated proceeds to date of GBP1.95 million

compared to an original investment cost of GBP1.13 million, which

is a multiple on cost to date of 1.7x and an IRR of 17.7% to date.

Further proceeds may be receivable in due course.

Workforce management November 2016

Biosite and secu rit y ser to GBP2.77 million

v i ces February 2020 1.5 x cost

-------------------------- --------------------- ----------------------

The Company sold its investment in Pattern Analytics Limited (trading

as "Biosite") to ASSA ABLOY AB for GBP2.65 million. Since investment

in 2016, the investment has generated proceeds of GBP2.77 million

compared to an original investment cost of GBP1.79 million, which

is a multiple on cost of 1.5x and an IRR of 21.0%.

Auction Techno SaaS based online October 2008 to GBP9.04 million

l ogy Group auction ma rk February 2020 4.5 x cost

e t place platform

---------------------- --------------------- ----------------------

The Company sold its investment in Turner Topco Limited (trading

as Auction Technology Group) to TA Associates for GBP5.28 million

(including GBP1.09 million loan interest due on completion; realised

gain in the year: GBP1.56 million). This investment generated proceeds

over the life of the investment of GBP9.04 million (including proceeds

received following a partial realisation from a sale to ECI Partners

in June 2014) compared to an original cost of GBP2.00 million,

which is a multiple on cost of 4.5x and an IRR of 28.9%.

Access IS Data capture and October 2015 to GBP8.38 million

scanning hardware August 2020 2.5 x cost

---------------------- --------------------- ----------------------

The Company sold its investment in Tovey Management Limited (trading

as Access IS) to ASSA ABLOY AB for GBP7.15 million (realised gain

in the year: GBP3.00 million). Since investment in 2015, the investment

has generated cash proceeds of GBP8.38 million compared to an original

investment cost of GBP3.31 million, which is a multiple on cost

of 2.5x and an IRR of 23.4%.

Blaze Signs Manufacturer and April 2006 to GBP3.39 million

installer of signs September 2020 2.5 x cost

---------------------- --------------------- ----------------------

The Company sold its investment in Blaze Signs Holdings Limited

via a secondary buy out backed by Elaghmore Advisor LLP and has

received cash proceeds of GBP1.20 million (including dividends)

(realised gain: GBP0.13 million). Over the 14 years this investment

was held, cash proceeds of GBP3.39 million have been received compared

to an original cost of GBP1.34 million, which is a multiple of

cost of 2.5x and an IRR of 13.1%.

Realisations after the year-end

After the year-end, the Company realised one investment, as detailed

below: Company Business Period of investment Total cash proceeds

over the life

of the investment

/ Multiple over

cost

Designer and distributor January 2006 to GBP1.79 million

Vectair of washroom products November 2020 8.3 x cost

------------------------- --------------------- --------------------

The Company sold its investment in Vectair Holdings Limited to

a consortium of US investment funds, including Oxbow Industries

and Arcspring, and has received cash proceeds (including dividends)

of GBP1.10 million. This investment generated proceeds over the

life of the investment of GBP1.79 million compared to original

cost of GBP0.22 million, which is a multiple of cost of 8.3x and

an IRR of 22.2%.

Loan stock repayments and other receipts

During the year, there were two partial realisations of Omega Diagnostics

Group plc which generated proceeds of GBP1.05 million and a realised

gain of GBP0.85 million. A GBP0.08 million loan repayment was received

from BookingTek, generating a nominal loss of GBP0.01 million. Finally,

following the decision of Jablite Holdings to enter a voluntary liquidation,

the Company recognised a realised loss of GBP0.09 million on that investment,

with some recovery still anticipated.

Mobeus Equity Partners LLP

Investment Adviser

9 December 2020

Investment Portfolio Summary

for the year ended 30 September 2020

Total Total Additional Total % of

cost at Valuation investments valuation portfolio

at at

30-Sep-20 30-Sep-19 30-Sep-20 by value

GBP GBP GBP GBP

-------------------------- ---------- ---------- ------------ ---------- ----------

Virgin Wines Holding

Company Limited 2,745,503 3,421,474 - 6,458,434 12.7%

Online wine retailer

-------------------------- ---------- ---------- ------------ ---------- ----------

MPB Group Limited 2,043,137 3,858,515 - 4,698,745 9.2%

Online marketplace for

used photographic

equipment

-------------------------- ---------- ---------- ------------ ---------- ----------

Preservica Limited 2,960,899 3,053,749 779,233 4,303,532 8.5%

Seller of proprietary

digital archiving

software

-------------------------- ---------- ---------- ------------ ---------- ----------

Data Discovery Solutions

Limited

(trading as Active

Navigation) 1,543,500 - 1,543,500 3,087,000 6.1%

Provider of global market

leading

file analysis software

for information

governance, security and

compliance

-------------------------- ---------- ---------- ------------ ---------- ----------

EOTH Limited (trading as

Equip Outdoor

Technologies) 1,383,313 2,939,441 - 2,986,028 5.9%

Distributor of branded

outdoor equipment

and clothing including

the Rab and

Lowe Alpine brands

-------------------------- ---------- ---------- ------------ ---------- ----------

My Tutorweb Limited 2,759,335 1,783,566 975,769 2,972,638 5.8%

Digital marketplace

connecting school

pupils seeking one-to-one

online

tutoring

-------------------------- ---------- ---------- ------------ ---------- ----------

Buster and Punch Holdings

Limited 2,046,612 1,176,202 1,536,496 2,740,635 5.4%

Industrial inspired

lighting and

interiors retailer

-------------------------- ---------- ---------- ------------ ---------- ----------

Proactive Group Holdings

Inc 988,390 2,486,769 - 2,486,769 4.9%

Provider of media

services and investor

conferences for companies

primarily

listed on secondary

public markets

-------------------------- ---------- ---------- ------------ ---------- ----------

Manufacturing Services

Investment

Limited (trading as

Wetsuit Outlet) 3,205,182 1,656,308 - 2,371,375 4.7%

Online retailer in the

water sports

market

-------------------------- ---------- ---------- ------------ ---------- ----------

Parsley Box Limited 925,800 925,800 - 2,168,135 4.3%

Supplier of home

delivered ambient

ready meals for the

elderly

-------------------------- ---------- ---------- ------------ ---------- ----------

I-Dox plc(1) 453,881 1,312,563 - 1,895,924 3.7%

Developer and supplier of

knowledge

management products

-------------------------- ---------- ---------- ------------ ---------- ----------

Vian Marketing Limited

(trading

as Red Paddle Co) 1,207,437 1,883,950 - 1,881,880 3.6%

Design, manufacture and

sale of

stand-up paddleboards and

windsurfing

sails

-------------------------- ---------- ---------- ------------ ---------- ----------

Media Business Insight

Holdings

Limited 3,666,556 2,661,708 - 1,407,127 2.8%

A publishing and events

business

focussed on the creative

production

industries

-------------------------- ---------- ---------- ------------ ---------- ----------

Arkk Consulting Limited

(trading

as Arkk Solutions) 1,526,007 1,546,354 - 1,348,963 2.7%

Provider of services and

software

to enable organisations

to remain

compliant with regulatory

reporting

requirements

-------------------------- ---------- ---------- ------------ ---------- ----------

Bleach London Holdings

Limited 721,452 - 721,452 1,232,358 2.4%

Hair colourants brand

-------------------------- ---------- ---------- ------------ ---------- ----------

Master Removers Group

2019 Limited

(trading as Anthony Ward

Thomas,

Bishopsgate and Aussie

Man & Van) 464,658 1,196,408 - 1,175,977 2.3%

A specialist logistics,

storage

and removals business

-------------------------- ---------- ---------- ------------ ---------- ----------

Rota Geek Limited 1,250,800 1,122,456 625,400 1,170,582 2.3%

Provider of cloud based

enterprise

software that uses

data-driven technologies

to help retail and

leisure organisations

schedule staff

-------------------------- ---------- ---------- ------------ ---------- ----------

Tharstern Group Limited 1,454,278 1,534,444 - 1,137,147 2.2%

Software based management

Information

systems for the printing

industry

-------------------------- ---------- ---------- ------------ ---------- ----------

Vectair Holdings Limited 53,400 935,546 - 1,020,351 2.0%

Designer and distributor

of washroom

products

-------------------------- ---------- ---------- ------------ ---------- ----------

IPV Limited 954,674 - 954,674 954,674 1.9%

Provider of media asset

software

-------------------------- ---------- ---------- ------------ ---------- ----------

Bella & Duke Limited 931,499 - 931,499 931,499 1.8%

A premium frozen raw dog

food provider

-------------------------- ---------- ---------- ------------ ---------- ----------

Bourn Bioscience Limited 1,610,379 349,376 - 552,130 1.1%

Management of In-vitro

fertilisation

clinics

-------------------------- ---------- ---------- ------------ ---------- ----------

Omega Diagnostics Group

plc 70,011 263,674 - 449,180 0.9%

In-vitro diagnostics for

food intolerance,

autoimmune diseases and

infectious

diseases

-------------------------- ---------- ---------- ------------ ---------- ----------

Muller EV Limited

(trading as Andersen

EV) 317,000 - 317,000 352,473 0.7%

Provider of premium

electric vehicle

(EV) chargers

-------------------------- ---------- ---------- ------------ ---------- ----------

CGI Creative Graphics

International

Limited 1,943,948 1,930,826 - 337,590 0.7%

Vinyl graphics to global

automotive,

recreation vehicle and

aerospace

markets

-------------------------- ---------- ---------- ------------ ---------- ----------

Kudos Innovations Limited 472,500 945,000 - 329,354 0.6%

Online platform that

provides and

promotes academic

research dissemination

-------------------------- ---------- ---------- ------------ ---------- ----------

Spanish Restaurant Group

Limited

(formerly Ibericos Etc.

Limited)

(trading as Tapas

Revolution) 1,397,386 1,512,372 - 186,300 0.4%

Spanish restaurant chain

-------------------------- ---------- ---------- ------------ ---------- ----------

RDL Corporation Limited 1,441,667 695,008 - 137,899 0.3%

Recruitment consultants

within the

pharmaceutical, business

intelligence

and IT industries

-------------------------- ---------- ---------- ------------ ---------- ----------

BookingTek Limited 779,155 87,233 - - 0.0%

Software for hotel groups

-------------------------- ---------- ---------- ------------ ---------- ----------

Oakheath Limited (trading

as Super

Carers) (in members'

voluntary liquidation) 649,528 - - - 0.0%

Online platform that

connects people

seeking home care from

experienced

independent carers

-------------------------- ---------- ---------- ------------ ---------- ----------

Aquasium Technology

Limited (3) 166,667 176,951 - - 0.0%

Manufacturing and

marketing of bespoke

electron beam welding

and vacuum

furnace equipment

-------------------------- ---------- ---------- ------------ ---------- ----------

Jablite Holdings Limited (in

members'

voluntary liquidation) 498,790 162,366 - 65,779 0.1%

Manufacturer of expanded

polystyrene

products

------------------------------------ ------------- ----------- ------------ ----------- ---------

BG Training Limited 53,125 26,563 - 13,281 0.0%

Technical training business

------------------------------------ ------------- ----------- ------------ ----------- ---------

Corero Network Security plc(4) 600,000 2,458 - 7,374 0.0%

Provider of e-business technologies

------------------------------------ ------------- ----------- ------------ ----------- ---------

Veritek Global Holdings Limited 2,289,859 - - - 0.0%

Maintenance of imaging equipment

------------------------------------ ------------- ----------- ------------ ----------- ---------

CB Imports Group Limited (trading

as Country Baskets) 175,000 - - - 0.0%

Importer and distributor of

artificial

flowers, floral sundries and home

decor products

------------------------------------ ------------- ----------- ------------ ----------- ---------

Racoon International Group Limited 655,851 - - - 0.0%

Supplier of hair extensions, hair

care products and training

------------------------------------ ------------- ----------- ------------ ----------- ---------

Oxonica Limited(4) 2,524,527 - - - 0.0%

International nanomaterials group

------------------------------------ ------------- ----------- ------------ ----------- ---------

NexxtDrive Limited/Nexxt E-drive

Limited(5) 487,014 - - - 0.0%

Developer and exploiter of

mechanical

transmission technologies

------------------------------------ ------------- ----------- ------------ ----------- ---------

Biomer Technology Limited (6) 137,170 - - - 0.0%

Developer of biomaterials for

medical

devices

0.0%

Disposed in year

------------------------------------ ------------- ----------- ------------ ----------- ---------

Tovey Management Limited (trading

as Access IS) - 4,144,573 - - 0.0%

Provider of data capture and

scanning

hardware

------------------------------------ ------------- ----------- ------------ ----------- ---------

Pattern Analytics Limited (trading

as Biosite) - 2,648,952 - - 0.0%

Workforce management and security

services for the construction

industry

------------------------------------ ------------- ----------- ------------ ----------- ---------

Turner Topco Limited (trading as

Auction Technology Group)(2) - 2,634,378 - - 0.0%

SaaS based online auction market

place platform

------------------------------------ ------------- ----------- ------------ ----------- ---------

Redline Worldwide Limited - 550,430 - - 0.0%

Provider of security services to

the aviation industry and other

sectors

------------------------------------ ------------- ----------- ------------ ----------- ---------

Blaze Signs Holdings Limited - 599,314 - - 0.0%

Manufacturer and installer of signs

------------------------------------ ------------- ----------- ------------ ----------- ---------

H Realisations (2018) Limited

(formerly

Hemmels Limited) - - - - 0.0%

Company specialising in the

sourcing,

restoration, selling and servicing

of high price, classic cars

Total 49,555,890 50,224,727 8,385,023 50,861,133 100.0%

------------------------------------ ------------- ----------- ------------ ----------- ---------

Portfolio split by type

Growth focused portfolio 30,138,643 37,931,047 74.6%

MBO focused portfolio 19,417,247 12,930,086 25.4%

Total 49,555,890 50,861,133 100.0%

Notes

(1) Investment formerly managed by Nova Capital

Management Limited until 31 August 2007.

(2) Shares and loan stock in Turner Topco Limited arose as proceeds

from the part realisation of ATG Media Holdings Limited in 2014.

(3) Investment formerly managed by Foresight Group LLP up to various

dates ending on or before 10 March 2009.

(4) Investment formerly managed by Nova Capital Management Limited

until 31 August 2007 and by Foresight Group until various dates ending

on or before 10 March 2009.

For further information on the Investment Portfolio, please see the Annual

Report and Financial Statements.

PRINCIPAL RISKS

The Directors acknowledge the Board's responsibilities for the Company's

internal control systems and have instigated systems and procedures for

identifying, evaluating and managing the principal risks faced by the

Company. This includes a key risk management review which takes place

at each quarterly Board meeting. The principal risks identified by the

Board, a description of the possible consequences of each risk and how

the Board manages each risk are set out below.

The risk profile of the Company changed as a consequence of the VCT regulations

introduced in 2015. As the Company is required to focus its investment

on growth capital investments in younger companies it is anticipated

that investment returns will be more volatile and will have a higher

risk profile. The Board remains confident that the Company and the Investment

Adviser has adapted to these new requirements and put in place appropriate

resource to identify and make suitable investments.

The Board regularly sets and reviews policies for financial risk management

and full details of these can be found in Note 16 to the Financial Statements.

Risk Possible How the Board manages risk

consequence

Investment Investment in VCT

and qualifying earlier * Th e Board regularly reviews the Company's Strategy

strategic stage unquoted including it s Investment Policy.

small companies

involves a higher

degree * Careful se l ec ti o n and review of the Investment

of risk than po rtfoli o on a regular basis.

investment in fully

listed companies.

Smaller companies * Th e Board seeks to ensure the Company has an ad

often have limited equate level of liquidity at all times.

product

lines, markets or

financial resources

and may be

dependent for their

management on a

smaller

number of key

individuals and may

also be more

impacted by

external events or

factors outside

their control.

Furthermore, as the

securities of such

smaller companies

held by the Company

are unquoted,

they less liquid,

which may cause

difficulties in

valuing and

realising these

securities.

-------------------- -----------------------------------------------------------

Loss of A breach of the VCT

approval Tax Rules may lead * T he Company's VCT qualifying status is continually

as a to the Company reviewed by the Board and the Inv estment Adviser.

Venture losing its approval

Capital as a VCT, which

Trust would result in * Th e Board receives regular r e p o rt s from it s

qualifying VCT Status Ad vi se r who has been retained by the

Shareholders who Board to monitor the VCT's compliance with the VCT

have not held their Rules.

shares for the

designated

period having to

repay the income

tax relief they

obtained and future

dividends paid by

the

Company being

subject to tax. The

Company would also

lose its exemption

from corporation

tax

on capital gains.

-------------------- -----------------------------------------------------------

Regulatory The Company is

required to meet * Regulatory and legislative developments are kept

its legal and under review by the Board.

regulatory

obligations as a

VCT, a listed

company

and its own

Alternative

Investment Fund

Manager (AIFM).

Failure to comply

might result in

suspension of the

Company's Stock

Exchange listing,

financial penalties

or a qualified

audit

report or a loss of

the Company's

status as a VCT.

Furthermore,

changes to the UK

VCT legislation

or the State-aid

rules could have an

adverse effect on

the Company's

ability to achieve

satisfactory

investment returns.

-------------------- -----------------------------------------------------------

Economic Factors such as the

and COVID-19 pandemic * The Board monitors

political and resulting

and other restrictions

external imposed by

risks government, the (i)the portfolio as a whole to ensure that the

impact of BREXIT, Company invests in a diversified portfolio

an economic of companies;

recession and

movements in (ii) developments in the macro-economic environment

interest rates such as movements in interest rates or

could affect general fluctuations in stock markets; and

trading

conditions for (iii) with regards to COVID-19, the Investment

smaller companies Adviser holds ongoing discussions with all

and consequently the portfolio companies to ascertain where support is

the value of the required. Cash comprises a significant

Company's proportion of net assets of the Company, further to

qualifying the successful exits and the fund-raise

investments. in the year giving the Company a strong liquidity

Movements in UK position. The portfolio has minimal exposure

Stock Market to sectors such as leisure, hospitality, retail and

indices may affect travel which are currently more at risk.

the valuation of

the VCT's

investments, as

well as affecting

the Company's own

share price and its

discount to net

asset value.

The COVID-19

pandemic is the

current risk to the

Company, the wider

population and

economy.

-------------------- -----------------------------------------------------------

Financial Failure of the

and systems (including * The Board carries out an annual review of the

operating breaches of cyber internal controls in place, reviews the risks facin

security) at any of g

the third-party the Company at each quarterly Board meeting and

service receives reports by exception.

providers that the

Company has

contracted with * It reviews the performance of the service providers

could lead to annually and has obtained assurance that such

inaccurate providers have controls in place to reduce the risk

reporting or of breaches of their cyber security.

monitoring.

Inadequate controls

could lead to the

misappropriation or

insecurity of

assets. Outsourcing

and the increase in

remote working

could give rise to

cyber and data

security risk and

internal

control risk.

-------------------- -----------------------------------------------------------

Market Shareholders may

liquidity find it difficult * The Board has a share buyback policy which seeks to

to sell their mitigate market liquidity risk for shareholders. Th

shares at a price is

which is close to policy is reviewed at each quarterly Board meeting.

the net

asset value.

-------------------- -----------------------------------------------------------

STATEMENT OF DIRECTORS' RESPONSIBILITIES

The Directors are responsible for preparing the Annual Report and the

Financial Statements in accordance with applicable law and regulations.

Company law requires the Directors to prepare Financial Statements for