TIDMITX

RNS Number : 8835T

Itaconix PLC

30 March 2021

Strictly Embargoed until 07.00, 30 March 2021

Itaconix plc

("Itaconix" or "the Company")

156% Revenue Growth for Full Year Results Ended 31 December

2020

Itaconix plc (AIM: ITX) (OTCQB: ITXXF), a leading innovator in

sustainable plant-based polymers used as essential ingredients in

everyday consumer products, announces Final Results for the year

ended 31 December 2020.

Commenting on the results, John R. Shaw, CEO of Itaconix,

said:

"We achieved 155.6% growth in revenues to $3.29 million and

reduced adjusted EBITDA losses to under $1 million from progress

with new and recurring orders in detergent, odour control, and

personal care applications. In addition, having completed a

successful fundraise, we have also substantially strengthened our

balance sheet and had healthy cash balances at the year end."

" With Polymers for Better Living(TM), Itaconix is dedicated to

decarbonisation to reduce the planet's carbon footprint and address

climate change. Our plant-based polymers are essential ingredients

in a new generation of safer, more sustainable consumer

products.

"2020 was transformational for our Company, as brands

increasingly looked to Itaconix to improve the competitive position

of their products with new performance and environmental claims.

Milestones achieved from major customer projects progressing to

launch in 2020 increased our revenues and our revenue potential in

a broadening range of home and personal care products. The

expanding foundation of formulations among our customers is

building a strong base of recurring use to underpin our continued

growth."

Financial Highlights

% difference 2020 2019

to previous

financial year $'000 $'000

Revenue +155.6% 3,292 1,288

---------------- -------- --------

Gross profit +156.4% 1,154 450

---------------- -------- --------

Gross profit margin +0.6% 35.1% 34.9%

---------------- -------- --------

Adjusted EBITDA ([1]) +59.6% (993) (2,457)

---------------- -------- --------

Cash used from operating activities +36.8% (1,157) (1,831)

---------------- -------- --------

Net cash at year-end +89.3% 1,448 765

---------------- -------- --------

(1) Adjusted for interest, tax, depreciation, amortization, and

exceptional items .

Operational Highlights

-- Grew revenues by 155.6% and gross profits by 156.4% with a

slight improvement in gross profit margins.

-- Strong growth in revenues to $3.29 million and gross profits

to $1.15 million reduced adjusted EBITDA losses by $1.5 million to

less than $1 million.

-- Completed successful $2.2 million fundraise in July 2020 via

an oversubscribed placing and subscription from existing and new

investors.

-- New Itaconix(R) TSI(TM) 322 polymer launched and is now

leading a new generation of dishwashing detergents with excellent

performance and high bio-based content, including the launch of two

new North American brands in 2020.

-- I taconix's ZINADOR(TM) polymers sold through Croda, a global

specialty chemicals leader, are seeing broader use for odour

control in homes. Demand continued to expand with wider adoption in

existing brands and initial usage by new brands.

-- Demand for Itaconix's bio-based hair fixative polymer sold

worldwide by Nouryon, a global specialty chemicals leader,

continued to grow.

-- VELAFRESH(TM) polymers gained important initial adoption as

key ingredients in specialty underarm deodorant brands.

-- Completed expansion of the executive team for a full

complement of capabilities and capacity to pursue the next phase of

revenue development.

-- Strong pipeline, with formulation activity using Itaconix(R)

TSI(TM)322 increasing in the second half of 2020.

-- Development of Itaconix's BIO*Asterix(TM) line of plant-based

functional additives presents breakthrough opportunities for

increasing the use of safer, sustainable materials through an

evolving line of plant-based functional ingredients.

Commenting on the outlook, John R. Shaw, CEO, added:

"With new urgency in consumer markets to address both

cleanliness and climate change, our years of development efforts

have propelled our commercial activities and results to a new stage

of growth. The trend towards sustainable consumer products is only

accelerating. As our current customers succeed, we are confident

that our products will be increasingly used as ingredients in major

brands. Despite some emerging operational headwinds in the supply

chain from secondary effects of the Covid-19 pandemic, we expect

the commercial momentum in 2020 to progress in 2021, particularly

as current customer products succeed in the market and major new

customer products continue to launch in 2021."

"With our strong base for continued revenue growth, we look

forward with increased confidence toward the Company's goal of

sustained profitability in the coming years."

- ends -

Enquiries:

Itaconix +1 (603) 775 4400

John R. Shaw / Laura Denner

N+1 Singer +44 (0) 207 496 3000

Peter Steel / James Moat (Corporate

Finance)

Tom Salvesen (Corporate Broking)

Belvedere Communications +44 (0) 20 3687 2756

John West / Llew Angus

This announcement contains information which, prior to its

disclosure, was inside information as stipulated under Regulation

11 of the Market Abuse (Amendment) (EU Exit) Regulations 2019/310

(as amended).

Notes to Editors

Itaconix develops and produces bio-based specialty polymers that

improve the safety, performance and sustainability of consumer and

industrial products, with technology and market leading positions

in non-phosphate detergents, odour control, and hair styling.

www.itaconix.com

CHAIRMAN'S STATEMENT

Polymers for Better Living(TM)

Itaconix plc is dedicated to reducing the planet's carbon

footprint and addressing climate change with plant-based polymers

that are essential ingredients in a new generation of safer, more

sustainable consumer products.

Our principal activities are the production and sale of

proprietary plant-based specialty ingredients that satisfy

consumers' increasing awareness of how their purchases impact

climate change and the environment. Our sustainable plant-based

polymers replace fossil-based ingredients while offering

uncompromising performance and cost. Most of our efforts are

focused on home and personal care applications where consumer

interest and desires for safer and more sustainable products are

particularly high.

We are continuing to advance the potential for consumer products

with near net zero carbon consumption through the plant-based

ingredients we produce and are developing, the energy-efficient

production processes we use, and more compact consumer products our

ingredients enable that use fewer natural resources and release

less chemicals into the environment.

We made great strides in 2020 towards fulfilling our potential

to make the world a better and safer place. Our polymers are key

ingredients in a growing number and range of home and personal care

products. Our progress was reflected in 155.6% revenue growth, our

leadership in next generation detergents with the launch of two new

products by major brands, and the introduction of our

Bio*Asterix(TM) plant-based functional ingredients.

We achieved this progress amid continuous uncertainty from the

Covid-19 pandemic that challenged our operations and our funding. I

greatly appreciate the unwavering dedication of our customers, our

shareholders, our employees, and our vendors to generate such a

transformative year of growth and advancement toward our

potential.

With Polymers for Better Living(TM), Itaconix is enabling new

generations of consumer products to fight climate change and

protect our environment.

James Barber

Chairman

CHIEF EXECUTIVE OFFICER'S STATEMENT

Overview

We completed a transformational year in 2020 as a leader in

sustainable plant-based polymers used as essential ingredients in

everyday consumer products. Brands increasingly looked to Itaconix

to improve the competitive position of their products with new

performance and environmental claims.

Major customer projects progressing to launch in 2020 increased

our revenues and our revenue potential in a broadening range of

home and personal care products. The expanding foundation of

formulations among our customers is building a strong base of

recurring use to underpin our continued growth.

As a result of this momentum, year on year revenues increased

and operating losses decreased from both new and recurring orders

in detergent, odour control, and personal care applications.

Having completed a successful fundraise in July 2020, we have

also substantially strengthened our balance sheet with healthy cash

balances at the year end.

Commercial progress

Our product revenues grew by 155.6% to $3.3m in 2020 compared to

$1.3m in 2019.

Revenues increased across all our home and personal care

polymers. Although aided by demand for household cleaning during

the Covid-19 pandemic, most of our increased revenues came from new

customer products entering the market after several years of

development.

Our new Itaconix(R) TSI(TM) 322 polymer is leading a new

generation of dishwashing detergents with excellent performance and

high bio-based content, including the launch of two new North

American brands in 2020 and another North American brand at the

start of 2021. New formulation activity with Itaconix(R) TSI(TM)322

increased in the second half of 2020 which we expect will lead to

additional usage in current and new brands in the second half of

2021. Although our Itaconix(R) CHT(TM) 122 polymer has established

use in the EU, the focus of formulation development during the

Covid-19 pandemic has slowed EU adoption of the added benefits

available with Itaconix(R) TSI(TM) 322.

In hair styling, we were pleased that demand for our unique

bio-based hair fixative polymer sold worldwide by Nouryon, a global

specialty chemicals leader, continued to grow despite a general

downturn in the personal care market during the Covid-19 pandemic.

This growth has come from more brands launching new products

containing the ingredient and an expansion in the applications for

the ingredient.

In homecare odour control, our ZINADOR(TM) polymers sold through

Croda, a global specialty chemicals leader, are similarly seeing

broader use. Demand continues to grow with expanding adoption in

existing brands and initial usage by new brands. We are seeing

increased focus and activity during the Covid-19 pandemic on home

odour control, which we expect to translate into continued revenue

growth.

In personal odour control, our VELAFRESH(TM) polymers are

gaining important initial adoption as key ingredients in specialty

underarm deodorant brands.

Our major new product development for 2020 was the announcement

of our BIO*Asterix(TM) line of plant-based functional additives. We

see breakthrough opportunities for reducing the carbon footprint of

consumer products and increasing the use of safer chemicals through

an evolving line of BIO*Asterix(TM) functional ingredients. Our

initial commercial work is focused on a joint development agreement

for potential use by a leading innovator in biodegradable

packaging.

Overall, active customer projects advancing or emerging out of

our sales development pipeline present multiple new revenue

opportunities as we are increasingly able to turn ingredient "wish

lists" into product sales. Growth in the second half of 2020 was

particularly strong, driven by both new orders and the increased

size of recurring orders.

Covid-19

We have experienced positive and negative effects of the

Covid-19 pandemic and continue to closely monitor emerging

issues.

The health and safety of our employees is our first and foremost

focus. We follow recommended policies and protocols for monitoring

individuals' health and mandatory social distancing measures or

remote access where possible. We operated continuously and

delivered on growing order volumes in 2020 through the

extraordinary efforts of our dedicated employees.

We implemented cost saving measures from March 2020 to August

2020 to conserve our available cash resources while receiving a US

Paycheck Protection Program loan in May and completing a fundraise

in July.

Our rapid responses allowed us to manage effectively through the

initial repercussions of the Covid-19 pandemic.

Secondary effects are starting to emerge in our and our

customers' supply chains around shipping delays, higher shipping

costs, higher raw material costs, and the availability of raw

materials that may delay the ramp up on some customer projects. We

continue to monitor these situations very closely.

Financial Performance, Funding and Cash

Revenues for the year were $3.3m, representing 155.6% growth

over 2019. As a result of the increase in revenues, adjusted EBITDA

has improved in line with management's expectations to ($1.0m).

Despite an increase in our operating expenses, which rose in the

second half to $1.6m compared to H1 2020 $1.0m, we managed to

maintain an attractive gross margin of 35.1% (2019: 34.9%). The

increase in operating expenses was mainly due to an increase in our

staff as we ramped up production volumes to meet demand.

Our operating losses decreased by 51.7% to $1.5m, highlighting

that the Company is making significant progress towards break-even

profitability.

Net cash balances as at year end were $1.4m. This was in part

due to the completion in July 2020 of a successful $2.2 million

fundraise via an oversubscribed placing and subscription from

existing and new investors. The net proceeds were used to fund

working capital requirements and invest in key staff to support our

continued growth, and are currently forecasted to provide

sufficient funding for our operations for the foreseeable future as

of the issuance of these financial statements, although there are

continuing uncertainties due to the Covid-19 pandemic as we advance

our medium-term plan for break-even net operating cash flow.

Overall, with an improved operating performance and a stronger

balance sheet, the Company has a much stronger financial position

for its next phase of growth.

People

We expanded and realigned our executive team to fulfil

increasing order volumes, create more demand for current products,

and add significant new revenue potential from our proprietary

itaconate chemistry platform.

In January 2021, after the reporting period, we appointed Helen

Cane as Vice President, Operations to manage our fulfilment

capabilities. In November 2020, we appointed Monna Manning as Vice

President, Marketing & Sales to lead our commercial

activities.

Increased experience and knowledge on our executive team offer

new opportunities for me and our Chief Technology Officer, Dr Yvon

Durant, to build our next phase of revenue development with new

products and collaborations for major unmet customer needs.

Shareholder Engagement

We have turned to virtual meetings to engage directly with

shareholders and to update the market on our progress towards

profitability as our products are more broadly adopted.

We held our first virtual investor meeting on 28 October 2020,

with access granted to all current investors, potential investors

and interested parties. We plan on continuing to use virtual

meetings to maintain open engagement with our shareholders, in

particular on our progress.

Outlook

2020 was a positive year of trading in many ways for Itaconix.

We experienced continued growth in the use of our proprietary

polymers as key ingredients in an expanding range of everyday

consumer products. Consumers and brand managers are increasingly

aware of the potential for consumer goods to reduce carbon

emissions and energy consumption and decrease the release of

harmful chemicals into the environment.

With new urgency in consumer markets to address both cleanliness

and climate change, our years of development efforts propelled our

commercial activities and results to a new stage of growth. We are

pleased that brands are recognising the role our plant-based

polymers play as sustainable materials within the decarbonisation

economy and we expect them to be increasingly adopted as core

ingredients by brands.

All indications are that our products will increasingly be taken

up by major brands and we expect the commercial momentum

experienced in 2020 to continue in 2021, particularly as current

customer products succeed in the market and major new customer

products continue to launch in 2021.

The expanding foundation of recurring revenues is creating a

strong base for continued revenue growth and progress toward the

Company's goal of sustained profitability in the coming years. We

look forward with increased optimism and confidence.

John R. Shaw

Chief Executive Officer

OUR STRATEGY

Principal Activities

Itaconix plc is a leading innovator in plant-based ingredients

for improving the safety and performance of consumer and industrial

products. Its proprietary polymer technologies generate a growing

range of new specialty ingredients with unique functionalities that

meet consumer demands for value and sustainability.

The Group's principal activities are the development of

plant-based polymers, the proprietary production of these

materials, and sales of these materials globally either directly or

through partners as ingredients in consumer product

formulations.

Most of the Group's efforts are focused on home and personal

care applications where consumer interest and desires for safer and

more sustainable products are particularly high.

Proprietary Ingredients with Unique Functionality

The Group has completed many years of exploratory research and

holds an extensive patent portfolio related to the production and

use of polymers made from itaconic acid. The commercial potential

for these materials as ingredients in consumer products stems from

the unique functionalities available through the chemical structure

of itaconic acid and from the bio-based production of itaconic acid

through fermentation using plant-based sugar sources.

Building on the Group's process of identifying a market need and

then developing a product to meet that need, initial products from

its itaconate chemistry platform have commercial momentum in

non-phosphate detergents, odour control, and hair styling. As these

products generate more revenues, Itaconix expects to identify more

opportunities for additional new products within its itaconate

chemistry platform.

Progress in 2020

The Group advanced its research and commercial activities in its

core product areas through its own efforts and commercial

collaborations with Nouryon and Croda, as detailed in the Chief

Executive Officer's Statement. Most notable was the entry of major

new customer products onto the market that drove dramatic revenue

growth, particularly in non-phosphate detergent sales. The Group is

well positioned for growth in the coming years.

The combination of dramatic revenue growth and continued costs

control in 2020 significantly advanced the Group towards its goals

of reducing cash use and reaching profitability. The Group's

efforts during the year included the elimination of the remaining

costs from the UK facility.

Key Performance Indicators (KPIs)

The three key performance indicators for the Group are:

-- Revenue

-- Adjusted EBITDA, adjusted for interest, tax, depreciation,

amortization, and exceptional items.

-- Cash

The Directors believe that revenue and adjusted EBITDA are key

performance indicators in measuring Group performance. The Group

seeks to commercialise its existing and new technologies and

generate revenues from a growing number of commercial agreements

with users of its products. Revenue performance is detailed in the

Chief Executive Officer's Statement above.

The Directors believe that a further important performance

measure is the Group's rate of cash expenditure and its effect on

cash resources. Net cash inflow for the period to 31 December 2020

was $0.7m compared to the same period in 2019 with net cash outflow

was $1.9m. Further details of cash flows in 2020 (and 2019) are set

out in the Group's Consolidated Cash Flow Statement below.

FINANCIAL REVIEW

Key performance metrics continue to improve as the Group gains

commercial momentum. Most notably, revenues for the year increased

by 155.6% from 2019. The gross profit margin remained consistently

high in 2020 at 35.1% compared to 34.9% in 2019. Cash used in

operations decreased from $1.8m in 2019 to $1.1m in 2020. This was

all complemented by the Group's successful fundraise in July 2020.

Below is a table showing the Group's key performance metrics:

2020 2019 2018

$'000 $'000 $'000

------------------------------------ ------- ------- -------

Revenue 3,292 1,288 881

Gross profit 1,154 450 140

Gross profit margin 35.1% 34.9% 15.9%

Adjusted EBITDA [2] (993) (2,457) (5,370)

Cash used from operating activities (1,157) (1,831) (6,973)

Net cash at year-end 1,448 765 2,655

Financial Performance

Revenue

Total revenues for the 12-month period ended 31 December 2020

were $3.3m, representing a 155.6% increase over 2019 revenues of

$1.3m. Revenues grew across all major product lines from detergent

polymers, hair styling polymers, and odour control. Detergent

polymers represented the largest area of growth with several new

end user products launched in 2020.

Revenues in all geographical regions increased. North America

represents 87.2% of the Group's revenue and grew by 154.3%. North

America revenue growth was due largely to the increased product

launches that used the Group's detergent polymers. Europe

represents 12.8% of the Group's revenue and grew by 164.4%.

European revenue growth is due to increased demand for the Group's

hair styling polymers supplied through Nouryon.

Gross Profit and Adjusted EBITDA(2)

Gross profit margin remained consistent between 34.9% in 2019

and 35.1% in 2020. As the Group continued to focus efforts on

fulfilment and commercialisation of the current itaconate polymer

technologies, gross profit increased from $450k in 2019 to $1,154k

in 2020, an increase of 156.4%.

Adjusted EBITDA is a non-IFRS measure but is widely recognised

in financial markets and it is used within the Group as a key

performance indicator. Adjusted EBITDA improved from a loss of

$2.5m in 2019 to a loss of $1.0m in 2020. The improvement in EBITDA

was due to the Group's gain in commercial momentum, improved gross

profit margin and the reduced cost structure from the 2018 Group

reorganization.

(2) Adjusted for interest, tax, depreciation, amortization, and

exceptional items.

Below is a reconciliation of Loss for the Year to Adjusted

EBITDA:

2020 2019 2018

$'000 $'000 $'000

-------------------------------------------- ------- ------- -------

Loss for the year (1,646) (1,358) (9,868)

------- ------- -------

Taxation 7 1 (187)

Depreciation 200 223 296

Amortization 198 198 -

Exceptional revaluation of contingent

consideration 339 (1,474) 3,323

Exceptional organizational restructuring (91) - 1,190

Finance income - (1) (4)

Movement on investment in associate - (46) (120)

------- ------- -------

Adjusted EBITDA (993) (2,457) (5,370)

Administrative Expenses

Administrative expenses consist of sales, marketing, operations,

research and development, and public company costs such as legal,

finance and the Group Board. These expenses were $2.6m in 2020 down

from $3.4m in 2019. The reduction in administrative expense was

largely due to cost cutting efforts to conserve cash through the

Covid-19 pandemic.

Costs and Available Cash

The Group's increasing revenues and overall cost reductions

resulted in Net Cash Outflow from Operations of $1.1m, which

represents an improvement from 2019 when Net Cash Outflow from

Operations was $1.8m. As at 31 December 2020, the Group held cash

of $1.4m. In addition to the improved operating cash flow, the

Group's cash at year end was higher than the prior year because the

Group completed a fund raise of $2.2m and received $0.2m from the

US Government Paycheck Protection Program.

Working capital

At year end, overall carrying value of inventory, trade and

other receivables, and trade and other payables had increased.

However, the working capital as a per cent of revenues had

decreased from 69.3% in 2019 to 56.7% in 2020. The most significant

increase in the working capital were the inventories and accounts

payable. Inventories increased from $0.5m in 2019 to $1.4m in 2020

to address growing customer demand and volume. The accounts payable

were increased at year end in relation to the inventory increase.

Trade and other payables increased from $0.7m in 2019 to $1.4 m in

2020.

Financial Position

At 31 December 2020, the Group had equity of ($0.6m) as compared

to ($1.0m) in 2019. This primarily resulted from a revaluation of

the deferred consideration net of the equity raise and stronger

operating results.

Revaluation of Deferred Consideration

As a result of revaluing deferred consideration with respect to

the acquisition of Itaconix Corporation in 2016, there is an

exceptional non-cash expense of $0.3m in 2020, which offsets the

exceptional non-cash income of $1.5m (excluding foreign exchange)

from 2019. Subsequent to year end, the Group is expecting to issue

shares to certain Sellers of Itaconix Corporation in the amount of

$0.1m by 31 March 2021.

Exceptional Expense on Reorganization

As part of the Group reorganization in 2018, certain costs to

close the UK facility were accrued. The former corporate

headquarters in Deeside, UK was leased through July 2021 and the

full value remaining on the lease was accrued. In September 2020,

the Group was able to surrender the lease to the landlord. This

relieved the remaining liability associated with the lease and the

Group recognized an income of $91k.

Financial Reporting

There were no new reporting standards adopted for the year end

31 December 2020 that have a material impact on the financial

statements.

Going Concern

The financial statements have been prepared on a going concern

basis. The Directors have reviewed the Company's and the Group's

going concern position taking account its current business

activities, budgeted performance and the factors likely to affect

its future development, set out in the Annual Report, and including

the Group's objectives, policies and processes for managing its

working capital, its financial risk management objectives and its

exposure to credit and liquidity risks.

The Directors have also taken into consideration the impact of

the Covid-19 pandemic on the Group's revenues and supply chain.

While there has not been a significant negative impact through the

report date on the Group revenues or supply chain due to the

pandemic, the Directors have applied sensitivities to the timing,

quantum, and growth of new customer projects in revenue models and

have assessed alternate supply chains that have been developed by

the Group to mitigate any issues in deliveries to our

customers.

As further detailed in the Directors' Report on page 29 and note

2 to the Annual Report available to view on the Company's website,

the Directors have reviewed the Group's cash flow forecasts

covering a period of at least 12 months from the date of approval

of the financial statements, which foresee that the Group will be

able to meet its liabilities as they fall due. However, the success

of the business is dependent on customer adoption of our products

in order to increase revenue and profit growth. Inability to

deliver this could result in the requirement to raise additional

funds.

Shareholdings and Earnings per Share

Itaconix had 432,448,253 shares in issue as at 31 December 2020.

The undiluted weighted average number of shares for the period to

31 December 2020 was 344,970,117. The difference in the two numbers

is the result of the issuance of new shares in July 2020. The

undiluted weighted average number of shares was used to calculate

the loss per share presented in note 3.

PRINCIPAL RISKS AND UNCERTAINTIES

Effective risk management is a priority for the Group to sustain

the future success of the business. Therefore, the Directors have

overall responsibility for the Group's risk management process but

have delegated responsibility for its implementation, the system of

controls which reduce risk and for reviewing their effectiveness to

the management team. The risk of uncertainties that the Group face

evolve over time, therefore the management team review and monitor

the emerging risks and update mitigation effort. The results are

reported to the Board.

Commercialisation Activities

Significant progress was made in 2020 toward achieving

profitability by increasing revenues and reducing costs.

Ultimately, it is uncertain whether the success of Itaconix

products will be in sufficient quantities for the Group to generate

an overall profit.

Management of risk: The Group has sought to manage this

commercialisation risk by partnering with market leaders for the

worldwide promotion of our leading products, continued development

of end-user formulas to provide customers with packaged solutions,

and continuous review of the market needs for Itaconix

products.

Dependence on Key Personnel

The Group depends on its ability to attract and retain a limited

number of highly qualified managerial and scientific personnel, the

competition for whom is intense. While the Group has conventional

employment arrangements with key personnel aimed at securing their

services for minimum terms, their retention cannot be

guaranteed.

Management of risk: The Group expanded its management team with

the hiring of two executives and has service contracts in place for

John R. Shaw as Chief Executive Officer and Dr. Yvon Durant as

Chief Technology Officer. In addition, the Group seeks to retain

key personnel in the US using an Equity Incentive Plan for share

option grants.

Customer Retention

The ability to retain key customers is critical to maintaining

revenue streams. The loss of key customers could impact business

results adversely.

Management of risk: Acceptance of our products in our customers'

end-product formulations is closely monitored and managed. Our

customer service includes regular engagement on the performance of

both our products and the end-products to ensure our ingredients

are delivering the desired value to our customers and

end-users.

Regulatory and Legislation

Regulatory bans on the use of phosphates as ingredients in

detergents have transformed the consumer detergent markets in

Europe and North America over the last ten years. Phosphates are

known to enter waterways through detergent effluent and act as a

nutrient for algae growth that subsequently cuts oxygen levels in

water and harms aquatic life. We believe that phosphates are likely

to be phased out in other jurisdictions around the world over time.

Itaconix polymers can act as effective replacements for phosphates

in detergent formulations and are used in numerous detergent

products in North America and Europe for this purpose.

Management of risk: The Group closely monitors regulatory

developments in the use of ingredients in consumer and industrial

products to assure compliance and find new revenue potential for

Itaconix polymers. Further, the Group regularly assesses the

relative performance and cost efficacy of Itaconix polymers to

current and emerging phosphate replacements to identify revenue

risks and opportunities.

Competition and Technology

The production and use of Itaconix polymers are subject to

technological change over time. There can be no assurance that

developments by others will not render the Group's product

offerings and research activities obsolete or otherwise

uncompetitive.

Management of risk: The Group employs experienced and

highly-trained polymer chemists to develop and protect the Group's

intellectual property. These efforts include continuous work on the

performance and cost advantages of Itaconix polymers. In addition,

the staff monitors technologies and patents through publications,

scientific conferences, and collaborations with other organisations

to identify new risks and opportunities.

Covid-19 Risk

The Group faces potential disruption to the demand for its

products, the operations of its production facility, the supply of

raw materials, and the supply of other ingredients going into

customer products due to the Covid-19 pandemic. The US operations

continued to operate while implementing recommended CDC guidance to

protect our employees and provide a safe work environment. Delayed

supply chain issues are emerging in early 2021 from extended

shipping times and the availability of other ingredients going into

customer products.

Management of risk: Management closely monitors Covid-19

regulatory developments and expected demand from customers.

Management and staff actively communicate with all major suppliers

and customers about upcoming demand and reliability of the supply

chain. The US operations also hold significant stock of long lead

raw materials from Asia.

Liquidity Risk

Itaconix seeks to manage financial risk by ensuring adequate

liquidity is available to meet foreseeable needs and to invest cash

assets safely and profitably. In July 2020, the Group completed a

$2.2m fundraise to support working capital and revenue growth. In

addition, short-term flexibility is achieved by holding significant

cash balances in Itaconix's functional currencies, notably UK

Sterling and US Dollars.

Credit Risk

The principal credit risk for Itaconix arises from its trade

receivables. To manage credit risk, new customers are subject to

credit review and all customer accounts are regularly reviewed for

debt aging and collection history. As at 31 December 2020, there

were no significant credit risk balances.

Foreign Exchange Risk

Itaconix Plc is a publicly traded holding company on the London

Stock Exchange. The Group's primary operations are in the US. These

US based operations transact trades with customers in North America

and internationally. Revenue and costs are exposed to variations in

exchange rates and therefore reported losses. In 2019, the Group

elected to convert the reporting currency from UK Sterling to US

Dollars. The US Dollar transactions represent a significant portion

of the functional currency transactions and therefore reduces the

Group's overall exposure to translation exchange risk.

Government Risk

The Group has potential exposure to government activities

related to Covid-19, Brexit, and US-China trade relations. Risks

related to Covid-19 are detailed above.

Brexit has created potential risks to the Group as the UK is no

longer part of the European Union. These risks include alignment of

various chemical regulations and trade relations between the UK and

US.

US trade tariffs with China have caused increases to certain raw

material costs and may continue to create volatility. These

increases have not caused any major issues with profitability to

date. Itaconix has assessed alternative supply sourcing from India

and other countries which are not affected by increased tariffs.

However, if an alternate supply is not available the Group is

prepared to pass cost increases through to customers if needed.

SUSTAINABILITY

Polymers for Better Living(TM)

Our polymers are advanced sustainable materials that can make

the world a better and safer place to live as essential ingredients

in the next generation of consumer products.

The composition of our polymers, our patented process to produce

them, their performance as ingredients in consumer product

formulas, and how these formulas are packaged and delivered to

consumers contribute to the fight against climate change with

plant-based carbon, sequestering carbon, energy efficiency, and

lighter consumer products.

Itaconix Ingredient Benefits as Advanced Sustainable

Materials

Product Plant-Based Decarbonisation Energy Lighter

Carbon Efficiency Products

Detergents

Itaconix(R) DSP

2K(TM) 100%

Itaconix(R) TSI(TM) >75%

Itaconix(R) CHT(TM) >80%

VELASOFT(TM) 100%

Odour Control

ZINADOR(TM) (Croda) 80-100%

VELAFRESH(TM) 80-100%

Hair & Skin Care

Amaze(TM) SP (Nouryon) 100%

======================== ================= ===================== ================= ===============

Plant-based carbon

The renewable carbon in the itaconic acid we use to make

Itaconix products is captured as carbon dioxide by plants. Corn

plants convert carbon dioxide into carbon in sugars that are used

to produce itaconic acid via fermentation. We bring this itaconic

acid into our patented process at our US operations to produce

polymers that have 75-100% plant-based carbon.

Decarbonisation

The increase of carbon dioxide as a greenhouse gas in our

atmosphere is a major cause of climate change. Carbon dioxide is

sequestered as carbon in Itaconix products for a period of time

until, depending on the circumstances, they degrade. During this

period, the amount of carbon held contributes to a reduction of

carbon dioxide in the atmosphere.

Energy efficiency

Improving energy consumption is a major sustainability goal for

Itaconix and within the chemical industry.

Itaconix's efforts start with its patented polymer production

process, which is efficient in its use of energy and capital

equipment. Less energy use translates into less direct and indirect

GHG emissions.

Itaconix is working to extend its energy efficiency efforts

across all of its operations and practices with the development of

reporting under the Streamlined Energy & Carbon Reporting

(SECR) framework. We began in 2020 with the direct and indirect

emissions from the purchase of electricity and natural gas. The

table below shows the energy consumption and estimated GHG

emissions at our US operations for the 12-month period ending 31

December 2020 from these activities.

Energy consumption GHG Emissions

(kWh) (tCO2e)

Direct and indirect emissions 162,840 44.59

------------------------ -------------------

Intensity ratio: tCO2e per

$m Net Revenue 13.51

------------------------ -------------------

We have selected an intensity metric based on tonnes of carbon

dioxide emissions (tCO2e) per $m Net Revenue. We will use this

ratio to monitor and extend our energy efficiency efforts further

into our operations and practices.

Lighter products

The multifunctional performance of Itaconix ingredients offers

the potential for more compact consumer products, particularly in

detergents. Compact products are lighter and can reduce greenhouse

gas emissions by using less chemicals, less packaging, and more

efficient transportation.

A study by a leading third-party sustainability research firm

estimated the potential for dishwashing detergents using Itaconix

ingredients to reduce greenhouse gas emissions.

Revenues from Advanced Sustainable Materials

Itaconix plc is dedicated to reducing the planet's carbon

footprint and addressing climate change with plant-based polymers

that are essential ingredients in a new generation of safer, more

sustainable consumer products.

Our financial results demonstrate that commercial and

environmental progress can advance equally through the value and

adoption of our ingredients. We are pleased to announce that 96%

percent of our 2020 revenues were derived from advanced sustainable

materials. This means that 96% of our revenues are related

specifically to the design, development, and manufacture of

materials that during their manufacture or through their use allow

for considerable increases in the efficiency of resource usage.

SECTION 172 STATEMENT

Statement of Compliance with Section 172 of the Companies Act

2006

The Directors are required to include a separate statement in

the Annual Report that explains how they have considered broader

stakeholder needs when performing their duty under Section 172(1)

of the Companies Act 2006. This duty requires that a director of a

company must act in the way he or she considers, in good faith,

would be most likely to promote the success of the company for the

benefit of its members as a whole, and in doing so have regard

(amongst other matters) to:

-- the likely consequences of any decision in the long term;

-- the interests of the company's employees;

-- the need to foster the company's business relationships with

suppliers, customers, and others;

-- the impact of the company's operations on the community and the environment;

-- the desirability of the company to maintain a reputation for

high standards of business conduct; and

-- the need to act fairly between members of the company.

In connection with its statement, the Board describes in general

terms how key stakeholders, as well as issues relevant to key

decisions are identified, and also the processes for engaging with

key stakeholders including employees and suppliers, and

understanding those issues. It is the board's view that these

requirements are predominantly addressed in the corporate

governance disclosures we have made in the directors' report, which

are themselves discussed more extensively on the company's

website.

A more detailed description is limited to matters that are of

strategic importance in order to remain meaningful and informative

for shareholders. The Board believes that two decisions taken

during the year fall into this category, and engaged with internal

and external stakeholders on these decisions:

-- 2020 Fundraise - The Directors, along with the Group's NOMAD

and broker, assessed the market for its appetite to support the

Group's fundraising efforts. Strategy and work were completed to

launch a fundraise in early 2020. This was determined to be the

optimal time to execute a fundraise as the 2019 revenue numbers

reflected the growth in polymer sales that shareholders were

expecting. These efforts in March 2020 were unsuccessful due to the

impact of Covid-19 on the London Stock Exchange. The fundraise was

completed in July 2020.

-- Covid-19 - The Group continually assesses the impact Covid-19

has on customer orders, supply chain and employees. Efforts have

been put in place to support customer demand, ensure safety stock,

and safeguard employees' wellness during these unprecedented

times.

James Barber John R. Shaw

Chairman Chief Executive Officer

CONSOLIDATED INCOME STATEMENT

For the year ended 31 December 2020

2020 2019

Notes $'000 $'000

---------------------------------------------- ----- ------- -------

Revenue 2 3,292 1,288

Cost of sales (2,138) (838)

---------------------------------------------- ----- ------- -------

Gross profit 1,154 450

Other operating income 50 62

Administrative expenses (2,595) (3,390)

---------------------------------------------- ----- ------- -------

Group operating loss before exceptional

items (1,391) (2,878)

Exceptional (expense) / income on revaluation

of contingent consideration (339) 1,474

Exceptional income on organizational

restructuring 91 -

Finance income - 1

Gain on sale of associate - 84

Share of loss of associate - (38)

---------------------------------------------- ----- ------- -------

Operating Loss before tax from operations (1,639) (1,357)

---------------------------------------------- ----- ------- -------

Taxation (7) (1)

---------------------------------------------- ----- ------- -------

Loss for the year from operations (1,646) (1,358)

Loss for the year (1,646) (1,358)

---------------------------------------------- ----- ------- -------

Basic and diluted loss per share 3 (0.5) (0.5)

---------------------------------------------- ----- ------- -------

Diluted loss per share 3 (0.5) (0.5)

---------------------------------------------- ----- ------- -------

CONSOLIDATED STATEMENT OF OTHER COMPREHENSIVE INCOME

For the year ended 31 December 2020

2020 2019

$'000 $'000

-------------------------------- ---- ------- -------

Loss for the year (1,646) (1,358)

Items that will be reclassified

subsequently to profit or loss

Exchange gains in translation

of foreign operations 8 48

-------------------------------------- ------- -------

Total comprehensive loss for

the year, net of tax (1,638) (1,310)

-------------------------------------- ------- -------

Attributable to:

Equity holders of parent (1,638) (1,310)

-------------------------------------- ------- -------

CONSOLIDATED BALANCE SHEET

At 31 December 2020

31 Dec 31 Dec

2020 2019

$'000 $'000

Non-current assets

Property, plant and equipment 501 701

Right-of-use assets 746 920

Investment in subsidiary

undertakings - -

1,247 1,621

------------------------------ -------- --------

Current assets

Inventories 1,361 504

Trade and other receivables 463 331

Cash and cash equivalents 1,448 765

------------------------------- -------- --------

3,272 1,600

------------------------------ -------- --------

Total assets 4,519 3,221

------------------------------- -------- --------

Financed by

Equity shareholders'

funds

Equity share capital 5,718 3,677

Equity share premium 46,135 46,135

Own shares reserve (5) (5)

Merger reserve 31,343 31,343

Share based payment reserve 10,335 10,317

Foreign translation reserve (211) (219)

Retained deficit (93,940) (92,245)

Total equity (625) (997)

------------------------------- -------- --------

Non-current liabilities

Contingent consideration 2,707 2,441

Note payable 51 -

Lease liabilities 476 750

------------------------------- -------- --------

3,234 3,191

------------------------------ -------- --------

Current liabilities

Trade and other payables 1,404 707

Notes payable 132 -

Contingent consideration 146 -

Lease liabilities 228 320

------------------------------- -------- --------

1,910 1,027

------------------------------ -------- --------

Total liabilities 5,144 4,218

------------------------------- -------- --------

Total equity and liabilities 4,519 3,221

------------------------------- -------- --------

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

At 31 December 2020

Equity Equity Own Merger Share Foreign Retained Total

share share shares reserve based translation deficit

capital premium reserve payment reserve

reserve

------------------------- --------- --------- --------- --------- --------- ------------- --------- --------

$'000 $'000 $'000 $'000 $'000 $'000 $'000 $'000

At 1 January 2019 3,677 46,135 (5) 31,343 10,293 (267) (90,887) 289

Loss for the year - - - - - - (1,358) (1,358)

Exchange differences

on translation of

foreign operations - - - - - 48 - 48

Share based payments - - - - 24 - - 24

------------------------- --------- --------- --------- --------- --------- ------------- --------- --------

At 31 December 2019 3,677 46,135 (5) 31,343 10,317 (219) (92,245) (997)

------------------------- --------- --------- --------- --------- --------- ------------- --------- --------

Loss for the year - - - - - - (1,646) (1,646)

Share issuance proceeds 2,041 205 - - - - - 2,246

Share issuance expenses 2,041 205 - - - - - 2,246

Exchange differences

on translation of

foreign operations - - - - - 8 - 8

Share based payments - - - - 18 - - 18

------------------------- --------- --------- --------- --------- --------- ------------- --------- --------

At 31 December 2020 5,718 46,135 (5) 31,343 10,335 (211) (93,940) (625)

------------------------- --------- --------- --------- --------- --------- ------------- --------- --------

CONSOLIDATED STATEMENT OF CASH FLOWS

For the year ended 31 December 2020

2019

2020 (Restated)

$'000 $'000

--------------------------------------- ----- ------- -----------

Net cash outflow from operating

activities (1,157) (1,831)

---------------------------------------------- ------- -----------

Proceeds from sale of property,

plant and equipment 20 40

Purchase of property, plant and

equipment - (39)

Proceeds from sales of associate

investment, net of transaction

costs - 211

Repayment on the loan to associate - 57

Interest received - loan to associate - 6

Cash loaned to subsidiary undertakings - -

Net cash inflow from investing

activities 20 275

---------------------------------------------- ------- -----------

Cash received from issue of shares 2,246 -

Transactions costs paid on the

issue of shares (254) -

Proceeds from government secured

debt 183 -

Repayment of lease liability (327) (320)

Interest paid - leases (28) (14)

Net cash inflow / (outflow) from

financing activities 1,820 (334)

---------------------------------------------- ------- -----------

Net inflow / (outflow) in cash

and cash equivalents 683 (1,890)

Cash and cash equivalents at

beginning of year 765 2,655

---------------------------------------------- ------- -----------

Cash and cash equivalents at

end of year 1,448 765

---------------------------------------------- ------- -----------

NOTES TO THE FINANCIAL INFORMATION

1. Accounting policies

Basis of presentation

The financial information set out in this document does not

constitute the Group's statutory accounts for the years ended 31

December 2019 or 2020. Statutory accounts for the years ended 31

December 2019 and 31 December 2020, which were approved by the

directors on 29 March 2021, have been reported on by the

Independent Auditors. The Independent Auditor's Reports on the

Annual Report and Financial Statements for each of 2019 and 2020

were unqualified, did draw attention to a matter by way of

emphasis, being going concern and did not contain a statement under

498(2) or 498(3) of the Companies Act 2006.

Statutory accounts for the year ended 31 December 2019 have been

filed with the Registrar of Companies. The statutory accounts for

the year ended 31 December 2020 will be delivered to the Registrar

of Companies in due course and will be posted to shareholders

shortly, and thereafter will be available from the Group's

registered office at Fieldfisher Riverbank House, 2 Swan Lane,

London, United Kingdom, EC4R 3TT and from the Group's website

https://itaconix.com/investor/reports-documents/

The financial information set out in these results has been

prepared using the recognition and measurement principles of

International Accounting Standards, International Financial

Reporting Standards and Interpretations in conformity with the

requirements of the Companies Act 2006. The accounting policies

adopted in these results have been consistently applied to all the

years presented and are consistent with the policies used in the

preparation of the financial statements for the year ended 31

December 2019, except for those that relate to new standards and

interpretations effective for the first time for periods beginning

on (or after) 1 January 2019. There are deemed to be no new

standards, amendments and interpretations to existing standards,

which have been adopted by the Group, that have had a material

impact on the financial statements.

The Group's financial information has been presented in US

Dollars (USD).

Going concern

The financial statements have been prepared on a going concern

basis. The Directors have reviewed the Company's and the Group's

going concern position taking account its current business

activities, budgeted performance and the factors likely to affect

its future development, set out in the Annual Report, and including

the Group's objectives, policies and processes for managing its

working capital, its financial risk management objectives and its

exposure to credit and liquidity risks.

The Group made a loss before exceptional items for the year of

$1,391k, had Net Current Assets at the period end of $1,308k and a

Net Cash Outflow from Operating Activities of $1,157k. Primarily,

the Group meets its day to day working capital requirements through

existing cash resources and had on hand cash, cash equivalents and

short-term deposits at the balance sheet date of $1,448k.

During the year, the Group reduced its expenditures and

successfully raised funds of $2,246k.

The Directors have reviewed the Group's cash flow forecasts

covering a period of at least 12 months from the date of approval

of the financial statements, which foresee that the Group will be

able to meet its liabilities as they fall due. However, the success

of the business is dependent on customer adoption of our products

in order to increase revenue and profit growth. Inability to

deliver this could result in the requirement to raise additional

funds.

The Directors have also taken into consideration the impact of

the Covid-19 pandemic on the Group's revenues and supply chain.

While there has not been a negative impact through the report date

on the Group revenues or supply chain due to the pandemic, the

Directors have applied sensitivities to the revenue models and have

assessed alternate supply chains that have been developed by the

Group to mitigate any issues to our customers.

The Directors have concluded that the circumstances set forth

above represent a material uncertainty, which may cast significant

doubt about the Company and Group's ability to continue as a going

concern. However, they believe that, taken as a whole, the factors

described above enable the Company and Group to continue as a going

concern for the foreseeable future. The financial statements do not

include the adjustments that would be required if the Company and

the Group were unable to continue as a going concern.

2. Revenue

Revenue recognised in the Group income statement is analysed as

follows:

2020 2019

$'000 $'000

Sale of goods 3,292 1,288

3,292 1,288

----- -----

Geographical information

2020 2019

$'000 $'000

North America 2,869 1,128

Europe 423 160

3,292 1,288

----- -----

The revenue information is based on the location

of the customer.

Segmental information

The revenue information above is derived from the continuing

operations. The Group therefore has one segment, the Specialty

Chemicals segment, which designs and manufactures proprietary

specialty polymers to meet customers' needs in the home care and

industrial markets and in personal care being the Group's principal

activities.

Net assets of the Group (being total assets less total

liabilities) are attributable to geographical locations as at 31

December 2020 as follows:

2020 2019

$'000 $'000

North America 932 1,251

Europe (1,557) (2,248)

(625) (997)

------- -------

3. Loss per share

Basic loss per share is calculated by dividing the loss

attributable to ordinary shareholders by the weighted average

number of ordinary shares in issue during the year.

2020 2019

Loss $'000 $'000

Loss for the purposes of basic and diluted

loss per share (1,646) (1,358)

------- -------

Weighted average number of ordinary shares

for the purposes of basic and diluted loss

per share ('000) 344,970 269,130

------- -------

Basic and diluted loss per share (0.5)c (0.5) c

------- -------

The loss for the period and the weighted average number of

ordinary shares for calculating the diluted earnings per share for

the period to 31 December 2020 are identical to those used for the

basic earnings per share. This is because the outstanding share

options would have the effect of reducing the loss per ordinary

share and would therefore not be dilutive.

4. Cautionary Statement

This document contains certain forward-looking statements

relating to Itaconix plc (the "Group"). The Group considers any

statements that are not historical facts as "forward-looking

statements". They relate to events and trends that are subject to

risk and uncertainty that may cause actual results and the

financial performance of the Group to differ materially from those

contained in any forward-looking statement. These statements are

made by the Directors in good faith based on information available

to them and such statements should be treated with caution due to

the inherent uncertainties, including both economic and business

risk factors, underlying any such forward-looking information.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

FR DKCBDBBKBPNB

(END) Dow Jones Newswires

March 30, 2021 02:00 ET (06:00 GMT)

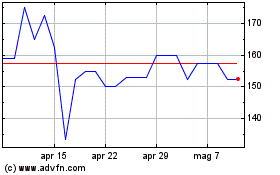

Grafico Azioni Itaconix (LSE:ITX)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni Itaconix (LSE:ITX)

Storico

Da Apr 2023 a Apr 2024