TIDMITX

RNS Number : 4030D

Itaconix PLC

28 October 2020

28 October 2020

Itaconix plc ("Itaconix" or the "Company")

Half year results for the period ended 30 June 2020

Sustainable Products Drive Major Revenue Growth

Itaconix (LSE: ITX) (OTCQB: ITXXF), a leading innovator in

sustainable specialty polymers, is pleased to announce its

unaudited interim results for the six months ended 30 June 2020

("2020").

A copy of the Interim Report & Accounts is available for

download on Itaconix's website at www.itaconix.com.

Financial Highlights

Financial results for the first half of 2020 show the increasing

uptake by major brands of the Company's sustainable products as key

ingredients in everyday consumer goods and the significant progress

made towards profitability from higher volumes across both home and

personal care applications.

-- First half revenues of $1.1 million were 80% higher than the

first half of 2019 and 59% higher than the second half of 2019.

First half revenues also represent 84% of revenues for the full

year of 2019.

-- Gross profits were $0.4 million, representing an increase of

129% over the first half of 2019 and 47% over the second half of

2019.

-- Gross profit margin was 37% compared to 35% for the full year

of 2019, remaining in line with Company expectations for a

specialty ingredient company.

-- Adjusted EBITDA(1) was a loss of $0.6 million, compared to a

loss of $1.2 million for the same period in 2019 and a loss of $1.2

million for the second half of 2019, reflecting the continued

trajectory towards achieving break-even profitability from

increasing revenues.

-- Gross operating loss of $0.8 million, representing a decrease

of 43% from losses of $1.4 million in both the first and second

half of 2019.

-- Cash and Cash Equivalents as at 30 June 2020 was $0.5

million, compared to $0.8 million as at 31 December 2019.

-- In May 2020, Itaconix Corporation received a US Government

Paycheck Protection Program Loan for $0.2m to support the business

through the Covid-19 pandemic.

-- In July 2020, the Company completed an equity raise with

gross proceeds of $2.2 million to fund operating costs and working

capital needs as revenues advance toward break-even

profitability.

Operational Highlights

The acceleration in revenues is the result of the continued

broadening of the customer base and advancement in customer

projects in the Company's major application areas:

-- Revenues increased across all of the Company's home and personal care polymers.

-- Although demand for household cleaning has surged during the

Covid-19 pandemic, major new revenues came from new customer

products entering the market with new levels of performance, cost

and sustainability.

-- We introduced our new Itaconix(R) TSI(TM) 322 detergent

polymer with use in two North American dishwashing detergent

brands.

-- The Company completed a supply agreement with New Wave Global

Services Inc. ("New Wave"), a leading North American detergent

supplier, on the pricing and supply of up to 1,000,000 lbs. of

Itaconix detergent polymers through 2021. Volumes in the first half

of 2020 exceeded management expectations.

-- Demand for our ZINADOR(TM) odour removal polymer continues to

expand into leading household brands and new regions through our

collaboration with Croda.

-- Revenues for our hairstyling polymer advanced through our collaboration with Nouryon.

-- The Company announced its new BIO*Asterix(TM) line of

functional additives and a joint development agreement for

potential use by a leading innovator in biodegradable

packaging.

Outlook

Itaconix has commercial momentum as current customer products

succeed in the market and new customer products continue to

progress to market in the next year. The expanding foundation of

recurring revenues is creating a strong base for continued revenue

growth toward the Company's goal of sustainable profitability in

the coming years.

John R. Shaw, CEO of Itaconix, stated: "Major advancements in

our customer pipeline allowed us to enter a new phase of commercial

growth in the first half of 2020. Our customers are succeeding with

new products that leverage the unique value and functionality of

our sustainable ingredients. When consumers purchase these new

products for their performance and cost, they also benefit the

environment through a reduction in the depletion of natural

resources, an increase in the use of safer chemicals, and a

reduction in the release of chemicals."

(1) Adjusted EBITDA is defined and reconciled to Operating loss

in Note 4 of the Interim Report.

For further information please contact:

Itaconix plc +1 603 775-4400

John R. Shaw / Laura Denner

N+1 Singer +44 (0) 207 496 3000

Peter Steel / James Moat (Corporate Finance)

Tom Salvesen (Corporate Broking)

About Itaconix

Itaconix develops and produces bio-based functional ingredient

that improve the safety, performance or sustainability of consumer

and industrial products, with technology and market leadership

positions in non-phosphate detergents, odour control, and hair

styling.

www.itaconix.com

Chief Executive's Statement

Itaconix is building a growing, high-gross-margin,

capital-efficient company around the use of our proprietary

sustainable chemistries as high-value ingredients in everyday

consumer products. Our near-term focus is to reach sustainable

revenues and profitability through our current efforts in

non-phosphate detergents, odour control, and hair styling.

Commercial Progress

We entered a new stage of revenue growth in the first half of

2020 as important customer projects began to convert into new order

volumes. Our polymers are delivered based on purchase orders

received from customers to blend and produce home and personal care

products. While we have some agreements with larger customers on

purchasing terms, order volumes are based on the underlying demand

for customers' end-products. As our customers launch and succeed in

the market with new consumer products based on our bio-based

polymers, our monthly revenues are increasing in size and

reliability from a growing base of recurring orders. We expect

these dynamics to continue as additional customer projects in our

pipeline convert into new order volumes.

In January, we announced the introduction of Itaconix(R) TSI(TM)

322 as our latest advance in high-performing detergent polymers.

Itaconix(R) TSI(TM) 322 is the result of our ongoing engagement

with current and potential customers on a new generation of

non-phosphate dishwashing detergents to meet changing consumer

buying behaviour. The key formulation breakthrough with Itaconix(R)

TSI(TM) 322 is the ability to deliver excellent performance while

replacing multiple ingredients to achieve cost savings and more

sustainable and compact detergent products.

In January, we also announced that the US Patent and Trademark

Office issued a new patent to the Company for the composition of

detergents containing Itaconix's novel bio-based polymers. This new

patent provides the Company with an additional layer of

intellectual property protection for the unique value of Itaconix

polymers in non-phosphate dishwasher detergents. In addition, the

new patent extends the Company's proprietary position in key

detergent compositions to 2037.

Also in January, we announced the delivery of the first order of

ZINADOR(TM) 35L to Croda. The Company had previously announced an

expansion of its global supply agreement in odour control products

with Croda to include both ZINADOR(TM) 22L and 35L. The new

ZINADOR(TM) 35L is a more concentrated version of Itaconix's

proprietary polymeric complex that delivers performance and cost

advantages in detergent and industrial applications.

In February, we extended our commercial relationship with New

Wave Global Services Inc. ("New Wave"), a leading North American

detergent supplier, with a licensing agreement for a new

dishwashing detergent formulation and a supply agreement to support

the growth in the Company's polymer volumes used in New Wave

products. The new dishwashing formulation is based on the

competitive advantages available with Itaconix(R) TSI(TM) 322.

Roll-out into New Wave's customer base began in the first half of

2020. The supply agreement provides New Wave with certainty on the

pricing and supply of up to 1,000,000 lbs. of the Company's

detergent polymers as New Wave volumes increase from both existing

and new customers.

In February, we announced our BIO*Asterix(TM) line of functional

additives based on a new range of bio-based chemistries derived

from itaconic acid. The Company developed the new BIO*Asterix(TM)

additives over the past three years for a wide range of potential

uses, ranging from biodegradable plastics to decorative paints. The

Company plans to launch its new product line in stages over the

next few years.

I believe the demonstrated value that our polymers provide as

key ingredients in everyday consumer products underpin our progress

and will generate continued demand growth to create a sizable

specialty ingredients company.

Financial Performance

Our financial results for the first half of 2020 show both the

increasing uptake of our products and the favourable operating

structure we have created to achieve profitability as revenues

grow:

First half revenues of $1.1 million were 80% higher than the

first half of 2019 and 59% higher than the second half of 2019.

First half revenues also represent 84% of revenues for the full

year of 2019.

Gross profits were $0.4 million, representing an increase of

129% over the first half of 2019 and 47% over the second half of

2019.

Gross profit margin was 37%, compared to 29% for the first half

of 2019 and 35% for the full year of 2019.

Adjusted EBITDA (see note 4 to the financial information) was a

loss of $0.6 million, compared to a loss of $1.2 million for the

same period in 2019 and a loss of $1.2 million for the second half

of 2019, reflecting the continued improvement in the Company's

profitability from increasing revenues.

Gross operating profit was a loss of $0.8 million, representing

a decrease of 43% from losses of $1.4 million in both the first and

second half of 2019.

Financial Resources

We ended the first half of 2020 with the announcement of an

equity fundraise to strengthen our balance sheet and support our

continued operations.

In March, we announced our efforts to extend the Company's cash

runway and conserve available working capital after an equity

fundraise was postponed due to uncertainty in the financial markets

caused by the Covd-19 pandemic.

In May, we announced that a combination of revenue growth, cost

reduction efforts, working capital measures, and government funding

programs had extended the Company's cash runway.

In July, we received the required shareholder approvals and

completed the equity fundraise. I greatly appreciate the strong

support we received from both existing and new shareholders for our

progress and development plans.

Covid-19 Pandemic

Major new revenues from a steady stream of new customer products

entering the market have allowed us to continue to operate and grow

as an essential business throughout the Covid-19 pandemic while

addressing several risks.

Most importantly, we are monitoring the safety and health of our

employees. We have aligned our operations with government

recommendations to limit exposure to Covid-19. We have also

eliminated travel while putting new efforts in place to regularly

engage with customers and vendors.

Although demand for household cleaning has surged during the

Covid-19 pandemic, we believe that the majority of our new revenues

come from new customer products that are capturing long-term market

share based on new levels of performance, cost and sustainability.

I expect our current and new customer projects to continue to

advance under the major scenarios for the Covid-19 pandemic.

As detailed above, we successfully managed our operations

through a period of funding constraints and now have the working

capital to meet the needs of our near-term revenue growth.

We continue to assess risks and potential issues in our supply

chain and are taking measures to assure the reliable supply of raw

materials from our vendors and delivery of our products to our

customers.

Outlook

Itaconix is at a new stage of long-term revenue growth and value

creation. The expanding customer base for our current products is

generating recurring revenues and financial performance that places

us on a discernible path to achieve our near-term goal of sustained

revenue growth to reach profitability. We have a pipeline of active

customer projects to reach beyond this goal and look firmly to the

future with continued optimism.

John R. Shaw

Chief Executive Officer

27 October 2020

Condensed consolidated income statement and statement of

comprehensive income

For the six months ended 30 June 2020

Unaudited Unaudited Audited

6 Months 6 Months Year to

to 30 June to 30 June 31 December

2020 2019 2019

(restated)

Notes $000 $000 $000

Revenue 5 1,086 604 1,288

Cost of sales (683) (428) (838)

----------- ----------- ------------

Gross profit 403 176 450

Other operating income 71 27 62

Administrative expenses (1,287) (1,638) (3,390)

----------- ----------- ------------

Group operating loss (813) (1,435) (2,878)

Finance income - - 1

Exceptional (expense) / income

on movement of contingent consideration 6 - (816) 1,474

Gain on sale of equity interest

in associate - 84 84

Share of profit of associate - (38) (38)

----------- ----------- ------------

Loss before tax (813) (2,205) (1,357)

Taxation (expense) credit (1) (7) (1)

----------- ----------- ------------

Loss for the period / year (814) (2,212) (1,358)

Other comprehensive income,

net of income tax

Items that may be reclassified

subsequently to profit or loss:

Exchange differences on translated

foreign operations 110 189 48

----------- ----------- ------------

Total comprehensive loss for

the period / year (704) (2,023) (1,310)

=========== =========== ============

Basic and diluted loss per share 7 (0.3p) (0.7p) (0.5p)

=========== =========== ============

Condensed consolidated statement of financial position

As at 30 June 2020

Unaudited Audited

As at As at

30 June 31 December

2020 2019

Notes $000 $000

Non-current assets

Property, plant and equipment 588 701

Right-of-use asset 822 920

--------- -----------

1,410 1,621

Current assets

Inventories 706 504

Trade and other receivables 290 331

Cash and cash equivalents 3 459 765

--------- -----------

1,455 1,600

--------- -----------

Total assets 2,865 3,221

========= ===========

Financed by

Equity shareholders' funds

Equity share capital 3,677 3,677

Equity share premium 46,135 46,135

Own shares reserve (5) (5)

Merger reserve 31,343 31,343

Share based payment reserve 10,324 10,317

Foreign translation reserve (109) (219)

Retained losses (93,058) (92,245)

--------- -----------

Total deficit (1,693) (997)

Non-current liabilities

Contingent consideration 6 2,274 2,441

Long-term lease liability 576 750

--------- -----------

2,850 3,191

--------- -----------

Current liabilities

Trade and other payables 1,385 707

Short-term lease liability 323 320

--------- -----------

1,708 1,027

--------- -----------

Total liabilities 4,558 4,218

--------- -----------

Total equity and liabilities 2,865 3,221

========= ===========

Interim condensed consolidated statement of cash flows

For the six months ended 30 June 2020

Unaudited Unaudited

6 Months 6 Months

to to

30 June 30 June

2020 2019

(restated)

$000 $000

Cash flows from operating activities

Operating loss (813) (2,205)

Adjustments for:

Finance expense - 2

Depreciation of property, plant and

equipment 108 109

Depreciation of right-of-use asset 99 106

Gain on disposal of equipment (15) (13)

Gain on sale of investment in associate - (84)

Share of loss from associate - 38

Recovery of loan to associate - (29)

Share option charge 8 15

Revaluation of deferred consideration - 816

(Gain) / loss on foreign exchange (57) 189

Taxation (1) (7)

Increase in inventories (202) (161)

Decrease in receivables 40 300

Increase in payables 496 70

--------- ----------

Net cash (outflow) from operating activities (337) (854)

--------- ----------

Cash flows from investing activities

Investment in associate undertaking,

net of transaction costs - 211

Repayment of the loan to associate - 57

Interest paid on loan to associates - 6

Proceeds from sale of property, plant

and equipment 20 40

Purchase of property, plant and equipment - (32)

--------- ----------

Net cash inflow from investing activities 20 282

--------- ----------

Cash flows from financing activities

Proceeds from government secured debt 183 -

Lease payments (183) (108)

Interest expense on lease payments 11 9

--------- ----------

Net cash (outflow) from financing activities 11 (99)

--------- ----------

Net (outflow) in cash and cash equivalents (306) (671)

Cash and cash equivalents at beginning

of the period 765 2,655

--------- ----------

Cash and cash equivalents at end of

the period 459 1,984

========= ==========

Notes to the interim condensed consolidated financial

statements

1. General information

These unaudited interim condensed financial statements of

Itaconix plc for the six months ended 30 June 2020 were approved

for issue in accordance with a resolution of the Board on 27

October 2020. Itaconix plc is a public limited company incorporated

in the United Kingdom whose shares are traded on the AIM Market of

the London Stock Exchange.

This half-yearly financial report is also available on the

Group's website at https://itaconix.com/investor/reports-documents/

.

2. Accounting policies

These interim consolidated financial statements have been

prepared using accounting policies based on International Financial

Reporting Standards (IFRS and IFRIC Interpretations) issued by the

International Accounting Standards Board ("IASB") as adopted for

use in the EU. They do not include all disclosures that would

otherwise be required in a complete set of financial statements and

should be read in conjunction with the 31 December 2019 ('2019')

Annual Report. The financial information for the half years ended

30 June 2020 and 30 June 2019 does not constitute statutory

accounts within the meaning of Section 434 (3) of the Companies Act

2006 and both periods are unaudited.

The annual financial statements of Itaconix Plc ('the Group')

are prepared in accordance with IFRS as adopted by the European

Union. The comparative financial information for the year ended 31

December 2019 included within this report does not constitute the

full statutory Annual Report for that period. The statutory Annual

Report and Financial Statements for 2019 have been filed with the

Registrar of Companies. The Independent Auditors' Report on the

Annual Report and Financial Statements for the year ended 31

December 2019 was unqualified, did draw attention to a matter by

way of emphasis, being going concern, and did not contain a

statement under 498(2) - (3) of the Companies Act 2006.

The interim condensed consolidated financial statements are

presented in US dollars and all values are rounded to the nearest

thousand ($'000) except when otherwise indicated. The interim

condensed consolidated financial statements are prepared on the

historical cost basis except for contingent consideration which

have been measured at fair value.

The Group has applied the same accounting policies and methods

of computation in its interim consolidated financial statements as

in its 31 December 2019 annual financial statements, except for

those that relate to new standards and interpretations effective

for the first time for periods beginning on (or after) 1 January

2020 and will be adopted in the 2020 financial statements. There

are deemed to be no new and amended standards and/or

interpretations that will apply for the first time in the next

annual financial statements that are expected to have a material

impact on the Group.

Reporting Currency

As noted in the Group's 2019 Annual Report, the Board decided to

change the reporting currency for the year end 31 December 2019 to

US Dollars (USD). The Board therefore believes that USD financial

reporting provides a reliable and more relevant presentation of the

Group's financial position, funding and treasury functions,

financial performance, and its cash flows. Coupled with the

evolution of the business, the Group's shareholder base is now

largely comprised of foreign investors to whom financial reporting

in GBP is of limited relevance. Internally, the Board also bases

its performance evaluation and many investment decisions on USD

financial information. As a result of this updated accounting

policy, the comparative information for the period ended 30 June

2019, has been restated in USD.

Going concern

This Interim Report has been prepared on the assumption that the

business is a going concern. In reaching their assessment, the

Directors have considered a period extending at least 12 months

from the date of approval of this half-yearly financial report.

This assessment has included consideration of the forecast

performance of the business for the foreseeable future and the cash

available to the Group. As such, the Directors have concluded that

there exists a material uncertainty which may cast doubt as to the

Group's ability to continue as a going concern. However, taking

account of the Group's working capital at the date of this report,

the Group's current revenue growth, and current shareholder

approval to raise capital if needed, the Directors believe the

Group will continue as a going concern for the foreseeable future.

The interim financial statements do not include the adjustments

that would be required if the Group were unable to continue as a

going concern.

Risks and uncertainties

The principal risks and uncertainties facing the Group remain

broadly consistent with the Principal Risks and Uncertainties

reported in Itaconix plc's 31 December 2019 Annual Report. Since

the 2019 Annual Report, the Board have been monitoring and

mitigating the effects of the following international events on the

Group's business:

Covid-19

In March 2020, the World Health Organisation declared a global

pandemic due to the spread of Covid-19. The pandemic has restricted

people's movements globally and caused economic disruption and

uncertainty to supply chain and customer stability. The impact of

Covid-19 has been considered as part of the Group's going concern

assessment with a focus on the impact on the Group's revenues,

working capital and non-current assets. Management have considered

the impact a non-adjusting balance sheet event.

Throughout the Covid-19 pandemic, the Group has maintained

operations as an essential business. Extraordinary efforts to

conserve available cash were taken in March 2020 to manage the

Group's working capital. In addition, new funding, via an equity

raise (see Note 8), was sourced in July 2020. While some customer

formulation activities have slowed, the surge in demand for

household detergents has significantly increased order volumes for

the Group's detergent polymers. Effective customer engagement has

continued without travel through adaptation and innovation in

customer communication and engagement.

Brexit

The United Kingdom ('UK') formally left the European Union

('EU') on 30 January 2020. The UK is now in a transition period,

being an intermediary arrangement covering matters like trade and

border arrangements, citizens' rights and jurisdiction on matters

including dispute resolution. The transition period is currently

due to end on 31 December 2020 and negotiations are ongoing to

determine and conclude a formal agreement. The Directors are

closely monitoring the situation and currently deem that the

effects of Brexit will not have a significant impact on the Group's

operations given that the Group operates predominantly outside the

UK.

3. Cash and cash equivalents

Unaudited Audited

As at As at

30 June 31 December

2020 2019

$000 $000

Cash at bank and in hand 459 765

--------- -----------

459 765

========= ===========

4. Reconciliation of Operating Loss to Adjusted EBITDA

The detail below shows the reconciliation of operating loss to

earnings before exceptional expense/(income), gain on sale of

equity interest in associate, share of profit of associate,

interest, taxes, depreciation and amortization (Adjusted

EBITDA).

Unaudited Unaudited Audited

6 Months 6 Months Year to

to 30 June to 30 June 31 December

2020 2019 2019

(restated)

$000 $000 $000

Loss for the period (814) (2,212) (1,358)

Exceptional expense (income) on

movement of contingent consideration - 816 (1,474)

Gain on sale of equity interest

in associate - (84) (84)

Share of profit of associate - 38 38

Interest - (1) (1)

Taxes 1 7 1

Depreciation 207 215 421

----------- ----------- --------------

Adjusted EBITDA (606) (1,221) (2,457)

=========== =========== ==============

5. Segmental analysis

Revenue by business segment:

The Group has one segment, the Specialty Ingredients segment,

which designs and manufactures proprietary specialty polymers to

meet customers' needs in the personal and consumer health care,

homecare and industrial sectors. This segment makes up the

continuing operations above.

Net assets of the Group are attributable solely to the UK and

US.

Unaudited Unaudited Audited

6 months 6 months Year to 31

to to December

30 June 2020 30 June 2019 2019

$000 $000 $000

(restated)

Revenue

Sale of goods 1,086 604 1,288

------------- ------------- -----------

Segment revenue 1,086 604 1,288

------------- ------------- -----------

Results

Depreciation & amortisation 207 215 421

Segment loss (822) (1,435) (2,878)

------------- ------------- -----------

Operating assets 2,865 5,089 3,221

------------- ------------- -----------

Operating liabilities 4,558 6,930 4,218

------------- ------------- -----------

Other disclosure:

Capital expenditure* Nil 32 39

------------- ------------- -----------

*Capital expenditure consists of additions of property, plant

and equipment, and intangible assets including assets from the

acquisition of subsidiaries.

Geographical information

Revenues Net assets

Unaudited Unaudited Audited Unaudited Audited

Six Months Six Months Year to 31 Six Months Year to 31

to to December to December

30 June 2020 30 June 2019 2019 30 June 2020 2019

(restated)

$000 $000 $000 $000 $000

Europe 93 125 160 (1,836) (2,195)

North America 993 479 1,128 499 1,198

1,086 604 1,288 (1,337) (997)

============= ============= ========== ============= ==========

The revenue information above is based on the location of the

customer.

6. Contingent consideration

$'000

As at 31 December 2019 (Audited) 2,441

Movement in fair value and discounting unwind -

Movement in foreign exchange (167)

-----

As at 30 June 2020 (Unaudited) 2,274

=====

During 2018, in conjunction with the fund raise, a restructuring

of the contingent consideration was executed. The contingent

consideration was restructured into two components:

-- A one-time issue of 15 million new Itaconix plc shares to the Sellers.

-- The continuation of the previous contingent consideration

mechanism (i.e. up to $6m in shares), but with the window of time

for potential achievement expanded to the end of 2023 (from the end

of 2020) and including all the revenues of the Group (which are

primarily from products based on the acquired technology in any

event).

It should also be noted that the second component summarised

above is intended to serve as an incentive programme for the two

members of management (John Shaw and Yvon Durant) who are also

Sellers and are entitled to 63% of the total contingent

consideration. Accordingly, they are not eligible for any cash

bonus or other share incentive programme until the end of 2020.

Simultaneously, the merger agreement with the former shareholders

of Itaconix Corporation and related agreements were amended to

remove various restrictive clauses, including minimum funding

requirements and employment terms.

Based on the share price at the execution of the restructuring

agreement in 2018, the 15m shares had a value of GBP0.3m which was

expensed immediately.

In respect of 2020, the deferred consideration was valued using

a discounted cash flow-based assessment of the expected sales of

the relevant products extracted from the latest Board approved

forecasts, consistent with the approach in prior years. A discount

rate of 11.2% was used. The valuation includes elements which are

unobservable and which have a significant impact on the fair value.

Accordingly, contingent consideration is classified as Level 3 fair

value measurement .

The value of the adjusted contingent component using the latest

Board approved forecasts and assumptions as above is $2.3m (31

December 2019 - $2.4m)

As a result of the changed revenue forecasts, earn out period,

and discount rate from the original value assessments, the

contingent consideration at 31 December 2019 was reduced to $2.4m.

Sensitivity analysis was also performed, summarised as follows:

-- If the sales in the period 2020 to 2022 were reduced by

$1.0m, the fair value would be reduced by approximately $0.4m

-- A 1% increase in the discount rate would reduce the fair value by $55k

Since the forecasts used were a conservative base case, the

computed fair value was deemed appropriate.

7. Weighted-average number of ordinary shares

Unaudited Unaudited

6 Months 6 Months

to to

30 June 30 June

2020 2019

Weighted average number of ordinary shares

for the

purposes of basic and diluted loss per

share ('000) 269,130 269,130

========= =========

8. Events after the reporting period

In July 2020, the Group successfully raised gross proceeds of

$2.2 million (GBP1.8 million) via an oversubscribed placing and

subscription from existing and new investors at the Issue Price of

1.1 pence ($0.01375) per share. A total of 163,318,182 new Ordinary

Shares were placed. The net proceeds of the Placing and

Subscription are expected to provide sufficient funding for the

Company until at least the end of 2021 during which the Company

expects to make significant progress towards its strategic

objective.

Subsequent to the reporting period, the Group surrendered its

leased building in Deeside, United Kingdom on 3 September 2020. The

Group is now released from future rent and building related

expenses.

9. Cautionary statement

This document contains certain forward-looking statements

relating to Itaconix plc ('the Company'). The Company considers any

statements that are not historical facts as "forward-looking

statements". They relate to events and trends that are subject to

risk and uncertainty that may cause actual results and the

financial performance of the Company to differ materially from

those contained in any forward-looking statement. These statements

are made by the Directors in good faith based on information

available to them and such statements should be treated with

caution due to the inherent uncertainties, including both economic

and business risk factors, underlying any such forward-looking

information.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR MRBBTMTJTTBM

(END) Dow Jones Newswires

October 28, 2020 03:00 ET (07:00 GMT)

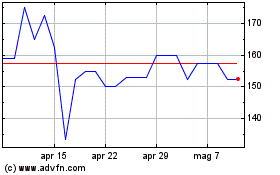

Grafico Azioni Itaconix (LSE:ITX)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni Itaconix (LSE:ITX)

Storico

Da Apr 2023 a Apr 2024