TIDMITX

RNS Number : 1435N

Itaconix PLC

28 September 2021

Itaconix plc

("Itaconix" or the "Company")

Half year results for the period ended 30 June 2021

Itaconix (AIM: ITX) (OTCQB: ITXXF), a leading innovator in

plant-based specialty polymers used as essential ingredients in

everyday consumer products, is pleased to announce its unaudited

interim results for the six months ended 30 June 2021.

John R. Shaw, CEO of Itaconix, commented:

"We continue to build a diverse foundation of consumer products

that rely on our ingredients to meet customer demands for

performance, price, and sustainability. Progress with new and

recurring orders from our growing customer base increased overall

revenues compared to the first half of 2020 and expanded the use of

our plant-based technology platform in the global low-carbon

economy. I am especially excited that a major brand set a new

standard for bio-based content by launching a new North American

dishwashing detergent in February based on Itaconix(R) TSI(TM)

322.

Highlights

-- First half revenues of $1.4 million were 26% higher than the

first half of 2020. Due to customer ordering patterns, these first

half revenues were 36% lower than in the second half of 2020.

-- Gross profits were $0.5 million, representing an increase of

30% over the first half of 2020 and decrease of 30% over the second

half of 2020.

-- Gross profit margin was 38% compared to 35% for the full year

of 2020, remaining in line with Company expectations for a

specialty ingredient company.

-- Adjusted EBITDA(1) was a loss of $0.7 million, compared to a

loss of $0.6 million for the same period in 2020, reflecting some

increase in investment spending on new products and

applications.

-- Loss before taxes was $0.2 million, represented a decrease of

78% from losses of $0.8 million in both the first and second halves

of 2020. Revaluation of the contingent consideration liability as a

non-cash item contributed $0.5 million to this decrease.

Forgiveness of the US PPP loan for Covid-19 government assistance

contributed another $0.2 million to this decrease.

-- Cash and cash equivalents as at 30 June 2021 was $1.4

million, compared to $1.4 million as at 31 December 2020.

-- In June 2021, the Company completed an equity raise with

gross proceeds of $1.5 million to fund general working capital

needs and new product development.

-- The Company received the London Stock Exchange's Green Economy Mark in recognition for its contributions to the global green economy.

Commenting on the outlook John R. Shaw, CEO added:

"Our revenue opportunities continue to grow in line with

increasing recognition of the role our ingredients play in meeting

demands from brands and retailers for more sustainable consumer

products. Order volumes are recovering from the disruptions we

experienced in the first half of the year, but we expect some

continuation in market volatility through to the first half of next

year. Underlying consumer demand for our products and new

application developments are generating new customers and revenue

potential for 2022."

(1) Adjusted EBITDA is defined and reconciled to Operating loss

in Note 4 of the Interim Report.

For further information please contact:

Itaconix plc +1 603 775-4400

John R. Shaw / Laura Denner

Belvedere Communications +44 (0) 20 3687 2756

John West / Llew Angus

finnCap +44 (0) 20 7220 0500

Ed Frisby / Abigail Kelly / Milesh Hindocha

(Corporate Finance)

Andrew Burdis / Sunila de Silva (ECM)

About Itaconix

Itaconix uses its proprietary plant-based polymer technology

platform to produce and sell specialty ingredients that improve the

safety, performance, and sustainability of consumer products. The

Company's current ingredients are enabling and leading new

generations of products in detergents, hygiene, and hair care.

Itaconix's contributions to the global low carbon economy are

recognised by the London Stock Exchange's Green Economy Mark.

www.itaconix.com

Chief Executive's Statement

Overview

Itaconix is using and growing its proprietary plant-based

polymer technology platform to build a large, high-gross-margin,

capital-efficient company that produces and sells key ingredients

used in everyday consumer products. From detergents and air

fresheners to shampoos and underarm deodorants, our ingredients are

adding efficacy and sustainability to a growing range of consumer

products that is creating a customer base for new and recurring

revenues. The demand for new generations of consumer products

continues to grow as the urgency to decarbonise our economies

intensifies. Brands and retailers face increasing pressures from

consumers and governments for more sustainable solutions,

particularly within the 360 million households across Europe and

North America.

Itaconix is pioneering new classes of plant-based polymers that

enable new levels of performance, value, and sustainability across

broad categories of consumer products. The first half of 2021 saw

continued development of a strong foundation for realising the

revenue potential in every household for our plant-based technology

platform. We have a diverse and growing base of customers and

products.

Operations

We are gaining more customers as our current polymers are

adopted as key ingredients in breakthrough consumer products.

We are excited about the growth in our detergent customer base

as important new brands use Itaconix(R) TSI(TM) 322 to produce new

compact products with excellent consumer value and new levels of

sustainability. We are particularly pleased that a major brand

launched a dishwashing detergent in North America that set a new

standard for plant-based content. With the recent announcement of

our first order for Itaconix(R) TSI(TM) 322 in Europe, we expect

our new EU customer to set a similar standard in Europe.

The increase in the detergent customer base did not translate

into higher detergent revenues for the period. These revenues were

flat compared to the same period in 2020 and lower than the second

half of 2020 due to inventory adjustments and supply chain delays.

Many brands and retailers reduced production to recalibrate

inventories for normalized consumer demand after stockpiling

product during the initial stages of the pandemic. Customer

production levels were also reduced by limited supplies of certain

other detergent components due to emergency plant shutdowns in

Texas and Delaware and shipping delays from Asia to North America.

We believe the underlying consumer demand for these products remain

strong.

Our on-going development efforts in odour neutralisation are

generating new applications, adoption by more brands, and

increasing consumer demand from the success of leading brands.

Strong demand for our odour neutralising polymers exceeded our

expectations and resulted in revenues for the period that were

higher than the same period in 2020 and ahead of the second half of

2020.

In hair care, our styling polymer enables both sustainability

and new styling capabilities. Early success with specialty brands

is generating both recurring orders and initial use by major

brands. Hair care revenues for the period were less than the same

period in 2020 and less than the second half of 2020 as shipments

in the last part of 2020 were sufficient to meet customer needs

during the lockdowns in North America and Europe. Underlying demand

remains steady and order volumes are recovering.

On the production side, delivery costs and times for key raw

materials for our polymers are increasing as suppliers continue to

struggle with shipping delays caused by the pandemic and disruption

throughout the supply chain. We have prudent stocks of raw

materials and have worked successfully to pass on additional costs

with product price increases to most of our customers.

LSE Green Economy Mark

Itaconix is demonstrating the ability to contribute to the

decarbonisation of global economies with plant-based ingredients

without compromising on performance or price. We were delighted to

receive the London Stock Exchange's Green Economy Mark in

recognition of this important milestone. This was awarded for our

contributions to the green economy in the LSE's Advanced Materials

industry sector. With increasing awareness of climate change, we

look forward to working with our customers and other plant-based

ingredient companies to decarbonise the global economy.

.

Funding

In June 2021, we raised $1.5 million in new funding through the

placement of new ordinary shares by way of a direct subscription

with one new institutional investor and one existing institutional

shareholder, IP Group plc. The proceeds of the fundraise are being

used for working capital purposes and new product development,

including the certainty of the Company's raw material and finished

goods supply chain.

Financial Results

Revenues of $1.4 million for the first half of the year were a

26% increase over the same period in 2020. These revenues were a

36% decrease on the second half of 2020 due to normal ordering for

customer product launches in early 2021, some stockpiling in

response to the pandemic in late 2020, and the inventory

adjustments and supply delays in this period that are detailed

above.

Odour control revenues in the first half of 2021 were higher

than the same period in 2020 and the second half of 2020. Detergent

revenues for the first half of 2021 were flat compared to the first

half of 2020 and less than the second half of 2020, primarily

reflecting strong customer orders to build inventory in the second

half of 2020. Hair care revenues for the period were less than the

same period in 2020 and the second half of 2020, again, due to the

delivery of large orders into customer inventories toward the end

of 2020.

Gross profits for the period were $0.5 million, representing

gross profit margins of 38% compared to 37% for the same period in

2020 and 35% for the full year of 2020.

Adjusted EBITDA(1) was a loss of $0.7 million, compared to a

loss of $0.6 million for the same period in 2020, reflecting some

increase in investment spending on new products and

applications.

Loss before taxes was $0.2 million, representing a decrease of

78% from losses of $0.8 million in both the first and second halves

of 2020. Revaluation of the contingent consideration liability as a

non-cash item contributed $0.5 million to this decrease.

Forgiveness of the US PPP loan for Covid-19 government assistance,

as other income, contributed another $0.2 million to this

decrease.

Net cash was $1.4 million at 30 June 2021 compared to $0.5

million at 30 June 2020 and $1.4 million at 31 December 2020.

Current Trading and Outlook

Itaconix is building a strong business base of recurring

revenues from existing customers and new recurring revenues from

new customers. Our revenue opportunities are growing in line with

the increasing recognition of the role our ingredients play in

meeting demands from brands and retailers for more sustainable

consumer products. We expect continued success at turning our

pipeline of customer projects into sizable new revenues,

particularly in detergents and odour neutralisation.

Revenues for full year 2021 will depend on the timing of initial

orders from new customers and applications launching in early 2022,

and on the continued recovery in detergent and hair care volumes

from the inventory adjustments and supply delays detailed

above.

In summary, we are extremely pleased at the rate at which our

ingredients are being incorporated into our customers' brands and

expect significant further success in the next twelve months. We

are seeing more opportunities to engage with customers and

potential collaboration partners on new generations of consumer

products using both current and new potential ingredients from our

proprietary plant-based technology platform. Our emerging work on

additional new products and applications is expected to further

grow our customer base and revenue potential.

John R. Shaw

Chief Executive Officer

27 September 2021

Condensed consolidated income statement and statement of

comprehensive income

For the six months ended 30 June 2021

Unaudited Unaudited

6 Months 6 Months

to to

30 June 30 June

2021 2020

Notes $000 $000

Revenue 5 1,366 1,086

Cost of sales (842) (683)

--------- ---------

Gross profit 524 403

Other income 4 183 71

Administrative expenses (1,399) (1,287)

--------- ---------

Group operating loss (692) (813)

Exceptional income on movement of

contingent consideration 6 514 -

--------- ---------

Loss before tax (178) (813)

Taxation credit (1) (1)

--------- ---------

Loss for the period (179) (814)

Other comprehensive income, net

of income tax

Items that may be reclassified subsequently

to profit or loss:

Exchange differences on translated

foreign operations (93) 110

--------- ---------

Total comprehensive loss for the

period (272) (704)

========= =========

Basic and diluted loss per share 7 (0.04p) (0.30p)

========= =========

Condensed consolidated statement of financial position

As at 30 June 2021

Unaudited Audited

As at As at

30 June 31 December

2021 2020

Notes $000 $000

Non-current assets

Property, plant and equipment 457 501

Right-of-use asset 645 746

--------- -----------

1,102 1,247

Current assets

Inventories 1,358 1,361

Trade and other receivables 274 463

Cash and cash equivalents 3 1,378 1,448

--------- -----------

3,010 3,272

--------- -----------

Total assets 4,112 4,519

========= ===========

Financed by

Equity shareholders' funds

Equity share capital 5,873 5,718

Equity share premium 47,633 46,135

Own shares reserve (5) (5)

Merger reserve 31,343 31,343

Share based payment reserve 10,366 10,335

Foreign translation reserve (304) (211)

Retained losses (94,119) (93,940)

--------- -----------

Total equity / (deficit) 787 (625)

Non-current liabilities

Contingent consideration 6 2,078 2,707

Note payable - 51

Long-term lease liability 395 476

--------- -----------

2,473 3,234

--------- -----------

Current liabilities

Trade and other payables 499 1,404

Notes payable - 132

Contingent consideration 151 146

Short-term lease liability 202 228

--------- -------------

852 1,910

--------- -------------

Total liabilities 3,325 5,144

--------- -------------

Total equity and liabilities 4,112 4,519

========= =============

Interim condensed consolidated statement of cash flows

For the six months ended 30 June 2021

Unaudited Unaudited

6 Months 6 Months

to to

30 June 30 June

2021 2020

$000 $000

Cash flows from operating activities

Operating loss before tax (178) (813)

Adjustments for:

Depreciation of property, plant and

equipment 86 108

Depreciation of right-of-use asset 101 99

Gain on disposal of equipment - (15)

Share option charge 31 8

Revaluation of deferred consideration (478) -

Gain on foreign exchange (93) (57)

Taxation (1) (1)

Decrease / (increase) in inventories 4 (202)

Decrease in receivables 189 40

(Decrease) / increase in payables (1,091) 496

--------- ---------

Net cash (outflow) from operating

activities (1,430) (337)

--------- ---------

Cash flows from investing activities

Proceeds from sale of property, plant

and equipment - 20

Purchase of property, plant and equipment (42) -

--------- ---------

Net cash (outflow) / inflow from investing

activities (42) 20

--------- ---------

Cash flows from financing activities

Cash received from issuing share of

stock, net 1,509 -

Proceeds from government secured debt - 183

Lease payments (88) (183)

Interest expense on lease payments (19) 11

--------- ---------

Net cash inflow from financing activities 1,402 11

--------- ---------

Net (outflow) in cash and cash equivalents (70) (306)

Cash and cash equivalents at beginning

of the period 1,448 765

--------- ---------

Cash and cash equivalents at end of

the period 1,378 459

========= =========

Notes of non-cash items

In April 2021, the Company issued 1,923,389 shares of stock to

satisfy the 2020 contingent consideration payment of $146k.

In April 2021, the Group received forgiveness from the US Small

Business Administration in the amount of $183k for the Covid-19

relief loan to support US employees.

Notes to the interim condensed consolidated financial

statements

1. General information

These unaudited interim condensed financial statements of

Itaconix plc for the six months ended 30 June 2021 were approved

for issue in accordance with a resolution of the Board on 27

September 2021. Itaconix plc is a public limited company

incorporated in the United Kingdom whose shares are traded on the

AIM Market of the London Stock Exchange.

This half-yearly financial report is also available on the

Group's website at https://itaconix.com/investor/reports-documents/

.

2. Accounting policies

These interim consolidated financial statements have been

prepared in accordance with UK adopted International Accounting

Standards (collectively "IFRS") . They do not include all

disclosures that would otherwise be required in a complete set of

financial statements and should be read in conjunction with the 31

December 2020 ('2020') Annual Report. The financial information for

the half years ended 30 June 2021 and 30 June 2020 does not

constitute statutory accounts within the meaning of Section 434 (3)

of the Companies Act 2006 and both periods are unaudited.

The annual financial statements of Itaconix Plc ('the Group')

are prepared in accordance with IFRS . The comparative financial

information for the year ended 31 December 2020 included within

this report does not constitute the full statutory Annual Report

for that period. The statutory Annual Report and Financial

Statements for 2020 have been filed with the Registrar of

Companies. The Independent Auditors' Report on the Annual Report

and Financial Statements for the year ended 31 December 2020 was

unqualified, did draw attention to a matter by way of emphasis,

being going concern, and did not contain a statement under 498(2) -

(3) of the Companies Act 2006.

The interim condensed consolidated financial statements are

presented in US dollars and all values are rounded to the nearest

thousand ($'000) except when otherwise indicated. The interim

condensed consolidated financial statements are prepared on the

historical cost basis except for contingent consideration which

have been measured at fair value.

The Group has applied the same accounting policies and methods

of computation in its interim consolidated financial statements as

in its 31 December 2020 annual financial statements, except for

those that relate to new standards and interpretations effective

for the first time for periods beginning on (or after) 1 January

2021 and will be adopted in the 2021 financial statements. There

are deemed to be no new and amended standards and/or

interpretations that will apply for the first time in the next

annual financial statements that are expected to have a material

impact on the Group.

Going concern

This Interim Report has been prepared on the assumption that the

business is a going concern. In reaching their assessment, the

Directors have considered a period extending at least 12 months

from the date of approval of this half-yearly financial report.

This assessment has included consideration of the forecast

performance of the business for the foreseeable future and the cash

available to the Group. As such, the Directors have concluded that

there exists a material uncertainty which may cast doubt as to the

Group's ability to continue as a going concern. However, taking

account of the Group's working capital at the date of this report,

the Group's current revenues, and current shareholder authority to

raise capital if needed, the Directors believe the Group will

continue as a going concern for the foreseeable future. The interim

financial statements do not include the adjustments that would be

required if the Group were unable to continue as a going

concern.

Risks and uncertainties

The principal risks and uncertainties facing the Group remain

broadly consistent with the Principal Risks and Uncertainties

reported in Itaconix plc's 31 December 2020 Annual Report.

3. Cash and cash equivalents

Unaudited Audited

As at As at

30 June 31 December

2021 2020

$000 $000

Cash at bank and in hand 1,378 1,448

--------- -----------

1,378 1,448

========= ===========

4. Reconciliation of Operating Loss to Adjusted EBITDA

The detail below shows the reconciliation of operating loss to

earnings before change in value of contingent consideration,

government loan forgiveness for Covid-19 relief, interest, taxes,

depreciation and amortisation (Adjusted EBITDA).

Unaudited Unaudited

6 Months 6 Months

to to

30 June 30 June

2021 2020

$000 $000

Loss for the period (179) (814)

Revaluation of contingent consideration (514) -

Other Income - government loan forgiveness (183) -

Taxes 1 1

Depreciation and amortisation 187 207

--------- ---------

Adjusted EBITDA (688) (606)

========= =========

5. Segmental analysis

Revenue by business segment:

The Group has one segment, the Specialty Ingredients segment,

which designs and manufactures proprietary specialty polymers to

meet customers' needs in the personal and consumer health care,

homecare and industrial sectors. This segment makes up the

continuing operations above.

Net assets of the Group are attributable solely to the UK and

US.

Unaudited Unaudited

6 months 6 months

to to

30 June 2021 30 June 2020

$000 $000

Revenue

Sale of goods 1,366 1,086

------------- -------------

Segment revenue 1,366 1,086

------------- -------------

Results

Depreciation and amortisation 187 207

Segment loss (210) (822)

------------- -------------

Operating assets 4,112 2,865

------------- -------------

Operating liabilities 3,325 4,588

------------- -------------

Other disclosure:

Capital expenditure* 42 Nil

------------- -------------

*Capital expenditure consists of additions of property, plant

and equipment, and intangible assets.

Geographical information

Revenues Net assets

Unaudited Unaudited Unaudited Audited

Six Months Six Months Six Months Year to

to to to 31 December

30 June 2021 30 June 2020 30 June 2021 2020

$000 $000 $000 $000

Europe 64 93 (635) (1,557)

North America 1,302 993 1,422 932

1,366 1,086 787 (625)

============= ============= ============= ============

The revenue information above is based on the location of the

customer.

6. Contingent consideration

$'000

As at 31 December 2020 (Audited) 2,853

Movement in fair value and discounting unwind (514)

Share issuance for contingent consideration 2020 (146)

Movement in foreign exchange 36

-----

As at 30 June 2021 (Unaudited) 2,229

=====

During 2018, in conjunction with the fund raise, a restructuring

of the contingent consideration was executed. The contingent

consideration was restructured into two components:

-- A one-time issue of 15 million new Itaconix plc shares to the Sellers.

-- The continuation of the previous contingent consideration

mechanism (i.e. up to $6m in shares), but with the window of time

for potential achievement expanded to the end of 2022 (from the end

of 2020) and including all the revenues of the Group (which are

primarily from products based on the acquired technology in any

event).

It should also be noted that the second component summarised

above was intended to serve as an incentive programme for the two

members of management (John Shaw and Yvon Durant) who were also

Sellers and are entitled to 63% of the total contingent

consideration. Accordingly, they were not eligible for any cash

bonus or other share incentive programme until the end of 2020.

Simultaneously, the merger agreement with the former shareholders

of Itaconix Corporation and related agreements were amended to

remove various restrictive clauses, including minimum funding

requirements and employment terms.

Based on the share price at the execution of the restructuring

agreement in 2018, the 15m shares had a value of GBP0.3m which was

expensed immediately.

In respect of 2021, the deferred consideration for the period

was valued using a discounted cash flow-based assessment of the

expected sales of the relevant products extracted from a recent

management prepared forecast, consistent with the approach in prior

years. A discount rate of 10.9% was used. The valuation includes

elements which are unobservable and which have a significant impact

on the fair value. Accordingly, contingent consideration is

classified as Level 3 fair value measurement.

The value of the adjusted contingent component using a recent

management prepared forecast and assumptions as above is $2.2m (31

December 2021 - $2.9m)

As a result of the changed revenue forecasts, earn out period,

and discount rate from the original value assessments, the

contingent consideration at 30 June 2021 was reduced to $2.2m.

Sensitivity analysis was also performed, summarised as follows:

-- If the sales in the period 2021 to 2022 were reduced by

$1.0m, the fair value would be reduced by approximately $0.4m

-- A 1% increase in the discount rate would reduce the fair value by $44k

Since the forecasts used were a conservative base case, the

computed fair value was deemed appropriate.

7. Weighted-average number of ordinary shares

Unaudited Unaudited

6 Months 6 Months

to to

30 June 30 June

2021 2020

Weighted average number of ordinary shares

for the

purposes of basic and diluted loss per

share ('000) 434,050 269,130

========= =========

8. Events after the reporting period

There were no material post balance sheet events .

9. Cautionary statement

This document contains certain forward-looking statements

relating to Itaconix plc. The Company considers any statements that

are not historical facts as "forward-looking statements". They

relate to events and trends that are subject to risk and

uncertainty that may cause actual results and the financial

performance of the Company to differ materially from those

contained in any forward-looking statement. These statements are

made by the Directors in good faith based on information available

to them and such statements should be treated with caution due to

the inherent uncertainties, including both economic and business

risk factors, underlying any such forward-looking information.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR FZGZLFNVGMZZ

(END) Dow Jones Newswires

September 28, 2021 02:00 ET (06:00 GMT)

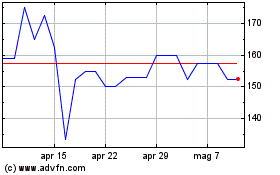

Grafico Azioni Itaconix (LSE:ITX)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni Itaconix (LSE:ITX)

Storico

Da Apr 2023 a Apr 2024