TIDMHIK

RNS Number : 7059Q

J.P. Morgan Securities PLC.

22 June 2020

Press release, 22(nd) June 2020

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION, DIRECTLY OR

INDIRECTLY, IN WHOLE OR IN PART, INTO OR IN THE UNITED STATES,

CANADA, AUSTRALIA, JAPAN OR SOUTH AFRICA OR ANY OTHER JURISDICTION

IN WHICH SUCH RELEASE, PUBLICATION OR DISTRIBUTION WOULD BE

PROHIBITED BY APPLICABLE LAW. THIS ANNOUNCEMENT IS FOR INFORMATION

PURPOSES ONLY AND DOES NOT CONSTITUTE OR FORM AN OFFER OR THE

SOLICITATION OF AN OFFER TO BUY IN ANY JURISDICTION, NOR SHALL

THERE BE ANY SALE, OF SECURITIES IN THE UNITED STATES, CANADA,

AUSTRALIA, JAPAN, SOUTH AFRICA OR ANY OTHER JURISDICTION IN WHICH

SALES WOULD BE PROHIBITED BY APPLICABLE LAW.

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION.

PLEASE SEE THE IMPORTANT NOTICE AT THE OF THIS ANNOUNCEMENT.

Proposed Placing of approximately 28 million ordinary shares in

Hikma Pharmaceuticals PLC ("Hikma" or the "Company")

Boehringer Ingelheim Invest GmbH ("Boehringer Ingelheim") today

announces its intention to sell up to approximately 28 million

ordinary shares (the "Placing Shares") in Hikma. The Placing Shares

will be offered by way of an accelerated bookbuild offering (the

"Bookbuild") to institutional investors only (the "Placing").

Concurrently with the Placing, Hikma has committed to buy back

from Boehringer Ingelheim such number of ordinary shares (the "Buy

Back Shares") as does not exceed an aggregate value of GBP295m

(being an amount approximately equal to 4.99% of the aggregate

market value of all the Shares of the Company at the close of

business on 22(nd) June 2020, less the value of the commitment fee

described below) (the "Buy Back"). The purchase price for each of

the Buy Back Shares will be equal to the sale price for each of the

Placing Shares (the "Buy Back Price"). The Buy Back Price is

subject to the price limit set out below. Hikma has separately

today entered into an agreement with Boehringer Ingelheim pursuant

to which Hikma will receive a commitment fee of 2 per cent. of the

aggregate value of the Buy Back Shares acquired at the Buy Back

Price (the "Commitment Fee"). Citigroup Global Markets Limited

("Citi") will act as riskless principal for the purpose of the Buy

Back.

The Buy Back is subject to the satisfaction of a number of

conditions, including the successful pricing of the Placing and

provided that the price payable by Hikma for the Buy Back Shares

does not exceed a per share amount equal to GBP24.71, which, net of

the 2% commitment fee, is equal to approximately GBP24.22, being

the average closing price of the five business days preceding

today's date. If the Placing Price is within the pricing limits

that apply to the Buy Back Price, the Placing cannot proceed unless

the Buy Back proceeds.

As of today, Boehringer Ingelheim owns 40 million ordinary

shares in Hikma, representing approximately 16.4 per cent. of the

issued ordinary share capital and voting rights in the Company.

Following the successful completion of the Placing and the Buy

Back, Boehringer Ingelheim would no longer hold any shares in the

Company.

Boehringer Ingelheim is a related party of Hikma for the

purposes of the Listing Rules by virtue of its approximately 16.4

per cent. shareholding in Hikma. The Buy Back by Hikma and the

associated payment of the Commitment Fee by Boehringer Ingelheim

constitute a smaller related party transaction falling within LR

11.1.10R(1) and this announcement is therefore made in accordance

with LR11.1.10R(2)(c). The aggregate amount of the Buy Back and the

commitment fee cannot be higher than approximately GBP301m.

The Bookbuild will commence immediately following the

publication of this announcement and may be closed at short notice.

A further announcement will be made following completion of the

Bookbuild, which will contain the number of Placing Shares and the

gross proceeds from the Placing. Boehringer Ingelheim reserves the

right, at its discretion, to determine and vary the number of

Placing Shares sold in the Placing, or sell no Placing Shares at

all.

Boehringer Ingelheim has engaged Citi and J.P. Morgan Securities

plc, which conducts its UK investment banking activities as J.P.

Morgan Cazenove ("J.P. Morgan Cazenove"), as bookrunners (the

"Joint Bookrunners") in connection with the Placing.

Rothschild & Cie ("Rothschild & Co") is acting as

financial adviser to Boehringer Ingelheim on the Placing.

The Company will not receive any proceeds from the Placing.

Enquiries

Citi, Joint Bookrunner +44 (0) 20 7986 4000

Suneel Hargunani

Andrew Seaton

Robert Way

J.P. Morgan Cazenove, Joint Bookrunner +44 (0) 20 7742 4000

Alex Watkins

Tobias Heilmaier

Rothschild & Co, Financial Adviser +44 (0) 20 7280 5000

Cyrille Harfouche

Adam Young

Chris Hawley

IMPORTANT NOTICE

This announcement is restricted and is not for publication,

distribution or release, directly or indirectly, in whole or in

part, in or into the United States of America (including its

territories and possessions, any state of the United States and the

District of Columbia and collectively, the "United States"),

Canada, Australia, Japan, South Africa or any other jurisdiction

where such publication, distribution or release would be unlawful.

The distribution of this announcement may be restricted by law in

certain jurisdictions and persons into whose possession this

document or other information referred to herein comes should

inform themselves about and observe any such restriction. Any

failure to comply with these restrictions may constitute a

violation of the securities laws of any such jurisdiction. No

action has been taken by Boehringer Ingelheim, Citi and J.P. Morgan

Cazenove or any of their respective affiliates that would, or which

is intended to, permit an offering of the Placing Shares or

possession or distribution of this announcement in any jurisdiction

where action for that purpose is required.

This announcement is for information purposes only and does not

constitute or form part of any offer or invitation for sale or

solicitation of an offer to purchase or subscribe for securities in

the United States, Canada, Australia, Japan, South Africa or any

other jurisdiction and the securities referred to herein have not

been registered under the securities laws of any such jurisdiction.

The Placing Shares have not been and will not be registered under

the United States Securities Act of 1933, as amended (the

"Securities Act") or under the securities laws of any state or

other jurisdiction of the United States, and may not be offered or

sold, directly or indirectly, in or into the United States, absent

registration under or an exemption from, or transaction not subject

to, the registration requirements of, the Securities Act. No public

offering of securities is being made in the United States or in any

other jurisdiction.

Members of the public are not eligible to take part in the

Placing. In member states of the European Economic Area (each, a

"Relevant Member State"), this announcement and any offer of

Placing Shares if made subsequently is directed exclusively at

persons who are "qualified investors" within the meaning of Article

2(e) of the Prospectus Regulation ("Qualified Investors") and, to

the extent applicable, any funds on behalf of which such a person

is subscribing for and acquiring the Placing Shares and that are

located in a Relevant Member State and are themselves a Qualified

Investor. For these purposes, "Prospectus Regulation" means

Regulation (EU) 2017/1129 (as supplemented by Commission delegated

Regulation (EU) 2019/980 and Commission delegated Regulation (EU)

2019/979). In the United Kingdom this announcement is only being

distributed to, and is only directed at, and any investment or

investment activity to which this announcement relates is available

only to, and will be engaged in only with, Qualified Investors who

are (i) investment professionals falling with Article 19(5) of the

UK Financial Services and Markets Act 2000 (Financial Promotion)

Order 2005 (as amended) (the "Order"); or (ii) high net worth

entities falling within Article 49(2)(a) to (d) of the Order, or

(iii) other persons to whom an offer of the Placing Shares may

otherwise be lawfully communicated (all such persons together being

referred to as "relevant persons"). Persons who are not relevant

persons should not take any action on the basis of this

announcement and should not act or rely on it.

The Placing Shares have not been, nor will they be, registered

under or offered in compliance with the securities laws of any

state, province or territory of Australia, Canada or Japan.

Accordingly, the Placing Shares may not (unless an exemption under

the relevant securities laws is applicable) be offered, sold,

resold or delivered, directly or indirectly, in or into Australia,

Canada or Japan or any other jurisdiction in which such activities

would be unlawful.

No prospectus or offering document has been or will be prepared

in connection with the Placing and no such prospectus is required

(in accordance with the Prospectus Regulation) to be published.

This announcement does not identify or suggest, or purport to

identify or suggest, the risks (direct or indirect) which may be

associated with an investment in Hikma or its shares. Any

investment decision in connection with the Placing must be made on

the basis of all publicly available information relating to Hikma

and Hikma' shares. Such information has not been independently

verified, and Boehringer Ingelheim, Citi and J.P. Morgan Cazenove

(together, the "Managers") and their respective affiliates are not

responsible, and expressly disclaim any liability, for such

information. The information contained in this announcement is for

background purposes only and does not purport to be full or

complete. No reliance may be placed for any purpose on the

information contained in this announcement or its accuracy or

completeness. Persons needing advice should consult an independent

financial adviser.

Neither the content of the Company's website (or any other

website) nor the content of any website accessible from hyperlinks

on the Company's website (or any other website) is incorporated

into or forms part of this Announcement.

This Announcement has been prepared for the purposes of

complying with applicable law and regulation in the United Kingdom

and the information disclosed may not be the same as that which

would have been disclosed if this Announcement had been prepared in

accordance with the laws and regulations of any jurisdiction

outside the United Kingdom.

In connection with the Placing, each of the Managers or any of

their respective affiliates may take up a portion of the Placing

Shares as a principal position and in that capacity may retain,

purchase, sell or offer to sell for its own account such Placing

Shares and other securities of Hikma or related investments in

connection with the Placing or otherwise. Accordingly, references

to the Placing Shares being issued, offered, subscribed, acquired,

placed or otherwise dealt in should be read as including any issue

or offer to, or subscription, acquisition, placing or dealing by

any of the Managers and any of their respective affiliates acting

as investors for their own accounts. The Managers do not intend to

disclose the extent of any such investment or transactions

otherwise than in accordance with any legal or regulatory

obligations to do so.

Citi and J.P. Morgan Cazenove, which are authorised by the

Prudential Regulatory Authority ("PRA") and regulated by the

Financial Conduct Authority ("FCA") and the PRA, are acting for

Boehringer Ingelheim as joint bookrunners only in connection with

the Placing and no one else, and will not be responsible to anyone

(including any Placees) other than Boehringer Ingelheim for

providing the protections offered to clients nor for providing

advice in relation to the Placing Shares or the Placing, the

contents of this Announcement or any transaction, arrangement or

other matter referred to in this announcement.

The contents of this Announcement are not to be construed as

legal, business, financial or tax advice. Each investor or

prospective investor should consult his, her or its own legal

adviser, business adviser, financial adviser or tax adviser for

legal, financial, business or tax advice.

Certain figures contained in this announcement, including

financial information, have been subject to rounding adjustments.

Accordingly, in certain instances, the sum or percentage change of

the numbers contained in this announcement may not conform exactly

with the total figure given.

This announcement includes statements that are, or may be deemed

to be, forward-looking statements. These forward-looking statements

may be identified by the use of forward-looking terminology,

including the terms "intends", "expects", "will", or "may", or, in

each case, their negative or other variations or comparable

terminology, or by discussions of strategy, plans, objectives,

goals, future events or intentions. These forward-looking

statements include all matters that are not historical facts and

include statements regarding intentions, beliefs or current

expectations. No assurances can be given that the forward-looking

statements in this announcement will be realised. As a result, no

undue reliance should be placed on these forward-looking statements

as a prediction of actual events or otherwise. The Company,

Boehringer Ingelheim and the Managers each expressly disclaim any

obligation or undertaking to update or revise publicly any

forward-looking statements, whether as a result of new information,

future events or otherwise, unless required to do so by applicable

law or regulation.

Rothschild & Co is acting for Boehringer Ingelheim only in

connection with the Placing and no one else, and will not be

responsible to anyone other than Boehringer Ingelheim for providing

the protections offered to clients the Managers nor for providing

advice in relation to the Placing Shares or the Placing, the

contents of this announcement or any transaction, arrangement or

other matter referred to in this announcement.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

IOEELLFLBQLEBBQ

(END) Dow Jones Newswires

June 22, 2020 12:09 ET (16:09 GMT)

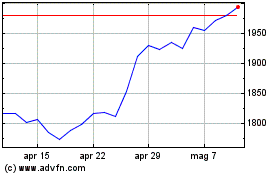

Grafico Azioni Hikma Pharmaceuticals (LSE:HIK)

Storico

Da Mar 2024 a Apr 2024

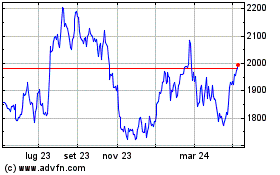

Grafico Azioni Hikma Pharmaceuticals (LSE:HIK)

Storico

Da Apr 2023 a Apr 2024