JCDecaux: Full-Year 2020 revenue

Full-Year 2020 revenue

· 2020

adjusted revenue down -40.6% to €2,311.8 million

· 2020

adjusted organic revenue down -38.1%

· Q4

2020 adjusted revenue down -38.0% to

€695.1 million

· Q4

2020 adjusted organic revenue down -33.9%

· No

quarterly guidance on adjusted organic revenue growth due to

Covid-19

Paris, January 28th, 2021 – JCDecaux

SA (Euronext Paris: DEC), the number one outdoor

advertising company worldwide, announced today its revenue for the

full-year 2020.

Following the adoption of IFRS 11 from January

1st, 2014, the operating data presented below is adjusted to

include our prorata share in companies under joint control. Please

refer to the paragraph “Adjusted data” on page 3 of this release

for the definition of adjusted data and reconciliation with

IFRS.The values shown in the tables are generally expressed in

millions of euros. The sum of the rounded amounts or variations

calculations may differ, albeit to an insignificant extent, from

the reported values.

2020 adjusted revenue decreased by -40.6% to

€2,311.8 million compared to €3,890.2 million in 2019. Excluding

the negative impact from foreign exchange variations and the

negative impact from changes in perimeter, adjusted organic revenue

decreased by -38.1%.Adjusted organic advertising revenue, excluding

revenue related to sale, rental and maintenance of street furniture

and advertising displays, decreased by -39.5% in 2020.

Adjusted revenue of the fourth quarter of 2020

decreased by -38.0% to €695.1 million compared to €1,122.0 million

in Q4 2019. Excluding the negative impact from foreign exchange

variations and the negative impact from changes in perimeter,

adjusted organic revenue decreased by -33.9%.Adjusted organic

advertising revenue, excluding revenue related to sale, rental and

maintenance of street furniture and advertising displays, decreased

by -34.9% in the fourth quarter of 2020.

By activity:

|

Full-Year adjusted revenue |

2020 (€m) |

2019 (€m) |

Reported growth |

Organic growth(a) |

|

Street Furniture |

1,131.1 |

1,688.2 |

-33.0% |

-31.9% |

|

Transport |

810.9 |

1,636.4 |

-50.4% |

-47.1% |

|

Billboard |

369.7 |

565.6 |

-34.6% |

-30.8% |

|

Total |

2,311.8 |

3,890.2 |

-40.6% |

-38.1% |

(a) Excluding acquisitions/divestitures and the impact of

foreign exchange

|

Q4 adjusted revenue |

2020 (€m) |

2019 (€m) |

Reported growth |

Organic growth(a) |

|

Street Furniture |

369.5 |

507.3 |

-27.2% |

-25.2% |

|

Transport |

215.4 |

458.7 |

-53.0% |

-47.6% |

|

Billboard |

110.2 |

156.0 |

-29.4% |

-21.7% |

|

Total |

695.1 |

1,122.0 |

-38.0% |

-33.9% |

(a) Excluding acquisitions/divestitures and the impact of

foreign exchange

By geographic area:

|

Full-Year adjusted revenue |

2020 (€m) |

2019 (€m) |

Reported growth |

Organic growth(a) |

|

Europe (b) |

694.3 |

997.9 |

-30.4% |

-30.6% |

|

Asia-Pacific |

603.5 |

1,105.0 |

-45.4% |

-40.9% |

|

France |

442.8 |

618.8 |

-28.4% |

-28.4% |

|

Rest of the World |

206.3 |

450.2 |

-54.2% |

-45.1% |

|

United Kingdom |

203.8 |

382.1 |

-46.7% |

-46.1% |

|

North America |

161.3 |

336.1 |

-52.0% |

-51.0% |

|

Total |

2,311.8 |

3,890.2 |

-40.6% |

-38.1% |

(a) Excluding acquisitions/divestitures and the

impact of foreign exchange (b) Excluding France and the

United Kingdom

Please note that the geographic comments

hereafter refer to organic revenue growth.

STREET FURNITURE

Full-year adjusted revenue decreased by -33.0%

to €1,131.1 million (-31.9% on an organic basis),

significantly impacted throughout the year by the Covid-19 pandemic

with Street Furniture audiences dropping by more than 60% during

lockdowns. As soon as these lockdowns were lifted, the urban

mobility increased significantly in most European and in some Asian

cities to reach pre-Covid level, while inner areas in cities such

as London, NYC, Chicago, Sydney, … with the highest workplace

density saw the lowest mobility increase. France and the Rest of

Europe performed much better than UK, Asia-Pacific, the Rest of the

World and North America thanks to better city audience figures.

In the fourth quarter, adjusted revenue

decreased by -27.2% to €369.5 million (-25.2% on an organic

basis), having the same trend as Q3 2020 impacted by lockdowns

or curfews taken by national governments and local authorities.

France, UK and the Rest of Europe performed better than the Rest of

the World, Asia-Pacific and North America.Fourth quarter adjusted

organic advertising revenue, excluding revenue related to sale,

rental and maintenance of street furniture were down -26.4%

compared to the fourth quarter of 2019.

TRANSPORT

Full-year adjusted revenue decreased by -50.4%

to €810.9 million (-47.1% on an organic basis), significantly

impacted throughout the year by the Covid-19 pandemic with

Transport audiences dropping around 90% during lockdowns.

International air travel restrictions continued during 2020 leading

to a 60% reduction in global passenger traffic with domestic air

travel coming back to pre‑Covid level in China towards the end of

the year. Subway audiences also returned to almost pre‑Covid level

in China at the end of the year while rail traffic for example in

UK remained far below pre‑Covid level. UK, France, the Rest

of the World and North America were the most affected regions.

In the fourth quarter, adjusted revenue

decreased by -53.0% to €215.4 million (-47.6% on an organic

basis), a slight improvement from Q3 2020, mainly driven by

Mainland China where the on-going recovery in domestic traffic

continued, in both metros and airports, but with advertising

revenue slightly lagging, while international air traffic remained

highly impacted. UK, North America and France were the most

affected regions.

BILLBOARD

Full-year adjusted revenue decreased by -34.6%

to €369.7 million (-30.8% on an organic basis), significantly

impacted throughout the year by the Covid-19 pandemic with car

traffic dropping by more than 60% during lockdowns. As soon as

lockdowns were lifted, there was a rapid return of driving

audiences with local advertising sales showing some resilience. UK,

North America and Asia-Pacific were the most affected regions.

In the fourth quarter, adjusted revenue

decreased by -29.4% to €110.2 million (-21.7% on an organic

basis), improving from Q3 2020 driven by the Rest of the

World, Asia-Pacific and UK but still affected by measures taken by

national governments and local authorities.

Commenting on the Group’s 2020 revenue

performance, Jean-Charles Decaux, Chairman of the Executive

Board and Co-CEO of JCDecaux, said:

“JCDecaux , the world’s largest Out-of-Home

media company, faced for the first time in its 56-year history a

dramatic global audience fall caused by the Covid-19 pandemic which

forced national, regional and local governments to impose

unprecedented mobility restrictions in modern history such as

lockdowns, curfews, closures of stores, restaurants, cinemas, …

As a result, the 2020 Group revenue dropped by

-40.6% to reach €2,311.8 million with an organic revenue

decline at -38.1%, with our digital revenue now representing 24% of

Group revenue.

Our Street Furniture and Billboard revenue

declined less than Transport reflecting better pedestrian and car

traffic audiences recovering rapidly when lockdowns were lifted.

Transport was the most affected part of our business with airports

strongly impacted by the collapse of international traffic.

By geography, France and the Rest of Europe

revenue improved the most over H2 2020, mainly thanks to

Street Furniture. In Asia-Pacific and more specifically in Mainland

China, businesses exposed to domestic audiences, including domestic

airport terminals, improved also during the second half of the

year, while international hubs remained heavily affected by little

international traffic. North America, the Rest of the World and UK

were the most affected regions across the 3 business segments

throughout the year.

In a media landscape increasingly fragmented and

more and more digital, out-of-home and digital out‑of‑home

advertising reinforce its attractiveness. As the most digitised

global OOH company with our new data-led audience targeting and

programmatic platform, our well diversified portfolio, our ability

to win new contracts, the strength of our balance sheet and the

high quality of our teams across the world, we believe we are well

positioned to benefit from the rebound.”

ADJUSTED DATA

Under IFRS 11, applicable from January 1st,

2014, companies under joint control are accounted for using the

equity method.However, in order to reflect the business reality of

the Group, operating data of the companies under joint control will

continue to be proportionately integrated in the operating

management reports used by directors to monitor the activity,

allocate resources and measure performance.Consequently, pursuant

to IFRS 8, Segment Reporting presented in the financial statements

complies with the Group’s internal information, and the Group’s

external financial communication therefore relies on this operating

financial information. Financial information and comments are

therefore based on “adjusted” data, consistent with historical data

prior to 2014, which is reconciled with IFRS financial

statements.In Q4 2020, the impact of IFRS 11 on adjusted

revenue was -€58.9 million (-€118.0 million in

Q4 2019), leaving IFRS revenue at €636.2 million

(€1,004.1 million in Q4 2019).For the full-year 2020, the

impact of IFRS 11 on adjusted revenue was -€212.0 million

(-€402.5 million for the full-year 2019), leaving IFRS revenue

at €2,099.8 million (€3,487.6 million for the full-year

2019).

ORGANIC GROWTH DEFINITION

The Group’s organic growth corresponds to the

adjusted revenue growth excluding foreign exchange impact and

perimeter effect. The reference fiscal year remains unchanged

regarding the reported figures, and the organic growth is

calculated by converting the revenue of the current fiscal year at

the average exchange rates of the previous year and taking into

account the perimeter variations prorata temporis, but including

revenue variations from the gains of new contracts and the losses

of contracts previously held in our portfolio.

|

€m |

|

Q1 |

Q2 |

Q3 |

Q4 |

FY |

|

2019 adjusted revenue |

(a) |

840.0 |

1,002.3 |

925.8 |

1,122.0 |

3,890.2 |

|

2020 IFRS revenue |

(b) |

658.2 |

310.4 |

495.0 |

636.2 |

2,099.8 |

|

IFRS 11 impacts |

(c) |

65.4 |

41.5 |

46.2 |

58.9 |

212.0 |

|

2020 adjusted revenue |

(d) = (b) + (c) |

723.6 |

351.8 |

541.2 |

695.1 |

2,311.8 |

|

Currency impacts |

(e) |

1.7 |

8.0 |

15.5 |

22.2 |

47.4 |

|

2020 adjusted revenue at 2019 exchange rates |

(f) = (d) + (e) |

725.3 |

359.9 |

556.7 |

717.3 |

2,359.2 |

|

Change in scope |

(g) |

(2.3) |

7.0 |

18.4 |

24.8 |

47.9 |

|

2020 adjusted organic revenue |

(h) = (f) + (g) |

723.0 |

366.8 |

575.2 |

742.1 |

2,407.1 |

|

Organic growth |

(i) = (h) / (a) |

-13.9% |

-63.4% |

-37.9% |

-33.9% |

-38.1% |

|

€m |

Impact of currency as of December 31st, 2020 |

|

BRL |

12.5 |

|

USD |

4.8 |

|

RMB |

4.7 |

|

AUD |

3.7 |

|

Other |

21.7 |

|

Total |

47.4 |

|

Average exchange rate |

FY 2020 |

FY 2019 |

|

BRL |

0.1697 |

0.2266 |

|

USD |

0.8755 |

0.8933 |

|

RMB |

0.1270 |

0.1293 |

|

AUD |

0.6043 |

0.6208 |

Next

information:2020 annual results: March 11th, 2021 (before

market)

Key Figures for JCDecaux

- 2020 revenue: €2,312m

- Present in 3,890 cities with more than 10,000 inhabitants

- A daily audience of more than 890 million people in more than

80 countries

- 13,210 employees

- Leader in self-service bike rental scheme: pioneer in

eco-friendly mobility

- 1st Out-of-Home Media company to join the RE100 (committed to

100% renewable energy)

- JCDecaux is listed on the Eurolist of Euronext Paris and is

part of the Euronext 100 and Euronext Family Business indexes

- JCDecaux is recognised for its extra-financial performance in

the FTSE4Good index and the MSCI and CDP 'A List' rankings

- 1,061,630 advertising panels worldwide

- N°1 worldwide in street furniture (517,800 advertising

panels)

- N°1 worldwide in transport advertising with more than 160

airports and 270 contracts in metros, buses, trains and tramways

(379,970 advertising panels)

- N°1 in Europe for billboards (136,750 advertising panels)

- N°1 in outdoor advertising in Europe (636,620 advertising

panels)

- N°1 in outdoor advertising in Asia-Pacific (260,700 advertising

panels)

- N°1 in outdoor advertising in Latin America (69,490 advertising

panels)

- N°1 in outdoor advertising in Africa (22,760 advertising

panels)

- N°1 in outdoor advertising in the Middle East (15,510

advertising panels)

For more information about JCDecaux, please

visit jcdecaux.com. Join us on Twitter, LinkedIn, Facebook,

Instagram and YouTube.

Forward looking statementsThis

news release may contain some forward-looking statements. These

statements are not undertakings as to the future performance of the

Company. Although the Company considers that such statements are

based on reasonable expectations and assumptions on the date of

publication of this release, they are by their nature subject to

risks and uncertainties which could cause actual performance to

differ from those indicated or implied in such statements.These

risks and uncertainties include without limitation the risk factors

that are described in the annual report registered in France with

the French Autorité des Marchés Financiers.Investors and holders of

shares of the Company may obtain copy of such annual report by

contacting the Autorité des Marchés Financiers on its website

www.amf-france.org or directly on the Company website

www.jcdecaux.com.The Company does not have the obligation and

undertakes no obligation to update or revise any of the

forward-looking statements.

Communications

Department: Agathe Albertini+33 (0) 1 30

79 34 99 – agathe.albertini@jcdecaux.com

Investor

Relations: Arnaud Courtial+33 (0) 1 30 79

79 93 – arnaud.courtial@jcdecaux.com

- 28-01-21 # Q4 2020_UK_vDEF

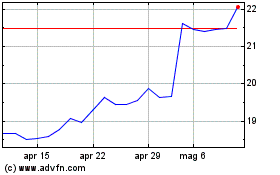

Grafico Azioni JCDecaux (EU:DEC)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni JCDecaux (EU:DEC)

Storico

Da Apr 2023 a Apr 2024