> Sales: €1,039 million (-17.5%

vs. September 30, 2019)

> EBITDA: €32 million (3.1% of sales)

> Operating cash flow: +€83

million

Regulatory News:

Jacquet Metals (Paris:JCQ):

On November 18, 2020 the Board of Directors chaired by Éric

Jacquet approved the consolidated financial statements for the

period ended September 30, 2020.

€m

Q3 2020

Q3 2019

30.09.20

9 months

30.09.19

9 months

Sales

312

375

1,039

1,259

Gross margin

73

83

235

288

% of sales

23.4%

22.2%

22.6%

22.8%

EBITDA 1

13

15

32

63

% of sales

4.2%

4.1%

3.1%

5%

Adjusted operating

income/(loss) 1

0.1

7

(3)

39

% of sales

0.0%

1.9%

-0.3%

3.1%

Operating

income/(loss)

0.2

7

(7)

39

Net income/(loss) (Group

share)

(4)

2

(19)

20

1 Adjusted for non-recurring items. The activity report

includes a definition of non-IFRS financial indicators and explains

the methods used to calculate them. The report is available at

corporate.jacquetmetals.com.

General comments

Group sales for the period ended September 30, 2020 amounted to

€1,039 million, down -17.5% compared to Septem- ber 30, 2019 (Q3:

-16.7%), while EBITDA amounted to +€32 million (Q3: +€13 million)

and operating cash flow equalled +€83 million (Q3: +€3

million).

As such, the Group has improved its financial structure compared

to 2019 year-end and ended the period with a net debt to equity

ratio (gearing) of 43%.

After a first half marked by interruptions of activity resulting

from the pandemic, market conditions in the third quarter were

characterized, for all divisions and regions, by low demand and

sales prices under pressure.

IMS group, the division specializing in the distribution of

engineering steels, suffered both from the slowdown in

manufacturing since 2019, particularly in Germany, a market

representing 46% of the division’s sales, and from its strong

foothold in Southern European markets particularily impacted by the

health crisis (this region accounts for 34% of IMS group sales

compared to 25% for JACQUET and 6% for STAPPERT).

Accordingly, IMS group sales were down -24.8% compared to

September 30, 2019 (Q3: -21.3% including a -4.1% price effect).

The activity of the JACQUET and STAPPERT divisions, which

specialize in the distribution of stainless steels, held up better,

with sales down -10.8% (Q3: -14.9% including a -4.9% price effect)

and -9.4% (Q3: -9.7% including a -4.6% price effect), respectively,

compared to 2019.

In a still uncertain health and macroeconomic environment,

market conditions are still challenging and the Group does not

expect to see a significant improvement over the coming months.

Moreover, with recent directives aimed at reducing the risk of

contamination particularly in Europe, the utilization rate of

distribution centers should be pretty low during the fourth

quarter.

All measures and initiatives required in order to limit the

impacts of the crisis on operating income and cash have been

implemented, however without jeopardizing the Group’s

development.

Savings plans have also been implemented in all divisions with

the goal of achieving global annual savings of €8 million.

Sales and earnings for the period

ended September 30, 2020

Consolidated sales amounted to €1,039 million, down -17.5%

compared to September 30, 2019 (Q3: -16.7%), including the

following effects:

> volumes sold: -15.5% (Q1: -9.8%; Q2: -24.4%; Q3: -12.4%);

> prices: -2.0% (Q1: -0.5%; Q2: -1.7%; Q3: -4.3%). Q3 2020

prices were down -3.1% compared to Q2 2020.

Gross margin amounted to €235 million, representing 22.6% of

sales (Q3: 23.4%), compared to 22.8% as of September 30, 2019.

Current operating expenses (excluding depreciation and

provisions) amounted to €202 million, down €23 million (-10%)

compared to September 30, 2019.

This reduction is mainly due to the adjustment of variable

expenses and the implementation of flexible staff working

arrangements. The latter resulted in a €7 million reduction in

personnel expenses.

EBITDA amounted to €32 million (3.1% of sales), compared to €63

million (5% of sales) as of September 30, 2019.

Lastly, the Group recorded depreciation expenses totaling €27

million and provision charges of €15 million, mostly related to

savings plans.

After recognition of these depreciation expenses and provisions,

the Group posted an operating loss of -€7.2 million (Q3: +€0.2

million) and a net loss (Group share) of -€19 million (Q3: -€4

million).

Financial position

As of September 30, 2020, the Group generated operating cash

flow of +€83 million.

Operating working capital amounted to €367 million compared to

€417 million at 2019 year-end. This decrease is mainly due to the

adaptation of inventory levels to market conditions (inventories

down -€73 million to €369 million).

Capital expenditure amounted to €22 million, including the

acquisition of the main IMS group distribution center in Italy for

€7.5 million.

After taking into account the dividend (€5 million paid in July)

and share buyback program (€6 million purchased between February

and September), net debt amounted to €147 million compared to €175

million as of December 31, 2019.

With a net debt to equity ratio (gearing) of 43% (46% at 2019

year-end), €326 million of cash and substantial lines of credit

(€735 million, €262 million of which is undrawn), the Group is in a

solid financial position to weather the present situation and its

potential developments.

Earnings by division as of September 30, 2020 excluding

impacts of IFRS 16

JACQUET

Stainless steel quarto plates

STAPPERT

Stainless steel long products

IMS group

Engineering steels

€m

Q3 2020

30.09.20

9 months

Q3 2020

30.09.20

9 months

Q3 2020

30.09.20

9 months

Sales

72

235

99

329

144

484

Change vs. 2019

-14.9%

-10.8%

-9.7%

-9.4%

-21.3%

-24.8%

Price effect

-4.9%

-1.7%

-4.6%

-1.4%

-4.1%

-2.6%

Volume effect

-10.0%

-9.1%

-5.1%

-8.0%

-17.2%

-22.3%

EBITDA 1 2

2.5

7.6

3.8

12.2

0.5

(4.7)

% of sales

3.5%

3.2%

3.8%

3.7%

0.3%

-1.0%

Adjusted operating

income/(loss) 2

0.6

0.8

3.0

9.6

(3.6)

(12.8)

% of sales

0.8%

0.3%

3.0%

2.9%

-2.5%

-2.7%

1 As of September 30, 2020, non-division operations and

the application of IFRS 16 – Leases contributed €4 million and €13

million to EBITDA respectively.

2 Adjusted for non-recurring items. The activity report

includes a definition of non-IFRS financial indicators and explains

the methods used to calculate them. The report is available at

corporate.jacquetmetals.com.

JACQUET specializes in the distribution of stainless steel

quarto plates. The division generates 68% of its business in Europe

and 25% in North America.

Sales amounted to €235 million, down -10.8% from €263 million as

of September 30, 2019:

> volumes: -9.1% (Q3: -10.0%); > prices: -1.7% (Q3: -4.9%

vs. Q3.19 and -3.2% vs. Q2.20).

Gross margin amounted to €64 mil- lion and represented 27.4% of

sales (Q3: 27.3%) compared to €79 million (30.2% of sales) as of

September 30, 2019.

EBITDA amounted to €7.6 million (Q3: €2.5 million) representing

3.2% of sales, compared to €19 million (7.2% of sales) as of

September 30, 2019.

STAPPERT specializes in the distribution of stainless steel long

products. The division generates 41% of its sales in Germany, the

largest European market.

Sales amounted to €329 million, down -9.4% from €364 million as

of September 30, 2019:

> volumes: -8.0% (Q3: -5.1%); > prices: -1.4% (Q3: -4.6%

vs. Q3 2019 and -4.7% vs. Q2 2020).

Gross margin amounted to €66 mil- lion and represented 20.0% of

sales (Q3: 20.7%) compared to €70 million (19.1% of sales) as of

September 30, 2019.

EBITDA amounted to €12.2 million (Q3: €3.8 million),

representing 3.7% of sales, compared to €12.4 million (3.4% of

sales) as of September 30, 2019.

IMS group specializes in the distribution of engineering steels,

mostly in the form of long products. The division generates 46% of

its sales in Germany, the largest European market.

Sales amounted to €484 million, down -24.8% from €644 million as

of Sep- tember 30, 2019:

> volumes: -22.3% (Q3: -17.2%); > prices: -2.6% (Q3: -4.1%

vs. Q3 2019 and -2.2% vs. Q2 2020).

Gross margin amounted to €105 million and represented 21.6% of

sales (Q3: 22.8%) compared to €139 million (21.6% of sales) as of

September 30, 2019.

EBITDA amounted to -€4.7 million (Q3: €0.5 million),

representing -1.0% of sales, compared to €15.3 million (2.4% of

sales) as of September 30, 2019.

Key financial informations

Income statement

30.09.20

30.09.19

€m

Q3 2020

Q3 2019

9 months

9 months

Sales

312

375

1,039

1,259

Gross margin

73

83

235

288

% of sales

23.4%

22.2%

22.6%

22.8%

EBITDA 1

13

15

32

63

% of sales

4.2%

4.1%

3.1%

5%

Adjusted operating

income/(loss) 1

0.1

7

(3)

39

% of sales

0.0%

1.9%

-0.3%

3.1%

Operating

income/(loss)

0.2

7

(7)

39

Net financial expense

(3)

(3)

(9)

(9)

Corporate income tax

(1)

(2)

(1)

(10)

Net income from discontinued

operations

—

1

—

3

Minority interests

(1)

(1)

(1)

(3)

Net income/(loss) (Group

share)

(4)

2

(19)

20

1 Adjusted for non-recurring items. The activity report

includes a definition of non-IFRS financial indicators and explains

the methods used to calculate them. The report is available at

corporate.jacquetmetals.com.

Cash flow

€m

30.09.20

9 months

30.09.19

9 months

Operating cash flow before change

in working capital

22

50

Change in working capital

61

(10)

Cash flow from operating

activities

83

40

Capital expenditure

(22)

(20)

Asset disposals

1

0

Dividends paid to shareholders of

Jacquet Metals SA

(5)

(17)

Interest paid

(10)

(9)

Other movements

(20)

21

Change in net debt

28

15

Net debt brought

forward

175

215

Net debt carried

forward

147

199

Balance sheet

€m

30.09.20

31.12.19

Goodwill

66

66

Net non-current assets

150

143

Right-of-use assets

74

85

Net inventory

369

442

Net trade receivables

150

152

Other assets

89

91

Cash & cash equivalents

326

206

Total assets

1,226

1,186

Shareholders’ equity

345

379

Provisions (including provisions

for employee benefit obligations)

111

99

Trade payables

153

178

Borrowings

474

381

Other liabilities

68

63

Lease liabilities

75

86

Total equity and

liabilities

1,226

1,186

Activity Report available:

corporate.jacquetmetals.com — 2020 Results : March 9, 2021

after close of trading Jacquet Metals is a European leader in the

distribution of specialty steels. The Group operates and develops a

portfolio which currently consists of three brands: JACQUET

stainless steel quarto plates - STAPPERT stainless steel

long products - IMS group engineering steels. With a

headcount of 3,006 employees, Jacquet Metals has a network of 103

distribution centers in 25 countries in Europe, China and North

America.

Compartment B ISIN : FR0000033904 Reuters :

JCQ.PA Bloomberg : JCQ FP

View source

version on businesswire.com: https://www.businesswire.com/news/home/20201118005895/en/

Jacquet Metals Thierry Philippe - Chief Financial Officer

comfi@jacquetmetals.com

NewCap - Investor Relations Emmanuel Huynh Tel. : +33 1 44 71 94

94 jacquetmetals@newcap.eu

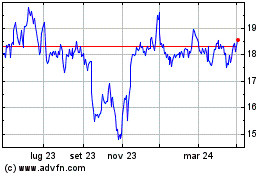

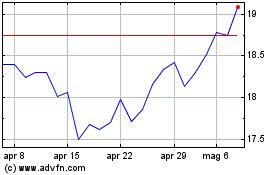

Grafico Azioni Jacquet Metals (EU:JCQ)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni Jacquet Metals (EU:JCQ)

Storico

Da Apr 2023 a Apr 2024