Japanese Yen Rises On Fed Tapering Worries

20 Maggio 2021 - 5:54AM

RTTF2

The Japanese yen moved higher against its most major trading

partners in the Asian session on Thursday amid safe-haven status,

as minutes of the Federal Reserve's April monetary policy meeting

hinted that several policymakers are willing to discuss about

tapering at upcoming meetings should the economic recovery continue

to gain momentum.

The minutes indicated that some Fed officials considered that it

may be appropriate to begin discussing a plan for adjusting the

pace of asset purchases at some point in upcoming meetings.

A "number of participants" observed that consumer prices could

remain elevated well into next year, although the Fed expected

inflationary pressures to ease when transitory factors fade.

Data from the Ministry of Finance showed that Japan posted a

merchandise trade surplus of 255.3 billion yen in April. That

exceeded expectations for a surplus of 140 billion following the

downwardly revised 662.2 billion yen surplus in March (originally

663.7 billion yen).

Exports surged 38.0 percent on year to 7.181 trillion yen,

beating forecasts for a gain of 30.9 percent after climbing 16.1

percent in the previous month. Imports advanced an annual 12.8

percent to 6.925 trillion yen versus expectations for a gain of 8.8

percent and up from 5.8 percent a month earlier.

Data from the Cabinet Office showed that Japan core machine

orders rose a seasonally adjusted 3.7 percent on month in March,

coming in at 798.1 billion yen. That missed expectations for an

increase of 6.4 percent following the 8.5 percent decline in

February.

On a yearly basis, core machine orders fell 2.0 percent -

beating forecasts for a fall of 2.6 percent after sinking 7.1

percent a month earlier.

The yen edged higher to 132.85 against the euro and 120.66

against the franc, from its early lows of 133.09 and 120.90,

respectively and held steady thereafter. Next key resistance for

the yen is seen around 129.00 against the euro and 116.5 against

the franc.

The yen gained to 153.95 against the pound, from its prior low

of 154.25, and was steady. Should the yen rises further, it may

find resistance around the 150.00 level.

The yen appreciated to 108.98 against the greenback, off its

previous low of 109.31. The yen is seen finding resistance around

the 107.00 mark.

The yen reached as high as 89.95 against the loonie earlier in

the session and held steady thereafter. On the upside, 88.00 is

possibly seen as its next resistance level.

In contrast, the yen dropped to 84.63 against the aussie and

78.47 against the kiwi, from Wednesday's closing values of 84.37

and 78.24, respectively. If the yen slides further, it may find

support around 88.00 against the aussie and 82.00 against the

kiwi.

Looking ahead, Eurozone current account and construction output

for March are due in the European session.

Canada new housing price index for April and U.S. weekly jobless

claims for the week ended May 15 will be released in the New York

session.

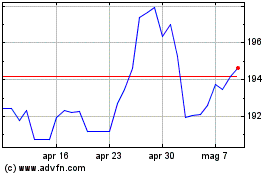

Grafico Cross Sterling vs Yen (FX:GBPJPY)

Da Mar 2024 a Apr 2024

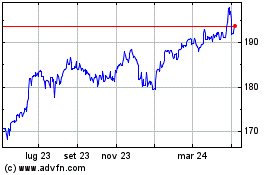

Grafico Cross Sterling vs Yen (FX:GBPJPY)

Da Apr 2023 a Apr 2024