TIDMJEL

RNS Number : 0610J

Jersey Electricity PLC

17 December 2020

JERSEY ELECTRICITY plc Preliminary Announcement of Annual

Results

Year Ended 30 September 2020

At a meeting of the Board of Directors held on 17 December 2020,

the final accounts for the year ended 30 September 2020 were

approved, details of which follow.

The financial information set out in the announcement does not

constitute the statutory accounts for the year ended 30 September

2020 or 2019, but is derived from those accounts. Statutory

accounts for 2019 have been delivered to the Jersey Registrar of

Companies, and those for 2020 will be delivered in early 2021. The

auditor reported on the accounts for both years and their reports

were unmodified.

A final dividend of 9.70p on the Ordinary and 'A' Ordinary

shares in respect of the year ended 30 September 2020 was

recommended (2019: 9.25p) . Together with the interim dividend of

6.80p (2019: 6.45p) the proposed total dividend declared for the

year was 16.50p on each share (2019: 15.70p).

The final dividend will be paid on 25 March 2021 to those

shareholders registered on 19 February 2021. A dividend on the 5%

cumulative participating preference shares of 1.5% (2019: 1.5%)

payable on 1 July 2021 was also recommended.

The Annual General Meeting will be held on 4 March 2021 at 12.30

pm at the Powerhouse, Queens Road, St Helier, Jersey.

M.P. Magee L. Floris

Finance Director Company Secretary

Direct telephone number: 01534 505201 Direct telephone number:

01534 505253

Email: mmagee@jec.co.uk Email: lfloris@jec.co.uk

17 December 2020

The Powerhouse

PO Box 45

Queens Road

St Helier

Jersey JE4 8NY

JERSEY ELECTRICITY plc

Preliminary Announcement of Annual Results

Year ended 30 September 2020

The Chairman, Phil Austin, comments:

"When we entered the year, we could not have imagined that the

world would be so impacted by a virus. As I write, countries across

the globe are battling COVID-19 and both lives and economies are

being hugely disrupted, with tragic consequences. Even now, the

world is far from through it.

Strong response to COVID-19

Though unprecedented, a critical service provider like Jersey

Electricity should be prepared for such events. I am pleased to

report that we were well prepared.

The Company has a well-tested contingency plan and had been

closely monitoring the COVID-19 situation since the beginning of

January, formally invoking its Business Continuity Plan in April.

Throughout the crisis, we have taken steps to keep our people and

the community safe, as well as maintaining continuity of

electricity supplies and other essential services, on which the

Island so depends.

The response of the whole workforce has been exceptional and I'd

particularly like to thank those who went out every day in the

field, or into their place of work, to ensure that we continued to

keep our organisation functioning and able to power homes,

businesses and Government throughout this difficult period. Through

our ongoing investment in technology, our people were able to

successfully migrate to home working, such that overall

productivity and performance levels have been remarkably

unaffected.

As well as focusing on core services, we took immediate action

to lessen any financial hardship of customers by deferring our 2.5%

tariff rise by six months, at a cost of around GBP1m. We also

adopted a more flexible approach to electricity customers and

investment property tenants. Measures included a more sympathetic

debt collection process and suspension of service terminations, and

we worked closely with Government and charities to establish new

processes to support vulnerable customers.

Given Jersey Electricity's scale and role, we offered the full

strength of the Company in support of the community by providing,

without charge and on a fast-track basis, new infrastructure,

plumbing and electrical services for Jersey's Nightingale Hospital,

including professional services support. In addition, Jersey

Electricity has fulfilled all its own contractual obligations and

has not taken advantage of any forms of Government furlough or

other financial support schemes.

Leaders in clean energy

Last year we communicated our new Vision "to enable life's

essentials and inspire a zero-carbon future". Whilst we continue to

flesh out how we can best support the Island to deliver carbon

neutrality, the COVID-19 pandemic has only re-emphasised the

importance of this Vision to the Company and to the Island as a

whole. There now seems to be a clear and widespread recognition of

the climate issue and, crucially, a real appetite to take action.

We have made considerable progress during the year in transforming

this Vision into tangible work streams, including, for example,

conducting a larger scale assessment of what investment is required

to facilitate carbon neutrality by 2030. It is now well understood

that our grid is substantially decarbonised and the only way Jersey

can materially reduce its carbon emissions is by switching from

high-carbon fossil fuels to low carbon imported or locally

generated electricity.

Resilient performance

Despite the challenges of COVID-19, the Company's financial

performance has been remarkably resilient. Revenue for 2019/20 was

GBP111.7m, 1% higher than last financial year. Electricity unit

sales initially fell 13% in the immediacy of lockdown, but largely

recovered, and for the full year were 619m units, only 1% lower

than those in the 2018/19 financial year.

Profit before tax was unchanged from the prior year at a level

of GBP14.8m, with the cost impact of the deferred tariff being

completely offset by outperformance in other areas, most notably

our Powerhouse retail business, which saw profits increase by

almost one third from GBP0.9m to GBP1.2m.

The Board has therefore recommended a final dividend for the

year of 9.70p, a 5% increase on the previous year, and payable on

25 March 2021.

Our core objective remains to deliver an affordable, secure and

sustainable supply of electricity now and long into the future -

and our performance this year, across all our key metrics, reflects

real success."

Financial Highlights 2020 2019

Revenue GBP111.7m GBP110.7m

Profit before tax GBP14.8m GBP14.8m

Earnings per share 37.94p 38.42p

Dividend paid per share 16.05p 15.25p

Final proposed dividend per share 9.70p 9.25p

Net cash/(debt) GBP5.5m GBP(5.1)m

----------------------------------- ------------ ----------

Group revenue for the year to 30 September 2020 at GBP111.7m was

1% higher than in the previous financial year. Energy revenues at

GBP85.1m were 2% lower than the GBP87.0m achieved in 2019. Lower

unit sales of electricity, linked to the COVID-19 crisis, combined

with the sale of heavy fuel oil to Guernsey Electricity last year

were the main reasons for the reduction. Revenue in the Powerhouse

retail business increased 17% from GBP15.2m in 2019 to GBP17.8m.

The business had a strong first half, but was impacted when the

shop was forced to close due to COVID-19, but then recovered well

helped by the strong on-line offering. Revenue in the Property

business, at GBP2.3m, was at the same level as last year despite

initial concerns that rental flows could be impacted by COVID-19 .

Revenue from JEBS, our building services business, increased from

GBP3.3m in 2019 to GBP3.8m. Revenue in our other businesses, at

GBP2.7m, was marginally lower than in 2019.

Cost of sales at GBP69.7m was GBP0.4m higher than last year with

the increased revenue level in the Powerhouse Retail business being

offset by a lower volume of imported units of electricity in 2020

and the costs associated with the sale of heavy fuel oil to

Guernsey Electricity last year.

Other income was recognised during the previous year arising

from the receipt of a GBP0.8m rebate for a subsea cable repair.

Operating expenses at GBP26.4m were GBP0.4m lower than last year

primarily due to the pension cost in 2019 being GBP0.6m higher than

in 2020.

Profit before tax for the year to 30 September 2020, at

GBP14.8m, was maintained at the same level as 2019 despite the

challenges of COVID-19.

Profits in our Energy business, at GBP12.3m, were at the same

level as in 2019. Unit sales volumes decreased from 627m to 619m

kilowatt hours with the impact of COVID-19 in the second half of

the financial year being the main reason. However, revenue from

electricity sales was GBP0.8m higher due to the sales mix, with an

increase in usage in domestic premises more than offsetting the

fall in the commercial sector. In 2019 Energy had a GBP1m profit

from the sale of heavy fuel oil being a 'one-off' transaction.

During this year overhead costs were GBP0.9m lower than in 2019

largely due to lower depreciation charges. In the financial year we

imported 95% of our requirements from France (2019: 94%) and

generated 0.2% of our electricity on island from our solar and

diesel plant (2019: 0.3%). The remaining 5% (2019: 6%) of our

electricity was purchased from the local Energy from Waste plant. A

planned 2.5% tariff rise from 1 April 2020 was postponed to 1

October 2020 to provide some further assistance to our customers in

light of the COVID-19 pandemic.

The GBP1.3m profit in our Property division, excluding the

impact of investment property revaluation, was GBP0.4m lower than

last year due mainly to accelerated depreciation on air

conditioning plant that was replaced during this year. Our

investment property portfolio moved up in value by GBP0.5m to

GBP21.8m based on advice from our external consultants who review

the position annually, due primarily to the growth in the value of

residential properties despite COVID-19 challenges.

Our Powerhouse retail business saw profits rise by 31% from

GBP0.9m to GBP1.2m in a turbulent year where flexibility in the

business model, due to our strong on-line presence, aided this

business during the COVID-19 crisis. The business was also helped

by our customers appearing to have more spending power, due to less

travel taking place, with some sales lines seeing material growth -

such as electric bikes.

JEBS, our building services unit, positively moved to a profit

of GBP0.2m against a GBP0.1m loss in 2019 as a result of an

increase in revenue, and a move to higher margin work.

Our other business units (Jersey Energy, Jendev, Jersey Deep

Freeze and fibre optic lease rentals) produced increased profits of

GBP0.8m being GBP0.2m above last year.

The net interest cost in 2020 was GBP1.4m being GBP0.1m higher

than in 2019 due to the implementation of IFRS 16

('Leases'). The taxation charge at GBP3.1m was marginally higher than the level in 2019.

Group basic and diluted earnings per share at 37.94p compared to

38.42p in 2019 due to profitability being similar in both

years.

Dividends paid in the year, net of tax, rose by 5%, from 15.25p

in 2019 to 16.05p in 2020. The proposed final dividend for this

year is 9.70p, a 5% rise on the previous year. Dividend cover, at

2.4 times, was marginally lower than comparable 2.5 times in

2019.

Net cash inflow from operating activities at GBP26.9m was

GBP0.8m lower than in 2019. Capital expenditure , at GBP11.2m was

GBP2.7m lower than GBP13.9m last year as there was material spend

in 2019 in completing the St Helier West primary sub-station.

Dividends paid were GBP5.0m compared to GBP4.7m in 2019. The

resultant position was that net cash at the year-end was GBP5.5m,

being GBP30.0m of borrowings offset by GBP35.5m of cash and cash

equivalents, which was GBP10.6m more positive than last year.

Our defined benefits pension scheme showed a s urplus at 30

September 2020, under IAS 19 "Employee Benefits", of GBP5.9m, net

of deferred tax, compared with a surplus of GBP8.3m at 30 September

2019. Assets rose 1% from GBP154.7m to GBP156.6m during the year.

However, liabilities also increased 4% from GBP144.2m to GBP149.3m

since the last year-end. This was largely due to the discount rate

assumption, which heavily influences the calculation of

liabilities, falling from 1.9% in 2019 to 1.6% in 2020, reflecting

sentiments in prevailing financial markets.

Impact of new accounting standard - IFRS 16 was adopted from 1

October 2019, applying the "modified retrospective" approach

whereby comparative figures are not restated. In adopting this

approach, the results for the year to 30 September 2020 are not

directly comparable with those reported in the prior year under the

previous applicable accounting standard IAS 17 "Leases".

This adoption has resulted in an increase in Group operating

profit of GBP86k, (a GBP189k reduction in rent expense has been

partially offset by an increase of GBP103k in depreciation).

Finance costs have increased by GBP131k, resulting in a decrease in

profit from operations before taxation of GBP45k. At 30 September

2020 the net value of right of use assets under IFRS 16 totalled

GBP2.9m, with a corresponding lease liability of GBP2.9m.

Whilst there is no impact on total cash and cash equivalents,

there has been a reclassification of lease payments resulting in a

deterioration of net cash flows arising from financing activities,

whilst there is a corresponding increase in net cash flows from

operating activities.

Consolidated Income Statement 2020 2019

For the year ended 30 September 2020 GBP000 GBP000

Revenue 111,747 110,709

Cost of sales (69,695) (69,282)

--------- ---------

Gross Profit 42,052 41,427

Other income - 750

Revaluation of investment properties 515 689

Operating expenses (26,360) (26,784)

--------- ---------

Group operating profit 16,207 16,082

Finance income 139 103

Finance costs (1,516) (1,365)

Profit from operations before taxation 14,830 14,820

Taxation (3,090) (2,969)

--------- ---------

Profit from operations after taxation 11,740 11,851

========= =========

Attributable to:

Owners of the Company 11,624 11,773

Non-controlling interests 116 78

--------- ---------

11,740 11,851

========= =========

Earnings per share

- basic and diluted 37.94p 38.42p

In 2020 the Directors have made a classification change in

relation to the amortisation of deferred infrastructure charges. In

order to present the results in a consistent format, the Directors

have reclassified the prior year reported results, increasing both

Operating expenses and Revenue by GBP415k, with no impact to Group

operating profit.

Consolidated Statement of Comprehensive 2020 2019

Income

GBP000 GBP000

Profit for the year 11,740 11,851

Items that will not be reclassified subsequently

to profit or loss:

Actuarial (loss)/gain on defined benefit

scheme (1,663) 7,643

Income tax relating to items not reclassified 333 (1,529)

-------- --------

(1,330) 6,114

Items that may be reclassified subsequently

to profit or loss:

Fair value gain/(loss) on cash flow hedges 1,290 (3,007)

Income tax relating to items that may be

reclassified (258) 601

-------- --------

1,032 (2,406)

Total comprehensive income for the year 11,442 15,559

Attributable to:

Owners of the Company 11,326 15,481

Non-controlling interests 116 78

-------- --------

11,442 15,559

Consolidated Balance Sheet

30 September 2020

2020 2019

GBP000 GBP000

NON-CURRENT ASSETS

Intangible assets 479 683

Property, plant and equipment 217,936 217,046

Right of use assets 2,899 -

Investment properties 21,755 21,240

Trade and other receivables 300 383

Retirement benefit surplus 7,315 10,417

Derivative financial instruments 277 208

Other investments 5 5

-------- ---------------

Total non-current assets 250,966 249,982

------------------------------------- -------- ---------------

CURRENT ASSETS

------------------------------------ -------- ---------------

Inventories 6,028 6,018

Trade and other receivables 16,645 17,995

Derivative financial instruments 960 197

Cash and cash equivalents 35,520 24,915

Total current assets 59,153 49,125

-------- ---------------

Total assets 310,119 299,107

---------------------------------------- -------- ---------------

LIABILITIES

------------------------------------ -------- ---------------

Trade and other payables 18,193 17,320

Current tax liabilities 2,742 2,714

Lease liabilities 65 -

Derivative financial instruments 143 298

Total current liabilities 21,143 20,332

-------- ---------------

NET CURRENT ASSETS 38,010 28,793

----------------------------------------

NON-CURRENT LIABILITIES

-------------------------------------- -------- ---------------

Trade and other payables 22,714 21,757

Lease liabilities 2,879 -

Derivative financial instruments - 303

Financial liabilities - preference

shares 235 235

Borrowings 30,000 30,000

Deferred tax liabilities 27,209 26,936

Total non-current liabilities 83,037 79,231

-------- ---------------

Total liabilities 104,180 99,563

-------- ---------------

Net assets 205,939 199,544

---------------------------------------- -------- ---------------

EQUITY

------------------------------------ -------- ---------------

Share capital 1,532 1,532

Revaluation reserve 5,270 5,270

ESOP reserve (120) (45)

Other reserves 875 (157)

Retained earnings 198,259 192,882

Equity attributable to owners of

the company 205,816 199,482

Non-controlling interests 123 62

-------- ---------------

Total equity 205,939 199,544

---------------------------------------- -------- ---------------

Consolidated

Statement of

Changes

in Equity for the

year ended Share Revaluation ESOP Other Retained

30 September 2020 capital reserve reserve reserves earnings Total

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

At 1 October 2019 1,532 5,270 (45) (157) 192,882 199,482

Total recognised

income and

expense for the

year - - - - 11,624 11,624

Funding of

employee share

option

scheme - - (78) - - (78)

Amortisation of

employee share

option scheme - - 3 - - 3

Unrealised gain

on hedges (net

of tax) - - - 1,032 - 1,032

Actuarial loss on

defined benefit

scheme (net of

tax) - - - - (1,330) (1,330)

Equity dividends - - - - (4,917) (4,917)

At 30 September

2020 1,532 5,270 (120) 875 198,259 205,816

=================== ==================== ============== ============== ============= ========

Share Revaluation ESOP Other Retained

capital reserve reserve reserves earnings Total

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

At 1 October 2018 1,532 5,270 (41) 2,249 179,666 188,676

Total recognised

income and

expense for the

year - - - - 11,773 11,773

Funding of

employee share

option

scheme - - (20) - - (20)

Amortisation of

employee share

option scheme - - 16 - - 16

Unrealised loss

on hedges (net

of tax) - - - (2,406) - (2,406)

Actuarial gain to

defined benefit

scheme (net of

tax) - - - - 6,114 6,114

Equity dividends - - - - (4,671) (4,671)

At 30 September

2019 1,532 5,270 (45) (157) 192,882 199,482

=================== ==================== ============== ============== ============= ========

Consolidated Statement of Cash Flows 2020 2019

for the year ended 30 September 2020 GBP000 GBP000

CASH FLOWS FROM OPERATING ACTIVITIES

Operating profit 16,207 16,082

Depreciation and amortisation charges 11,424 11,604

Share based reward charges 3 16

Gain on revaluation of investment property (515) (689)

Pension operating charge less contributions

paid 1,439 1,977

Profit on sale of fixed assets (24) (2)

--------- ---------

Operating cash flows before movement in

working capital 28,534 28,988

Working capital adjustments:

Decrease/(increase) in inventories (10) 1,074

(Increase)/decrease in trade and other

receivables 1,433 (2,675)

Increase in trade and other payables 1,071 4,023

--------- ---------

Net movement in working capital 2,494 2,422

Interest paid (1,376) (1,356)

Preference dividends paid (9) (9)

Income taxes paid (2,714) (2,300)

--------- ---------

Net cash flows from operating activities 26,929 27,745

CASH FLOWS FROM INVESTING ACTIVITIES

Purchase of property, plant and equipment (10,922) (13,850)

Investment in intangible assets (337) (90)

Deposit interest received 139 103

Net proceeds from disposal of fixed assets 24 2

--------- ---------

Net cash flows used in investing activities (11,096) (13,835)

CASH FLOWS FROM FINANCING ACTIVITIES

Equity dividends paid (4,917) (4,671)

Dividends paid to non-controlling interest (55) (69)

Purchase of shares by Employee Benefit

Trust (78) -

Repayment of lease liabilities (189) -

--------- ---------

Net cash flows used in financing activities (5,239) (4,740)

Net increase in cash and cash equivalents 10,594 9,170

Cash and cash equivalents at beginning

of year 24,915 15,735

Effect of foreign exchange rates 11 10

Cash and cash equivalents at end of year 35,520 24,915

In 2020 the Directors have made a presentational change in

relation to deposit interest received, presenting this within

investing activities, in compliance with IAS 7 "Statement of Cash

Flows". In the prior year deposit interest received was presented

within financing activities. In order to present the consolidated

cash flow statement in a consistent format, the Directors have

reclassified prior year's deposit interest received of GBP103k.

This adjustment has had no impact on the 2019 reported Net increase

in cash and cash equivalents.

Notes to the accounts

Year ended 30 September 2020

1. Basis of Preparation

The consolidated financial statements of Jersey Electricity plc,

for the year ended 30 September 2020, have been prepared in

accordance with International Financial Reporting Standards (IFRS)

as adopted by the European Union (EU), including International

Accounting Standards and Interpretations issued by the

International Financial Reporting Interpretations Committee

(IFRIC). This is consistent with the accounting policies in the 30

September 2019 annual report and accounts, except for IFRS16, the

impacts of which are disclosed in the 31 March 2020 interim

report.

While the financial information included in this preliminary

announcement has been prepared in accordance with the appropriate

recognition and measurement criteria, this announcement does not

itself contain sufficient information to comply with IFRS. The

Group expects to publish full financial statements that comply with

IFRS in early 2021.

The Group has considerable financial resources together with a

large number of customers both corporate and individual. As a

consequence, the directors believe that the Group is well placed to

manage its business risks successfully, including the impact of

COVID-19. The directors have a reasonable expectation that the

Group has adequate resources to continue in operational existence

for the foreseeable future. For this reason, they continue to adopt

the going-concern basis in preparing the financial statements.

Segmental information

Revenue and profit information are analysed between the business segments

as follows:

2020 2020 2020 2019 2019 2019

External Internal Total External Internal Total

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

Revenue

Energy - arising in the course

of ordinary business 85,140 122 85,262 84,322 126 84,448

- arising from the sale of heavy

fuel oil - - - 2,723 - 2,723

Building Services 3,767 1,027 4,794 3,286 809 4,095

Retail 17,825 60 17,885 15,199 59 15,258

Property 2,266 645 2,911 2,262 612 2,874

Other 2,749 891 3,640 2,917 898 3,815

--------- --------- -------- --------- --------- --------

111,747 2,745 114,492 110,709 2,504 113,213

Intergroup elimination (2,745) (2,504)

-------- --------

Revenue 111,747 110,709

-------- --------

Operating profit

Energy 12,257 12,281

Building Services 216 (79)

Retail 1,176 895

Property 1,270 1,679

Other 773 617

-------- --------

15,692 15,393

Revaluation of investment properties 515 689

Operating profit 16,207 16,082

-------- --------

The revaluation of investment properties is shown separately

from Property operating profit as this income is reflected solely

by a movement in reserves.

In 2020 the Directors have made a classification change in

relation to the amortisation of deferred infrastructure charges. In

order to present the results in a consistent format, the Directors

have reclassified the prior year reported results, increasing both

Operating expenses and Revenue by GBP415k, with no impact to Group

operating profit.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

FR UBAVRRSUUAAA

(END) Dow Jones Newswires

December 17, 2020 10:20 ET (15:20 GMT)

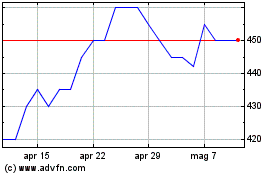

Grafico Azioni Jersey Electricity (LSE:JEL)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni Jersey Electricity (LSE:JEL)

Storico

Da Apr 2023 a Apr 2024