TIDMJLEN

RNS Number : 5349G

Jlen Environmental Assets Grp

26 November 2020

26 November 2020

JLEN Environmental Assets Group Limited

Announcement of half-year results for the period to 30 September

2020

The Directors of JLEN Environmental Assets Group Limited (the

"Company" or "JLEN") are pleased to announce the Company's

half-year results to 30 September 2020.

Financial highlights

- Portfolio valuation as at 30 September 2020 of GBP552.9m (31 March 2020: GBP537.1m)

- NAV per ordinary share of 96.1 pence as at 30 September 2020

(31 March 2020: 97.5 pence), reduction primarily driven by the

effect of the reduction in long-term electricity and gas price

forecasts

- Further interim dividend of 1.69 pence per share declared

making total dividend declared for the six months to 30 September

2020 of 3.38 pence, in line with the target set out in the 2020

Annual Report. Cash dividend cover of 1.1 times on dividends

declared during the period

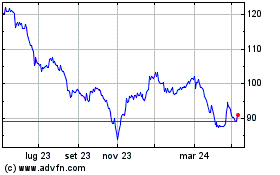

- Share price total return for the period since IPO of 69.8% (8.5% annualised)

Portfolio highlights

- Two acquisitions completed this period in the anaerobic

digestion (AD) and Hydropower sectors, increasing the Company's

diversification

- Diversified portfolio now 34% wind, 27% AD, 22% Solar, 15%

waste and wastewater and 2% Hydro and battery by value

- Operating performance of the portfolio during the six-month

period was strong across most of the portfolio, with exceptions

mainly driven by the Covid-19 pandemic or grid operator maintenance

or constraints

- Wind, Solar, AD and Hydro portfolios generation all above budget for the six-month period

- Bio Collectors food waste project operating well but gas

production negatively impacted by Covid-19 pandemic as waste

volumes fall

Other highlights

- Joined the FTSE 250 in June 2020

- Strong pipeline of assets for further growth

Dividend Timetable

Ex-dividend date 3 December 2020

Record date 4 December 2020

Payment date 30 December 2020

Richard Morse, Chairman of JLEN, said:

"JLEN's portfolio has operated well for the period under review

and the market outlook for the Company is positive. This is despite

the wider challenges brought on by the global pandemic. The

infrastructure and renewables markets remain favourable in both

context of global and UK government policy and financial support

for decarbonisation initiatives. Our acquisition pipeline presents

further scope for diversification, following this decarbonisation

agenda."

Half-year report

A copy of the half-year report has been submitted to the

National Storage Mechanism and will shortly be available at

www.morningstar.co.uk/uk/NSM. The annual report will also be

available on the Company's website at www.jlen.com where further

information on JLEN can be found.

Details of the conference call for analysts and investors

A webinar for the annual results will be held at 10:00 a.m. (UK

time) on 26 November, hosted by Chris Holmes and Chris Tanner,

Co-lead Investment Advisers to JLEN. To register for the webinar,

please contact Newgate Communications on +44 (0)20 3757 6880 or by

email at JLEN@newgatecomms.com.

Presentation materials will be posted on the Company's website,

www.jlen.com, from 9.00am.

For further information, please contact:

Foresight Group +44(0)20 3667 8100

Chris Tanner

Chris Holmes

Winterflood Investment Trusts +44(0)20 3100 0000

Neil Langford

Chris Mills

Newgate Communications +44(0) 20 3757 6880

Elisabeth Cowell

Ian Silvera

Megan Kovach

ABOUT US

JLEN Environmental Assets Group Limited ("JLEN", the "Company"

or the "Fund") is an environmental infrastructure investment fund

which aims to provide shareholders with a sustainable, progressive

dividend, paid quarterly, and to preserve the capital value of its

portfolio on a real basis over the long term through the

reinvestment of cash flows not required for the payment of

dividends.

JLEN's investment policy is to invest in a diversified portfolio

of environmental infrastructure projects that have the benefit of

long--term, predictable, wholly or partially inflation--linked cash

flows supported by long--term contracts or stable regulatory

frameworks.

At 30 September 2020, the portfolio included onshore wind, PV

solar, anaerobic digestion, waste & wastewater processing and

hydropower projects in the UK and two onshore wind projects in

France. The wind, solar, anaerobic digestion and hydropower

projects are supported by the UK's and France's commitment to

low-carbon energy generation targets whilst the waste &

wastewater processing projects benefit from long--term contracts

backed by the UK Government.

OUR PURPOSE

JLEN aims to invest in a diversified portfolio of environmental

infrastructure projects that support more environmentally friendly

approaches to economic activity whilst generating a sustainable

financial return. It seeks to integrate consideration of

sustainability and environmental, social and governance ("ESG")

management into its activities, which help to manage risks and

identify opportunities.

AT A GLANCE AT 30 SEPTEMBER 2020

Our results for the six -- month period ended 30 September

2020.

HY 2020 FY 2020 Change

-------------------------- --------- --------- ------

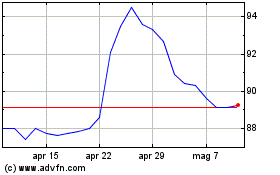

Market capitalisation GBP647.9m GBP606.9m +6.8%

Share price 118.5p 111.0p +6.8%

Net Asset Value GBP525.3m GBP533.0m -1.4%

Net Asset Value per share 96.1p 97.5p -1.4%

Portfolio value GBP552.9m GBP537.1m +2.9%

-------------------------- --------- --------- ------

HY 2020 HY 2019 Change

----------------------------- ------- ------- ------

Half-year dividend per share 3.38p 3.33p +1.5%

----------------------------- ------- ------- ------

-- Dividend of 3.38 pence per share declared for the six months

to 30 September 2020 (six months to 30 September 2019: 3.33 pence).

Cash dividend cover of 1.1x in the period

-- Two acquisitions completed in the period, giving a total of 32 assets

-- NAV per share 96.1 pence, down from 97.5 pence per share at

31 March 2020 mainly due to the reduction in long--term electricity

and gas price forecasts

-- Total shareholder return since IPO to 30 September 2020 of 69.8% (8.48% annualised)

-- Profit before tax for the period of GBP10.7 million

(six--month period ended 30 September 2019: GBP16.2 million)

-- The portfolio has operated well despite the challenges of the Covid-19 pandemic

-- Strong pipeline of assets for future growth

PORTFOLIO AT A GLANCE

JLEN's portfolio comprises a diversified mix of environmental

infrastructure assets.

Wind

Ownership

interest

-------------------------------------------------------------------------------------------- ---------

Bilsthorpe

10.2MW 1.0 ROC wind farm. Five MM82 Senvion turbines. 100%

-------------------------------------------------------------------------------------------- ---------

Burton Wold Extension

14.4MW 0.9 ROC wind farm. Nine General Electric 1.6MW--100 turbines. 100%

-------------------------------------------------------------------------------------------- ---------

Carscreugh

15.3MW 0.9 ROC wind farm. 18 Gamesa G52 turbines. 100%

-------------------------------------------------------------------------------------------- ---------

Castle Pill

3.2MW 1.0 ROC wind farm. Three 900kW EWT and one 0.5MW Nordtank turbines. 100%

-------------------------------------------------------------------------------------------- ---------

Dungavel

26MW 0.9 ROC wind farm. 13 Vestas 2MW V80 turbines. 100%

-------------------------------------------------------------------------------------------- ---------

Ferndale

6.4MW 1.0 ROC wind farm. Eight 800kW Enercon turbines. 100%

-------------------------------------------------------------------------------------------- ---------

Hall Farm

24.6MW 1.0 ROC wind farm. 18 MM82 Senvion turbines. 100%

-------------------------------------------------------------------------------------------- ---------

Le Placis Vert

4MW FiT accredited wind farm. Five Enercon E-53 turbines. 100%

-------------------------------------------------------------------------------------------- ---------

Llynfi Afan

24MW 0.9 ROC wind farm. 12 Gamesa 2MW G80 turbines. 100%

-------------------------------------------------------------------------------------------- ---------

Moel Moelogan

14.3MW wind farm. Nine Siemens SWT-62-1.3MW and two Bonus--1.3MW turbines. 1.0 ROC on both

turbine types. 100%

-------------------------------------------------------------------------------------------- ---------

New Albion

14.4MW 0.9 ROC wind farm. Seven MM92 Senvion turbines. 100%

-------------------------------------------------------------------------------------------- ---------

Plouguernével

4MW FiT accredited wind farm. Five Enercon E-53 turbines. 100%

-------------------------------------------------------------------------------------------- ---------

Wear Point

8.2MW 0.9 ROC wind farm. Four Senvion MM82 turbines. 100%

-------------------------------------------------------------------------------------------- ---------

13 assets

169.0 MW

Anaerobic digestion

Ownership

interest

------------------------------------------------------------------------------------------------ ---------

Biogas Meden

Biogas--to--grid anaerobic digestion plant. Accredited under both the Renewable Heat Incentive

("RHI") and Feed--in Tariff ("FiT"), c.5MWth and 0.4MWe. 100%

------------------------------------------------------------------------------------------------ ---------

Egmere Energy

Agricultural biogas--to--grid anaerobic digestion plant. Accredited under both the RHI and

FiT, c.5MWth and 0.5MWe. 100%

------------------------------------------------------------------------------------------------ ---------

Grange Farm

Agricultural biogas--to--grid anaerobic digestion plant. Accredited under both the RHI and

FiT, c.5MWth and 0.5MWe. 100%

------------------------------------------------------------------------------------------------ ---------

Icknield Farm(1)

Agricultural biogas--to--grid anaerobic digestion plant. Accredited under both the RHI and

FiT, c.5MWth and 0.4MWe. 53%

------------------------------------------------------------------------------------------------ ---------

Merlin Renewables

Agricultural biogas--to--grid anaerobic digestion plant. Accredited under both the RHI and

FiT, c.5MWth and 0.5MWe. 100%

------------------------------------------------------------------------------------------------ ---------

Peacehill Farm

Agricultural biogas--to--grid anaerobic digestion plant. Accredited under both the RHI and

FiT, c.5MWth and 0.25MWe. 49%

Vulcan Renewables

Agricultural biogas--to--grid anaerobic digestion plant. Accredited under both the RHI and

FiT, c.5MWth and 0.5MWe. 100%

------------------------------------------------------------------------------------------------ ---------

Warren Energy

Agricultural biogas--to--grid anaerobic digestion plant. Accredited under both the RHI and

FiT, c.5MWth and 0.5MWe. 100%

------------------------------------------------------------------------------------------------ ---------

8 assets

40.0 MW

(1) JLEN also provides a senior secured loan facility to the project.

Solar

Ownership

interest

------------------------------------------------------------------------------------------------ ---------

Amber

9.8MW comprising two separate sites: Five Oaks (4.8MW) and Fryingdown (5MW). Both accredited

under the pre--August 2011 UK FiT regime. 100%

------------------------------------------------------------------------------------------------ ---------

Branden

14.7MW comprising two separate sites: Luxulyan & Tredinnick (8.9MW) and Victoria (5.8MW),

both accredited for two ROCs. 100%

------------------------------------------------------------------------------------------------ ---------

CSGH

33.5MW combined capacity comprising four sites: Higher Tregarne (4.9MW) accredited for 1.6

ROCs, Crug Mawr (7.5MW), Golden Hill (6.3MW) and Shoals Hook (14.8MW) accredited for 1.4 ROCs. 100%

------------------------------------------------------------------------------------------------ ---------

Monksham

Total generating capacity of 10.7MW. Accredited for 1.6 ROCs. 100%

------------------------------------------------------------------------------------------------ ---------

Panther - small-scale solar portfolio

6.5MW portfolio of 1,099 systems of domestic rooftop, commercial rooftop and ground mount

solar installations, distributed across England, Scotland and Wales. Accredited under the

UK FiT regime. 100%

------------------------------------------------------------------------------------------------ ---------

Pylle Southern

Total generating capacity of 5MW. Accredited under the UK FiT regime. 100%

------------------------------------------------------------------------------------------------ ---------

6 assets

80.2 MW

Waste & wastewater

Ownership

interest

------------------------------------------------------------------------------------------------ ---------

Bio Collectors

The Bio Collectors food waste anaerobic

digestion plant processes around

100,000 tonnes of food waste each

year. The Bio Collectors waste collection

business collects food waste from

in and around Greater London. 70%

------------------------------------------------------------------------------------------------ ---------

ELWA

The ELWA project processes around 440,000 tonnes of household waste each year from four London

boroughs. 80%

------------------------------------------------------------------------------------------------ ---------

Tay

The Tay wastewater treatment project services the equivalent of around 250,000 people from

the Dundee and Arbroath areas. 33%

------------------------------------------------------------------------------------------------ ---------

3 assets

11.7 MW

Hydro (and battery storage)

Ownership

interest

---------------------------------------------------------------------------------------------- ---------

Northern Hydropower

Two run-of--river hydro plants and an operational battery storage system. Both hydro plants

accredited under FiT, combined capacity between both hydro plants and the battery storage

system is 1.8MW. 100%

---------------------------------------------------------------------------------------------- ---------

Yorkshire Hydropower

Two run--of--river hydro plants and an operational battery storage system. Both hydro plants

accredited under FiT, combined capacity between both hydro plants and the battery storage

system is 2MW. 100%

---------------------------------------------------------------------------------------------- ---------

2 assets

3.8 MW

FEIP

FEIP Skaftåsen Vindkraft AB

35 turbine wind farm under construction.

-------------------------------------------------------------------------------------------

FEIP Torozos

94MW wind farm, which comprises 27 SGRE 132m, 3.5MW wind turbines spread across two sites.

-------------------------------------------------------------------------------------------

MARKET AND OPPORTUNITIES

The transition to a low-carbon economy presents a variety of

investment opportunities in environmental infrastructure that JLEN

is well positioned to access.

Low-carbon solutions for heat and transport are also considered

crucial to meet net zero targets; infrastructure will be necessary

to facilitate this transition.

Through JLEN's diversified mandate the Board believes that the

Company is well positioned to capture investment opportunities

across these evolving markets as the build out of sustainable

infrastructure takes on new forms, technology and financing

structures. The benefits of diversification, whether through

climatic conditions, market dynamics or technology type, are

expected to create a resilient portfolio.

Market developments Investment policy Investment outlook

---------------------------------- ----------------------------- ------------------------------

Against the backdrop The Company invests in

of international collaboration environmental infrastructure

to limit further climate projects, being those

change, the decarbonisation that utilise natural

of the energy system or waste resources or

is an integral part of support more environmentally

developing a sustainable friendly approaches to

future. To make this economic activity.

happen a significant

investment into new environmental

infrastructure will be

required.

---------------------------------- ----------------------------- ------------------------------

Global investment into Generation of renewable Within the UK, a recent

renewable energy generation energy Government announcement

will be significant to to support up to double

meet climate targets. the capacity of renewable

55% of the EU's energy energy in the next Contracts

consumption will need for Difference auction,

to come from renewable opening in late 2021,

sources by 2030, requiring demonstrates the commitment

some EUR400 billion of to this sector. Although

investment. Increasing offshore wind is at the

electrification of end heart of this near-term

users will drive increased strategy, an important

power demand to be met contribution will come

from renewable sources. from other sectors. Within

Europe, countries are

establishing their intentions

on how to meet their

climate objectives.

---------------------------------- ----------------------------- ------------------------------

Energy efficiency is Projects that promote Low-carbon investment

an integral part of addressing energy efficiency opportunities could encompass

climate change. Within combined heat and power

the UK, widespread deployment systems, batteries storage

of energy efficiency and flexible generation,

measures will be required low-carbon agriculture,

to meet the net zero co-location of battery

target now enshrined storage with existing

in law. New infrastructure assets, electric vehicle

will be required that and low--carbon transport

either offers a more infrastructure such as

efficient way to generate biofuels.

or distribute energy

or a means to reduce

the demand of energy

users.

---------------------------------- ----------------------------- ------------------------------

Water deficits are expected Supply and treatment Following waste reduction

to become more prevalent of water and processing measures, further investment

in the UK with wetter of waste into materials recycling

winters and drier summers. will be required; new

The UK water industry legislation for food

has pledged to achieve waste collection is expected

net zero carbon emissions to generate demand for

by 2030. Diverting biodegradable new and expanded anaerobic

waste from landfill remains digestion facilities.

a key policy and the Energy from waste facilities

use of carbon capture are being developed to

and storage alongside reduce residual waste

bioenergy facilities to landfill.

will play a future role

in meeting climate objectives.

---------------------------------- ----------------------------- ------------------------------

The scale of the climate Geographic spread of JLEN's mandate supports

challenge has resulted investments geographic diversification,

in government policy reducing its exposure

drivers on a global scale. to the UK power market,

Technologies and commercial regulatory framework

partners can provide and weather systems.

continuity across jurisdictions The Investment Adviser

whilst more localised can take advantage of

climate conditions and in-country presence across

market dynamics present Europe and Australia

diversification opportunities. to generate investment

opportunities outside

of the UK.

---------------------------------- ----------------------------- ------------------------------

CHAIRMAN'S STATEMENT

JLEN's portfolio has operated well, despite Covid-19, which has

adversely affected electricity prices. Our acquisition pipeline

presents further scope for diversification, supporting a

lower-carbon economy.

On behalf of the Board, I am pleased to present the Half-year

Report of JLEN Environmental Assets Group Limited for the six

months ended 30 September 2020.

Timeline

March 20

-- Paid a dividend of 1.665 pence per share (relating to the

three-month period ended 31 December 2019)

April 20

-- Investment into Peacehill Farm anaerobic digestion plant for

an aggregate amount of c.GBP11 million

June 20

-- Paid a dividend of 1.665 pence per share (relating to the

three-month period ended 31 March 2020)

-- Announced the appointment of Stephanie Coxon as non--executive Director

-- JLEN joins FTSE 250

September 20

-- JLEN Annual General Meeting

-- Announced the resignation of Denise Mileham as non--executive Director

-- Paid a dividend of 1.69 pence per share (relating to the

three--month period ended 30 June 2020)

-- Acquisition of Northern Hydropower comprising two operational

hydropower stations and a battery storage system for a total

consideration, including working capital, of GBP4.74 million

Results

During the period under review, the Company's renewables

portfolio has operated well, with the wind, solar and anaerobic

digestion ("AD") portfolios all exceeding their generation budget.

This is despite the challenges of operating during the ongoing

Covid-19 pandemic, which continues to impact unfavourably on energy

prices. The Company has made two investments in UK projects during

the period: the acquisition of a minority shareholding in an AD

facility and the 100% acquisition of a hydro portfolio with

co-located battery.

Each acquisition sees us build onto existing asset classes in

the portfolio, allowing JLEN to benefit further from its existing

presence in these markets. Hydro and AD assets have high levels of

subsidy support, reducing exposure to electricity and gas prices,

and have demonstrated resilience in the face of the Covid-19

pandemic.

The Board, meanwhile continues to be pleased with the way in

which the Investment Adviser transfer to Foresight has gone. The

greater origination network of Foresight has led to more

opportunities being considered.

JLEN's profit before tax for the six-month period to 30

September 2020 was GBP10.7 million (six months to 30 September

2019: GBP16.2 million) and earnings per share for the period was

2.0 pence (six months to 30 September 2018: 3.3 pence). The Board

remains positive that the portfolio is well positioned to deliver

the targeted dividends to shareholders and reaffirms its guidance

of 6.76 pence for the year to 31 March 2021.

The Net Asset Value ("NAV") per share at 30 September 2020 was

96.1 pence, down from 97.5 pence at 31 March 2020 mainly due to the

reduction in long--term electricity and gas price forecasts.

Cash received from the portfolio by way of distributions, which

includes interest, loan repayments and dividends, was GBP24.4

million (six months to 30 September 2019: GBP22.8 million). Net

cash inflows from the investment portfolio (after operating and

finance costs) of GBP20.1 million (six months to 30 September 2019:

GBP18.5 million) cover the interim dividends of GBP18.3 million

paid in the half--year period by approximately 1.1 times (six

months to 30 September 2019: GBP16.4 million; 1.1 times). On a

dividend-declared basis for the half year, dividend cover was 1.1

times.

Dividend policy

For the year to 31 March 2020, the Company achieved its target

dividend of 6.66 pence per share by the payment of four interim

dividends.

In line with the total target for the year ending 31 March 2021

of 6.76 pence per share set out in our 2020 Annual Report, a

quarterly dividend of 1.69 pence per share was paid in September

2020 for the quarter to 30 June 2020. I am pleased to announce that

the Board has declared an interim dividend of 1.69 pence per share

for the quarter to 30 September 2020, payable on 30 December 2020,

to shareholders on the register as at 4 December 2020. The

ex-dividend date will be 3 December 2020. As noted in the 2020

Annual Report, for years after the current year ending 31 March

2021 the Directors intend to follow a progressive dividend

policy.

Portfolio performance

Total generation for the period from JLEN's diverse renewables

portfolio (excluding the Bio Collectors food waste plant) was

463GWh, 2.5% above budget. The three main constituents of the

portfolio - wind, solar and AD - all delivered generation ahead of

budget.

The AD portfolio is now the largest producer of energy on a GWh

basis for the half--year period covering the summer months of April

to September (50% by GWh energy generated). Gas generation

(measured in GWh energy generated) was 230GWh, 1.8% ahead of

budget. The majority of plants comfortably exceeded their budgets,

with the only material exceptions being the Vulcan and Meden plants

that experienced downtime relating to equipment failures which have

since been rectified. As reported in the Annual Report 2020, the

Vulcan upgrade project to double the capacity of the plant has now

been completed and a further expansion to the plant's capacity is

being implemented to increase the capacity by a further 25-30%.

Feedstock buffer levels have been increased across the portfolio to

protect against downtime should there be a poor harvest or further

impacts caused to the feedstock supply by the Covid--19

pandemic.

The wind portfolio (37% by GWh energy generated) performed well

and production was 2.1% above budget, generating 172GWh. Wind

resource was in line with expectations while availability was

generally good across the whole portfolio and the Directors are

pleased to note that the warranted availability of the Siemens

Gamesa Renewable Energy ("SGRE") sites, which were formerly Senvion

sites, has increased by 4% since January 2020. During the period,

the technical wind asset management services underwent a

competitive tender process, reducing costs to the portfolio and

increasing the scope of the asset management contracts.

The solar portfolio (13% by GWh energy generated) generated 6.7%

above budget on irradiation that was 5.6% higher during the period

than the long-term average. The main detractor from performance was

a planned grid constraint in Shoals Hook from August to September.

Adjusting for this, generation would have been 9.0% above budget.

Performance for the rest of the portfolio was generally

satisfactory. The Directors are pleased to see the solar portfolio

perform well during a period of high irradiation following a focus

on resolving residual operational issues on certain assets.

Both concession-based projects have continued to perform in line

with expectations. The ELWA waste management project has continued

to exceed its key contractual targets although waste recycling

percentages have been marginally impacted by Covid-19. The Tay

wastewater project experienced low flows in early spring, but

rainfall in more recent months has improved and the project

continues to perform well financially.

Bio Collectors, the food waste collection and treatment plant,

has experienced a reduction in food waste tonnages as a result of

Covid-19 and while this is having a material impact on its gas

production throughput, the plant is operating well and management

is taking this opportunity of low throughput to make process

improvements to the plant. As the trend for lower levels of waste

due to the pandemic is expected to continue for some months,

management is also sourcing alternative feedstocks for the plant to

help mitigate some of the shortfall.

Acquisitions

During the period under review, the Company announced

investments into two further project vehicles, bringing the total

capacity of the renewable energy assets in the portfolio to 304.7MW

at the period end. As with the Company's other assets, they have a

proven operational history and are supported by a high proportion

of inflation--linked revenues backed by government subsidy regimes.

The investments are:

Peacehill Farm anaerobic digestion plant

On 2 April 2020, the Company announced an investment into

Peacehill Farm AD plant, located in Wormit, Fife in Scotland, for

an aggregate amount of c.GBP11 million. The investment comprises

the provision of a debt facility and subscription for a minority

equity stake in JLEAG AD Limited which holds, through its wholly

owned subsidiary Peacehill Gas Limited, the rights and operational

assets at the Peacehill Farm AD plant. The plant has a thermal

capacity of c.5MWth and predominantly produces biomethane to be

injected into the national gas grid. In addition, the plant also

has a 0.25MWe CHP engine and is accredited under the Renewable Heat

Incentive ("RHI") and Feed--in Tariff ("FiT") schemes.

Peacehill is JLEN's eighth investment into agricultural

gas--to--grid AD plants and continues to build upon the Company's

considerable presence in this part of the market.

Northern Hydropower portfolio

On 17 September 2020, the Company acquired two operational

hydropower assets for GBP4.74 million, including working capital.

The plants are located in Yorkshire and Cornwall and the

Yorkshire-based asset includes a co--located battery storage

system. The assets acquired are:

-- De Lank hydro, a 99kW hydro project located on the De Lank

River, commissioned in October 2011;

-- Knottingley hydro, a 500kW dual turbine hydro project located

on the River Aire, which was commissioned in October 2017; and

-- a 1.2MW battery co-located at Knottingley, commissioned in January 2018.

Both hydro projects are accredited under the 20-year FiT scheme.

The battery storage project at Knottingley is trading under a

dispatch agreement with Limejump Ltd. This is the Company's second

investment into hydro projects with co-located battery storage,

further increasing the diversification profile of the

portfolio.

In January 2020, JLEN announced a commitment of EUR25 million to

Foresight Energy Infrastructure Partners SCSp ("FEIP"), a

Luxembourg limited partnership investment vehicle. In addition to

the GBP1.4 million investment made in the previous reporting

period, a further investment of GBP4.8 million has been provided to

the vehicle for investment into a construction stage Swedish wind

farm - Skaftåsen Vindkraft AB - and Torozos, an operational 94MW

wind farm in Spain.

These investments are included in the analysis of JLEN's

portfolio on a look-through basis. The Board is pleased that its

investment in FEIP is delivering the objective of providing JLEN

with an effective means of diversifying into European markets

without being overly concentrated in individual assets.

Post the period end, John Laing Group plc ("JLG") informed the

Company of its intention to terminate the First Offer Agreement

("FOA"), under which the Company had a right of first offer to

acquire environmental infrastructure investments in certain

European countries that JLG wishes to sell. This right will

terminate on the 13 November 2021.

While the FOA was useful to the Company in securing pipeline in

the early years of its existence, its importance in recent years

has been negligible. The last asset acquired from JLG under the FOA

was the Llynfi Afan wind farm in December 2017, nearly three years

ago. The Company was not planning for any further acquisitions

through this route and JLG has stated publicly that it plans to

move away from renewable energy investment in future. As additional

context, the Investment Adviser role transferred from John Laing

Capital Management Ltd (a subsidiary of JLG) to Foresight Group LLP

in June 2019. I would like to thank JLG for all its support during

the early years of the Company and wish it success in the

future.

Debt facilities

JLEN benefits from a committed revolving credit facility ("RCF")

of GBP170 million which matures in June 2022. At the date of

issuing this report, GBP127.6 million is undrawn and available to

fund acquisitions. The RCF is provided by HSBC, NIBC, ING and

Santander.

Share capital

The Company has not issued new equity in the period. Investor

appetite for the renewable infrastructure sector has remained

strong and JLEN has traded at a significant premium to NAV. This

has been supported by the Company's prudent approach to valuations

and low portfolio volatility due to diversification of risks across

technologies. However, as outlined above, JLEN has significant

funding capacity for new acquisitions and the Directors are mindful

of the cash drag effect on performance from raising money from

shareholders without having an immediate use for that cash. The

Directors consider that the Company is in a strong position and

will only consider raising new equity when it is in the best

interests of shareholders as a whole.

Valuation

The Net Asset Value at 30 September 2020 is GBP525.3 million,

comprising GBP552.9 million portfolio valuation, GBP12.8 million of

cash held by the Group, together with outstanding revolving credit

debt of GBP42.4 million and a positive working capital balance of

GBP2.0 million.

The Investment Adviser has prepared a fair market valuation of

the portfolio as at 30 September 2020. This valuation is based on a

discounted cash flow analysis of the future expected equity and

loan note cash flows accruing to the Group from each portfolio

investment. This valuation uses key assumptions which are

recommended by the Investment Adviser using its experience and

judgement, having considered available comparable market

transactions and financial market data in order to arrive at a fair

market value.

To provide assurance to the Board with respect to the valuation,

an independent verification exercise of the methodology and

assumptions applied by Foresight is performed by a leading

accountancy firm and an opinion is provided to the Directors. The

Directors have satisfied themselves as to the methodology used and

the assumptions adopted and have approved the valuation of GBP552.9

million for the portfolio of 32 investments as at 30 September

2020.

In light of continued uncertainty around the impacts of Covid-19

on power prices and the recent volatility of projections, the Board

has approved the adoption of a third consultant's forecasts in its

valuations at 30 September 2020. This amendment to the blended

curve has already been adopted by a number of peer funds, and

provides a robust valuation methodology that reduces the risk of

volatility from a single consultant deviating from general

consensus. The revised blended curve is shown within the investment

portfolio and valuation section below.

Risks and uncertainties

The principal risks facing the Company are set out in the Annual

Report 2020 and these are all still considered relevant. In the

period under review and in the near term, the Investment Adviser

considers that Covid-19 is a dominant risk facing the Company with

various indirect additional risks caused by the pandemic to

consider. To date, the Company has proved to be resilient in this

challenging environment and most assets have continued to perform

well. Where assets have experienced a downturn in response to the

pandemic, the Investment Adviser has been able to overcome or

partially mitigate the difficulties through various methods, which

are expanded upon in the operational review section of this

report.

One of the consequences of the pandemic was a dramatic reduction

in the national demand for electricity during the first "lockdown"

period. This impacted the wholesale price of electricity and led to

the Company's generation assets earning less from sale of

electricity than expected. The Company is protected to some degree

from electricity price volatility by its diversified portfolio,

which features several revenue streams that are not connected to

the electricity price. The Investment Adviser has also hedged

against price risk by taking out short--term fixed price

arrangements with PPA providers. The Company has fixed price

arrangements in place for 55% of the wind and solar portfolio by

generation for the winter 2020 season and 41% of the portfolio for

the summer 2021 season.

Finally, the Board and Investment Adviser continue to monitor

the situation with Brexit negotiations and while it is not expected

that they will significantly impact the portfolio, which is 98%

based in the UK, they remain alert to possible impacts on the

supply chain for spare parts for the portfolio assets and European

off-taking arrangements relating to JLEN's waste assets.

Environmental, social and governance

JLEN's purpose is to invest in projects which support more

environmentally friendly approaches to economic activity and, by

virtue of this, has always had a good environmental profile. As the

Fund has grown in size and influence, social and governance

criteria have developed because of JLEN's focus on these areas as

an integral part of its investment process for identifying high

quality infrastructure assets and best practice in their

governance.

The Board, as advised by the Investment Adviser, considers ESG

matters to be important to promote responsible and ethical

investment and as a tool to ensure effective asset management,

reduce risks and increase the resilience of the portfolio over the

long term. In the Annual Report 2020, JLEN articulated a set of ESG

objectives and committed to developing a number of key performance

indicators ("KPIs") to inform these objectives in a way which is

meaningful and transparent. Work on these KPIs is ongoing and more

information on their development can be found in the ESG section

below.

The Covid-19 pandemic has arguably brought ESG matters to the

forefront of public awareness and JLEN's strong ESG credentials

have helped to mitigate some of the downsides caused by the

pandemic. Our Investment Adviser, Foresight, continues to recommend

and implement processes to prioritise the health, safety and

wellbeing of staff at our sites and Foresight's own staff.

Outlook

The market outlook for the Company is positive. This is despite

wider challenges brought on by the global pandemic. The

infrastructure and renewables markets remain favourable in both the

context of global and UK Government policy and financial support

for decarbonisation initiatives. This is echoed by strong activism

at a grassroots level and by funds under management targeting this

sector.

In recent months, the UK Government has demonstrated its

commitment to a low-carbon economy by announcing its support for

doubling the capacity of renewable energy in the next Contracts for

Difference auction which opens in late 2021. A commitment to

develop a new bioenergy strategy has also been announced, details

of which will follow in the Energy White Paper, expected to be

released by the end of 2020.

The Company has not experienced any Covid-related adverse impact

to its pipeline, which remains robust, as demonstrated by the two

assets acquired in the period. The Company continues to see an

advantage to shareholders in surveying the wider environmental

infrastructure market, where the Directors anticipate superior

risk-adjusted returns than core market sectors.

While renewable energy generation remains our principal interest

and focus, the Company will also consider eco-friendly

opportunities in sectors such as transport and low--carbon heat

that have the characteristics of infrastructure investments such as

inflation-linked cash flows and stable revenues, supported by

long-term contracts or regulatory support. We anticipate

continental Europe becoming a more active market for investigation

of new opportunities over the coming period.

In the same vein, the Directors expect to see an increase in

allocation to construction stage assets within the overall limit of

15% of NAV. In part this is due to the Company's existing

commitment of EUR25 million to Foresight Energy Infrastructure

Partners being progressively drawn down as that fund continues to

invest in a diversified portfolio of greenfield European renewables

projects. The Company also aims to make some direct investments in

projects that feature an element of construction risk for assets

with a short build period and a proven, standardised design. Value

enhancement activity within JLEN's current portfolio also

continues, with construction projects underway at three of the AD

projects to increase gas yield.

Board matters

Further to the AGM results announcement on 3 September 2020,

where opposition was received to the enlarged general authority for

the Board to issue shares representing an additional 10% of the

Company's issued share capital on a non-pre-emptive basis (over and

above the 10% issuance which was approved by shareholders at the

AGM), we have not been made aware of any concerns regarding the

Company or its operations from our dialogue with key investors. The

opposition we received is understood to reflect the general stance

taken by shareholder governance groups and is not directly related

to the Company.

As announced in the notice of AGM circulated on 30 June 2020,

Denise Mileham did not stand for re--election at the AGM on 3

September 2020. My fellow Directors and I are extremely grateful

for Denise's contribution to the Board, having served as a Director

since the Company's launch in 2014 and having demonstrated an

exceptional commitment to the role during her tenure. We wish

Denise the very best for the future.

As set out in the 31 March 2020 Annual Report, the Board remains

focused on taking forward its succession planning arrangements,

which will include addressing the balance of gender diversity

represented on the Board.

It only remains for me to thank my fellow Directors and our

advisers for all their efforts. We may face uncertain times but the

Company is well set up to meet the challenges ahead robustly and

successfully.

Richard Morse

Chairman

25 November 2020

FUND OBJECTIVES

The Fund's key objectives and the measures against which they

are assessed are summarised below:

Financial

---------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Objectives KPIs Principal risks (for Outlook for 2021

details see pages

28 to 36 of the 2020

Annual Report)

----------------- -------------------------------------------------------- --------------------------------------------------------- -----------------------------------------------------------

Predictable 3.38p

income dividend declared * Volume of resource * Weak outlook for UK power prices weighs on revenues

growth for for the half year

shareholders

Provide investors * 3.38 pence dividend declared for half year to 30 * Power prices * Progressive dividend policy announced at the full

with a dividend September 2020 year

of

6.76 pence per * Inflation

share * 6.76 pence dividend target(1) for year to 31 March

for the year to 2021, up 1.5% from 2020

31 * Changes in the legislative and regulatory framework

March 2021. that affect renewables and PPP projects

* Operational risks in the portfolio

----------------- -------------------------------------------------------- --------------------------------------------------------- -----------------------------------------------------------

Preservation of GBP525.3m

capital Net Asset Value * Valuation risks (volume/energy * Speed of recovery in demand for electricity showing

over the longer 96.1p prices/inflation/feedstock costs/operational encouraging signs but remains uncertain given

term Net Asset Value per performance) Covid-19

To preserve the share

capital

value of the * NAV GBP525.3 million, down 1.4% from GBP533.0 mill * Lack of future pipeline and/or funding * Assets demonstrating resilience in the face of

portfolio ion Covid-19 are likely to be attracting a premium value

over the long at 31 March 2020

term * Increased competition

on a real basis

through * Net Asset Value per share 96.1 pence, down 1.4 pen

active management ce * Changes in the legislative and regulatory framework

of the portfolio against 97.5 pence at 31 March 2020 that affect renewables and PPP projects

and the

reinvestment

of cash flows not

required for the

payment of

dividends.

----------------- -------------------------------------------------------- --------------------------------------------------------- -----------------------------------------------------------

Investment, 32

growth project investments * Lack of future pipeline and/or funding * Increased demand for renewable energy to meet global

and GBP552.9m green targets

diversification portfolio value

To invest in 304.7MW * Increased competition

environmental total diversified

infrastructure capacity

projects * Changes in the legislative and regulatory framework

in accordance * Portfolio value GBP552.9 million, up 2.9% from that affect renewables and PPP projects

with GBP537.1 million at 31 March 2020

the Company's

investment

policy with * Predominantly UK portfolio balanced by sector: 34%

established wind, 27% AD, 22% solar, 15% waste & wastewater an

technologies, d

operational 2% hydro

track records and

that have the

benefit * 32 project investments

of long--term,

predictable,

wholly or * Largest individual asset 7.9% (limit 25%)

partially

inflation--linked

cash flows * Revenue mix: 25% merchant power, 61% green benefit

supported s,

by long--term 14% PFI

contracts

or stable

regulatory

frameworks.

----------------- -------------------------------------------------------- --------------------------------------------------------- -----------------------------------------------------------

Environmental, social and governance

Promote the Develop positive Ensure effective,

efficient relationships with ethical governance * Over the next full year 2020/21 a series of KPIs will

use of resources the communities in across the portfolio be developed to help the Fund track the portfolio's

To invest into which JLEN works To manage portfolio performance against each of the three ESG objectives

projects To encourage positive assets in a way that set out here; more information is on pages 31 to 35

that manage the relationship--building promotes ethical, of the Half-year Report

availability between portfolio effective governance.

of natural assets and the communities

resources, in which they sit.

whether through

utilisation

of renewable

resources,

increasing

resource

or energy

efficiency,

or reusing or

recovering

waste.

----------------- -------------------------------------------------------- --------------------------------------------------------- -----------------------------------------------------------

(1) These are targets only and not profit forecasts. There can

be no assurance that these targets will be met.

RISKS AND RISK MANAGEMENT

JLEN has a comprehensive risk management framework.

The Company's approach to risk governance and its risk review

process are set out in the risks and risk management section of the

Annual Report 2020.

The principal risks to the achievement of the Company's

objectives are unchanged from those reported on pages 28 to 36 of

the Annual Report 2020. Developments in relation to these principal

risks, particularly those which could potentially have a short to

medium-term impact during the period to 31 March 2021, are outlined

below.

Covid-19

Since the start of the first lockdown in March 2020, the Company

has experience of how the assets have performed in light of the

challenges presented by the Covid--19 pandemic. The main short-term

risk has been the impact on power prices referred to below.

Operationally, the portfolio has proven to be resilient, as

demonstrated by the encouraging energy generation results from the

renewables portfolio. The pandemic has presented some specific

issues to individual projects such as Bio Collectors and the

Directors are of the view that these risks are understood and

assessed where possible. The longer-term macro risks associated

with Covid-19 are not yet clear but could include measures such as

higher taxes and/or higher inflation to deal with increased

government borrowing incurred to counter the pandemic.

Power prices

The Covid-19 pandemic and the associated reduction in economic

activity related to counter-measures have significantly affected

power prices due to the reduction in demand for electricity and

gas. This is a risk in the short to medium term; however, it is not

certain that prices will recover to previously forecast levels.

This risk is somewhat mitigated by the large percentage of the

portfolio which is subsidised and by power price and gas price

hedges which are in place. Beyond Covid-19, the long--term build

out of renewable energy infrastructure may change the balance

between supply and demand in energy markets which may result in low

power prices at times of high generation due, for example, to

favourable wind conditions or solar irradiation.

Political risk - Brexit

On 31 January 2020, the UK ceased to be a member of the European

Union, entering a limited transition period until 31 December 2020.

At this stage it is not clear what the precise impact on the UK

environmental infrastructure sector will be once the UK ceases to

be subject to EU regulation and to have the same degree of market

access. The UK Government remains committed to UK infrastructure

development and whilst the UK Government may not in future be bound

by EU-set renewable obligations, the UK is still bound by national

and international renewable obligations, including the commitment

to "net zero" carbon emissions by 2050. While Brexit is a

short-term to medium--term risk that must be considered, more than

98% of the portfolio by value is located in the UK, and should not

be directly affected by the transition. The Investment Adviser

continues to monitor possible disruptions to European supply

chains.

Climate risk and Task Force on Climate-related Financial

Disclosures ("TCFD") reporting

At the beginning of the year the Financial Conduct Authority

("FCA") issued a proposal that would require all premium listed

companies to align their reporting to the TCFD framework for

companies with a financial year end from December 2021. The

implementation of this proposal has been delayed due to Covid-19;

however, the Investment Adviser is working towards reporting

climate risk and considerations that will satisfy the TCFD

requirements, in accordance with the FCA's proposed timelines.

As a long-term investor, JLEN is able to manage risk with a

long-term perspective. This means it can take long-term views on

climate risk in its portfolio. With altering weather patterns

brought on by climate change, resource availability and security of

the assets is a key area of focus for the Fund. The diversification

of the technologies that the Fund invests in means that the Fund is

not wholly reliant on any one weather resource, which spreads the

climate risk across the portfolio and helps to mitigate

unpredictable weather patterns in both the short and long term.

INVESTMENT PORTFOLIO AND VALUATION

Portfolio value increased to GBP552.9 million at 30 September

2020 from GBP537.1 million at 31 March 2020.

Investment portfolio

At 30 September 2020, the Group's investment portfolio comprised

interests in 32 project vehicles:

Capacity Commercial operations

Asset Location Type Ownership (MW) date

---------------------- ---------- -------------------- --------- -------- ---------------------

Bilsthorpe UK (Eng) Wind 100% 10.2 Mar 2013

Burton Wold Extension UK (Eng) Wind 100% 14.4 Sep 2014

Carscreugh UK (Scot) Wind 100% 15.3 Jun 2014

Castle Pill UK (Wal) Wind 100% 3.2 Oct 2009

Dungavel UK (Scot) Wind 100% 26.0 Oct 2015

Ferndale UK (Wal) Wind 100% 6.4 Sep 2011

Hall Farm UK (Eng) Wind 100% 24.6 Apr 2013

Le Placis Vert France Wind 100% 4.0 Jan 2016

Llynfi Afan UK (Wal) Wind 100% 24.0 Mar 2017

Jan 2003 & Sep

Moel Moelogan UK (Wal) Wind 100% 14.3 2008

New Albion UK (Eng) Wind 100% 14.4 Jan 2016

Plouguernével France Wind 100% 4.0 May 2016

Wear Point UK (Wal) Wind 100% 8.2 Jun 2014

---------------------- ---------- -------------------- --------- -------- ---------------------

Biogas Meden UK (Eng) Anaerobic digestion 100% 5.0(1) Mar 2016

Egmere Energy UK (Eng) Anaerobic digestion 100% 5.0(2) Nov 2014

Grange Farm UK (Eng) Anaerobic digestion 100% 5.0(2) Sep 2034

Icknield Farm UK (Eng) Anaerobic digestion 53% 5.0(1) Dec 2014

Merlin Renewables UK (Eng) Anaerobic digestion 100% 5.0(2) Dec 2013

Peacehill Farm UK (Scot) Anaerobic digestion 49% 5.0(3) Dec 2015

Vulcan Renewables UK (Eng) Anaerobic digestion 100% 5.0(2) Oct 2013

Warren Energy UK (Eng) Anaerobic digestion 100% 5.0(2) Dec 2015

---------------------- ---------- -------------------- --------- -------- ---------------------

Amber UK (Eng) Solar 100% 9.8 Jul 2012

Branden UK (Eng) Solar 100% 14.7 Jun 2013

CSGH UK (Eng) Solar 100% 33.5 Mar 2014 & 2015

Monksham UK (Eng) Solar 100% 10.7 Mar 2014

Panther UK (Eng) Solar 100% 6.5 2011-2014

Pylle Southern UK (Eng) Solar 100% 5.0 Dec 2015

---------------------- ---------- -------------------- --------- -------- ---------------------

Bio Collectors UK (Eng) Waste management 70% 11.7 Dec 2013

ELWA UK (Eng) Waste management 80% n/a 2006

Tay UK (Scot) Wastewater 33% n/a Nov 2001

---------------------- ---------- -------------------- --------- -------- ---------------------

Oct 2017 & Oct

Northern Hydropower UK (Eng) Hydropower 100% 1.8(4) 2011

Oct 2015 & Nov

Yorkshire Hydropower UK (Eng) Hydropower 100% 2.0(4) 2016

---------------------- ---------- -------------------- --------- -------- ---------------------

FEIP Skaftåsen

Vindkraft AB Sweden Wind n/a n/a Under construction

FEIP Torozos Spain Wind n/a n/a Dec 2019

---------------------- ---------- -------------------- --------- -------- ---------------------

Total 304.7

------------------------------------------------------ --------- -------- ---------------------

(1) MWth (thermal) and an additional 0.4MWe CHP engine for on-site power provision.

(2) MWth (thermal) and an additional 0.5MWe CHP engine for on-site power provision.

(3) MWth (thermal) and an additional 0.25MWe CHP engine for on-site power provision.

(4) Includes a 1.2MW battery storage.

The JLEN portfolio comprises a diversified range of assets

across different geographies, sectors, technologies and revenue

types, as illustrated in the analysis below as at 30 September 2020

(by portfolio value and distributions from projects):

Portfolio value split by sector

Wind: 34%

Anaerobic digestion: 27%

Solar: 22%

Waste & wastewater: 15%

Hydro: 2%

Portfolio value split by geography

UK: 98%

Rest of Europe: 2%

Portfolio value split by remaining asset life

Up to 10 Years: 9%

11 to 20 years: 50%

More than 20 years: 41%

Weighted average remaining asset life of the portfolio is 18.9

years.

Portfolio distributions split by inflation linkage(1)

Inflation linked: 76%

Non-inflation linked: 24%

Portfolio distributions split by revenue type(1)

Merchant power: 24%

Green benefits: 62%

PFI:14%

Portfolio operator exposure (percentage of portfolio value)

Future Biogas: 22%

Siemens Gamesa: 21%

ROC Energy: 11%

Renewi: 7%

Vestas: 6%

Other: 33%

(1) Based on project revenues from volumes/generation during the

period and assumes project cash flow distributions reflect revenue

split at each project.

Portfolio valuation

The Investment Adviser is responsible for carrying out the fair

market valuation of the Company's investments, which is presented

to the Directors for their approval and adoption. The valuation is

carried out on a quarterly basis as at 30 June, 30 September, 31

December and 31 March each year.

The Directors' valuation of the portfolio at 30 September 2020

was GBP552.9 million, compared to GBP537.1 million at 31 March

2020. The increase of GBP15.8 million is the net impact of new

acquisitions, cash received from investments, changes in

macroeconomic, power price and discount rate assumptions, and

underlying growth in the portfolio. A reconciliation of the factors

contributing to the growth in the portfolio during the period is

shown in the chart on page 19 of the Half-year Report.

The movement in value of investments during the six-month period

ended 30 September 2020 is shown in the table below:

30 Sept 31 Mar

2020 2020

GBPm GBPm

---------------------------------------------------------------------------------------------------- ------- ------

Valuation of portfolio at opening balance 537.1 523.6

Acquisitions in the period/year (including post-acquisition adjustments and deferred consideration) 24.9 57.9

Cash distributions from portfolio (24.4) (45.0)

---------------------------------------------------------------------------------------------------- ------- ------

Rebased opening valuation of portfolio 537.6 536.5

Changes in forecast power prices (12.0) (56.9)

Changes in economic assumptions (1.6) (13.1)

Changes in discount rates 8.8 19.6

Changes in exchange rates 0.1 0.1

Balance of portfolio return 20.0 50.9

---------------------------------------------------------------------------------------------------- ------- ------

Valuation of portfolio 552.9 537.1

Fair value of intermediate holding companies (27.7) (4.2)

---------------------------------------------------------------------------------------------------- ------- ------

Investments at fair value through profit or loss 525.2 532.9

---------------------------------------------------------------------------------------------------- ------- ------

Allowing for investments of GBP24.9 million (including

post-acquisition adjustments and deferred consideration) and cash

receipts from investments of GBP24.4 million, the rebased valuation

is GBP537.6 million. The portfolio valuation at 30 September 2020

is GBP552.9 million (31 March 2020: GBP537.1 million), representing

an increase over the rebased valuation of 2.8% during the

period.

Valuation assumptions

The investments in JLEN's portfolio are valued by discounting

the future cash flows forecast by the underlying assets' financial

models.

Each movement between the rebased valuation and the 30 September

2020 valuation is considered below:

Forecast power prices

The project cash flows used in the portfolio valuation at 30

September 2020 reflect contractual fixed price arrangements under

PPAs, where they exist, and short--term market forward prices for

the next two years where they do not. The Company maintains a

programme of rolling price fixes for its wind and solar projects,

typically having the majority of projects on fixed price

arrangements for the next six to 12 months in order to reduce the

revenue risk from price volatility.

Where generating projects in the portfolio do not have a fixed

price under their PPAs, JLEN has reflected the prices in the table

below (gross of PPA discounts):

Avg. GBP/MWh Summer Winter

------------- ------- -------

Electricity 44 (34) 51 (43)

Gas 12 (9) 14 (13)

------------- ------- -------

At 30 September 2020, 75% of the renewable energy portfolio's

electricity price exposure was subject to a fixed price or a floor

arrangement for the winter 2020/21 season and 78% for the summer

season 2021.

After the initial two-year period, the project cash flows assume

future electricity and gas prices in line with a blended curve

informed by the central forecasts from three established market

consultants, adjusted by the Investment Adviser for

project-specific arrangements and price cannibalisation as

required. The Company believes the addition of a third market

consultant's curve into the blended curve provides a more robust

forecast that reduces volatility arising from short--term changes

in any individual consultant's projections.

JLEN has recognised a decrease in lifetime electricity price

expectations across the portfolio. Compared to the assumptions used

in the valuation at 31 March 2020, on a time-weighted average

basis, the net decrease in the electricity price assumptions is

approximately 3.5% over the period to 2050 (being an average

increase of 9% over the next three years offset by a 6% reduction

per annum thereafter).

The overall change in forecasts for future electricity and gas

prices compared to forecasts at 31 March 2020 has decreased the

valuation of the portfolio by GBP12.0 million.

The graph at the top of the page 21 of the Half-year Report

represents the blended weighted power curve used by the Company,

reflecting the forecast of three leading market consultants,

adjusted by the Investment Adviser to reflect its judgement of

capture discounts and a normalised view across the portfolio of

expectations of future price cannibalisation resulting from

increased penetration of low marginal cost, intermittent generators

on the GB network.

Revenue analysis

The graph at the bottom of the page 21 of the Half-year Report

shows the way in which the revenue mix of the renewables portfolio

changes over time, given the assumptions made regarding future

power prices set out above. As one would expect, merchant power

revenues increase in later years as the subsidies that projects

currently enjoy expire.

On a net present value basis (using the discount rate applicable

to each project), the relative significance of each revenue

category (including PFI) is as follows:

Contribution

to

portfolio

Revenue type value

--------------------------------- ------------

PPA/FiT with floor arrangement 20%

ROC buyout 18%

ROC recycle 1%

Ancillary revenues 1%

PPA market revenue (electricity) 23%

PPA market revenue (gas) 5%

PFI 10%

Short-term fixed price under PPA <1%

RHI 22%

--------------------------------- ------------

According to this analysis, the proportion of Fund revenues that

come from the sale of wholesale electricity and gas is 23% and 5%

respectively. This is a low proportion of merchant power revenue

relative to peers and reflects the broader diversification of

JLEN's portfolio.

Economic assumptions

Macroeconomic assumptions in respect of inflation, corporation

tax and deposit interest rates have remained relatively stable

during the period. RPI inflation rates assumed in the valuation at

30 September 2020 are 2.17% in 2020 (31 March 2020: 2.17%) stepping

to 2.75% from 2025 onwards (31 March 2020: 2.75%), whilst CPI is

assumed at a long-term rate of 2% for UK assets, and 1.5% for 2020

and all subsequent years (31 March 2020: 1.5%) for the French

assets.

The long--term UK corporation tax rate assumed is 19% (31 March

2020: 19%). The equivalent rate for the French assets is 28% (31

March 2020: 28%) stepping down to 26.5% in 2021 and 25% from 2022

(31 March 2020: step down to 26.5% in 2021 and 25% in 2022).

UK deposit rates assumed in the valuation are 0.5% to 2023 and

1.5% thereafter (31 March 2020: 1.75% in 2020 with a gradual

increase to a long--term rate of 2.5%). French deposit rates are

assumed at 0.5% (31 March 2020: 0.5%).

The euro/sterling exchange rate used to value the

euro--denominated investments in France was EUR1.10/GBP1 at 30

September 2020 (EUR1.12/GBP1 at 31 March 2020).

The overall reduction in value resulting from changes to

economic assumptions in the period is GBP1.6 million.

Discount rates

The discount rates used in the valuation exercise represent the

Investment Adviser's and the Board's assessment of the rate of

return in the market for assets with similar characteristics and

risk profile. The discount rates are reviewed on a regular basis

and updated to reflect changes in the market and in the project

risk characteristics.

During the period since 31 March 2020, there has continued to be

strong demand for income--producing infrastructure assets. The

Investment Adviser, based on its experience of bidding in the

secondary market, has proposed a reduction in the discount rate

used for valuing UK solar and wind assets. This reduction reflects

market discount rate observations and the reduction in risk driven

by lower forecast merchant power prices described above.

The discount rate used for asset cash flows which have received

lease extensions beyond the initial investment period of 25 years

retains a premium of 1% for subsequent years, reflecting the

merchant risk of the expected cash flows beyond the initial 25-year

period.

The overall increase in value resulting from changes to discount

rates in the period is GBP8.8 million.

Taking the above into account and reflecting the change in mix

of the portfolio during the year, the overall weighted average

discount rate ("WADR") of the portfolio was 7.3% at 30 September

2020 (31 March 2020: 7.4%).

Balance of portfolio return

This represents the balance of valuation movements in the year

excluding the factors noted above. The balance of the portfolio

return mostly reflects the impact on the rebased portfolio value,

all other measures remaining constant, of the effect of the

discount rate unwinding and also some additional valuation

adjustments from updates to individual project revenue assumptions.

The total represents an uplift of GBP20.0 million.

Valuation sensitivities

The Net Asset Value of the Company is the sum of the discounted

value of the future cash flows of the underlying asset financial

models, the cash balances of the Company and UK HoldCo, and the

other assets and liabilities of the Group less Group debt.

The portfolio valuation is the largest component of the Net

Asset Value and the key sensitivities are considered to be the

discount rate applied in the valuation of future cash flows and the

principal assumptions used in respect of future revenues and

costs.

A broad range of assumptions is used in our valuation models.

These assumptions are based on long--term forecasts and are not

affected by short--term fluctuations in inputs, whether economic or

technical. The Investment Adviser exercises its judgement in

assessing both the expected future cash flows from each investment

based on the project's life and the financial models produced by

each project company and the appropriate discount rate to

apply.

The key assumptions are as follows:

Discount rate

The WADR of the portfolio at 30 September 2020 was 7.3% (31

March 2020: 7.4%). A variance of plus or minus 0.5% is considered

to be a reasonable range of alternative assumptions for discount

rates.

Volumes

Base case forecasts for intermittent renewable energy projects

assume a "P50" level of electricity output based on reports by

technical consultants. The P50 output is the estimated annual

amount of electricity generation (in MWh) that has a 50%

probability of being exceeded - both in any single year and over

the long term - and a 50% probability of being underachieved. Hence

the P50 is the expected level of generation over the long term.

The P90 (90% probability of exceedance over a 10--year period)

and P10 (10% probability of exceedance over a 10--year period)

sensitivities reflect the future variability of wind and solar

irradiation and the uncertainty associated with the long--term data

source being representative of the long--term mean.

Separate P10 and P90 sensitivities are determined for each asset

and historically the results presented on the basis they are

applied in full to all wind and solar assets. This implies

individual project uncertainties are completely dependent on one

another; however, a Portfolio Uncertainty Benefit analysis

performed by a third-party technical adviser identified a positive

portfolio effect from investing in a diversified asset base. That

is to say that the lack of correlation between wind and solar

variability means P10 and P90 sensitivity results should be

considered independent. Therefore, whilst the overall P90

sensitivity decreases NAV by 6.6 pence, the impact from solar and

wind separately is only 1.4 pence and 5.2 pence respectively, as

shown in the chart on page 25 of the Half-year Report.

Agricultural anaerobic digestion facilities do not suffer from

similar deviations as their feedstock input volumes (and

consequently biogas production) are controlled by the site

operator.

For the waste & wastewater processing projects, forecasts

are based on projections of future flows and are informed by both

the client authorities' own business plans and forecasts and

independent studies where appropriate. Revenues in the PPP projects

are generally not very sensitive to changes in volumes due to the

nature of their payment mechanisms.

Electricity and gas prices

Electricity and gas price assumptions are based on the

following: for the first two years, cash flows for each project use

forward electricity and gas prices based on market rates unless a

contractual fixed price exists, in which case the model reflects

the fixed price followed by the forward price for the remainder of

the two--year period. For the remainder of the project life, a

long--term blend of central case forecasts from three established

market consultants and other relevant information is used, and

adjusted by the Investment Adviser for project-specific

arrangements and price cannibalisation. The sensitivity assumes a

10% increase or decrease in power prices relative to the base case

for each year of the asset life after the first two--year period.

While power markets can experience movements in excess of +/-10% on

a short-term basis, the sensitivity is intended to provide insight

into the effect on the NAV of persistently higher or lower power

prices over the whole life of the portfolio. The Directors feel

that +/-10% remains a realistic range of outcomes over this very

long time horizon, notwithstanding that shocks will occur from time

to time.

Feedstock prices

Feedstock accounts for over half of the operating costs of

running an AD plant. As feedstocks used for AD are predominantly

crops grown within existing farming rotation, they are exposed to

the same growing risks as any agricultural product. The sensitivity

assumes a 10% increase or decrease in feedstock prices relative to

the base case for each year of the asset life.

Inflation

Each project in the portfolio receives a revenue stream which is

either fully or partially inflation--linked. The inflation

assumptions are described in the macroeconomic section above. The

sensitivity assumes a 0.5% increase or decrease in inflation

relative to the base case for each year of the asset life.

Euro/sterling exchange rates

As the proportion of the portfolio assets with cash flows

denominated in euros represented approximately less than 2% of the

portfolio value at 30 September 2020, the Directors consider the

sensitivity to changes in euro/sterling exchange rates to be

insignificant.

Corporation tax

The UK corporation tax assumptions applied in the portfolio

valuation are outlined in the notes to the condensed unaudited

financial statements. The sensitivity below assumes a 2% increase

or decrease in the rate of UK corporation tax relative to the base

case for each year of the asset life.

Sensitivities - impact on NAV at 30 September 2020

The chart on page 25 of the Half-year Report shows the impact of

the key sensitivities on Net Asset Value per share, with the GBP

labels indicating the impact of the sensitivities on portfolio

value

OPERATIONAL REVIEW

The renewables portfolio has operated well, with the wind,

solar, hydro and AD portfolios all exceeding their generation

targets.

Total generation for the period from the portfolio (excluding

the Bio Collectors food waste plant) was 463GWh, 2.5% above budget.

The three main constituents of the portfolio - wind, solar and AD -

all delivered generation ahead of budget. The dividend remains well

covered despite lower power prices than a year ago.

Investment performance

The change in total NAV reflects the updates for recent

operational performance, changes in assumptions for future

electricity and gas prices and value enhancements. The Directors

have also considered the discount rates seen in the secondary

markets for environmental infrastructure assets in arriving at the

forecasts used in the valuation.

The NAV per share at 30 September 2020 was 96.1 pence, down from

97.5 pence at 31 March 2020, mainly due to a reduction of