TIDMJUST

RNS Number : 6139L

Just Group PLC

14 January 2021

NEWS RELEASE www.justgroupplc.co.uk

14 January 2021

JUST GROUP plc

BUSINESS UPDATE FOR THE YEAR ENDED 31 DECEMBER 2020

Just Group plc ("Just", the "Group") announces a business update

for the year ended 31 December 2020.

Highlights

-- Retirement Income sales for 2020 up 12% to GBP2.1bn. Defined Benefit

De-risking ("DB") sales were up 22% during the year to GBP1.5bn

-- Further reducing our exposure to UK property risk by completing the

sale of a book of GBP540m of lifetime mortgages ("LTMs"). Separately,

we have transacted a third no-negative equity guarantee ("NNEG") hedge,

covering GBP280m of LTMs

Retirement Income sales for 2020 up 12% to GBP2.15bn

12 months to 12 months to

Just Group new business(2) 31/12/20 31/12/19 Change

GBPm GBPm %

Defined Benefit De-risking 1,508 1,231 22

Guaranteed Income for Life

(incl. Care)(3) 637 687 (7)

Retirement Income sales 2,145 1,918 12

The growth of 12% in Retirement Income sales for the year was

due to a 22% increase in DB premiums.

The defined benefit market remains buoyant - this has been the

second highest year for market transaction volumes and the industry

pipeline is very strong. During the year we have written 23

transactions. DB De-risking sales in the second half of the year

were over GBP1bn, a record six months for the Group.

The market for guaranteed income for life solutions has

continued to recover following the COVID-19 related sales

disruption in the first half of the year. Sales in the second half

were similar to the second half of 2019.

The percentage solvency capital strain on new business has

reduced further in the second half.

Increasing Just's balance sheet resilience by reducing property

risk

We continue to implement management actions to reduce the

exposure and sensitivity of our balance sheet to the UK property

market. In December we completed two transactions:

-- the sale of GBP540m of lifetime mortgage balances(1) ; and

-- completion of our third NNEG hedge covering GBP280m of lifetime mortgages.

Combined, these two transactions are solvency capital ratio

neutral, but more importantly they reduce the sensitivity of the

Group's solvency ratio to any potential future fall in UK property

prices.

We have sold the beneficial interest in GBP540m of LTMs, which

is approximately 8% of our mortgage portfolio at year-end. Just

will continue to provide LTM customer servicing activities on

behalf of the purchaser. The sale proceeds were immediately

reinvested in corporate bonds, with the reduced yield resulting in

a one-off reduction in IFRS net equity of GBP90m. However, over

time a proportion will be allocated to new illiquid assets reducing

this initial impact.

We are pleased to have completed our third NNEG hedge, which

provides protection for a further c.GBP280m of LTM mortgages and

increases the total amount of mortgages covered by the hedges to

GBP1.3bn, 20% of the LTM portfolio at year-end. We expect to

complete further NNEG hedges during 2021.

These transactions add to the multiple management actions

executed in 2019 and 2020, which have significantly strengthened

the Group's solvency position, and are reducing our property risk

exposure following changes in the regulatory environment in 2018.

We continue to actively evaluate further opportunities to reduce

property risk on the balance sheet.

Further UK COVID-19 related restrictions

Following the announcement of the third set of government

restrictions, we continue to be committed to supporting our

colleagues, customers and distributors. We expect our wholesale and

retail markets to continue to function as normal during the current

restrictions, as they did during November 2020. We continue to

monitor and assess the potential impacts of COVID-19 restrictions

and Brexit on the UK economy, including future house prices, as we

look to finalise our year-end assumptions.

Solvency II capital ratio(4) improvement

The Solvency II capital ratio was 145% at 30 June 2020. The net

proceeds of GBP177m from the issue of debt in October has improved

the ratio by 9 percentage points. Economic sensitivities in the

second half are expected to be broadly neutral - with a small

benefit from property growth above long-term assumptions,

offsetting the cost of further credit migration and no major impact

from interest rates.

David Richardson, Group Chief Executive, said:

"I am pleased that we continued to deliver on our commitments to

shareholders during 2020 to improve the Group's capital position.

We have also taken steps to improve balance sheet resilience and

reduce our exposure to UK property prices through the sale of a LTM

portfolio and the execution of our third NNEG hedge.

I am also delighted with the new business performance, where the

strong pipeline we indicated at the time of our interim results in

August has converted well, resulting in Retirement Income sales 12%

ahead of 2019. This will have a positive impact on new business and

operating profit. We have maintained strong pricing discipline

throughout, which is reflected in further reductions in our capital

strain percentage on new business. This performance is particularly

pleasing against the challenging and uncertain backdrop of COVID-19

that we faced during 2020.

As we head into 2021, supporting the welfare of our colleagues,

providing outstanding service to our customers and distribution

partners, and further improving the resilience of our capital

position remain our top priorities. We have a strong pipeline of

new business and we start the year with increased confidence.

We look forward to presenting our full year results on 11 March

2021."

FINANCIAL CALENDAR DATE

Results for the year ended 31 December 11 March 2021(5)

2020

=================

Note 1: Amount outstanding, including rolled up interest

Note 2: Numbers in table subject to rounding.

Note 3: Care Plan sales are now reported within GIfL. 2019

comparators have been adjusted.

Note 4: Solvency II capital coverage ratio is estimated

Note 5: Assuming no significant disruption from the current

lockdown

Note 6: All the figures are unaudited

Enquiries

Investors / Analysts Media

Alistair Smith, Investor Relations Stephen Lowe, Group Communications

Telephone: +44 (0) 1737 232 792 Director

alistair.smith@wearejust.co.uk Telephone: +44 (0) 1737 827 301

press.office@wearejust.co.uk

Paul Kelly, Investor Relations

Telephone: +44 (0) 20 7444 8127 Temple Bar Advisory

paul.kelly@wearejust.co.uk Alex Child-Villiers

William Barker

Telephone: +44 (0) 20 7183 1190

A copy of this announcement will be available on the Group's

website www.justgroupplc.co.uk

JUST GROUP PLC

GROUP COMMUNICATIONS

Enterprise House

Bancroft Road

Reigate

Surrey RH2 7RP

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

UPDUOUBRABUAAAR

(END) Dow Jones Newswires

January 14, 2021 02:00 ET (07:00 GMT)

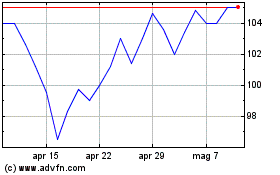

Grafico Azioni Just (LSE:JUST)

Storico

Da Mar 2024 a Apr 2024

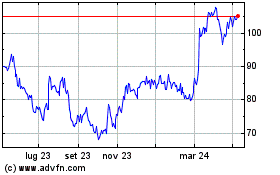

Grafico Azioni Just (LSE:JUST)

Storico

Da Apr 2023 a Apr 2024