Kerry Group PLC Kerry - EUR750m Sustainability-Linked Notes (5115T)

24 Novembre 2021 - 6:41PM

UK Regulatory

TIDMKYGA

RNS Number : 5115T

Kerry Group PLC

24 November 2021

24 November 2021

LEI: 635400TLVVBNXLFHWC59

KERRY GROUP

Kerry announces EUR750 million Sustainability-Linked Notes due

2031

Kerry Group plc, the global taste & nutrition company, today

announces that it has successfully priced the issue of EUR750

million 0.875% Sustainability-Linked Notes due 2031 issued through

its subsidiary Kerry Group Financial Services Unlimited Company and

which are guaranteed by Kerry Group plc (the "Notes").

The proceeds from the issuance of the Notes will be used for

general corporate purposes, including the repayment of indebtedness

and the funding of acquisitions in the ordinary course of

business.

The Notes are expected to be assigned ratings of BBB+ by S&P

and Baa2 by Moody's, respectively. The Notes will be admitted to

the Official List of Euronext Dublin and admitted to trading on the

Global Exchange Market.

This announcement is for information purposes only and does not

constitute a prospectus or offering memorandum or an offer to

acquire any securities and is not intended to provide the basis for

any credit or any other third party evaluation of the Notes or the

transaction (the "Transaction") and should not be considered as a

recommendation that any investor should subscribe for or purchase

any of the Notes. Neither this announcement nor any other

documentation or information (or any part thereof) delivered or

supplied under or in relation to the Transaction or the Notes shall

be deemed to constitute an offer of or an invitation to purchase or

subscribe for the Notes. This announcement does not constitute an

offer to sell, exchange or transfer any Notes and is not soliciting

an offer to purchase, exchange or transfer any Notes in any

jurisdiction where such offer, sale, exchange or transfer is not

permitted or is unlawful.

Any investment decision made in connection with the Notes issue

must be based solely on the information contained in the final

Offering Circular relating to the Notes published by Kerry Group

Financial Services Unlimited Company.

Disclaimer: Intended Addressees

Relevant stabilisation regulations including FCA/ICMA apply. The

manufacturer target market (MiFID II and MiFIR Product Governance)

is eligible counterparties and professional clients only (all

distribution channels). No EU PRIIPs or UK PRIIPs key information

document (KID) has been prepared as the Notes are not available to

retail investors in EEA or in the UK.

This announcement does not constitute an offering of securities

for sale in any jurisdiction and is not for distribution in or into

the United States.

The Notes have not been and will not be registered under the

United States Securities Act of 1933, as amended (the "Securities

Act"), or any relevant securities laws of any state of the United

States and, subject to certain exceptions, the Notes may not be

offered, sold or delivered in the United States or to, or for the

account or benefit of, U.S. persons, as such terms are defined in

Regulation S under the Securities Act. No public offering of the

Notes is being or will be made in the United States of America or

any other jurisdiction.

In member states of the EEA, this announcement is directed only

at persons who are "qualified investors" within the meaning of

Regulation (EU) 2017/1129.

In the UK, this announcement is directed only at persons who are

"qualified investors" within the meaning of Regulation (EU)

2017/1129 as it forms part of domestic law of the UK by virtue of

the European Union (Withdrawal) Act 2018.

This communication is being distributed to, and is directed only

at, persons in the United Kingdom in circumstances where section

21(1) of the Financial Services and Markets Act 2000 does not

apply.

A rating is not a recommendation to buy, sell or hold securities

and may be subject to revision, suspension or withdrawal at any

time by the assigning rating organisation.

CONTACT INFORMATION

=============================================

Investor Relations

Marguerite Larkin , Chief Financial

Officer

+353 66 7182292 | investorrelations@kerry.ie

William Lynch , Head of Investor

Relations

+353 66 7182292 | investorrelations@kerry.ie

Media

Catherine Keogh , Chief Corporate

Affairs & Brand Officer

+353 45 930188 | media@kerry.com

Website

www.kerrygroup.com

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IODPPGQGGUPGGMC

(END) Dow Jones Newswires

November 24, 2021 12:41 ET (17:41 GMT)

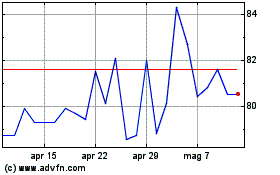

Grafico Azioni Kerry (LSE:KYGA)

Storico

Da Mar 2024 a Apr 2024

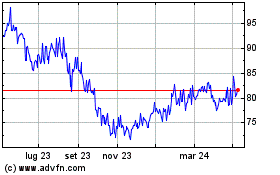

Grafico Azioni Kerry (LSE:KYGA)

Storico

Da Apr 2023 a Apr 2024