TIDMKGF

RNS Number : 3150L

Kingfisher PLC

11 January 2021

Kingfisher plc

Q4 pre-close trading update

11 January 2021: Kingfisher plc ('Company', 'Group' or

'Kingfisher') is today providing an update on Q4 trading to

date.

Q4 trading to 9 January

As announced on 19 November 2020, Kingfisher's Q3 20/21 Group

LFL (1) sales were up 17.4%, while Q4 20/21 Group LFL sales (to 14

November) (2) were up 12.6%.

Since then, Kingfisher has continued to experience strong demand

across its markets with Q4 20/21 Group LFL sales (to 9 January

2021) (3) up 16.9%. Financial year to date (1 February 2020 to 9

January 2021), Group LFL sales are up 6.5%.

Based on trading to date, the Group is comfortable with the top

end of the range of current sell-side analyst estimates(4) for FY

20/21 adjusted profit before tax.

Operational status

While our c.1,380 stores remain open for in-store purchasing and

click & collect, under strict social distancing and safety

protocols, recent restrictions imposed within the United Kingdom

and Republic of Ireland mean that some discrete areas of certain

B&Q stores have been temporarily closed. For further detail on

this and the current lockdown restrictions in each of our markets,

as of 11 January 2021, please refer to the 'Supplementary

information' section below.

LFL sales by month in Q4 (to date)

Monthly sales % LFL(1) Change

--------------------

Nov 2020 Dec 2020

--------------------- --------- ---------

UK & Ireland +24.0% +20.8%

France (0.1)% +29.4%

Other International +1.3% +11.6%

- Poland +0.2% +9.7%

- Iberia(5) (6.3)% +20.6%

- Romania(6) +17.4% +12.5%

Group LFL(7) +11.4% +22.1%

--------------------- --------- ---------

E-commerce sales(8) +155.4% +154.3%

Overall, Q4 20/21 Group LFL sales (to 9 January 2021) are up

16.9%, supported by e-commerce sales growth of over 150%.

The slower growth in November, relative to Q3 and December,

largely reflects the impact in France of a negative calendar effect

year on year (c.-5% impact on LFL sales), the closure of certain

ranges within stores during the November lockdown, and the less

favourable trend for trade-oriented business versus general home

improvement, due to the stringent restrictions in France.

Sales growth in December accelerated, helped by significantly

stronger growth in France (in both Castorama France and Brico

Dépôt) post the November lockdown. The UK & Ireland continued

to perform strongly in December, with growth at Screwfix

accelerating from November. Screwfix is on track to reach GBP2

billion of total sales in FY 20/21.

LFL sales by week in Q4 (to date)

Sales: 4 weeks to % LFL(1) Change

----------------------------------------------

28 November 2020 week 1(9) week 2(9) week 3(9) week 4(9)

--------------------- ---------- ---------- ---------- ----------

UK & Ireland +31.6% +17.3% +24.0% +30.3%

France (5.6)% +8.2% +10.6% +3.9%

Other International +2.8% +5.8% +2.4% (4.5)%

- Poland +1.6% +7.6% +4.3% (7.4)%

- Iberia (2.5)% (8.5)% (9.4)% +3.2%

- Romania +19.1% +16.6% +7.4% +5.4%

Group LFL(7) +13.1% +12.0% +15.5% +14.7%

--------------------- ---------- ---------- ---------- ----------

E-commerce sales(8) +144.2% +155.9% +163.7% +165.4%

Sales: 6 weeks % LFL(1) Change

to

-----------------------------------------------------------

9 January 2021 week week week week week week

5(9) 6(9) 7(9) 8(9) 9(9) 10(9)

----------------- -------- -------- -------- -------- -------- ---------

UK & Ireland +17.9% +20.2% +23.0% +23.6% +23.2% +14.4%

France +28.2% +26.7% +26.7% +13.1% +26.8% +15.9%

Other

International +7.1% +13.9% +8.5% +5.7% +4.9% +22.7%

- Poland +3.1% +15.5% +6.7% +4.7% +1.0% +26.0%

- Iberia +18.1% +15.1% +18.7% +5.5% +23.6% +11.3%

- Romania +18.9% +1.1% +8.9% +13.5% +7.5% +19.9%

-------- -------- -------- --------

Group LFL(7) +19.5% +21.2% +21.1% +15.6% +21.3% +16.2%

----------------- -------- -------- -------- -------- -------- ---------

E-commerce

sales(8) +135.7% +150.9% +152.1% +215.6% +155.8% +149.9%

Thierry Garnier, Chief Executive Officer, said:

"The safety of our customers and teams remains our first

priority while we fulfil the essential needs of our customers. We

will continue to support our colleagues during these most difficult

times, and I want to express my sincere appreciation for all our

teams as they continue to operate in such a challenging

environment.

" While the strength of our Q4 trading, to date, is reassuring,

uncertainty over COVID-19 and the impact of lockdown restrictions

in most of our markets continue to limit our visibility. Longer

term, we are confident that the strategic and operational actions

we are taking are building a strong foundation for sustainable

long-term growth. We also believe that the renewed focus on homes

is supportive for our markets.

"We look forward to providing a more detailed update within our

FY 20/21 results on 22 March 2021. In the meantime, I wish you all

a happy and safe New Year."

Supplementary information

FY 2020/21 Technical guidance

Significant updates to our previous guidance are noted below in

italics.

Income statement:

-- Sales outlook

- Uncertainty over COVID-19 and the impact of lockdown restrictions

-- Costs

- Anticipate that FY 20/21 adjusted profit before tax will

include c.GBP85m of non-recurring cost savings, net of any one-off

COVID-related costs

- COVID-related costs(10) - expected to be c.GBP45m, which

includes one-off and recurring elements

- Central costs - expected to be c.GBP58m (FY 19/20: GBP62m)

- UK and Republic of Ireland business rates - as previously

announced, Kingfisher will forego all business rates relief for the

20/21 tax year. c.GBP130m of Kingfisher's annual business rates

bill was eligible for this relief, of which c.GBP110m would have

fallen in FY 20/21

- Furlough - no claims under furlough programmes in the UK

(including the Job Retention Bonus) and France since 1 July; repaid

UK furlough benefit received in H1 20/21 (c.GBP23m) in November

2020

-- Net finance costs

- Expected to be in line with prior year (FY 19/20: GBP173m,

before exceptional items) due to incremental financing costs for

PGE, CCFF and RCFs, offset by impact of reduced lease liability

-- Adjusted profit before tax

- Comfortable with the top end of the range of current sell-side analyst estimates(4)

-- Tax rate

- Group adjusted effective tax rate expected to be c.23%(11) (FY 19/20: 26%)

-- Exceptional items

- Expect to record c.GBP15-20m of restructuring costs in H2

20/21 in relation to the Group's new commercial operating model (as

announced in September 2020)

Cash flow:

-- PGE - in December 2020, the Group repaid its French Term

facility in full, including c.GBP549m of capital and c.GBP3m of

interest

-- Capital expenditure - gross capex of c.GBP280m (FY 19/20:

GBP342m); c.GBP70m of further expenditure deferred into FY

21/22

-- Tax - incremental one-off cash impact this year of c.GBP50m

from HMRC accelerated UK corporation tax payments

Previously announced 11 store closures in France:

-- All 11 stores now closed:

- 3 stores closed in France (1 Castorama, 2 Brico Dépôt) in H2 19/20

- 4 Castorama stores closed in H1 20/21

- 4 further Castorama stores closed in H2 20/21 to date, of

which 2 are to be converted to Brico Dépôt stores (opening in FY

21/22)

-- All cash costs of closures in FY 20/21 fully provided for in previous periods

Operational status by market

All our c.1,380 stores remain open for in-store purchasing and

click & collect, under strict social distancing and safety

protocols. The current lockdown restrictions and operational status

in each of our markets, as of 11 January 2021, is noted below.

Country Lockdown restrictions Essential retail Kingfisher commentary

status

England National lockdown Building merchants All B&Q and Screwfix

restrictions in place and suppliers of stores open. B&Q showrooms

from 5 January, including products and tools closed in line with

non-essential retail used in building government requirements.

closures work and repairs, Virtual design appointments

and garden centres, available

classified as essential

---------------------------- ------------------------- ---------------------------------

Scotland National lockdown Building merchants All B&Q and Screwfix

restrictions in place and suppliers of stores open. B&Q showrooms

from 5 January until products and tools closed in line with

at least 31 January used in building government requirements.

work and repairs Virtual design appointments

classified as essential available

---------------------------- ------------------------- ---------------------------------

Wales National 'Tier 4' Hardware retail All B&Q and Screwfix

restrictions in place essential stores open. B&Q showrooms,

from 20 December; garden centres, and

to be reviewed every discrete areas of non-essential

three weeks products closed in

line with government

requirements. Virtual

showroom design appointments

available

---------------------------- ------------------------- ---------------------------------

Northern National lockdown Hardware retail All B&Q and Screwfix

Ireland from 26 December for essential stores open

six weeks; to be reviewed

after four weeks

---------------------------- ------------------------- ---------------------------------

Republic 'Level 5' restrictions Hardware retail All B&Q and Screwfix

of Ireland from 24 December with essential. No 'January stores open. B&Q garden

non-essential retail sales' permitted centres closed in line

closures from 31 December; for essential retail with government requirements

to be reviewed on

12 January

---------------------------- ------------------------- ---------------------------------

France National lockdown Hardware retail All Castorama and Brico

ended on 15 December; essential during Dépôt stores

curfew from 8pm-6am previous lockdown open

(6pm-6am in certain

regions)

---------------------------- ------------------------- ---------------------------------

Poland National restrictions Hardware retail All Castorama stores

in place until 17 essential open. Limit on the

January. Closure of number of people allowed

non-essential retail in stores

from 28 December

---------------------------- ------------------------- ---------------------------------

Romania Some national restrictions Hardware retail All Brico Dépôt

in place 'tolerated' stores open

---------------------------- ------------------------- ---------------------------------

Spain National state of Hardware retail All stores open, with

emergency declared essential in Asturias, restrictions in certain

25 October. 17 regions Aragón and areas (such as reduced

have power to impose Andalusia, but not opening hours, space

additional, varied in other regions open to the customer,

restrictions and limits on the people

allowed in stores)

---------------------------- ------------------------- ---------------------------------

Portugal National state of Hardware retail All stores open, with

emergency in place essential. No national restrictions in certain

store closures areas (such as reduced

opening hours and limits

on the number of people

allowed in stores)

---------------------------- ------------------------- ---------------------------------

Footnotes

(1) LFL (like-for-like) sales growth represents the constant

currency, year on year sales growth for stores that have been open

for more than one year.

(2) 'Q4 20/21 Group LFL sales (to 14 November)' represent the

period from 1 November 2020 to 14 November 2020 (compared against

the equivalent period in the prior year, from 3 November 2019 to 16

November 2019). The figures are provisional and exclude certain

non-cash accounting adjustments relating to revenue

recognition.

(3) 'Q4 20/21 Group LFL sales (to 9 January 2021)' represent the

period from 1 November 2020 to 9 January 2021 (compared against the

equivalent period in the prior year, from 3 November 2019 to 11

January 2020). The figures are provisional and exclude certain

non-cash accounting adjustments relating to revenue

recognition.

(4) According to Company-compiled consensus estimates as of 4

January 2021, the current range of sell-side analyst expectations

for FY 20/21 adjusted profit before tax is GBP667m to GBP742m.

(5) Brico Dépôt Spain and Portugal.

(6) Kingfisher's subsidiary in Romania prepares its financial

statements to 31 December. Its monthly results presented are for

October and November, i.e. one month in arrears. The weekly results

presented have no corresponding delay.

(7) Group LFL includes total e-commerce sales and excludes Koçta

(Kingfisher's 50% JV in Turkey).

(8) E-commerce sales are total sales derived from online

transactions, including click & collect. This includes sales

transacted on any device, however not sales through a call centre.

E-commerce sales change covers the total Group.

(9) Weekly sales figures are for the Sunday-to-Saturday weeks

from 1 November 2020 (compared against prior year

Sunday-to-Saturday weeks from 3 November 2019). The figures are

provisional and exclude certain non-cash accounting adjustments

relating to revenue recognition.

(10) Includes costs of PPE and social distancing, donations, new

store layouts, additional store security, and bonuses to frontline

store staff.

(11) Subject to the blend of profit within the Group's various

jurisdictions.

Information contained within this announcement is deemed to

constitute inside information as stipulated under the Market Abuse

Regulations No. 596/2014. Upon the publication of this

announcement, this inside information is now considered to be in

the public domain. This announcement is being released on behalf of

Kingfisher by Paul Moore, Company Secretary.

Contacts

Tel: Email:

Investor Relations +44 (0) 20 7644 investorenquiries@kingfisher.com

1082

Media Relations +44 (0) 20 7644 corpcomms@kingfisher.com

1030

Teneo +44 (0) 20 7420 Kfteam@teneo.com

3184

About Kingfisher plc

Kingfisher plc is an international home improvement company with

approximately 1,380 stores, supported by a team of 79,000

colleagues. We operate in eight countries across Europe under

retail banners including B&Q, Castorama, Brico Dépôt, Screwfix,

TradePoint and Koçta . We offer home improvement products and

services to consumers and trade professionals who shop in our

stores and via our e-commerce channels. At Kingfisher, our purpose

is to help make better homes accessible for everyone.

Forward-looking statements

You are not to construe the content of this announcement as

investment, legal or tax advice and you should make your own

evaluation of the Company and the market. If you are in any doubt

about the contents of this announcement or the action you should

take, you should consult a person authorised under the Financial

Services and Markets Act 2000 (as amended) (or if you are a person

outside the UK, otherwise duly qualified in your jurisdiction).

The financial information referenced in this announcement is not

audited and does not contain sufficient detail to allow a full

understanding of the results of the Group. Nothing in this

announcement should be construed as either an offer or invitation

to sell or any offering of securities or any invitation or

inducement to any person to underwrite, subscribe for or otherwise

acquire securities in any company within the Group or an invitation

or inducement to engage in investment activity under section 21 of

the Financial Services and Markets Act 2000 (as amended).

Certain information contained in this announcement may

constitute "forward-looking statements" (including within the

meaning of the safe harbour provisions of the United States Private

Securities Litigation Reform Act of 1995), which can be identified

by the use of terms such as "may", "will", "would", "could",

"should", "expect", "anticipate", "project", "estimate", "intend",

"continue", "target", "plan", "goal", "aim" or "believe" (or the

negatives thereof) or other variations thereon or comparable

terminology. These forward-looking statements include all matters

that are not historical facts and include statements regarding the

Company's intentions, beliefs or current expectations and those of

our Officers, Directors and employees concerning, amongst other

things, the Company's results of operations, financial condition,

changes in global or regional trade conditions, changes in tax

rates, changes to customer preferences, liquidity, prospects,

growth and strategies, acts of war or terrorism worldwide, work

stoppages, slowdowns or strikes, public health crises, outbreaks of

contagious disease, environmental disruption or political

volatility. By their nature, forward-looking statements involve

inherent risks, assumptions and uncertainties that could cause

actual events or results or actual performance of the Company to

differ materially from those reflected or contemplated in such

forward-looking statements. For further information regarding risks

to Kingfisher's business, please consult the risk management

section in the company's Annual Report (as published). No

representation or warranty is made as to the achievement or

reasonableness of and no reliance should be placed on such

forward-looking statements.

The Company does not undertake any obligation to update or

revise any forward-looking statement to reflect any new information

or change in circumstances or in the Company's expectations.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTDKDBKCBKDDDD

(END) Dow Jones Newswires

January 12, 2021 02:00 ET (07:00 GMT)

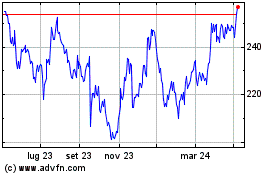

Grafico Azioni Kingfisher (LSE:KGF)

Storico

Da Mar 2024 a Apr 2024

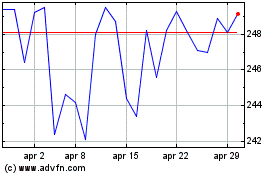

Grafico Azioni Kingfisher (LSE:KGF)

Storico

Da Apr 2023 a Apr 2024