LVMH Is Firing on the One Cylinder That Matters

16 Ottobre 2020 - 1:04PM

Dow Jones News

By Carol Ryan

Take away Louis Vuitton and Christian Dior and the world's

biggest luxury company looks down at heel. All that matters for

now, though, is the rapid recovery of those two brands.

Shares in LVMH Moët Hennessy Louis Vuitton jumped 7% on Friday

morning following the release of its eye-catching third-quarter

results on Thursday evening. The standout surprise was the fashion

and leather division, home to Louis Vuitton and Christian Dior,

where sales increased by 12%, much better than the slight drop

analysts had penciled in.

The wider company performance was more mixed but far better than

in the first half. Sales at constant exchange rates were down just

7% in the three months through September compared with the same

period last year, a vast improvement on the 38% decline clocked in

the second quarter. Chinese shoppers are spending freely again on

luxury, and demand from local U.S. and European consumers was also

surprisingly strong.

Tiffany & Co.'s attempt to steal LVMH's thunder with an

unscheduled update earlier on Thursday got little attention. The

U.S. jeweler said sales in August and September were down slightly,

but operating profit increased by a quarter compared with the same

months of 2019. The legal dispute over the two companies' derailed

$16 billion takeover was barely mentioned on a call with

investors.

Of LVMH's 70 or so luxury brands, a handful are carrying the

entire group for now. Louis Vuitton and Christian Dior are the

group's biggest profit engines, with the lucrative fashion and

leather division generating around two-thirds of total operating

profits in normal times. Their rapid recovery bodes well for

margins. Sales of Hennessy cognac were also robust in the U.S.,

although management did attribute this to a temporary boost to

consumers' disposable income from federal subsidies.

There are problems in every other part of the business, however.

A slump in travel retail hit sales of watches and jewelry, as well

as LVMH's perfume and cosmetics brands. The retail unit was the

weakest performer of all. The company's cratering duty-free

business DFS dragged comparable sales down 29% in the third

quarter. Until travel gets back to normal -- possibly not until

2024, according to the International Air Transport Association --

these businesses will weigh on performance.

LVMH's share price is now very close to the record set in

January and on a much higher multiple of expected earnings. Can

that be justified with the outlook for one-third of its profits so

uncertain? Investors seem happy to ignore the company's knottier

problems for now. In those parts of the business that management

can control -- and the ones that matter most for the bottom line --

LVMH's performance is hard to fault.

Write to Carol Ryan at carol.ryan@wsj.com

(END) Dow Jones Newswires

October 16, 2020 06:49 ET (10:49 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

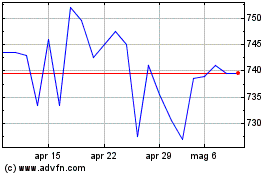

Grafico Azioni Christian Dior (EU:CDI)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni Christian Dior (EU:CDI)

Storico

Da Apr 2023 a Apr 2024