Land Securities Group PLC Dividend declaration, results date and correction (4534N)

01 Febbraio 2021 - 8:00AM

UK Regulatory

TIDMLAND

RNS Number : 4534N

Land Securities Group PLC

01 February 2021

1 February 2021

Land Securities Group PLC ('Landsec')

Dividend declaration, confirmation of annual results date and

correction to December rent collection data

In the half-yearly results released on 10 November, Landsec

announced it was resuming quarterly dividends commencing with a

12.0p per share payment on 4 January 2021, representing an

aggregated payment for the first two quarters of the year. Landsec

today confirms that the third quarterly dividend for the 2020/21

financial year will be 6.0p per ordinary share and will be paid on

30 March 2021 to shareholders on the register at the close of

business on 26 February 2021. The dividend will be paid entirely as

a Property Income Distribution. The last date for DRIP elections is

9 March 2021.

Landsec also confirms that it will announce its annual results

for the financial year ended 31 March 2021 on Tuesday 18 May 2021.

The format of the results presentation and dial-in details will be

confirmed closer to the announcement date.

The following amendment has been made to the December quarter

rent collection announcement released on 12 January 2021 at 07:00

under RNS Number 3165L.

Landsec's December quarter rent collection announcement issued

on 12 January stated that, for the period from 25 March 2020 to 24

December 2020, the rent collection rate for Offices was 99% and 82%

for the rest of Central London. The allocation between these two

sectors was incorrect. The correct rent collection figures were 99%

and 70% respectively. All other details remain unchanged.

The table below shows the corrected information:

For the period ended 24 December 2020(1)(2)

Agreed changes

in payment terms

Gross

amounts Impact Net amounts Amounts Amounts

due for of CVAs Deferred due for received received

the period(3) and admins Concessions payments the period(3) to date to date

GBPm GBPm GBPm GBPm GBPm GBPm %

-------------------- --------------- ------------ ------------ ---------- --------------- ---------- ----------

Offices 253 - - (2) 251 249 99

Offices - previously

disclosed 224 - - (2) 222 220 99

Rest of Central

London 48 (1) (4) - 43 30 70

Rest of Central

London - previously

disclosed 77 (1) (4) - 72 59 82

Regional retail 153 (8) (11) (3) 131 76 58

Urban opportunities 23 (1) (1) (1) 20 11 55

Subscale sectors 76 (5) (5) (2) 64 42 66

Total 553 (15) (21) (8) 509 408 80

-------------------- --------------- ------------ ------------ ---------- --------------- ---------- ----------

1. Including our proportionate share of subsidiaries and joint

ventures, as explained in the Presentation of financial information

above.

2. All amounts are shown gross of VAT. Where an amount billed

remains uncollected and is subsequently written off, the VAT

component will be recovered by the Group.

3. Due dates from 25 March 2020 to 24 December 2020. Does not

include 25 December 2020 quarter day rents.

Ends

About Landsec

At Landsec, we strive to connect communities, realise potential

and deliver sustainable places.

As one of the largest real estate companies in Europe, our

GBP11.8bn portfolio spans 24 million sq ft (as at 30 September

2020) of well-connected retail, leisure, workspace and residential

hubs. From the iconic Piccadilly Lights in the West End and the

regeneration of London's Victoria, to the creation of retail

destinations at Westgate Oxford and Trinity Leeds, we own and

manage some of the most successful and memorable real estate in the

UK.

We aim to lead our industry in critical long-term issues - from

diversity and community employment to carbon reduction and climate

resilience. We deliver value for our shareholders, great

experiences for our customers and positive change for our

communities.

Find out more at landsec.com

Please contact:

Investors Press

Ed Thacker Jonathan Sibun (Tulchan Group)

+44 (0)20 7024 5185 +44 (0)7779 999 683

Edward.Thacker@landsec.com JSibun@tulchangroup.com

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCWPUAUGUPGGMU

(END) Dow Jones Newswires

February 01, 2021 02:00 ET (07:00 GMT)

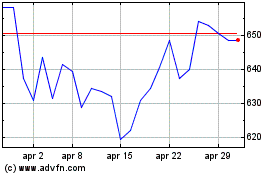

Grafico Azioni Land Securities (LSE:LAND)

Storico

Da Mar 2024 a Apr 2024

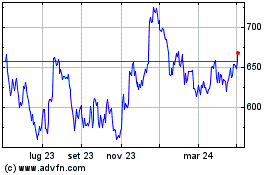

Grafico Azioni Land Securities (LSE:LAND)

Storico

Da Apr 2023 a Apr 2024