Land Securities Group PLC March 2021 quarter day rent collection (2148V)

13 Aprile 2021 - 8:00AM

UK Regulatory

TIDMLAND

RNS Number : 2148V

Land Securities Group PLC

13 April 2021

13 April 2021

Land Securities Group PLC ('Landsec')

March 2021 quarter day rent collection

In response to the continued impact of Covid-19 on Landsec's

operations, the Company has issued the following information on

March rent collection. Footfall and sales performance for the year

to 31 March 2021 will be provided in our annual results

announcement which will be published on 18 May 2021.

Cash collection and customer support

We continue to take a proactive approach to addressing the

challenges the pandemic presents to our people, our customers and

our business. Our marketing and operations teams have been working

with our brand partners to prepare for yesterday's re-opening of

non-essential shops in England and Wales and the expected

re-opening in Scotland on 26 April.

In early April 2020, we established a customer support fund of

GBP80m for occupiers who most need our help to survive. To date,

GBP39m of rent concessions has been allocated to customers. We

expect this figure to increase as some of our customers, who have

not yet paid their rent, enter into discussions with us following

the Government's announcement about re-opening non-essential retail

and the lifting of the rent moratorium at the end of June. We will

update on this at our annual results on 18 May.

GBP110m of rent was due on the 25 March payment date. The table

below shows the amount and percentage of this rent collected within

five working days after adjusting for the impact of customers

having entered CVAs and administrations, concessions agreed out of

the fund and agreed monthly and deferred payment terms. 67% of this

net rent was paid within five working days, compared with 65% for

the equivalent period last year.

25 March 2021 quarter(1)(2)

Agreed changes in

payment terms

Net

Day 5

amount

amounts received

Gross

amounts Impact Monthly Day 5 Day 5

due 25 of CVAs payment Deferred due 25 amount amount

March and admins Concessions terms payments March received received Mar 20

GBPm GBPm GBPm GBPm GBPm GBPm GBPm % %

-------------- --------- ----------- ------------ --------- --------- --------- --------- --------- ---------

Offices 63 - - (2) - 61 53 87 86

Rest of

Central

London 9 - - (2) - 7 2 29 47

Regional

retail 16 - (1) (2) - 13 5 38 36

Urban

opportunities 5 - - - - 5 2 40 35

Subscale

sectors 17 (1) - (2) - 14 5 36 30

110 (1) (1) (8) - 100 67 67 65

-------------- --------- ----------- ------------ --------- --------- --------- --------- --------- ---------

1. Including our proportionate share of subsidiaries and joint ventures.

2. All amounts are shown gross of VAT. Where an amount billed

remains uncollected and is subsequently written off, the VAT

component will be recovered by the Group.

Of the GBP33m of rent outstanding, GBP10m relates to customers

who have withheld payment pending documentation of agreed

concessions. Assuming all agreed concessions are completed and the

GBP10m of withheld rent is received, the rent collection rate for

the quarter would increase from 67% to approximately 77%.

For the period from 25 March 2020 to 24 March 2021, 84% of the

net amounts due for this period has been received.

The reported collection rates for the net amounts due at each

quarter day during the 2020/21 financial year are as follows (all

as at day five):

Day 5 collection rates during the 2020/21 financial year

24 June 29 Sept 25 Dec 25 Mar

2020 2020 2020 2021

Day 5 Day 5 Day 5 Day 5

amount amount amount amount

received received received received

% % % %

-------------------- ---------- ---------- ---------- ----------

Offices 81 82 87 87

Rest of Central

London 29 33 29 29

Regional

retail 29 28 36 38

Urban opportunities 29 36 40 40

Subscale

sectors 24 20 33 36

60 62 65 67

-------------------- ---------- ---------- ---------- ----------

Ends

About Landsec

At Landsec, we strive to connect communities, realise potential

and deliver sustainable places.

As one of the largest real estate companies in Europe, our

GBP11.8 billion portfolio spans 24 million sq ft (as at 30

September 2020) of well-connected retail, leisure, workspace and

residential hubs. From the iconic Piccadilly Lights in the West End

and the regeneration of London's Victoria, to the creation of

retail destinations at Westgate Oxford and Trinity Leeds, we own

and manage some of the most successful and memorable real estate in

the UK.

We aim to lead our industry in critical long-term issues - from

diversity and community employment to carbon reduction and climate

resilience. We deliver value for our shareholders, great

experiences for our customers and positive change for our

communities.

Find out more at landsec.com

Please contact:

Investors Press

Ed Thacker Jonathan Sibun (Tulchan Group)

+44 (0)20 7024 5185 +44 (0)7779 999 683

Edward.Thacker@landsec.com JSibun@tulchangroup.com

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCDZGMDRZVGMZM

(END) Dow Jones Newswires

April 13, 2021 02:00 ET (06:00 GMT)

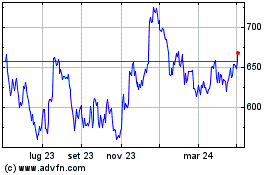

Grafico Azioni Land Securities (LSE:LAND)

Storico

Da Mar 2024 a Apr 2024

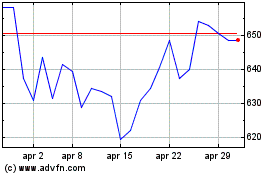

Grafico Azioni Land Securities (LSE:LAND)

Storico

Da Apr 2023 a Apr 2024