TIDMLND

RNS Number : 5348X

Landore Resources Limited

01 September 2020

LANDORE RESOURCES LIMITED

(AIM Ticker: LND.L)

DRILLING AND EXPLORATION PROGRAMME 2020/21

AND PIT OPTIMISATION REVIEW

BAM GOLD DEPOSIT

JUNIOR LAKE PROPERTY

London, United Kingdom 1(st) September 2020 - Landore Resources

Limited (AIM:LND) ("Landore Resources" or "the Company") is pleased

to provide an update on the Drilling and Exploration programme for

2020-2021 on the BAM Gold Deposit, Junior Lake Property, Ontario,

Canada ("BAM Gold Deposit") together with a 'Pit Optimization

Review' showing the significant enhancement of value of the

discovered ounces at higher gold prices for the benefit of

shareholders.

HIGHLIGHTS

-- BAM GOLD DEPOSIT-PIT OPTIMISATION REVIEW

In response to the significant increase in the price of gold

since the Company's Preliminary Economic Assessment ("PEA") was

updated in December 2019, a 'Pit Optimisation Review' (the

"Review") complete with physicals and financial analysis' at

various gold prices ranging from US$1,500 to US$2,400 has been

prepared. The Review shows revenue increasing from US$842 Million

to US$1,977 Million over that range. The Review covering the five

Pit Shell Options considered the existing Indicated and Inferred

Resource based on drilling completed to date.

A full copy of the above Review can is available on the

Company's website www.landore.com

-- PRICE SENSITIVITY ANALYSIS

The December 2019 Updated PEA for the BAM Gold project provided

a price sensitivity analysis of the 'Extended case' which, at a

gold price of US$1,560, would produce a Post Tax, Net Present value

(NPV) of US$227m.

At the current gold price of US$ 1,900 that Post tax NPV would

be elevated to US$370m

-- DRILLING TO COMMENCE IN OCTOBER 2020

Preparations are well advanced to commence the autumn-winter

drilling campaign on the BAM Gold Deposit, consisting of:

-- 7,500 metres of HQ Diamond core for Resource Infill and

Extension.

-- 3,000 metres of HQ Diamond core for Depth Potential and

-- 3,500 metres of HQ Diamond core for Exploration Target

definition

for a total of 14,000 metres of drilling aimed for completion in

March 2021. Landore is fully funded for the above planned

works.

-- EXPLORATION COMMENCED IN JULY 2020

Landore commenced an infill soil-till sampling programme in July

2020, covering 2,400 metres from the western extent of the BAM Gold

Deposit, aimed at confirming the drill targets identified in the

highly successful 2019 soil-till campaign. 455 samples with

controls have been submitted to the laboratory for analysis with

results expected in September 2020. An additional soil-till

sampling programme has commenced on the highly prospective area

covering 2,000 metres to the east of the BAM Gold Deposit.

.

Commenting on this report, Chief Executive Officer of Landore

Resources, Bill Humphries, said:

"The 2020-21 drilling and exploration programme is aimed to grow

the existing resource to over 1.3 million ounces of gold together

with establishing a defined 'Exploration Target' in excess of one

million ounces in the highly prospective zones to the east and west

of the existing resource further confirming the Directors view that

the BAM Gold Deposit has the clear potential to become a

multi-million ounce deposit."

BAM GOLD-PIT OPTIMISATION REVIEW

In response to the significant increase in the price of gold

since the Preliminary Economic Assessment (PEA) was updated in

December 2019, Cube Consulting were requested to provide a 'Pit

Optimisation Review' complete with physicals and financial

Analysis' at various gold prices ranging from US$1,500 to

US$2,400.

The Review covering the five Pit Shell Options considered the

existing Indicated and Inferred Resource with drilling completed to

date as shown on the sections in the review. No additional drilling

is required in these Pit shells.

Tables extracted from Pit Optimisation Review

BAM Gold Project

2019 Block Model - Model Reporting and Pit Optimisation

Review

24th August 2020

Physicals Analysis at Various Gold Prices

Physicals

Analysis

Material Run Shell

Type Base Total Waste Strip Mill Feed Material

Price Tonnes Tonnes Tonnes Au Rec.

(USD) RL (Mt) (Mt) Ratio (Mt) g/t Au kOz

------ ------- ------- ------ ------- ----- --------

Indicated

+ Inferred B 21 1500 130.0 95.2 80.7 5.6 14.5 1.23 561.5

------------- ----- ------ ------- ------ ------- ------- ------ ------- ----- --------

B 31 1800 100.0 136.7 118.2 6.4 18.5 1.15 669.2

------------------- ------ ------- ------ ------- ------- ------ ------- ----- --------

B 38 2000 95.0 157.7 137.2 6.7 20.5 1.11 714.8

------------------- ------ ------- ------ ------- ------- ------ ------- ----- --------

B 44 2200 60.0 198.4 174.7 7.4 23.7 1.06 791.2

------------------- ------ ------- ------ ------- ------- ------ ------- ----- --------

B 51 2400 50.0 219.0 193.9 7.7 25.1 1.04 823.7

------------------- ------ ------- ------ ------- ------- ------ ------- ----- --------

Costing Analysis at Various Gold Prices

Costing

analysis

Material Run Shell

Type Mining Process Revenue Undiscounted Cost Incremental

Price Cost Cost Cash Flow

(USD) ($M) ($M) Au ($M) ($M) /Oz Cost /Oz

------- -------- ------------ ------------------------- --------- ------------

Indicated

+

Inferred B 21 1500 235.0 243.1 842.3 364.2 $ 851 $ 1,481

----------- ----- ------ ------ ------- -------- ------------ ------------------------- --------- ------------

B 31 1800 340.7 310.3 1,204.6 553.6 $ 973 $ 1,784

----------------- ------ ------ ------- -------- ------------ ------------------------- --------- ------------

B 38 2000 394.9 343.1 1,429.6 691.5 $ 1,033 $ 1,995

----------------- ------ ------ ------- -------- ------------ ------------------------- --------- ------------

B 44 2200 499.4 397.6 1,740.7 843.6 $ 1,134 $ 2,165

----------------- ------ ------ ------- -------- ------------ ------------------------- --------- ------------

B 51 2400 551.0 421.4 1,977.0 1,004.6 $ 1,180 $ 2,392

----------------- ------ ------ ------- -------- ------------ ------------------------- --------- ------------

Notes: No capital costs included in the input parameters

End of Extract

BAM GOLD DEPOSIT:

The BAM Gold Deposit extends for 3,700 metres from 400E to 4100E

and remains open down dip and along strike to the east and the

west. The BAM Gold Deposit is located approximately mid-way along a

highly prospective Archean greenstone belt which traverses the

Junior Lake Property from east to west for approximately 31

kilometres. The favora ble greenstone belt ranges from 0.5 to 1.5

kilometres wide and hosts multiple known gold occurrences including

the Lamaune Gold Prospect .

The updated Mineral Resource Estimate (MRE) for the BAM Gold

Deposit (details of which were notified on 7(th) January 2020)

reported: 31,083,000 tonnes (t) at 1.02 grams/tonne (g/t) for

1,015,000 ounces of gold including 21,930,000t at 1.06g/t for

747,000 ounces gold in the Indicated category.

Notes on classification:

Indicated Resource is where the quantity of drilling combined

with grade and quality is high enough to assume continuity between

the drill locations. At the BAM Gold Deposit the Indicated category

was achieved with 50m x 50m drill spacing. An Indicated Resource is

required to advance the BAM Gold Deposit into Pre-feasibility

studies.

Inferred mineralisation at the BAM Gold Deposit was achieved

with 100m x 50m drill spacing and requires additional infill

drilling to be advanced to Indicated category.

Exploration Target is where limited drilling combined with grade

and geology similar to the adjacent Resource can provide direct

drill targets.

In the four campaigns completed to date, infill drilling on the

BAM Gold Deposit has successfully advanced the identified

exploration targets to Inferred category and the Inferred to

Indicated category.

Autumn-Winter Drilling Programme:

Preparations are well advanced to commence the autumn-winter

drilling campaign on the BAM Gold Deposit in October 2020.

The programme consists of:

7,500 metres of HQ Diamond core planned for infill drilling of

the inferred portion of the resource both within and surrounding

the Indicated resource and to further extend the defined resource

500 metres to the east and west.

3,000 metres of HQ Diamond core planned to test for depth

potential of high grade zones beneath both the west and east pit

shells. Landore's Engineering Consultant, Cube Consulting of Perth,

Western Australia, has provided possible targets for drilling of

these zones.

3,500 metres of HQ Diamond core for Exploration Target

definition in the highly prospective zones identified by soil-till

sampling 2,400 metres to the west and 2,000 metres to the east of

the existing resource.

For a total of 14,000 metres aimed for completion in March

2021.

Landore is fully funded for the above planned works.

Exploration - Soil-Till Sampling Programme:

The Company'geological team commenced an infill soil-till

sampling programme in July 2020, covering 2,400 metres from the

western extent of the BAM Deposit, aimed at confirming the drill

targets identified in the highly successful 2019 soil-till

campaign. 455 samples with controls have been submitted to the

laboratory for analysis with results expected by late September

2020. An additional soil-till sampling programme has commenced on

the highly prospective area covering 2 kilometres to the east of

the BAM Gold Deposit.

A grid was first established 2400 metres westwards along strike

from the BAM Gold Resource with north-south lines established every

100 metres. The samples were then collected from the B horizon,

below the organic and humus level at a nominal distance of 25m

along the grid lines using a Dutch auger.

The soil sampling and assay procedure used in this campaign is

the same as reported in the 9(th) December 2019 notification

regarding the 2019 geological and soil sampling campaign on the

Felix-Junior Lake area.

Planning:

At the conclusion of the 2020-21 drilling campaign an updated

MRE and PEA will be prepared on the BAM Gold Deposit.

BAM Gold Resource and PEA:

A Technical Report and Preliminary Economic Assessment ("PEA")

of the BAM Gold Project was released on 20(th) February 2019. The

PEA is in compliance with the requirements of the Canadian National

Instruments 43-101 Standards of Disclosure for Mineral Projects

("NI 43-101").

The Junior Lake Property:

The Junior Lake Property, 100% owned by Landore Resources,

together with the contiguous Lamaune Iron property (90.2% owned)

(jointly the "Junior Lake Property"), consisting of 30,507

hectares, is located in the province of Ontario, Canada,

approximately 235 kilometres north-northeast of Thunder Bay and is

host to: The BAM Gold Deposit; the B4-7

Nickel-copper-cobalt-Platinum-Palladium-gold Deposit; the VW

Nickel-Copper-cobalt Deposit; Lamaune Gold Prospect and numerous

other precious and base metal occurrences.

Brian Fitzpatrick, (MAusIMM CP.), Principal Geologist of Cube

Consulting Pty Ltd., Perth, Western Australia, a Qualified Person

as defined in the Canadian National Instrument 43-101 and the AIM

Rules for Companies, and responsible for the preparation of the BAM

Gold Project-Pit Optimisation Review 24(th) August 2020.

Michele Tuomi, (P.Geo., BSc. Geology), Director/VP Exploration

of Landore Resources Canada Inc. and a Qualified Person as defined

in the Canadian National Instrument 43-101 and the AIM Rules for

Companies, has reviewed and verified all scientific or technical

mining disclosure contained in this announcement.

- ENDS -

About Landore Resources

Landore Resources is an exploration company that seeks to grow

shareholder value through the acquisition, exploration and

development of precious and base metal projects in eastern Canada.

The Company is primarily focused on the development of the Junior

Lake Project. Landore Resources has mineral rights to 5 properties

in eastern Canada. The Company is headquartered in Guernsey, with

an exploration office located in Thunder Bay, Ontario, Canada.

Covid-19

The Company is following Government Covid-19 guidelines in its

operations in Canada.

For more information, please contact:

Bill Humphries, Chief Executive Officer Tel: 07734 681262

Glenn Featherby, Finance Director Tel: 07730 420318

Landore Resources Limited www.landore.com

Derrick Lee / Peter Lynch Tel: 0131 220 6939

Cenkos Securities plc

Nominated Advisor and Broker

This announcement contains inside information as defined in

Article 7 of the Market Abuse Regulation No 596/2014.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

DRLWPUWCRUPUUBG

(END) Dow Jones Newswires

September 01, 2020 02:00 ET (06:00 GMT)

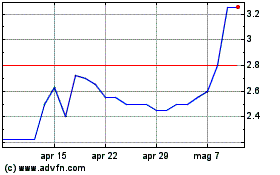

Grafico Azioni Landore Resources (LSE:LND)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni Landore Resources (LSE:LND)

Storico

Da Apr 2023 a Apr 2024