TIDMLND

RNS Number : 4749Z

Landore Resources Limited

21 September 2020

21 September 2020

Landore Resources Limited

("Landore Resources" or the "Company")

Interim Results for the Six Months Ended 30 June 2020

Landore Resources Limited (AIM:LND) is pleased to announce its

interim results for the six months ended 30 June 2020.

For more information, please contact:

Landore Resources Limited

Bill Humphries, Chief Executive Officer Tel: 07734 681262

Glenn Featherby, Finance Director Tel: 07730 420318

Cenkos Securities plc (Nominated Advisor and Broker)

Derrick Lee / Peter Lynch Tel: 0131 220 9100

MANAGEMENT DISCUSSION AND ANALYSIS

FOR THE SIX MONTHSED 30 JUNE 2020

General

The following discussion of performance, financial condition and

future prospects should be read in conjunction with the interim

consolidated financial statements of Landore Resources Limited

("Landore Resources" or the "Company") and its subsidiaries

(together, "the Group") and notes thereto for the period from 1

January 2020 to 30 June 2020. All amounts are stated in

sterling.

Overview

Landore Resources is admitted to trading on the AIM market

operated by the London Stock Exchange plc, with the trading symbol

LND.L. The Company is based in Guernsey in the Channel Islands and

its 100 per cent owned operating subsidiary, Landore Resources

Canada Inc. ("Landore Canada"), is engaged in the exploration and

development of a portfolio of precious and base metal properties in

North America.

Results of Operations

The financial results for the six months to 30 June 2020 show a

loss of GBP695,406 (2019: loss GBP697,542). These results were in

line with expectations. Exploration costs were GBP102,750 (2019:

GBP262,254).

Three placings and subscriptions were completed between 1

January and 30 June 2020. On 14 January 2020, the Company completed

a placing and subscription to raise gross proceeds of GBP225,000

through the issue of 32,142,857 new ordinary shares at a price of

0.7 pence per share. On 24 April 2020, the Company raised further

gross proceeds of GBP260,000 through the issue of 38,518,519 shares

at a price of 0.675 pence per share, with each subscriber receiving

one warrant per ordinary share subscribed for, exercisable at 1

pence each. On 29 June 2020, the Company completed a placing and

subscription to raise gross proceeds of GBP2.8 million through the

issue of 414,814,815 new ordinary shares at a price of 0.675 pence

per share, with each subscriber receiving one warrant per ordinary

share subscribed for, exercisable at 1 pence each, with the shares

issued and funds being received after the period end in July

2020.

The Group cash at bank at 30 June 2020 was GBP79,000, with the

proceeds of the placing announced on 29 June 2020 being received

post period end. The Group has no debt but will need to raise

further equity in order to carry out its future exploration and

development activities beyond the current drilling and exploration

programme, and also for additional working capital. At present, the

Group has sufficient funding to complete the current drilling and

exploration programme and to meet Group working capital

requirements to the end of June 2021.

Operations

Landore Canada, is actively engaged in mineral exploration in

Eastern Canada. Landore Canada owns or has the mineral rights to

four properties in Eastern Canada, a 90.2 per cent controlling

interest in Lamaune Iron Inc. ("Lamaune"), which owns the property

adjacent to Junior Lake, and a 30 per cent interest in the West

Graham property located in the Sudbury Nickel Belt.

Landore Canada, through its 100 per cent owned subsidiary

Brancote US, owns or has the mineral rights to a further eight

properties for 99 claims in the State of Nevada.

Landore Canada's primary operational focus is on the growth of

the BAM East Gold Deposit located on the 100 per cent owned, highly

prospective Junior Lake Property, Northwestern Ontario ("Junior

Lake").

Full details of the Group's projects, including maps, Canadian

National Instrument 43-101 (NI 43-101) resource reports,

geophysical surveys etc. can be viewed on the Group's website,

www.landore.com .

The Junior Lake Property:

The Junior Lake property, 100 per cent owned by Landore Canada,

is located in the province of Ontario, Canada, approximately 235

kilometres north-northeast of Thunder Bay and is host to the

recently discovered BAM Gold Deposit, the B4-7

Nickel-Copper-Cobalt-PGEs deposit and the adjacent Alpha PGEs zone.

Junior Lake also contains the VW Nickel deposit and numerous other

highly prospective mineral occurrences.

BAM Gold Deposit:

During 2018, Landore Resources' exploration efforts were

targeted at increasing the Junior Lake, BAM Gold resource towards

1,000,000 ounces of gold, and upgrading Inferred mineral resources

to an Indicated status, the results of which were subsequently used

to complete a revised Mineral Resource Estimate with Technical

Report. Both targets were achieved on time and within budget.

Cube Consulting Pty Ltd ("Cube") was engaged by Landore

Resources Canada Inc. ("Landore") to conduct a revised Mineral

Resource Estimate with Technical Report, in compliance with the

requirements of the Canadian National Instruments 43-101 Standards

of Disclosure for Mineral Projects ("NI 43-101"), on the BAM Gold

Project, in Ontario, Canada.

The revised Mineral Resource Estimate and Technical Report were

reported by Landore on 7th January and 9th April 2020

respectively.

Highlights of the Drilling and Resource Update include:

-- The new Mineral Resource Estimate (MRE) modelling has

increased the BAM Gold resource to: 31,083,000 tonnes (t) at 1.02

grams/tonne (g/t) for 1,015,000 ounces of gold including

21,930,000t at 1.06g/t for 747,000 ounces gold in the Indicated

Category.

-- The BAM Gold Deposit now extends for 3,700 metres from 400E

to 4100E and remains open down dip and along strike to the east and

the west. In addition, the recently completed Soil sampling program

has identified widespread gold mineralisation along strike to the

west for a further 7 kilometres.

In response to the significant increase in the price of gold

since the Company's Preliminary Economic Assessment ("PEA") was

updated in December 2019, a 'Pit Optimisation Review' (the

"Review") complete with physicals and financial analysis' at

various gold prices ranging from US$1,500 to US$2,400 has been

prepared. The Review shows revenue increasing from US$842 million

to US$1,977 million over that range. The Review covering the five

Pit Shell Options considered the existing Indicated and Inferred

Resource based on drilling completed to date.

The December 2019 Updated PEA for the BAM Gold project provided

a price sensitivity analysis of the 'Extended case' which, at a

gold price of US$1,560, would produce a Post Tax, Net Present value

(NPV) of US$227 million. At the current gold price of US$1,900 that

Post tax NPV would be elevated to US$370 million.

Drilling and exploration is planned to commence in October 2020

to further extend the known BAM Gold Zone to the east and west and

to test any potential mineralisation identified in the recently

completed soil sampling exploration program (as reported 9th

December 2019). In addition, deep holes are planned to test the

continuity of high grade mineralisation below the existing BAM Gold

Deposit.

The continued rapid growth of the BAM Gold Deposit together with

the possible future development of the other known gold prospects

along this highly prospective 31 kilometre long Archean greenstone

belt bodes well for the future of the Junior Lake Property hosting

a multi-million ounce gold deposit.

Social and environmental responsibility:

The Group believes that a successful project is best achieved

through maintaining close working relationships with First Nations

and other local communities. This social ideology is at the

forefront of the Group's exploration initiatives and the Company

seeks to establish and maintain co-operative relationships with

First Nations communities, hiring local personnel and using local

contractors and suppliers where possible. Careful attention is

given to ensure that all exploration activity is performed in an

environmentally responsible manner and abides by all relevant

mining and environmental acts. Landore takes a conscientious role

towards its operations, and is aware of its social responsibility

and its environmental duty.

18 September 2020

UNAUDITED CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

FOR THE SIX MONTHSED 30 JUNE 2020

Group Group

Six months Six months

ended ended

30 June 30 June

Notes 2020 2020

GBP GBP

Exploration costs 2 (102,750) (262,254)

Administrative expenses (592,669) (435,350)

Operating loss (695,419) (697,604)

Finance income 13 62

Loss before income tax (695,406) (697,542)

Income tax expense - -

------------ ------------

Loss for the period (695,406) (697,542)

============ ============

Other comprehensive loss:

Exchange difference on translating

foreign

operations (1,946) (333)

------------ ------------

Other comprehensive loss for the

year

net of tax (1,946) (333)

============ ============

Total comprehensive loss for the

period (697,352) (697,875)

============ ============

Loss attributable to:

Equity holders of the Company (694,901) (697,281)

Non-controlling interests (505) (261)

============ ============

(695,406) (697,542)

Total comprehensive loss attributable

to:

Equity holders of the Company (696,847) (697,614)

Non-controlling interests (505) (261)

============ ============

(697,352) (697,875)

Loss per share attributable to

the

equity holders of the Company

during the year

- basic & diluted 3 (GBP0.001) (GBP0.001)

============ ============

The Group's operating loss relates to continuing operations.

UNAUDITED CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

FOR THE SIX MONTHSED 30 JUNE 2020

Share Cumulative Non-

Share options Retained translation controlling

capital reserve earnings reserve interest Total

GBP GBP GBP GBP GBP GBP

Balance at

1 January 2019 41,247,016 726,453 (41,432,637) (312,633) (2,305) 225,894

Loss for the period - - (697,281) - (261) (697,542)

Other comprehensive loss in the period - - - (333) - (333)

Issue of ordinary share capital 1,100,000 - - - - 1,100,000

Placing expenses (141,312) - - - - (141,312)

Share options lapsed - (9,029) 9,029 - - -

Balance at

30 June 2019 42,205,704 717,424 (42,120,889) (312,966) (2,566) 486,707

============ ======== ============= ============ ============ ==========

Balance at

1 January 2020 42,915,903 640,347 (43,353,485) (343,517) (3,227) (143,979)

Loss for the period - - (694,901) - (505) (695,406)

Other comprehensive loss in the period - - - (1,946) - (1,946)

Issue of ordinary share capital 553,000 - - - - 553,000

Placing expenses (57,700) - - - - (57,700)

Balance at

30 June 2020 43,411,203 640,347 (44,048,386) (345,463) (3,732) (346,031)

============ ======== ============= ============ ============ ==========

UNAUDITED CONSOLIDATED STATEMENT OF FINANCIAL POSITION

AT 30 JUNE 2020

Group Group Group

As at As at As at

30 June 2020 30 June 2019 31 December

GBP GBP 2019

GBP

Assets Notes

Non-current assets

Property, plant and

equipment 28,688 36,456 32,323

28,688 36,456 32,323

-------------- -------------- -------------

Current assets

Trade and other receivables 13,880 48,651 19,965

Cash and cash equivalents 79,032 689,089 107,668

-------------- -------------- -------------

92,912 737,740 127,633

-------------- -------------- -------------

Total assets 121,600 774,196 159,956

-------------- -------------- -------------

Equity

Capital and reserves

attributable to the

Company's equity holders

Share capital 4 43,411,203 42,205,704 42,915,903

Share options reserve 640,347 717,424 640,347

Retained earnings 5 (44,048,386) (42,120,889) (43,353,485)

Cumulative translation

reserve (345,463) (312,966) (343,517)

-------------- -------------- -------------

Total equity shareholders'

funds (342,299) 489,273 (140,752)

-------------- -------------- -------------

Non-controlling interests (3,732) (2,566) (3,227)

-------------- -------------- -------------

Total equity (346,031) 486,707 (143,979)

-------------- -------------- -------------

Liabilities

Current liabilities

Trade and other payables 431,911 251,481 269,058

Income tax liabilities 35,720 36,008 34,877

-------------- -------------- -------------

467,631 287,489 303,935

-------------- -------------- -------------

Total liabilities 467,631 287,489 303,935

-------------- -------------- -------------

Total equity and liabilities 121,600 774,196 159,956

============== ============== =============

UNAUDITED CONSOLIDATED STATEMENT OF CASH FLOWS

FOR THE SIX MONTHSED 30 JUNE 2020

Group Group

Six months ended Six months ended

30 June 2020 30 June 2019

GBP GBP

Cash flows from operating activities

Operating loss (695,419) (697,604)

Finance income 13 62

Depreciation of tangible fixed assets 4,315 8,925

Decrease/(increase) in receivables 6,271 (4,109)

Increase in payables 226,954 142,433

----------------- -----------------

Net cash outflow from operating activities (457,866) (550,293)

Cash flows from financing activities

Issue of ordinary share capital 485,000 1,000,000

Issue costs (57,700) (41,312)

----------------- -----------------

Net cash inflow from financing activities 427,300 958,688

Net (decrease)/increase in cash and cash equivalents (30,566) 408,395

Cash and cash equivalents at beginning of period 107,668 277,458

Exchange gain on cash and cash equivalents 1,930 3,236

----------------- -----------------

Cash and cash equivalents at end of period 79,032 689,089

================= =================

NOTES TO THE FINANCIAL STATEMENTS

FOR THE SIX MONTHSED 30 JUNE 2020

1 Basis of accounting and accounting policies

The financial statements have been prepared in accordance with

International Financial Reporting Standards ("IFRS") as adopted by

the European Union at the time of preparing these financial

statements (August 2020). The Directors have elected not to apply

IAS 34 Interim Financial Reporting.

The financial statements have not been audited and have been

prepared on the historical cost basis. The principal accounting

policies adopted are consistent with those adopted in the annual

accounts to 31 December 2019.

2 Exploration expenditure and mineral properties

1 January Net Expenditure Accumulated

2020 in Period expenditure

GBP GBP 30 June

2020

GBP

Junior Lake/Lamaune

Lake 22,819,766 99,647 22,919,413

Miminiska Lake 1,530,941 1,107 1,532,048

Lessard 705,347 - 705,347

Frond Lake 84,976 1,392 86,368

Wottam 61,558 - 61,558

Others, including Swole

Lake, West Graham and

Root Lake 79,310 604 79,914

25,281,898 102,750 25,384,648

=========== ================ =============

Mineral properties at 30 June 2020 represent accumulated costs

to date incurred by Landore Resources Canada Inc., a subsidiary of

Landore Resources Limited. On acquisition of Landore Resources

Canada Inc. on 5 April 2006 the fair value of those costs incurred

to date was considered to be GBPnil. All subsequent expenditure in

the period has been charged to the income statement in accordance

with the group accounting policy.

3 Loss per share

The loss per share is based on the loss for the period and the

weighted number of ordinary shares in issue during the period,

being 1,352,123,678 (June 2019: 1,067,620,594).

Diluted loss per share

The potential ordinary shares which arise as a result of the

options in issue are not dilutive under the terms of IAS 33 because

they would not increase the loss per share. Accordingly, there is

no difference between the basic and dilutive loss per share.

4 Share capital

30 June 1 January

2020 2020

GBP GBP

Issued:

1,384,261,884 (December 2019:

1,303,600,508) ordinary shares

of nil par value 43,411,203 42,915,903

============= =============

On 21 January 2020, 32,142,857 ordinary shares were issued at a

price of GBP0.007 each as part of a share subscription raising

GBP225,000 before issue costs.

On 13 February 2020, 10,000,000 ordinary shares were issued at a

price of GBP0.0068 each to Richard Prickett as part of his

compensation for taking a reduced salary from 1 July 2015 which was

intended to be deferred and in recognition of his long service to

the Company.

On 4 May 2020, 38,518,519 ordinary shares were issued at a price

of GBP0.00675 each as part of a share subscription raising

GBP260,000 before issue costs.

As part of this share issue one warrant was issued with each new

ordinary share, totalling 38,518,519 warrants, with an exercise

price of GBP0.01 per ordinary share and are exercisable for two

years from the date of admission of the placing shares to AIM. No

value has been ascribed to these warrants as they are deemed not to

have been issued in exchange for goods or services and therefore no

value is ascribed per IFRS 2.

Share

capital

2020

GBP

At 1 January 2020 42,915,903

Shares issued in the period 553,000

Share issue costs (57,700)

At 30 June 2020 43,411,203

===========

5 Retained earnings

GBP

At 1 January 2020 (43,353,485)

Loss for the period (694,901)

At 30 June 2020 (44,048,386)

=============

6 Events after the interim reporting period

On 29 June 2020 the Company announced that it had conditionally

raised gross proceeds of GBP2.8m through a placing of 414,814,815

new ordinary shares at a price of 0.675 pence per new ordinary

share and the issue of 414,814,815 warrants to new and existing

institutional investors in the Company. The placing was approved by

the Company's shareholders at the Company's Extraordinary General

Meeting held on 13 July 2020.

On 24 July 2020 the Company issued a total of 48,000,000 options

over new ordinary shares to certain Directors and employees of the

Company. The options have an exercise price of 1.2 pence and can be

exercised from 24 January 2021 until 23 July 2025. Following this

award, there were 134,250,000 options outstanding.

On 20 August 2020 the number of issued ordinary shares of no par

value each in the Company was reduced by a multiple of 20. Upon the

share consolidation becoming effective, the 478,222,223 existing

warrants exercisable at 1 pence and the 7,142,857 existing warrants

exercisable at 0.875 pence currently outstanding were adjusted to

23,911,111 warrants exercisable at 20 pence and 357,142 warrants

exercisable at 17.50 pence respectively. Similarly, following the

share consolidation, the Company had a total of 6,712,500 options

outstanding. Following the share consolidation and admission of the

new ordinary shares to trading on AIM, the total number of shares

in issue and voting rights in the Company was 89,953,835.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR BDGDCRUBDGGI

(END) Dow Jones Newswires

September 21, 2020 02:00 ET (06:00 GMT)

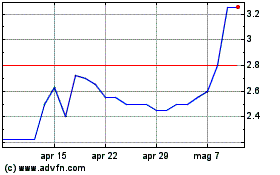

Grafico Azioni Landore Resources (LSE:LND)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni Landore Resources (LSE:LND)

Storico

Da Apr 2023 a Apr 2024