TIDMLND

RNS Number : 9503T

Landore Resources Limited

24 July 2020

24 July 2020

Landore Resources Limited

("Landore Resources" or the "Company")

Proposed Share Capital Consolidation

Landore Resources Limited (AIM:LND), today announces a proposed

share capital consolidation ("Share Consolidation") of the existing

ordinary share capital of the Company ("Ordinary Shares").

The effect of the proposed Share Consolidation will be to reduce

the number of issued ordinary shares of no par value each in the

Company ("Ordinary Shares") by a multiple of 20, which is expected

to increase the trading price of the resulting ordinary share

proportionally.

The Board considers the Share Consolidation to be in the best

interests of the Company and the shareholders in the Company

("Shareholders"), as it believes that the effect of the Share

Consolidation will be to improve the market liquidity of and

trading activity in the Company's shares. The Directors believe

that the existing share capital structure is no longer appropriate,

as the high number of shares in issue combined with the relatively

low price per share is thought to result in excess volatility and

reduced liquidity in the Company's shares. By proceeding with the

Share Consolidation, the Directors anticipate that a higher price

per share will improve the marketability of the Company and could

increase interest from institutional investors in the UK and

overseas which should improve the liquidity of the Company's

shares.

As it is proposed that all existing ordinary shares held in the

Company be consolidated, the proportion of the issued ordinary

share capital of the Company held by each Shareholder immediately

before and after the Capital Reorganisation will remain relatively

unchanged, other than for small changes that may arise from the

rounding for fractional entitlements.

Implementation of the Share Consolidation requires the approval

of Shareholders. This approval is being sought at an Extraordinary

General Meeting of the Company ("EGM"), which is scheduled to be

held at 12.00 p.m. on 20 August 2020 (or as soon as thereafter

following completion of the Annual General Meeting) at La Tonnelle

House, Les Banques, St Sampson, Guernsey, GY1 3HS at which the

resolution necessary to give effect to the Share Consolidation will

be put to Shareholders.

A circular ("Circular") containing the notice of EGM, which

provides details of the Share Consolidation, and form of proxy, is

to be posted to Shareholders on 27 July 2020. The notice of EGM

will also be made available at the Company's website,

www.landore.com

Further details in relation to the Share Consolidation

As at 23 July 2020 (being the latest practicable date prior to

the publication of this announcement), the Company had

1,799,076,699 Ordinary Shares in issue ("Existing Ordinary

Shares"), with each share having a mid-market price at the close of

business on such date (as derived from the Daily Official List) of

1.18 pence per share.

The Share Consolidation will consist of the following steps:

-- the Company intends to issue a single further Ordinary Share

prior to the Record Date, so as to ensure that the total number of

Ordinary Shares in issue immediately prior to completion of the

Share Consolidation is exactly divisible by 20. Subject to the

passing of the relevant resolutions at the EGM, the additional

Ordinary Share will be issued on 20 August 2020 at a subscription

price per Ordinary Share of 1.18 pence (being the closing middle

market price of an Ordinary Share on 23 July 2020, being the latest

practicable date prior to publication of this announcement).

-- the consolidation of every 20 Existing Ordinary Shares of no

par value each into one New Ordinary Share of no par value ("New

Ordinary Shares").

The Share Consolidation is anticipated to become effective at 6

p.m. on 20 August 2020. The New Ordinary Shares arising on

implementation of the Share Consolidation will have the same rights

as the Existing Ordinary Shares, including in respect of voting

rights, entitlement to dividends and other rights. The issued share

capital of the Company immediately following the Share

Consolidation is expected to comprise 89,953,835 New Ordinary

Shares of no par value, which will be equal to the number of

Existing Ordinary Shares immediately prior to the Share

Consolidation divided by 20.

To reflect the Share Consolidation, the Board is proposing to

reduce the number of shares that are subject to outstanding options

("Options") by a multiple of 20 and increase the option exercise

price by the same multiple. This would apply to any new Options

that are issued after the date of this announcement and prior to

the Record Date. Any fractional entitlement to shares will be

rounded down. The overall amount payable by an Optionholder looking

to exercise his Option after the Share Consolidation will remain

the same and the proportion of the issued share capital over which

an Option is subsisting will also remain the same.

Similarly, the 478,222,223 existing warrants exercisable at 1

pence and the 7,142,857 Existing Warrants exercisable at 0.875

pence currently outstanding (together, the "Existing Warrants") at

the date hereof will, upon the Share Consolidation becoming

effective (and assuming no Existing Warrants are exercised prior to

the date), be adjusted to 23,911,111 warrants exercisable at 20

pence and 357,142 warrants exercisable at 17.50 pence respectively.

The terms of the Existing Warrant Instruments ("Warrant

Instruments") provide that, in the event of any consolidation of

the share capital of the Company, the number of Ordinary Shares for

which the outstanding subscription rights pursuant to the Existing

Warrants may be exercised and the exercise price payable on

exercise of an Existing Warrant shall be adjusted so that the

overall amount payable by a warrantholder looking to exercise his

Existing Warrants after the Share Consolidation will remain the

same and the proportion of the issued share capital over which the

Existing Warrants are subsisting will also remain the same. Any

fractional entitlement to shares will be rounded down. Notice of

adjustments to outstanding Existing Warrants will be sent to

individual warrantholders together with a new warrant certificate

as soon as reasonably practicable following the date on which any

such adjustment shall take effect.

Application will be made for the New Ordinary Shares to be

admitted to trading on AIM. Dealings in the Existing Ordinary

Shares will cease at close of business on the date of the EGM and

dealings in the New Ordinary Shares are expected to commence the

following business day.

The ISIN code for the New Ordinary Shares is GG00BMX4VR69 and

the SEDOL number is BMX4VR6.

Expected timetable of principal events

Circular posted to Shareholders 27 July 2020

Latest time and date for receipt of 12 p.m. on 18 August

Forms of Proxy 2020

Additional 1 Ordinary Share issued 20 August 2020

Extraordinary General Meeting 12 p.m. on 20 August

2020 (or as soon as thereafter

following completion

of the Annual General

Meeting)

Record Date and completion of Share 6 p.m. on 20 August 2020

Consolidation

Expected date on which New Ordinary 8.00 a.m. on 21 August

Shares will be admitted to trading on 2020

AIM

Expected date for CREST accounts to 21 August 2020

be credited with New Ordinary Shares

Expected date for dispatch of certificates by 4 September 2020

in respect of those New Ordinary Shares

to be issued in certificated form

Effect of COVID-19 regulations on the Extraordinary General

Meeting

In light of the Guernsey Quarantine Restrictions, the Company

strongly encourages all Shareholders not residing in Guernsey on

the date of this announcement to submit their Form of Proxy,

appointing the Chairman of the Extraordinary General Meeting as

proxy. If the Guernsey Quarantine Requirements continue to apply on

the date of the Extraordinary General Meeting, Shareholders who

have arrived in Guernsey within a period prior to the date of the

Extraordinary General Meeting which is shorter than the quarantine

period specified in the Guernsey Quarantine Restrictions may not be

allowed to attend the Extraordinary General Meeting in person and

anyone who attempts to do so may be refused entry. The situation

regarding COVID-19 is constantly evolving, and the Government of

Guernsey may change current restrictions or implement further

measures relating to the holding of general meetings during the

affected period. Any changes to the Extraordinary General Meeting

(including any change to the location of the Extraordinary General

Meeting) will be communicated to Shareholders before the meeting

through our website at https://www.landore.com/index.php and, where

appropriate, by announcement made by the Company to a Regulatory

Information Service. It is suggested that Shareholders consult

www.covid19.gov.gg for updates closer to the date of the

meeting.

Voting on the resolutions will be by way of a poll rather than a

show of hands. A poll ensures that the votes of Shareholders who

are unable to attend the Extraordinary General Meeting, but who

have appointed proxies, are taken into account in the final voting

results.

Given the current restrictions on attendance in person,

Shareholders are encouraged to appoint the chair of the meeting as

their proxy rather than a named person who will not be permitted to

attend the physical meeting. Shareholders are further asked to

appoint the chair of the meeting as their proxy electronically

where possible.

Should Shareholders wish to ask any questions in relation to the

resolutions, which they may otherwise have asked at the

Extraordinary General Meeting had they been in attendance, they are

encouraged to contact the Company prior to the Extraordinary

General Meeting by email to whumphries@landore.com.

Shareholders will find accompanying the Circular, a Form of

Proxy, for use in connection with the Extraordinary General

Meeting. The Form of Proxy should be completed and returned in

accordance with the instructions thereon so as to be received by

the Company's Registrar Agents, Computershare Investor Services

(Guernsey) Limited, as soon as possible and in any event not later

12pm on 18 August 2020.

Recommendation

The Directors consider that the Share Consolidation is in the

best interests of the Company and Shareholders as a whole.

Accordingly, the Directors unanimously recommend Shareholders to

vote in favour of the resolutions as they will do in respect of

their Ordinary Shares in the Company, which in aggregate total

162,402,911 Ordinary Shares representing approximately 9.03 per

cent. of the Existing Ordinary Shares.

For more information, please contact:

Landore Resources Limited

Bill Humphries, Chief Executive Officer Tel: 07734 681262

Glenn Featherby, Finance Director Tel: 07730420318

Cenkos Securities plc (Nominated Advisor and Broker)

Derrick Lee / Peter Lynch Tel: 0131 220 9771

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

MSCDGGDRSSDDGGX

(END) Dow Jones Newswires

July 24, 2020 02:01 ET (06:01 GMT)

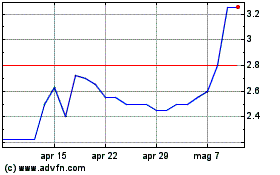

Grafico Azioni Landore Resources (LSE:LND)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni Landore Resources (LSE:LND)

Storico

Da Apr 2023 a Apr 2024