TIDMLOGP

RNS Number : 1341D

Lansdowne Oil & Gas plc

17 February 2020

The information contained within this announcement is deemed by

the Company to constitute inside information as stipulated under

the Market Abuse Regulations (EU) No. 596/2014 ("MAR"). Upon the

publication of this announcement via Regulatory Information Service

("RIS"), this inside information is now considered to be in the

public domain. If you have any queries on this, then please contact

Steve Boldy, the Chief Executive Officer of the Company

(responsible for arranging release of this announcement).

17 February 2020

Lansdowne Oil & Gas plc

("Lansdowne" or the "Company")

Equity Placing and

Conversion of Shareholder Loans

Lansdowne Oil & Gas plc (AIM: LOGP), the North Celtic Sea

focused, oil and gas company, is pleased to announce that it has

raised GBP488,000 by way of a placing of 81,333,333 new ordinary

shares of 0.1 pence each (the "Placing Shares") with existing

investors (the "Placees") at a placing price of 0.6 pence per

Placing Share (the "Placing Price") (the "Placing"). Brandon Hill

Capital Limited ("BHC") acted as broker.

The proceeds of the Placing will be used to meet the Company's

expected share of Barryroe costs and to fund the Company's ongoing

working capital requirements until the end of 2020.

BHC and LC Capital Targeted Opportunities Fund, L.P. ("LCCTOF")

have both also agreed to convert the outstanding amount of their

2019 loans to the Company, amounting to GBP155,605.48 (comprising

of GBP150,000 principal and GBP5,605.48 accrued interest) each,

into new ordinary shares at the Placing Price (together the "Loan

Conversions").

The Placing and Notable Subscriptions

The Company has raised gross proceeds of GBP488,000 through the

issue of the Placing Shares. The Placing Shares will represent

approximately 10.2% per cent of the enlarged share capital of the

Company (following the issue of the Placing Shares and the Initial

Loan Shares (as defined below)).

Oliver Stansfield and Neal Griffith, both Directors of BHC, the

Company's second largest shareholder, have agreed to each subscribe

on a pro rata basis to their current shareholdings in the Company,

being 3.01% and 3.91% respectively, representing a combined

investment of GBP34,600 for 5,766,667 Placing Shares.

The Placing Shares will rank pari passu with the existing

ordinary shares in all respects. Application has been made for the

Placing Shares to be admitted to trading on AIM and dealings are

expected to commence on 20 February 2020 ("Admission").

Tim Torrington, Non-Executive Chairman, intends to subscribe for

2,000,000 new ordinary shares, representing a subscription of

GBP12,000 (the "Director Subscription"), resulting in a total gross

fundraise of GBP500,000. Further details relating to the Director

Subscription are expected to be announced shortly.

The Loans

As previously announced on 25 June 2019, the Company entered

into loan agreements with BHC and LCCTOF for, in aggregate,

GBP300,000 (together, the "Shareholder Loans"). Since entering into

the agreements, all funds were drawn by the Company under the

Shareholder Loans.

BHC and LCCTOF have agreed to convert the amount currently

outstanding under the Shareholder Loans into new ordinary shares at

the Placing Price. This will result in the issue of 25,934,246 new

ordinary shares to each of BHC and LCCTOF. Of these, 49,736,666 new

ordinary shares (the "Initial Loan Shares") will be issued under

the Company's existing authorities and 2,131,826 new ordinary

shares (the "Further Loan Shares") will be subject to shareholder

approval.

The Initial Loan Shares will rank pari passu with the existing

ordinary shares in all respects. Application has been made for the

Initial Loan Shares to be admitted to trading on AIM and dealings

are expected to commence on Admission.

Conditional upon the passing of the necessary shareholder

resolutions to approve the allotment and issue of the Further Loan

Shares, such ordinary shares will rank pari passu with the then

existing ordinary shares in all respects and application will be

made for admission to trading of such ordinary shares on AIM. A

further announcement will be made in due course.

Warrants

In connection with the Placing and the conversion of the

Shareholder Loans, the Company will also grant a total of

137,368,491 warrants, on a one warrant per Placing or Loan Share

basis, to subscribe for new ordinary shares in the Company at a

price of 1.2 pence per share, with an expiry of 31 December 2020.

The issue of these warrants will be subject to shareholder approval

and they will be exercisable from the date of such approval. In the

event all of the warrants are exercised before their expiry at year

end, the Company would receive a further GBP1.65 million in

cash.

Use of Proceeds

The proceeds of the Placing are expected to be sufficient to

fund the Company's share of costs on the Barryroe Licence and for

on-going working capital requirements to the end of 2020.

Related Party Transactions

BHC and LC Capital & Affiliates, as substantial shareholders

of the Company, are considered to be "related parties" as defined

under the AIM Rules and accordingly, the Loan Conversions and grant

of associated warrants constitutes a related party transaction for

the purposes of Rule 13 of the AIM Rules ("Related Party

Transaction").

Similarly, given their role as Directors of BHC, the

participation of Oliver Stansfield and Neal Griffith in the Placing

on a pro rata basis to their existing shareholdings is considered

to be a Related Party Transaction.

The Directors independent of the Placing, Loan Conversions and

grant of warrants, who for this purpose are Steve Boldy, John

Aldersey-Williams and Jeffrey Auld, consider, having consulted with

the Company's nominated adviser, SP Angel Corporate Finance LLP,

that these transactions are fair and reasonable insofar as the

Company's shareholders are concerned.

General Meeting

The Company will call a general meeting (the "General Meeting")

to be held on or around 18 March 2020 to approve the issue of the

Further Loan Shares and the warrants and a further announcement

will be made in relation to matter this in due course.

Total Voting Rights

Following admission of the Placing Shares and the Initial Loan

Shares, the Company will have in issue 796,419,845 ordinary shares

of 0.1 pence each. No ordinary shares are held in treasury.

Therefore, the total number of voting rights in the Company will be

796,419,845.

The above total current voting rights number is the figure which

may be used by shareholders as the denominator for the calculation

by which they will determine if they are required to notify their

interest in, or a change to their interest in the Company under the

FCA's Disclosure Guidance and Transparency Rules.

Substantial Shareholders

Following admission of the Placing Shares and the Initial Loan

Shares:

-- Brandon Hill Capital Limited and Directors of BHC will be

collectively interested in 168,630,644 ordinary shares representing

21.17% of the Company's issued share capital; and

-- LC Capital & Affiliates will be interested in 215,336,693

ordinary shares representing 27.04% of the Company's issued share

capital.

Further to the intended Director Subscription and subject to

shareholder approval at the General Meeting, following admission of

the Further Loan Shares:

-- BHC will be interested in 169,696,557 ordinary shares

representing 21.20% of the Company's issued share capital; and

-- LC Capital & Affiliates will be interested in 216,402,606

ordinary shares representing 27.03% of the Company's issued share

capital.

Tim Torrington, Non-Executive Chairman of Lansdowne,

commented:

"The Placing and Loan Conversions provide funding for the

Company to the end of 2020. During this period the Company will

continue with its ongoing farm-out campaign on Barryroe, with a

number of parties currently active in the data room, and it is the

Board's target to complete a farm-out deal within the next six

months.

"The Company can also report that in addition to the traditional

farm-out discussions, interest is also being shown in the potential

to combine a Barryroe development with carbon sequestration,

utilising existing infrastructure, which is an exciting

concept.

"I would like to thank all our existing shareholders for their

support and patience they have shown. The Board remains steadfast

in its belief of the significant potential of Barryroe and is

focused on unlocking the inherent value within Lansdowne. With

existing 2C resources of 69MMboe (and additional exploration

potential), the Company is trading at a valuation of less than

US$0.08 per contingent resource barrel. Accordingly, we believe

there is the scope for a significant re-rating of the Company

valuation upon any positive operational developments."

For further information please contact:

Lansdowne Oil & Gas plc +353 1 963 1760

Steve Boldy

SP Angel Corporate Finance LLP +44 (0) 20 3470 0470

Nominated Adviser and Joint Broker

Stuart Gledhill

Richard Hail

Stephen Wong

Brandon Hill Capital +44 (0) 20 3463 5061

Joint Broker

Oliver Stansfield

Notes to editors:

About Lansdowne

Lansdowne Oil & Gas (LOGP.LN) is a North Celtic Sea focused,

oil and gas exploration and appraisal company quoted on the AIM

market and head quartered in Dublin.

For more information on Lansdowne, please refer to

www.lansdowneoilandgas.com .

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

MSCEANAKFEPEEFA

(END) Dow Jones Newswires

February 17, 2020 02:00 ET (07:00 GMT)

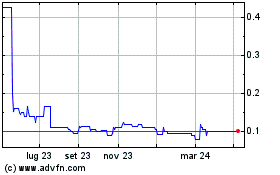

Grafico Azioni Lansdowne Oil & Gas (LSE:LOGP)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni Lansdowne Oil & Gas (LSE:LOGP)

Storico

Da Apr 2023 a Apr 2024