TIDMLTHM

RNS Number : 5989R

Latham(James) PLC

01 July 2020

James Latham PLC

("James Latham" or the "Company")

Final Results

Chairman's statement

I am pleased to report good trading results for the financial

year to 31 March 2020

Revenue for the financial year to 31 March 2020 was GBP247.1m,

up 5.1% on last year's GBP235.1m. Like for like volumes increased

by 1.8%, with the growth mainly on delivered business from our own

warehouses, with a reduction in direct volumes shipped from the

ports or from the manufacturers. The cost price of our products

steadily fell throughout the year, ending the year 3.3% lower than

the comparative twelve months. Abbey Wood in Ireland has been

successfully integrated into the Lathams business and is now

starting to provide a useful contribution to the Group's

results.

Gross profit for the financial year to 31 March 2020 was 17.6%

compared with 17.2% in the previous financial year. This figure

includes warehouse costs, which have increased due to extended

working hours with four of our depots now working 24 hours a day

and further investment in our racking systems.

Profit before tax is GBP15.7m, up GBP0.4m on last year's

GBP15.3m. Profit after tax for the year is GBP12.5m, up from last

year's GBP12.4 m

Earnings per share is 63.1p (2019: 63.1p). Adjusted earnings per

ordinary share (see Note 5), adjusted for the effect on the

introduction of IFRS 16 on Leasing this year and the previous

year's results of the property profit and the one off cost relating

to Guaranteed Minimum Pensions were 64.0p (2019: 61.6p) an increase

of 3.9%.

As at 31 March 2020 net assets have increased to GBP104.3m

(2019: GBP98.0m). We have adopted IFRS 16 on Leasing in these

results, which has had an insignificant effect on profit before.

Non current assets have increased by GBP7.5m from 31 March 2019.

GBP4.9m of this increase relates to the creation of a new asset

class of Right of Use Assets relating to the introduction of IFRS

16 on Leasing. In addition we acquired Dresser Mouldings (Rochdale)

Ltd for cash consideration of GBP1.0m, and have also invested

GBP1.0m in redeveloping the Gateshead warehouse. Inventory levels

have increased to GBP44.3m from GBP42.4m last year. Trade

receivables at the year end were GBP4.4m higher than the previous

year as we saw a reduction in cash received at the end of March due

to the COVID-19 pandemic. However trade receivables have now

returned close to normal levels. There was another low bad debt

charge of 0.20% of turnover for the year. Cash and cash equivalents

of GBP17.0m (2019: GBP15.5m), remain strong with good cash flows

from operating activities.

At 31 March 2020 the deficit of the defined benefit scheme under

IAS19 (revised) was GBP11.8m, up GBP3.1m compared with GBP8.7m last

year. The calculation of the pension deficit remains very sensitive

to changes in assumptions, and was affected by the reduction in

market values of investments at the end of March.

Final dividend

The Board has declared a final dividend of 10.0p per Ordinary

Share (2019: 12.9p). The dividend is payable on 4 September 2020 to

ordinary shareholders on the Company's register at close of

business on 7 August 2020. The ex-dividend date will be 6 August

2020. The total dividend per ordinary share of 15.5p for the year

(2019: 17.9p) is covered 4.1 times by earnings (2019: 3.5 times).

The board considers this level of dividend to be prudent given the

balance between the good results achieved in the year to 31 March

2020 and the difficult market conditions experienced during the

first quarter of the current financial year caused by the COVID-19

pandemic.

Current and future trading

The board responded quickly and decisively to protect the

business and the employees from COVID-19, with quick action to

reduce costs where possible, manage the stock and preserve cash.

COVID-19 has had a considerable affect on the start of our trading

year. We remained open at most of our distribution sites to support

NHS projects and other essential services, as well as servicing our

customers that managed to remain open. April was a particularly

challenging month with sales at 40% of April 2019 sales. We have

seen more customers coming back to work throughout May, with

positive trends on numbers of orders taken and total number of

trading customers, with sales at 60% of May 2019 sales. This

positive trend is continuing in June, and sales are expected to be

80% of June 2019 sales. I have been incredibly pleased at how our

staff have managed to work through this challenging period, and the

resilience of the business. The skill of our senior staff with the

support of the board has undoubtedly limited the negative impact of

COVID-19 on the business. The full impact of the virus and the

effect on the wider economy are impossible to predict at this

stage.

Development Strategy

The board believes that there are plenty of opportunities to

develop and grow our business. The strength of the business will

allow us to avoid the worst of any potential downturn in the

economy and seize on any opportunities to further develop the

business. We will continue to look to grow the business through any

suitable acquisitions to support key market sectors and also

identify new products in market sectors where we are focussing our

efforts. We will continue to invest in our warehouses and extend

the working day at our depots to ensure that we meet the future

delivery needs of our existing and new customers. Our focus will be

on completing the Gateshead site development, and a significant

racking project at our Thurrock facility. We have also fast tracked

our on line presence project, and the use of technology as we look

to drive more efficiencies into our business, to ensure we are in

the best place possible to deal with the future. There are clearly

challenges as we enter a post Brexit and COVID-19 world, but the

board remains confident that the Company is in a position of

strength which will allow us to plan for a positive future.

Nick Latham

Chairman

30 June 2020

This announcement contains inside information for the purposes

of Article 7 of the Market Abuse Regulation (EU) No 596/2014.

For further information please visit www.lathams.co.uk or

contact:

James Latham plc Tel: 01442 849 100

Nick Latham, Chairman

David Dunmow, Finance Director

SP Angel Corporate Finance LLP

Matthew Johnson / Charlie Bouverat (Corporate Tel: 0203 470 0470

Finance)

Abigail Wayne (Corporate Broking)

JAMES LATHAM PLC

CONSOLIDATED INCOME STATEMENT

For the year to 31 March 2020

Audited Audited

--------------------------------------- ----------------- -----------------

Year to 31 March Year to 31 March

2020 2019

--------------------------------------- ----------------- -----------------

GBP000 GBP000

--------------------------------------- ----------------- -----------------

Revenue 247,100 235,132

Cost of sales (including warehouse

costs) (203,656) (194,686)

--------------------------------------- ----------------- -----------------

Gross profit 43,444 40,446

Selling and distribution costs (19,251) (18,082)

Administrative expenses (8,196) (7,896)

Operating Profit 15,997 14,468

Profit on disposal of property - 1,052

Finance income 82 71

Finance costs (417) (256)

--------------------------------------- ----------------- -----------------

Profit before tax 15,662 15,335

Tax expense (3,181) (2,913)

--------------------------------------- ----------------- -----------------

Profit after tax attributable

to owners of the parent company 12,481 12,422

======================================= ================= =================

Earnings per ordinary share (basic) 63.1p 63.1p

======================================= ================= =================

Earnings per ordinary share (diluted) 63.0p 63.0p

======================================= ================= =================

All results relate to continuing operations.

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

For the year to 31 March 2020

Audited Audited

------------------------------------------- -------- ---------

2020 2019

------------------------------------------- -------- ---------

GBP000 GBP000

------------------------------------------- -------- ---------

Profit after tax attributable to owners

of the parent company 12,481 12,422

Other comprehensive income

Actuarial loss on defined benefit pension

scheme (4,823) (1,360)

Deferred tax relating to components

of other comprehensive income 916 314

Foreign translation gain/(charge) 80 (31)

------------------------------------------- -------- ---------

Other comprehensive income for the year,

net of tax (3,827) (1,077)

------------------------------------------- -------- ---------

Total comprehensive income attributable

to owners of the parent company 8,654 11,345

=========================================== ======== =========

JAMES LATHAM PLC COMPANY REGISTRATION NUMBER 65619

CONSOLIDATED BALANCE SHEET

At 31 March 2020

Audited Audited

--------------------------------------- ---------- ---------

2020 2019

--------------------------------------- ---------- ---------

GBP000 GBP000

--------------------------------------- ---------- ---------

Assets

Non-current assets

Goodwill 872 523

Other intangible assets 1,822 1,989

Property, plant and equipment 35,952 34,159

Right-of-use-assets 4,895 -

Deferred tax asset 2,258 1,577

Total non-current assets 45,799 38,248

Current assets

Inventories 44,288 42,350

Trade and other receivables 47,046 42,613

Cash and cash equivalents 16,950 15,541

Total current assets 108,284 100,504

--------------------------------------- ---------- ---------

Total assets 154,083 138,752

--------------------------------------- ---------- ---------

Current liabilities

Lease liabilities 1,178 -

Trade and other payables 28,686 27,113

Tax payable - 1,193

--------------------------------------- ---------- ---------

Total current liabilities 29,864 28,306

Non-current liabilities

Interest bearing loans and borrowings 592 597

Lease liabilities 3,857 -

Retirement and other benefit

obligation 11,812 8,714

Other payables 392 413

Deferred tax liabilities 3,289 2,762

--------------------------------------- ---------- ---------

Total non-current liabilities 19,942 12,486

--------------------------------------- ----------

Total liabilities 49,806 40,792

--------------------------------------- ---------- ---------

Net assets 104,277 97,960

======================================= ========== =========

Capital and reserves

Issued capital 5,040 5,430

Share-based payment reserve 25 259

Own shares (619) (923)

Capital reserve 398 3

Retained earnings 99,433 93,191

--------------------------------------- ---------- ---------

Total equity attributable to

equity shareholders of the parent

company 104,277 97,960

======================================= ========== =========

The Company's profit for the year was GBP2,971,000 (2019:

GBP679,000).

JAMES LATHAM PLC

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

Attributable to the owners of the parent company

Share-based

Issued payment Own shares Capital Retained Total

capital reserve reserve earnings Equity

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Balance at 1 April

2018 - audited 5,040 184 (529) 3 85,091 89,789

Profit for the year - - - - 12,422 12,422

Other comprehensive

income:

Actuarial loss on

defined benefit pension

scheme - - - - (1,360) (1,360)

Deferred tax relating

to components of other

comprehensive income - - - - 314 314

Foreign translation

charge - - - - (31) (31)

---------- ------------ ------------- ---------- ----------- ---------

Total comprehensive

income for the year - - - - 11,345 11,345

Transactions with

owners:

Dividends - - - - (3,363) (3,363)

Exercise of options - (19) - - 19 -

Deferred tax on share

options - - - - 31 31

Transfer of treasury

shares - - (82) - 82 -

Write down on conversion

of ESOP shares - - 14 - (14) -

Purchase of preference

shares 390 - (478) - - (88)

Change in investment

in ESOP shares - - 152 - - 152

Share-based payment

expense - 94 - - - 94

---------- ------------ ------------- ---------- ----------- ---------

Total transactions

with owners 390 75 (394) - (3,245) (3,174)

Balance at 31 March

2019 - audited 5,430 259 (923) 3 93,191 97,960

Change in accounting

policy (IFRS16) - - - - 291 291

Deferred tax on IFRS

16 - - - - (55) (55)

As at 1 April 2019

(as restated) 5,430 259 (923) 3 93,427 98,196

Profit for the year - - - - 12,481 12,481

Other comprehensive

income:

Actuarial loss on

defined benefit pension

scheme - - - - (4,823) (4,823)

Deferred tax relating

to components of other

comprehensive income - - - - 916 916

Foreign translation

charge - - - - 80 80

---------- ------------ ------------- ---------- ----------- ---------

Total comprehensive

income for the year - - - - 8,654 8,654

Transactions with

owners:

Dividends - - - - (3,633) (3,633)

Exercise of options - (253) (261) - 1,463 949

Deferred tax on share

options - (45) - - - (45)

Purchase of preference

shares 5 - - - - 5

Cancellation of preference

share (395) - 478 395 (478) -

Change in investment

in ESOP shares - - 87 - - 87

Share-based payment

expense - 64 - - - 64

---------- ------------ ------------- ---------- ----------- ---------

Total transactions

with owners (390) (234) 304 395 (2,648) (2,573)

Balance at 31 March

2020 - audited 5,040 25 (619) 398 99,433 104,277

========== ============ ============= ========== =========== =========

JAMES LATHAM PLC

CONSOLIDATED CASH FLOW STATEMENT

For the year to 31 March 2020

Audited Audited

--------------------------------------- -------- --------

2020 2019

--------------------------------------- -------- --------

GBP000 GBP000

--------------------------------------- -------- --------

Net cash flow from operating

activities

Cash generated from operations 13,528 10,115

Interest paid (3) (8)

Income tax paid (3,851) (2,651)

--------------------------------------- -------- --------

Net cash inflow from operating

activities 9,674 7,456

--------------------------------------- -------- --------

Cash flows from investing activities

Interest received and similar

income 82 71

Acquisition of businesses net

of cash and cash equivalents

acquired (578) (1,604)

Purchase of property, plant

and equipment (3,886) (2,362)

Proceeds from sale of property,

plant and equipment 152 1,743

Net cash outflow from investing

activities (4,230) (2,152)

--------------------------------------- -------- --------

Cash flows from financing activities

Sale of treasury shares 1,036 152

Purchase of treasury shares - (478)

Lease liability payments (1,390) -

Equity dividends paid (3,633) (3,363)

Preference dividend paid (48) (63)

Net cash outflow from financing

activities (4,035) (3,752)

--------------------------------------- -------- --------

Increase in cash and cash equivalents

for the year 1,409 1,552

======================================= ======== ========

Cash and cash equivalents at

beginning of the year 15,541 13,989

--------------------------------------- -------- --------

Cash and cash equivalents at

end of the year 16,950 15,541

======================================= ======== ========

JAMES LATHAM PLC

Notes to the audited preliminary financial information

1. The preliminary financial information presented in this

report is audited and has been prepared in accordance with the

recognition and measurement principles of International Financial

Reporting Standards ('IFRS') as adopted by the EU set out in the

Group accounts for the years ended 31 March 2019 and 31 March 2020,

except for IFRS 16 'Leases" in respect of 31 March 2019, and does

not contain all the information to be disclosed in financial

statements prepared in accordance with IFRS.

2. The directors propose a final dividend of 10.0p per ordinary

share, which will absorb GBP1,990,000 (2019: 12.9p absorbing

GBP2,537,000), payable on 4 September 2020 to shareholders on the

Register at the close of business on 7 August 2020. The ex-dividend

date is 6 August 2020.

The figures for the year ended 31 March 2019 and as at 31 March

2020 have been extracted from the audited statutory accounts for

that year. The statutory accounts for the year ended 31 March 2020

have yet to be delivered to the Registrar of Companies and have

been prepared in accordance with IFRS as adopted by the EU and

those parts of the Companies Act 2006 that remain applicable to

companies reporting under IFRS. The preliminary financial

information does not constitute statutory accounts within the

meaning of Section 434 of the Companies Act 2006, and does not

contain all the information required to be disclosed in a full set

of IFRS financial statements.

Statutory accounts for the year ended 31 March 2020 will be

delivered to the Registrar of Companies and sent to Shareholders

shortly. The Annual Report and Accounts may also be viewed in due

course on James Latham plc's website at www.lathams.co.uk

The audit report on the statutory financial statements for the

year ended 31 March 2020 is unqualified and does not include

reference to any matters to which the auditor drew attention by way

of emphasis without qualifying the report and does not contain any

statement under Section 498(2) or (3) of the Companies Act

2006.

Statutory accounts for the year ended 31 March 2019 have been

filed with the Registrar of Companies. The auditor's report on

those accounts was unqualified and did not include reference to any

matters to which the auditor drew attention by way of emphasis

without qualifying the report and did not contain a statement under

section 498(2) and (3) of the Companies Act 2006.

3. This announcement was approved and authorised for issue by

the Board of Directors on 30 June 2020.

4. Net cash flow from operating activities

Year to Year to 31

31 March March 2019

2020 audited audited

GBP000 GBP000

Profit before tax 15,662 15,335

Adjustment for finance income and cost 335 185

Depreciation, amortisation and impairment 3,790 2,036

Profit on disposal of property, plant

and equipment (121) (1,079)

Increase in inventories (1,659) (2,282)

Increase in receivables (3,963) (1,105)

Increase)/(decrease) in payables 1,244 (1,825)

Retirement benefits non cash amounts (1,904) (1,213)

Translation non cash amounts 80 (31)

Share-based payments non cash amounts 64 94

Cash generated from operations 13,528 10,115

-------------- ------------

5. Earnings per ordinary share is calculated by dividing the net

profit for the period attributable to ordinary shareholders by the

weighted average number of ordinary shares outstanding during the

period.

Year to Year to 31

31 March March 2019

2020 audited audited

GBP000 GBP000

Net profit attributable to ordinary shareholders 12,481 12,422

GMP equalisation - 746

Profit on disposal of property - (1,052)

IFRS16 Leases 186 -

------------------- -------------------

Net profit attributable to ordinary shareholders

adjusted for GMP equalisation cost, profit

on disposal of property and IFRS16 Leases 12,667 12,116

=================== ===================

Number '000 Number '000

Weighted average share capital 19,781 19,674

Add: diluted effect of share capital options

issued 23 28

Weighted average share capital for diluted

earnings per ordinary share calculation 19,804 19,702

------------------- -------------------

The earnings per share figure is shown on the Income statement.

In the previous year, the earnings were stated after the profit on

a disposal of property and GMP equalisation and in the current

year, we have the effect of IFR16 leases. The figures below show

the earnings per share if these 3 items were excluded to show a

comparable figure:

Earnings per ordinary share (basic, excluding

GMP equalisation, profit on disposal of

property and IFR16 Leases) 64.0p 61.6p

====== ======

Earnings per ordinary share (diluted,

excluding GMP equalisation, profit on

disposal of property and IFRS 16 Leases) 64.0p 61.5p

====== ======

6. The Annual General Meeting of James Latham plc will be held

at Unit 1 Swallow Park, Finway Road, Hemel Hempstead, Herts, HP2

7QU on 2 September 2020 at 12.30pm.

Impact of COVID-19

Due to the current restrictions imposed due to the COVID-19

pandemic, the Annual General Meeting this year will not be open for

shareholders to attend in person. To ensure that your vote counts,

please submit your proxy form appointing the Chairman as your

proxy. Questions can be submitted in advance to plc@lathams.co.uk

and these will be answered during the meeting. Full voting details

and answers to questions will be posted on the Investor Page at

www.lathams.co.uk/investors .

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

FR FMMATMTAJBJM

(END) Dow Jones Newswires

July 01, 2020 02:00 ET (06:00 GMT)

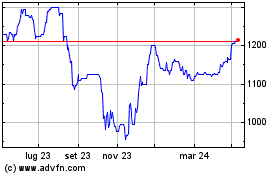

Grafico Azioni Latham (james) (LSE:LTHM)

Storico

Da Mar 2024 a Apr 2024

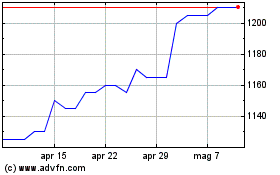

Grafico Azioni Latham (james) (LSE:LTHM)

Storico

Da Apr 2023 a Apr 2024