TIDMLTHM

RNS Number : 3954G

Latham(James) PLC

25 November 2020

James Latham plc

("James Latham" or the "Company")

HALF YEARLY RESULTS FOR THE PERIODED 30 SEPTEMBER 2020

Chairman's statement

Unaudited results for the six months trading to 30 September

2020

Revenue for the six months ended 30 September 2020 was

GBP107.0m, down 14.8% on GBP125.6m for the same period last year.

Revenue in Q2 was 5.3% up on the same period last year highlighting

the strong recovery from Q1 which as previously reported was

significantly impacted by the first lockdown. Month on month trends

continue to improve with September being ahead of the same month

last year. We have had strong volume growth in both delivered and

direct commodity panel products. Cost prices on both timber and

panels have been slowly rising during the period. All sites have

coped very well with the local lockdowns and all the other

challenges that they have faced during this unprecedented

period.

Gross profit, which includes warehouse costs, for the six month

period ended 30 September 2020 was 16.9% compared with 17.4% in the

comparative six months. Overheads have been very well controlled

during the 6 months.

Operating profit was GBP6.5m, down 22.7% on the GBP8.5m profit

for the same period last year. Profit before tax was GBP6.3m

compared with GBP8.3m for the same period last year. Earnings per

ordinary share were 25.6p (2019: 33.8 p) a decrease of 24.3%.

As at 30 September 2020 net assets are GBP109.1m (2019:

GBP97.6m). Stock volume levels have remained stable throughout the

six months, although the strong sales at the end of Q2 resulted in

a temporary reduction in our inventory values. Trade receivables

have continued to show good debtor day figures, with bad debts at a

very low figure. Cash and cash equivalents of GBP26.1m (2019:

GBP16.5m) remain strong due to the reduced inventory figures and

also good collections of our trade receivables. We continue to take

advantage of additional early settlement discount opportunities

with our suppliers.

These positive results are a good indication of the strength of

our business model, and the importance of having a diversified

customer base.

The calculation of the pension deficit remains very sensitive to

changes in assumptions, and the pension deficit under IAS19 is

calculated as decreasing from GBP11.8m at 31 March 2020 to GBP8.8m

at 30 September 2020. This is largely due to a recovery in the plan

asset valuations, although discount rates continue to fall which

add to the deficit.

Interim dividend

The Board has declared an increased interim dividend of 5.7p per

Ordinary Share (2019: 5.5p), which is covered 4.5 times (2019: 6.1

times). The dividend is payable on 29 January 2021 to ordinary

shareholders on the Company's Register at close of business on 4

January 2021. The ex-dividend date will be 31 December 2020.

Current and future trading

The second half of 2020/21 has started strongly with margins

slightly ahead of the previous period. We are seeing significant

increased volumes of commodity products, but reduced volumes of

some of our added value panel products which predominantly go into

market sectors that have been adversely affected by the COVID-19

pandemic, such as hospitality, exhibitions and shopfitting.

Purchase prices of many of our commodity panel products continue to

rise with some extended lead times. The majority of our customers

are busy, and we remain confident that we will have a strong end to

our financial year. The investment in our Gateshead facility is now

complete, and we are mid-way through a large racking project at our

Thurrock facility which will improve the stock holding and

efficiency of the warehouse. This project will be completed by end

March 2021.

We have been working for some time in preparation for Brexit and

have acted on the risks to our business. Our supply chain team have

been working closely with suppliers and intermediaries and have

identified the best routes to market, and we have increased stock

levels of those products most at risk of disruption.

We remain committed to continued investment in the business,

both in our existing depots and in looking for other opportunities

to grow our market position.

Nick Latham

Chairman

25 November 2020

This announcement contains inside information for the purposes

of Article 7 of the Market Abuse Regulation (EU) No 596/2014.

For further information please visit www.lathams.co.uk or

contact:

James Latham plc Tel: 01442 849 100

Nick Latham, Chairman

David Dunmow, Finance Director

SP Angel Corporate Finance LLP

Matthew Johnson / Charlie Bouverat (Corporate Tel: 0203 470 0470

Finance)

Abigail Wayne (Corporate Broking)

JAMES LATHAM PLC

CONSOLIDATED INCOME STATEMENT

For the six months to 30 September 2020

Six months Six months Year to

to 30 Sept. to 30 Sept. 31 March

2020 unaudited 2019 unaudited 2020 audited

GBP000 GBP000 GBP000

Revenue 107,034 125,609 247,100

Cost of sales (including warehouse costs) (88,985) (103,726) (203,656)

Gross profit 18,049 21,883 43,444

Selling and distribution costs (7,449) (9,703) (19,251)

Administrative expenses (4,056) (3,712) (8,196)

Operating profit 6,544 8,468 15,997

Finance income 5 46 82

Finance costs (236) (198) (417)

Profit before tax 6,313 8,316 15,662

Tax expense (1,215) (1,630) (3,181)

Profit after tax attributable to owners

of the parent company 5,098 6,686 12,481

Earnings per ordinary share (basic) 25.6p 33.8p 63.1p

Earnings per ordinary share (diluted) 25.6p 33.8p 63.0p

============================================== ================ ================ ==============

All results relate to continuing operations.

JAMES LATHAM PLC

CONSOLIDATED STATEMENT OF COMPREHENSIVE

INCOME

For the six months to 30 September 2020

Six months Six months Year to

to 30 Sept. to 30 Sept. 31 March

2020 unaudited 2019 unaudited 2020 audited

GBP000 GBP000 GBP000

---------------------------------------------- ---------------- ---------------- --------------

Profit after tax 5,098 6,686 12,481

Other Comprehensive income

Actuarial gains/(loss) on defined benefit

pension scheme 1,923 (6,767) (4,823)

Deferred tax relating to components of other

comprehensive income (365) 1,150 916

Foreign translation credit 23 12 80

---------------------------------------------- ---------------- ---------------- --------------

Other comprehensive income for the period,

net of tax 1,581 (5,605) (3,827)

---------------------------------------------- ---------------- ---------------- --------------

Total comprehensive income, attributable

to owners of the parent company 6,679 1,081 8,654

============================================== ================ ================ ==============

JAMES LATHAM PLC

CONSOLIDATED BALANCE SHEET

At 30 September 2020

As at 30 As at 30 As at 31

Sept. 2020 Sept. 2019 March 2020

unaudited unaudited audited

GBP000 GBP000 GBP000

ASSETS

Non-current assets

Goodwill 872 523 872

Intangible assets 1,738 1,905 1,822

Property, plant and equipment 35,477 34,581 35,952

Right-of-use-asset 4,629 4,344 4,895

Deferred tax asset 1,694 2,560 2,258

Total non-current assets 44,410 43,913 45,799

Current assets

Inventories 41,360 42,501 44,288

Trade and other receivables 44,764 45,697 47,046

Cash and cash equivalents 26,159 16,538 16,950

Total current assets 112,283 104,736 108,284

Total assets 156,693 148,649 154,083

------------------------------------------- ------------ ------------ ------------

Current liabilities

Lease liabilities 1,242 1,143 1,178

Trade and other payables 30,122 28,321 28,686

Current tax payable - 86 -

------------------------------------------- ------------ ------------ ------------

Total current liabilities 31,364 29,550 29,864

Non-current liabilities

Interest bearing loans and borrowings 592 592 592

Lease liabilities 3,579 3,252 3,857

Retirement and other benefit obligation 8,774 14,637 11,812

Other payables - 180 392

Deferred tax liabilities 3,264 2,856 3,289

------------------------------------------- ------------ ------------ ------------

Total non-current liabilities 16,209 21,517 19,942

Total liabilities 47,573 51,067 49,806

Net assets 109,120 97,582 104,277

=========================================== ============ ============ ============

Capital and reserves

Issued capital 5,040 5,040 5,040

Share-based payment reserve 96 89 25

Own shares (542) (891) (619)

Capital reserve 398 398 398

Retained earnings 104,128 92,946 99,433

------------------------------------------- ------------ ------------ ------------

Total equity attributable to shareholders

of the parent company 109,120 97,582 104,277

=========================================== ============ ============ ============

JAMES LATHAM PLC

CONSOLIDATED CASH FLOW STATEMENT

For the six months to 30 September 2020

Six months Six months Year to

to 30 Sept to 30 Sept 31 March

2020 unaudited 2019 unaudited 2020 audited

GBP000 GBP000 GBP000

------------------------------------------------ ---------------- ---------------- --------------

Net cash flow from operating activities

Cash generated from operations 13,565 8,040 13,528

Interest paid - (3) (3)

Income tax paid (950) (2,552) (3,851)

Net cash inflow from operating activities 12,615 5,485 9,674

------------------------------------------------ ---------------- ---------------- --------------

Cash flows from investing activities

Interest received and similar income 5 46 82

Acquisition of businesses net of cash acquired - - (578)

Purchase of property, plant and equipment (785) (1,512) (3,886)

Proceeds from sale of property, plant and

equipment 6 119 152

Net cash outflow from investing activities (774) (1,347) (4,230)

------------------------------------------------ ---------------- ---------------- --------------

Cash flows before financing activities

Sale of treasury shares - - 1,036

Purchase of treasury shares - (5) -

Lease liability payments (621) (572) (1,390)

Equity dividends paid (1,987) (2,540) (3,633)

Preference dividend paid (24) (24) (48)

Cash outflow from financing activities (2,632) (3,141) (4,035)

------------------------------------------------ ---------------- ---------------- --------------

Increase in cash and cash equivalents for

the period 9,209 997 1,409

================================================

Cash and cash equivalents at beginning of

the period 16,950 15,541 15,541

Cash and cash equivalents at end of the

period 26,159 16,538 16,950

================================================ ================ ================ ==============

JAMES LATHAM PLC

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

Attributable to owners of the

parent company

Share-based

Issued payment Own Capital Retained Total

capital reserve shares reserve earnings equity

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

As at 1 April 2019 (audited) 5,040 259 (923) 3 93,427 98,177

Profit for the period - - - - 6,686 6,686

Other comprehensive income:

Actuarial loss on defined

benefit

pension scheme - - - - (6,767) (6,767)

Deferred tax relating to

components

of other comprehensive income - - - - 1,150 1,150

Foreign translation charge - - - - 12 12

--------------------------------- ------------ ---------------- ----------- ----------- ------------- ----------

Total comprehensive income for

the period - - - - 1,081 1,081

Transaction with owners:

Dividends - - - - (2,540) (2,540)

Exercise of options - (181) (520) - 1,488 787

Deferred tax on share options - (32) - - (32) (64)

Purchase of preference shares 5 - - - - 5

Cancellation of preference

shares (395) - 478 395 (478) -

Change in investment in ESOP

shares - - 74 - - 74

Share-based payment expense - 43 - - - 43

--------------------------------- ------------ ---------------- ----------- ----------- ------------- ----------

Total transactions with owners (390) (170) 32 395 (1,562) (1,676)

--------------------------------- ------------ ---------------- ----------- ----------- ------------- ----------

Balance at 30 September 2019

(unaudited) 5,040 89 (891) 398 92,946 97,582

Profit for the period - - - - 5,795 5,795

Other comprehensive income:

Actuarial gain on defined

benefit

pension scheme - - - - 1,944 1,944

Deferred tax relating to

components

of other comprehensive income - - - - (234) (234)

Foreign translation charge - - - - 68 68

--------------------------------- ------------ ---------------- ----------- ----------- ------------- ----------

Total comprehensive income for

the period - - - - 7,573 7,573

Transactions with owners:

Dividends - - - - (1,093) (1,093)

Exercise of options - (72) 259 - (25) 162

Deferred tax on share options - (13) - - 32 19

Change in investment in ESOP

shares - - 13 - - 13

Share-based payment expense - 21 - - - 21

--------------------------------- ------------ ---------------- ----------- ----------- ------------- ----------

Total transactions with owners - (64) 272 - (1,086) (878)

--------------------------------- ------------ ---------------- ----------- ----------- ------------- ----------

Balance at 31 March 2020

(audited) 5,040 25 (619) 398 99,433 104,277

Profit for the period - - - - 5,098 5,098

Other comprehensive income:

Actuarial gain on defined

benefit

pension scheme - - - - 1,923 1,923

Deferred tax relating to

components

of other comprehensive income - - - - (365) (365)

Foreign translation charge - - - - 23 23

Total comprehensive income for

the period - - - - 6,679 6,679

Transactions with owners:

Dividends - - - - (1,987) (1,987)

Exercise of options - (8) - - 3 (5)

Change in investment in ESOP

shares - - 77 - - 77

Share-based payment expense - 79 - - - 79

--------------------------------- ------------ ---------------- ----------- ----------- ------------- ----------

Total transactions with owners - 71 77 - (1,984) (1,836)

--------------------------------- ------------ ---------------- ----------- ----------- ------------- ----------

Balance at 30 September 2020

(unaudited) 5,040 96 (542) 398 104,128 109,120

================================= ============ ================ =========== =========== ============= ==========

JAMES LATHAM PLC

NOTES TO THE HALF YEARLY REPORT

1. The results presented in this report are unaudited and they have

been prepared in accordance with the recognition and measurement principles

of International Financial Reporting Standards ('IFRS') as adopted

by the EU and on the basis of the accounting policies expected to

be used in the financial statements for the year ending 31 March 2021.

The half yearly report does not include all the disclosures that would

be required for full compliance with IFRS. The figures for the year

ended 31 March 2020 are extracted from the statutory accounts of the

group for that period.

2. The directors propose an interim dividend of 5.7p per ordinary

share which will absorb GBP1,133,000 (2019: 5.5p absorbing GBP1,085,000),

payable on 29 January 2021 to shareholders on the Company's Register

at the close of business on 4 January 202. The ex-dividend date is

31 December 2020.

3. This half yearly report does not constitute statutory financial

accounts within the meaning of section 434 of the Companies Act 2006.

The statutory accounts for the year ended 31 March 2020 were filed

with the Registrar of Companies. The audit report on those financial

statements was not qualified and did not contain a reference to any

matters to which the auditor drew attention by way of emphasis without

qualifying the report and did not contain a statement under section

498 (2) or (3) of the Companies Act 2006. The half yearly report has

not been audited by the Company's auditor.

4. Earnings per ordinary share is calculated by dividing the net profit

for the period attributable to ordinary shareholders by the weighted

average number of ordinary shares outstanding during the period.

Six months Six months Year to

to 30 Sept to 30 Sept 31 March

2020 unaudited 2019 unaudited 2020 audited

GBP000 GBP000 GBP000

Net profit attributable to ordinary shareholders 5,098 6,686 12,481

Number '000 Number '000 Number

'000

Weighted average share capital 19,876 19,759 19,781

Add: diluted effect of share capital options

issued 26 33 23

Weighted average share capital for diluted

earnings per ordinary share calculation 19,902 19,792 19,804

---------------- ---------------- --------------

5. Net cash flow from operating activities

Six months Six months Year to

to 30 Sept to 30 Sept 31 March

2020 unaudited 2019 unaudited 2020 audited

GBP000 GBP000 GBP000

Profit before tax 6,313 8,316 15,662

Adjustment for finance income and expenditure 231 152 335

Depreciation and amortisation 2,017 1,797 3,790

Profit on disposal of property, plant

and equipment (6) (119) (121)

Increase in inventories 2,928 (151) (1,659)

Increase in receivables 2,193 (3,084) (3,963)

Increase/(decrease) in payables 962 1,162 1,244

Own shares non cash amounts 77 853 -

Retirement benefits non cash amounts (1,247) (941) (1,904)

Translation non cash amounts 23 12 80

Share-based payments non cash amounts 74 43 64

Cash generated from operations 13,565 8,040 13,528

---------------- ---------------- --------------

6. Copies of this statement will be posted on our website, www.lathams.co.uk

. A copy can be emailed or posted upon application to the Company

Secretary, James Latham plc, Unit 3 Swallow Park, Finway Road Hemel

Hempstead, Herts, HP2 7QU, or by email to plc@lathams.co.uk

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR FEUEFLESSEEF

(END) Dow Jones Newswires

November 25, 2020 02:00 ET (07:00 GMT)

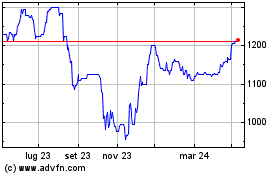

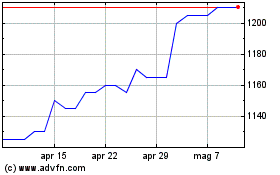

Grafico Azioni Latham (james) (LSE:LTHM)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni Latham (james) (LSE:LTHM)

Storico

Da Apr 2023 a Apr 2024