TIDMLWDB

RNS Number : 4291Q

Law Debenture Corp PLC

26 February 2021

The Law Debenture Corporation p.l.c.

26 February 2021

Strong overall performance with 5.8% increase in full year

dividend

The Law Debenture Corporation p.l.c. ("Law Debenture") today

published its results for the year ended 31 December 2020.

Group Highlights:

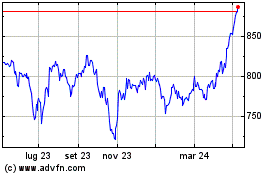

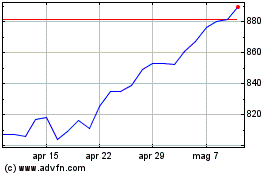

-- Share price total return [1] for 2020 of 12.9%, outperforming

the FTSE Actuaries All-Share Index by 22.7%

-- Continued strong performance from the Independent

Professional Services business (IPS) supports dividend growth

-- GBP20m acquisition of UK company secretarial business from

Eversheds Sutherland (International) LLP ("CSS"), which completed

at the end of January 2021 and has not been factored into the

financial statements as at 31 December 2020

-- Continued low ongoing charges (0.55%), compared to the industry average of 1.02% [2]

-- GBP10,000 invested in Law Debenture ten years ago would be

worth GBP27,746 as at 31 December 2020 [3]

Dividend Highlights:

-- 2020 FY dividends increased by 5.8% to 27.5 pence per ordinary share (2019: 26.0p)

-- Dividend yield of 3.8% [4] , Q4 dividend of 8.00 pence per ordinary share

-- Transitioned to quarterly dividends, creating greater

regularity and predictability around dividend payments

Investment Highlights:

-- Net Asset Value (NAV) per share (with debt at par) grew 3.6% [5]

-- Moved to daily NAV publication from the start of August to increase transparency

-- Law Debenture has consistently outperformed its benchmark on

short- and longer-term performance measures

1 year 3 years 5 years 10 years

NAV total return debt at

par(5) 3.6% 15.6% 59.1% 147.8%

NAV total return debt at

fair value(5) 2.0% 13.2% 53.0% 134.7%

Share price total return 12.9% 24.3% 67.3% 174.8%

FTSE Actuaries All-Share

Index(3) (9.8)% (2.7)% 28.5% 71.9%

IPS Highlights:

-- Leading wholly-owned independent provider of professional

services which helps support dividend growth, a key differentiator

to other investment trusts

-- Revenue increase of 8.5% and earnings per share are up 9.5%

on prior period, reflecting consistent growth under new management

team, funding over a third of the increased 2020 full year

dividend

-- Fair value of the IPS business increased by 18.3% in 2020 to

GBP136.0m (2019 increase was 21%) [6]

Longer-Term Record:

-- 132 years of value creation for shareholders

-- 42 years of increasing or maintaining dividends to shareholders

-- 116.5% [7] increase in dividend over ten years

Commenting, Robert Hingley, Chairman, said:

"Law Debenture seeks to combine long-term capital growth and

steadily increasing income. In light of the Covid-19 pandemic, Law

Debenture has delivered a good performance in 2020, demonstrating

the advantages of its unique structure, which allows increased

flexibility in portfolio construction. Following the step change in

dividend in 2019, we are pleased again to propose to increase our

full year dividend at a time of widespread dividend cuts across the

market. This illustrates our continued resilience and strong

revenue reserves.

Our investment portfolio's long-term performance remains well

ahead of its benchmark and our IPS business has now delivered three

years of strong, high single-digit growth, despite some significant

macroeconomic headwinds. Long-term income sustainability is a key

priority and the Group's aim is to continue to deliver gradually

increasing dividend payments in excess of inflation over time."

Commenting, Denis Jackson, Chief Executive Officer, said:

"2020 was another successful year for Law Debenture with a share

price total return of 12.9%, outperforming its benchmark by 22.7%.

On behalf of the management team, I would like to express my

deepest gratitude to everyone for their incredible work through the

pandemic. Both the long and short-term performance of our

investment portfolio remains strong. We have an excellent

investment management team, who the Board is confident is well

placed to continue to position the equity portfolio for future

longer-term growth.

We are encouraged that IPS has delivered on its ambitions, with

a third year of high single digit earnings per share growth,

despite a challenging macroeconomic backdrop. Reflecting these

improved earnings and growth prospects, the valuation of our IPS

business increased by 18.3% in 2020.

We still see opportunities to grow revenue and earnings

significantly over time. IPS has attractive financial

characteristics and we continue to invest in talent and technology

to take advantage of material market share opportunities. We are

proud to welcome the CSS team and view the acquisition as both

strategically and financially compelling with attractive

longer-term revenue synergy opportunities. Ultimately, the

strengthening of IPS will facilitate our aim of producing long-term

capital growth and steadily increasing income for our

shareholders."

Investment Portfolio:

Our portfolio of investments is managed by James Henderson and

Laura Foll of Janus Henderson Investors.

Our objective is to achieve long-term capital growth in real

terms and steadily increasing income. The aim is to achieve a

higher rate of total return than the FTSE Actuaries All-Share Index

Total Return through investing in a diversified portfolio of

stocks.

Independent Professional Services:

We are a leading provider of independent professional services,

built on three excellent foundations: our Pensions, Corporate Trust

and Corporate Services businesses. We operate internationally, with

offices in the UK, New York, Ireland, Hong Kong, Delaware and the

Channel Islands.

Companies, agencies, organisations and individuals throughout

the world rely upon Law Debenture to carry out our duties with the

independence and professionalism upon which our reputation is

built.

Law Debenture +44 (0)20 7606 5451

Denis Jackson, Chief Executive denis.jackson@lawdeb.com

Officer hester.scotton@lawdeb.com

Hester Scotton, Chief Financial trish.houston@lawdeb.com

Officer

Trish Houston, Chief Operating

Officer +44 (0)20 7353 4200

lawdebenture@tulchangroup.com

Tulchan Communications (Financial

PR)

David Allchurch

Deborah Roney

Laura Marshall

(1) Source: Bloomberg.

(2) Ongoing charges are for the year ended 31 December 2020. Law

Debenture ongoing charges have been calculated based on data held

by Law Debenture. Industry average data was sourced from The

Association of Investment Companies (AIC) industry as at 31

December 2020. No performance related element to the fee.

(3) Calculated on a total return basis assuming dividend

re-investment between 31 December 2010 and 31 December 2020.

(4) Based on a closing share price of 723p as at 24 February

2021.

(5) NAV is calculated in accordance with the AIC methodology,

based on performance data held by Law Debenture including fair

value of the IPS business and long-term borrowings. NAV is shown

with debt measured at par and with debt measured at fair value.

(6) Increase in annual valuation of IPS business, excluding

change in surplus net assets.

(7) Calculated on total dividend payments in respect of

accounting periods ended 31 December 2010 to 31 December 2020.

ANNUAL FINANCIAL REPORT

YEARED 31 DECEMBER 2020 (AUDITED)

This is an announcement of the Annual Financial Report of The

Law Debenture Corporation p.l.c. as required to be published under

DTR 4 of the UKLA Listing Rules.

The Directors recommend a final dividend of 8.00p per share

making a total for the year of 27.50p. Subject to the approval of

shareholders, the final dividend will be paid on 15 April 2021 to

holders on the register of the record date of 12 March 2021 . The

annual financial report has been prepared in accordance with

International Financial Reporting Standards (IFRS) as adopted by

the European Union.

The financial information set out in this Annual Financial

Report does not constitute the Company's statutory accounts for

2019 or 2020. Statutory accounts for the years ended 31 December

2019 and 31 December 2020 have been reported on by the Independent

Auditor. The Independent Auditor's Reports on the Annual Report and

Financial Statements for 2019 and 2020 were unqualified, did not

draw attention to any matters by way of emphasis and did not

contain a statement under 498(2) or 498(3) of the Companies Act

2006.

Statutory accounts for the year ended 31 December 2019 have been

filed with the Registrar of Companies. The statutory accounts for

the year ended 31 December 2020 will be delivered to the Registrar

in due course.

The financial information in this Annual Financial Report has

been prepared using the recognition and measurement principles of

International Accounting Standards, International Financial

Reporting Standards and Interpretations adopted for use in the

European Union (collectively Adopted IFRSs). The accounting

policies adopted in this Annual Financial Report have been

consistently applied to all the years presented and are consistent

with the policies used in the preparation of the statutory accounts

for the year ended 31 December 2020. The principal accounting

policies adopted are unchanged from those used in the preparation

of the statutory accounts for the year ended 31 December 2019.

Financial summary

31 December 31 December

2020 2019

GBP000 GBP000 Change

-------------------------- ----------- ----------- --------

Net assets(1) 787,219 830,139 (5.2)%

Pence Pence

Net Asset Value (NAV) per

share at fair value(1) * 666.15 702.17 (5.1)%

Revenue return per share

Investment portfolio 12.12 22.18 (45.4)%

Independent professional

services 9.35 8.54 +9.5%

Group charges 0.09 (0.04) N/M

Group revenue return per

share 21.56 30.68 (29.7)%

Capital (loss)/return per

share (19.06) 79.27 N/M

Dividends per share 27.50 26.00 +5.8%

Share price 690.00 650.00 +6.2%

%%

Ongoing charges(3) * 0.55 0.48

Gearing(3) 95

Premium/(Discount)* 3.6 (7.4)

-------------------------- ----------- ----------- --------

Performance

1 year 3 years 5 years 10 years

% % % %

-------------------------------- ------ ------- ------- --------

NAV total return(2*) (with debt

at par) 3.6 15.6 59.1 147.8

NAV total return(2*) (with debt

at fair value) 2.0 13.2 53.0 134.7

FTSE Actuaries All-Share Index

Total Return(4) (9.8) (2.7) 28.5 71.9

Share price total return(4*) 12.9 24.3 67.3 174.8

Change in Retail Price Index(4) 0.9 6.4 13.0 29.4

-------------------------------- ------ ------- ------- --------

* Items marked "*" are considered to be alternative performance

measures and are described in more detail in the full annual report

and accounts.

The 2019 gearing has been restated to reflect the revised

approach to the calculation. The calculation is aligned with AIC

guidance and presents Net Debtors as a percentages of Shareholders'

Funds.

(1) Please refer below for calculation of net asset value.

(2) NAV is calculated in accordance with the AIC methodology,

based on performance data held by Law Debenture including fair

value of the IPS business and long-term borrowings. NAV is shown

with debt measured at par and with debt measured at fair value.

(3) Source: AIC. Ongoing charges are based on the costs of the

investment trust and include the Janus Henderson Investors'

management fee of 0.30% of NAV of the investment trust. There is no

performance related element to the fee. Gearing is described in the

strategic report below and in our alternative performance measures

in the full annual report. and accounts and includes a restatement

of 2019.

(4) Source: Refinitiv Datastream

Robert Laing's retirement

Robert Laing has informed the Board of his intention to retire

as a Non-Executive Director of the Company at the conclusion of its

Annual General Meeting, scheduled to take place on 7 April 2021.

The Board would like to thank Robert for his significant

contribution over the years and wish him every continued success

for the future.

Claire Finn will succeed Robert Laing as Chair of the

Remuneration Committee, with effect from 7 April 2021.

Chairman's statement

In what has been a challenging year, Law Debenture has shown

good resilience and I am delighted to introduce our 2020 annual

report.

Performance

2020 was a very difficult year. The impact of Covid-19 on our

lives has been substantial and has led to significant economic

volatility. Although the recent approval and rollout of new

vaccines usher in hope, it is difficult to assess how long this

period of instability will last.

However, the strength and capabilities of your Company have been

evident in these volatile times. During the period, our active

investment managers have demonstrated the value in their

stock-picking strategy. Despite the current backdrop, Law Debenture

saw a share price total return of 12.9% in 2020, outperforming the

FTSE Actuaries All-Share Index by 22.7%, which declined by 9.8%.

Over the same period, your Company's net asset value (with debt at

par) grew 3.6%(1) .

We are proud of this achievement and our ability to deliver on

our aim of producing long-term capital growth and steadily

increasing income for our shareholders.

The Board remains strongly focused on longer-term performance.

Over the three-year period to 31 December 2020, the NAV per share

(with debt at par) total return was up 15.6%, which compares

favourably with the 2.7% total return of the FTSE All-Share Index

and, over ten years, your Company saw a NAV per share total return

of 147.8%, outstripping the 71.9% total return for the FTSE

All-Share Index.

We are continuing to closely monitor and actively manage the

impact of Covid-19 on our portfolio and clients. We are also taking

the necessary precautions to protect both our employees and the

communities in which we operate.

Dividend

Law Debenture has a proud history of maintaining or increasing

its dividend payments for 42 years.

The Covid-19 crisis has highlighted the unique benefits that Law

Debenture's structure offers. The severe turbulence across global

markets in 2020 caused a large proportion of listed companies to

suspend or cut their dividends in order to protect their businesses

over the long-term. The stable income provided by our IPS business

means that we are not as dependent as many on the payouts from our

underlying investments, illustrating the trust's relative

resilience in a downturn. The IPS business has funded over a third

of our dividends to shareholders over the past eleven years. It

continues to demonstrate a good performance at a time of

significant market instability.

Furthermore, as with all investment trusts, we have the ability

to hold back a portion of our income received each year. These

revenue reserves help us to maintain or continue increasing our

dividends in times of economic distress. At the start of 2020, we

had one of the strongest reserves positions within the UK Equity

Income sector with a Group retained earnings of GBP62.5m(2) .

Understandably, having regular, reliable income is now more

important than ever for many of our shareholders. We listened to

feedback from our investors and in July, transitioned to a

quarterly dividend cycle, providing greater regularity around

dividend payments.

Subject to your approval, we propose paying a final dividend of

8 pence per ordinary share. The dividend will be paid on 15 April

2021 to holders on the register on the record date of 12 March

2021. This will provide shareholders with a total dividend of 27.5

pence per share for 2020 and represents a dividend yield of 3.8%

based on our share price of 723p pence on 24 February 2021.

As we have done this year, we will continue to listen and

respond to feedback, to deliver value for our shareholders.

Our investment portfolio

Our experienced investment management team, led by James

Henderson and Laura Foll, has left us well-positioned for future

longer-term growth. The investment managers' review below contains

a more detailed explanation from James and Laura on the portfolio's

performance.

Through these difficult times, your Board continues to support

the investment managers' strategy of investing in high-quality

companies at attractive valuations, which offer good total return

opportunities. With markets in their current state, the advantages

of Law Debenture's structure have been evident. The cash that we

generate from our IPS business has allowed James and Laura to avoid

potential value traps, as other income funds may be forced into a

narrower selection of stocks to maintain their own dividend

yield.

IPS business

Within the IPS business, our diverse revenue streams have shown

resilience in these difficult macroeconomic conditions.

During the period, we continued to deliver growth. Over the

course of 2020, IPS grew its revenues by 8.5% while earnings per

share grew by 9.5% compared to 2019. This is built on two previous

years of good performance and, over the last three years, revenues

have grown by 27.1% and earnings per share by 29.7% in total.

We maintained operational continuity throughout the Covid-19

pandemic and did not furlough any employees, implement any pay cuts

or make any redundancies related to Covid-19.

In December, we were pleased to announce the acquisition of a

company secretarial business line (CSS) from Konexo UK, a division

of Eversheds Sutherland (International) LLP, for GBP20 million. The

acquisition was an important step forward in supporting Law

Debenture's strategy. The expansion of our existing company

secretarial offering will enable us to grow in an attractive core

business and meet increasing customer needs in a specialised

market.

The Board believes that the IPS business continues to have good

prospects for further organic growth and we remain alert to

opportunities presented by acquisitions which meet Law Debenture's

strict financial and strategic criteria.

Environmental, Social and Governance (ESG) considerations

Robust governance, transparency and accountability are embedded

in our corporate values. Within our IPS business, utilities'

consumption and business travel are critical aspects of our

environmental and carbon footprint. In 2020, we were pleased to

move into a new 'green' office and adopt paperless ways of working

and we look forward to increasing our focus on ESG in 2021. The

Board will be conducting a full internal review on ESG and we plan

to monitor our emissions and evaluate carbon reduction targets,

step up employee engagement and ensure individual voices continue

to be heard. Many of our IPS activities constitute governance

services and we strive to maximise the potential of all our

colleagues and partners.

This year there were several new appointments within our senior

leadership, as covered later in this report. I am proud that we

have strong female representation across our management team. We

are working to ensure that ethnic diversity is appropriately

represented within our organisation, but we acknowledge that there

is more work to do. We are committed to progressing this further in

2021.

Our investment managers have an ESG policy of discussing any

material issues directly with their investee companies and

monitoring for improvement. They are not afraid to exit positions

where management fail to deliver expected improvements. In

addition, James and Laura are always looking for companies that are

actively seeking to address ESG issues. Holdings exposed to the

need to decarbonise the global economy have performed extremely

well during the year, including Ceres Power and ITM Power. ESG

issues are considered both directly by James and Laura, and also by

the experienced responsible investing team at Janus Henderson.

While they do have quantitative metrics on ESG available for the

portfolio, they are not at present explicitly screening companies

out on ESG ratings as the data quality is sometimes unreliable.

This will be kept under review.

The Board

I would like to thank our CEO, Denis Jackson, for his tireless

efforts during 2020, particularly in relation to the acquisition of

the CSS business and delivering another set of strong results for

your Company. The Board worked closely with our CEO to restructure

our Executive Leadership team. We were delighted to appoint Trish

Houston as our new COO and welcomed her as an Executive Director on

the Board on 2 September. She is a chartered accountant with almost

two decades of experience in financial services. Her in-depth

sector knowledge will be invaluable as we continue to make progress

against our stated growth strategy.

Katie Thorpe stood down as CFO in October and was succeeded by

Hester Scotton, who joined Law Debenture in 2019 as Head of

Internal Controls and Group Money Laundering and Reporting Officer.

The management transition has gone well, with both Hester and Trish

playing integral roles in our acquisition of CSS from Konexo UK. I

look forward to working with them both as we look to continue our

growth trajectory.

The Executive Leadership team was further strengthened with the

promotion of Kelly Stobbs to General Counsel.

After nine years on the Board, Robert Laing will be stepping

down as non-executive director and Chairman of the Remuneration

Committee. We would like to thank him for his significant

contribution to the Company over the years and wish him all the

best in the future.

Report and accounts

Every year we reflect on the format and disclosure of the

reports and accounts, striving to improve how we communicate with

shareholders. For 2020 you will notice we have presented additional

disclosure within our risk management section and simplified our

presentation of the remuneration report. We cannot ignore the

impact of Covid-19 and have set out in full within the Strategic

Report how we have responded to the pandemic to protect our key

stakeholders. We will continue to listen to shareholders and

analysts, reflecting on the areas they find important and evolving

our reporting to make sure we have the appropriate level of

transparency. We continue to develop an integrated ESG narrative

and see this as the start of a journey and will be looking to

continue to evolve our reporting into 2021 and beyond.

Looking forward

The Board is confident in the expertise of our investment

managers and their strategy of investing in high-quality companies

with strong competitive characteristics. Where the current

valuation does not reflect the long-term prospects, these companies

should continue to deliver attractive returns to shareholders.

The prospects of the IPS businesses remain positive due to their

strong market positions and good reputation, supported by strong

governance and regulatory drivers in the markets in which they

operate.

Overall, the Board is confident that your Company is positioned

to perform well in the long-term and our unique structure is well

placed to serve shareholders searching for a reliable and growing

income stream.

In closing, we are grateful to our people for their tremendous

work and efforts in delivering a good set of results in 2020 and

for their ongoing dedication to our business.

Robert Hingley

Chairman

25 February 2021

(1) NAV is calculated in accordance with the AIC methodology,

based on performance data held by Law Debenture including fair

value of the IPS business and long-term borrowings. NAV is shown

with debt measured at par and with debt measured at fair value.

(2) Investec Securities analysis from 30 March 2020, based on

Group Revenue Return, including professional services fees.

Calculated on an annualised basis on dividend payments in respect

of accounting years between 1 January 2011 and 31 December 2020.

Group retained earnings were GBP62.5m as at 1 January 2020.

Chief Executive Officer's review

Introduction

2020 was a year of significant turbulence and uncertainty, which

saw companies around the world being forced to adapt quickly and

nimbly to a continually changing environment. For the UK, the

macroeconomic uncertainty caused by Covid-19, combined with an

ongoing lack of clarity on its future relationship with the EU, our

largest export market, saw the fastest contraction in economic

activity of modern times.

However, our generally robust performance through the year

reflects well on our ability to withstand major operational and

market challenges. It is with great pride that I can say I now feel

more optimistic than ever about the longer-term growth trajectory

of Law Debenture, the strength of our business model and quality of

our investment managers, James Henderson and Laura Foll of Janus

Henderson Investors. As a UK Equity Income Trust, this Company

works to ensure shareholders can depend on us for regular, reliable

income. We aim to gradually increase income, by increasing dividend

payments in excess of inflation over time. 2020 was a year which

showcased how the unique combination of our equity portfolio and

leading global professional services business can drive value for

our stakeholders.

The Board at Law Debenture is focused on delivering for

stakeholders over the longer-term and we are proud to have

delivered a 117% increase in dividend over the last ten years with

42 years of increasing or maintaining dividends to shareholders.

This is all supported by the diversified nature of IPS revenues,

which funded around 35% of dividends for the trust over the

preceding 10 years.

At the AGM on 7 April 2020 when talking to the potential impact

of lockdown on the IPS business we stated that "we would get a

bloody nose, but overall the diversified mix of revenue streams

would serve us well". Almost one year on, that still feels like an

appropriate assessment. IPS business net revenues for the full year

were up 8.5% at GBP34.5m (2019: GBP31.8m) and earnings per share up

by 9.5% to 9.35p (2019: 8.54p). At the start of 2019 we committed

to shareholders that we would seek to grow our IPS business by mid

to high single digits. Given everything that 2020 threw at us, we

are proud to have been able to deliver growth within this targeted

range.

Our unique proposition as an investment trust is that the IPS

business allows James and Laura increased flexibility in portfolio

construction. This was highlighted in 2020. The combination of our

strong reserves position and the resilience of the IPS revenues

allowed our investment managers to maintain or increase exposures

to great companies whose dividends are challenged in the

short-term. Moreover, the strength of our diversified income

streams allowed us to invest into some emerging companies with

excellent long-term growth prospects who will not be paying

dividends for many years.

We have also invested in our central leadership team and

functions to provide greater support to the IPS business. As part

of this, I have built out our Executive Leadership team. I am

delighted to welcome Trish Houston as COO. During the year, Hester

Scotton was promoted to CFO and Kelly Stobbs was promoted to

General Counsel.

Net Revenue Net Revenue Net Revenue Growth

2018 2019 2020 2019/2020

DIVISION GBP000 GBP000 GBP000 %

------------------- ----------- ----------- ----------- ----------

Pensions 9,488 10,598 11,479 8.3%

Corporate trust 8,362 9,024 10,788 19.5%

Corporate services 11,734 12,167 12,226 0.5%

Total 29,584 31,789 34,493 8.5%

Taking each business in turn:

Corporate trust

Law Debenture was founded 132 years ago to be a bond trustee.

Our role as a bond trustee is to act, as a conduit, between the

issuer of a bond and the bondholders themselves. Typical duties for

us include being a point of contact between the issuer and its

bondholders and receiving certain financial, security and covenant

information from the issuer, for which we are usually paid an

inflation-linked annual fee throughout the lifetime of the bond. We

started 2020 with approximately GBP5m of annual revenues

contractually secured.

We also earn revenue from 'post issuance work', such as

documentation changes, which can arise over the life of the bond.

The revenue and risk profile can change substantially when a bond

issuer becomes stressed or a bond issue itself goes into default.

In these circumstances, the trustee may be required to perform a

material amount of extra work in order to optimise returns for all

bondholders. Such default scenarios may involve the business

incurring costs and can take many years to play out. That said,

given a favourable result, this may lead to incremental revenues

for the business. We do not wish any operating difficulties on any

of the issuers in our portfolio. Nonetheless, the

countercyclicality of post issuance work with the economic cycle

has been demonstrated time and again throughout our history.

Our corporate trust team are considered and careful in taking on

new business. This disciplined approach has produced consistent

profits for over a century. Our shareholders should understand that

short-term swings in our revenue (and in turn our profit) may

result from adopting a prudent approach to provisioning, as

specific long-term default situations work their way through to a

conclusion.

Market dynamics

Following the challenging operating environment in 2019,

remarkably the onset of Covid-19 and the actions of policy makers

provided a favourable operating environment for this business.

Primary market activity recovered well in 2020 and we were able

to capture our fair share of roles on new bond issues. Our main

market, Europe, had a particularly challenging 2019 with investment

banking revenues down 14%, but recovered well in 2020 with debt

issuance revenues up 21%.

Post issuance work increased materially as many businesses

around the world saw their revenues severely challenged, or in some

cases even evaporate completely, as economies went into 'lockdown'.

While we have seen some bankruptcies, policymakers have provided a

number of support mechanisms that have enabled businesses to stay

afloat in some form or another. Unsurprisingly, this has led to a

plethora of covenant waivers and restructuring type work. The

longer-term position for many challenged companies and sectors

remains unclear as the global economy works its way through this

crisis.

Highlights

We took on a significant number of new appointments in 2020. We

are proud to have been appointed by many of the UK's leading

companies including BP, Legal & General, British Telecom and

Vodafone for various roles.

Eliot Solarz, Head of Corporate Trust, continues to invest in

his team and build on our reputation for technical knowledge, speed

and innovation. We will always play to our strengths and are able

to compete highly effectively against global banks for more complex

products.

The growth of our escrow offering in 2020 was particularly

pleasing. Many of our investors who have purchased a home may be

familiar with the concept of an escrow. In the case of a house

purchase often a solicitor receives execution documentation from

the various parties involved (e.g. buyer/seller/bank/title company

etc.) and the associated monies. Having satisfied themselves that

all is in order, the solicitor then distributes the proceeds and

documentation accordingly to the various parties. Eliot's team does

not perform escrows for house purchases, but the principles that

underpins his team's work in this area are in essence the same.

The demand for rapid responses to Covid-19 exposed many

procurement processes as being cumbersome and overly engineered.

Happily, our escrow offering, was able to move fast and respond to

rapidly evolving demand. Particularly pleasing was the role that we

played on several PPE related escrows as various NHS trusts looked

to urgently source supply from around the world. In addition, we

upped our profile on escrows related to M&A, pensions,

litigation and commercial real estate transactions. Our escrow

balances ended the year over five times higher than at the start of

2020.

In 1910, we were trustee to the Kansai Railway in Japan and we

continue to support long dated infrastructure financing. In 2020,

we were appointed as the security trustee to the IFC backed Almaty

Ring Road in Kazakhstan.

We continue to build on our expertise to support financings in

renewable energy, as demonstrated by the case study on Falck

Renewables found in the full annual report and accounts. In

addition, as the year ended, we signed as Security Agent for the

IFC/ADB backed Nur Novi solar power project in Uzbekistan.

As we mentioned in last year's review, social housing is an

important and growing part of our book of business. We are thrilled

to have been appointed as bond and security trustee on the GBP2.5

billion note programme launched by London and Quadrant during the

year.

Outlook for our corporate trust business

As we have mentioned above, certain aspects of our corporate

trust business are strongly countercyclical. Recent history tells

us that, as the world economy recovered from the global financial

crisis, our post issuance workload should remain at elevated levels

for some time to come.

Levels of primary market activity are very difficult to predict.

The see-saw of the past two years is clear evidence of this, and we

have no crystal ball when looking at 2021. That said, we have a

broad suite of products, deep and long standing relationships with

clients, law firms and financial institutions, which give us

confidence that we should continue to build on the gains made in

our corporate trust business over the past three years.

Pensions

Our pensions business completed its fourth successive year of

positive growth with revenues up by 8.3% for the year. We continue

to invest heavily in this business.

Initially founded over 50 years ago as a pension trustee

business, this remains very much at the core of our offering. More

recently, we have expanded our governance offerings under our

Pegasus brand to provide a much broader range of services from

pensions secretarial through to fully outsourced pensions scheme

management. We remain the largest and longest established

independent professional pension trustee business in the UK.

Market dynamics

In the short-term, the stresses placed on the world economy by

Covid-19 have further highlighted the need for best in class

pensions governance. At precisely the same time that scheme assets

and liabilities were experiencing extreme volatility, sponsoring

employer covenants came under significant strain as operating

conditions for many businesses were severely disrupted. With the

need to rapidly move the administrative monthly payment of pensions

to a robust and secure remote operating environment, the necessity

for top quality scheme oversight was evident. That said, following

a burst of activity in March and April in particular, the move to

virtual meetings has resulted in shorter meetings which reduced our

time based charges. We expect that this will reverse somewhat as

Government remote working requirements begin to fade away.

Over the medium-term, the Pensions Regulator's drive towards a

smaller number of better governed defined benefit schemes continues

to build momentum and plays to our strengths. Consolidation

provides an opportunity for smaller schemes to enhance their

governance. A larger asset base may well give a scheme the

financial resources to employ a professional trustee. Put simply,

we act for under 5% of the 5,500 defined benefit schemes in the UK

so there is plenty of room to grow our market share in what we

believe is a growing market.

While the negative effects of Covid-19 will hopefully only be

temporary, the Pensions Regulator backed the expansion of

stewardship definitions and the advancement of ESG investment

agendas are looking increasingly permanent. Best in class standards

are rapidly evolving. There is significant opportunity for us to

help our clients stay ahead of the game as the investing world

addresses the impact on the environment and on society in

general.

Highlights

2020 was the year that our outsourced pensions executive

service, Pegasus, came of age. Pegasus continued to see strong

revenue growth in 2020 and we are confident that Pegasus will

continue to increase our share of total pensions revenue. We have

widely received positive feedback from our quickly growing client

base. What has been particularly pleasing is our ability to execute

relatively small appointments well, and nurture these into much

broader relationships. Chief financial officers use tough operating

conditions to focus capital allocation on activities that

differentiate their specific company's offering while

simultaneously outsourcing essential but non-core functions, such

as Pensions Administration, where our Pegasus business can provide

support to oversee such changes. Our Pegasus business has also

fared well in the 'temporary staff' market where, for example,

opportunities to provide maternity cover have added further strings

to our bow. Our sole trustee solution continues to build momentum

and resonates well with buyers looking for a 'one stop shop'

approach to their governance needs.

On the trustee side we did much to enhance our reputation for

innovation. We also executed well and added to our expertise in

longevity swaps, buy-ins and buy-outs, such as the work we did for

Baker Hughes (UK) and the British Bankers' Association.

Increasingly too, we have much to offer clients as they navigate

the tricky pensions waters that lap against M&A activity, such

as the work we have been appointed to undertake for Cobham.

Finally, and without wishing ill on any firm, our experience of

dealing with distressed and restructuring type situations, in both

the public and private markets, continues to grow

significantly.

Outlook for our pensions business

A broad and stable set of foundations underpins the long-term

growth potential of our pensions business. An aging population, a

growing middle class, a relatively recent auto-enrolment regime and

strong moves by regulators to professionalise the governance of

schemes creates a sound platform on which to build. Our team is

well placed to enable us to solve our clients' problems. Our

reputation has been hard won over five decades. We will continue to

invest in our people and nurture the next generation of problem

solvers in this growing market.

I would like to thank Michael Chatterton, Head of Pensions, and

Mark Ashworth, Chairman of Pensions, for encouraging their team to

continuously produce advantageous outcomes for our clients.

Corporate services

Overall the diversification within the IPS revenue streams

served us well in 2020, but our corporate services businesses were

adversely affected by the pandemic. This revenue stream consists of

three components: our company secretarial and accounting offering,

the Safecall whistleblowing business and our service of process

business. Year on year revenues of GBP12.2m were broadly flat.

Market dynamics

Company secretarial and accounting

The growing market for company secretarial offerings is

underpinned by three main factors. Firstly, ever increasing

reporting demands on businesses from governments and regulatory

authorities. Secondly, increased desire by corporations to focus

their efforts on their particular unique value proposition and

outsource critical but non-differentiating aspects of their

business. Thirdly, the increasing speed of corporate lifecycles and

ever-changing market dynamics hand an advantage to those

organisations that can access new markets quickly and simply.

Expertise combined with ease of use will remain at the core of our

ability to effectively compete in this market.

Highlights

Company secretarial and accounting

We have been in this business in a modest way for well over

twenty years and we understand it well. Our existing business, led

by Mark Filer, grew soundly off a small base in 2020. Particularly

noteworthy were roles on residential mortgage backed

securitisations (RMBS), that we were appointed to for LendInvest,

an increasingly disruptive property lending company in the UK. We

further deepened our relationship with Atom Bank, a fast growing UK

challenger bank, where we acted on their new RMBS issue. We were

delighted to take on a significant piece of work with one of the

largest pension schemes in the UK, the Universities Superannuation

Scheme, to help them service an equity release funding platform. We

also took on our largest ever company secretarial appointment to

date on the back of a complex restructuring of a significant real

estate portfolio.

On 29 January, 2021 we completed the acquisition of the company

secretarial business of Konexo UK, a division of Eversheds

Sutherland (International) LLP. This significantly expands our

footprint in this exciting market.

We believe that we can increase our market share in this growing

market, and we are confident that there are significant avenues for

us to explore across our c.450 new clients with respect to other

Law Debenture offerings. The acquired business is headed by Andy

Casey. We have very much enjoyed welcoming our new colleagues to

Law Debenture and look forward to working closely with them in the

future.

Market dynamics

Whistleblowing

Regulatory frameworks continue to be established. The UK

parliament had its first reading of The Office of the Whistleblower

Bill in 2020 and in 2021 the European Whistleblowing Directive (the

Directive) comes into force. The Directive requires that all

European companies with over 50 employees and EUR10million in

turnover have a whistleblowing solution in place. ISO37002 for

Whistleblowing Management Systems is expected to be established in

2021. Despite the fact that this is a relatively new market,

private equity investors have been quick to see its growth

potential and have been consistently buying up operators and

consolidating businesses. While many competitors have followed a

lowest cost proposition based around call centre staff following

scripts, our offering is based on highly trained employees who

follow a clearly defined process. Issues raised by employees were

at record levels as they used our service to flag concerns around

working conditions in particular.

Highlights

Whistleblowing

We have received much unsolicited praise for our work during the

year. Boards, General Counsels, Heads of Human Resources, Heads of

Risk and Compliance and employers have seen real value in the

quality and timeliness of our work. However, the period from March

until June 2020 was dominated by a 'no new projects' mentality as

potential buyers adjusted to the uncertainties caused by Covid-19.

Sales picked up as the year progressed and we ended with roughly

the same number and same annual contract values of new wins as the

prior year. We ended the year with revenues up approximately

11.3%.

High quality clients that we were thrilled to onboard during the

year included Brompton Cycles, Channel 4 (see the case study found

in the full annual report and accounts), Co-op Food, Morgan Sindall

and Wolseley (renamed Ferguson).

After 22 years at the helm Graham Long, who founded this

business along with his late father Alan, will step back from the

day-to-day running of this business during 2021. Safecall has been

an amazing success story as Graham has taken this from just an idea

to a market leading whistleblowing business that helps employees

from well over 500 companies all over the world. As we look to

accelerate our growth and adapt the use of technology to support

this business, Graham felt that the next chapters should be written

with the help of a fresh perspective. At this time, our search for

a new Managing Director has just started and Graham will remain

fully engaged to ensure a smooth transition. Our thanks to Graham,

but not farewell just yet, as he will continue to be Non-Executive

Chairman of the Safecall Board.

Service of process

Our service of process business, headed up by Anne Hills, is the

highest volume transactional business with the least recurring

contractual revenues of all the IPS businesses. It is highly

correlated to the global economic cycle. Contractions in the global

economy mean that fewer commercial transactions are completed,

which in turn reduces the demand for a service process agent to

complete documentation. In 2020, we experienced our toughest year

since the global financial crisis.

Our history over many economic cycles in this area gives us

confidence that as the world economy recovers, so too will our

revenues. Our referral network has been nurtured over many decades

and is global. In the meantime, we continue to invest in enhancing

our use of technology to create a seamless user experience for our

clients in this high volume business.

Outlook for our corporate services business

We believe that the governance services businesses that combine

to make up our corporate services offering all operate in markets

that have sound long-term growth prospects. They are, after all,

elements that make up the "G" in ESG. However, 2020 reminds us that

even the most robust long-term businesses are not immune from

unexpected short-term challenges. We have held our nerve and

increased our investment in these business at a time when many

competitors could simply not afford to do so, with the aim of

ensuring we can meet the needs of our customers simply and to the

highest of standards.

Technology

If 'Covid' was the word of the year for 2020 then 'Zoom' must be

a close second. If we could have received a pound for each time we

said "you're on mute", we would have all done rather well. Surely

one of the largest gains that the global economy will benefit from,

as we emerge from the Covid-19 crisis, is the crash course in

technology that we all received as we transitioned to fully remote

working in March 2020. It was the digital era's equivalent of a

rapid mass literacy program.

I am delighted to report that our own technology platform was up

to the challenge. Having joined us in December 2018 our Chief

Technology Officer (CTO), David Williams, was front and centre in

ensuring that, after 131 years of being on site, our business was

able to seamlessly transition to a virtual existence. Under David's

leadership, our excellent and growing technology team has

transitioned much of our outdated hosted infrastructure to

cloud-based services. These changes bring an increased scale to our

operations and enhance our controls and security.

We are increasingly agile users of third party software

applications to support our various businesses. We have also

invested significantly in customising platforms to both simplify

and improve our clients' user experience.

This past year saw the launch of a number of initiatives for our

Safecall business. Potential clients can now purchase our Safecall

whistleblowing services online. In addition, we have a suite of

e-learning modules that clients can roll out to all staff that

covers everything from the basics through to training for managers

in how to appropriately handle whistleblowing cases. We rapidly

shifted classroom based training to online to meet client demand,

hosting 15 such events in the second half of 2020.

These gains are hard earned, but we must quicken our pace of

change. As we start 2021, we are determined to further enhance our

operational efficiency and resilience, and to creatively evolve our

products and services. We expanded our IT team in 2020 and will do

so again in 2021. Increasingly, we are using technology to

interface with our clients and our future success will depend on

our ability to satisfy their rapidly accelerating demands.

Property

2020 was certainly an interesting year for the lease on our Head

Office to expire. After plenty of searching we settled on a new

lease for premises at 100 Bishopsgate, EC2N 4AG. Despite the

challenges of 2020, this move was successfully completed during the

year.

The new building has excellent transport links as it is situated

across the street from Liverpool Street station. Importantly, the

building has been designed to limit its impact on the environment,

as shown on the diagram in the full annual report and accounts.

An unintended consequence of the eleven months since lockdown

last March has been a most thorough test of our remote working

environment. It is clear we are able to work from home. Some staff

felt that there were productivity gains when the need arose to

avoid distractions and spend an extended period to complete a

complex piece of client work. However, it is also clear that to

work optimally we must retain a modern fit for purpose office

environment. We are collectively more efficient and creative. We

benefit from collaboration and we have more fun.

In 2021, when Government guidance encourages a return to the

workplace, we plan to allow employees to work up to two days per

week from home with their manager's approval. This allows our staff

to retain flexibility and keep the gains of periodic remote

working, while ensuring that for the majority of our time we are in

a communal environment where we are most effective.

Given our change in work patterns, our shift of much of our IT

infrastructure to cloud-based services, and the huge digitalisation

initiative, we were able to reduce our physical footprint by

approximately one third.

Like a house move, an office move provides a wonderful

opportunity to throw things away. In common with many professional

services firms we had paper everywhere. It was a huge one-off

project but we were able to digitalise many decades worth of

materials. This makes retrieval easier, reduces demand for physical

storage space and reduces our costs.

As part of this process, we uncovered many items which showcased

our rich history. These included a glorious 999 year lease on a

property complete with wax seal signed six weeks before the Battle

of Waterloo. Sadly the lease was not ours, rather it belonged to a

client.

Having moved in during early December, we look forward to

welcoming our staff and our clients to our new space as 2021

unfolds.

Prospects

Although it is impossible to predict when global economies and

our everyday lives will return to normal post the turmoil that

Covid-19 has brought, I remain optimistic in our longer-term

outlook. Your Company is resilient and prospects remain bright with

a strong and dedicated team.

We closed the year in a solid position, despite the economic

turmoil. Your Company continued to execute against its stated

strategy of growing the IPS business. We acquired the company

secretarial business of Konexo UK, taking an important step forward

to cement our position in a growing and attractive sector. This

strengthens our IPS business and its longer-term earnings outlook.

We look forward to continuing to grow and develop the IPS business

and build greater market share by seeking to further capitalise on

the significant market opportunities available through both organic

investment and disciplined acquisitions, where appropriate.

Over the last three years we have shown an IPS compound annual

growth rate (CAGR) of 8.3% and 9.1% respectively for revenue and

earnings per share. There have been ups and downs by individual

area but this correlates well with our mid to high single digit

medium-term growth ambition.

It is in challenging times like these when good judgement and

extensive knowledge is critical to a successful investment strategy

and I am grateful that Law Debenture has been able to benefit from

both James's and Laura's expertise and experience. I am confident

that their focus on selecting strong business models and attractive

valuation opportunities, coupled with a deep understanding of

companies and industries, will enable them to continue to position

the equity portfolio for future longer-term growth and

outperformance.

On behalf of the Board, I would like to thank our shareholders

for their continued support and confidence in our abilities during

a particularly tumultuous time. At Law Debenture, we greatly value

our culture and close partnership with clients. I would also like

to express my deepest thanks to our employees; their commitment has

shone through. I look forward to keeping you updated on the Group's

future operational and strategic achievements.

Denis Jackson

Chief Executive Officer

25 February 2021

Investment manager's review

The equity portfolio

In a wholly unpredictable year, diversity within the investment

portfolio was particularly important. This portfolio benefitted

from its aim to be a 'one stop shop' for investors, by holding

equities in a deliberately diverse collection of well-managed,

market leading companies. While the majority of the portfolio (82%)

was invested in the UK at year end, much of underlying revenues

from the portfolio were derived from overseas. In addition to

geographic diversity, the long list of holdings, 137 at year end,

alongside the broad range of end market operations, meant that the

portfolio held enough beneficiaries from the current environment to

show of growth 3.6% in absolute terms during the year, while the

FTSE All-Share benchmark fell 9.8%. We will go on to discuss the

largest contributors to performance in greater detail, but the need

to decarbonise the global economy and the shift of much of consumer

spending to online were common themes among the best

performers.

By the calendar year end we were roughly neutral net investors

within the portfolio. However, during the course of the year we

invested heavily in the spring and, by the end of March, had

invested GBP36.8m (net). This net investment was then gradually

reduced as valuations rose, particularly in the final month of the

year. Geographically, sales were concentrated in North America,

where on a net basis we sold GBP30.5m during the year, while

purchases were concentrated in the UK, where on a net basis we

purchased GBP24.8m. This geographic difference was not driven by a

macroeconomic view. The US stocks sold during the year, such as

Microsoft, had on average performed well and were trading on high

valuations versus history, while we were finding a number of

attractive valuation opportunities in the UK.

Our investment strategy

We take a bottom-up approach, spending a great deal of time with

the management teams of our portfolio companies, conducting

detailed analysis of the strengths, weaknesses and growth prospects

of those companies into which we invest your money. Were there to

be a common theme amongst the diverse portfolio, it would be that

the majority of companies held are market leaders in the product or

service they are providing. This market leadership could be in the

UK or on a global scale; it could be a small niche market such as

UK paving stones (Marshalls) or a large global market such as

oncology drugs (Bristol-Myers Squibb). What we are looking for is

companies with excellent products or services and with experienced

management teams that can help navigate different market

environments.

We are patient with our positions and invest for the long-term.

We build up positions gradually. Having taken the decision to

invest in a stock, we typically begin by investing around 30bps of

overall net asset value, and then add to this over time, depending

upon the risk profile of an individual stock.

Our long list of stocks allows us to moderate our position size

where we perceive the investment case is higher risk than may be

the case elsewhere in the portfolio. This means that we take a

risk-based approach to our position sizing, while ensuring that, if

we get something right, the sizing is sufficient to influence the

portfolio performance as a whole. Our patience keeps our portfolio

turnover low, reducing the drag of dealing costs on returns to our

investors. That patience has rewarded our shareholders; over 10

years, the portfolio has outperformed the benchmark index by 69%

(valuing debt at par).

ESG considerations in our investment strategy

Responsible investing, incorporating ESG, has always been an

integral feature of our process as we are long-term investors.

Therefore any material ESG issues are also material to the

investment case. These issues are of growing prominence to both

investors and companies and whilst they have always been an

implicit part of the investment process, we are now explicitly both

monitoring internally and discussing with company management teams

any particular issues of concern. We have decided not to explicitly

exclude any sectors, partly because the data quality on the more

difficult to measure environmental and social area is not robust,

and partly because, in our view, it is better to engage with

companies to encourage better practices rather than to sell the

shares. In addition to monitoring the risks associated with ESG

issues, we also aim to invest in companies that are seeking

positively to address these challenges, such as the need to

decarbonise the economy. One such area is hydrogen fuel cells, and

portfolio performance this year has benefitted from exposure to

this area.

1 year 3 years 5 years 10 years

% % % %

------------------------------- ------ ------- ------- --------

NAV total return (with debt at

par)(1) 3.6 15.6 59.1 147.8

NAV total return (with debt at

fair value)(1) 2.0 13.2 53.0 134.7

FTSE Actuaries All-Share Index

total return(2) (9.8) (2.7) 28.5 71.9

(1) NAV is calculated in accordance with AIC methodology, based

on performance data held by Law Debenture including fair value of

IPS business. NAV total return with debt at par excludes the fair

value of long-term borrowings, where NAV total return with debt at

fair value includes the fair value adjustment.

(2) Source: Refinitiv Datastream, all references to 'FTSE

All-Share' and 'benchmark' in this review refer to the FTSE

Actuaries All-Share Index total return.

Overview of 2020

The lessons the authorities learnt in the financial crisis of

2008/9 proved invaluable in dealing with the crisis brought about

by Covid-19. Co-ordinated quantitative easing and fiscal stimulus

saved the global economy from the extreme fall-out that might have

happened as businesses were forced to close their doors as

'lockdown' was imposed. The authorities' actions stabilised markets

and Law Debenture's asset value was virtually unchanged on the

year. The economy and its outlook, however, were impacted

dramatically and we saw a rapid acceleration of existing structural

trends. For instance the move in retailing from physical stores to

online was already happening but it received an extraordinary

boost. The desire for decarbonisation of the economy was well in

motion but again the progression has been rapidly advanced by the

desire to rebuild a more sustainable environment after the

pandemic. These trends have had a massive effect on equity prices,

with the best performing areas of the portfolio being in companies

that are working towards the goal of decarbonisation, and the worst

being the property companies that own retail space, along with

aerospace companies.

Economic backdrop

The UK economy contracted violently in March as the virus took

hold and 'lockdown' was enforced. The gradual easing of

restrictions saw a rapid recovery in economic activity that was

further aided by the prospect of a limited free trade deal with the

European Union. However, by the year end the re-imposition of

'lockdown' meant the pick-up in activity lost momentum. During this

period there has been an extraordinary shift to private saving and

the state increasing its borrowing. This can be done as interest

rates remain very low. However, a great deal of production has been

lost, some capital spend programmes have been deferred and

unemployment has risen. The economy has materially shrunk; UK GDP

on consensus is estimated to have contracted 11.3% in 2020. Some

economic activity will recover relatively quickly. However, higher

government debt and the losers from structural change in consumer

behaviour will remain long-term issues for the economy. In this

economic environment we need to be invested in companies that have

a credible way forward to deal with a testing economic

backdrop.

UK market backdrop

Prior to 2020, the UK equity market had underperformed other

developed equity markets in the period following the EU referendum

vote in 2016. 2020 was no exception, meaning that over a five-year

period the UK equity market has underperformed Continental Europe

by 38% and the US by 90%.

The reasons for this underperformance include the uncertain

future trading relationship with the EU and the sector composition

of the UK market, with comparatively more in underperforming

sectors such as energy, and comparatively less in outperforming

sectors such as technology. During 2020 there was also a larger

contraction in UK GDP following the pandemic than in other major

economies. With the UK economy forecast to grow strongly in 2021

(5.3% on consensus numbers), and a free trade agreement on goods

reached with the EU, these overhangs on the UK equity market could

be lifting at a time when UK companies are trading at a stark

valuation discount to their global peers. The graph provided in the

full annual report and accounts shows the discount of the UK market

relative to the US and Europe on cyclically adjusted

price/earnings. The UK also trades at a discount using other

valuation methods such as price/book.

Income backdrop

In prior years, we have emphasised the unique advantage of Law

Debenture's structure, with the income generated by the IPS

business allowing greater flexibility to invest in lower or zero

dividend yield stocks within the investment portfolio. This allows

us to focus on capital generation, while knowing that historically

approximately a third of the Trust's income has been provided by

the IPS business. In a year when investment income fell 38% to

GBP18.1m (2019: GBP29.2m) as a result of the pandemic

(approximately in line with the fall seen in the wider UK market),

this greater flexibility provided by the growing income from the

IPS business helped the Trust from both an income and a capital

perspective.

From a shareholder perspective, the share of Group income

generated by the IPS business this year grew to 43.4% (1) .

Therefore the fall in investment income was partially offset by

growing income from the IPS business. This, combined with the large

historical revenue reserve, allowed the Board to confidently grow

the dividend 5.8% year on year.

From a capital perspective, the below-benchmark portfolio yield

at the start of 2020 insulated the portfolio from being overly

exposed to among the worst performers last year. The best

illustration of this is the comparative performance of the FTSE 350

High Yield index and the FTSE 350 Low Yield index last year, where

it can be seen that on average higher yielding stocks substantially

underperformed.

While 2020 was a challenging year for UK dividends, in the

latter half of the year there were reasons for optimism on the UK

dividend outlook. Many companies held in the portfolio which had

suspended dividends in the first half of the year, chose to resume

paying and in some cases catch up on missed payments. In the

banking sector, while dividends remained forcibly suspended by the

regulator, there were clear indications from management teams that

when restrictions were lifted they would seek to resume dividends.

Following updated guidance from the regulator we expect modest

dividends to resume.

In 2021, we expect investment income from the portfolio to rise,

but not to reach 2019 levels. Some companies held, including Royal

Dutch Shell and BP, have permanently rebased their dividends lower

as they seek to transition their portfolios gradually away from

fossil fuels towards renewable energy. Other companies (such as

those exposed to the aerospace industry) continue to have

limitations on their trading as a result of the pandemic and

therefore will not return to paying dividends until 2022 at the

earliest.

(1) Calculated on IPS contribution to total earnings per share for year end 31 December 2020.

Top five contributors

The following five stocks produced the largest absolute

contribution for 2020:

Share price

total return Contribution

Stock (%) (GBPm)

------------------- -------------- -------------

Ceres Power 403.8 33.5

ITM Power 626.1 13.3

Herald Investment

Trust 51.7 6.0

Rio Tinto 21.5 3.6

Royal Mail 49.2 3.4

Source: Share price total returns from Bloomberg, all in

GBP.

Portfolio attribution

There were broadly two themes to the best performers during the

year; companies exposed to the need to decarbonise the global

economy, and companies exposed to the shift of much of consumer

spending online.

Ceres Power , which designs hydrogen fuel cells, and ITM Power,

which produces electrolysers that can be used to generate 'green

hydrogen' from renewable energy, were both among the best

performers. In both cases the technology has existed for some time,

but one of the catalysts for the shares performing well was they

both received external validation from strong commercial

partnerships; Ceres agreed a manufacturing licence agreement with

Bosch, and later in the year Doosan in South Korea, while ITM Power

formed a partnership with industrial gas producer Linde. These

commercial partnerships came at a time when many developed

economies are increasingly willing to make substantial investments

in 'green technology' in order to meet future environmental

targets.

Both Herald Investment Trust and Royal Mail benefited from the

accelerated move 'online' in 2020. Herald invests predominantly in

technology shares, which performed exceptionally well last year as

businesses shifted to working remotely and were increasingly

reliant on cloud computing, and consumer spending moved

increasingly online. Royal Mail had for many years seen a gradual

decline in letters and an increase in parcel delivery; this trend

was accelerated last year, allowing them to progress with their

reconfiguration of the delivery network and reallocation of costs

towards parcels.

Top five detractors

The following five stocks produced the largest negative impact

on the portfolio valuation for 2020:

Share price

total return Contribution

Stock (%) (GBPm)

------------------- -------------- -------------

Royal Dutch Shell (43.8) (12.3)

Hammerson (82.4) (9.2)

GlaxoSmithKline (20.6) (7.3)

BP (46.0) (6.9)

HSBC (36.0) (5.7)

Source: Share price total returns from Bloomberg, all in

GBP.

The worst performing stocks during the year were broadly those

exposed to a fall in economic activity, whether via the fall in the

oil price as transportation fuel demand fell markedly (Royal Dutch

Shell, BP in the table above) or those exposed to further declines

in already low interest rates and uncertain loan losses (HSBC).

GlaxoSmithKline in the table above is the exception to this, with

earnings expectations remaining largely unchanged during the year

as a result of its defensive end markets (vaccines, pharmaceuticals

and consumer healthcare). The underperformance could be due to

lower earnings growth than pharmaceutical peers as they continue to

invest heavily in research and development in order to improve

their pipeline. We continue to view this as a long-term opportunity

and it remains a top ten holding.

Portfolio activity

What we have been buying

The most material decision during the year was to be net

investors during the peak of the market weakness in spring. March

was the most active month for net investment, where we invested an

additional GBP14.8m in the portfolio.

The investment process aims to identify market leading,

well-managed businesses and invest at the point of which they are

out of favour. There was an abundance of these opportunities during

the spring. We invested broadly, adding to both existing positions

such as Aviva, and establishing new positions such as Anglo

American and Marks & Spencer. While there was deliberately no

commonality in these additions in terms of geography or end-market

exposure, we focused purchases on companies that would benefit from

a global economic recovery following the pandemic. This modest

shift in the portfolio towards sectors that are more cyclical can

be seen in the sector composition at year end, with a higher

weighting in, for example, materials and oil and gas than the

previous year. It is also evident in the top five purchases

detailed below, which are spread between financials, materials and

oil and gas.

What we have been selling

Sales during the year were predominantly for either valuation

reasons or driven by corporate activity. For example Microsoft,

which had for a number of years been the largest overseas holding

in the portfolio, performed well following the pandemic and in our

view there were better valuation opportunities elsewhere. Ceres

Power was reduced following strong performance, partially in order

to fund other investments in the alternative energy sector such as

AFC Energy.

The position in insurer RSA was sold following a takeover offer

from overseas peers. Towards the end of the year there was a

notable pick-up in takeover activity in the UK, with another of the

portfolio's holdings (Elementis) also receiving a takeover

approach. This is a theme that we expect to continue in the current

year while there continues to be a valuation gap between UK and

other developed equity markets.

Five largest purchases

The largest five purchases during the year are detailed

below:

Total purchased

Stock (GBPm)

---------------- ----------------

M&G 7.4

Barclays 7.1

Anglo American 6.9

Aviva 6.7

BP 6.3

Five largest sales

The largest five sales during the year are detailed below:

Total sold

Stock (GBPm)

----------------------- -----------

Ceres Power 21.4

AstraZeneca 13.3

Flutter Entertainment 12.0

Microsoft 10.9

RSA Insurance 10.7

Outlook

Structural changes that are happening in the economy throw up

opportunities, as well as severe challenges for companies. The

speed of the change has accelerated as a result of Covid-19, but

reflects the longer-term trend that intellectual capital has been

replacing physical assets as the driving force for corporate

success. The shelf life of intellectual capital can be short. This

is the reason behind the need for an active rather than a passive

approach to portfolio management. We will retain a broad and

relatively long list of stocks. We are always on the lookout for

stocks that are reasonably valued and have characteristics that

cannot be found in the UK. The focus, though, will be predominantly

in the UK as this is where value can be found. The companies will

be serving a wide range of end markets. Diversity is important in

order to achieve a reasonable level of consistency in returns.

The companies held are adapting to the challenging economic

backdrop. The key is to have excellent products and services that

remain relevant to the customer. This usually means an emphasis on

research and productive capital expenditure. Therefore the

portfolio is about the individual companies, and it is not a proxy

for the economy. The overall valuation of the stocks held remains

undemanding using history as a guide. Therefore, the intention is

to retain a reasonable level of gearing so that the portfolio is

fully exposed to the opportunities that can be found in the equity

market.

James Henderson & Laura Foll

Investment manager

25 February 2021

Portfolio by Sector and Value

Portfolio by sector

2020 2019

-------------------- ------ ------

Oil and gas 11.6% 9.7%

Basic materials 9.3% 6.4%

Industrials 22.0% 23.2%

Consumer goods 6.2% 5.2%

Health care 5.2% 8.9%

Consumer services 8.9% 10.2%

Telecommunications 1.9% 1.1%

Utilities 4.8% 4.0%

Financials 28.5% 28.9%

Technology 1.6% 2.4%

Geographical distribution of portfolio by value

2020 2019

---------------- ------ ------

United Kingdom 82.1% 80.7%

North America 5.4% 8.3%

Europe 10.1% 7.8%

Japan 1.1% 1.1%

Other Pacific 0.9% 0.9%

Other 0.4% 1.2%

Fifteen largest holdings

as at 31 December 2020

Approx. Valuation Appreciation/ Valuation

Rank % of Market 2019 Purchases Sales (Depreciation) 2020