TIDMLDSG

RNS Number : 7530L

Leeds Group PLC

15 January 2021

Issued on behalf of Leeds Group plc Embargoed: 7.00am

Date: 15 January 2021

Leeds Group plc

("Leeds Group" or the "the Group")

Unaudited Interim Results for the six months ended 30 November

2020

The unaudited interim results of Leeds Group plc ("Leeds Group"

or "the Group") for the six months ended 30 November 2020 are

presented as follows:

This announcement contains inside information for the purposes

of Article 7 of EU Regulation 596/2014 (MAR) and has been arranged

for release by Jan G Holmstrom, Chairman. The Directors of the

Company accept responsibility for the content of this

announcement.

Enquiries:

Leeds Group plc Cairn Financial Advisers LLP

Dawn Henderson - 01937 547877 Liam Murray/Sandy Jamieson - 020 7213 0880

Chairman's Statement

The business of the Group is that of a wholesaler and retailer

of fabrics and haberdashery and is conducted by its German trading

subsidiary Hemmers/Itex Textil Import Export GmbH ("Hemmers") and

Stoff-Ideen-KMR GmbH ("KMR"), a subsidiary of Hemmers also based in

Germany. The Chinese subsidiary of Hemmers, Chinoh-Tex Ltd

("Chinoh-Tex") ceased trading in November 2019 and was liquidated

in the financial year to 31 May 2020, as such it has been regarded

as a discontinued operation in the previous year's figures within

these financial statements.

The Group achieved sales from continuing operations in the

period of GBP19,956,000 (2019: GBP18,600,000). Even though the

Covid-19 situation is still impacting the global economy, sales for

Hemmers and KMR in the first six months of the financial year have

been higher than expected, with sales at Hemmers increasing to

GBP15,598,000 (2019: GBP14,525,000) and KMR sales increasing to

GBP4,358,000 (2019: GBP4,075,000). Since the half year end, there

have been further countrywide restrictions imposed by the German

government, which at present is expected to initially affect

trading in both businesses from 16 December 2020 to 31 January

2021. KMR shops will be closed during this period and the business

of Hemmers will be reduced, although online business will still be

able to continue. Hemmers and KMR management will work hard to

manage the situation and reduce all costs as far as possible given

the reduced level of trading and both companies should benefit from

any government financial support provided.

The Group made a profit from continuing operations after tax of

GBP735,000 (2019: loss of GBP712,000). The earnings per share from

continuing activities was 2.6 pence (2019: loss per share 2.6

pence). The profit for Hemmers for the half year was GBP729,000

(2019: loss of GBP515,000) and the profit for KMR for the half year

was GBP145,000 (2019: loss of GBP251,000). The effect of prior year

cost cutting measures is now evident with a reduction in costs.

Management is focused on aligning the business with sales demand

and competing in markets where it can make acceptable margins.

On 31 December 2020, the UK left the European Union having

secured a deal acceptable to both the UK and the European Union. As

advised in previous announcements, the Directors' do not believe

this will impact the Group as the business of Leeds Group is

conducted entirely by Hemmers and KMR both of which are

incorporated in Germany, and their exports to the UK account for

only approximately 3% of Group revenue.

Group net bank debt, as analysed in note 3, was GBP4,034,000 as

at 30 November 2020 (30 November 2019: GBP6,843,000; 31 May 2020:

GBP3,517,000). In accordance with the newly introduced IFRS 16 with

regard to accounting for leases, right-of-use assets, finance lease

liabilities of GBP1,968,000 have been recognised as at 30 November

2020. (30 November 2019: GBP2,707,000; 31 May 2020:

GBP2,405,000).

I would like to thank all employees throughout the Group for

their continued hard work and support.

Jan G Holmstrom

Chairman

15 January 2021

Unaudited Consolidated Statement of Comprehensive Income

for the six months ended 30 November 2020

6 months 6 months Year to

to to 31 May

30 November 30 November 2020

2020 2019 GBP000

GBP000 GBP000

------------------------------------------- -------------- -------------- --------------------

Continuing operations

Revenue 19,956 18,600 35,067

Cost of sales (15,371) (15,039) (29,039)

Gross profit 4,585 3,561 6,028

Distribution costs (1,442) (1,561) (2,876)

Administrative costs (2,293) (2,741) (4,908)

Profit/(loss) from operations 850 (741) (1,756)

Finance expense (115) (139) (260)

Profit/(loss) before tax 735 (880) (2,016)

Taxation - 168 (6)

Profit/(loss) from continuing operations 735 (712) (2,022)

Discontinued operations (Loss)

from discontinued operations - (416) (332)

Profit/(loss) for the period/year

attributable to the equity holders

of the Parent Company 735 (1,128) (2,354)

Other comprehensive (loss)/income

for the period/year (63) (406) 196

Total comprehensive profit/(loss)

for the period/year attributable

to the equity holders of the Company 672 (1,534) (2,158)

=========================================== ============== ============== ====================

Earnings/(loss) per share for profit attributable to the equity

holders of the Company

6 months 6 months Year to

to to 31 May

30 November 30 November 2020

2020 2019

------------------------------------------ -------------- -------------- ----------

Basic and diluted total earnings/(loss)

per share (pence) 2.6p (4.1)p (8.6)p

========================================== ============== ============== ==========

Basic and diluted earnings/(loss)

from continuing operations per

share (pence) 2.6p (2.6)p (7.4)p

========================================== ============== ============== ==========

Basic and diluted (loss)

from discontinued operations per

share (pence) - (1.5)p (1.2)p

========================================== ============== ============== ==========

Unaudited Consolidated Statement of Financial Position

at 30 November 2020

As at As at As at

30 November 30 November 31 May

2020 2019 2020

GBP000 GBP000 GBP000

--------------------------------- -------------- -------------- ----------

Assets

Non-current assets

Property, plant and equipment 8,104 8,043 8,183

Right-of-use assets 1,962 2,695 2,374

Investment property - 965 -

Intangible assets 66 69 67

Total non-current assets 10,132 11,772 10,624

--------------------------------- -------------- -------------- ----------

Current assets

Inventories 10,851 12,245 10,188

Trade and other receivables 3,862 4,486 3,464

Corporation tax recoverable 77 778 206

Derivative financial asset - 5 -

Cash and cash equivalents 905 1,331 1,104

Total current assets 15,695 18,845 14,962

--------------------------------- -------------- -------------- ----------

Total assets 25,827 30,617 25,586

================================= ============== ============== ==========

Liabilities

Non-current liabilities

Loans and borrowings (1,751) (2,027) (1,950)

Lease liabilities (1,075) (1,747) (1,478)

Total non-current liabilities (2,826) (3,774) (3,428)

--------------------------------- -------------- -------------- ----------

Current liabilities

Trade and other payables (2,532) (3,429) (2,877)

Loans and borrowings (3,188) (6,147) (2,671)

Lease liabilities (893) (960) (927)

Derivative financial liability (33) - -

Provisions (100) (100) (100)

Total current liabilities (6,746) (10,636) (6,575)

--------------------------------- -------------- -------------- ----------

Total liabilities (9,572) (14,410) (10,003)

================================= ============== ============== ==========

TOTAL NET ASSETS 16,255 16,207 15,583

================================= ============== ============== ==========

Capital and reserves attributable

to

equity holders of the company

------------------------------------ ---- -------- -------- --------

Share capital 3,792 3,792 3,792

Capital redemption reserve 600 600 600

Treasury share reserve (807) (807) (807)

Foreign exchange reserve 2,678 2,139 2,741

Retained earnings 9,992 10,483 9,257

TOTAL EQUITY 16,255 16,207 15,583

===================================== ============= ======== ========

Unaudited Consolidated Cash Flow Statement

for the six months ended 30 November 2020

6 months 6 months Year to

to to 31 May

30 November 30 November 2020

2020 2019 GBP000

GBP000 GBP000

------------------------------------------ -------------- -------------- -----------

Cash flows from operating activities

Profit/(loss) for the period/year 735 (1,128) (2,354)

Adjustments for:

Depreciation of property, plant

and equipment 381 393 723

Depreciation of right-of-use assets 447 448 876

Depreciation of investment property - 9 13

Amortisation of intangible assets - - 6

Finance expense - interest on bank

loans 80 95 174

Finance expense - interest lease

liabilities 35 44 86

Movement in derivative financial

assets 33 (5) -

(Gain)/loss on sale of fixed assets (30) 5 (32)

Taxation (credit)/expense - (168) 6

Cash flows generated from/(used

in) operating activities before

changes in working capital and

provisions 1,681 (307) (502)

(Increase)/decrease in inventories (713) (944) 1,735

(Increase)/decrease in trade and

other receivables (416) (159) 965

(Decrease)/increase in trade and

other payables (323) 888 38

Cash generated from/(used in) operating

activities 229 (522) 2,236

Taxation received 134 93 519

Net cash flows generated from/(used

in) operating activities 363 (429) 2,755

========================================== ============== ============== =============

Investing activities

Purchase of property, plant and

equipment (347) (217) (560)

Proceeds from sale of fixed assets 38 6 1,317

Net cash (used in)/generated from

investing activities (309) (211) 757

========================================== ============== ============== =============

Financing activities

Bank borrowings drawdown/(repaid) 339 1,533 (2,378)

Repayment of principal on lease

liabilities (475) (436) (840)

Repayment of interest on lease

liabilities (35) (44) (86)

Bank interest paid (80) (95) (174)

Net cash (used by)/generated from

financing activities (251) 958 (3,478)

========================================== ============== ============== =============

Net (decrease)/increase in cash

and cash equivalents (197) 318 34

Translation (loss)/gain on cash

and cash equivalents (2) (52) 5

Cash and cash equivalents at beginning

of period/year 1,104 1,065 1,065

Cash and cash equivalents at end

of period/year 905 1,331 1,104

========================================== ============== ============== =============

Unaudited Consolidated Statement of Changes in Equity

for the six months ended 30 November 2020

Share Capital Treasury Foreign Retained Total

capital redemption share exchange earnings equity

reserve reserve reserve

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

------------------------ ---------- ------------- ---------- ----------- ----------- ---------

At 1 June 2020 3,792 600 (807) 2,741 9,257 15,583

Profit for the period - - - - 735 735

Other comprehensive

loss - - - (63) - (63)

At 30 November 2020 3,792 600 (807) 2,678 9,992 16,255

======================== ========== ============= ========== =========== =========== =========

Share Capital Treasury Foreign Retained Total

capital redemption share exchange earnings equity

reserve reserve reserve

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

---------------------- ---------- ------------- ---------- ----------- ----------- ----------

At 1 June 2019 3,792 600 (807) 2,545 11,611 17,741

Loss for the period - - - - (1,128) (1,128)

Other comprehensive

loss - - - (406) - (406)

At 30 November 2019 3,792 600 (807) 2,139 10,483 16,207

====================== ========== ============= ========== =========== =========== ==========

Share Capital Treasury Foreign Retained Total

capital redemption share exchange earnings equity

reserve reserve reserve

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

---------------------- ---------- ------------- ---------- ----------- ----------- ---------

At 1 June 2019 3,792 600 (807) 2,545 11,611 17,741

Loss for the year - - - - (2,354) (2,354)

Other comprehensive

income - - - 196 - 196

At 31 May 2020 3,792 600 (807) 2,741 9,257 15,583

====================== ========== ============= ========== =========== =========== =========

The following describes the nature and purpose of each reserve

within equity:

Reserve Description and purpose

------------------------ -----------------------------------------------------

Capital redemption Amounts transferred from share capital on redemption

reserve of issued shares

Treasury share reserve Cost of own shares held in treasury

Foreign exchange Gains/(losses) arising on retranslation of

reserve the net assets of overseas operations into

sterling

Retained earnings Cumulative net gains/(losses) recognised in

the consolidated statement of comprehensive

income after deducting the cost of cancelled

treasury shares

Notes to the Interim Results

for the six months ended 30 November 2020

1. Basis of preparation

This announcement has been prepared in accordance with

International Financial Reporting Standards, International

Accounting Standards and Interpretations (collectively IFRS) issued

by the International Accounting Standards Board (IASB) as adopted

by the European Union ("adopted IFRS"), and with the Companies Act

2006 applicable to companies reporting under IFRS.

Going Concern

When considering its opinion about the application of the going

concern basis of preparation of the interim results, the Directors

have given due consideration to the historic performance of the

Group, the robustness of forecasts prepared for the period to 31

May 2022, the ongoing impact of the Covid-19 pandemic on the

business, its suppliers and its customers, the financing facilities

available to the Group and the circumstances in which these could

be limited or withdrawn.

Forecasts were prepared for the period to 31 May 2022 which

indicate a return to profit over the period. These forecasts were

prepared in the knowledge of current Covid-19 conditions and

assumed that there would be no protracted period of total lockdown.

Both Hemmers and KMR are located in Germany and both businesses

responded well to the Covid-19 outbreak in March 2020, KMR was

directly impacted by the first countrywide lockdown measures put in

place in Germany with all stores having to close. After the first

lockdown, KMR stores performed ahead of both last year and

forecast. Hemmers saw significantly reduced demand during the first

lockdown but like KMR, has traded strongly in the first half of the

current year, ahead of last year and forecast. Since the

countrywide lockdown on 16 December 2020, KMR stores have closed

again and Hemmers have again seen reduced trading. Hemmers and KMR

management are now working hard to manage the effects on the

businesses of the second lockdown in the same way as they did

during the first lockdown and will again benefit from any

government financial support provided.

Bank debt has reduced in the first half and the businesses are

trading within their banking facilities. The Directors have

prepared sensitivities on these forecasts and will continually

review the current situation with regard to the Covid-19 pandemic,

but the Directors are of the currently available facilities will be

sufficient for all the various scenarios.

Considering the progress made to restructure the Group, the

trading results in the first half of the current financial year,

the likely ongoing impact of the Covid-19 pandemic and the headroom

available on the Hemmers working capital facility, the Directors

are of the opinion that it is appropriate to apply the going

concern basis of preparation to the financial statements.

2. Profit/(loss) per share

Ordinary shares of 12 pence each used in the calculation of

earnings per share:

6 months 6 months Year to

to to 31 May

30 November 30 November 2020

2020 2019

------------------------------ -------------- -------------- ------------

Number of shares (basic and

diluted) 27,320,843 27,320,843 27,320,843

============================== ============== ============== ============

3. Analysis of net bank debt

6 months 6 months Year to

to to 31 May

30 November 30 November 2020

2020 2019 GBP000

GBP000 GBP000

-------------------------------------- -------------- -------------- ---------

Cash 905 1,331 1,104

Loans repayable in less than

one year (3,188) (6,147) (2,671)

Loans repayable in more than

one year (1.751) (2,027) (1,950)

Net bank debt at end of period/year (4,034) (6,843) (3,517)

====================================== ============== ============== =========

4. Segmental information

Chinoh-Tex, Hemmer's China based subsidiary, ceased trading in

November 2019 and, therefore, has been reported as a discontinued

operation.

Group external revenue 6 months 6 months Year to

to to 31 May

30 November 30 November 2020

2020 2019 GBP000

GBP000 GBP000

-------------------------- -------------- -------------- ----------

Continuing operations

Hemmers 15,598 14,525 27,060

KMR 4,358 4,075 8,007

19,956 18,600 35,067

Discontinued operations

Chinoh-Tex - 493 488

Group external revenue 19,956 19,093 35,555

========================== ============== ============== ==========

Group profit/(loss) before tax 6 months 6 months Year to

to to 31 May

30 November 30 November 2020

2020 2019 GBP000

GBP000 GBP000

--------------------------------- -------------- -------------- -----------

Continuing operations

Hemmers 729 (515) (1,593)

KMR 145 (251) (331)

Holding company (139) (114) (92)

735 (880) (2,016)

Discontinued operations

Chinoh-Tex - (416) (332)

Group profit/(loss) before tax 735 (1,296) (2,348)

================================= ============== ============== ===========

Group net assets 6 months 6 months Year to

to to 31 May

30 November 30 November 2020

2020 2019 GBP000

GBP000 GBP000

-------------------------- -------------- -------------- ----------

Continuing operations

Hemmers 11,779 11,180 11,211

KMR 1,729 1,865 1,394

Holding company 2,747 2,956 2,978

16,255 16,001 15,583

Discontinued operations

Chinoh-Tex - 206 -

Group net assets 16,255 16,207 15,583

========================== ============== ============== ==========

5 . Forward-Looking Statements

Certain statements made in this announcement are forward-looking

statements. These forward-looking statements are not historical

facts but rather are based on the Company's current expectations,

estimates, and projections about its industry; its beliefs; and

assumptions. Words such as 'anticipates,' 'expects,' 'intends,'

'plans,' 'believes,' 'seeks,' 'estimates,' and similar expressions

are intended to identify forward-looking statements. These

statements are not a guarantee of future performance and are

subject to known and unknown risks, uncertainties, and other

factors, some of which are beyond the Company's control, are

difficult to predict, and could cause actual results to differ

materially from those expressed or forecasted in the

forward-looking statements. The Company cautions security holders

and prospective security holders not to place undue reliance on

these forward-looking statements, which reflect the view of the

Company only as of the date of this announcement. The

forward-looking statements made in this announcement relate only to

events as of the date on which the statements are made. The Company

will not undertake any obligation to release publicly any revisions

or updates to these forward-looking statements to reflect events,

circumstances, or unanticipated events occurring after the date of

this announcement except as required by law or by any appropriate

regulatory authority.

6. Other information

The financial information in this report does not constitute

statutory accounts within the meaning of section 434 of the

Companies Act 2006.

The interim results for the six months ended 30 November 2020

and 30 November 2019 are unaudited. The interim financial

statements have been prepared using accounting policies consistent

with International Financial Reporting Standards (IFRS) and

International Financial Reporting Interpretations Committee (IFRIC)

interpretations as endorsed by the European Union. The same

accounting policies, presentation and methods of computation have

been followed in the preparation of these results as were applied

in the Company's latest annual audited financial statements. The

Group has chosen not to comply with IAS 34 'Interim Financial

Statement' in these interim financial statements.

The financial information for the year ended 31 May 2020 does

not constitute the full statutory accounts for that period. The

Annual Report and Financial Statements for the year ended 31 May

2020 have been filed with the Registrar of Companies. The

Independent Auditor's Report on the Annual Report and Financial

Statements for the year ended 31 May 2020 was unqualified, did not

draw attention to any matters by way of emphasis, and did not

contain a statement under 498(2) or 498(3) of the Companies Act

2006.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR USRSRABUAAAR

(END) Dow Jones Newswires

January 15, 2021 02:00 ET (07:00 GMT)

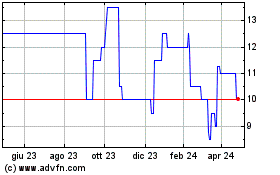

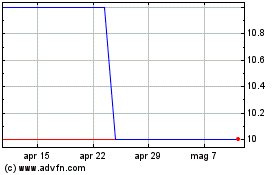

Grafico Azioni Leeds (LSE:LDSG)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni Leeds (LSE:LDSG)

Storico

Da Apr 2023 a Apr 2024