TIDMLSAA TIDMLSAB TIDMLSAD TIDMLSAE

RNS Number : 0168L

Life Settlement Assets PLC

27 April 2020

LIFE SETTLEMENT ASSETS PLC

(the "Company" or "LSA")

LEI: 2138003OL2VBXWG1BZ27

Annual Results Announcement for the year ended 31 December

2019

STRATEGIC REPORT

Introduction

LSA, a closed-ended investment trust company which invests in

and manages portfolios of whole and fractional interests in life

settlement policies issued by life insurance companies operating

predominantly in the United States, is pleased to announce its

financial results for the year ended 31 December 2019. The annual

financial report is being made available to be viewed on the

Company's website at

https://www.lsaplc.com/investor-relations/reports-company-literature/

and will be submitted to and available for inspection at

http://www.morningstar.co.uk/uk/nsm .

The well-established US life settlement market enables

individuals to sell their Policies to investors at a higher cash

value than they would otherwise receive from insurance companies

(if they were cancelled or surrendered at the date of sale) Certain

of the investments by the Company in these life settlement assets

have been made at a significantly discounted acquisition cost from

distressed situations where the original purchaser of the Policy is

in liquidation.

Corporate objective

The Company's objective is to generate long-term returns for

investors by managing its portfolios of life settlement interests

so that the realised value of the Policies at maturity exceeds the

aggregate cost of acquiring the Policies, ongoing premiums,

management fees and other operational costs The Company seeks to

achieve this for each of its separate Share Classes.

Core competencies

Through the combination of its Board and its strategic

partnerships with service providers, LSA has core competencies in

the following areas:

-- Assessment of the underlying value of life settlement policy

portfolios;

-- Access to investment opportunities, especially to portfolios

of policies where the Company already has an interest;

-- Management of strategic partnerships with service providers

providing investment management, actuarial, administration, company

secretarial and tracking services to enable the efficient operation

of its business; and

-- Cash flow management to balance returns to Shareholders with

financing ongoing acquisition costs

Through these competencies the Company has developed a

successful track record of realising value for Shareholders.

STRATEGIC ISSUES AND REPORTING

The Strategic Report has been prepared to help Shareholders

understand the operation of the Company and assess its

performance.

Basis of preparation

The Strategic Report has been prepared in accordance with the

requirements of Section 414A to 414D of the Companies Act 2006 (the

"Act") The Strategic Report also discloses the Company's risks and

uncertainties as identified by the Board, the key performance

indicators used by the Board to measure the Company's performance,

the strategies used to implement the Company's objectives, the

Company's environmental, social and ethical policy and the

Company's anticipated future developments.

Section 172(1) Statement

Under Section 172 ("s172") of the Companies Act 2006 the

directors of a company are required to act in the way they consider

will most likely promote the success of the company for the benefit

of its members as a whole. In doing this, section 172 requires

directors to include these factors:

-- likely consequences of any decisions in the long-term;

-- interests of the company's employees;

-- need to foster the company's business relationships with

suppliers, customers and others;

-- impact of the company's operations on the community and

environment;

-- desirability of the company maintaining a reputation for high

standards of business conduct, and

-- need to act fairly as between members of the company.

In discharging the s172 duties the Board have regard to the

factors set out above, although is should be noted that the Company

does not have any employees. It also has regard to other factors

where relevant. It is acknowledged that every decision the Board

make will not necessarily result in a positive outcome for all

stakeholders. By considering the Company's purpose and objectives

together with its strategic priorities and having a process in

place for decision-making, the Board do, however, aim to make sure

that decisions are consistent and predictable.

It is normal practice for Investment companies to delegate

authority for day-to-day administration and management of the

assets to third parties. At every Board meeting a review of

financial and operational performance, as well as legal and

regulatory compliance, is undertaken. The Board also review other

areas over the course of the financial year including the Company's

business strategy; key risks; stakeholder-related matters;

diversity and inclusivity; environmental matters; corporate

responsibility and governance, compliance and legal matters.

During the period Board received information to understand the

interests and views of the Company's key stakeholders;

Shareholders, the Administrator; Acheron as Investment Manager to

the Trusts, the four Trusts responsible for the portfolio of each

share class and the Servicing Agents. One of the Company's

Directors sits as trustee of these Trusts and provides regular

updates on each Trust. This information was distributed in a range

of different formats including reports and presentations on the

Company's financial and operational performance, non-financial

KPIs, risk and the outcomes of specific engagement's with

stakeholders. As a result, the Board have received useful feedback

which allows them to understand the nature of any stakeholder

concerns and to comply with the s172 duty to promote the success of

the Company. The Board engages with the key stakeholders in a

variety of ways, including the publication of Annual and

Half-Yearly Reports and Accounts, monthly fact sheets,

announcements of results, information provided on the Company's

website and at the Annual General Meeting. Shareholders are invited

to contact the Directors at any opportunity either via Acheron or

through the Company Secretary.

During the year the Board has considered:

--the distribution of cash through dividends to Shareholders and

returned $14.5 million across all share classes as shown in note

18;

--the retention of cash as working capital to meet the payment

of ongoing premiums to service the portfolio of life policies;

--the buyback of shares through the stock market and via a

tender offer. Full details are given in note 21 on page 76 of the

Annual Report;

--the assessment of the valuation of the portfolio during the

year including selecting an appropriate discount factor based on

research available and the mix of policies in the portfolio;

--the advantages and disadvantages of the proposal to merge

share classes A, D and E and concluding that the cost savings,

strengthening of ownership of the underlying policies and

improvement in the marketability of the Company's shares meant that

the proposal should being put to a Shareholder vote at a General

Meeting; and

--the outcomes of meetings with the Trustees and Servicing

Agents in the United States to protect the Company's interests in

the Life Policies held in each Trust.

Subsequent to the year end, the impact of the Covid-#19 pandemic

on the Company's operations, that of its service providers and on

the valuation of its portfolio and concluding that the effect was

expected to be minimal.

Employees

The Company has no employees as it engages third parties to

provide all necessary services to the Company.

Community and Environment

As an investment company with no offices of its own nor any

employees the Company has minimal carbon emissions. Where possible,

meetings are held by electronically to reduce the Company's impact

on the environment. The Company does not make any political or

charitable donations.

Service Providers

The Company engages a number of service providers who it regards

as key to its ongoing business, the Board recognise that the

continued engagement with these service providers is vital and the

success of these service providers is synonymous with the success

of the Company. It receives reports from providers and regularly

monitors the contribution they make to the Company's operations.

The Administrator, Company Secretary, Investment Manager and

Trustee of the underlying Trusts all attend Board Meetings.

Investment Strategy

The Company seeks to generate long-term returns for investors by

investing in the life settlement market, through each of the

separate Share Classes. The Company aims to manage its investment

in portfolios of life settlement products so that the realised

value of the policy maturities exceeds the aggregate cost of

acquiring the policies, ongoing premiums, management fees and other

operational costs. The Company's investment Objective and Policy

are stated on page 17 of the Annual Report.

Investments and underlying assets

As at 31 December 2019 each Share Class was invested in

underlying assets as follows:

-- Ordinary A Share Class ("LSAA") invests in life insurance

policies acquired from special or "distressed" situations, with

exposure to both HIV (average age mid to late 50s) and elderly

insureds (average age mid to late 80s). It is a widely diversified

portfolio by gender and the number of lives insured with circa

4,400 underlying policies, and exposure to whole and fractional

policies.

-- Ordinary B Share Class ("LSAB") invests in life insurance

policies exposed only to elderly insureds (average age mid to late

80s) with exposure to whole and fractional policies.

-- Ordinary D and E Share Classes ("LSAD" and "LSAE") - both

these Share Classes invest in separate portfolios comprising

predominantly fractional policies with exposure to both HIV and

elderly insureds, where the LSAA and/or LSAB Share Classes are

already fractional owners.

Comparative benchmarks and performance

Due to the lack of directly comparable companies investing in

the secondary market in life policies, the Company does not follow

a specific sector or geographic benchmark, although indirect

comparisons may be made from time to time with relevant market

indices

The life settlement market has a low correlation with

traditional equity and fixed income markets, as returns are

dependent on the actuarial and mortality rate assumptions used.

This, coupled with current low interest rates, can make this an

attractive alternative asset class.

The performance of the Company against its key performance

indicators is shown below.

Ongoing Charges

The Company's total annual costs (investment management fees and

other expenses) are 6 2% of net assets for the year to 31 December

2019.

Dividends/Distributions

During the period the Company paid special dividends to LSAA

Shareholders of 5.50 US cents per share (total USD 2.5 million),

LSAD Shareholders of 66.09 US cents per share (total USD 6.0

million) and LSAE Shareholders of 355.37 US cents per share (total

USD 6.0 million).

Chairman's Statement

It gives me great pleasure to present my first Annual Report as

Chairman of LSA and your Company`s second report since admission to

the London Stock Exchange in March 2018. However, I am also

conscious that I am writing at a time of great uncertainty for many

around the world due to the Coronavirus pandemic ("Covid-19").

Investment Overview

As shown in the financial highlights below, the year to 31

December 2019 proved to be a positive year for your Company.

The maturities received in the year were such that the Company

was able to make significant distributions to Shareholders by way

of special dividends of 5.50 US cents per A share, 66.09 US cents

per D share and 355.37 US cents per E share as shown in note

18.

In addition, the Company used the additional proceeds from

maturities to return USD 10.0 million to A Shareholders under a

tender offer in July 2019. The Company also repurchased 500,000 D

shares at a cost of USD 500,000 and 166,666 E shares at a cost of

USD 500,000. Further details are given in note 21 of the Annual

Report.

After the distributions and repurchases mentioned above, the

year-end NAV of class A increased by 10.4% whilst classes B, D and

E reduced by 8.1%, 33.6% and 52.9% respectively. When adding back

the dividends paid to Shareholders during the year, the NAV

increased by 13.5% per A share, 19 6% per D share and 21 8% per E

share. In contrast the NAV of class B declined by a just over 8.1%,

reflecting the very different composition of its portfolio when

compared to the other share classes.

I would draw your attention to the Investment Manager's Report

set out below where the underlying detail of this performance is

set out. As in previous years, given the nature of its asset base,

the Company has engaged Lewis and Ellis to provide an independent

actuarial valuation of the portfolio of life policies and they have

confirmed the approach taken by our Investment Manager is both

accurate and represents fair value. Further details can be found in

our Investment Manager`s report, and I would particularly draw your

attention to the comments regarding the changes we have made to the

Board's assessment of fair value for the HIV portfolio.

Retention of cash

In our Half Year Report published in September 2019 we drew

attention to certain factors which are likely to affect the future

management of our portfolios. Firstly, as stated in the Company's

announcement in January 2020, is the decision to retain more cash

in order to ensure the Company is in a position to take advantage

of any opportunity to consolidate our portfolios of fractional

policies with the purchase of additional fractions of those

policies. Currently two opportunities are being pursued by our

Investment Manager, which if concluded successfully, will add to

the longer-term value of our assets.

Structural changes

On 31 March 2020, the four Trusts through which the Company

invests in the underlying assets of the Company were merged (the

"Trusts Merger") in order to reduce annual operating costs and to

reduce operational risks without creating cross liabilities.

Following the Trusts Merger, the Company's life settlement assets

are held by a single continuing trust, namely the Acheron Portfolio

Trust, which is expected to achieve significant future cost

savings.

Furthermore, proposals to merge the share classes A, D and E

have been advanced since the year end with details of the Merger

published in a Circular sent to Shareholders on 2 April 2020. Given

the very different nature of the structure of Class B, with no

exposure to HIV policies, the Board has decided after careful

consideration not to propose the merger of class B at this stage,

although this will be kept under review and may be considered at a

later date depending on how the projected maturities develop.

Overall, the Board believes that the simplified share class

structure resulting from the Merger should provide both improved

liquidity for the holders of the merged Share Classes and also a

clearer investment case for new investors in the future as well as

the potential for nearer term cash flow enhancements to the

existing A Ordinary Shareholders.

A general meeting has been convened on 28 April 2020 at which

Shareholders have been invited to consider and, if thought fit, to

pass the necessary resolutions to give effect to the Merger.

Board changes

The Company also announced in its Half Year Report that Jean

Medernach had announced his intention to step down as a Director

and Chairman of your Company. The Board would like to record its

thanks to Jean for his guidance and skill in helping the Company

with the transition from Luxembourg to the UK.

I am delighted to welcome Christopher Casey to the Board and as

Chair of the Audit Committee. Chris brings with him a wealth of

experience both as a board member of other Investment Trusts and

also as a former partner of KPMG.

Change of Auditor

In September 2019, we were informed that Grant Thornton had

decided that having performed a strategic review of their business,

for commercial reasons, they would not continue as the Company's

Auditors. After reviewing the various options available I am

delighted that we were able to appoint BDO as replacement

Auditors.

Company Secretary

Following a review of our service providers, during the second

half of the year the Board decided that the Company would be better

served if the functions of Company Secretary and Financial

Controller were carried out by the same firm. As a result, the

Board decided to terminate the contract with Maitland

Administration Services Limited and concentrate both these roles

with ISCA Administration Services Limited.

Covid-19

The Board has reviewed the implications of the global Covid-19

pandemic and has put in place robust measures to maintain the

ongoing operation of its business, and to ensure continued

compliance by the Company of its regulatory obligations. Whilst

there can be no guarantee that there will be no business

interruption, to date there has been no impact on the

administration of the Company or its assets, and the Board has

received details from its key service providers of the steps they

are taking to protect their employees and operations.

The Board remains confident that all share classes offer our

investors important defensive qualities, which remain highly

decorrelated from equities and bonds and the current volatility of

those markets.

As a result, the Board have concluded that the current pandemic

is likely to have a minimal effect on the Company's operations and

results. Further details can be found in the Viability Statement

below.

Outlook

In the face of the many challenges and uncertainty facing global

economies, communities and individuals, as they grapple with the

impact of Covid-19, the Board believes that the investment

opportunity offered by LSA, and the underpinning effect of its

engagement with the life settlement market in the USA, will

continue to offer value to all its direct and indirect

stakeholders. With the various changes and streamlining actions

described above being taken since the middle of last year, I

believe that although many challenges lie ahead, the Company is now

better positioned to attain its strategic objectives and move onto

the next stage of its development.

Michael Baines

Chairman

27 April 2020

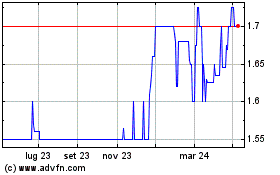

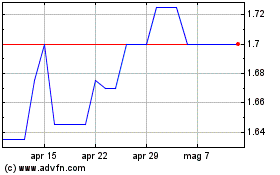

Company Performance

Performance analysis by Share Class is provided in the tables

below

As at As at Percentage

31 December 31 December change

LSAA 2019 2018 (%)

---------------------------------------------------- ------------- ------------- -----------

Net assets attributable to

Shareholders (USD '000) 89,108 91,649 (2.8)

Shares in Issue 39,891,391 45,446,946 (12.2)

NAV per share (USD) 2.23 2.02 10.4

Closing share price (USD) 1.78 1.45 22.8

Discount to NAV (%) (20.2) (28.1) 7.9

Total Maturities (USD '000) 41,742 20,826 100.4

Split of maturities - HIV (USD

'000) 5,985 14,008 (57.3)

- non-HIV (USD '000) 35,757 6,818 424.4

Net income from portfolio (USD

'000) 19,427 2,446 694.2

Profit/(loss) before tax (USD

'000) 10,140 (3,811) 366.1

---------------------------------------------------- ------------- ------------- -----------

As at As at Percentage

31 December 31 December change

LSAB 2019 2018 (%)

---------------------------------------------------- ------------- ------------- -----------

Net assets attributable to

Shareholders (USD '000) 14,863 16,150 (8.0)

Shares in Issue 14,596,098 14,596,098 -

NAV per share (USD) 1.02 1.11 (8.1)

Closing share price (USD) 0.63 0.60 5.0

Discount to NAV (%) (38.2) (45.8) 7.6

Total Maturities (USD '000) 3,410 5,242 (34.9)

Split of maturities - HIV (USD n/a n/a -

'000)

- non-HIV (USD '000) 3,410 5,242 (34.9)

Net income from portfolio (USD

'000) (608) (1,765) 65.6

(Loss) before tax (USD '000) (1,286) (2,455) 47.6

---------------------------------------------------- ------------- ------------- -----------

As at As at Percentage

31 December 31 December change

LSAD 2019 2018 (%)

---------------------------------------------------- ------------- ------------- -----------

Net assets attributable to

Shareholders (USD '000) 7,310 11,591 (36.9)

Shares in Issue 8,792,561 9,262,561 (5.4)

NAV per share (USD) 0.83 1.25 (33.6)

Closing share price (USD) 0.85 0.60 41.7

Premium/(discount) to NAV (%) 2.4 (51.9) 54.3

Total Maturities (USD '000) 7,949 3,719 113.7

Split of maturities - HIV (USD

'000) 431 466 (7.5)

- non-HIV (USD '000) 7,518 3,253 131.1

Net income from portfolio (USD

'000) 3,557 569 525.1

Profit/(loss) before tax (USD

'000) 2,220 (70) 3,271.4

---------------------------------------------------- ------------- ------------- -----------

As at As at Percentage

31 December 31 December change

LSAE 2019 2018 (%)

---------------------------------------------------- ------------- ------------- -----------

Net assets attributable to

Shareholders (USD '000) 3,512 8,247 (57.4)

Shares in Issue 1,566,603 1,733,269 (9.6)

NAV per share (USD) 2.24 4.76 (52.9)

Closing share price (USD) 1.90 1.70 11.8

Discount to NAV (%) (15.2) (64.3) 49.1

Total Maturities (USD '000) 5,625 2,989 88.2

Split of maturities - HIV (USD

'000) 145 226 (35.8)

- non-HIV (USD '000) 5,480 2,763 98.3

Net income from portfolio (USD

'000) 2,797 761 267.5

Profit before tax (USD '000) 1,767 249 609.6

---------------------------------------------------- ------------- ------------- -----------

Key Performance Indicators (KPIs)

The Board monitors success in implementing the Company's

strategy against a range of Key Performance Indicators ("KPIs"),

which are viewed as significant measures of success over the longer

term. These key indicators are those provided in the performance

tables above. Although performance relative to the KPIs is

monitored over quarterly periods, it is success over the long-term

that is viewed as more important. This is particularly important

given the inherent volatility of maturities and short-term

investment returns.

The Board has adopted the following KPIs:

Share Price - a key measure for Shareholders to show the most

likely realisable value of this investment if it was sold. Changes

in the share price are closely monitored by the Board.

NAV per share - as this is the primary indicator of the

underlying value attributable to each share.

Premium/(discount) to NAV - as this measure can be used to

monitor the difference between the underlying Net Asset Value and

share price.

Total maturities (USD) - the value of the total maturities in

USD provides an indicator of the underlying cash flow that the

Company receives from its main source of income - policy

maturities. There are factors which could impact the outcome of

this performance measure including: average life expectancy and the

age of the underlying policy holders. Please note that the Actual

to Expected ("A/E") ratio, which is closely linked to the total

maturities KPI, is a key method by which the Board seeks to

anticipate the level of maturities. The A/E ratio measures the

declared maturities compared to the projected maturities based on

the actuarial models. A ratio close to 100% indicates maturities

correspond exactly to the model. A percentage greater than 100%

means the maturities are more than anticipated by the models and

less than 100% the opposite is the case.

Earnings per share - this is a key measure of financial

performance used to assess the fortunes of the Company over each

financial period.

Running Costs - The Ongoing Charges of the Company for the

financial year under review represented 6.2% (2018: 5.4%) of

average net assets.

Shareholders should note that this ratio has been calculated in

accordance with the Association of Investment Companies' ("AIC")

recommended methodology, published in May 2012. This figure

indicates the annual percentage reduction in Shareholder returns as

a result of recurring operational expenses. Although the Ongoing

Charges figure is based on historic information, it does provide

Shareholders with a guide to the level of costs that may be

incurred by the Company in the future.

Please Note: The Company regularly uses performance measures to

present its financial performance. These measures may not be

comparable to similar measures used by other companies, nor do they

correspond to IFRS standards or other accounting principles .

Investment Manager's Report

The Life Settlement Market

The year ended 31 December 2019 was generally a good year for

the life settlement market, which continues to attract increasing

attention. Conning & Co, in its recent fourteenth Annual Life

Settlement Report, explores the expansion of the life settlement

industry relative to carrier performance, cost-of-insurance

drivers, a surge in retiring baby boomers, and growing interest

from investors.

Based on demographics and market dynamics, Conning foresees that

the life settlement market could see double-digit expansion over

the next ten years. The life settlement market would reach over USD

200 billion in cumulative life settlement transactions by 2028,

supported by a continued healthy supply of investors, a stable

regulatory environment and a large pool of policies to choose from.

In addition, the tertiary market is expected to continue thriving,

allowing the settlement market to maintain stable year-over-year

growth. One point that will continue to require improvements is the

viators medical assessment, with Life Expectancy playing a critical

role in the valuation of life settlements.

Portfolio Overview

LSA's current portfolios in the Trusts is subdivided into

portfolios exposed to either HIV policy holders or non-HIV policy

holders. For Class A, D and E Shareholders, the respective sizes of

these segments are USD 146 million for life settlements for non-HIV

policy holders. For all share classes, the respective sizes of

these segments are USD 381 million for HIV. The face-weighted

average age for the non-HIV segment is about 89.2 years. This

translates into a life expectancy for a normal population of five

years for men and six years for women. Class B is not exposed to

HIV.

HIV life expectancy is a difficult variable to assess. The

current face-weighted average age of the HIV population is about

60.2 years old; however actual mortality is similar to a population

of about 15 to 20 years older. Therefore, assuming the HIV policies

have the life expectancy of the general male population aged 78,

the average life expectancy for HIV policy holders could be around

15 years.

The current total premiums paid on this portfolio is about USD

20 million across all share classes. For 2020, we will retain USD

18m as a basis for premium projections. Premiums are reducing year

on year as the large elderly policies in the portfolio

progressively reach maturity.

During 2019, investments were made in four small portfolios of

fractional policies in which the Company is already a fractional

owner for a total face cost of USD 1.0m. Fractional policies are

single life insurance policies initially purchased by multiple

investors, each of whom acquired a fractional interest. These

acquisitions are critical to ensure the premiums on fractional

policies that LSA is exposed to continue to be paid and do not

lapse. These policies are mainly held in the Acheron Portfolio

Trust (LSAA) which is significantly exposed to such fractional

policies.

The following table provides information on the Company's

policies by Share Class and by exposure to HIV and non-HIV positive

insureds, as at 31 December 2019.

HIV and Non-HIV Exposed Policies (all values in USD)

LSAA HIV Non-HIV Total

Number of policies 4,233 182 4,415

Total face value (net of

advances on policies) 358,298,484 75,535,147 433,833,631

Valuation 42,380,000 15,751,000 58,131,000

Percentage of net face

value 11.8% 20.9% 13.4%

LSAB HIV Non-HIV Total

Number of policies n/a 96 96

Total face value n/a 45,504,840 45,504,840

Valuation n/a 10,739,000 10,739,000

Percentage of face value n/a 23.6% 23.6%

LSAD HIV Non-HIV Total

Number of policies 367 76 443

Total face value 15,966,447 16,306,527 32,272,974

Valuation 1,916,000 4,527,000 6,443,000

Percentage of face value 12.0% 27.8% 20.0%

LSAE HIV Non-HIV Total

Number of policies 161 56 217

Total face value 6,679,096 8,183,789 14,862,885

Valuation 887,000 1,841,000 2,728,000

Percentage of face value 13.3% 22.5% 18.4%

The US actuary provided valuations for all portfolios for the

year ended 31 December 2019. The valuations shown were derived by

adopting an actuarial approach. The actuaries performed an

2010-2019 A/E Study based on the observed mortality occurrences.

Some improvements to the HIV mortality assumptions were made based

on 2012-2019 A/E ratio. HIV figures from 2010 and 2011 were removed

as the A/E ratios were significantly higher. This ensures a more

conservative set of estimates. As a result, both HIV and non-HIV

segments reached long-term A/E ratio of circa 100% even excluding

these outperforming years, as is shown in the graphs titled HIV and

Non-HIV on page 15 of the Annual Report. In addition, none of the

life expectancies from medical underwriters were used in the 2019

valuation. The Life Expectancy reports were not only out of date,

but overall projections by medical underwriters had proven to be

poor.

Maturities

The year saw declared maturities and A/E in the different Share

Classes as follow:

Maturities (USD) Class A Class B Class D Class E

HIV 5,984,541 - 431,125 144,846

Non-HIV 35,757,459 3,409,601 7,517,875 5,480,154

Total 41,742,000 3,409,601 7,949,000 5,625,000

A/E* All classes

HIV 83%

Non-HIV 95%

* in the number of lives, from the US actuary reports

In the non-HIV segment, the two largest exposures matured in

2019, contributing USD 35 million across all Share Classes.

Although Non-HIV A/E in the number of lives is 95%, those two

maturities have pushed the non-HIV A/E in monetary terms to 177%

across all the share classes and 209% in Class A. This is above our

internal projection of one extra-large maturity for this year, but

not a sufficient factor for a model revision. However, Class B only

shared USD 1.7 million in those two exposures, leading to the lower

A/E ratio and poorer performance in 2019.

On the other hand, the HIV segment performed under expectations

by 17% in the year under review. Compared to previous years, the

HIV mortality rate seems lower in younger age ranges but much

higher in above 70-year-old range. It means that the observed

mortality curve in 2019 is steeper than before. An internal

exercise was performed to study the possible impact on valuation

from the change in the curve. By applying last year's best fit

mortality curve to the portfolio, rather than the model currently

in use, the valuation of the whole HIV portfolio for Class A would

decrease by USD 0.6 million, or about 2%.

After the realisation of two largest exposures, the HIV face

value concentration increased by 5% to 80% in Class A. The

increased exposure to HIV only is increasing not only the risk

concentration of the portfolio, but also reducing cash flow in the

coming years. In order to adjust the portfolio risk return ratio

for this steady increase in concentration, the discount rate

applied to HIV was increased from 11% to 12% in July 2019.

Going forward

The mortality of the insureds in the portfolio will continue to

be the most significant factor that will affect the financial

results for the Company. This will have a direct impact on cash

flow, not only due to the maturities that will or will not be

collected, but also in terms of premiums that will have to be paid

or not. We will continue to follow the recent research on mortality

in general and especially on long-term HIV trends. The steepening

of this year's HIV mortality curve is a potential validation of our

view that HIV sufferers' health conditions worsen much more rapidly

than the general population as they age. This results in long-term

patients having a worse medical status that is different from

patients of the same age that only recently contracted the

disease.

Acheron Capital

27 April 2020

Overview of Strategy and Investment Policy

Investment Objective

The Company's investment objective is to generate long-term

returns for investors by investing in the life settlement market.

The Company has not established target rates of return with respect

to its investments.

Investment Policy

The Company will seek to achieve the Company's Investment

Objective in respect of each Share Class as follows:

A Ordinary Share Class (LSAA)

The assets attributable to the A Ordinary Share Class are

predominantly invested in life insurance policies acquired from

special or "distressed" situations, with exposure to both HIV and

elderly insureds.

The Company met this Investment Policy by acquiring the entire

beneficial interest in the Acheron Portfolio Trust from the

Predecessor Company shortly after Admission.

B Ordinary Share Class (LSAB)

The assets attributable to the B Ordinary Share Class are

predominantly invested in life insurance policies exposed only to

elderly insureds.

The Company met this Investment Policy by acquiring the entire

beneficial interest in the Lorenzo Tonti 2006 Portfolio Trust from

the Predecessor Company shortly after Admission.

D Ordinary Share Class and E Ordinary Share Class (LSAD and

LSAE)

The assets attributable to the D and E Ordinary Share Classes

are invested predominantly in Fractional Policies with exposure to

both HIV and elderly insureds, where the A and/or B Share Classes

are already fractional owners.

The Company met these Investment Policies by acquiring the

entire beneficial interest in: a) the Avernus Portfolio Trust, in

respect of the D Ordinary Share Class; and b) the Styx Portfolio

Trust, in respect of the E Ordinary Share Class, from the

Predecessor Company shortly after Admission.

Source of Policies

In respect of each Share Class, such Policies will be or have

been obtained from a variety of sources, primarily in the United

States.

Further acquisitions

The Company has announced that it intends to retain a larger

proportion of cash receipts from policy maturities in order to be

in a position to fund potential investment opportunities through

the acquisition and consolidation of the remaining fractions or

participations of certain of the US trusts and conservatorships in

which the Company was already indirectly invested. These

opportunities were expected to arise over the forthcoming years as

a result of the ageing (and therefore reducing size) of the

underlying portfolios in which the Company was invested and as a

result of the Investment Manager's proactive steps to protect and

maximise the value of the assets. Accordingly, as surplus cash

accumulates from policy maturities, the Board will carefully

balance the amount that should be distributed to Shareholders and

that which should be retained to fund future potential investment

opportunities.

The Company may also raise additional capital in the future to

acquire further Policies that meet the Investment Objective and

Investment Policy of the relevant Share Class (or those of a Share

Class to be established in future). Such Policies will subsequently

be granted to the relevant Trust.

Investment Controls

Any transaction involving more than 10% of the Gross Asset Value

of the Company, directly or indirectly, will require the prior

approval of the Board in writing.

Hedging and use of derivatives

The Company and/or the Trusts may also hold derivative or other

financial instruments designed for efficient portfolio management

or to hedge interest or inflation risks. The Trusts may invest in

liquidity management products as deemed fit by the Trustee or the

Investment Manager, as well as mortality hedging products as deemed

fit by the Investment Manager, including, but not limited to,

mortality related Insurance Linked Securities ("ILS").

Dividend Policy

The Company has no stated dividend target. The Company aims to

distribute a substantial portion of its funds derived from its

operations in respect of a Share Class as dividends to Shareholders

of that share class. There can be no assurance that the Company

will be able to achieve this aim.

The Company will only pay dividends on the Ordinary shares to

the extent that it has sufficient financial resources available for

that purpose.

In accordance with regulation 19 of the Investment Trust

(Approved Company) (Tax) Regulations 2011, the Company will not

(except to the extent permitted by those regulations) retain more

than 15% of its income (as calculated for UK tax purposes) in

respect of any accounting period.

Borrowing

As at the date of this Report, the Company as a small registered

Alternative Investment Fund ("AIF") does not intend to borrow due

to the costs and regulatory implications that this would entail.

However, the Company reserves the right to borrow in the future in

appropriate circumstances and at the discretion of the Board (or,

subject to the terms of the applicable Investment Management

Agreement, the Investment Manager if such borrowing is at Trust

level), provided that any such borrowing entered into in respect

of, or attributable to, a Share Class shall be limited to a maximum

of 10% of the Net Asset Value of such Share Class (at the time the

borrowing is incurred).

In addition, the Board (or the Investment Manager, subject to

any limits imposed by the Board) has discretion to make short-term

loans out of the assets attributable to one Share Class to another

Share Class where the Board or the Investment Manager (as the case

may be) considers it necessary in order to fully or partially

remedy a cash-flow shortfall in respect of that other Share

Class.

Policy Advances

The Company does utilise policy advances to provide an

acceleration of the cash flow to the Company. A policy advance

refers to excess cash withdrawn from cash reserves generated at the

level of the life insurance contracts. Policy advances will be

deducted from any proceeds when the maturities are collected. These

policy advances are also described in Note 3.4 of the Annual

Report. The Board is of the opinion that these policy advances do

not constitute borrowing for the purposes of the Alternative

Investment Fund Managers Directive ("AIFMD").

Cash Management

Pending reinvestment or distribution of cash receipts, cash

received by the Company and the Trusts may be held on deposit, in

cash, cash equivalents, near cash instruments, money market

instruments and money market funds and cash funds in line with the

risk appetite specified by the Board.

The Trusts' Investment Manager must ensure that the Company's

and each Trust's liabilities can be met as they fall due.

Corporate and Operational Structure

The Board retains responsibility for key elements of the

Company's strategy, including the following:

- the Company's investment policy which determines the diversity

of the Company's portfolio. The Board sets limits and restrictions

with the aim of reducing risk and maximising returns;

- the appointment, amendment or removal of the Company's

third-party service providers; and ensuring an effective system of

oversight over the Company's risk management and corporate

governance.

In order to effectively undertake its duties, the Board may seek

expert legal advice. It can also call upon the advice of the

Company Secretary.

The Board act in a way that they consider to be in good faith

and is most likely to promote the success of the Company for the

benefit of its Shareholders as a whole, and in doing so have regard

(amongst other matters) to:

- the likely consequences of any decision in the long-term;

- the impact of the Company's operations on the community and

the environment;

- the desirability of the Company maintaining a reputation for

high standards of business conduct; and

- the need to act fairly to avoid conflicts between the

interests of the Directors and those of the Company.

The Company has outsourced various operations to various

third-party service providers as detailed below:

- Investment Management: As it is an internally managed

investment trust, the Company has not appointed an investment

manager to provide it with investment managerial services. However,

each of the Trusts have appointed the Investment Manager, Acheron

Capital Limited as their investment manager under the Investment

Management Agreements with effect from the date of Admission. The

Investment Manager is authorised and regulated by the FCA (under

reference number 443685). Further details of Investment Management

Agreements are set out in Part 6 of the Prospectus dated January

2018.

- The Trustee: The Trustee of each of the Trusts is Dr Robert

Edelstein who is also a Director of the Company.

- The Registrar: Link Market Services Limited has been appointed

as the Company's Registrar.

- Administrator: The Company has appointed Compagnie Européenne

de Révision Sàrl as its Administrator.

- Company Secretary: With effect from 1 December 2019, ISCA

Administration Services Limited has been appointed as Company

Secretary.

- Tracking and Servicing Agents: The Trusts have appointed a

Tracking and Servicing Agent to assess on a regular basis if

Consenting Individuals have passed away. If Consenting Individuals

have passed away the Tracking and Servicing Agent obtains

respective death certificates and ensures that they are delivered

to the insurance company that issued the relevant Policy so that

applicable death benefits can be claimed. Each Trust has entered

into a servicing agreement with the Tracking and Servicing Agent

detailing the services the Tracking and Servicing Agent will

provide. As at the date of this Report, Litai Assets LLC, Fort

Lauderdale and the Asset Servicing Group, Oklahoma City, have both

been appointed by the Trusts to service life settlement policy

interests owned by the Trusts.

- Actuaries: The Company engages actuaries to estimate the life

expectancy of individuals insured under particular Policies or

portfolios of Policies. Actuaries provide life expectancy or

valuation estimates based on a more general set of assumptions and

experience.

Principal Risks

The Company is exposed to a number of potential risks and

uncertainties. These risks could have a material impact on

financial performance and position and could cause actual results

to differ materially from expected and historical results.

The Company faces a number of risks in the normal course of its

activities and as a result the management of those risks the

Company faces is essential. The Board maintains the overall

responsibility for risk management but has delegated to the Audit

Committee the task of regular and robust assessments of the

Company's risks and controls. The Audit Committee has accordingly

established a robust process to identify and monitor the risks

faced by the Company. The process involves the maintenance of a

risk register, which identifies the risks facing the Company and

assesses each risk on a scale, classifying the probability of the

risk and the potential impact that an occurrence of the risk could

have on the Company. A number of day-to-day risk management

functions of the Trusts are undertaken by the Trusts' Investment

Manager, who regularly reports to the Audit Committee.

Risk Mitigation

Mortality risk

Changes in mortality rates may The Investment Manager regularly

adversely affect the performance assesses mortality rates based

of the Policies held by the on available information.

Company in respect of a Share

Class.

-------------------------------------------

Premium management risk

Unanticipated volatility in Management monitors cash on

mortality rates makes liquidity an ongoing basis in accordance

management of premium reserves with the practice and limits

difficult, as the Company (or set by the Board.

the Trusts) need to be able

to meet premiums and costs at

all times. Failure to pay a

premium may result in the relevant

Policy lapsing and the Company

being unable to receive insured

sums as a result.

-------------------------------------------

Volatility risk

The portfolio of each Share The Investment Manager seeks

Class may be more volatile than to ensure a diversified portfolio

expected as a consequence of of policies.

certain policies representing

a larger proportion of the portfolio

than other policies.

-------------------------------------------

Fractional premium risk

The other parties in a fractional The Investment Manager regularly

policy may not renew the premium has first refusal in this event

leading to the policy lapsing. and will decide whether a policy

is worth retaining or whether

it should be allowed to lapse.

If it is considered the policy

should be retained the Company

will pay the premium that remains

unpaid by the other party. The

Company is under no obligation

to pay for a policy which it

considers is uneconomic.

-------------------------------------------

Advance age mortality risk

There is a lack of data to reliably The Company has engaged an independent

determine general or disease Actuary to perform its own assessment

specific mortality at advanced of the value of the portfolio

ages, as well as the date beyond of policies. Valuation differences

which a Policy no longer has between the two models are investigated.

value. This makes the use of

statistically unproven assumptions

necessary. As a consequence,

should such assumptions prove

to be incorrect, the Company's

performance and that of the

Ordinary Shares may fall short

of expectations.

-------------------------------------------

Discount rate risk

The discount rate used for reporting The discount rate applied is

or valuation purposes may be regularly assessed by the Investment

on a portfolio basis or on a Manager based on available information.

bottom up Policy by Policy or Changes in discount rate will

Policy type by Policy type basis, only be made once approved by

which can create material value the Board.

differences. Further, there

is no well-established market

discount rate, which makes the

use of specific discount rates

for actuarial purposes subjective.

-------------------------------------------

Modelling risk

The Investment Manager uses The Company has engaged an independent

modelling in determining the Actuary to perform its own assessment

investments to make; however, of the value of the portfolio

if the assumptions made by the of policies. Valuation differences

Investment Manager in building between the two models are investigated.

these models are or were materially

incorrect, there could be a

substantial adverse effect on

the Net Asset Value of the Ordinary

Shares participating in the

relevant Policies and the Company's

performance and that of the

Ordinary Shares may fall short

of expectations.

-------------------------------------------

Tax

Any changes in the Company's The Company intends at all times

tax status or to conduct its affairs so as

in taxation legislation could to enable it to qualify as an

affect the value of investments investment trust for the purposes

held by the Company, affect of Section 1158 of the Corporation

the Company's ability to provide Tax Act 2010. Both the Board

returns to Shareholders and and the Investment Manager are

affect the tax treatment for aware of the requirements which

Shareholders of their investments are to be fulfilled in any accounting

in the Company. The results period for the Company to maintain

of the Company would also likely its investment trust status.

be adversely affected if the The conditions required to satisfy

Company were not eligible to the investment trust criteria

claim benefits under the current shall be monitored by the compliance

income tax treaty between the function of the Investment Manager

United Kingdom and the United and performance of the same

States. In conformity with the shall be reported to the Board

income tax treaty, withholding on a quarterly basis. The Board

tax on matured policies is not monitors the trading of the

due if at least 6% of the average main class of Shares regularly

capital stock of the main class to assess the 6% requirement.

of Shares is traded annually This helps ensure that action

on a recognised stock exchange. could be taken to encourage

Changes in taxation may also more trading and reduce the

adversely affect the results likelihood of incurring a tax

of the Company. charge.

-------------------------------------------

Breach of applicable legislative

obligations The Company engages only with

The Company and its third-party third-party service providers

service providers are subject which hold the appropriate regulatory

to various legislative and regulatory approvals for the function they

regimes. Any breach of applicable are to perform and can demonstrate

legislative and/or regulatory that they can adhere to the

obligations could have a negative regulatory standards required

impact on the Company and impact of them. Each appointment is

returns to Shareholders. governed by agreements which

contain the ability for the

Company to terminate the arrangements

with each of these counterparties

with limited notice should such

counterparty continually or

materially breach any of their

legislative obligations, or

their obligations to the Company

more broadly. Additionally,

each of the counterparties is

subject to regular performance

and compliance monitoring by

the Investment Manager, as appropriate

to their function, to ensure

that they are acting in accordance

with applicable regulations

and are aware of any upcoming

regulatory changes which may

affect the Company.

-------------------------------------------

Counterparty risk

If an insurance company that Insurance companies are required

has issued a Policy in which to separate their operations

the Company invests defaults, between General Insurance and

the Company may not receive Life Insurance, meaning the

one or more payments owing to effect on the assets and the

it. risk on Life Settlement policies

would be ring fenced in the

event of significant business

difficulties. The HIV policies

are protected by a State Guarantee

up to USD150k-USD200k per policy

which covers a significant proportion

of these policies. Non-HIV policies

tend to be of a higher value

than that covered by the State

Guarantee and involve some risk,

but the insurance industry spreads

their risk through re-insurance

in many asset backed companies

across the world.

-------------------------------------------

Other risks specific to the Company

As described on page 34 of the Annual Report, the Board and

Audit Committee have an ongoing process of monitoring and reviewing

risks and internal controls. The principal risks and mitigations

are highlighted above.

Litigation risk: The assignment of life insurance policies can

be a contentious matter and the sector has historically been

subject to high levels of litigation.

Premium assumptions risk: Changes in the amount of premiums

charged by the insurance company that has issued a Policy may

increase the costs borne by the Company and adversely affect its

performance.

Reliance on key individuals: The Company relies on key

individuals to manage the day-to-day affairs of the Company. There

can be no assurance as to the continued service of these key

individuals. The departure of key individuals without adequate

replacement may have a material adverse effect on the Company's

prospects and results. Accordingly, the ability of the Company to

achieve its investment objective depends heavily on the experience

of the Investment Manager's team, and more generally, on the

ability of the Investment Manager to attract and retain suitable

staff.

Fluctuations in the market price of the Company's shares: The

market price of the Company's shares may not reflect the Net Asset

Value of each Share Class and may fluctuate widely in response to

different factors. There can be no assurance that the Company's

shares will be repurchased by the Company even if they trade

materially below their Net Asset Value. Similarly, the shares may

trade at a premium to Net Asset Value whereby the shares can trade

on the open market at a price that is higher than the value of the

underlying assets. There can be no assurance, express or implied,

that Shareholders will receive back the amount of their investment

in the Company's shares.

Third-Party Service Providers: The Company has no employees and

the Directors have all been appointed on a non-executive basis.

Whilst the Company has taken all reasonable steps to establish and

maintain adequate procedures, systems and controls to enable it to

comply with its obligations, the Company relies upon the

performance of third-party service providers for its executive

function. In particular, the Investment Manager, Administrator,

Registrar and Company Secretary. The termination of service

provision by any service provider, or failure by any service

provider to carry out its obligations to the Company, or to carry

out its obligations to the Company in accordance with the terms of

its appointment, could have a material adverse effect on the

Company's operations and its ability to meet its investment

objective.

Achievement of the Investment Objective: There can be no

assurance that the Company will be successful in implementing the

Investment Objective.

For a detailed description of the Company's financial risks,

please refer to note 4 of the Annual Report.

Viability Statement and Other Disclosures

The Directors have assessed the prospects of the Company over a

longer period than the 12 months referred to in the 'Going Concern'

guidelines.

The Board conducted this review focusing on a period of three

years. This period was selected as it is aligned with the Company's

strategic planning. In making this assessment the Board also

considered the Company's principal risks.

Investment trusts in the UK operate in a well-established and

robust regulatory environment and the Directors have assumed

that:

-- Investors will continue to want to invest in closed-end

investment trusts because the fixed capitalisation structure is

suited to pursuing the current investment strategy; and

-- the Company's remit of investing in life settlement assets

predominantly in the U.S. will continue to be attractive to

investors.

The Company's primary source of income is from policy

maturities. As the timing of these maturities is not entirely

predictable the Board sometimes will need to take advantage of

policy advances. The Company can utilise policy advances in order

for premiums to be maintained active. A policy advance refers in

this case to excess cash withdrawn from cash reserves generated at

the level of the life insurance contracts. Policy advances are

deducted from any proceeds when the maturities are collected.

In the unlikely event that maturities and policy advances are

insufficient to meet ongoing cash and policy premium obligations,

the Directors have the authority to make short-term borrowing

arrangements with financial institutions. These borrowing options

are explained in more detail in the Strategic Report above.

As with all investment vehicles, there is a risk that the

performance of individual investments will vary and that capital

may be lost, but this is not regarded as a threat to the viability

of the Company. Operationally, the Company retains title to all

assets including the life settlement assets and cash.

The closed-end nature of the Company means that, unlike an

open-ended fund, it does not need to liquidate positions when

Shareholders wish to sell their shares, the expenses of the Company

are predictable and modest in comparison with the assets and there

are no capital commitments currently foreseen which would alter

that position. Taking these factors into account, the Directors

confirm that they have a reasonable expectation that the Company

will continue to operate and meet its expenses as they fall due

over the next three years.

The Company's portfolio consists primarily of U.S. investments,

accordingly, the Company believes that the "Brexit" process will

not materially affect the prospects for the Company, but the Board

will continue to keep developments under review.

In assessing the viability of the Company, the Board has fully

considered the risks of the current Covid-19 pandemic and the

effect any additional maturities may have on insurance companies

within the life settlement market. The potential risk to the

Company and the mitigation is shown above under Counterparty risk.

The Board has considered the position of the Company in the

unlikely event that maturities are not paid out in full. Over the

last year the Company has returned cash received from large

maturities to Shareholders in the form of dividends, buybacks and a

tender offer. It should be noted that such payments are not fixed

and are at the Board's discretion based on the cash available at

the time.

The Board have concluded that the effect of the current pandemic

on the Company's asset valuation and its ability to service those

assets through the payment of premiums is likely to be minimal.

Donations

The Company made no political or charitable donations during the

year under review.

Environment, human rights, employee, social and community

issues

The Company is required by law to provide details of

environmental matters (including the impact of the Company on the

environment), employee, human rights, social and community issues

(including information about any policies it has in relation to

these matters and the effectiveness of those policies). The Company

does not have any employees and the Board is composed of

independent non-executive Directors. As an investment trust, the

Company has a minimal impact on the environment. The Company aims

to minimise any detrimental effect that its actions may have by

adhering to applicable social legislation, and as a result does not

maintain specific policies in relation to these matters.

The Company has no internal operations and therefore no

greenhouse gas emissions to report nor does it have responsibility

for any other emissions producing sources, including those within

its underlying investment portfolio.

In carrying out its investment activities and in relationships

with suppliers, the Company aims to conduct itself responsibly,

ethically and fairly.

Modern Slavery Act

The Company is not within the scope of the Modern Slavery Act

2015 because it has insufficient turnover and is therefore not

obliged to make a human trafficking statement.

Approval

The Strategic Report was approved by the Board of Directors on

27 April 2020 and signed on its behalf by:

Michael Baines

27 April 2020

GOVERNANCE

Extract from Report of the Directors

Share Capital

At the year-end there were 39,891,391 A Ordinary Shares of $0.01

each, 14,596,098 B Ordinary Shares of $0.01 each, 8,792,561 D

Ordinary Shares of $0.01 each and 1,566,603 E Ordinary Shares of

$0.01 each, none of which are held in Treasury. The buybacks of the

Company's shares during the year are shown in note 21 of the Annual

Report. All shares are listed on the Specialist Fund Segment of the

main market of the London Stock Exchange.

Going Concern

The financial statements of the Company have been prepared on a

going concern basis. The forecast

projections and actual performance are reviewed on a regular

basis throughout the period. In assessing the Company's ability to

continue as a going concern the Board has fully considered the

effect of the current pandemic. Further details are shown in the

Viability Statement above. The Directors believe that this is

appropriate to prepare the financial statements on a going concern

basis and that the Company has adequate resources to continue in

operational existence for the foreseeable future and is financially

sound. The Company is able to meet from its assets, all of its

liabilities including annual premiums and its ongoing charges.

The full Annual Report and Accounts contains the following

statement regarding responsibility for the Financial

Statements:

Statement of Directors' Responsibilities

The Directors are responsible for preparing the Annual Report

and the financial statements in accordance with applicable law and

regulations.

Company law requires the Directors to prepare financial

statements for each financial year. Under that law the Directors

are required to prepare the financial statements in accordance with

International Financial Reporting Standards (IFRSs) as adopted by

the European Union. Under company law the Directors must not

approve the financial statements unless they are satisfied that

they give a true and fair view of the state of affairs of the

Company and of the profit or loss of the Company for that

period.

In preparing these financial statements, the Directors are

required to:

-- select suitable accounting policies and then apply them

consistently;

-- make judgements and accounting estimates that are reasonable

and prudent;

-- state whether they have been prepared in accordance with

IFRSs as adopted by the European Union, subject to any material

departures disclosed and explained in the financial statements;

-- prepare the financial statements on the going concern basis

unless it is inappropriate to presume that the Company will

continue in business; and

-- prepare a Directors' Report, a Strategic Report and

Directors' Remuneration Report which comply with the requirements

of the Companies Act 2006.

The Directors are responsible for keeping adequate accounting

records that are sufficient to show and explain the Company's

transactions and disclose with reasonable accuracy at any time the

financial position of the Company and enable them to ensure that

the financial statements comply with the Companies Act 2006 and, as

regards the financial statements, Article 4 of the IAS Regulation.

They are also responsible for safeguarding the assets of the

Company and hence for taking reasonable steps for the prevention

and detection of fraud and other irregularities. The Directors are

responsible for ensuring that the Annual Report and accounts, taken

as a whole, are fair, balanced, and understandable and provides the

information necessary for Shareholders to assess the Company's

performance, business model and strategy.

Website publication

The Directors are responsible for ensuring the Annual Report and

the financial statements are made available on a website. Financial

statements are published on the Company's website in accordance

with legislation in the United Kingdom governing the preparation

and dissemination of financial statements, which may vary from

legislation in other jurisdictions. The maintenance and integrity

of the Company's website is the responsibility of the Directors.

The Directors' responsibility also extends to the ongoing integrity

of the financial statements contained therein.

Directors' responsibilities pursuant to DTR4

The Directors confirm to the best of their knowledge:

-- The financial statements have been prepared in accordance

with International Financial Reporting Standards (IFRSs) as adopted

by the European Union and Article 4 of the IAS Regulation and give

a true and fair view of the assets, liabilities, financial position

and profit of the Company.

-- The Annual Report includes a fair review of the development

and performance of the business and the financial position of the

Company, together with a description of the principal risks and

uncertainties that they face.

Michael Baines

Chairman

27 April 2020

NON-STATUTORY ACCOUNTS

The financial information set out below does not constitute the

Company's statutory accounts for the years ended 31 December 2019

or 31 December 2018 but is derived from those accounts. Statutory

accounts for the year ended 31 December 2018 have been delivered to

the Registrar of Companies and statutory accounts for the year

ended 31 December 2019 will be delivered to the Registrar of

Companies in due course. The Auditor has reported on those

accounts; their reports were (i) unqualified, (ii) did not include

a reference to any matters to which the Auditor drew attention by

way of emphasis without qualifying their report and (iii) did not

contain a statement under Section 498 (2) or (3) of the Companies

Act 2006. The text of the Auditor's reports can be found in the

Company's full Annual Report and Accounts at www.lsaplc.com

Life Settlement Assets PLC

Statement of Comprehensive Income

for the year ended 31 December 2019

2019 2018*

Revenue Capital Total Revenue Capital Total

Notes USD'000 USD'000 USD'000 USD'000 USD'000 USD'000

Income

Income from life

settlement portfolios 4 868 - 868 566 - 566

Gains from life settlement

portfolios 5 - 23,381 23,381 - 1,339 1,339

Other income 6 941 - 941 133 - 133

Net foreign exchange

loss (17) - (17) (27) - (27)

Total income 1,792 23,381 25,173 672 1,339 2,011

Operating expenses

Investment management

fees 7 (1,852) (3,285) (5,137) (2,101) 75 (2,026)

Other expenses (5,994) - (5,994) (4,776) - (4,776)

(Loss)/profit before

finance costs and

taxation (6,054) 20,096 14,042 (6,205) 1,414 (4,791)

Finance costs

Interest payable (1,201) - (1,201) (1,296) - (1,296)

(Loss)/profit before

taxation (7,255) 20,096 12,841 (7,501) 1,414 (6,087)

Taxation 8 (130) - (130) - - -

(Loss)/profit for

the year (7,385) 20,096 12,711 (7,501) 1,414 (6,087)

-------- -------- -------- -------- -------- --------

Basic and diluted

returns per share (USD) (USD) (USD) (USD) (USD) (USD)

Return per class

A share 9 (0.135) 0.369 0.234 (0.125) 0.041 (0.084)

Return per class

B share 9 (0.036) (0.052) (0.088) (0.045) (0.123) (0.168)

Return per class

D share 9 (0.069) 0.313 0.244 (0.073) 0.065 (0.008)

Return per class

E share 9 (0.271) 1.328 1.057 (0.270) 0.414 0.144

All revenue and capital items in the above statement derive from

continuing operations of the Company.

The Company does not have any income or expense that is not

included in the profit for the year and therefore the profit for

the year is also the total comprehensive income for the year.

The total column of this statement is the Statement of Total

Comprehensive Income of the Company. The supplementary revenue and

capital columns are prepared in accordance with the Statement of

Recommended Practice ("SORP") issued by the Association of

Investment Companies ("AIC") in October 2019.

* For the period 16 August 2017 to 31 December 2018.

The notes form part of these financial statements.

Life Settlement Assets PLC

Statement of Financial Position

as at 31 December 2019

2019 2018

Note USD'000 USD'000

------------------------------------- ------ --------- ---------

Non-current assets

Financial assets at fair value

through profit or loss

- Life settlement investments 10,11 78,041 89,813

- Shares in subsidiary - 25,232

--------- ---------

78,041 115,045

Current assets

Maturities receivable 3,867 17,797

Trade and other receivables 697 940

Premiums paid in advance 9,231 13,328

Cash and cash equivalents 28,992 10,587

--------- ---------

42,787 42,652

--------- ---------

Total assets 120,828 157,697

--------- ---------

Current liabilities

Other payables (981) (2,015)

Provision for performance fees 12 (5,054) (2,813)

Liabilities to subsidiary 13 - (25,232)

--------- ---------

Total liabilities (6,035) (30,060)

--------- ---------

Net assets 114,793 127,637

--------- ---------

Represented by

Capital and reserves

Share capital 648 711

Share premium - 133,013

Special reserve 107,458 -

Capital redemption reserve 63 -

Capital reserve 21,510 1,414

Revenue reserve (14,886) (7,501)

--------- ---------

Total equity attributable to

ordinary shareholders of the

Company

SSshareholders of the shareholders

of the Company 114,793 127,637

--------- ---------

Net Asset Value per share basic

and diluted

Class A shares USD 14 2.234 2,017

Class B shares USD 14 1.018 1,107

Class D shares USD 14 0.831 1,247

Class E shares USD 14 2.242 4,758

These financial statements were approved by the Board of

Directors on 27 April 2020 and signed on its behalf by:

Michael Baines, Chairman

Registered in England and Wales with Company Registration

number: 10918785

The notes form part of these financial statements.

Statement of Changes in Equity

for the year ended 31 December 2019

Capital

Share Share Special redemption Capital Revenue

capital premium reserve reserve reserve reserve Total

USD'000 USD'000 USD'000 USD'000 USD'000 USD'000 USD'000

--------- ---------- --------- ------------ --------- --------- ---------

Balance as at 31

December 2018 711 133,013 - - 1,414 (7,501) 127,637

Comprehensive income

for the year - - - - 20,096 (7,385) 12,711

Contributions by

and distributions

to owners

Cancellation of

Share premium account - (133,013) 133,013 - - - -

Tender offer July

2019 (56) - (10,050) 56 - - (10,050)

Share buybacks

for

cancellation (7) - (1,005) 7 - - (1,005)

Dividends paid

in year - - (14,500) - - - (14,500)

Balance as at

31 December 2019 648 - 107,458 63 21,510 (14,886) 114,793

--------- ---------- --------- ------------ --------- --------- ---------

Of which:

Realised gains 17,619

Unrealised gains 3,891

Capital

Share Share Special redemption Capital Revenue

capital premium reserve reserve reserve reserve Total

USD'000 USD'000 USD'000 USD'000 USD'000 USD'000 USD'000

--------- ---------- --------- ------------ --------- --------- ---------

Balance as at 16

August 2017 - - - - - - -

Comprehensive income

for the period - - - - 1,414 (7,501) (6,087)

Contributions by

and distributions

to owners

Shares issued on

incorporation 67 - - - - - 67

Additional Shares

issued on 26 March

2018 711 133,013 - - - - 133,724

Redemption of redeemable

shares (67) - - - - - (67)

Balance as at 31

December 2018 711 133,013 - - 1,414 (7,501) 127,637

--------- ---------- --------- ------------ --------- --------- ---------

Of which:

- Realised (loss) (1,248)

- Unrealised gains 2,662

The Special reserve was created as a result of the cancellation

of the Share premium account following a court order issued on 18

June 2019. The Special reserve is distributable and may be used to

fund purchases of the Company's own shares and to make

distributions to Shareholders.

The revenue and realised capital reserves are also distributable

reserves.

The notes form part of these financial statements.

Life Settlement Assets PLC

Cash Flow Statement

for the year ended 31 December 2019

Notes 2019 2018*

USD'000 USD'000

------------------------------------------------- ------ --------- --------

Cash flow used in operating activities

Cash flow used in operating activities

Profit/(loss) for the year 12,711 (6,087)

Non-cash adjustment

- movement on portfolios 15,989 8,700

* value adjustment on shares in subsidiary (360) (5)

Investment in life settlement portfolios 11 (1,167) (1,272)

Movements in "policy advances" 11 (3,050) (233)

Changes in operating assets and liabilities

Changes in maturities receivables 13,930 (3,927)

Changes in trade and other receivables 243 (363)

Changes in premiums paid in advance 4,097 561

Changes in other payables (1,034) (5,625)

Changes in performance provision 2,241 -