TIDMLIO

RNS Number : 3726G

Liontrust Asset Management PLC

25 November 2020

Embargoed until 0700 hours, Wednesday 25 November 2020

LIONTRUST ASSET MANAGEMENT PLC

HALF YEARLY REPORT FOR THE SIX MONTHSED

30 SEPTEMBER 2020

Liontrust Asset Management Plc ("Liontrust", the "Company", or

the "Group"), the independent fund management group, today

announces its Half Yearly Report for the six months ended 30

September 2020.

Results:

-- Adjusted profit before tax(1) of GBP22.3 million (2019:

GBP17.0 million), an increase of 31% compared to the equivalent

period last year

-- Profit before tax of GBP6.9 million (2019: GBP9.3 million), a

decrease of 26% compared to the equivalent period last year. This

includes costs of GBP15.4 million (2019: GBP7.7 million) relating

to acquisition related and associated restructuring costs; the

amortisation of the related intangible assets and other non-cash

and non-recurring costs (see note 6 below)

-- Gross profit of GBP63 million (2019: GBP46 million), an

increase of 37% compared to the equivalent period last year

Dividend:

-- First Interim dividend per share of 11.0 pence (2019: 9.0

pence), which will be payable on 8 January 2021, the shares going

ex-dividend on 3 December 2020, an increase of 22% compared to the

equivalent payment last year.

Assets under management and advice:

-- On 30 September 2020, assets under management and advice

("AuMA") were GBP20.6 billion, an increase of 28% since the start

of the financial year and 41% compared to AuMA on 30 September

2019

-- The acquisition of the Architas UK Investment Business

completed on 30 October 2020 adding GBP5.6 billion to AuMA

-- AuMA as at close of business on 20 November 2020 were GBP28.1

billion, which includes AuMA related to the acquisition of the

Architas UK Investment Business

(1) This is an Alternative Performance Measure, see note 2

below.

Inflows:

-- Net inflows for the six months ended 30 September 2020 of

GBP1,748 million (2019: GBP1,367 million), an increase of 28%

compared to the equivalent period last year

Commenting on the results, John Ions, Chief Executive, said:

"I am delighted the momentum of the strong first quarter has

continued through the half year.

It has been a challenging period for everyone. Covid-19

continues to affect all parts of the economic and social fabric of

the country and its effects will be felt for many years to come. I

have said before that the asset management industry has a vital

role to play in this recovery, from the provision of capital that

enables companies and the economy to grow to the equally important

role as guardians of people's savings to enable them to lead a

better future.

It is a testament to the quality of people at Liontrust, the

processes we have in place and our ability to deliver for clients

that we have been able to continue to generate such large inflows.

The scale of the achievement is shown by Liontrust continuing to

appear in the top 10 for retail sales in the UK. According to the

Pridham Report, Liontrust had the 6th highest net retail sales in

the UK and the 8th highest gross retail sales in the UK in the

third quarter of 2020.

Active fund management can continue to benefit investors by

meeting their expectations. The Liontrust Economic Advantage team

have been doing this for more than 20 years through their robust

and repeatable investment process, which is evidenced by long-term

fund performance.

Over the last 10 years, the Liontrust Special Situations Fund

has outperformed the FTSE All Share by 6.88% on an annualised basis

and the Liontrust UK Smaller Companies Fund has outperformed the

FTSE Small Cap ex ITs Index by 8.76%(2) .

Active managers have the opportunity to add value through

sustainable investment if they avoid greenwashing. At the heart of

any successful business are its clients, and ours are clearly

telling us they want their money to have a positive impact on

society and the world at large. To ensure Liontrust delivers this,

we are committed to pushing forward our levels of engagement to

produce the best possible outcomes for investors.

Over the past 10 years, the Liontrust SF UK Growth Fund has

outperformed the MSCI UK by 5.64% on an annualised basis and the

Liontrust SF Global Growth Fund has outperformed the MSCI World by

2.32%(2) .

This success is reflected in the independent recognition of

Liontrust and our investment teams. Harriet Parker was named ESG

Fund Manager of the Year at the Women in Finance Awards on 12

November 2020. On the same day, Liontrust won three categories at

the FTAdviser Investment Club Awards: Small to Mid Investment Group

of the year, UK Smaller Companies Fund of the year (Liontrust UK

Smaller Companies Fund) and Mixed Asset Fund of the year (Liontrust

SF Managed Growth Fund).

Sustainable investment is also providing asset managers with the

opportunity to connect with investors because of the strength of

the emotional interest in delivering a healthier, cleaner and safer

world that has been heightened by the pandemic.

The strength of the Liontrust brand, client relationships and

communications have helped grow the AuMA of the Sustainable

Investment team and ensure strong positive inflows for Liontrust as

a whole in 2020. We continually strive to ensure clients receive

the best possible service, and for this reason we are increasing

our spend on our digital capability.

On 30 October, we completed the acquisition of the Architas UK

Investment Business, adding GBP5.6 billion of AuMA, creating a

significant multi-asset multi-manager proposition and substantially

enhancing our distribution potential and service to financial

advisers. We have successfully integrated the investment team,

funds and the rest of the team into Liontrust, ensuring as seamless

a transition as possible for clients.

This acquisition, the greater diversification it gives us and

the progress we have made this year mean Liontrust is well

positioned to maintain our growth and have a positive impact on our

investors, shareholders and the wider society."

(2) Source: Financial Express to 30 September 2020 as at 19

November 2020, bid-bid, total return, net of fees , based on

primary share classes.

For further information please contact:

Liontrust Asset Management Plc (Tel: 020 7412 1700, Website:

liontrust.co.uk)

John Ions

Vinay Abrol

Simon Hildrey - Chief Marketing Officer

David Boyle - Head of Corporate Development

N+1 Singer Advisory LLP (Tel: 020 7496 3000)

Corporate Broking- Tom Salvesen

Panmure Gordon (Tel: 020 7886 2500)

Corporate Advisory: Stephen Howard

Corporate Broking: Charles Leigh-Pemberton

Chairman's Statement

I am proud of how well your Company has responded to the ongoing

challenges posed by Covid-19 and the actions taken to try to defeat

the virus. The Company and all employees reacted and adapted

quickly to the pandemic and working from home.

Liontrust has continued to operate efficiently and productively

with no disruption for investors, with your Company generating

strong net positive flows of GBP1.75 billion in the six months to

30 September. This has been achieved without the usual face-to-face

interaction with colleagues, clients and companies that is so

important to the normal functioning of asset management.

The Board has been very impressed with what the business and

everyone working at Liontrust has accomplished during the first

lockdown and subsequently. The investment processes have been truly

tested and have shown their robustness.

This is a credit to your management, the business processes in

place and the culture of Liontrust. Key decisions have continued to

be made and implemented, ensuring that Liontrust will come out of

the Covid-19 pandemic in a strong position.

These decisions include the acquisition of the Architas UK

Investment Business, which was successfully completed on 30 October

2020. Acquiring and integrating a new business is challenging at

the best of times but especially so and impressive during a global

pandemic. The Board thanks everyone for their hard work, dedication

and professionalism in completing this purchase.

The addition of the Architas UK Investment Business is part of

Liontrust 's strategic objective of expanding distribution and

product and of acquiring talent. This acquisition will

significantly increase our presence among financial advisers and

enable us to enhance further our service levels.

Liontrust also announced after the reporting period the sale of

the Asia team to Somerset Capital Management LLP and closing the

European Income and Macro Thematic investment teams. The decision

was part of a review of our fund ranges and an evaluation of where

best to allocate our resources and we are proposing to merge the

funds of the European Income and Macro Thematic teams with funds

managed by the Cashflow Solution, Economic Advantage and Global

Equity teams.

Our six fund management teams are providing investors with

strong long-term performance and they have the scale and are

investing in asset classes that will enable them to grow their

AuMA. They are aided in this by excellent sales and marketing,

robust operations and moving to a single administration platform

across our fund ranges.

Next month we will be issuing Liontrust's first Assessment of

Value Report which evaluates whether our funds are delivering value

to our investors. This has been an important and beneficial process

for Liontrust to go through, including asking for the views of our

clients, and we believe this will be informative and useful for our

investors.

It is for these reasons that I have confidence in Liontrust

withstanding the current challenges and continuing to deliver for

investors and to expand the business.

Results

Liontrust has delivered profit before tax of GBP6.874 million

(2019: GBP9.303 million), a decrease of 26% compared to the

equivalent period last year.

The adjusted profit before tax was GBP22.296 million (2019:

GBP17.017 million), an increase of 31%. Adjusted profit before tax

is disclosed in order to give shareholders an indication of the

profitability of the Group excluding non-cash expenses

(depreciation and intangible asset amortisation) and non-recurring

(acquisition related and associated restructuring, share

incentivisation and severance compensation related) expenses.

See note 6 below for a reconciliation of adjusted profit (or

loss) before tax.

Dividend

In accordance with the Company's dividend policy, and to create

more balance between the First and Second Interim dividends, the

Board is declaring a First Interim dividend of 11.0 pence per share

(2019: 9.0 pence), an increase of 22%, which will be payable on 8

January 2020 to shareholders who are on the register as at 4

December 2020, the shares going ex-dividend on 3 December 2020.

The Company has a Dividend Reinvestment Plan ("DRIP") that

allows shareholders to reinvest dividends to purchase additional

shares in the Company. For shareholders to apply the proceeds of

this and future dividends to the DRIP, application forms must be

received by the Company's Registrars by no later than 18 December

2020. Existing participants in the DRIP will automatically have the

dividend reinvested. Details on the DRIP can be obtained from Link

Asset Services on 0371 664 0381 or at www.signalshares.com. (calls

are charged at the standard geographic rate and will vary by

provider. Calls outside the United Kingdom will be charged at the

applicable international rate. Lines are open between 09:00 -

17:30, Monday to Friday excluding public holidays in England and

Wales).

Assets under management and advice

On 30 September 2020, our AuMA stood at GBP20,598 million(3) and

were broken down by type and process as follows:

Process Total Institutional UK Retail Multi-Asset Offshore

Funds

(GBPm) (GBPm) (GBPm) (GBPm) (GBPm)

Economic Advantage 7,856 252 7,408 - 196

Sustainable Investment 7,466 45 6,914 - 507

Global Equity 2,491 195 2,296 - -

Cashflow Solution 1,067 678 338 - 51

Multi-Asset 963 - - 963 -

Global Fixed Income 755 - 332 - 423

Total - 30 September

2020 20,598 1,170 17,288 963 1,177

Architas UK Investment

Business(4) 5,617 - 4,855 762 -

Total including

Architas UK Investment

Business 26,215 1,170 22,143 1,725 1,177

On 20 November 2020, our AuMA was GBP28,060 million(4) .

(3) Asia Income team AuMA is excluded as the investment team and

funds are in the process of being transferred to Somerset Capital

Management LLP or being closed. AuMA for the European Income team

is included in the Cashflow Solution investment team AuMA and the

Macro Thematic team AuMA is included in the Global Equity

investment team and Economic Advantage investment team AuMA.

(4) The acquisition of the Architas UK Investment Business

completed on 30 October 2020 adding GBP5,617 million to AuMA.

Inflows

The net inflows over the six months to 30 September 2020 are

GBP1,748 million (2019: GBP1,367 million). A reconciliation of fund

flows and AuMA over the six months to 30 September 2020 is as

follows:

Offshore

Total Institutional UK Retail Multi-Asset Funds

(GBPm) (GBPm) (GBPm) (GBPm) (GBPm)

Opening AuMA - 1 April

2020 16,078 988 13,275 840 975

Net flows 1,748 50 1,607 28 63

Market and Investment

performance 2,869 132 2,488 95 154

Acquisition/(Disposal)

of AuMA(5) (97) - (82) - (15)

Closing AuMA - 30

September 2020 20,598 1,170 17,288 963 1,177

(5) The sale of the Asia Income investment team was announced on

2 October 2020 and is expected to complete in the first quarter of

2021.

UK Retail Fund Performance (Quartile ranking)

Quartile Quartile Quartile Quartile Launch

ranking - ranking ranking ranking Date/ Manager

Since Launch/Manager - 5 year - 3 year - 1 year Appointed

Appointed

------------------------------- ---------------------- ---------- ---------- ---------- ---------------

Economic Advantage

funds

------------------------------- ---------------------- ---------- ---------- ---------- ---------------

Liontrust UK Growth

Fund 1 1 1 2 25/03/2009

------------------------------- ---------------------- ---------- ---------- ---------- ---------------

Liontrust Special

Situations Fund 1 1 1 1 10/11/2005

------------------------------- ---------------------- ---------- ---------- ---------- ---------------

Liontrust UK Smaller

Companies Fund 1 1 1 1 08/01/1998

------------------------------- ---------------------- ---------- ---------- ---------- ---------------

Liontrust UK Micro

Cap Fund 1 - 1 1 09/03/2016

------------------------------- ---------------------- ---------- ---------- ---------- ---------------

Sustainable Future

funds

------------------------------- ---------------------- ---------- ---------- ---------- ---------------

Liontrust Monthly

Income Bond Fund 2 2 4 3 12/07/2010

------------------------------- ---------------------- ---------- ---------- ---------- ---------------

Liontrust SF Managed

Growth Fund 1 1 1 1 19/02/2001

------------------------------- ---------------------- ---------- ---------- ---------- ---------------

Liontrust SF Corporate

Bond Fund 1 2 3 2 20/08/2012

------------------------------- ---------------------- ---------- ---------- ---------- ---------------

Liontrust SF Cautious

Managed Fund 1 1 1 1 23/07/2014

------------------------------- ---------------------- ---------- ---------- ---------- ---------------

Liontrust SF Defensive

Managed Fund 1 1 1 1 23/07/2014

------------------------------- ---------------------- ---------- ---------- ---------- ---------------

Liontrust SF European

Growth Fund 1 1 1 1 19/02/2001

------------------------------- ---------------------- ---------- ---------- ---------- ---------------

Liontrust SF Global

Growth Fund 3 1 1 1 19/02/2001

------------------------------- ---------------------- ---------- ---------- ---------- ---------------

Liontrust SF Managed

Fund 1 1 1 1 19/02/2001

------------------------------- ---------------------- ---------- ---------- ---------- ---------------

Liontrust UK Ethical

Fund 2 1 1 1 01/12/2000

------------------------------- ---------------------- ---------- ---------- ---------- ---------------

Liontrust SF UK Growth

Fund 2 1 1 1 19/02/2001

------------------------------- ---------------------- ---------- ---------- ---------- ---------------

Global Equity funds(6)

------------------------------- ---------------------- ---------- ---------- ---------- ---------------

Liontrust Balanced

Fund 1 1 1 1 31/12/1998

------------------------------- ---------------------- ---------- ---------- ---------- ---------------

Liontrust China Fund 4 4 3 3 31/12/2004

------------------------------- ---------------------- ---------- ---------- ---------- ---------------

Liontrust Emerging

Market Fund 3 2 3 3 30/09/2008

------------------------------- ---------------------- ---------- ---------- ---------- ---------------

Liontrust European

Opportunities Fund 2 4 4 4 29/11/2002

------------------------------- ---------------------- ---------- ---------- ---------- ---------------

Liontrust Global

Smaller Companies

Fund 1 1 1 1 01/07/2016

------------------------------- ---------------------- ---------- ---------- ---------- ---------------

Liontrust Global

Alpha Fund 1 1 1 1 31/12/2001

------------------------------- ---------------------- ---------- ---------- ---------- ---------------

Liontrust Global

Dividend Fund 2 2 1 1 20/12/2012

------------------------------- ---------------------- ---------- ---------- ---------- ---------------

Liontrust Global

Equity Fund 1 1 1 1 31/12/2001

------------------------------- ---------------------- ---------- ---------- ---------- ---------------

Liontrust Global

Technology Fund 2 - 1 2 15/12/2015

------------------------------- ---------------------- ---------- ---------- ---------- ---------------

Liontrust Income

Fund 1 1 1 1 31/12/2002

------------------------------- ---------------------- ---------- ---------- ---------- ---------------

Liontrust Japan Equity

Fund 3 2 3 2 22/06/2015

------------------------------- ---------------------- ---------- ---------- ---------- ---------------

Liontrust Japan Opportunities

Fund 1 4 4 4 30/09/2002

------------------------------- ---------------------- ---------- ---------- ---------- ---------------

Liontrust US Income

Fund 4 3 4 4 30/09/2010

------------------------------- ---------------------- ---------- ---------- ---------- ---------------

Liontrust US Opportunities

Fund 1 2 1 1 31/12/2002

------------------------------- ---------------------- ---------- ---------- ---------- ---------------

Cashflow Solution funds

------------------------------------------------------------------------------- ---------- ---------------

Liontrust European

Growth Fund 1 2 3 2 15/11/2006

------------------------------- ---------------------- ---------- ---------- ---------- ---------------

Liontrust Global

Income Fund 4 4 4 4 03/07/2013

------------------------------- ---------------------- ---------- ---------- ---------- ---------------

Source: Financial Express to 30 September 2020 as at 20 November

2020, bid-bid, total return, net of fees , based on primary share

classes. The Liontrust UK Mid Cap Fund, Liontrust UK Opportunities

Fund, Liontrust Asia Income Fund and funds previously managed by

the European Income and Macro Thematic investment teams are

excluded. Past performance is not a guide to future performance,

investments can result in total loss of capital. The above funds

are all UK authorised unit trusts or UK authorised ICVCs (primary

share class).

(6) Liontrust Latin America Fund, Liontrust Russia Fund and

Liontrust India Fund are not included as they are in IA sectors

that are not rankable (e.g. Specialist and Unclassified) as it

would not be a fair comparison to make.

Outlook

Liontrust's focus on robust investment processes and building

performance, a business, a brand and client relationships for the

long term have proved their value during this year's crisis. This

gives Liontrust resilience and the ability to continue to grow in

the future.

Alastair Barbour

Non-executive Chairman

Consolidated Statement of Comprehensive

Income

Six months ended 30 September

2020

Six Six Year

months

months to to ended

30-Sep-20 30-Sep-19 31-Mar-20

(unaudited) (unaudited) (audited)

Notes GBP'000 GBP'000 GBP'000

Revenue 4 75,780 53,098 124,025

Cost of sales 4 (12,724) (7,167) (17,393)

------------------------------------ ------ ------------ ------------ ----------

Gross profit 63,056 45,931 106,632

Unrealised profit on financial

assets 316 251 (283)

Administration expenses 5 (56,436) (36,873) (89,711)

------------------------------------ ------ ------------ ------------ ----------

Operating profit 6,936 9,309 16,638

Interest receivable 4 6 18

Interest payable (66) (12) (148)

------------------------------------ ------ ------------ ------------ ----------

Profit before tax 6,874 9,303 16,508

Taxation 7 (1,588) (1,727) (3,544)

------------------------------------ ------ ------------ ------------ ----------

Profit for the period 5,286 7,576 12,964

Other comprehensive income - - -

Total comprehensive income 5,286 7,576 12,964

==================================== ====== ============ ============ ==========

Pence Pence Pence

----------------------------------- ------ ------------ ------------ ----------

Basic earnings per share 8 9.21 15.02 24.68

Diluted earnings per share 8 9.00 14.51 23.87

------------------------------------ ------ ------------ ------------ ----------

Consolidated Balance

Sheet

As at 30 September 2020

30-Sep-20 30-Sep-19 31-Mar-20

(unaudited) (unaudited) (audited)

Notes GBP'000 GBP'000 GBP'000

Assets

Non current assets

Intangible assets 9 36,565 10,497 37,922

Goodwill 19,626 11,872 19,626

Property, plant and

equipment 6,875 1,830 7,850

63,066 24,199 65,398

------------------------ ------ -------------- ---------------------------------- -------------------------

Current assets

Trade and other

receivables 186,119 117,518 175,532

Financial assets 10 1,859 3,264 2,817

Cash and cash

equivalents 98,602 27,769 40,294

------------------------- ------

Total current assets 286,580 148,551 218,643

------------------------- ------ -------------- ---------------------------------- -------------------------

Liabilities

Non current liabilities

Deferred tax liabilities (6,197) (1,508) (6,440)

Lease liability (6,668) (2,066) (5,769)

Total non current

liabilities (12,865) (3,574) (12,209)

------------------------- ------ -------------- ---------------------------------- -------------------------

Current liabilities

Trade and other payables (190,312) (115,584) (181,693)

DVBAP liability (367) (374) (845)

Corporation tax payable (1,314) - (734)

Total current

liabilities (191,993) (115,958) (183,272)

------------------------- ------ -------------- ---------------------------------- -------------------------

Net current assets 94,587 32,593 35,371

------------------------- ------ -------------- ---------------------------------- -------------------------

Net assets 144,788 53,218 88,560

========================= ====== ============== ================================== =========================

Shareholders' equity

Ordinary shares 606 509 555

Share premium 121,809 19,745 57,439

Capital redemption

reserve 19 19 19

Retained earnings 27,544 36,491 36,409

Own shares held (5,190) (3,546) (5,862)

Total equity 144,788 53,218 88,560

========================= ====== ============== ================================== =========================

Consolidated Cash Flow Statement

Six months ended 30 September

2020

Six Six Year

months

months to to ended

30-Sep-20 30-Sep-19 31-Mar-20

(unaudited) (unaudited) (audited)

GBP'000 GBP'000 GBP'000

Cash flows from operating activities

Cash inflow from operations 74,765 63,627 96,359

Cash outflow from operations (71,090) (62,941) (79,019)

Cash inflow from changes in unit

trust receivables and payables 2,357 576 1,561

----------------------------------------- ------ ---------------------------------- ------------------------- ----------

Net cash from operations 6,032 1,262 18,901

Interest received 4 6 18

Tax paid (1,316) - -

---------------------------------- ------------------------- ----------

Net cash from operating activities 4,720 1,268 18,919

----------------------------------------- ------ ---------------------------------- ------------------------- ----------

Cash flows from investing activities

Purchase of property, plant and

equipment (99) - (174)

Cash acquired from acquisition

of Neptune - - 3,661

Purchase of financial assets - (1,362) (1,362)

Sale of financial assets 1,334 1,333 1,333

Purchase of seeding investments (47) (50) (169)

Sale of seeding investments - 51 50

----------------------------------------- ---------------------------------- ------------------------- ----------

Net cash from/(used in)used in

investing activities 1,188 (28) 3,339

----------------------------------------- ------ ---------------------------------- ------------------------- ----------

Cash flows from financing activities

Purchase of own shares - (732) (3,310)

Sale of own shares 672 477 743

Lease financing costs - (228) -

Issue of shares 66,170 1,537 -

Dividends paid (14,442) (10,076) (14,948)

--------------------------------- ------ ------ ---------------------------------- ------------------------- ----------

Net cash from/(used in) financing

activities 52,400 (9,022) (17,515)

Net increase/(decrease) in cash

and cash equivalents 58,308 (7,782) 4,743

Opening cash and cash equivalents* 40,294 35,551 35,551

Closing cash and cash equivalents 98,602 27,769 40,294

========================================= ====== ================================== ========================= ==========

* Cash and cash equivalents consist only of cash balances.

Consolidated Statement of Change in Equity (unaudited)

Six months ended 30 September 2020

Share Share Capital Retained Own shares Total

capital premium redemption earnings held Equity

GBP '000 GBP '000 GBP '000 GBP '000 GBP '000 GBP '000

Balance at 1 April

2020 brought forward 555 57,439 19 36,409 (5,862) 88,560

Profit for the

period - - - 5,286 - 5,286

-------------------------- ------------------------ ------------------------ ------------------------ ----------------------- ------------------------ ---------

Total comprehensive

income for the

period - - - 5,286 - 5,286

Dividends paid - - - (14,442) - (14,442)

Shares issued 51 64,370 - - - 64,421

Sale of own shares - - - - 672 672

Equity share options

issued - - - 823 - 823

Equity share options

settled - - - (532) - (532)

Balance at 30 September

2020 606 121,809 19 27,544 (5,190) 144,788

========================== ======================== ======================== ======================== ======================= ======================== =========

Consolidated Statement of Change in Equity (unaudited)

Six months ended 30 September 2019 (Restated)

Share Share Capital Retained Own shares Total

capital premium* redemption earnings* held Equity

GBP '000 GBP '000 GBP '000 GBP '000 GBP '000 GBP '000

Balance at 1 April 2019

brought forward 507 19,745 19 38,591 (3,291) 55,571

Adjustment to opening

reserves - IFRS 16 Leases - - - (716) - (716)

------------------------ ------------------------ ------------------------ ------------------------ ------------------------ ---------

Revised 1 April 2019

brought forward 507 19,745 19 37,875 (3,291) 54,855

Profit for the period - - - 7,576 - 7,576

----------------------------- ------------------------ ------------------------ ------------------------ ------------------------ ------------------------ ---------

Total comprehensive income

for the period - - - 7,576 - 7,576

Dividends paid - - - (10,076) - (10,076)

Shares issued 2 - - - - 2

Purchase of own shares - - - - (255) (255)

Equity share options

issued/(settled) - - - 1,116 - 1,116

Balance at 30 September

2019 509 19,745 19 36,491 (3,546) 53,218

============================= ======================== ======================== ======================== ======================== ======================== =========

* as noted in note 1 v) of the 31 March Annual report, the financial

statements were restated to reflect the correct treatment of

the settlement of LTIPs

Consolidated Statement of Change in Equity (audited)

Year ended 31 March 2020

Ordinary Share Capital Retained Own shares Total

shares premium redemption earnings held Equity

GBP '000 GBP '000 GBP '000 GBP '000 GBP '000 GBP '000

Balance at 1 April 2019

brought forward 507 19,745 19 38,591 (3,291) 55,571

Adjustment to opening

reserves - IFRS 16 Leases - - - (218) - (218)

------------------------ ------------------------ ------------------------ ------------------------ ------------------------ ---------

Revised 1 April 2019

brought forward 507 19,745 19 38,373 (3,291) 55,353

Profit for the year - - - 12,964 - 12,964

Total comprehensive income

for the year - - - 12,964 - 12,964

Dividends paid - - - (14,948) - (14,948)

Shares issued 48 37,694 - - - 37,742

(Purchase)/sale of own

shares - - - - (2,652) (2,652)

EBT share option settlement - - - - 81 81

Share options issued - - - 1,934 - 1,934

Equity share options

settled - - - (1,914) - (1,914)

Balance at 31 March

2020 555 57,439 19 36,409 (5,862) 88,560

======================== ======================== ======================== ======================== ======================== =========

Notes to the Financial Statements

1. Principal accounting policies

This Half Yearly Report is unaudited and does not constitute

statutory accounts within the meaning of s434 of the Companies Act

2006. The financial information for the half years ended 30

September 2020 and 2019 has not been audited or reviewed by the

auditors pursuant to the Auditing Practices Board guidance on

Review of Interim Financial Information. The statutory accounts for

the year ended 31 March 2020, which were prepared in accordance

with International Financial Reporting Standards, comprising

standards and interpretations approved by either the International

Accounting Standards Board or the International Financial Reporting

Interpretations Committee or their predecessors, as adopted by the

European Union ("IFRS"), and with those parts of the Companies Act

2006 applicable to companies reporting under IFRS, have been

delivered to the Registrar of Companies. The auditors' opinion on

these accounts was unqualified and did not contain a statement made

under s498 of the Companies Act 2006.

The financial statements have been prepared in accordance with

the Disclosure Guidance and Transparency Sourcebook and with IAS 34

'Interim Financial Reporting'.

The accounting policies applied in this Half Yearly Report are

consistent with those applied in the Group's most recent annual

accounts

2. Alternative Performance Measures

The Group assess its performance using a variety of measures

that are not defined under IFRS and are therefore termed

alternative performance measures ("APM's").

The Group uses the APM's to present its financial performance,

in a manner which is aligned with the requirements of our

stakeholders. By presenting these APM's it enables comparison with

our peers who may use different accounting policies.

The Group uses the following APM's:

Alternative Performance

Measure Definition Reconciliation

Adjusted profit before Profit before taxation, Note 6

tax depreciation and amortisation,

share incentivisation

expenses and non-recurring

items (which include:

professional fees relating

to acquisitions, cost

reduction, restructuring

and severance compensation

related costs).

This is used to present a measure of profitability of the Group

which is aligned to the requirements of shareholders, potential

shareholders and financial analysts, and which removes the effects

of financing and capital investment, which eases the comparison

with the Group's competitors who may use different accounting

policies and financing methods. Calculation of Adjusted profit

before tax excludes share incentivisation expenses for similar

reasons to above, and in particular provides shareholders, potential

shareholders and financial analysts a consistent year on year

basis of comparison of a "profit before tax number", when comparing

the current year to the previous year and also when comparing

multiple historical years to the current year, of how the underlying

business is performing without the effects of share incentivisation

expenses which can be influenced by other factors such as the

timing of grants due to prohibited periods, shareholder approval

of share incentivisation plans, and other factors.

Adjusted operating Operating Profit before Note 6

profit depreciation and amortisation,

share incentivisation

expenses and non-recurring

items (which include:

professional fees relating

to acquisitions, cost

reduction, restructuring

and severance compensation

related costs).

This is used to present a measure of profitability of the Group

which is aligned to the requirements of shareholders, potential

shareholders and financial analysts, and which removes the effects

of financing and capital investment, which eases the comparison

with the Group's competitors who may use different accounting

policies and financing methods. Calculation of Adjusted operating

profit before tax excludes share incentivisation expenses for

similar reasons to above, and in particular provides shareholders,

potential shareholders and financial analysts a consistent year

on year basis of comparison of a "operating profit number",

when comparing the current year to the previous year and also

when comparing multiple historical years to the current year,

of how the underlying business is performing without the effects

of share incentivisation expenses which can be influenced by

other factors such as timing of grants due to prohibited periods,

shareholder approval of share incentivisation plans, and other

factors.

Revenues excluding Gross profit less any Note 4

performance fees revenue attributable

to

performance related

fees.

This is used to present a consistent year on year measure of

revenues within the business, removing the element of revenue

that may fluctuate year on year.

Adjusted basic earnings Adjusted profit before

per share tax divided by the weighted

average number of shares

in issue for the period n/a

Adjusted diluted earnings Adjusted profit before

per share tax divided by the diluted

weighted average number

of shares in issue for

the period n/a

3. Segmental reporting

The Group's operates in only one business segment - Investment

management.

The Group offers different fund products through different

distribution channels. All financial, business and strategic

decisions are made centrally by the Board, which determines the key

performance indicators of the Group. The Group reviews financial

information presented at a Group level. The Board, is therefore,

the chief operating decision-making body for the Group. The

information used to allocate resources and assess performance is

reviewed for the Group as a whole. On this basis, the Group

considers itself to be a single-segment investment management

business.

4. Revenue

Six Six Year

months

to months to ended

30-Sep-20 30-Sep-19 31-Mar-20

(unaudited) (unaudited) (audited)

GBP'000 GBP'000 GBP'000

Revenue

- Revenue 75,780 53,098 123,021

- Performance fee revenue - - 1,004

---------------------------- ------------ ------------ ----------

Total Revenue 75,780 53,098 124,025

---------------------------- ------------ ------------ ----------

Cost of sales (12,724) (7,167) (17,393)

Gross Profit 63,056 45,931 106,632

============================ ============ ============ ==========

Revenue from earnings includes:

1. Investment management on unit trusts, open-ended investment

companies sub-funds, portfolios and segregated accounts;

2. Performance fees on unit trusts, open-ended investment

companies sub-funds, portfolios and segregated accounts;

3. Fixed administration fees on unit trusts and open-ended

investment companies sub-funds;

4. Net value of sales and repurchases of units in unit trusts

and shares in open-ended investment companies (net of

discounts);

5. Net value of liquidations and creations of units in unit

trusts and shares in open-ended investment companies sub-funds;

6. Box profits on unit trusts; and

7. Foreign currency gains and losses.

Cost of sales includes:

1. Operating expenses including (but not limited to) keeping a

record of investor holdings, paying income, sending annual and

interim reports, valuing fund assets

and calculating prices, maintaining fund accounting records,

depositary and trustee oversight and auditors;

2. Rebates paid on investment management fees;

3. Sales commission paid or payable; and

4. External investment advisory fees paid or payable.

5. Administration expenses

Six Six Year

months

to months to ended

30-Sep-20 30-Sep-19 31-Mar-20

(unaudited) (unaudited) (audited)

GBP'000 GBP'000 GBP'000

Employee related expenses

Director and employee costs 11,710 5,695 14,047

Pension costs 656 310 866

Share incentivisation expense 2,049 4,194 3,725

DBVAP expense 856 702 1,335

Severance compensation 214 - 1,886

15,485 10,901 21,859

Non employee related expenses

Members' drawings charged as

an expense 16,387 14,029 31,993

Members' share incentivisation

expense 1,045 348 1,126

Professional services(1) 10,047 1,540 8,437

Depreciation and Intangible asset

amortisation(2) 2,429 1,424 5,392

IFRS16 related finance costs - (240) -

Other administration expenses 11,043 8,871 20,904

----------------------------------- ------------ ------------ ----------

Total administration expenses 56,436 36,873 89,711

=================================== ============ ============ ==========

(1) Includes costs relating to the re organisation of Neptune

outsourced transfer agency administration and acquisition costs

related to the purchase of the Architas UK Investment Business.

(2) Includes Fixed asset depreciation, depreciation on leases

under IFRS16 and amortisation of intangible assets

6. Adjusted profit before tax

Adjusted profit before tax is reconciled in the table below:

Six Six Year

months

to months to ended

30-Sep-20 30-Sep-19 31-Mar-20

(unaudited) (unaudited) (audited)

GBP'000 GBP'000 GBP'000

Profit for the period 5,286 7,576 12,964

Taxation 1,588 1,727 3,544

----------------------------------- ------------ ------------ ----------

Profit before tax 6,874 9,303 16,508

Share incentivisation expense 3,094 4,542 4,851

DBVAP expense net of gain or

loss 540 452 1,551

Severance compensation 214 - 2,296

Professional services(1) 10,047 1,540 8,436

IFRS 16 finance costs (902) (240) (980)

Depreciation and Intangible asset

amortisation(2) 2,429 1,424 5,392

Adjustments 15,422 7,718 21,546

----------------------------------- ------------ ------------ ----------

Adjusted profit before tax 22,296 17,021 38,054

----------------------------------- ------------ ------------ ----------

Interest receivable (4) (6) (18)

Interest payable (2) - 12 -

Adjusted operating profit 22,292 17,027 38,036

----------------------------------- ------------ ------------ ----------

Adjusted basic earnings per share 31.46 27.34 58.68

Adjusted diluted earnings per

share 30.74 26.41 56.74

----------------------------------- ------------ ------------ ----------

(1) Includes costs relating to the re organisation of Neptune

outsourced transfer agency administration and acquisition costs

related to the purchase of the Architas UK Investment Business.

(2) Includes Fixed asset depreciation, depreciation on leases

under IFRS16 and amortisation of intangible assets

7. Taxation

The half yearly tax charge has been calculated at the estimated

full year effective UK corporation tax rate of 19% (2019: 19%).

8. Earnings per share

The calculation of basic earnings per share is based on profit

after taxation and the weighted average number of Ordinary Shares

in issue for each period. The weighted average number of Ordinary

Shares for the six months ended 30 September 2020 was 57,406,615

(30 September 2019: 50,430,636, 31 March 2020: 52,531,287). Shares

held by the Liontrust Asset Management Employee Trust are not

eligible for dividends and are treated as cancelled for the

purposes of calculating earnings per share.

Diluted earnings per share is calculated on the same bases as

set out above, after adjusting the weighted average number of

Ordinary Shares for the effect of options to subscribe for new

Ordinary Shares that were in existence during the six months ended

30 September 2020. The adjusted weighted average number of Ordinary

Shares so calculated for the period was 58,757,394 (30 September

2019: 52,212,068, 31 March 2020: 54,320,477). This is reconciled to

the actual weighted number of Ordinary Shares as follows:

30-Sep-20 30-Sep-19 31-Mar-20

Weighted average number of Ordinary

Shares 57,406,615 50,430,636 52,531,287

Weighted average number of dilutive

Ordinary shares under option:

- to Liontrust Long Term Incentive

Plan 1,323,491 1,776,755 1,779,742

- to Liontrust Company Share

Option Plan 27,288 4,677 9,448

Adjusted weighted average number

of Ordinary Shares 58,757,394 52,212,068 54,320,477

===================================== =========== =========== ===========

9. Intangible assets

Intangible assets represent investment management contracts that

have been capitalised upon acquisition and are amortised on a

straight-line basis over a period of 10 years or 20 years depending

on the type of contracts acquired. The intangible asset on the

balance sheet represents investment management contracts as

follows:

30-Sep-20 30-Sep-19 31-Mar-20

GBP'000 GBP'000 GBP'000

Investment management contracts

acquired from Argonaut - 1,497 -

Investment management contracts

acquired from ATI 7,800 9,000 8,400

Investment management contracts

acquired from Neptune 28,765 - 29,522

36,565 10,497 37,922

========== ========== ==========

10. Financial Assets

The Group holds financial assets that have been categorised

within one of three levels using a fair value hierarchy that

reflects the significance of the inputs into measuring the fair

value. These levels are based on the degree to which the fair value

is observable and are defined as follows:

- Level 1 fair value measurements are those derived from quoted

prices (unadjusted) in active markets for identical assets and

liabilities;

- Level 2 fair value measurements are those derived from inputs

other than quoted prices included within level 1 that are

observable for the asset or liability, either directly (i.e. as

prices) or indirectly (i.e. derived from prices);

- Level 3 fair value measurements are those derived from

valuation techniques that include inputs for the asset or liability

that are not based on observable market data.

As at the balance sheet date all financial assets are

categorised as Level 1.

Under IFRS9 all financial assets are categorised as Assets held

at fair value through profit and loss.

The financial assets consist of units held in the Group's

collective investment schemes as part of a 'manager's box (as

detailed below), assets held by the EBT in respect of the Liontrust

DBVAP and assets held in Liontrust Global Funds plc to assist

administration. The holdings are valued on a mid or bid basis.

11. Related party transactions

During the six months to 30 September 2020 the Group received

fees from unit trusts and ICVCs under management of GBP59,466,000

(2019: GBP41,619,000). Transactions with these funds comprised

creations of GBP3,021,616,000 (2019: GBP2,106,127,000) and

liquidations of GBP1,405,734,000 (2019: GBP927,652,000). As at 30

September 2020 the Group owed the unit trusts GBP175,286,000 (2019:

GBP103,944,000) in respect of unit trust creations and was owed

GBP165,831,000 (2019: GBP103,831,000) in respect of unit trust

cancellations and fees.

During the six months to 30 September 2020 the Group received

fees from offshore funds under management of GBP3,044,000 (2019:

GBP2,093,000). Transactions with these funds comprised purchases of

GBP0 (2019: GBP40,000) and sales of GBP0 (2019: GBP0). As at 30

September 2020 the Group was owed GBP546,000 (2019: GBP365,000) in

respect of management fees.

Directors and management can invest in funds managed by the

Group on commercial terms that are no more favourable than those

available to staff in general.

12. Post balance sheet date event

On 30 October 2020, the Company acquired all of the ordinary

shares in Architas Multi-Manager Limited and Architas Advisory

Services Limited (together, the "Architas UK Investment Business"),

and subsequently renamed Liontrust Multi Asset Limited and

Liontrust Advisory Services Limited respectively.

The acquisition completed on 30 October 2020 for consideration

of up to GBP75 million in cash (inclusive of the expected net asset

value of the Architas UK Investment Business), funded from the

proceeds of a placing of ordinary shares of the Company, which was

completed in July 2020 and the Company's cash resources.

At the date of issue of these financial statements, the

valuation of the balance sheets is not complete. An updated

disclosure, including the valuation of the balances, will be

included in the 2021 Annual Report & Financial Statements.

13. Key risks

The Directors have identified the risks and uncertainties that

affect the Group's business and believe that they will be

substantially the same for the second half of the year as the

current risks as identified in the 2019 Annual Report. These can be

broken down into risks that are within the management's influence

and risks that are outside it.

Risks that are within management's influence include areas such

as the expansion of the business, prolonged periods of

under-performance, loss of key personnel, human error, poor

communication and service leading to reputational damage and

fraud.

Risks outside the management's influence include falling

markets, a deteriorating UK economy, investment industry price

competition and hostile takeovers.

Management monitor all risks to the business, they record how

each risk is mitigated and have developed indicators to identify

increased risk levels. Management recognise the importance of risk

management and view it as an integral part of the management

process which is tied into the business model and is described

further in the Risk management and internal control section on page

49 of the 2020 Annual Report and Note 2 "Financial risk management"

on page 106 of the 2020 Annual Report.

14. Contingent assets and liabilities

The Group can earn performance fees on some of the segregated

accounts and funds that it manages. In some cases a proportion of

the fee earned is deferred until the next performance fee is

payable or offset against future underperformance on that account.

As there is no certainty that such deferred fees will be

collectable in future years, the Group's accounting policy is to

include performance fees in income only when they become due and

collectable and therefore the element (if any) deferred beyond 30

September 2020 has not been recognised in the results for the

year.

There were no contingent liabilities.

15. Directors' responsibilities

The Directors confirm that this condensed set of financial

statements has been prepared in accordance with IAS 34 as adopted

by the European Union, and that the Half Yearly Report herein

includes a fair review of the information required by DTR 4.2.7,

being an indication of important events that have occurred during

the first six months of the current financial year and their impact

on the condensed set of financial statements; and a description of

the principal risks and uncertainties for the remaining six months

of the year; and DTR 4.2.8, being related party transactions that

have taken place in the first six months of the current financial

year and that have materially affected the financial position or

performance of the Group during that period; and any changes in the

related party transactions described in the last Annual Report and

Accounts that could have a material effect on the financial

position or performance of the Group in the past six months of the

current financial year.

By Order of the Board

John Ions Vinay Abrol

Chief Executive Chief Operating Officer and Chief Financial

Officer

24 November 2020

Forward Looking Statements

This report contains certain forward-looking statements with

respect to the financial condition, results of operations and

businesses and plans of the Group. These statements and forecasts

involve risk and uncertainty because they relate to events and

depend upon circumstances that have not yet occurred. There are a

number of factors that could cause actual results or developments

to differ materially from those expressed or implied by these

forward-looking statements and forecasts. Nothing in this

announcement should be construed as a profit forecast.

END

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR BUBDBXDDDGGS

(END) Dow Jones Newswires

November 25, 2020 02:00 ET (07:00 GMT)

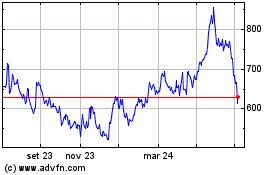

Grafico Azioni Liontrust Asset Management (LSE:LIO)

Storico

Da Mar 2024 a Apr 2024

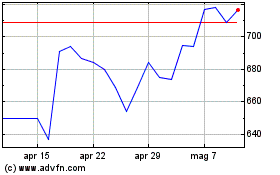

Grafico Azioni Liontrust Asset Management (LSE:LIO)

Storico

Da Apr 2023 a Apr 2024