Litigation Capital Management Ltd Disputes Finance Facility with Global Law Firm (0353W)

13 Agosto 2020 - 8:17AM

UK Regulatory

TIDMLIT

RNS Number : 0353W

Litigation Capital Management Ltd

13 August 2020

13 August 2020

Litigation Capital Management Limited

(LCM or the Company)

Disputes finance facility with a leading global law firm

Litigation Capital Management Limited (AIM:LIT), a specialist

alternate asset manager and leading international disputes

financing solutions provider, announces the establishment of a

tailored Disputes finance facility with DLA Piper ("DLA"),

significantly expanding LCM's reach into major global disputes hubs

and strengthening its presence in markets that are currently

under-penetrated by litigation finance.

Via a newly formed litigation fund created and managed for

clients of the law firm, LCM has agreed to grant access to funding

for disputes undertaken by DLA and its clients that meet LCM's

rigorous due diligence process. The objective of the facility is to

provide clients of the global firm with a bespoke and streamlined

disputes finance product tailored specifically to its needs.

Clients of DLA will have access to the fund in all qualifying

global jurisdictions. The facility is in the nature of a portfolio,

enabling LCM to finance a greater number and variety of global

disputes at reduced capital risk.

London-headquartered DLA has over 4,000 partners located in more

than 40 countries throughout Africa, the Americas, Asia Pacific,

Europe and the Middle East.

Nick Rowles-Davies, Executive Vice Chairman of LCM : comments:

"We are delighted to be working DLA's highly respected global

disputes practice. This agreement fortifies LCM's position globally

as a provider of the most innovative and unique disputes financing

solutions in the market. The growing acceptance of disputes finance

means corporates now expect their legal service providers to offer

them alternative fee arrangements, such as those that this

collaboration now presents."

Patrick Moloney, Chief Executive Officer of LCM , added: "LCM

consistently strives to develop strategies for the origination of

quality investment opportunities. As part of a competitive process,

this facility was secured through a solutions-based approach by

agreeing a tailored structure specifically to meet the needs of the

international law firm and its clients. We expect this relationship

to be a long and prosperous one for LCM, the law firm and its

clients."

Enquiries

Litigation Capital Management c/o Alma PR

Patrick Moloney, Chief Executive

Officer

Canaccord (Nomad and Joint Tel: 020 7523 8000

Broker)

Bobbie Hilliam

Investec Bank plc (Joint Broker) Tel: 020 7597 5970

David Anderson

Alma PR Tel: 020 3405 0205

Justine James LCM@almapr.co.uk

Rebecca Sanders-Hewett

Susie Hudson

NOTES TO EDITORS

Litigation Capital Management (LCM) is a global provider of

disputes finance which operates two business models. The first is

direct investments made from LCM's permanent balance sheet capital

and the second is fund and/or asset management. Under those two

business models, LCM currently pursues three investment strategies:

Single-case funding, Corporate portfolio funding and Acquisitions

of claims. LCM generates its revenue from both its direct

investments and also performance fees through asset management.

LCM has an unparalleled track record driven by disciplined

project selection and robust risk management.

Currently headquartered in Sydney, with offices in London,

Singapore, Brisbane and Melbourne, LCM listed on AIM in December

2018, trading under the ticker LIT.

www.lcmfinance.com

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

CNTGLGDISBBDGGX

(END) Dow Jones Newswires

August 13, 2020 02:17 ET (06:17 GMT)

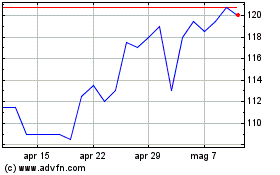

Grafico Azioni Litigation Capital Manag... (LSE:LIT)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni Litigation Capital Manag... (LSE:LIT)

Storico

Da Apr 2023 a Apr 2024