Litigation Capital Management Ltd Incentive Awards (2037C)

15 Ottobre 2020 - 11:30AM

UK Regulatory

TIDMLIT

RNS Number : 2037C

Litigation Capital Management Ltd

15 October 2020

15 October 2020

Litigation Capital Management Limited

("LCM" or the "Company")

Incentive Awards

Litigation Capital Management Limited (AIM:LIT), an alternative

asset manager specialising in dispute financing solutions

internationally, announces that it has granted a number of

incentive awards to employees of the Company in the form of shares

to be issued pursuant to the LCM Loan Share Plan.

The following table details the quantum of awards granted and

the recipients. Subject to the terms of the LCM Loan Share Plan,

participants may nominate another person to be issued the

awards.

Employee Position Incentive Number of

scheme shares awarded

Chief Executive

Patrick Moloney Officer LSP 291,597

================= =========== ================

Non-PDMR Employees Various LSP 324,923

================= =========== ================

LCM Loan Share Plan ("LSP")

The Company has in place a LSP. Ordinary Shares issued to

recipients under the LSP ("LSP Shares") generally rank equally with

all existing shares from the date of issue.

The LSP Shares are issued to the recipient at market value and

due to the vesting conditions attached to them (e.g. continuous

employment conditions and share price hurdles) represent a share

based payment arrangement.

The LSP awards, unless stated otherwise, will vest over a three

year period in four equal tranches from the date of issue. In

addition, the LSP awards are subject to malus and clawback

provisions. The awards vests in full in the event of a change of

control at any time.

Application will be made for the 616,520 ordinary shares to be

admitted to trading on AIM. It is expected that admission will take

place on 23 October 2020. Following the allotment and issue, the

Company's issued share capital consists of 115,654,666 ordinary

shares. The Company does not hold any shares in Treasury, as such

the total number of shares in issue with voting rights is

115,654,666.

The above figure of 115,654,666 may be used by shareholders as

the denominator for the calculations by which they will determine

if they are required to notify their interest in, or a change to

their interest in, the Company under the Financial Conduct

Authority's Disclosure Guidance and Transparency Rules.

Enquiries

Litigation Capital Management c/o Alma PR

Patrick Moloney, Chief Executive

Officer

Canaccord (Nomad and Joint Tel: 020 7523 8000

Broker)

Bobbie Hilliam

Investec Bank plc (Joint Broker) Tel: 020 7597 5970

David Anderson

Alma PR Tel: 020 3405 0205

Justine James LCM@almapr.co.uk

Rebecca Sanders-Hewett

Susie Hudson

Kieran Breheny

NOTES TO EDITORS

Litigation Capital Management (LCM) is an alternate asset

manager specialising in disputes financing solutions

internationally, which operates two business models. The first is

direct investments made from LCM's permanent balance sheet capital

and the second is third party fund management. Under those two

business models, LCM currently pursues three investment strategies:

Single-case funding, Portfolio funding and Acquisitions of claims.

LCM generates its revenue from both its direct investments and also

performance fees through asset management.

LCM has an unparalleled track record driven by disciplined

project selection and robust risk management.

Currently headquartered in Sydney, with offices in London,

Singapore, Brisbane and Melbourne, LCM listed on AIM in December

2018, trading under the ticker LIT.

www.lcmfinance.com

The following notifications are intended to satisfy the

Company's obligations under Article 19(3) of EU Regulation No

596/2014 (the Market Abuse Regulation).

Notification and public disclosure of transactions by persons

discharging managerial responsibilities and persons closely

associated with them

1. Details of the Person discharging managerial responsibilities

("PDMR") / person closely associated with them ("PCA")

a) Name Patrick John Moloney

------------------------------ -----------------------------------------

2. Reason for the notification

-------------------------------------------------------------------------

a) Position / status Executive Director

------------------------------ -----------------------------------------

b) Initial notification Initial notification

/ amendment

------------------------------ -----------------------------------------

3. Details of the issuer, emission allowance market participant,

auction platform, auctioneer or auction monitor

-------------------------------------------------------------------------

a) Name Litigation Capital Management Limited

------------------------------ -----------------------------------------

b) Legal Entity Identifier 213800J2B5SI8F515244

------------------------------ -----------------------------------------

4. Details of the transaction(s): section to be repeated for

(i) each type of instrument; (ii) each type of transaction;

(iii) each date; and (iv) each place where transactions have

been conducted

-------------------------------------------------------------------------

a) Description of the Ordinary Shares

financial instrument

------------------------------ -----------------------------------------

b) Nature of the transaction Interest in Ordinary Shares under a Loan

Share Plan

------------------------------ -----------------------------------------

c) Price(s) and volume(s) Price(s) Volume(s)

66.55 pence 291,597

----------

------------------------------ -----------------------------------------

d) Aggregated information

* Aggregated volume N/A - single transaction

* Aggregated price

* Aggregated total

------------------------------ -----------------------------------------

e) Date of the transaction 13 October 2020 (UK)

------------------------------ -----------------------------------------

f) Place of the transaction Outside a trading venue

------------------------------ -----------------------------------------

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

DSHGCBDGSDBDGGU

(END) Dow Jones Newswires

October 15, 2020 05:30 ET (09:30 GMT)

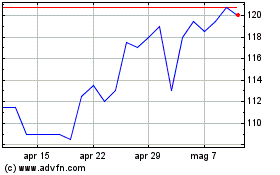

Grafico Azioni Litigation Capital Manag... (LSE:LIT)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni Litigation Capital Manag... (LSE:LIT)

Storico

Da Apr 2023 a Apr 2024