TIDMLLOY

RNS Number : 8110D

Lloyds Banking Group PLC

30 October 2020

FOR DISTRIBUTION ONLY OUTSIDE THE UNITED STATES, ITS TERRITORIES

AND POSSESSIONS TO PERSONS OTHER THAN "U.S. PERSONS" (AS DEFINED IN

REGULATION S OF THE UNITED STATES SECURITIES ACT OF 1933, AS AMED

(THE "SECURITIES ACT")). NOT FOR RELEASE, PUBLICATION OR

DISTRIBUTION IN OR INTO, OR TO ANY PERSON LOCATED OR RESIDENT IN,

ANY OTHER JURISDICTION WHERE IT IS UNLAWFUL TO RELEASE, PUBLISH OR

DISTRIBUTE THIS DOCUMENT.

30 October 2020

LLOYDS BANKING GROUP PLC

(incorporated in Scotland with limited liability under

registered number 95000)

Legal Entity Identifier (LEI: H7FNTJ4851HG0EXQ1Z70)

(the "Issuer")

NOTICE

to the holders of the

GBP1,494,392,000 7.625 per cent. Fixed Rate Reset Additional

Tier 1 Perpetual Subordinated Contingent Convertible Securities

Callable 2023 (ISIN: XS1043552188) (the "PNC9 Securities")

GBP750,009,000 7.875 per cent. Fixed Rate Reset Additional Tier

1 Perpetual Subordinated Contingent Convertible Securities Callable

2029 (ISIN: XS1043552261) (the "PNC15 Securities") (each a "Series"

and together the "Securities", and the holders thereof, the

"Securityholders") of the Issuer presently outstanding.

The Issuer has today given a Notice in respect of the Securities

for the purpose of soliciting consent from the Securityholders to

the modification of the terms and conditions (the "Conditions") of

the relevant Series and consequential or related amendments to the

transaction documents for the relevant Series of Securities such

that (i) the Reset Reference Rate (as defined in the relevant

Conditions) ceases to be a London Inter Bank Offered Rate ("LIBOR")

linked mid-swap rate and becomes a Sterling Overnight Index Average

("SONIA") linked mid-swap rate; (ii) an adjustment (the "Reset

Reference Rate Adjustment") is made to reflect the economic

difference between the LIBOR and SONIA rates; and (iii) the Margin

(as defined in the relevant Conditions) applicable to each Series

of Securities remains unaltered; (iv) the fallbacks relating to the

Reset Reference Rate are amended; and (v) new fallbacks are

included in case a Benchmark Event (as defined in the Updated

Consent Solicitation Memorandum) occurs with respect to the Reset

Rate of Interest, as proposed by the Issuer for approval by a

separate extraordinary resolution of the holders of each such

Series (each an "Extraordinary Resolution"), all as further

described in the updated consent solicitation memorandum dated 30

October 2020 (the "Updated Consent Solicitation Memorandum") (each

such invitation an "Updated Consent Solicitation").

On 29 September 2020 the Issuer launched its consent

solicitation in respect of the Securities in order to present a

proposal to Securityholders to implement the transition to SONIA

(the "Original Securityholder Proposal"). The Issuer is launching

this Updated Consent Solicitation following its decision to modify

the Original Securityholder Proposal. Securityholders should note

that any electronic voting instructions cast in respect of the

Original Securityholder Proposal will not be valid in respect of

the Updated Consent Solicitation and any Securities blocked

pursuant to such electronic voting instructions have been

unblocked.

The Proposed Amendments as set out in the Updated Consent

Solicitation Memorandum are identical to the proposed amendments

set out in the Original Securityholder Proposal save in respect of

the calculation of the Reset Reference Rate Adjustment and

consequential adjustment to the definitions of "Adjusted Reset

Reference Rate" and "Reset Reference Rate Adjustment", as more

particularly outlined in the Updated Consent Solicitation

Memorandum.

In light of the ongoing developments in relation to coronavirus

(COVID-19), and current guidance issued by the UK government, it

may become impossible or inadvisable to hold each relevant Meeting

at a physical location. Accordingly, in accordance with the

provisions of the relevant Trust Deed the Issuer has requested that

the Trustee prescribe appropriate regulations regarding the holding

of the relevant Meeting via teleconference.

1. Notice of meetingS in respect of the SECURITIES

The Notice will be available for viewing at the Issuer's

website:

https://www.lloydsbankinggroup.com/investors/fixed-income-investors/consent-solicitation/

2. Indicative timetable for the updated consent solicitation

Set out below is an indicative timetable showing one possible

outcome for the timing of the Updated Consent Solicitations, which

will depend, among other things, on timely receipt (and non

revocation) of instructions, the rights of the Issuer (where

applicable) to extend, waive any condition of, amend and/or

terminate either Updated Consent Solicitation (other than the terms

of the relevant Extraordinary Resolution) as described in the

Updated Consent Solicitation Memorandum and the passing of each

Extraordinary Resolution at the initial Meeting for the relevant

Series. Accordingly, the actual timetable may differ significantly

from the timetable below.

Date/Time Action

30 October 2020 1. Notice to be delivered to the Clearing Systems.

(At least 21 clear days before the Meeting) Release of the Notice through the regulatory news service

of the London Stock Exchange.

Copies of the Updated Consent Solicitation Memorandum to

be available from the Tabulation

Agent and the Securityholder Information (as defined in

the Notice) to be available for inspection,

as indicated, at the specified office of the Principal

Paying and Conversion Agent and on

the website of the Issuer

(https://www.lloydsbankinggroup.com/investors/fixed-incom

e-investors/consent-solicitation

) (the "Issuer's Website"). From this date,

Securityholders may arrange for Securities held

by Clearstream, Luxembourg and/or Euroclear in their

accounts to be blocked in such accounts

and held to the order and under the control of the

Principal Paying and Conversion Agent in

order to obtain a form of proxy or give valid Consent

Instructions or Ineligible Holder Instructions,

to the Tabulation Agent.

By 10 a.m.(London time) (11 a.m. CET) 2. Expiration Deadline.

on 20 November 2020 Final time by which Securityholders have arranged for:

(At least 48 hours before the Meeting) (i) obtaining a form of proxy from the Principal Paying

and Conversion Agent in order to attend

(via teleconference) and vote at the relevant Meeting; or

(ii) receipt by the Tabulation Agent of valid Consent

Instructions or Ineligible Holder Instructions

in accordance with the procedures of Clearstream,

Luxembourg and/or Euroclear.

3. Final time by which Securityholders have given notice to

the Tabulation Agent (via the relevant

Clearing Systems) of any intended revocation of, or

amendment to, Consent Instructions or

Ineligible Holder Instructions previously given by them.

10 a.m. (London time) (11 a.m. CET) 4. SECURITYHOLDERS' MEETING HELD

on 23 November 2020 The initial Meeting in respect of:

(i) the PNC9 Securities will commence at 10.00

a.m. (London time) (11.00 a.m. CET); and

(ii) the PNC15 Securities will commence at

10.15 a.m. (London time) (11.15 a.m. CET) or

after

the completion of the PNC9 Securities Meeting

(whichever is later).

If the relevant Extraordinary Resolutions are passed at the relevant Meeting:

As soon as reasonably practicable after the 5. Announcement of the results of the Meetings and, if the

Meetings relevant Extraordinary Resolution

is passed, satisfaction (or not) of the Eligibility

Condition.

Delivery of notice of such results to Euroclear and

Clearstream, Luxembourg for communication

to their account holders and an announcement released on

the regulatory news service of the

London Stock Exchange.

At or around 2 p.m. (London time) (3 p.m. CET) 6. Pricing Time and Pricing Date

on 23 November 2020 Solicitation Agent to determine the relevant Reset

(the "Pricing Date") Reference Rate Adjustment in respect of

each Series.

A pricing announcement will be delivered through the

Clearing Systems and released through

the regulatory news service of the London Stock Exchange

as soon as practicable following

the Pricing Time on the Pricing Date.

23 November 7. If the relevant Extraordinary Resolution is passed at the

(the "Effective Date") relevant initial Meeting (or at

a subsequent adjourned Meeting) and the Eligibility

Condition is satisfied, the relevant Supplemental

Trust Deed will be executed by the Issuer and the Trustee

and the modifications to the Conditions

of the relevant Series described in the Updated Consent

Solicitation Memorandum will be implemented

with effect on and from 23 November 2020 (the "Effective

Date")

If a quorum is not achieved at a Meeting or the quorum is achieved and the relevant Extraordinary

Resolution is passed but the Eligibility Condition is not satisfied, such Meeting shall be

adjourned and the adjourned Meeting of Securityholders for that Series will be held at a date

as will be notified to the Securityholders in the notice of the adjourned Meeting.

The adjourned Meeting will be held in accordance with the terms of the relevant Trust Deed.

If the relevant Extraordinary Resolution is passed at the adjourned Meeting and the Eligibility

Condition is satisfied in respect of the relevant Series, the relevant Supplemental Trust

Deed will be executed by the Issuer and the Trustee and the modifications with respect to

such Series described in the Updated Consent Solicitation Memorandum will be implemented on

the Effective Date.

Securityholders are advised to check with any bank, securities

broker or other intermediary through which they hold Securities

when such intermediary would need to receive instructions from a

Securityholder in order for that Securityholder to be able to

participate in, or revoke their instruction to participate in, the

relevant Updated Consent Solicitation before the deadlines

specified above. The deadlines set by any such intermediary and

each Clearing System for the submission and revocation of Consent

Instructions may be earlier than the relevant deadlines specified

above.

No consent fee will be payable in connection with the Updated

Consent Solicitations.

Capitalised terms used but not defined herein shall have the

meanings set out in the Updated Consent Solicitation

Memorandum.

Further information relating to the Updated Consent Solicitation

can be obtained directly from the Solicitation Agent and the

Tabulation Agent:

Lloyds Bank Corporate Markets plc Lucid Issuer Services Limited

10 Gresham Street Tankerton Works

London EC2V 7AE 12 Argyle Walk

United Kingdom London WC1H 8HA

Telephone: +44 20 7158 1719/1726 United Kingdom

Attention: Liability Management Team Telephone: +44 20 7704 0880

Email: liability.management@lloydsbanking.com Attention: Arlind Bytyqi

Email: lloydsbank@lucid-is.com

DISCLAIMER: This announcement must be read in conjunction with

the Updated Consent Solicitation Memorandum. The Updated Consent

Solicitation Memorandum contains important information which should

be read carefully before any decision is made with respect to the

Updated Consent Solicitation. If any Securityholder is in any doubt

as to the action it should take or is unsure of the impact of the

implementation of the relevant Extraordinary Resolution, it is

recommended to seek its own financial and legal advice, including

in respect of any tax consequences, immediately from its broker,

bank manager, solicitor, accountant, independent financial, tax or

legal adviser. Any individual or company whose Securities are held

on its behalf by a broker, dealer, bank, custodian, trust company

or other nominee must contact such entity if it wishes to

participate in the Updated Consent Solicitation or otherwise

participate in the relevant Meeting.

The distribution of the Updated Consent Solicitation Memorandum

in certain jurisdictions may be restricted by law. Persons into

whose possession the Updated Consent Solicitation Memorandum comes

are required to inform themselves about, and to observe, any such

restrictions.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCZBLFXBBLBFBF

(END) Dow Jones Newswires

October 30, 2020 10:03 ET (14:03 GMT)

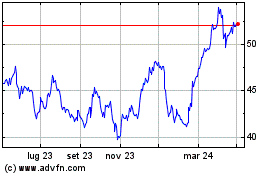

Grafico Azioni Lloyds Banking (LSE:LLOY)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni Lloyds Banking (LSE:LLOY)

Storico

Da Apr 2023 a Apr 2024