Lloyds Unexpectedly Swings to a 1st Half Pretax Loss After High Impairments

30 Luglio 2020 - 8:53AM

Dow Jones News

By Sabela Ojea

Lloyds Banking Group PLC reported Thursday an unexpected swing

to a pretax loss for the first half of 2020 after booking a large

impairment charge due to the coronavirus pandemic and said that its

outlook remains highly uncertain.

The U.K.'s largest retail bank posted a pretax loss of 602

million pounds ($782.4 million) compared with a profit of GBP2.90

billion for the same period a year earlier. The lender was expected

to report a pretax profit of GBP42 million for the first six months

of the year, according to its own compilation of consensus.

The FTSE-100 lender's net income decreased 38% to GBP5.48

billion. The bank was expected to post a net income of GBP7.4

billion for the period, according to its own compilation of

forecasts.

The bank took impairments of GBP2.39 billion in the second

quarter after booking a GBP1.43 billion charge in the first quarter

of the year due to the coronavirus pandemic, a total of 3.82

billion, up from the expected GBP2.9 billion impairments for the

first-half based on Lloyds' compilation of estimates.

The bank ended the period with a common equity Tier 1 ratio--a

key measure of balance-sheet strength--of 14.6%, up from 13.6% at

the year-earlier period.

Write to Sabela Ojea at sabela.ojea@wsj.com; @sabelaojeaguix

(END) Dow Jones Newswires

July 30, 2020 02:38 ET (06:38 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

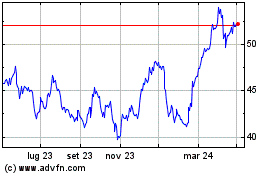

Grafico Azioni Lloyds Banking (LSE:LLOY)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni Lloyds Banking (LSE:LLOY)

Storico

Da Apr 2023 a Apr 2024