TIDMLSR

RNS Number : 8134C

Local Shopping REIT (The) PLC

20 June 2019

FOR IMMEDIATE RELEASE

20 June 2019

The Local Shopping REIT plc ("the Company")

Results for the six months ended 31 March 2019

The directors of The Local Shopping REIT plc are pleased to

announce the Company's unaudited consolidated interim results for

the six months ended 31 March 2019.

Enquiries:

Bill Heaney, Company Secretary +44 20 7355 8800

Rupert Wallman, Fund Manager +44 20 7355 8800

Chairman's Statement

During the period under review the asset management team

continued to progress the Company's property disposal programme,

comprising both the sale of investment properties and the

preparation of properties for marketing, as noted in the report

below. At a corporate level, the Company's activity during the

period focussed on, in the first instance, the Board's initiation

of plans to fulfil the Company's investment policy by returning

capital to shareholders via a members' voluntary liquidation and,

thereafter, the takeover bid by the Company's largest shareholder,

Thalassa Holdings Ltd ("Thalassa"), which had opposed the Board's

proposals.

The Board considered that the takeover proposal was not in the

best interests of shareholders as a whole, and the bid received

insufficient support from the Company's members to take effect.

However, dealing with the bid was an expensive exercise, the cost

of which is reflected in the interim financial statements.

As was announced by the Board following the lapse of Thalassa's

offer, the directors opened a dialogue with Thalassa to explore

whether a capital return to shareholders could be achieved on terms

acceptable to shareholders without resorting to an application to

the Court for a winding-up on Just and Equitable grounds (which

shareholders had approved at the general meeting held on 5 April

2019).

The outcome of these discussions, involving proposals to return

capital to shareholders by way of a capital reduction and share

buy-back tender offer, was set out in the announcement issued by

the Board on 18 June 2019. As indicated in that announcement, the

strike price per share for the share buy-back tender offer will be

equal to the net asset value per share set out in the Company's

interim accounts for 31 March 2019 contained in this report, which

is 31.33 pence per share.

The directors will shortly send a circular to shareholders

containing full details of the buy-back tender offer together with

a notice of general meeting to approve the necessary

resolutions.

Directors' Review

Basis of Preparation

The 30 September 2018 financial statements were prepared on a

break up basis, the directors having noted the likelihood that the

property sales programme would be completed during the coming

financial year, the Company's investment policy of returning cash

to shareholders and the advice of the Company's auditors.

Accordingly, the directors concluded that the financial statements

for 30 September 2018 should not be prepared on the Going Concern

basis. In view of the continuing progress with the property sales

programme and the continued prosecution of the Company's investment

policy of returning cash to shareholders, the directors consider it

appropriate to prepare these financial statements on a break-up

basis.

Financial Results and Portfolio Performance

The Company made a loss before tax on an IFRS basis for the

period of GBP1.90 million (or 2.30 pps). This compares with an IFRS

loss of GBP2.87 million (or 3.48 pps) for the equivalent period of

2017-18 and a loss of GBP7.15 million (or 8.7 pps) for the full

year to 30 September 2018.

Portfolio Revaluation

As the Company's accounts are prepared on a break-up basis, the

individual properties are held on the balance sheet at their net

realisable value, being their valuation (or contracted sales price

where applicable), less estimated sales costs. At 31 March 2019,

the Company held 10 properties. Of these, 9 investment properties

were revalued by Allsop LLP, a firm of independent chartered

surveyors, at GBP3.625 million, reflecting an equivalent yield

(excluding the residential element) of 13.98% before estimated

transaction costs. The remaining property not valued by Allsop LLP

became subject to a sale contract shortly after the period end, so

its carrying value equates to its contracted sale price less

estimated sale costs. The resultant carrying value of the 10

properties held at 31 March 2019 was GBP3.656 million (September

2018: GBP22.317 million).

Cash and Net Asset Value

At 31 March 2019 the Company held GBP22.76 million in cash.

The Net Asset Value was GBP25.85 million or 31.33 pps (September

2018: GBP27.73 million or 33.6 pps).

Property Disposals

During the period we continued to focus on property disposals,

contracting to sell or completing sales on a further 65 properties

at an aggregate price of GBP18.7 million, 1.77% above carrying

value at the time of sale.

Of the 10 properties remaining in the portfolio at 31 March

2019, one is under contract for sale, completion on which is

expected shortly, and terms have been agreed for the sale of three

other properties. The remaining six properties are either being

actively marketed or prepared for marketing.

Asset Management

Asset management activities during the period focussed on

preparing properties for sale, primarily by maximising occupancy

and opportunities for rental growth, as well as a small number of

repair and maintenance projects.

Financing

The Company did not utilise any external funding facilities

during the period.

Taxation

The Group continued to operate as a UK REIT during the period,

under which any profits and gains from the property investment

business are exempt from Corporation Tax provided certain

conditions continue to be met. The Group fulfilled the UK REIT

conditions during the period. The investment objective of the

Company remains for its remaining property assets to be sold and

the Company's cash reserves to be distributed to its members. On

the disposal of the property assets, the Company will exit the UK

REIT regime. Discussions have taken place with HMRC to ensure that

this will take place in an orderly manner. Should the Group depart

the UK REIT regime, it would at that point become liable to

Corporation Tax. However, the Board believes that the Group's

activities would be unlikely to generate any material Corporation

Tax liability.

Dividend

In line with the Group's current dividend distribution policy no

interim dividend will be paid. The Board will continue to review

the dividend policy in line with progress with the investment

strategy.

Principal Risks and Uncertainties for the Remaining Six Months

of the Financial Year

The risks facing the Group for the remaining six months of the

financial year remain consistent with those described in detail in

the Annual Report for the year ended 30 September 2018 (available

on the Group's website: www.localshoppingreit.co.uk).

These centre on:

-- Changes in the macroeconomic environment

-- Higher than anticipated property maintenance costs

-- Changes to legal environment, planning law or local planning policy

-- Regulatory requirements in connection with the property portfolio

-- Information technology systems and data security

-- Financial and property market conditions

However, the potential impact of these risk areas on the Company

has been mitigated by the considerable reduction in the size of the

Company's property portfolio, meaning that the dominant portion of

the Company's assets is now held as cash.

The Group does not speculate in derivative financial

instruments. Whilst the Group is exposed to the risk of non-payment

of trade receivables by its tenants, the Directors consider that

this does not comprise an undue concentration of credit risk, given

the reduced amounts involved. The level of arrears is monitored

continually by the Group's asset managers and are subject to

monthly review at executive level.

Responsibility Statement

We confirm that to the best of our knowledge:

(a) the condensed set of financial statements has been prepared

in accordance with IAS 34 Interim Financial Reporting as adopted by

the EU: and (b) the Interim Management Report includes a fair

review of the information required by:

DTR 4.2.7R of the Disclosure and Transparency Rules, being an

indication of important events that have occurred during the first

six months of the financial year and their impact on the condensed

set of financial statements; and a description of the principal

risks and uncertainties for the remaining six months of the year;

and

DTR 4.2.8R of the Disclosure and Transparency Rules, being

related party transactions that have taken place in the first six

months of the current financial year and that have materially

affected the financial position or performance of the entity during

that period; and any changes in the related party transactions

described in the last annual report that could do so.

Signed on behalf of the Board who approved the interim

management report on 20 June 2019.

S J East

Director

Independent Review Report to The Local Shopping REIT plc

Conclusion

We have been engaged by the company to review the condensed set

of financial statements in the half-yearly financial report for the

six months ended 31 March 2019 which comprises the Condensed

Consolidated Income Statement, Condensed Consolidated Statement of

Comprehensive Income, Condensed Consolidated Balance Sheet,

Condensed Consolidated Statement of Cash Flows, Condensed

Consolidated Statement of Changes in Equity and the related

explanatory notes.

Based on our review, nothing has come to our attention that

causes us to believe that the condensed set of financial statements

in the half-yearly financial report for the six months ended 31

March 2019 is not prepared, in all material respects, in accordance

with IAS 34 Interim Financial Reporting as adopted by the EU and

the Disclosure Guidance and Transparency Rules ("the DTR") of the

UK's Financial Conduct Authority ("the UK FCA").

Scope of review

We conducted our review in accordance with International

Standard on Review Engagements (UK and Ireland) 2410 Review of

Interim Financial Information Performed by the Independent Auditor

of the Entity issued by the Auditing Practices Board for use in the

UK. A review of interim financial information consists of making

enquiries, primarily of persons responsible for financial and

accounting matters, and applying analytical and other review

procedures. We read the other information contained in the

half-yearly financial report and consider whether it contains any

apparent misstatements or material inconsistencies with the

information in the condensed set of financial statements.

A review is substantially less in scope than an audit conducted

in accordance with International Standards on Auditing (UK) and

consequently does not enable us to obtain assurance that we would

become aware of all significant matters that might be identified in

an audit. Accordingly, we do not express an audit opinion.

The impact of uncertainties due to the UK exiting the European

Union on our audit

Uncertainties related to the effects of Brexit are relevant to

understanding our audit of the financial statements. All audits

assess and challenge the reasonableness of estimates made by the

directors, such as the value of investment properties held for sale

and related disclosures. All of these depend on assessments of the

future economic environment and the company's future prospects and

performance.

Brexit is one of the most significant economic events for the

UK, and at the date of this report its effects are subject to

unprecedented levels of uncertainty of outcomes, with the full

range of possible effects unknown. We applied a standardised

firm-wide approach in response to that uncertainty when assessing

the Company's future prospects and performance. However, no audit

should be expected to predict the unknowable factors or all

possible future implications for a company and this is particularly

the case in relation to Brexit.

Emphasis of matter - non-going concern basis of preparation

We draw attention to the disclosure made in note 1 to the

financial statements which explains that the financial statements

are now not prepared on the going concern basis for reasons set out

in that note.

Directors' responsibilities

The half-yearly financial report is the responsibility of, and

has been approved by, the directors. The directors are responsible

for preparing the half-yearly financial report in accordance with

the DTR of the UK FCA.

As disclosed in note 1, the annual financial statements of the

Group are prepared in accordance with International Financial

Reporting Standards as adopted by the EU. The directors are

responsible for preparing the condensed set of financial statements

included in the half-yearly financial report in accordance with IAS

34 as adopted by the EU.

Our responsibility

Our responsibility is to express to the company a conclusion on

the condensed set of financial statements in the half-yearly

financial report based on our review.

The purpose of our review work and to whom we owe our

responsibilities.

This report is made solely to the company in accordance with the

terms of our engagement to assist the company in meeting the

requirements of the DTR of the UK FCA. Our review has been

undertaken so that we might state to the company those matters we

are required to state to it in this report and for no other

purpose. To the fullest extent permitted by law, we do not accept

or assume responsibility to anyone other than the company for our

review work, for this report, or for the conclusions we have

reached.

Mark Flanagan

for and on behalf of KPMG LLP

Chartered Accountants

31 Park Row

Nottingham

NG1 6FQ

20 June 2019

Condensed Consolidated Income Statement for the six months ended

31 March 2019

Note

Unaudited Unaudited Audited

Six months Six months Year ended

ended ended

31 March 31 March 30 September

2019 2018 2018

GBP000 GBP000 GBP000

----- ----------- ----------- -------------

Gross rental income 459 2,250 3,381

----- ----------- ----------- -------------

Property operating expenses 3 (672) (1,200) (2,451)

----- ----------- ----------- -------------

Net rental income (213) 1,050 930

----- ----------- ----------- -------------

Loss on disposal of investment

properties held for sale 4 (147) (902) (1,417)

----- ----------- ----------- -------------

Change in fair value of

investment properties held

for sale 9 (295) (2,103) (4,536)

----- ----------- ----------- -------------

Administrative expenses 5 (1,261) (552) (1,522)

----- ----------- ----------- -------------

Operating loss before net

financing costs (1,916) (2,507) (6,545)

----- ----------- ----------- -------------

Financing income 6 20 1 2

----- ----------- ----------- -------------

Financing expenses 6 (4) (364) (611)

----- ----------- ----------- -------------

Loss before taxation (1,900) (2,870) (7,154)

----- ----------- ----------- -------------

Tax 7 - - -

----- ----------- ----------- -------------

Loss for the financial period

from discontinued operations (1,900) (2,870) (7,154)

----- ----------- ----------- -------------

Loss for the financial period

attributable to equity holders

of the parent Company (1,900) (2,870) (7,154)

----- ----------- ----------- -------------

Basic and diluted loss per

share on loss for the financial

period (2.30)p (3.48)p (8.67)p

----- ----------- ----------- -------------

Basic and diluted loss per

share on discontinued operations

for the period 11 (2.30)p (3.48)p (8.67)p

----- ----------- ----------- -------------

Condensed Consolidated Statement of Comprehensive Income for the

six months ended 31 March 2019

Unaudited Unaudited Audited

---------------------------------------------

Six months Six months Year ended

ended ended

---------------------------------------------

31 March 31 March 30 September

2019 2018 2018

GBP000 GBP000 GBP000

--------------------------------------------- ----------- ----------- -------------

Loss for the period (2,870) -

--------------------------------------------- ----------- ----------- -------------

Loss for the financial year on discontinued

operations (below) (1,900) - (7,154)

---------------------------------------------- ----------- ----------- -------------

Total comprehensive loss for

the period (1,900) (2,870) (7,154)

---------------------------------------------- ----------- ----------- -------------

Attributable to:

--------------------------------------------- ----------- ----------- -------------

Equity holders of the parent

Company (1,900) (2,870) (7,154)

---------------------------------------------- ----------- ----------- -------------

Unaudited Unaudited Audited

---------------------------------------------

Six months Six months Year ended

ended ended

---------------------------------------------

31 March 31 March 30 September

2019 2018 2018

GBP000 GBP000 GBP000

--------------------------------------------- ----------- ----------- -------------

Revenue less expenses for the period

on discontinued operations (1,605) (2,618)

---------------------------------------------- ----------- ----------- -------------

Fair value adjustment of assets

held for sale from discontinued

operations (295) - (4,536)

---------------------------------------------- ----------- ----------- -------------

Total comprehensive loss for

the period (1,900) - (7,154)

---------------------------------------------- ----------- ----------- -------------

Taxation on discontinued operations - -

--------------------------------------------- ----------- ----------- -------------

Total loss for the financial

year on discontinued operations

(above) (1,900) (7,154)

---------------------------------------------- ----------- ----------- -------------

Condensed Consolidated Balance Sheet as at 31 March 2019

Note Unaudited Unaudited Audited

------------------------------- -----

31 March 31 March 30 September

2019 2018 2018

------------------------------- -----

GBP000 GBP000 GBP000

------------------------------- ----- ---------- ---------- -------------

Non-current assets

----- ---------- ---------- -------------

Investment properties 9 - 25,236 -

----- ---------- ---------- -------------

Total non-current assets - 25,236 -

----- ---------- ---------- -------------

Current assets

----- ---------- ---------- -------------

Trade and other receivables 844 6,099 4,341

----- ---------- ---------- -------------

Investment properties held

for sale 9 3,656 10,825 22,317

----- ---------- ---------- -------------

Cash 22,755 1,968 3,292

----- ---------- ---------- -------------

Total current assets 27,255 18,892 29,950

----- ---------- ---------- -------------

Total assets 27,255 44,128 29,950

----- ---------- ---------- -------------

Non current liabilities

----- ---------- ---------- -------------

Interest bearing loans and

borrowings 10 - (9,353) -

----- ---------- ---------- -------------

Finance lease liabilities - (429) -

----- ---------- ---------- -------------

Total non-current liabilities - (9,782) -

----- ---------- ---------- -------------

Current liabilities

----- ---------- ---------- -------------

Interest bearing loans and

borrowings 10 - (392) -

----- ---------- ---------- -------------

Trade and other payables (1,402) (1,986) (2,217)

----- ---------- ---------- -------------

Total current liabilities (1,402) (2,378) (2,217)

----- ---------- ---------- -------------

Total liabilities (1,402) (12,160) (2,217)

----- ---------- ---------- -------------

Net assets 25,853 31,968 27,733

----- ---------- ---------- -------------

Equity

----- ---------- ---------- -------------

Issued capital 18,334 18,334 18,334

----- ---------- ---------- -------------

Reserves - 3,773 3,773

----- ---------- ---------- -------------

Capital redemption reserve 1,764 1,764 1,764

----- ---------- ---------- -------------

Retained earnings 5,755 8,097 3,862

----- ---------- ---------- -------------

Total attributable to equity

holders of the Company 25,853 31,968 27,733

Condensed Consolidated Statement of Cash Flows for the six

months ended 31 March 2019

Note Unaudited Unaudited Audited

---------------------------------- -----

Six months Six months Year ended

ended ended

---------------------------------- -----

31 March 31 March 30 September

2019 2018 2018

GBP000 GBP000 GBP000

---------------------------------- ----- ----------- ----------- -------------

Operating activities

----- ----------- ----------- -------------

Loss for the financial period (1,900) (2,870) (7,154)

----- ----------- ----------- -------------

Adjustments for:

----- ----------- ----------- -------------

Loss on change in fair value

of investment properties

held for sale 9 295 2,103 4,536

----- ----------- ----------- -------------

Net financing (income)/costs 6 (16) 363 609

----- ----------- ----------- -------------

Loss on disposal of investment

properties held for sale 147 902 1,417

----- ----------- ----------- -------------

Employee benefit trust shares

vesting 20 49 98

----- ----------- ----------- -------------

(1,454) 547 (494)

----- ----------- ----------- -------------

Decrease /(Increase) in trade

and other receivables 3,497 (3,965) (2,198)

----- ----------- ----------- -------------

Decrease in trade and other

payables (815) (689) (265)

----- ----------- ----------- -------------

1,228 (4,107) (2,957)

----- ----------- ----------- -------------

Interest paid - (278) (445)

----- ----------- ----------- -------------

Bank facility fees paid (4) -

----- ----------- ----------- -------------

Loan arrangement fees paid - - (23)

----- ----------- ----------- -------------

Interest received 20 1 2

----- ----------- ----------- -------------

Net cash flows from operating

activities 1,244 (4,384) (3,423)

----- ----------- ----------- -------------

Investing activities

----- ----------- ----------- -------------

Proceeds from sale of investment

properties held for sale 18,222 16,903 27,380

----- ----------- ----------- -------------

Acquisition of and improvements

to (3) (78) (188)

----- ----------- ----------- -------------

investment properties held

for sale

----- ----------- ----------- -------------

Cash flows from investing

activities 18,219 16,825 27,192

----- ----------- ----------- -------------

Net cash flows from operating

activities and investing

activities 19,463 12,441 23,769

----- ----------- ----------- -------------

Financing activities

----- ----------- ----------- -------------

Repayment of borrowings - (20,928) (30,932)

----- ----------- ----------- -------------

Cash flows from financing

activities - (20,928) (30,932)

----- ----------- ----------- -------------

Net increase (decrease)

in cash 19,463 (8,487) (7,163)

----- ----------- ----------- -------------

Cash at beginning of period 3,292 4,159 10,455

----- ----------- ----------- -------------

Cash at end of period 22,755 (4,328) 3,292

----- ----------- ----------- -------------

An acquisition reserve arose when the Company acquired Gilfin

Property Holdings Limited ("Gilfin") in 2007, and the acquisition

consideration was part cash and part shares in The Local Shopping

REIT plc.

During the current period all the remaining Gilfin properties

were disposed of, and Gilfin entered into a members' voluntary

liquidation. A distribution has been received from the liquidator

for an amount in excess of the carrying value of Gilfin.

Accordingly, the gain on acquisition has now been realised, and the

reserve has been transferred to distributable profits.

Condensed Consolidated Statement of Changes in Equity for the

six months ended 31 March 2019

Capital

-------------------------------

Share redemption Retained

-------------------------------

capital Reserves reserve earnings Total

GBP000 GBP000 GBP000 GBP000 GBP000

------------------------------- -------- --------- ----------- --------- --------

At 30 September 2017 18,334 3,773 1,764 10,918 34,789

-------- --------- ----------- --------- --------

Total comprehensive loss

-------- --------- ----------- --------- --------

for the period

-------- --------- ----------- --------- --------

Loss for the period - - - (2,870) (2,870)

-------- --------- ----------- --------- --------

Transactions with owners,

-------- --------- ----------- --------- --------

recorded directly in

equity

-------- --------- ----------- --------- --------

Dividends - - - - -

-------- --------- ----------- --------- --------

Share based payments - - - 49 49

-------- --------- ----------- --------- --------

Total contributions by - - - - -

and

-------- --------- ----------- --------- --------

distributions to owners

-------- --------- ----------- --------- --------

At 31 March 2018 18,334 3,773 1,764 8,097 31,968

-------- --------- ----------- --------- --------

Total comprehensive loss

-------- --------- ----------- --------- --------

for the period

-------- --------- ----------- --------- --------

Loss for the period - - - (4,284) (4,284)

-------- --------- ----------- --------- --------

Transactions with owners,

-------- --------- ----------- --------- --------

recorded directly in

equity

-------- --------- ----------- --------- --------

Dividends - - - - -

-------- --------- ----------- --------- --------

Share based payments - - - 49 49

-------- --------- ----------- --------- --------

Total contributions by - - - - -

and

-------- --------- ----------- --------- --------

distributions to owners

-------- --------- ----------- --------- --------

At 30 September 2018 18,334 3,773 1,764 3,862 27,733

-------- --------- ----------- --------- --------

Total comprehensive loss

-------- --------- ----------- --------- --------

for the period

-------- --------- ----------- --------- --------

Loss for the period - - - (1,900) (1,900)

-------- --------- ----------- --------- --------

Transactions with owners,

-------- --------- ----------- --------- --------

recorded directly in

equity

-------- --------- ----------- --------- --------

Dividends - - - - -

-------- --------- ----------- --------- --------

Share based payments - - - 20 20

-------- --------- ----------- --------- --------

Release of Gilfin acquisition - - -

reserve to

-------- ----------- --------

distributable reserve (3,773) 3,773

-------- --------- ----------- --------- --------

Total contributions by - - - - -

and

-------- --------- ----------- --------- --------

distributions to owners

-------- --------- ----------- --------- --------

At 31 March 2019 18,334 - 1,764 5,755 25,853

-------- --------- ----------- --------- --------

Following the liquidation of Gilfin Property Holdings Limited

during the period, the acquisition reserve which arose when Gilfin

Property Holdings Limited was acquired in 2007 has become available

for distribution.

Notes to the Half Year Report for the six months ended 31 March

2019

1 Accounting policies

Basis of preparation

The condensed set of financial statements has been prepared

in accordance with IAS 34 "Interim Financial Reporting" as

adopted by the EU.

The annual financial statements of the Group are prepared in

accordance with International Financial Reporting Standards

(IFRSs) as adopted by the EU. As required by the Disclosure

and Transparency Rules of the Financial Services Authority,

the condensed set of financial statements has been prepared

applying the accounting policies and presentation that were

applied in the preparation of the Company's published consolidated

financial statements for the year ended 30 September 2018 (with

which they should be read in conjunction).

The Group has adopted IFRS 15 Revenue from Contracts with Customers

and IFRS 9 Financial Instruments from 1 January 2018. Neither

of these standards has a material effect on the Group's financial

statements.

IFRS 16 replaces existing leases guidance, including IAS 17

Leases, IFRIC(R) 4 Determining whether an Arrangement contains

a Lease, SIC-15(R) Operating Leases - Incentives and SIC-27

Evaluating the Substance of Transactions Involving the Legal

Form of a Lease. The standard is effective for annual periods

beginning on or after 1 January 2019. Early adoption is permitted.

IFRS 16 introduces a single, on-balance sheet lease accounting

model for lessees. A lessee recognises a right-of-use asset

representing its right to use the underlying asset and a lease

liability representing its obligation to make lease payments.

There are recognition exemptions for short-term leases and

leases of low-value items. Lessor accounting remains similar

to the current standard - i.e. lessors continue to classify

leases as finance or operating leases.

The adoption of IFRS 16 is not expected have a material effect

on the Group's financial statements.

As explained in the 30 September 2018 financial statements,

the financial statements are not prepared on a going concern

basis.

The comparative figures for the financial year ended 30 September

2018 are not the Company's statutory accounts for that financial

year. Those accounts have been reported on by the Company's

Auditors and delivered to the Registrar of Companies. The report

of the Auditors was (i) unqualified, (ii) did include a reference

to the financial statements not being prepared on a going concern

basis to which the Auditors drew attention by way of emphasis

without qualifying their report, and (iii) did not contain

a statement under section 498 (2) or (3) of the Companies Act

2006.

2 Segmental reporting

IFRS 8 requires operating segments to be identified on the

basis of internal reports that are regularly reported to the

chief operating decision maker to allocate resources to the

segments and to assess their performance.

Since the strategy review in July 2013 the Group has identified

one operation and one reporting segment which is reported to

the Board on a quarterly basis. The Board of directors is considered

to be the chief operating decision maker.

3 Property Operating Expenses

Six months Six months Year ended

ended ended

------------------------------

31 March 31 March 30 September

2019 2018 2018

------------------------------

GBP000 GBP000 GBP000

------------------------------ ----------- ----------- -------------

Bad debt charge (26) (106) (221)

------------------------------- ----------- ----------- -------------

Head rent payments (3) (12) (37)

------------------------------- ----------- ----------- -------------

Repairs (209) (437) (993)

------------------------------- ----------- ----------- -------------

Business rates and council

tax (2) (130) (185)

------------------------------- ----------- ----------- -------------

Irrecoverable service

charge (41) (23) (122)

------------------------------- ----------- ----------- -------------

Utilities (94) (60) (108)

------------------------------- ----------- ----------- -------------

Insurance (11) (21) (53)

------------------------------- ----------- ----------- -------------

Managing agent fees (99) (113) (158)

------------------------------- ----------- ----------- -------------

Leasing costs (32) (159) (266)

------------------------------- ----------- ----------- -------------

Legal & professional (74) (72) (173)

------------------------------- ----------- ----------- -------------

EPC amortisation, abortives,

and miscellaneous (81) (67) (135)

------------------------------- ----------- ----------- -------------

Total property operating

expenses (672) (1,200) (2,451)

------------------------------- ----------- ----------- -------------

In common with many property organisations, the company's

portfolio is a mix of residential, opted and non-opted properties

for VAT. In the above table the applicable VAT which is not

recovered has been included directly in the cost.

4. Property disposals

Six months Six months Year ended

ended ended

31 March 31 March 30 September

2019 2018 2018

------------- ------------- -----------------

Number Number Number

Number of sales 65 46 107

--------------------------- ------------- ------------- ------------- -----------------

GBP000 GBP000 GBP000

--------------------------- ------------- ------------- ------------- -----------------

Average value 288 376 264

--------------------------- ------------- ============= ============= =================

Sales

--------------------------- ------------- ------------- ------------- -----------------

Total sales 18,695 17,277 28,198

--------------------------- ------------- ------------- ------------- -----------------

Carrying value (18,369) (17,805) (28,797)

--------------------------- ------------- ------------- ------------- -----------------

Profit/(Loss) on disposals

before transaction costs 326 (528) (599)

--------------------------- ------------- ============= ============= =================

Transaction costs

--------------------------- ------------- ------------- ------------- -----------------

Legal fees (201) (114) (339)

--------------------------- ------------- ------------- ------------- -----------------

Agent fees, marketing and

brochure costs (238) (236) (426)

--------------------------- ------------- ------------- ------------- -----------------

Disbursements (6) (2) (2)

--------------------------- ------------- ------------- ------------- -----------------

Non recoverable VAT (on

non-opted

and residential elements) (28) (22) (51)

--------------------------- ------------- ------------- ------------- -----------------

Total transaction costs (473) (374) (818)

--------------------------- ------------- ============= ============= =================

Loss on disposals after

transaction

costs (147) (902) (1,417)

--------------------------- ------------- ------------- ------------- -----------------

Transaction costs as

percentage

of sales value 2.5% 2.2% -2.9%

--------------------------- ------------- ------------- ------------- -----------------

5. Administrative expenses

Six months Six months Year ended

ended ended

-------------------------------------

31 March 31 March 30 September

2019 2018 2018

-------------------------------------

GBP000 GBP000 GBP000

------------------------------------- ----------- ----------- -------------

Investment manager fees (232) (304) (496)

-------------------------------------- ----------- ----------- -------------

Legal and professional (885) (51) (186)

-------------------------------------- ----------- ----------- -------------

Tax and audit (49) (57) (113)

-------------------------------------- ----------- ----------- -------------

Remuneration costs* (69) (99) (194)

-------------------------------------- ----------- ----------- -------------

Other 29 (19) (41)

-------------------------------------- ----------- ----------- -------------

Irrecoverable VAT on administration

expenses** (55) (22) (92)

-------------------------------------- ----------- ----------- -------------

Provision for liquidators'

fees - - (250)

-------------------------------------- ----------- ----------- -------------

Provision for legal costs

of winding up (150)

-------------------------------------- ----------- ----------- -------------

Total administrative expenses (1,261) (552) (1,522)

-------------------------------------- ----------- ----------- -------------

* Remuneration costs include GBP20,000 (30 September 2018: GBP 98,000,

31 March 2018; GBP49,000) in respect of the expensing of employee

share options which vest in 2019 onwards or if liquidation targets

are met. This amount has a corresponding entry in equity and has

no impact on the Company's net assets now or in the future.

** The company's portfolio contains residential elements and commercial

properties not opted for VAT. Accordingly, VAT on overheads is not

fully recoverable.

6. Net financing income

Six months Six months Year ended

ended ended

----------------------------------

31 March 31 March 30 September

2019 2018 2018

----------------------------------

GBP000 GBP000 GBP000

---------------------------------- ----------- ----------- -------------

Interest receivable 20 1 2

----------------------------------- ----------- ----------- -------------

Financing income 20 1 2

----------------------------------- ----------- ----------- -------------

Bank loan interest - (278) (327)

----------------------------------- ----------- ----------- -------------

Amortisation of loan arrangement

fees - (58) (261)

----------------------------------- ----------- ----------- -------------

Head rents treated as finance - (14) -

leases

---------------------------------- ----------- ----------- -------------

Bank facility fees (4) (14) (23)

----------------------------------- ----------- ----------- -------------

Financing expenses (4) (364) (611)

----------------------------------- ----------- ----------- -------------

Net financing income/(costs) 16 (363) (609)

----------------------------------- ----------- ----------- -------------

7. Taxation

From 11 May 2007, the Group elected to join the UK REIT regime.

As a result, the Group is exempt from corporation tax on the profits

and gains from its investment business from this date, provided

it continues to meet certain conditions. Non-qualifying profits

and gains of the Group (the residual business) continue to be subject

to corporation tax. The directors consider that all the rental income

post 11 May 2007 originates from the Group's tax-exempt business.

On entering the UK REIT regime, a conversion charge equal to 2%

of the gross market value of properties involved in the property

rental business, at that date, became due which was paid in full.

Due to the availability of losses no provision for corporation tax

has been made in these accounts. The deferred tax asset not recognised

relating to these losses can be carried forward indefinitely. It

is not anticipated that these losses will be utilised in the foreseeable

future.

8. Dividends

No dividends have been paid since December 2012.

9. Investment properties

Total

--------------------------

GBP000

-------------------------- ---------

At 1 October 2018 22,317

---------

Additions 3

---------

Disposals (18,369)

---------

Fair value adjustments (295)

---------

At 31 March 2019 3,656

---------

The investment properties have all been revalued to their fair

value at 31 March 2019.

For the Group as a whole Allsop LLP, a firm of independent

chartered surveyors valued the Group's property portfolio at 31

March 2019, 30 September 2018, 31 March 2018 and 30 September 2017.

On 30 September 2017, 31 March 2018 and 30 September 2018 Allsop

LLP performed a full valuation of approximately 25% of the Group's

properties (including site inspections) and a desktop valuation of

the remainder of the portfolio. On 31 March 2019 Allsop LLP

performed a desktop valuation of all the Group's remaining

properties, other than one property for which a sale contract was

entered into shortly after the period end, the carrying value of

which equates to its contracted sale price less estimated sale

costs.

All properties owned by the Group at 31 March 2019 have been

subject to a full valuation, including inspection over the two-year

period. These valuations were undertaken in accordance with the

Royal Institute of Chartered Surveyors Appraisal and Valuation

Standards on the basis of market value. Market value is defined as

the estimated amount for which a property should exchange on the

date of valuation between a willing buyer and a willing seller in

an arm's length transaction, after proper marketing wherein the

parties had each acted knowledgeably, prudently and without

compulsion.

A reconciliation of the portfolio valuation at 31 March 2019 to

the total value for investment properties given in the Consolidated

Balance Sheet is as follows:

31 March 31 March 30 September

2019 2018 2018

-----------------------------------

GBP000 GBP000 GBP000

----------------------------------- --------- --------- -------------

Portfolio valuation * 3,656 35,632 22,317

------------------------------------ --------- --------- -------------

Investment properties held

for sale (3,656) (10,825) (22,317)

Head leases treated as investment 429 -

properties held under

--------- --------- -------------

finance leases in accordance

with IAS 17

------------------------------------ --------- --------- -------------

Total per Consolidated Balance - 25,236 -

Sheet

------------------------------------ --------- --------- -------------

* Revalued assets and held for sale at net realisable value

10. Interest-bearing loans and borrowings

31 March 31 March 30 September

2019 2018 2018

---------------------------

GBP000 GBP000 GBP000

--------------------------- --------- --------- -------------

Non-current liabilities

--------------------------- --------- --------- -------------

Secured bank loans - 9,556 -

--------------------------- --------- --------- -------------

Loan arrangement fees - (203) -

--------------------------- --------- --------- -------------

- 9,353 -

--------------------------- --------- --------- -------------

Current liabilities

--------------------------- --------- --------- -------------

Current portion of secured - 392 -

bank loans

--------------------------- --------- --------- -------------

All bank borrowings were secured by fixed charges over certain

of the Group's property assets and floating charges over the

companies which own the assets charged.

The Group's loans were fully repaid in July 2018.

11. Earnings per share and Basic earnings per share

The calculation of basic earnings per share was based on the

profit attributable to ordinary shareholders and a weighted

average number of ordinary shares outstanding, calculated as

follows:

Loss attributable to ordinary

shares

Six months Six months Year ended

ended ended

31 March 31 March 30 September

2019 2018 2018

GBP000 GBP000 GBP000

----------- ----------- -------------

Loss for the financial period (1,900) (2,870) (7,154)

---------------------------------- ----------- ----------- -------------

Loss per share (2.30)p (3.48)p (8.67)p

---------------------------------- ----------- ----------- -------------

Weighted average number of

shares

31 March 31 March 30 September

2019 2018 2018

---------------------------------

Number Number Number

000 000 000

--------------------------------- ----------- ----------- -------------

Issued ordinary shares 91,670 91,670 91,670

---------------------------------- ----------- ----------- -------------

Treasury shares (9,164) (9,164) (9,164)

---------------------------------- ----------- ----------- -------------

Weighted average number of

ordinary shares 82,506 82,506 82,506

---------------------------------- ----------- ----------- -------------

Diluted earnings per share

There is no difference between the basic and diluted earnings

per share.

12. Net asset value (NAV)

The number of shares used to calculate net asset value per

share is as follows:

31 March 31 March 30 September

2019 2018 2018

------------------------------------

Number Number Number

000 000 000

------- --------- --------- --------------

Number of shares in issue 91,670 91,670 91,670

--------------------------------------------- --------- --------- --------------

Less: shares held in Treasury (9,164) (9,164) (9,164)

--------------------------------------------- --------- --------- --------------

82,506 82,506 82,506

------- --------- --------- --------------

31 March 31 March 30 September

2019 2018 2018

------------------------------------

GBP000 GBP000 GBP000

------------------------------------ ------- --------- --------- --------------

Net assets per Consolidated

Balance Sheet 25,853 31,968 27,733

--------------------------------------------- --------- --------- --------------

Net asset value per share GBP0.31 GBP0.39 GBP0.34

--------------------------------------------- --------- --------- --------------

13. Derivative financial

instruments

Derivative financial instruments were in the past held by the

Group in the form of interest rate swaps used to manage the

Group's interest rate exposure. These were fully paid down in

the year to 30 September 2016. The Company continues to monitor

the interest rate environment and may enter into some hedging

arrangements in the future. However, given the currently low

and stable rates and the Company's sales programme, this would

not be advantageous at present.

14. Related parties

There have been no transactions with related parties which have

materially affected the financial position or performance of

the Group during the current or previous period nor have there

been any changes in related party transactions which could have

a material effect on the financial position or performance of

the Company during the first six months of the current financial

year.

15. Significant contracts

With effect from 22 July 2013 the Company entered into a management

agreement with Internos Global Investors Limited ("Internos").

In April 2019 Internos changed its name to Principal Real Estate

Europe Limited ("Principal"). Under this agreement the Company

pays to Principal:

1. an annual management fee of 0.70% of the gross asset value

of the Company, subject to a minimum fee of GBP1m in each of

the first two years, GBP0.95m for the third year and GBP0.9m

for the fourth year. This minimum fell away in July 2018;

2. an annual performance fee of 20% of the recurring operating

profits above a pre-agreed target recurring profit;

3. fees for property sales, as follows:

up to GBP50m: nil

GBP50m - GBP150m: 0.5% of sales

over GBP150m: 1% of sales;

4. a terminal fee of 5.7% of cash returned to the Company's

shareholders in excess of 36.1 pence per share per annum from

the Effective Date outside of dividend payments (the "Terminal

Fee Hurdle"). The Terminal Fee Hurdle rises by 8% per annum

after the first year but reduces on a pro-rata daily basis each

time equity is returned to shareholders outside of dividend

payments from recurring operating profits.

Under the terms of the agreement, Principal received a fee of

GBP232,000 (September 2018: GBP416,000; March 2018: GBP304,000).)

ENDS

Important Notices

BDO LLP ("BDO"), which is authorised and regulated by the

Financial Conduct Authority in the United Kingdom, is acting

exclusively as financial adviser to the Company and no one else in

connection with the prospective capital reduction and share

buy-back tender offer announced by the Company on 18 June 2019 (the

"Offer") and will not be responsible to anyone other than the

Company for providing the protections afforded to clients of BDO or

for providing advice in connection with the Offer or any other

matter referred to in this announcement.

This announcement is not intended to, and does not, constitute

or form part of any offer, invitation or solicitation of any offer

to purchase, otherwise acquire, subscribe for, sell or otherwise

dispose of any securities or the solicitation of any vote or

approval in any jurisdiction. The Offer (if made) will be made

solely by certain documentation which will contain the full terms

and conditions of any offer (if made), including details of how

such offer may be accepted. This announcement has been prepared in

accordance with English law and the Code and information disclosed

may not be the same as that which would have been prepared in

accordance with laws outside the United Kingdom. The release,

distribution or publication of this announcement in jurisdictions

outside the United Kingdom may be restricted by the laws of the

relevant jurisdictions and therefore persons into whose possession

this announcement comes should inform themselves about, and

observe, any such restrictions. Any failure to comply with the

restrictions may constitute a violation of the securities laws of

any such jurisdiction.

Disclosure requirements of the Takeover Code (the "Code")

Under Rule 8.3(a) of the Code, any person who is interested in

1% or more of any class of relevant securities of an offeree

company or of any securities exchange offeror (being any offeror

other than an offeror in respect of which it has been announced

that its offer is, or is likely to be, solely in cash) must make an

Opening Position Disclosure following the commencement of the offer

period and, if later, following the announcement in which any

securities exchange offeror is first identified. An Opening

Position Disclosure must contain details of the person's interests

and short positions in, and rights to subscribe for, any relevant

securities of each of (i) the offeree company and (ii) any

securities exchange offeror(s). An Opening Position Disclosure by a

person to whom Rule 8.3(a) applies must be made by no later than

3.30 pm (London time) on the 10th business day following the

commencement of the offer period and, if appropriate, by no later

than 3.30 pm (London time) on the 10th business day following the

announcement in which any securities exchange offeror is first

identified. Relevant persons who deal in the relevant securities of

the offeree company or of a securities exchange offeror prior to

the deadline for making an Opening Position Disclosure must instead

make a Dealing Disclosure.

Under Rule 8.3(b) of the Code, any person who is, or becomes,

interested in 1% or more of any class of relevant securities of the

offeree company or of any securities exchange offeror must make a

Dealing Disclosure if the person deals in any relevant securities

of the offeree company or of any securities exchange offeror. A

Dealing Disclosure must contain details of the dealing concerned

and of the person's interests and short positions in, and rights to

subscribe for, any relevant securities of each of (i) the offeree

company and (ii) any securities exchange offeror(s), save to the

extent that these details have previously been disclosed under Rule

8. A Dealing Disclosure by a person to whom Rule 8.3(b) applies

must be made by no later than 3.30 pm (London time) on the business

day following the date of the relevant dealing.

If two or more persons act together pursuant to an agreement or

understanding, whether formal or informal, to acquire or control an

interest in relevant securities of an offeree company or a

securities exchange offeror, they will be deemed to be a single

person for the purpose of Rule 8.3.

Opening Position Disclosures must also be made by the offeree

company and by any offeror and Dealing Disclosures must also be

made by the offeree company, by any offeror and by any persons

acting in concert with any of them (see Rules 8.1, 8.2 and

8.4).

Details of the offeree and offeror companies in respect of whose

relevant securities Opening Position Disclosures and Dealing

Disclosures must be made can be found in the Disclosure Table on

the Takeover Panel's website at www.thetakeoverpanel.org.uk,

including details of the number of relevant securities in issue,

when the offer period commenced and when any offeror was first

identified. You should contact the Panel's Market Surveillance Unit

on +44 (0)20 7638 0129 if you are in any doubt as to whether you

are required to make an Opening Position Disclosure or a Dealing

Disclosure.

Publication on website

A copy of this announcement will, subject to certain

restrictions relating to persons resident in restricted

jurisdictions, be available on the Company's website at

www.localshoppingreit.co.uk by no later than 12 noon on the

Business Day following the date of this announcement. For the

avoidance of doubt, the content of the website referred to above is

not incorporated into and does not form part of this

announcement.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

IR QKLFFKQFBBBF

(END) Dow Jones Newswires

June 20, 2019 02:00 ET (06:00 GMT)

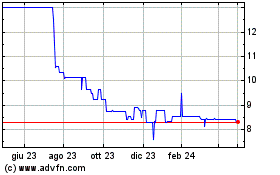

Grafico Azioni Alina (LSE:ALNA)

Storico

Da Mar 2024 a Apr 2024

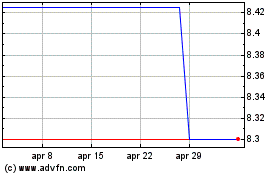

Grafico Azioni Alina (LSE:ALNA)

Storico

Da Apr 2023 a Apr 2024