TIDMLFI

LONDON FINANCE & INVESTMENT GROUP PLC

Final Results

18 September 2020

LONDON FINANCE & INVESTMENT GROUP PLC

("Lonfin", "the Company" or "the Group")

Unaudited Preliminary Results for the year ended 30th June 2020

Dividend Declaration

London Finance & Investment Group PLC. (LSE: LFI, JSE: LNF), the investment

company whose assets primarily consist of Strategic Investments and a General

Portfolio, today announces its unaudited Preliminary Results for the year ended

30th June 2019 and the Board's Dividend Declaration.

Strategy, Business Model and Investment Policy

Lonfin is an investment company whose objective is to generate growth in

shareholder value in real terms over the medium to long term whilst maintaining

a progressive dividend policy.

The Group's investment policy is to invest in a range of 'Strategic', 'General

Portfolio' and from time to time 'Other Investments'. General Portfolio

Investments comprise liquid stock market investments, both in equity

instruments and bonds, and, at the Board's discretion, 'Other Investments' are

typically property and other physical assets. Strategic Investments are

significant investments in smaller UK quoted companies. These are balanced by

the General Portfolio, which consists of a broad range of investments in major

USA, UK and other European companies which provides a diversified exposure to

international equity markets.

Further information on the Group's Investment Policy can be found in the

Directors' Report on page 44.

The Group's net assets per share for 2020 have decreased from the previous year

to 50.6p and 17.6% over the last five years. Shareholders' dividends for 2020

remains the same at 1.15p and increased by 15% over the last five years.

Information on the Group's performance against the Board's key performance

indicators (KPIs) is set out on page 9 of this report.

Results

* Net assets have reduced to 50.6p per share (2019 restated - 58.5p per

share)

* Strategic Investments have decreased in value over the year, from GBP

7,596,000 to GBP6,291,000

* Strategic investments are yielding 2.6% (2019 - 3.6%)

* The General Portfolio has decreased, adjusting for investment purchases

and sales, over the year, by 13% from GBP11,383,000 to GBP9,948,000

* Fair value movement is GBP1,265,000

* No significant increase in Group operating costs

* A final dividend of 0.60p per share is recommended, making a total of 1.15p

per share for the year (2019 - 1.15p)

The Company and its subsidiaries ("Group") recorded an operating profit for the

year, before interest, tax and changes to the fair value adjustments of

investments of GBP130,000, compared to an restated operating profit for the

previous year, before tax and changes to the fair value adjustments of

investments, of GBP366,000. The significant decrease in fair value of strategic

investments that occurred during the year has led to Total Comprehensive Loss

for the year of GBP2,112,000 compared to restated loss of GBP1,767,000 for the

previous year. Basic and headline losses per share are 2.6p (2019- earnings of

2.9p).

Strategic Investments

Strategic Investments have reduced in value by GBP1,305,000 due to the market

movements in the share prices.

Western Selection PLC ("Western")

The Group holds 7,860,515 ordinary shares, being 43.8%, of the issued share

capital of Western.

On 18th September 2020, Western announced unaudited preliminary results showing

a loss after tax of GBP180,000 for the year to 30th June 2020 (2019 loss - GBP

2,611,000). Losses per share are 1.0p (2019 - 14.5p).

Western's Board has not recommend payment of an interim or a final dividend for

the year, compared to the payment of an interim dividend of 1.1p for 2019.

Western's net assets at market value at 30th June 2020 were GBP8,127,000

equivalent to 45p per share, a decrease of 29.7% from 64p last year.

Our share of the net assets of Western, including the value of Western's

investments at market value, was GBP3,560,000 (2019 - GBP5,005,000). The fair value

for Western recorded in the Statement of Financial Position is the market value

of GBP2,751,000 (2019 - GBP3,576,000). This represents 17.3% (2019 - 19.3%) of the

net assets of the Group.

Western's objective is to generate growth in value for shareholders over the

medium to long term and pay a progressive dividend. Western's business model is

to take sizeable minority stakes in relatively small companies usually before

or as their shares are admitted to trading on one of the UK's stock exchanges

and have directors in common through which they can provide advice and support

for these growing companies. These may or may not become associated companies.

The aim is that these companies ("Core Holdings") will grow to a stage at which

Western's support is no longer required and its stake can be sold over time

into the relevant stock market. Companies that are targeted as Core Holdings

will have an experienced management team, a credible business model and good

prospects for growth.

Western is a strategic investment which is technically a subsidiary of the

Company that has not been consolidated due to the application of the investment

entity exemption under IFRS 10.

David Marshall is the Chairman of Western and Edward Beale is non-executive

director.

Western's main Core Holdings are Northbridge Industrial Services plc, Brand

Architekts Group plc and Bilby Plc.

An extract from Western's announcement on 18th September 2020 relating to its

main Core Holdings is set out below:

Core Holdings

Northbridge Industrial Services plc ("Northbridge")

Northbridge hires and sells specialist industrial equipment to a non-cyclical

customer base. With offices or agents in the UK, USA, Dubai, Germany, Belgium,

France, Australia, New Zealand, China and Singapore, Northbridge has a global

customer base. This includes utility companies, the oil and gas sector,

shipping, construction and the public sector. The product range includes

loadbanks, transformers and oil tools. Further information about Northbridge is

available on their website: www.northbridgegroup.co.uk

Northbridge, which is admitted to trading on AIM, announced its results for the

year ended 31 December 2019 on 7 April 2020 and recorded a loss after tax of GBP

236,000 for the year (2018- loss after tax GBP2,409,000). No dividend was

recommended by Northbridge and no dividends were received by Western from

Northbridge during the year (2019 - GBPNil).

Western holds 3,300,000 Northbridge shares which represents 11.8% of

Northbridge's issued share capital. The market value of this investment at 30

June 2020 was GBP2,739,000 (2019 - GBP4,900,500) which represents approximately

33.7% (2019 - 42 %) of Western's net assets.

Brand Architekts Group plc ("BAG")

BAG, which is admitted to trading on AIM, is a beauty brands business

specialising in the delivery a growing portfolio of innovative and exciting new

products, spanning areas such as haircare, skincare and body care, to consumers

and retailers. Further information about BAG is available on its website:

https://www.brandarchitekts.com/

BAG announced its interim results for the 28 week period ended 11 January 2020

on 10 March 2020 and reported profit after tax of GBP6,600,000 (2019 final

results for the 52 week period - GBP3,640,000). This figure was heavily impacted

by the profit of GBP8.8m on disposal of its manufacturing business, offset by a

loss on discontinued operations of GBP2.5m.

Western holds 1,300,000 BAG shares which represents 7.6% of BAG's issued share

capital. The market value has decreased to GBP1,625,000 (2019 - GBP2,502,000),

which represents approximately 20% (2019 - 21.4%) of Western's net assets.

Edward Beale is a non-executive director of BAG.

Bilby Plc ("Bilby")

Bilby is an established, and award winning, provider of gas installation,

maintenance and general building services to local authority and housing

associations across London and South East England. They have a strategy of

growing organically and by acquisition. Further information about Bilby is

available on their website: www.bilbyplc.com.

Bilby, which is admitted to trading on AIM, announced its results for the year

ended 31 March 2020 on 27 July 2020 showing a profit after tax of GBP1,379,000

compared to a loss after tax of GBP8,596,000 for the previous year ended 31 March

2019. No interim dividends were paid during the year and Bilby's Board did not

recommend a final dividend (2019 - GBP67,500).

Western holds 6,336,363 Bilby shares which represents 10.79% of Bilby's issued

share capital. Following the additional GBP400,000 acquisitions during the year,

the market value of this investment on 30 June 2020 has increased to GBP1,235,590

(2019- GBP877,000),which represents approximately 15.2% (2019 - 7.5%) of

Western's net assets.

Associated Companies

Tudor Rose International Limited ("Tudor Rose International")

As announced in our final results on 30 September 2019, this investment had

been fully provided against. With effect from 8 April 2020 the Company sold its

entire shareholding of 441,090 A Ordinary shares and 175,000,000 Preference

shares in Tudor Rose International for GBP3 plus contingent deferred

consideration and an option to repurchase the shares at the same value. The

option to repurchase the shares may be exercised on any date between 1 April

2022 and 31 March 2023. No deferred consideration is expected, and the Board

does not expect to exercise the option to repurchase the shares.

Edward Beale and David Marshall resigned as directors of the Company with

effect from 11 March 2020.

Finsbury Food Group plc ("Finsbury")

Finsbury is one of the largest producers and suppliers of premium cakes, bread

and morning goods in the UK and currently supplies most of the UK's major

supermarket chains. Further information about Finsbury, which is admitted to

trading on AIM, is available on its website: www.finsburyfoods.co.uk

At 30th June 2020, Lonfin held 6,000,000 Finsbury shares, representing 4.6% of

Finsbury's issued share capital. The market value of the holding was GBP3,540,000

as at 30th June 2020 (cost - GBP1,724,000) and represents approximately 22% (2019

- 22%) of Lonfin's net assets.

As at the date of publication, Finsbury has not announced their final results

for the year ended 30th June 2020 to be able to present in these financial

statements.

Edward Beale was a non-executive director of Finsbury up until 23rd November

2016.

General Portfolio

The investments comprising the General Portfolio at 30th June 2020 are below:

Composition of General Portfolio

At 30th June 2020

GBP000 %

L'Oreal 548 5.5

Nestle 540 5.4

LVMH Moet Hennessey 533 5.4

Investor AB SEK6.25 'B' 445 4.5

Pernod Ricard 440 4.4

Unilever 439 4.4

Procter & Gamble Co 434 4.4

Schindler-Holdings AG CHF1.00 REGD (Post Subd) 410 4.1

Heineken Holding 403 4.1

Brown Forman (B) 396 4.0

Antofagasta 375 3.8

Reckitt Benckiser Group 364 3.7

Givaudan 362 3.6

Diageo 342 3.4

Danone 336 3.4

British American Tobacco 304 3.1

Henkel Preferred 311 3.1

Phillip Morris International Inc 289 2.9

3M Co 276 2.8

Becton Dickinson & Co 265 2.7

Exxon Mobil Corp 233 2.3

Deutsche Post 222 2.2

Royal Dutch Shell B 220 2.2

Compagnie Financiere Richemont SA 211 2.1

HSBC Holding 208 2.1

Anheuser Busch Inbev SA 191 1.9

BASF 190 1.9

AP Moeller-Maersk A/S 179 1.8

Otis Worldwide Corp 175 1.8

Raytheon (previously United Technologies Corp) 170 1.7

Imperial Brands 137 1.3

9,948 100

Analysis by currency GBP000 %

Euro 3,173 31.9

Sterling 2,390 24.0

US Dollar 2,238 22.5

Swiss Franc 1,523 15.3

Swedish Kronas 445 4.5

Danish Kronas 179 1.8

9,948 100

The portfolio is diverse with material interests in Food and Beverages, Natural

Resources, Chemicals and Tobacco. We believe that the portfolio of quality

companies we hold has the potential to outperform the market in the medium to

long term.

At 30th June 2020, the number of holdings in the General Portfolio was 31 (2019

- 30). We have decreased the amount invested in the General Portfolio over the

year by GBP170,000 (2019 - decreased by GBP49,000).

The opening value of our General Portfolio investments at 30th June 2019 was GBP

11,383,000 which compared with a cost of such investments at the same date of GBP

6,208,000. After investment purchases

during the year of GBP163,000 and investment sales (including selling expenses)

during the same period of GBP966,000, the value of the General Portfolio

investments as at 30th June 2020 had decreased by 13% to GBP9,948,000. Further

details of our General Portfolio investments are set out on page 12.

Board Changes

Whilst the Board is satisfied that it has a sufficient spread of skills,

experience and support within the Board to operate the Company and to develop

the Company's investment business, the Board will continue to seek further

suitable Board candidates who can add value to the Board.

Operations, Directors and Employees

All of our operations and those of Western, with the exception of investment

selection, are outsourced to our subsidiary, City Group PLC ("City Group").

City Group also provides office accommodation, company secretarial, finance and

head office services to a number of other companies. City Group is responsible

for the initial identification and appraisal of potential new strategic

investments for the Company and the day to day monitoring of existing strategic

investments and employs 6 people.

Dividend

The Board recommends a final dividend of 0.60p (ZAR 12.61848 cents) per share,

making a total of 1.15p (ZAR 24.18542 cents) per ordinary share for the year

(2019 - 1.15p). Subject to shareholders' approval at the Company's AGM to be

held on Wednesday, 25th November 2020, the dividend will be paid on Wednesday,

2nd December 2020 to those shareholders on the register at the close of

business on Friday, 20th November 2020. Shareholders on the South African

register will receive their dividend in South African rand converted from

sterling at the closing rate of exchange on Thursday, 17th September 2020 being

GBP1= ZAR 21.0308

JSE Disclosure Requirements

In respect of the normal gross cash dividend, and in terms of the South African

Tax Act, the following dividend tax ruling only applies to those shareholders

who are registered on the South African register on Friday, 20th November

2020.

* The number of shares in issue as at the dividend declaration date is

31,207,479;

* The dividend has been declared from income reserves. Funds are sourced from

the Company's main bank account in London and is regarded as a foreign

dividend by South African shareholders; and

* The Company's UK Income Tax reference number is 948/L32120.

Dividend dates:

Last date to trade (SA) Tuesday, 17th November 2020

Shares trade ex-dividend Wednesday, 18th November 2020

(SA)

Shares trade ex-dividend Thursday, 19th November 2020

(UK)

Record date (UK and SA) Friday, 20th November 2020

Pay date Wednesday, 2nd December 2020

The JSE Listings Requirements require disclosure of additional information in

relation to any dividend payments.

Shareholders registered on the South African register are advised that a

dividend withholding tax will be withheld from the gross final dividend amount

of ZAR 12.61848 cents per share at a rate of 20% unless a shareholder

qualifies for an exemption; shareholders registered on the South African

register who do not qualify for an exemption will therefore receive a net

dividend of ZAR 10.094784 cents per share. The dividend withholding tax and

the information contained in this paragraph is only of direct application to

shareholders registered on the South African register, who should direct any

questions about the application of the dividend withholding tax to

Computershare Investor Services (Pty) Limited, Tel: +27 11 370 5000.

Share certificates may not be de-materialised or re-materialised between

Wednesday, 18th November 2020 and Friday, 20th November 2020, both days

inclusive. Shares may not be transferred between the registers in London and

South Africa during this period either.

Outlook

The continued political and economic uncertainty in Europe, where a Brexit

trade deal has yet to be delivered, and globally, with Covid-19 and the

negative impact from tariff issues, will clearly impact on world economies and

we can expect further volatility and turbulence in the markets ahead. Whilst

the last 12 months have been challenging for the Group's investments,

particularly its Strategic Investments, and we can expect further challenges

ahead, the Board is confident that the Group has a solid base of investments

which can lead to further capital growth in the medium to long term.

Future Developments

The Group's development and its financial performance are dependent on the

success of its Investment Strategy and the continued support of its

Shareholders. Against a background of challenging and uncertain times in the

markets particularly due to Covid-19, the Board continues to seek out

investments which will generate growth in shareholder value. The Board also

continues to monitor and enhance the quality of investments in the General

Portfolio. A resolution was put to Shareholders at last year's AGM to amend the

Company's Investment Policy so that up to 40 investments may be held in the

Company's General Portfolio at any time. The resolution was approved. Aside

from this change, the Board continues to pursue its current Investment Policy

and has no plans to make any further changes to the policy in the near future.

As at 30th June 2020, the Company held 31 investments in the General Portfolio.

18 September 2020

The Company's 2020 Annual Report and Accounts will be finalised shortly and

sent to shareholders.

This announcement contains inside information for the purposes of Article 7 of

EU Regulation 596/2014.

The directors of the Company accept responsibility for the contents of this

announcement.

For further information, please contact:

London Finance & Investment Group PLC: 020 7796 9060

David Marshall/Edward Beale)

Johannesburg Sponsor:

Sasfin Capital (a member of the Sasfin Group)

Consolidated Statement of Total Comprehensive Income

For the year ended 30th June

Restated for

IFRS 16

Operating Income Notes 2020 2019 2019

GBP000 GBP000 GBP000

Dividends receivable 425 687 687

Rental and other income 150 130 130

Profits on sales of investments 68 15 15

Management service fees 284 260 260

927 1,092 1,092

Administrative expenses

Investment operations 4a (417) (398) (398)

Management services 4a (380) (328) (334)

Total administrative expenses (797) (726) (732)

Operating profit 3 130 366 360

Unrealised changes in the carrying value of

General Portfolio investments 13 (700) 748 748

Exceptional costs 4b - (67) (67)

Interest payable (62) (57) (34)

Profit before taxation (632) 990 1,007

Tax income/(expense) 7 (164) (95) (95)

Profit after taxation (796) 895 912

Non-controlling interest (11) 13 5

Profit attributable to shareholders (807) 908 917

Other comprehensive income/(expense)

Items that will not be reclassified to

profit or loss

Unrealised changes in the carrying value of

Strategic investments (1,305) (3,054) (3,054)

Other taxation -

Deferred tax 7 - 379 379

Total Other Comprehensive (Loss)/Income

attributable to shareholders (1,305) (2,675) (2,675)

Total Comprehensive (Loss)/Income

attributable to owners of the parent (2,112) (1,767) (1,758)

Reconciliation of headline earnings

Basic and diluted earnings per share 9 (2.6)p 2.9p 2.9p

Adjustment for the unrealised changes in the

carrying value of investments, net of tax - - (2.3)p

Headline earnings per share 9 (2.6)p 2.9p 0.6p

Consolidated Statement of Financial Position

At 30th June

Restated

for IFRS 16

2020 2019 2019

Notes GBP000 GBP000 GBP000

Non-current Assets

Property, Plant and Equipment 10 31 39 39

Right of use asset 11 512 568 -

Investments 13 6,291 7,596 7,596

6,834 8,203 7,635

Current Assets

Listed investments 13 9,948 11,383 11,383

Trade and other receivables 14 166 194 194

Cash and cash equivalents 269 240 240

10,383 11,817 11,817

Current Liabilities

Trade and other payables 15 (225) (232) (279)

Lease liabilities 11 (52) (49) -

Borrowings 16 - (400) (400)

(277) (681) (679)

Net Current Assets 10,106 11,136 11,138

Non-current Liabilites

Lease liabilities 11 (519) (583) -

Deferred Taxation 17 (520) (395) (395)

(1,039) (978) (395)

Total Assets less Total Liabilities 15,901 18,361 18,378

Capital and Reserves

Ordinary share capital 18 1,560 1,560 1,560

Share premium account 2,320 2,320 2,320

Unrealised profits and losses on 1,708 6,085 6,085

investments

Share of retained realised profits and 4,712 4,565 4,574

losses of subsidiaries

Company's retained realised profits 5,498 3,739 3,739

and losses

Capital and reserves attributable to 15,798 18,269 18,278

owners

Non-controlling interests 103 92 100

Total Capital and Reserves 15,901 18,361 18,378

Company Statement of Financial Position

At 30th June

2020 2019

Notes GBP000 GBP000

Non-current Assets

Investments in Group companies 12 2,074 528

Current Assets

Listed investments 13 9,948 11,383

Trade and other receivables 14 16 23

Cash and cash equivalents 91 101

10,055 11,507

Current Liabilities

Trade and other payables 15 (132) (131)

Borrowings 16 - (400)

(132) (531)

Net Current Assets 9,923 10,976

Deferred Taxation 17 (520) (395)

Total Assets less Total Liabilities 11,477 11,109

Capital and Reserves

Ordinary share capital 18 1,560 1,560

Share premium account 18 2,320 2,320

Unrealised profits and losses on investments 18 2,099 3,490

5,979 7,370

Realised Profit and Loss

Balance at 1st July 3,739 4,253

Net Profit/(Loss)/ for the period 2,118 (154)

Dividends paid (359) (360)

Balance at 30th June 5,498 3,739

Equity shareholders' funds 11,477 11,109

Under Section 408 of the Companies Act 2006, the Parent Company is exempt from

the requirement to present its own income statement.

Consolidated Statement of Cash Flows

For the year ended 30th June

Restated

for IFRS 16

Notes 2020 2019 2019

GBP000 GBP000 GBP000

Cash flows from operating activities

(Loss)/Profit before tax (632) 990 1,007

Adjustments for non-cash -

Finance expense 62 57 34

Depreciation charges 10 13 13

Depreciation on right of use asset 62 46 -

Unrealised changes in the fair value 13 1,265 (756) (756)

of investments

Realised gain on disposal of 13 (633) (7) (7)

investments

Decrease in trade and other 10 58 58

receivables

Decrease in trade and other payables (7) (112) (83)

Taxes paid 7 (39) (44) (44)

Net cash inflow from operating 98 245 222

activities

Cash flows from investment activity

Acquisition of property, plant and (2) (39) (39)

equipment

Acquisition of current investments (163) (611) (611)

Proceeds from disposal of current 13 966 667 667

investments

Net cash inflow from investment 801 17 17

activity

Cash flows from financing

Interest paid (31) (18) (18)

Interest paid on lease liabilities (31) (23) -

Repayment of lease liabilities (49) - -

Equity dividends paid (359) (360) (360)

Net (repayment)/drawdown of loan 16 (400) 75 75

facilities

Net cash outflow from financing (870) (326) (303)

Increase/(Decrease) in cash and cash 20 29 (64) (64)

equivalents

Cash and cash equivalents at the 240 304 304

beginning of the year

Cash and cash equivalents at end of 269 240 240

the year

Company Statement of Cash Flows

For the year ended 30th June

Notes 2020 2019

GBP000 GBP000

Cash flows from operating activities

Profit before tax 891 644

Adjustments for non-cash and non-operating

activities -

Finance expense 31 35

Release of Impairment provision 12 (1,681) -

Unrealised changes in the fair value of 13 1,266 (756)

investments

Realised gain on disposal of investments 13 (633) (7)

Decrease in trade and other receivables 7 13

Decrease in trade and other payables (16) (11)

Overseas Taxes paid 7 (39) (43)

Net cash outflow from operating activities (174) (125)

Cash flows from investment activity

Acquisition of investments (163) (611)

Proceeds from disposal of investments 966 667

Net cash inflow from investment activity 803 56

Cash flows from financing

Interest paid (15) (18)

Equity dividends paid (359) (360)

Decrease in loan to subsidiary 12 135 374

Net (repayment)/drawdown of loan facilities 16 (400) 75

Net cash (outflow)/inflow from financing (639) 71

(Decrease)/Increase in cash and cash (10) 2

equivalents

Cash and cash equivalents at the beginning of 101 99

the year

Cash and cash equivalents at end of the year 91 101

Consolidated Statement of Changes in Shareholders' Equity

Ordinary Share Premium Unrealised profits Share of Retained Company's Total Non-Controlling Total

Share Capital Account and losses on realised profits retained realised Interests Equity

Investments and losses of profits and

Subsidiaries losses

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

Year ended 30th

June 2020

Balances at 1st

July 2019 1,560 2,320 6,085 4,565 3,739 18,269 92

18,361

(Loss)/profit for - - (1,391) 147 437 (807) 11 (796)

the Year

Other Comprehensive - - (1,305) - - (1,305) - (1,305)

Income

Total comprehensive

income - - (2,696) 147 11

437 (2,112) 2,101)

Impairment - - (1,681) - 1,681 - - -

provision released

Dividends paid and - - - - (359) (359) - (359)

total transactions

with shareholders

Balnaces at 30th

June 2020 1,560 2,320 4,712 5,498) 103

1,708 15,798 15,901

Year ended 30th June

2019 (Restated for

IFRS 16)

Balances at 1st July

2018 20,501

1,560 2,320 8,056 4,207 4,253 20,396 105

Profit/(loss) for the - - 704 367 (154) 917 (5) 912

Year

IFRS 16 Adjustment - - - (9) - (9) (8) (17)

Other Comprehensive - - (2,675) - - (2,675) - (2,675)

Income

Total comprehensive

income - -

(1,971) 358 (154) (1,767) (13) (1,756)

Dividends paid and - - - - (360) (360) - (360)

total transactions

with shareholders

Balances at 30th June

2019

1,560 2,320 6,085 4,565 3,739 18,269 92 18,361

Company Statement of Changes in Shareholders' Equity

Ordinary Share Premium Unrealised Realised Equity

Share Capital Account profits and profits and Total

losses on losses

Investments

GBP000 GBP000 GBP000 GBP000 GBP000

Year ended 30th June 2020

Balances at 1st July 2019 1,560 2,320 3,490 3,739 11,109

(Loss)/profit for the Year and - - (1,391) 2,118 727

total comprehensive income

Dividends paid and total - - - (359) (359)

transactions with shareholders

Balances at 30th June 2020

1,560 2,320 2,099 5,498 11,477

Year ended 30th June 2019

Balances at 1st July 2018 1,560 2,320 2,786 4,253 10,919

Profit/(loss) for the Year and - - 704 (154) 550

total comprehensive income

Dividends paid and total - - - (360) (360)

transactions with shareholders

Balances at 30th June 2019

1,560 2,320 3,490 3,739 11,109

Notes:

1. Basic earnings per share and Headline earnings per share

Basic (loss)/earnings per share, based on the loss attributable to the

shareholders after tax and non-controlling interests of GBP807,000 (2019 -

restated profit GBP908,000) and on 31,207,479 shares issued

Headline earnings are required to be disclosed by the JSE.

Headline (loss)/earnings per share are based on the loss attributable to the

shareholders after tax and non-controlling interests, before unrealised changes

in the fair value of investments net of tax, of GBP807,000 (2019 - restated

profit GBP908,000) and on 31,207,479 shares issued plus 80,000 share options

granted in 2016.

1. Net assets per share

The net assets per share are calculated taking investments at fair value and on

31,207,479 shares (2019- 31,207,479) being the weighted average of the number

of shares in issue during the year.

1. Financial information

The financial information in this preliminary announcement does not

constitute the Company's statutory accounts for the year ended 30th June

2020 within the meaning of Section 435 of the Companies Act 2006.

The accounts have been prepared in accordance with International Financial

Reporting Standards (IFRS) as adopted by the European Union and with those

parts of the Companies Act 2006 applicable to companies reporting under

IFRS. The accounts are prepared on the historical cost bases, except for

certain assets and liabilities which are measured at fair value, in

accordance with IFRS. The audited accounts for the Group for the year ended

30th June 2019 were reported on with an unqualified audit report and did

not contain an emphasis of matter paragraph or any statement under section

498 of the Companies Act 2006 and have been delivered to the Registrar of

Companies.

2. Copies of this Announcement

Copies of this announcement are held at the Company's registered office, 1

Ely Place, London, EC1N 6RY (tel. 020 7796 9060) and are available for a

period of 14 days from the date of this announcement.

END

(END) Dow Jones Newswires

September 21, 2020 02:00 ET (06:00 GMT)

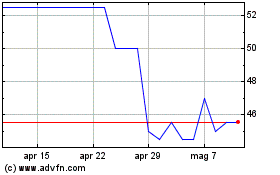

Grafico Azioni London Finance & Investm... (LSE:LFI)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni London Finance & Investm... (LSE:LFI)

Storico

Da Apr 2023 a Apr 2024