LondonMetric Property PLC 260,000 SQ FT OF URBAN LOGISTICS LETTINGS AGREED (3677E)

07 Luglio 2021 - 8:00AM

UK Regulatory

TIDMLMP

RNS Number : 3677E

LondonMetric Property PLC

07 July 2021

7 July 2021

LONDONMETRIC AGREES 260,000 SQ FT OF URBAN LOGISTICS

LETTINGS

IN BEDFORD AND NORTHAMPTON

LondonMetric Property Plc ("LondonMetric") announces that it has

exchanged contracts on two new lettings totalling c.260,000 sq ft,

each on 15 year lease terms, with 10 years to break.

At its Bedford Link development, LondonMetric has let 172,000 sq

ft to Carlton Packaging, one of the UK and Europe's leading

e-commerce packaging suppliers, at a rent of GBP1.33 million pa

(GBP7.70 psf), which is subject to five-yearly rent reviews at the

higher of CPI plus 1% or open market. The recently developed

warehouse is BREEAM Excellent and, under the terms of the letting,

250kW of solar PV will be installed. The letting crystallises a

yield on cost of 7.3%.

At Grange Park, Northampton, following a minor refurbishment,

LondonMetric has re-let 86,000 sq ft to My 1st Years, a supplier of

baby and children's gifts, at a rent of GBP0.65 million pa (GBP7.50

psf), representing a 29% uplift versus the previous passing rent.

The rent is subject to five-yearly reviews of CPI plus 1%.

Mark Stirling, Asset Director of LondonMetric, commented:

"These are excellent lettings at what are record rents for the

respective schemes and which demonstrate the continued strength of

occupier demand for quality warehouse space. They also reduce

warehouse vacancy across the LondonMetric portfolio to less than

1%.

"We continue to make good progress with pre-letting the final

warehouse at Bedford Link, which totals 360,000 sq ft and is due to

complete at the end of this year."

For further information, please contact:

LondonMetric Property Plc

Andrew Jones / Mark Stirling / Martin McGann

Tel: +44 (0) 20 7484 9000

FTI Consulting

Dido Laurimore / Richard Gotla / Andrew Davis

Tel: +44 (0)20 3727 1000

About LondonMetric Property Plc

LondonMetric is a FTSE 250 REIT that owns one of the UK's

leading listed logistics platforms alongside a diversified long

income portfolio, with 15 million sq ft under management. It owns

and manages desirable real estate that meets occupiers' demands,

delivers reliable, repetitive and growing income-led returns and

outperforms over the long term.

Further information is available at www.londonmetric.com

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCRFMFTMTAMBBB

(END) Dow Jones Newswires

July 07, 2021 02:00 ET (06:00 GMT)

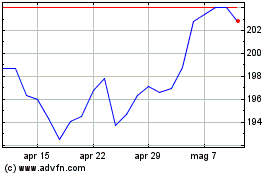

Grafico Azioni Londonmetric Property (LSE:LMP)

Storico

Da Mar 2024 a Apr 2024

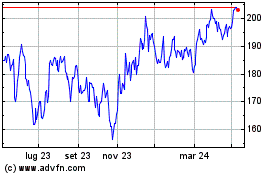

Grafico Azioni Londonmetric Property (LSE:LMP)

Storico

Da Apr 2023 a Apr 2024