LondonMetric Property PLC GBP11.6m of Long Income Acquisitions (7457O)

03 Giugno 2020 - 8:00AM

UK Regulatory

TIDMLMP

RNS Number : 7457O

LondonMetric Property PLC

03 June 2020

3 June 2020

LONDONMETRIC PROPERTY PLC

LONDONMETRIC ANNOUNCES GBP11.6 MILLION OF LONG INCOME

ACQUISITIONS AND THE COMPLETION OF A GBP13.3 MILLION DISPOSAL IN

ROTHERHAM

LondonMetric Property Plc ("LondonMetric") announces two long

income acquisitions for a total consideration of GBP11.6 million,

reflecting a blended net initial yield of 5.1%.

The first transaction comprises a sale and leaseback portfolio

of five roadside service centres in London for GBP9.6 million. The

assets are let to Kwik Fit and located in Barnet, Whetstone,

Hounslow, Hammersmith and Slough with each having strong underlying

residual value supported by alternative use, principally

residential.

LondonMetric has also purchased, via a forward funding contract,

a prominent new build roadside asset in Rushden for GBP2.0 million

let to Euro Garages. The property will consist of a convenience

store, petrol station and drive through Starbucks and cover a

two-acre site, where nearby industrial and high density residential

more than underpins the purchase price.

Together, these assets have a WAULT of 17 years and all benefit

from contractual rental uplifts.

Separately, LondonMetric has completed the GBP13.3 million

disposal of a regional distribution warehouse in Rotherham at a net

initial yield of 5.0%. The sale of the warehouse, let to the Royal

Mail for a further eight years, was announced in December 2019

subject to delayed completion.

Andrew Jones, Chief Executive of LondonMetric, commented:

"We continue to actively acquire long income properties in good

locations that offer attractive triple net income and certainty of

income growth. These assets are let on very long leases to strong

covenants with whom we have established relationships and,

following our recent equity fundraising, we are in legals on a

number of other opportunities with similarly attractive

characteristics."

Cushman & Wakefield acted for Kwik Fit on the sale and

leaseback portfolio.

For further information, please contact:

LondonMetric Property Plc

Andrew Jones / Martin McGann / Gareth Price

Tel: +44 (0) 20 7484 9000

FTI Consulting

Dido Laurimore / Richard Gotla

Tel: +44 (0) 20 3727 1000

About LondonMetric Property Plc

LondonMetric is a FTSE 250 REIT that owns one of the UK's

leading listed logistics platforms alongside a diversified long

income portfolio. It owns and manages desirable real estate that

meets occupiers' demands, delivers reliable, repetitive and growing

income-led returns and outperforms over the long term. LondonMetric

has 16 million sq ft under management. Further information is

available at www.londonmetric.com

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

ACQBCGDLRGGDGGD

(END) Dow Jones Newswires

June 03, 2020 02:00 ET (06:00 GMT)

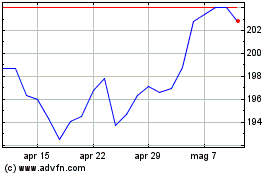

Grafico Azioni Londonmetric Property (LSE:LMP)

Storico

Da Mar 2024 a Apr 2024

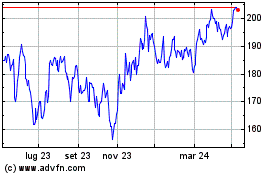

Grafico Azioni Londonmetric Property (LSE:LMP)

Storico

Da Apr 2023 a Apr 2024