TIDMLMP

RNS Number : 8011F

LondonMetric Property PLC

19 November 2020

LONDONMETRIC PROPERTY PLC

("LondonMetric" or the "Group" or the "Company")

HALF YEAR RESULTS FOR THE SIX MONTHSED 30 SEPTEMBER 2020

SECTOR AND ASSET CALLS UNDERPIN RESILIENT AND GROWING INCOME

DELIVERING STRONG PORTFOLIO OUTPERFORMANCE

LondonMetric today announces its half year results for the six

months ended 30 September 2020.

Six months to

30 September Six months to

Income Statement 2020 30 September 2019

------------------------------ ------------- ------------------

Net rental income (GBPm)(1,2) 61.3 54.9

IFRS net rental income

(GBPm) 59.6 52.3

EPRA Earnings (GBPm)

(2) 42.3 35.2

EPRA EPS (p) (2) 4.75 4.6

Dividend per share (p) 4.2 4.0

IFRS Reported Profit

/ (Loss) (GBPm) 85.1 (10.2)

30 September

Balance Sheet 2020 31 March 2020

------------------------------ ------------- ------------------

IFRS net assets (GBPm) 1,597.9 1,431.8

EPRA NTA per share (p)

(2,3) 175.5 170.3

IFRS NAV per share (p) 176.3 171.0

LTV (%)(1,2) 32.4 35.9

1. Including share of joint ventures, excluding non-controlling interest

2. Further details on alternative performance measures can be

found in the Financial Review and definitions can be found in the

Glossary

3. EPRA net tangible assets (NTA) is a new reporting measure

that replaces EPRA net asset value this year. Discussed further in

the Financial Review and note 7 to the financial statements

Continued focus on resilient and growing income increases

earnings and dividend

-- Net rental income up 12% to GBP61.3m(1) , on an IFRS basis net rental income increased 14%

-- EPRA earnings up 20% to GBP42.3m, +4% on a per share basis

-- Dividend progression of 5% to 4.2p, 113% covered, including Q2 dividend declared of 2.1p

-- Rent collection strong with less than 1% forgiven or

outstanding for the period. 98% of Q3 rents collected with 1%

deferred

Sector alignment and asset selection delivering strong portfolio

performance

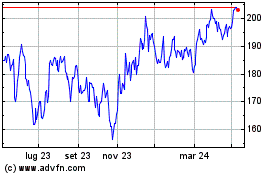

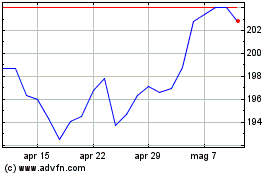

-- Total Property Return of 4.9%, outperforming IPD All Property by 650bps

-- Capital return of 2.3% (IPD All Property: -3.7%), regional

and urban logistics best performing sectors

-- EPRA NTA per share increased by 3% to 175.5p driven by 4.8p valuation gain

-- IFRS net assets increased 12% to GBP1,597.9m

-- Total Accounting Return of 5.6%

Distribution weighting of 68.2%, including urban logistics at

35.4%, with growth in grocery exposure to 10.9% from investment

activity

-- GBP98.5m of acquisitions let to strong credits with a WAULT

of 17.6 years and 88% of rent subject to contractual uplifts

-- GBP71.9m of disposals, largely shorter let urban logistics,

where the WAULT to first break was 7.2 years

-- Further GBP18m of assets sold post period end

75 asset management initiatives completed and strong progress on

developments

-- GBP2.8m pa income uplift and 2.9%(2) like for like income growth

-- Lettings signed with WAULT of 13.9 years and open market rent reviews +22%

-- 251,000 sq ft of developments completed and 657,000 sq ft

under construction as we proceed with 350,000 sq ft at Bedford and

120,000 sq ft at Tyseley, where we expect to start construction

shortly

Resilient GBP2.4bn portfolio focused on operationally light

assets with reliable, repetitive and growing income

characteristics

-- WAULT of 11.5 years and occupancy of 98.5%

-- Gross to net income ratio of 98.7% and contractual rental uplifts on 55.3% of income

-- Income diversification and granularity improved further with

top 10 occupiers accounting for 35.0% of rent

Balance sheet strengthened with further corporate

efficiencies

-- LTV of 32.4% with a GBP120m equity raise in the period

-- Continued balance sheet discipline with weighted average debt

maturity of 4.7 years and cost of debt at 2.5%

-- EPRA cost ratio reduced further to 13.7% (-60bps)

Andrew Jones, Chief Executive of LondonMetric, commented :

"We continue to live in truly unprecedented times which are

affecting many aspects of our lives. Whilst society and economies

will undoubtedly recover from the pandemic, Covid-19 has

accelerated a number of structural changes which are having a

profound and permanent impact on real estate. Market conditions are

exposing both winning and losing strategies which, combined with a

continuation of low for longer interest rates, is intensifying the

demand for the right real estate that can deliver a reliable,

repetitive and growing income.

"Our activity and performance during the period represents a

continuation and endorsement of our strategy to position ourselves

firmly on the right side of structural trends. Logistics and

grocery have been clear beneficiaries of the pandemic, as

businesses have sought to future proof their operations in response

to the seemingly unstoppable rise in e-commerce penetration and

respond to changes in the way we live and shop. With both near term

and longer-term drivers underpinning our portfolio, our long held

sector conviction calls continue to be reaffirmed and support our

strong outperformance.

"Whilst we remain vigilant to the impact of Covid-19, our focus

on owning the right assets in the winning sectors that can generate

a secure and growing dividend, positions us well for the future. We

will continue to assess and anticipate the wider macro changes in

helping to frame the shape of our future portfolio."

For further information, please contact:

LondonMetric Property Plc: +44 (0)20 7484 9000

Andrew Jones (Chief Executive)

Martin McGann (Finance Director)

Gareth Price (Investor Relations)

FTI Consulting:

+44 (0)20 3727 1000

Dido Laurimore Londonmetric@fticonsulting.com

Richard Gotla

Andrew Davis

Meeting and audio webcast

A live audio webcast and conference call will be held at 8.30am

today.

The conference call dial-in for the meeting is: +44 (0)330 336

9125 (Participant Passcode: 1236198).

For the live webcast see:

https://webcasting.brrmedia.co.uk/broadcast/5f69c52883507b593b46d0c8

An on demand recording will be available shortly after the

meeting from the same link and from:

http://www.londonmetric.com/investors/reports-and-presentations

Notes to editors

LondonMetric is a FTSE 250 REIT that owns one of the UK's

leading listed logistics platforms alongside a diversified long

income portfolio, with 16 million sq ft under management. It owns

and manages desirable real estate that meets occupiers' demands,

delivers reliable, repetitive and growing income-led returns and

outperforms over the long term. Further information is available at

www.londonmetric.com

Neither the content of LondonMetric's website nor any other

website accessible by hyperlinks from its website are incorporated

in, or form part of this announcement nor, unless previously

published by means of a recognised information service, should any

such content be relied upon in reaching a decision to acquire,

continue to hold, or dispose of shares in LondonMetric. This

announcement may contain certain forward-looking statements with

respect to LondonMetric's expectations and plans, strategy,

management objectives, future developments and performance, costs,

revenues and other trend information. These statements and

forecasts involve risk and uncertainty because they relate to

future events and circumstances. There are a number of factors

which could cause actual results or developments to differ

materially from those expressed or implied by these forward-looking

statements and forecasts. Certain statements have been made with

reference to forecast price changes, economic conditions and the

current regulatory environment. Any forward-looking statements made

by or on behalf of LondonMetric speak only as of the date they are

made. LondonMetric does not undertake to update forward-looking

statements to reflect any changes in LondonMetric's expectations

with regard thereto or any changes in events, conditions or

circumstances on which any such statement is based. Nothing in this

announcement should be construed as a profit forecast. Past share

price performance cannot be relied on as a guide to future

performance.

Alternative performance measures: The Group financial statements

are prepared in accordance with IFRS where the Group's interests in

joint ventures and non-controlling interests are shown as single

line items on the income statement and balance sheet. Management

reviews the performance of the business principally on a

proportionately consolidated basis, which includes the Group's

share of joint ventures and excludes non-controlling interests on a

line by line basis. Alternative performance measures are financial

measures which are not specified under IFRS but are used by

management as they highlight the underlying performance of the

Group's property rental business and are based on the EPRA Best

Practice Recommendations (BPR) reporting framework which is widely

recognised and used by public real estate companies.

CEO Overview

Today's backdrop continues to be shaped by the acceleration of

many macro trends as we adapt to the disruption brought about by

Covid-19.

The acceleration of structural trends brought about by the

pandemic is both profound and permanent, creating a new economic

reality and investment environment. These structural forces,

together with a further intensification in the search for income,

is having a fundamental impact on real estate with an increasing

polarisation of sub sector performances as market turbulence

exposes both winning and losing strategies.

Logistics, healthcare and the grocery sectors continue to be the

standout performers and are enjoying an ever-wider margin of

victory. Conversely, legacy retail sub-sectors are facing an

acceleration of secular declines as shopping centres and shopping

parks experience rapid downward repricing, more than even the most

bearish experts predicted. Like in many other areas of the economy,

trends that were expected to take years, are now occurring in

months, and in some cases weeks.

We are also seeing disruption in some of the traditionally more

stable real estate sub-sectors as falling occupational demand

exposes the rational pricing of offices, leisure, hospitality and

student accommodation. These sectors are looking less resilient

today than they did at the start of the year and their weakness

will strengthen investor desire for exposure to structurally

supported sectors.

Whilst we are conscious of short term issues, our overriding

concern is the medium and long term drivers of returns. The

composition of our GBP2.4 billion portfolio continues to be

influenced by the trends that originate outside real estate but

that are fundamentally shaping its future. This approach has seen

us align 95% of our assets into the structurally supported sectors

of logistics and long income, as well as tilt our exposure towards

urban logistics and grocery-led convenience. In addition, we

continue to upscale our asset base into the highest quality

opportunities that offer reliable, repetitive and growing income

whilst providing strong intrinsic values and capital

protection.

We continue to pride ourselves on our process, discipline and

rationality. During the period, we deployed c.GBP100 million across

the logistics, grocery and roadside sectors. Whilst we could have

done much more, our rigorous approach tempered our activity as we

look to buy the best assets at the right price and hold them for a

long time. Indeed, our long term approach to capital allocation saw

us dispose of GBP61 million of shorter let and poorer located

logistics assets. The vast majority of these receipts are not due

until next year which allows us time to reinvest. We are always

open to selling assets when prices become full, even when there is

nothing immediate to buy as a replacement.

Operationally, we have performed well over the half year with

high levels of rent collection and strong like for like rental

growth delivered through lettings, rent reviews and numerous

regearing initiatives with the WAULT on leases signed of 14

years.

Our total property return of 4.9% significantly outperformed IPD

All Property by 650 bps, EPRA earnings per share increased by 3.9%

and EPRA net tangible assets per share rose by 3.1%. This

performance gives us the confidence to increase our dividend per

share for the period by 5.0%, which is 113% covered by

earnings.

Looking forward, we believe that the portfolio is well placed to

deliver on our sustainable and progressive dividend policy.

Technological and behavioural changes are fundamentally altering

the way we live, work and shop

The world continues to evolve and digitise at an increasingly

rapid rate, with Covid-19 accelerating shifts in how society

interacts and how the economy operates. These structural changes

are fundamentally affecting how we live, work and shop. Trends that

were expected to have taken years to play out are now occurring

within a matter of months.

Previously high barriers of entry to online retail were toppled

in a matter of weeks and consumers quickly realised the

convenience, safety and security of online shopping. It took 23

years for online grocery penetration to reach 7% of total food

shopping. However, since March, we have seen it double to over 13%

as 6.5 million new shoppers ordered their groceries online for the

first time. General merchandise penetration has also increased

dramatically since the first lockdown with average penetration

rates rising from 24% to over 40%, which helped to increase overall

online sales to 28% of all retail in September. We have seen these

shifts act as a catalyst for many retailers to better integrate

online and physical offerings, as store picked fulfilment

intensified to meet the surge in online orders.

Whilst the latest lockdown is likely to have caused less

disruption to the consumer than the first back in March, it is only

serving to reinforce the changes that we have seen in consumer

behaviour and further alter the corporate landscape. What we can be

certain about is that the tectonic plates are not reverting to

where they were.

The search for income continues to intensify and real estate is

attracting greater investor attention

We continue to believe that income will be the defining

characteristic of this decade's investing environment and that

income-led total return strategies will continue to outperform.

Whilst Covid-19 may have dramatically altered the interest rate

curve, the one element that it has not changed is the demographic

tsunami of an ageing population requiring an income return. The

global lockdown and imminent recession have not only lowered

interest rates further but also ensured that they will inevitably

stay lower for longer as governments and central banks are unlikely

to take their foot off the quantitative easing accelerator to

provide liquidity to a fragile global economy.

Today, 80% of global fixed income securities are yielding less

than 2% and corporate dividends have been cut significantly. This

is intensifying the demand for alternative assets that can deliver

a reliable, repetitive and growing income. We believe that, in an

economy of zero interest rates, investors can't afford not to buy

more alternative asset classes such as real estate and

infrastructure.

The right real estate can offer a fantastic arbitrage over

benchmark rates along with inflation protection. This is driving up

demand for 'in vogue' real estate assets as investors look for

safety; as opposed to the allure of higher yielding but less secure

income propositions. In this environment, smart real estate

investing will focus on the structurally supported asset classes,

the strength of the credits as well the reliability, granularity,

sustainability and trajectory of the rental income.

Logistics continues to experience strong tailwinds and benefit

from a weight of money

Investors are frantically trying to increase their allocation

towards logistics as they look to exit legacy assets and take

advantage of the sector's strong dynamics which have only

strengthened during the pandemic. Unsurprisingly, this has pushed

prime yields to a record low of 4% and very recent evidence

suggests there could be more compression to follow.

In many ways, the warehousing sector is enjoying an almost

perfect storm of limited new supply and growing demand. There has

been a step change increase in demand from short term occupier

requirements during the early stages of lockdown to longer term

requirements driven by higher online penetration. Furthermore, we

expect to see sustained demand from Brexit uncertainties as 'just

in time' logistics infrastructures are replaced by 'just in case'

strategies.

These dynamics continue to generate continued rental growth in

logistics where, despite strong increases to date, rents remain

affordable and still represent a very small proportion of a

company's operational costs. Rental growth is particularly strong

in urban logistics where there is high demand to meet ever growing

consumer expectations of quicker and more accurate deliveries in an

environment where the supply response is far more challenging due

to competition from higher value alternative uses.

The sector tailwinds are reflected in our total property return

for distribution of 8.0% and are supporting our development

activities where we will deliver 0.7 million sq ft next year at an

expected yield on cost of 7.2%. Our urban assets were strong

performers, delivering a total property return of 6.3% and open

market rental growth on rent reviews of 21%. It is unsurprising

therefore, that this sub-sector remains our strongest conviction

call and our ambitions remain undimmed.

Long income property is benefiting from disruption and

delivering attractive returns

Long income assets have increasingly been sought after because

of their defensive, long dated and growing income characteristics.

A long-let property with a high quality counterparty, guaranteed

income growth, no operational costs and offering a yield 400bps

higher than government bonds is an attractive proposition in

today's low interest rate environment and one we believe remains

underappreciated. This spread is even more appealing when you add

on indexation or guaranteed rental uplifts.

Our "all weather" long income assets focus on sectors that are

largely considered essential or non-discretionary. We therefore

believe that these assets are much less susceptible to the

migration of spend online and that they will continue to benefit

from the ongoing changes in the way people shop and live; namely

grocery and convenience food, roadside services, discount,

essential, trade and DIY. During the pandemic, we saw a strong

underlying trading performance across all of these categories which

is reflected in our high rent collection levels and a total

property return for long income of 2.3%.

Whilst most of our long income is within insulated categories,

2% of our total portfolio is exposed to out-of-town leisure and

hotels which has not been immune to the severity of the lockdown

and delivered a property return of -12.0%. We continue to work

closely with our occupiers affected.

During the period, we improved our long income portfolio with

the GBP62 million acquisition of five Waitrose food stores as well

as GBP22 million of other purchases, all let on very long leases

with the benefit of indexation. Our approach to sell when prices

become full has seen us dispose of further assets post period end,

including two M&S convenience stores at a NIY of 4.0%. In order

to ensure that our long income assets remain 'fit for purpose', our

asset management activity saw us extend leases, diversify our

occupier base and invest in geographies with higher intrinsic

values.

Physical retail continues to reprice but still remains a value

trap

Many of the challenges facing today's retailers are not new and

structural forces have been at play now for many years. However,

today's unprecedented environment has accelerated the changes such

that legacy retail strategies have been completely unmasked. Hoping

the way we shop returns to previous norms is not a strategy.

Whilst rents are continually resetting, much of the retail

sector still feels like a value trap as the high initial cap rates

feel increasingly temporary. Many in the market are taking their

cues from price action rather than values. These assets are often

cheap for a reason and the correlation between price and value is

far from perfect. Whilst we believe some parts of the retail market

are financially capable of being repurposed (with a number of

examples underway) we don't believe that this applies to the

majority and remain of the opinion that the majority of UK retail

is "over shopped", "under demolished" and still "over priced".

The virtual tills are ringing louder than ever and the

continuing transfer of sales from stores to online is resetting

rents on a continuous basis. The pandemic has acted as a catalyst

for better integration of online and physical shopping and, like

many of our customers, we do believe that stores have a role to

play in the retail supply chain either through showrooms, click and

collect, returns or as fulfilment facilities. However, if they are

to have a viable future, their rental levels still have a long way

to fall.

Unsurprisingly, the UK has seen a number of tenant failures.

Many legacy retailers will blame the disruption on lockdown but the

truth is that many of these companies have been around for a long

time, have a high street presence they no longer need and have been

struggling to reposition their businesses. The pandemic has simply

exacerbated their difficulties and accelerated their demise. An

interesting view is that the current operational health of these

occupiers is analogous to the virus itself: Covid-19 is not fatal

for the vast majority, however, when it encounters someone with an

immune system already weakened by age and/or pre-existing ailments,

it can be terminal.

We are living in a truly unprecedented world which makes it

difficult to have a strong conviction on where it all lands. When

something is too difficult to assess with a strong conviction, then

we prefer to just move on to another opportunity - what could be

simpler than that.

Our operations continue to enhance income metrics with the

portfolio demonstrating its resilience

The unprecedented disruption has aggressively tested our "all

weather" portfolio. Whilst the majority of our assets have

performed in line or ahead of expectations, we remain alert to the

few that are underperforming. Our shock absorbers are ensuring that

we are better placed than most but they can never guarantee total

immunity to extreme conditions.

Each quarter of 2020 has felt like a year and, as the pandemic

ensued, we focused on ensuring that our balance sheet and cash flow

remained robust, maintaining our long and strong portfolio metrics

and progressing our development activity only where we had good

visibility on letting success.

Our rent collection in the period was very strong and has

continued to remain at high levels. Against an annual rent roll of

GBP125 million, rent forgiven in the period totalled just GBP0.3

million with a further GBP0.2 million remaining unpaid, of which a

significant proportion relates to a property where we are securing

vacant possession for a new letting to Lidl.

This performance reflects the resilience of the portfolio, the

reliability of our income and the strength or our occupier

relationships. Recognising the negative impact that the pandemic

has had on a very select number of our occupiers, we did offer some

rent free concessions in exchange for value enhancing asset

management initiatives as well as agree some short term rental

deferral arrangements, all of which are being honoured.

During the period, we concluded 75 occupier initiatives, adding

GBP2.8 million per annum of additional rent and helping to deliver

like for like income growth of 2.9%. Lettings were signed with

lease lengths of nearly 14 years which helped to increase the

portfolio's WAULT from 11.2 years to 11.5 years, despite the

passage of time.

Occupancy remains high at 98.5% and our gross to net income

ratio of 98.7% continues to reflect the portfolio's very low

operational costs. We continue to increase our exposure to rent

reviews with contractual uplifts, which now account for 55.3% of

our income and provides a great long term hedge against the risk of

inflation.

After successfully letting the first phase at our Bedford

development, we commenced the speculative build out of another

165,000 sq ft which completes in January 2021 and is seeing strong

interest from potential occupiers. The favourable demand/supply

dynamics have seen a number of competing buildings let in the area

and has given us the confidence to progress with a build out of a

further 350,000 sq ft which will complete in Q3 2021 and conclude

our c.700,000 sq ft development in Bedford. We have also made good

progress at our Tyseley urban logistics development, where we have

gained planning on the next phase totalling 120,000 sq ft and

negotiations are well progressed which should allow us to commence

construction shortly.

We successfully raised GBP120 million of equity in the period

through a placing that was significantly oversubscribed and

provided us with resources to tap new and attractive investment

opportunities that would seldom otherwise be available in a

normalised market. Including cash receipts from sales that

exchanged but didn't complete in the period, our LTV is 32.4% which

provides us with firepower to make further investments.

Outlook

It is clear that the road to recovery from the pandemic will

undoubtedly be uneven with divergent trends, accelerating

structural shifts and enduring changes in consumer behaviour.

Our portfolio continues to perform strongly and we have built up

a collection of excellent assets that are closely aligned to the

structural tailwinds and offer reliable, predictable and growing

income streams. Combined with our strong operational platform and

high economic alignment, we are well placed to navigate these

uncertain times and will remain prudent in our decision making and

rational in our approach, work with our occupiers, protect our

capital and ensure that we emerge from this period stronger, better

placed and ready to take advantage of compelling new

opportunities.

Our approach is less about having to be 100% right every time,

but more about not getting it wrong. Our investment philosophy of

allocating capital to structurally supported sectors is simple but

when identifying opportunities, we don't just assess the potential

returns but weigh them against the risks involved and stress

incurred. Therefore, whilst the property market presents lots of

opportunities, we let most go, preferring to focus on quality

investments that offer long term income, capital growth and

downside protection from strong intrinsic values. After all, we

will continue to invest like it is our own money, because it

is.

Taking a step back and looking forward there is no doubt that

many things will eventually go back to the way they were. However,

given the material disruption, many will not. Therefore, we will

continue to assess and anticipate those changes that are temporary

but more importantly the macro changes that will be more permanent.

This is where the new opportunities will be and it will help frame

how we shape our future portfolio.

Whilst we cannot predict the future, we do know that our

tactical switch has positioned us on the right side of the

structural changes. As a long term investor, we remain optimistic

about the future and whilst we will invest like optimists we will

continue to prepare like realists.

Property Review

Our investment activity continues to improve the portfolio's

quality and resilience

Acquisitions in the period totalled GBP98.5 million and were let

for an average of 17.6 years, with 88% of income subject to

contractual rental uplifts. These acquisitions related to

grocery-led convenience and roadside as well as urban logistics

assets located in London. They were high quality opportunities at

attractive prices that would seldom present themselves in a

normalised market.

Disposals in the period totalled GBP71.9 million and consisted

primarily of seven shorter let urban logistics warehouses with a

WAULT to first break of 7.2 years. Here, we were prepared to trade

assets where the market's expectation of rental growth and future

returns exceeded our own. Post period end, we have sold a

further

GBP18 million, mostly relating to the sale of two convenience

food stores.

Disposed(1,2)

Acquired (GBPm) (GBPm)

----------------------------- --------------- -------------

Urban logistics 14.1 60.8

Regional & mega distribution - -

Long income 84.4 5.2

Office, residential &

retail parks - 5.9

----------------------------- --------------- -------------

Total 98.5 71.9

----------------------------- --------------- -------------

(1) Excludes GBP64.4 million of disposals, predominantly larger

box distribution, that exchanged in the previous year but completed

in the period

(2) GBP61.3 million of disposals relate to assets that exchanged

in the period with delayed completions

Assisted by a strong capital performance in the period, the

value of our distribution platform increased to

GBP1,668 million, representing 68.2% of the portfolio. The urban

logistics sector is our key conviction call and remains our largest

weighting, representing 35.4% of the portfolio. Over the period,

our weighting to mega distribution fell further to 13.5% primarily

due to the completion of a mega warehouse sale that exchanged in

the prior year.

Long income increased from 24.0% of the portfolio to 26.4%,

following significant net investment into grocery led convenience

and roadside assets, with these two sub sectors now dominating our

long income exposure.

The remaining 5.4% of the portfolio is deemed non-core and is

split between:

-- Offices, where we have nine remaining of the 11 acquired through the Mucklow acquisition

-- Retail parks, where six remain following a sale in the period for GBP4.1 million

-- Residential, where four flats were sold in the period and a

further four remain of the 149 originally owned.

Portfolio split

Urban Logistics 35.4%

Regional Distribution 19.3%

Mega Distribution 13.5%

Long Income 26.4%

Retail Parks 3.0%

Offices & Residential 2.4%

---------------------- -----

Our portfolio metrics continue to reflect our focus on

generating long and growing income

The portfolio's WAULT has increased since the year end from 11.2

years to 11.5 years and continues to provide a high level of income

security with only 7.0% of income expiring within three years and

45.8% within 10 years.

Occupancy remained high at 98.5% and our gross to net income

ratio of 98.7% continues to compare highly favourably against our

peers and reflects the portfolio's very low operational

requirements.

In the period, we undertook 75 occupier initiatives adding

GBP2.8 million per annum of additional rent and helping to deliver

like for like income growth of 2.9%. These initiatives consisted

of:

-- Contractual rental uplifts which apply to 55.3% of our

income, where 18 fixed and RPI linked reviews were settled

delivering GBP0.3 million of increased rent at an average of 8%

above passing on a five yearly equivalent basis;

-- Open market rent reviews, where 10 reviews were settled

delivering GBP0.8 million of increased rent at an average of 22%

above passing on a five yearly equivalent basis; and

-- Leasing activity, where we signed 47 new leases and regears

with average lease lengths of 13.9 years delivering GBP1.7 million

of increased rent. Six of these deals related to two occupiers

where, in response to Covid-19, we agreed to a rent free concession

in exchange for greater term certain, increasing the WAULT on those

assets to 22 years.

Over the period since March 2020, our contracted income

increased from GBP123.3 million to GBP125.4 million. Following post

period end investment activity, contracted income has reduced to

GBP121.2 million.

Our focus on income diversification, granularity and occupier

credit is delivering strong rent collection despite Covid-19

Our investment and asset management actions over a number of

years have increased the resilience of our portfolio by not only

allocating capital to structurally supported sectors but also by

improving our income's diversification and granularity as well as

the credit strength of our occupiers.

We have a diverse occupier base by type of business and our top

ten occupiers account for 35% of contracted income compared to 51%

in March 2019. In the period, we significantly increased our

exposure to Waitrose who now represent 2.6% of income and are our

eighth largest occupier.

The Covid-19 pandemic created unprecedented disruption but,

despite this uncertainty, our rent collection has been very strong.

We collected 96.5% of rent due in the period and just 0.8% of rent

was forgiven or remains outstanding, some of which relates to a

property where we are securing vacant possession for a new letting

to Lidl.

This resilience reflects high occupier contentment, our close

occupier relationships, their financial strength, our forthright

response to non-payment as well as the operational importance of

our distribution assets and the non-discretionary grocery-led

convenience and essential characteristics of our long income

assets.

As noted further above, we did offer some rent free concessions

in exchange for value enhancing asset management initiatives and we

also agreed some short term rental deferral arrangements, all of

which are being honoured. These account for the remaining 2.7% of

rent that was due in the period.

In respect of third quarter rents due up to 1 November 2020, 98%

has now been collected, 1% has been deferred under previously

agreed payment plans and 1% is outstanding. 100% of our

distribution rent due has been or is being collected, with long

income at 98%, offices at 97% and retail parks at 92%.

Valuation and total return performance

Over the six months, the portfolio delivered a strong total

property return of 4.9%, significantly outperforming the IPD All

Property index of -1.6%:

-- Distribution delivered 8.0%

-- Long income delivered 2.3% despite, as expected, our leisure assets dragging performance

-- Offices delivered 2.1% and retail parks delivered -1.7%

Portfolio outperformance was driven by both management actions

and through capturing rental reversion which helped to deliver

strong capital growth of 2.3% compared to IPD All Property of

-3.7%. Distribution delivered a 5.7% increase and long income was

0.5% lower, whilst offices and retail parks fell by 0.9% and 5.6%

respectively.

The investment portfolio's EPRA topped up net initial yield is

4.9% and the equivalent yield is 5.4% with a like for like

valuation movement of 7bps over the period. ERV growth for the

portfolio was driven by distribution which saw a 1.3% increase;

urban logistics and regional saw growth of 1.1% and 2.6%

respectively whilst mega distribution was flat. Overall ERV growth

was 0.2%.

Distribution Review

Our exposure to the distribution sector increased further in the

period to GBP1,668 million, accounting for 68.2% of our total

portfolio, with over half of our distribution assets in urban

logistics. Reflecting the strong sector dynamics, our distribution

portfolio continues to enjoy high occupancy at 98% and performed

well over the six months, delivering a property return of 8.0% with

regional distribution generating the best returns of 12.8%, driven

by strong performance in regional developments that either

completed in the period or are nearing completion.

As at 30 September 2020 Urban Regional Mega

------------------------------------- -------------- ------------------------ --------------------------

Up to

Typical warehouse size 100,000 sq ft 100,000 to 500,000 sq ft In excess of 500,000 sq ft

Value (1) GBP865.7m GBP472.4m GBP329.8m

WAULT 7.8 years 13.6 years 15.7 years

Average Rent (psf) GBP6.80 GBP6.40 GBP5.60

ERV (psf) GBP7.20 GBP6.70 GBP5.60

ERV growth (6 months) 1.1% 2.6% -

Topped up NIY 4.7% 4.4% 4.0%

Contractual uplifts 34% 76% 100%

Total Property Return (6 months) (1) 6.3% 12.8% 5.9%

------------------------------------- -------------- ------------------------ --------------------------

(1) Includes developments

Distribution investment activity

As investor appetite for logistics has continued to grow, this

has pushed yields to record lows of c.4% and significantly reduced

the number of compelling investment opportunities.

We did however deploy GBP13.7 million of capital expenditure on

our distribution estate, principally our development at Bedford and

forward funding at Goole. We also acquired two highly reversionary

urban logistics warehouses in London for GBP14.1 million reflecting

a net initial yield of 3.7% and a reversionary yield of 4.9%. These

investments consisted of:

-- a 14,000 sq ft warehouse acquired for GBP3.2 million and let

to Royal Mail in Epsom for 5.1 years, where we have since settled

the rent review at 39% ahead of passing, which increases the

running yield from 3.8% at acquisition to 5.2%; and

-- a 32,000 sq ft warehouse acquired for GBP10.9 million and let

at a rent of GBP13.40 psf to Ocado for 8.2 years in

Walthamstow.

The strength of investor appetite prompted us to take advantage

of approaches for a number of our assets where we saw less

potential for rental growth. In the period, we sold GBP60.8 million

of shorter let urban logistics at a net initial yield of 5.2%.

These consisted of:

-- a 21,000 sq ft warehouse sold for GBP3.5 million let to

Fenton Packaging in Hemel Hempstead with a WAULT of less than a

year; and

-- a portfolio of six distribution warehouses sold for GBP57.3

million in various locations including Worcester, Leamington Spa,

Royston, and Huyton. The assets are let to retailer Hamleys, CEVA,

ITAB, Transmec and Grupo Antolin, an automotive supplier to JLR,

and have a WAULT to first break of 7.5 years. Completion of the

sale has been delayed until March 2021.

Post period end, we sold a 25,000 sq ft urban logistics unit in

Edinburgh for GBP3.4 million with three years left to break and

acquired a highly reversionary urban logistics unit in Colliers

Wood for GBP2.5 million at a NIY of 4.0% through a 15 year sale and

leaseback with open market rent reviews.

Distribution asset management activity

Distribution lettings and regears in the period were signed on

0.7 million sq ft. These deals were mostly on urban logistics

warehousing, added GBP1.8 million per annum of additional income

and had a WAULT of 9.8 years with incentives equivalent to less

than six months' rent free. Regears delivered an increase in the

WAULT from 8.1 years to 12.6 years.

The most significant activity was:

-- 141,000 sq ft letting at Stoke

-- 113,000 sq ft of lettings and regears across our multi-let urban warehousing

-- 78,000 sq ft regear in Thorne

-- 70,000 sq ft regear in Barton

-- 48,000 sq ft regear in Fareham

-- 41,000 sq ft regear in Milton Keynes

-- 38,000 sq ft letting to Network Rail at Stargate in Birmingham

-- 35,000 sq ft regear in Wednesbury

-- 34,000 sq ft letting to an online pharmacy at a recently refurbished property in Greenford

Distribution rent reviews in the period were settled across 2.0

million sq ft. They added GBP1.0 million per annum of income at 13%

above previous passing rent on a five yearly equivalent basis:

-- eight urban reviews were settled at 17% above passing rent on

a five yearly equivalent basis, with open market reviews achieving

21% uplifts;

-- three regional reviews were settled at 19% above passing rent

on a five yearly equivalent basis, with two open market reviews

settled with DHL and Royal Mail achieving 27% uplifts; and

-- two mega reviews, both contractual uplifts, were settled at

8% above passing rent on a five yearly equivalent basis.

Long Income Review

Our long income assets are typically single tenant assets with

low operational requirements that are benefiting from the changes

in the way people live and shop. They are insulated from structural

dislocation and are predominantly focused on grocery, wholesale,

roadside services, discount and essential retail, trade and

DIY.

Over the period, our exposure to long income grew from GBP563

million to GBP645 million, representing 26.4% of our total

portfolio, as we transacted on significant net investment in

grocery/convenience and roadside assets with these two sub sectors

now accounting for over 40% of our long income exposure.

The long income assets have a WAULT of 13.9 years, are 100% let

to strong occupiers at affordable average rents of GBP15.10 psf and

are valued at an attractive topped up NIY of 5.5%. The average lot

size is c.GBP5 million with 62% of income subject to contractual

uplifts.

Over the period, our long income assets delivered a total

property return of 2.3% driven by an attractive income yield.

Excluding the leisure assets which, as expected dragged

performance, total property return would have been 3.6%.

Long income portfolio

Convenience

As at 30 September / Grocery NNN Trade Leisure &

2020 & Roadside Retail(2,3) & DIY Hotel

---------------------- -------------------- --------------------- --------------------- ----------------------

Value (1) GBP267.2m GBP175.2m GBP147.5m GBP55.0

WAULT 16.6 years 9.5 years 13.4 years 21.3 years

Average Rent (psf) GBP16.90 GBP21.20 GBP9.10 GBP17.10

Topped up NIY 4.6% 6.9% 5.5% 5.8%

Equivalent Yield 5.0% 6.6% 5.9% 7.0%

Contractual uplifts 94% 22% 59% 100%

Total Property Return

(6 months) (1) 3.0% 2.8% 5.7% -12.0%

Largest Occupiers B&M, Currys, DFS, B&Q, Howdens, Jewson, Odeon

Aldi, BP, Dunelm, Home Kwik Fit, Safestore (x5 cinemas)

Co-op, Costco, Bargains, Pets at Selco, Wickes Premier Inn (x1 hotel)

Euro Garages Home, Smyths Toys,

Lidl, M&S, Waitrose The Range

---------------------- -------------------- --------------------- --------------------- ----------------------

(1) Includes developments

(2) Properties in our MIPP joint venture are held within NNN

Retail

(3) TPR for Convenience/Grocery and Roadside rises to 5.0% if

acquisition costs are excluded

Long income investment activity

In the period, GBP84.4 million of long income assets were

purchased at a blended NIY of 4.5% and a reversionary yield of

5.1%. The acquisitions were all grocery-led convenience or roadside

assets, had a WAULT of 18.9 years and all benefited from

contractual rental uplifts. They have strong residual value

supported by alternative use, principally residential, and for

some, vacant possession value is above the purchase price. They

consisted of:

-- a GBP62.0 million sale and leaseback portfolio of five

convenience food stores let to Waitrose for 20 years and located in

Keynsham, Malmesbury, Paddock Wood, Towcester and Yateley. The

assets also operate as online fulfilment centres for Waitrose and

John Lewis;

-- a GBP10.8 million portfolio of three BP/M&S convenience

service stations in Brentwood, Pevensey and Lewes let to BP for 16

years;

-- a GBP9.6 million sale and leaseback portfolio of five service

centres in London let to Kwik Fit; and

-- a GBP2.0 million new build roadside convenience store, petrol

station and drive through Starbucks in Rushden let to Euro Garages

for 25 years;

Disposals totalled GBP5.2 million and were sold at a blended NIY

of 5.0%, consisting of:

-- a short let stand-alone Matalan unit in Leicester sold for GBP3.4 million; and

-- four Kwik Fit service centres let for 15 years and sold for GBP1.8 million

Post period end, we sold two M&S food stores in Haslemere

and Ferndown for GBP14.7 million, reflecting a NIY of 4.0%.

Long income leasing and rent review activity

In the period, we signed five regears with a WAULT of 21.5

years. These related to our cinemas where, in response to the

pandemic, we agreed lease extensions in return for a rent free

period.

Rent reviews settled in the period generated an uplift of GBP0.2

million at 12% above previous passing on a five yearly equivalent

basis. These reviews were mostly related to convenience assets with

RPI or fixed uplifts.

Development Review

In the period, we completed 251,000 sq ft of developments

generating GBP1.6 million of additional rent per annum, reflecting

a yield on cost of 5.3%. We have another 657,000 sq ft of

development under way or due to commence shortly that is expected

to generate GBP5.6 million of additional rent per annum, reflecting

a yield on cost of 7.2%. The expenditure on these developments over

the next 12 months is expected to total c.GBP56 million, of which

c.GBP35 million is committed.

Sq ft Income Yield on

Completed in the period ('000) (GBPm) cost (%)

------------------------ ------- ------- ---------

Croda, Goole (funding) 232 1.3 5.2

Weymouth (Aldi) 19 0.3 5.7

------------------------ ------- ------- ---------

Total 251 1.6 5.3

------------------------ ------- ------- ---------

Under construction & commencing shortly

-----------------------------------------------------

Bedford (Phase 2b) (1) 350 2.5 8.5

Bedford (Phase 2a) (1) 165 1.2 6.7

Tyseley (Phase 2) (1,2) 120 1.6 6.0

Wallingford (funding) 22 0.3 5.0

Total 657 5.6 7.2

------------------------ ------- ------- ---------

(1) Anticipated yield on cost and rents

(2) Construction subject to concluding current pre-let

discussions

Goole funding

Completion of a 232,000 sq ft distribution warehouse pre-let to

Croda for 20 years which was forward funded.

Weymouth

A 19,000 sq ft convenience store pre-let to Aldi completed in

July 2020. Offers have been received on the letting of two small

pods totalling a further 6,000 sq ft, where development remains

conditional on planning.

There is further development potential at the site.

Bedford Link

On site with the development of a regional distribution

warehouse totalling 165,000 sq ft which is expected to complete in

January 2021 and is seeing good occupier interest.

We have also commenced speculative construction of the final

phase of our development at Bedford Link which comprises a 350,000

sq ft regional distribution unit. Completion is expected in Q3

2021.

Tyseley

In the previous year, we completed 135,000 sq ft of distribution

development at our Tyseley site. 69,000 sq ft has been let and we

continue to let the remaining space.

We expect to commence shortly the development of a further

120,000 sq ft of distribution warehousing. Occupier discussions are

highly advanced and planning consent has been received subject to a

customary review period.

There is a further 15,000 sq ft of development potential which

we are in pre-let discussions on.

Wallingford funding

Forward funding of a 22,000 sq ft trade counter development in

Wallingford pre-let to MKM and Howdens with a WAULT of 18 years.

Construction has commenced with completion expected by the end of

the year.

Other development potential

Many of our long income assets are well located in suburban

locations with strong alternative use, such as residential, and

have the potential to be repurposed over time. We continually look

to upgrade existing long income assets and exploit potential

opportunities. Near term development potential includes

reconfiguration of:

-- a 51,000 sq ft long income NNN retail asset in New Malden,

London, which is predominantly let to Dixons and where planning has

been received to accommodate an additional convenience food

store;

-- a 32,000 sq ft long income trade asset in Ashford, Surrey,

where we are securing vacant possession and where planning is in

progress to accommodate an additional store let to Lidl on a 25

year lease; and

-- a 48,000 sq ft long income NNN retail asset in Orpington,

London, previously let to Carpetright, where we have agreed a new

20 year lease with Lidl to accommodate them alongside a smaller

Carpetright unit. Planning has been received and we are satisfying

certain conditions before commencing works.

Sustainability and ESG

We continue to improve the quality of our assets through

development and asset management.

All of our completed developments in the period were certified

as BREEAM Very Good. At Bedford Link, we are on site developing two

BREEAM Excellent buildings totalling c.515,000 sq ft and, at

Tyseley, we expect to commence shortly the development of a 120,000

sq ft building that is also expected to be BREEAM Excellent. These

projects would take the proportion of BREEAM Excellent developments

under construction to 97%.

At Bedford Link, development of the smaller building of 165,000

sq ft is showing a significant reduction in development related

carbon emissions compared to the earlier development phase. We are

setting even higher construction and energy standards on the larger

building of 350,000 sq ft which should see us make further

reductions in development related emissions as well as further

improve the building's environmental credentials.

As part of our corporate wide sustainability target this

financial year to introduce a net zero carbon ambition, we are also

looking at how we can manage the buildings at Bedford Link so as to

achieve net zero carbon. We are retrospectively installing energy

monitoring on the buildings already completed and are installing as

standard on the units under development.

We continue to engage with our occupiers on energy efficiency

initiatives including solar PV installations, LED lighting

upgrades, Electric Vehicle (EV) charging and improving the

environmental performance of our buildings, particularly across our

distribution portfolio. In the period, 1.5MW of solar was installed

at our 357,000 sq ft logistics warehouse in Warrington and we are

rolling out further EV charging points across our long income

assets and development assets.

Over the period, we maintained our Green Star status in the

Global Real Estate Sustainability Benchmark ('GRESB') 2020 survey.

Our score of 65% (2019: 71%) continues to compare favourably

against the average score of our peers of 61% (2019: 67%) and is

significantly up from the 34% we achieved in 2014.

Further detail on sustainability & ESG related matters can

be found in our latest Responsible Business report on our

website:

https://www.londonmetric.com/sites/london-metric/files/sustainability/lmp_responsible_business_2020.pdf

Financial Review

Despite the challenges posed by the global pandemic that has

dominated our lives for nearly eight months, we have again

delivered a very strong set of results with both earnings and NAV

progression, underpinned by a strong balance sheet and robust

portfolio metrics. We remain very well placed with a resilient

portfolio, lower leverage and significant liquidity to navigate the

uncertain times ahead.

Earnings growth includes a full six months' contribution from

the A&J Mucklow Group which we acquired in June last year, and

we have benefited from the deployment of funds raised through a

GBP120 million equity placing in May into attractive income

producing investment assets in our preferred portfolio sectors.

Rent collection has been a key priority and we have utilised the

close relationships we have with our tenants to provide assistance

where necessary and negotiate asset management initiatives and

concessions that benefit both parties.

EPRA earnings per share increased by 3.9% to 4.75p, driven by an

11.7% increase in net rental income and 9.6% reduction in finance

costs. We have continued to focus on growing our dividend, which at

4.2p per share for the half year, is a 5% increase over the

comparative period last year and 1.13 times covered by EPRA

earnings per share. Our shareholders continue to receive the full

benefit of our successful investment strategy, as we have continued

to pay our dividend despite the challenging market conditions.

IFRS reported profit is GBP85.1 million compared to a loss of

GBP10.2 million last year which included one off acquisition costs

related to the Mucklow transaction of GBP57.2 million. IFRS net

assets have increased to

GBP1,597.9 million, predicated on a strong portfolio performance

and valuation gain of GBP42.8 million or 4.8p per share and

including the proceeds from the equity raise. Our portfolio has

remained resilient and continues to be well positioned to weather

the disruption we have and continue to face, with 94.6% of our

assets in the structurally supported logistics and long income

sectors.

EPRA has introduced new reporting metrics for net asset value

this year and we have adopted EPRA net tangible assets (NTA) as our

primary measure and key performance indicator to replace EPRA net

asset value. EPRA NTA per share is on a fully diluted basis and

prior year comparatives have been presented for the new measure

accordingly. At 30 September, EPRA NTA per share was 175.5p,

reflecting an increase of 3.1% over the period (March 2020 EPRA

NTA: 170.3p per share).

Our financial position was strengthened by the equity placing,

which alongside asset disposals has helped to reduce LTV to 32.4%

at the half year from 35.9% in March. Our other financing metrics

remain strong. Average cost of debt has fallen to 2.5% (March 2020:

2.9%), largely as a result of the cancellation of GBP350 million

short dated interest rate swaps in April, leaving only 45% of debt

drawn hedged through fixed coupon facilities which will allow us to

continue to take advantage of existing and future low rates of

interest. Our headroom has increased to GBP267 million from GBP220

million in March, providing ongoing operational optionality and

security in these unprecedented times.

Presentation of financial information

The Group financial statements have been prepared in accordance

with IFRS. Management monitors the performance of the business

principally on a proportionately consolidated basis, which includes

the Group's share of joint ventures ('JV') and excludes any

non-controlling interest ('NCI') on a line by line basis. The

figures and commentary in this review are presented on a

proportionately consolidated basis, consistent with our management

approach, as we believe this provides a meaningful analysis of

overall performance. These measures are alternative performance

measures, as they are not defined under IFRS.

The Group uses alternative performance measures based on the

European Public Real Estate Association ('EPRA') Best Practice

Recommendations ('BPR') to supplement IFRS, in line with best

practice in our sector, as they highlight the underlying

performance of the Group's property rental business and exclude

property and derivative valuation movements, profits and losses on

disposal of properties, financing break costs, goodwill and

acquisition costs, all of which may fluctuate considerably from

year to year. These are adopted throughout this report and are key

business metrics supporting the level of dividend payments.

In October 2019, EPRA introduced three new measures of net asset

value: EPRA net tangible assets (NTA), EPRA net reinstatement value

(NRV) and EPRA net disposal value (NDV). EPRA NTA is considered to

be the most relevant measure for the Group and replaces EPRA NAV as

the primary measure of net asset value this half year.

Further details, definitions and reconciliations between EPRA

measures and the IFRS financial statements can be found in note 7

to the financial statements, Supplementary notes i to vii and in

the Glossary.

Income statement

EPRA earnings for the Group and its share of joint ventures are

detailed as follows:

Group JV NCI 2020 Group JV NCI 2019

For the six months to 30 September GBPm GBPm GBPm GBPm GBPm GBPm GBPm GBPm

----------------------------------- ------ ----- ------- ------ ------ ----- ------- ------

Gross rental income 60.3 2.7 (0.9) 62.1 52.9 3.3 (0.6) 55.6

Property costs (0.7) (0.1) - (0.8) (0.6) (0.1) - (0.7)

----------------------------------- ------ ----- ------- ------ ------ ----- ------- ------

Net rental income 59.6 2.6 (0.9) 61.3 52.3 3.2 (0.6) 54.9

Management fees 0.4 (0.2) - 0.2 0.6 (0.3) - 0.3

Administrative costs (8.0) - - (8.0) (7.7) - 0.1 (7.6)

Net finance costs (10.7) (0.7) 0.1 (11.3) (11.8) (0.8) 0.1 (12.5)

Other(1) - - 0.1 0.1 - - 0.1 0.1

----------------------------------- ------ ----- ------- ------ ------ ----- ------- ------

EPRA earnings 41.3 1.7 (0.7) 42.3 33.4 2.1 (0.3) 35.2

----------------------------------- ------ ----- ------- ------ ------ ----- ------- ------

(1) Other items include the tax charge attributable to the

non-controlling interest

Net rental income

We continue to focus on growing our underlying net rental income

and delivering dividend progression for our shareholders. The

pandemic has only intensified our search for income, which has

increased by 11.7% to

GBP61.3 million. The Mucklow portfolio, which we acquired on 27

June 2019, contributed fully this half year delivering gross rental

income of GBP13.1 million, compared with GBP6.9 million last half

year. Other movements in net rental income are reflected in the

table below.

GBPm GBPm

-------------------------------------------- ----- ------

Net rental income 2019 54.9

Additional rent from existing properties(1) 1.0

Additional rent from developments(2) 0.8

Additional rent from acquisitions(3) 10.1

Rent lost through disposals(3) (4.4)

-----

Additional rent from net acquisitions 5.7

Increase in rent provision(4) (1.0)

Increase in property costs (0.1)

--------------------------------------------- ----- ------

Net rental income 2020 61.3

--------------------------------------------- ----- ------

(1) Properties held since 1 April 2019

(2) Developments completed since 1 April 2019

(3) Acquisitions and disposals completed since 1 April 2019,

including the Mucklow portfolio

(4) Represents increases in provisions against group trade

debtors of GBP0.6 million (as reflected in note 10 to the financial

statements), MIPP JV rent debtors of GBP0.2 million and rent free

lease incentives in investment property of GBP0.2 million

Additional income from existing properties and developments is

based on properties held and developments completed since April

2019. On this basis, we generated additional rent from lettings,

rent reviews and regears of our existing portfolio and completed

developments of GBP1.8 million, which included GBP0.8 million

additional surrender premium receipts.

Income from net acquisitions of GBP5.7 million included the

additional Mucklow contribution of GBP6.2 million and the impact of

other net disposals which reduced income by GBP0.5 million compared

to the comparative period.

We have assessed the recoverability of our period end trade

debtor and lease incentive balances in accordance with IFRS 9, and

have increased our provision by GBP1.0 million since September

2019. At the half year, our provision against trade debtors is

GBP0.8 million, as reflected in note 10 to the financial

statements. This comprises an allowance for specific trade debtors

of GBP0.2 million and an expected credit loss provision of GBP0.6

million, which incorporates the potential widespread disruption

caused by lockdown restrictions implemented to combat the spread of

the virus over the next 12 months. However, our latest rent

collection rates have been exceptionally strong and we will

continue to monitor these over the second half of the year and

adjust our provision accordingly.

Property costs have increased marginally by GBP0.1 million and

our property cost leakage remains low at 1.3% (September 2019:

1.3%, March 2020: 1.2%).

Rent collection

Our rent collection in the period was very strong and has

continued to remain at high levels post period end. We have

collected 96.5% of rents due in the period and just 0.8% or GBP0.5

million remains unpaid or has been forgiven, some of which relates

to a property where we are securing vacant possession for a new

letting to Lidl. In respect of our third quarter rents due by 1

November, we have collected 98%, previously agreed deferrals apply

to a further 1% and 1% remains unpaid.

However, we have not been immune to the impact of the pandemic

and have proactively supported a number of our tenants who have

faced cash flow challenges by implementing deferred payment plans

and initiatives which offer short term rental concessions in

exchange for value enhancing asset management initiatives, all of

which are being honoured and account for the remaining 2.7% of rent

that was due in the period.

Administrative costs

Administrative costs have increased by GBP0.4 million to GBP8.0

million and are stated after capitalising staff costs of GBP1.1

million (September 2019: GBP1.0 million) in respect of time spent

on development projects in the period. The increase over the

comparative period last year includes an additional three months'

overheads for Mucklow of GBP0.2 million.

EPRA cost ratio

We continue to monitor our operational costs closely and use the

EPRA cost ratio to measure our effective management of costs.

Having fallen 60 bps over the year to 13.7%, it remains one of the

lowest in our sector.

30 September 2020 30 September 2019 31 March 2020

% % %

----------------------------------------------- ----------------- ----------------- -------------

EPRA cost ratio including direct vacancy costs 13.7 14.3 14.2

EPRA cost ratio excluding direct vacancy costs 13.4 13.6 13.3

----------------------------------------------- ----------------- ----------------- -------------

The ratio reflects total operating costs as a percentage of

gross rental income. The full calculation is shown in Supplementary

note iv.

Net finance costs

Net finance costs, excluding the costs associated with repaying

debt and terminating hedging arrangements on sales and refinancing

in the period were GBP11.3 million, a decrease of GBP1.2 million

over the previous period.

This reflected lower interest charges of GBP0.9 million and

additional interest capitalised and receivable on developments of

GBP0.3 million.

The average interest rate payable over the period was lower than

in the previous comparative period, due primarily to the

cancellation in April 2020 of GBP350 million interest rate swaps

that hedged our unsecured facilities. This reduced the proportion

of our drawn debt hedged to 45% and our cost of debt at the period

end to 2.5% (September 2019: 3.0%, March 2020: 2.9%). The

corresponding swap break cost was GBP4.9 million, which we expect

to be paid back over the next 12 months from interest cost

savings.

Further detail is provided in notes 4 and 9 to the financial

statements.

Share of joint ventures

EPRA earnings from joint venture investments were GBP1.7

million, a decrease of GBP0.4 million over the comparative period

as reflected in the table below.

2020 2019

For the six months to 30 September GBPm GBPm

------------------------------------------------- ----- -----

Metric Income Plus Partnership (MIPP) 1.8 2.0

LMP Retail Warehouse JV (DFS) - 0.1

LSP London Residential Investments (Moore House) (0.1) -

EPRA earnings 1.7 2.1

------------------------------------------------- ----- -----

As reported last year, our interest in DFS is now consolidated

in the Group accounts and our partner's 18% share reflected as a

non-controlling interest. During the period, DFS contributed GBP3.9

million in total to EPRA earnings compared with GBP2.4 million for

the previous comparative period. The increase was due to the

receipt of a surrender premium of GBP1.5 million at Carlisle in the

half year.

Income from our MIPP joint venture fell by GBP0.2 million due to

an increase in the rent provision for one property where we are

securing vacant possession for a new letting to Lidl.

The Group received net management fees of GBP0.2 million for

acting as property advisor to each of its joint ventures, which

have fallen by GBP0.1 million as a result of movements in property

valuations and sales.

Taxation

As the Group is a UK REIT, any income and capital gains from our

qualifying property rental business are exempt from UK corporation

tax. Any UK income that does not qualify as property income within

the REIT regulations is subject to UK tax in the normal way.

The Group's tax strategy is compliance oriented; to account for

tax on an accurate and timely basis and meet all REIT compliance

and reporting obligations. We seek to minimise the level of tax

risk and to structure our affairs based on sound commercial

principles. We strive to maintain an open dialogue with HMRC with a

view to identifying and solving issues as they arise. There were no

issues raised in the period.

We continue to monitor and comfortably comply with the REIT

balance of business tests and distribute as a Property Income

Distribution ('PID') 90% of REIT relevant earnings to ensure our

REIT status is maintained. The Group has paid the required PID for

the year to 31 March 2020 ahead of the deadline of 31 March 2021.

In accordance with REIT regulations, GBP3.8 million was withheld

from distributions and paid directly to HMRC in the period.

IFRS reported profit

A full reconciliation between EPRA earnings and IFRS reported

profit is given in note 7(b) to the accounts and is summarised in

the table below.

For the six NCI NCI

months to 30 Group JV GBPm 2020 Group JV GBPm 2019

September GBPm GBPm GBPm GBPm GBPm GBPm

-------------- ----------- ----------- ----------- ----------- ------------ ----------- ----------- ------------

EPRA earnings 41.3 1.7 (0.7) 42.3 33.4 2.1 (0.3) 35.2

Revaluation of

property 44.3 (1.8) 0.3 42.8 19.3 (3.5) 0.8 16.6

Fair value of

derivatives 4.7 (0.1) - 4.6 (2.5) (0.3) - (2.8)

Profit/(loss)

on disposal 0.3 (0.1) 0.1 0.3 0.6 (2.3) - (1.7)

Debt/hedging

break costs (4.9) - - (4.9) (0.3) - - (0.3)

Impairment of

goodwill - - - - (48.3) - - (48.3)

Acquisition

costs - - - - (8.9) - - (8.9)

-------------- ----------- ----------- ----------- ----------- ------------ ----------- ----------- ------------

IFRS reported

profit/(loss) 85.7 (0.3) (0.3) 85.1 (6.7) (4.0) 0.5 (10.2)

-------------- ----------- ----------- ----------- ----------- ------------ ----------- ----------- ------------

The Group's reported profit for the period was GBP85.1 million

compared with GBP47.0 million in the previous period before

exceptional goodwill and acquisition costs. The GBP38.1 million

increase was primarily due to the property revaluation being

GBP26.2 million higher and increased EPRA earnings of GBP7.1

million.

Property sales in the period generated a GBP0.3 million profit

over book value compared with a loss of GBP1.7 million last year.

The total profit over original cost was GBP7.1 million,

representing a return of 10.4%. Disposals are discussed in detail

in the Property Review.

The favourable movement in the fair value of derivatives is

offset by the swap break cost of GBP4.9 million, resulting in a

charge of GBP0.3 million in the period compared to a total charge

of GBP3.1 million last year.

Balance sheet

EPRA net tangible assets (NTA) is a new performance measure

introduced this year and for the Group replaces the previous metric

of EPRA net assets as a key performance indicator that reflects

both income and capital returns. It excludes the fair valuation of

derivative instruments that are reported in IFRS net assets. A

reconciliation between IFRS and EPRA NTA is detailed in the table

below and in note 7(c) to the financial statements. EPRA NTA per

share is on a fully diluted basis and prior year comparatives have

been presented for the new measure accordingly.

EPRA net tangible assets for the Group and its share of joint

ventures are as follows:

30 September

Group JV NCI 2020 Group JV NCI 31 March 2020

As at GBPm GBPm GBPm GBPm GBPm GBPm GBPm GBPm

---------------------- ------- ------ ------- ------------ ------- ------ ------- -------------

Investment property 2,372.8 89.1 (11.3) 2,450.6 2,273.6 92.4 (14.9) 2,351.1

Trading property 1.1 - - 1.1 1.1 - - 1.1

---------------------- ------- ------ ------- ------------ ------- ------ ------- -------------

2,373.9 89.1 (11.3) 2,451.7 2,274.7 92.4 (14.9) 2,352.2

Gross debt (841.6) (37.5) - (879.1) (932.7) (42.1) - (974.8)

Cash 38.8 3.6 (0.2) 42.2 81.8 5.1 (0.8) 86.1

Other net liabilities (21.1) (0.5) 5.5 (16.1) (34.3) (0.6) 8.6 (26.3)

---------------------- ------- ------ ------- ------------ ------- ------ ------- -------------

EPRA NTA 1,550.0 54.7 (6.0) 1,598.7 1,389.5 54.8 (7.1) 1,437.2

---------------------- ------- ------ ------- ------------ ------- ------ ------- -------------

Derivatives - (0.8) - (0.8) (4.7) (0.7) - (5.4)

---------------------- ------- ------ ------- ------------ ------- ------ ------- -------------

IFRS net assets 1,550.0 53.9 (6.0) 1,597.9 1,384.8 54.1 (7.1) 1,431.8

---------------------- ------- ------ ------- ------------ ------- ------ ------- -------------

IFRS reported net assets have increased 11.6% since March to

GBP1,597.9 million. This incorporates the net proceeds received

from the equity raise of GBP116.6 million.

Both IFRS NAV per share and EPRA NTA per share have increased

3.1% since March to 176.3p and 175.5p per share respectively. The

movement in EPRA NTA and EPRA NTA per share is reflected in the

table below.

EPRA EPRA NTA

NTA per share

GBPm p

------------------------- ------- ----------

EPRA NTA at 1 April 2020 1,437.2 170.34

EPRA earnings 42.3 4.75

Dividends(2) (37.5) (4.21)

Property revaluation 42.8 4.80

Equity raise 116.6 -

Other movements(1) (2.7) (0.17)

At 30 September 2020 1,598.7 175.51

-------------------------- ------- ----------

(1) Other movements include debt break costs (GBP4.9 million)

offset by share based awards (GBP1.6 million), scrip share issue

savings (GBP0.3 million) and profit on sales (GBP0.3 million)

(2) Dividend per share is based on the weighted average number

of shares in the period. The actual dividend paid in the period was

4.3p as reflected in note 6 to the financial statements

The increase in EPRA NTA per share was principally due to the

property revaluation gain of 4.8p per share, as EPRA earnings per

share of 4.75p covered the dividend paid in the period.

The movement in EPRA NTA per share, together with the dividend

paid in the period, results in a total accounting return of 9.5p or

5.6% per share. Total accounting return is a key performance

indicator and component of the variable element of Directors'

remuneration arrangements. The strong growth in the period of 5.6%

is significantly ahead of the previous half year return of 2.4%.

The full calculation can be found in supplementary note viii.

Equity raise

In May 2020, we successfully raised gross proceeds of GBP120

million through an equity placing that was substantially

oversubscribed. A total of 66.7 million new ordinary shares were

issued at a price of 180.0p per share, representing a discount of

1.5% to the previous day's closing share price. The net proceeds

after issue costs of GBP116.6 million were used to acquire income

producing assets including a portfolio of five Waitrose stores for

GBP62 million as set out in the Property Review.

Dividend

The Company has continued to declare quarterly dividends and has

offered shareholders a scrip alternative to cash payments.

The Company paid the third and fourth quarterly dividends for

the year to 31 March 2020 of GBP37.5 million or 4.3p per share in

the period as reflected in note 6 to the financial statements. The

Company issued 0.2 million ordinary shares under the terms of the

Scrip Dividend Scheme, which reduced the cash dividend payment by

GBP0.3 million to GBP37.2 million. The fourth quarterly dividend of

2.3p per share for the year to 31 March 2020 was a cautious

progression given the circumstances of the global pandemic, taking

the total dividend for that year to 8.3p, a 0.1p increase over the

previous year.

The first quarterly payment for the current year of 2.1p per

share was paid as a Property Income Distribution (PID) in October

2020. The second quarterly dividend will comprise a PID of 2.1p per

share and has been approved by the Board for payment in January