LondonMetric Property PLC LONDONMETRIC ACQUIRES GROCERY-LED ASSET FOR GBP18M (6350L)

14 Settembre 2021 - 8:00AM

UK Regulatory

TIDMLMP

RNS Number : 6350L

LondonMetric Property PLC

14 September 2021

14 September 2021

LONDONMETRIC PROPERTY PLC

LONDONMETRIC aCQUIRES grocery-LED ASSET for GBP18 million

LondonMetric Property Plc ("LondonMetric") has acquired a

grocery-led property in South Ruislip, West London, for GBP18.0

million.

The 41,000 sq ft building is let to Aldi and B&M and has a

WAULT of 9.4 years. It generates GBP0.9 million p.a. of rent

(GBP21.40 psf), c.40% of which has RPI linked rent reviews.

Prominently located on a 3.5 acre site adjacent to an Asda

supermarket, the asset was substantially refurbished in 2015 and

its sizeable car park provides further asset management

potential.

Separately, Metric Income Plus Limited Partnership,

LondonMetric's joint venture with Universities Superannuation

Scheme Ltd, has sold a portfolio of three DIY and homeware

properties for GBP14.2 million (LondonMetric share: GBP7.1 million)

to a US investor. Located in Speke, Barnsley and Beverley, the

properties are let to Wickes and Dunelm and have a WAULT of 10.2

years.

The sale price reflects a 9% premium to the 31 March 2021 book

value.

Andrew Jones, Chief Executive of LondonMetric, commented:

"The recent sale of our Aldi/M&S store in Liverpool and the

sale of three further properties today demonstrates the continued

demand for our long income assets.

"The proceeds of these sales have been reinvested into a very

well let grocery-led asset in a strong London geography. The

acquisition not only provides greater certainty of income growth

but also further asset management opportunities."

For further information, please contact:

LondonMetric Property Plc

Andrew Jones / Martin McGann / Gareth Price

Tel: +44 (0) 20 7484 9000

FTI Consulting

Dido Laurimore / Richard Gotla / Andrew Davis

Tel: +44 (0)20 3727 1000

About LondonMetric Property Plc

LondonMetric is a FTSE 250 REIT that owns one of the UK's

leading listed logistics platforms alongside a diversified long

income portfolio, with 16 million sq ft under management. It owns

and manages desirable real estate that meets occupiers' demands,

delivers reliable, repetitive and growing income-led returns and

outperforms over the long term.

Further information is available at www.londonmetric.com

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCLJMLTMTBBBTB

(END) Dow Jones Newswires

September 14, 2021 02:00 ET (06:00 GMT)

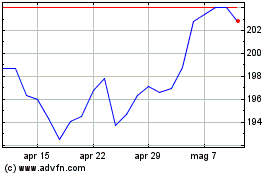

Grafico Azioni Londonmetric Property (LSE:LMP)

Storico

Da Mar 2024 a Apr 2024

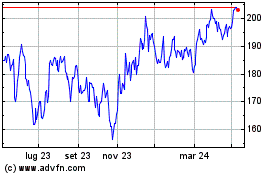

Grafico Azioni Londonmetric Property (LSE:LMP)

Storico

Da Apr 2023 a Apr 2024