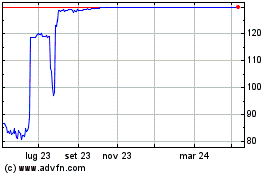

TIDMLOOK

RNS Number : 7562D

Lookers PLC

01 July 2021

01 July 2021

LOOKERS plc ("Lookers" or the "Group")

Preliminary results announcement for the year ended 31 December

2020

Full year 2021 outlook ahead of current expectations

Multiple growth opportunities ahead

Lookers plc, one of the leading UK motor retail and aftersales

service groups, today announces its preliminary results for the

year ended 31 December 2020 (the "year")

Highlights

-- Revenue of GBP3.7bn (2019: GBP4.8bn) impacted by lockdown and

trading restrictions throughout the year.

-- Underlying profit before tax of GBP14.1m (2019: GBP4.0m) with

strong performance in the second half of the year, more than

offsetting a challenging first half. Statutory profit before tax of

GBP2.0m (2019: Loss before tax GBP45.7m).

-- Outperformance against the UK retail new car market of 9.6

percentage points with resilient trading in used cars and

aftersales.

-- Significant restructuring activity completed, reducing

headcount, strengthening the Group's operating model and materially

reducing the cost base. On track to deliver annualised savings of

approximately GBP50m.

-- Strong balance sheet with a valuable property portfolio of c.GBP300m (77p per share).

-- Reduction in net debt benefitting from management actions.

Net debt has reduced further in 2021, with a net cash position

currently of approximately GBP18m.

-- Revolving Credit Facility extension agreed with existing

banking club for an initial GBP150m.

-- FCA investigation into the Group's historic sales processes

closed without sanctions, resulting in the release of the prior

year GBP10.4m provision.

Financial Summary

FYR 2020 FYR 2019 Var %

Underlying*

Underlying profit before

tax GBPm GBP14.1m GBP4.0m 253%

Underlying earnings per

share (p) 2.93p 0.83p 253%

Statutory

Revenue GBPm GBP3,699.9m GBP4,806.5m (23%)

Profit/(loss) before tax

GBPm GBP2.0m (GBP45.7m) n/a

Loss per share (p) (1.05p) (10.74p) 90%

Dividend per share (p) - 1.48p -

Net debt GBPm** GBP40.7m GBP59.5m 31.6%

-------------------------- ------------ ------

* Underlying profit before tax is profit before tax and

non-underlying items. Underlying earnings per share is earnings per

share after tax and before non-underlying items (see Note 3).

** Bank loans and overdrafts less cash and cash equivalents,

excluding stocking loans, vehicle rental liabilities and lease

liabilities under IFRS 16.

Strategic Priorities

-- Investment and development of the Group's omni-channel

customer experience, enhancing choice through a hybrid combination

of digital engagement and high-quality forecourt service.

-- Harnessing growth from the transition to electric vehicles

through infrastructure investment and connected car services,

alongside the roll-out of new aftersales products and services.

-- Continued focus on driving operational excellence through

further productivity improvements, effective cash management and a

robust approach to capital allocation.

-- Focus and investment in people and systems to support the

Group's simplification, controls, engagement and transparency

initiatives.

Current Trading and Outlook

-- Trading in the first six months of the year has been

exceptionally strong underpinned by robust consumer demand, ongoing

outperformance of the UK retail new car market, improving used

vehicle margins and the Group's self-help restructuring

programme.

-- As we look forward into the second half of 2021 there remains

some uncertainty driven by the ongoing impact of COVID-19 and

notable supply restrictions in both new and used vehicles which

have been tightening in recent weeks.

-- Notwithstanding these uncertainties given the strength of

performance during the first half of 2021 the Board remains

confident about the outlook for the remainder of 2021.

Mark Raban, Chief Executive Officer, said:

"2020 was a challenging year for the Group dealing with both the

impact of COVID-19 and the Group's legacy issues.

We are emerging from this period operationally, financially and

culturally as a better business, focused on putting the customer at

the centre of everything we do.

We expect to build on the strong momentum within the business,

underpinned by our excellent manufacturer relationships,

omni-channel technology platform and fantastic Lookers colleagues.

We are now in a great position to benefit from the many growth

opportunities available for the business."

Details of results webcast

There will be a webcast at 9 :30am UK time on 1 July for

analysts and institutional investors. To register please contact

MHP Communications on +44 (0)20 3128 8193 / 8778, or by email on

lookers@mhpc.com

Enquiries:

Lookers

Mark Raban, Chief Executive Officer 0161 291 0043

Anna Bielby, Interim Chief Financial Officer

MHP Communications

Tim Rowntree / Simon Hockridge / Alistair de Kare-Sliver 07709

496 125 / 020 3128 8193

The Company is registered in England at Lookers House, 3

Etchells Road, West Timperley, Altrincham WA14 5XS. Company

registration number 00111876. LEI number 213800TSB8PJEACDAV33

Chairman's statement

Introduction

I was appointed Chairman of the Board on 4 September 2006 and it

is with some sadness that I present my final Chairman's statement.

The recruitment process for my successor is progressing as planned

and I will step down when an appointment is confirmed later this

year.

Like all businesses, over the years Lookers has experienced many

challenges and none greater than those of 2020. The COVID-19 global

pandemic resulted in the complete closure and severe disruption to

our normal business operations and trading patterns throughout much

of the year. This had a material impact on our financial

performance. During this time, we made many changes and

enhancements to our operating model which not only helped mitigate

the impact of COVID-19 but also served to act as a catalyst for

permanent change and improvement across the business.

In addition, in June 2020 we requested the FCA temporarily

suspend our shares whilst we investigated potentially fraudulent

transactions in one of our operating divisions, concluded a

substantial independent investigation and delayed the publication

of both the full year 2019 results and interim 2020 results.

Following the successful conclusion of these matters, we requested

and were granted restoration of our shares to the official list of

the London Stock Exchange on 29 January 2021.

In June 2020 we also announced a material restructuring

programme to prepare the business for a more sustainable future and

to optimise the many opportunities we believe lie ahead.

The combination of these issues resulted in material uncertainty

throughout much of the year.

"I am extremely grateful for the support and patience that we

have received from our stakeholders, including the UK government,

throughout what has been a very challenging period for both the

business and our people."

Strategy

Following this period of uncertainty and reflecting on our

learnings throughout the COVID-19 pandemic, we refreshed our

strategy. The customer remains front and centre of everything we

do, underpinned by the right brands in the right locations. Our

strategic building blocks are centred on delivering operational

excellence, providing an engaging and safe environment for all our

colleagues and customers, enabling technology both front and back

of house and simplifying and strengthening our policy

framework.

Our strategic initiatives are focused on continuing with

increasing our efficiency and improved cash management, digital

investment, preparing for electrification which we see as the

biggest opportunity in a generation and our controls enhancement

programme.

COVID-19

On 23 March 2020, in order to protect the safety and welfare of

our people and customers and in response to the UK Government's

social distancing advice, we temporarily closed all our trading

locations. Following the introduction of new operating measures,

the Group partly reopened 31 locations to provide essential repairs

and maintenance to key workers' vehicles alongside 10 parts

distribution centres.

From the middle of May 2020 we progressively opened all our

locations in a manner consistent with appropriate local

regulations. We implemented new operational processes to ensure the

appropriate COVID-19 secure protocols were in place protecting both

staff and customers. This included the complete redesign of our

sales processes to offer a fully contactless experience.

In November 2020 further restrictions came into effect and as a

result we were only able to provide our customers with pre-booked

aftersales appointments and to provide both new and used vehicles

sales using our Click & Drive contactless solution as the

showrooms remained closed. In December 2020 various regional and

tiered restrictions were implemented across England, Scotland and

Ireland.

On 4 January 2021 a third national lockdown commenced which saw

our vehicle showrooms closed. This situation continued until 12

April 2021 (Northern Ireland - 30 April 2021) when we were

delighted to be able to re-open the entire business as normal.

We remain committed to providing the best possible service

whilst ensuring the well-being of both our colleagues and

customers.

Restructuring

In June 2020 the Board undertook a review of the Group to

consider the future operating model in light of potential demand, a

reduced dealership estate and structural changes taking place

across the industry. As a result, the Board took the difficult

decision to commence redundancy consultations across all areas of

the business, which resulted in approximately 1,500 redundancies

and the closure or consolidation of 12 sites. The Board carefully

considered all options and regrettably considered this action as

being necessary in the current environment to sustain, protect and

enhance the business over the long term.

Performance in 2020

The financial performance of the Group during the year was

significantly impacted by the disruption caused by the COVID-19

global pandemic together with a number of non-underlying one-off

costs resulting from the Group's restructuring programme,

impairment of goodwill and costs in relation to the investigation

and resolution of legacy accounting issues.

Statutory profit before tax for the year was GBP2.0m (2019:

restated loss of GBP45.7m). Excluding the impact of non-underlying

items, the Group recorded an underlying profit before tax* of

GBP14.1m (2019: restated GBP4.0m).

The first six months of the year (H1) proved very challenging

with the complete closure and lockdown of operations for over two

months. As we emerged from lockdown, performance in the second six

months of the year (H2) improved materially. This was driven by

strong outperformance of the retail new car market, improved used

car margins, the early benefits of the Group's restructuring

initiatives and several operational improvements implemented during

lockdown. Underlying profit before tax* in H2 was GBP50.2m (2019:

loss (GBP18.1m)). Our performance in H2 brings me confidence that

we can deliver our 1.5% - 2.0% target return on sales over the long

term.

Refinancing

Throughout the year the Board was focused on preserving cash and

protecting the Group's liquidity position. As at 31 December 2020

net debt* was GBP40.7m (2019: GBP59.5m). This reduction has been

delivered through increased control and focus on all aspects of

working capital management and a robust approach to capital

allocation.

In May 2021 we agreed with our Banking Club a new credit

facility providing an initial GBP150m expiring in September 2023. I

would like to take the opportunity to thank our Banking Club for

all their support over the last 18 months.

Regulatory relations

As previously reported, we have been working internally to

review our governance, systems and controls including as they

relate to our regulated activities. On 2 March 2021 we announced

that the FCA had advised the Board of its decision to close the

investigation against Lookers Motor Group Limited for the possible

mis-selling of regulated products between January 2016 and June

2019. The FCA closed the investigation without applying any

sanction but noted several concerns relating to the historic

culture, systems and controls of the Group which the Board fully

accepted.

The Group is satisfied that the FCA confirmation represents an

adjusting event after the balance sheet date as this provides proof

that there was not an obligating event and have therefore and have

released the GBP10.4m provision made in the 2019 financial

statements in 2020.

Management and Board changes

2020 was a year of significant change as we sought to refresh

and reshape the Board to prepare for the significant opportunities

and challenges ahead. Richard Walker, Sally Cabrini, Stuart

Counsell and Tony Bramall all left the Board as planned during

2020.

We were delighted to appoint Mark Raban as Chief Executive

Officer in February 2020 and Duncan McPhee as Chief Operating

Officer in January 2021.

Anna Bielby was appointed as Interim Chief Financial Officer in

January 2021 for a term of six months. Since then she has made a

very valuable contribution to the Group. She has agreed to extend

her assignment and will leave the Group at the end of July 2021

following completion of a number of big projects. A search for

Anna's replacement is underway.

* Alternative performance measure - see Note 15

Heather Jackson was appointed Senior Independent Director and

Chair of the Remuneration Committee in July 2020 and November 2020

respectively. On 13 April 2021 Heather advised the Board of her

decision to step down to focus on her increasing non-executive

directorships and business interests.

Vicky Mitchell assumed the role of Chair of Lookers Motor Group,

the FCA regulated entity, in July 2020.

We were also pleased to appoint Robin Churchouse as an

independent Non-Executive Director and Chair of Audit and Risk

Committee in December 2020 and January 2021 respectively, and Paul

Van der Burgh as Non-Executive Director in April 2021 and then as

Senior Independent Director from May 2021.

As the search for my successor continues the Board has asked me

to remain as Chair in order to ensure an orderly handover, and I

therefore stood for re-election at the 2021 AGM.

I would like to thank all my Board colleagues, past and present,

for their continued support and contribution to the Group.

Dividends

The Board remains mindful of its relationships and commitments

to all stakeholders. The dividend policy remains that subject to

satisfactory trading prospects, dividends are covered around 3.0 to

3.5 times underlying earnings and paid in approximately one third

(interim dividend) and two thirds (final dividend) split.

In the light of the financial performance during the period,

continued uncertainty around COVID-19 and as part of its ongoing

actions to protect the Group's balance sheet the Board has decided

not to recommend any dividends for the year.

Current trading and financial outlook

In line with COVID-19 restrictions, the Group's showrooms

remained closed until 12 April 2021 (Northern Ireland - 30 April

2021). Despite these restrictions, the Group continued to take

orders and fulfil vehicle handovers through its dealership teams,

call centres and website. These activities were underpinned by our

Click & Drive and contact-less technology platform.

As we announced on 25 May 2021 and 28 June 2021, trading across

the Group has been robust since the reopening of our dealerships.

We continue to experience strong consumer demand and ongoing

outperformance of the UK retail new car market. Used vehicle

margins also remain strong, benefitting from improving residual

values and greater operational focus. In addition to these market

trends the Group continues to benefit from its enhanced hybrid

omni-channel customer offer, and the decisive self-help

restructuring initiatives implemented last year.

As we look forward into the second half of 2021 there remains

some uncertainty driven by the ongoing impact of COVID-19 and

notable supply restrictions in both new and used vehicles which

have been tightening in recent weeks - the former in part due to

the current worldwide semiconductor chip shortage.

Notwithstanding these uncertainties, given the strength of

performance during the first half of 2021, the Board remains

confident about the outlook for the remainder of 2021.

Conclusion

2020 was a very challenging year. I am extremely proud of how

our people responded, showing real dedication and flexibility. I

would like to personally thank the whole Lookers team for their

understanding and dedication during such a challenging time for the

Group.

We have always enjoyed strong relationships with our Original

Equipment Manufacturer (OEM) Brand Partners and are grateful for

their support across a range of financial and other measures during

the year.

The investigation into our financial systems and accounting

controls, the delay in the publication of our 2019 results and the

subsequent temporary suspension of our shares were a great

disappointment. With these matters now resolved we can look to the

future with increased confidence.

Lookers is a great business with great brands and great people.

It is difficult to look too far ahead at the moment, but I am

reassured that we have the resilience to weather the current storm

and the agility to emerge as a business which can build on its

strong foundations. We can now move forward from here focussing on

the many thousands of customers who rely on us for their

mobility.

It has been a great privilege to chair Lookers , and I wish all

my colleagues, our stakeholders, and my successor as Chair every

future success.

Phil White

Chairman

30 June 2021

Operating review

Market overview

The new car market in 2020 was severely disrupted by the

COVID-19 global pandemic. UK new vehicle registrations at 1.63m was

the lowest level on record since 1992 and represented a decline of

29.4% versus 2019. New vehicle registrations to fleet customers

were 0.88m representing 54.2% of the total market, declining by

31.7%. New vehicles registrations to retail customers declined by

26.6%.

Registrations of diesel and petrol engines continued to decline

being 48% and 33% below 2019 respectively. There are notable

regulatory pressures facing our OEM Brand Partners in achieving

emissions targets. As a result of changing customer preferences and

the evolving legislative landscape the registrations of alternative

fuel vehicles continued to gain market share and showed a growth of

67%. The Board believes that the continued migration towards pure

electric vehicles represents a significant opportunity for the

Group.

In the period the Group outperformed the new car market and

currently enjoys a 6.2% (2019: 5.8%) share of the UK retail

market.

The used car market remains an area of material opportunity for

the Group. In 2020 there were approximately 6.8m used vehicle

transactions. Throughout the COVID-19 global pandemic consumers

have continued to favour private transportation and in the period

after the first lockdown in particular the Group experienced strong

demand for cheaper used cars as consumers sought second and third

vehicles for the household.

Aftersales represents the servicing and repair of vehicles and

sale of franchised parts. In the UK the car parc is approximately

36.7m cars and light commercial vehicles, with a significant

proportion under three years old. This represents a significant

opportunity for franchised motor dealers, and we are focused on

developing the aftersales business and investing in our offering

through initiatives to increase volumes and margins.

The internet remains the primary means for our customers to

research and determine which new or used cars they are interested

in buying. As the Group responded to COVID-19 we made many

enhancements to our online capabilities including launching Click

& Drive, online finance applications, remote document

authorisation and contactless handover. These initiatives have

helped to mitigate the financial impact of COVID-19 trading

restrictions and to ensure the continued safety of customers and

our colleagues.

Operations summary

Total revenue GBP3,699.9m (2019 restated: GBP4,806.5m) was 23.0%

lower than 2019. Like-for-like (LFL*) revenue declined by 20.4%

with revenue from new cars, used cars and aftersales all declining

as a result of the temporary closure of the Group's dealerships as

a consequence of the COVID-19 global pandemic.

Analysis of revenue

Revenue 2020 2019 GBPm Variance 2020 LFL 2019 LFL LFL variance

GBPm (restated) GBPm GBPm

New cars 1,709.3 2,226.4 (23.2%) 1,690.3 2,135.3 (20.8%)

-------- ------------ --------- --------- --------- -------------

Used cars 1,779.1 2,326.3 (23.5%) 1,757.1 2,214.3 (20.6%)

-------- ------------ --------- --------- --------- -------------

Aftersales 383.8 495.3 (22.5%) 378.0 470.0 (19.6%)

-------- ------------ --------- --------- --------- -------------

Leasing and

other 148.4 153.3 (3.2%) 136.0 137.3 (0.9%)

-------- ------------ --------- --------- --------- -------------

Less: intercompany (320.7) (394.8) (313.6) (376.0)

-------- ------------ --------- --------- --------- -------------

Total 3,699.9 4,806.2 (23.0%) 3,647.8 4,580.9 (20.4%)

-------- ------------ --------- --------- --------- -------------

* See Glossary of terms on Note 16

Analysis of gross profit

Gross profit 2020 GBPm 2019 GBPm Variance 2020 LFL 2019 LFL LFL variance

(restated) GBPm GBPm

New cars 109.2 147.0 (25.7%) 107.6 143.3 (24.9%)

---------- ------------ --------- --------- --------- -------------

Used cars 117.9 138.1 (14.6%) 116.8 135.1 (13.5%)

---------- ------------ --------- --------- --------- -------------

Aftersales 164.6 211.9 (22.3%) 161.7 198.3 (18.5%)

---------- ------------ --------- --------- --------- -------------

Leasing

and other 19.3 16.1 19.9% 18.0 17.7 1.7%

---------- ------------ --------- --------- --------- -------------

Total 411.0 513.1 (19.9%) 404.1 494.4 (18.3%)

---------- ------------ --------- --------- --------- -------------

Gross Margin

% 11.1% 10.7% 11.1% 10.8%

---------- ------------ --------- --------- --------- -------------

Gross profit decreased by 19.9% to GBP411.0m (2019: GBP513.1m)

driven by the revenue shortfall. Gross margin at 11.1% was 0.4

percentage points ahead of 2019. Gross margin in the first six

months of the year (H1) was broadly flat recovering in the second

six months of the year (H2) as the Group drove stronger used

vehicle margin.

New cars

New cars 2020 2019 Variance 2020 LFL 2019 LFL LFL variance

Retail unit

sales 46,665 59,212 (21.2%) 45,784 55,179 (17.0%)

------- -------- --------- --------- --------- -------------

Fleet unit

sales 39,890 53,694 (25.7%) 39,834 52,687 (24.4%)

------- -------- --------- --------- --------- -------------

Total unit

sales 86,555 112,906 (23.3%) 85,618 107,866 (20.6%)

------- -------- --------- --------- --------- -------------

Gross margin

% 6.4% 6.6% 6.4% 6.7%

------- -------- --------- --------- --------- -------------

The sale of new cars represented 26.6% (2019: 28.7%) of total

gross profit. The COVID-19 global pandemic had a material impact on

UK new car registrations during 2020. The start of lockdown during

March resulted in a market decline of 44.4%, before the full impact

was felt in April and May, with the market recording a decline of

97.3% and 89.0% respectively. This had a material impact on the

overall H1 new car market which declined by 48.5%. Against this on

a like-for-like basis, the Group's sale of new units declined by

45.2% representing a modest outperformance against the UK

market.

In H2 the new car market showed some recovery with UK new

vehicle registrations declining by 6.2% year-on-year. The Group's

new vehicle sales performance improved materially in H2,

benefitting from several operational initiatives and recording an

outperformance of the total market by 16.2%.

Used cars

Used cars 2020 2019 Variance 2020 LFL 2019 LFL LFL variance

Retail unit

sales 78,341 100,764 (22.3%) 76,968 94,629 (18.7%)

------- -------- --------- --------- --------- -------------

Gross margin

% 6.6% 5.9% 6.6% 6.1%

------- -------- --------- --------- --------- -------------

The sale of used cars represented 28.7% (2019: 26.9%) of total

gross profit. Like-for-like used unit sales declined by 18.7% which

is a resilient result given the serious disruption caused by

various lockdown restrictions throughout the year.

Gross margin was 0.7 percentage points ahead of 2019. In H1

gross margin was below last year's levels as the Group took active

measures to reduce overall used car stock levels and significantly

improve the ageing profile in response to the initial lockdown.

These measures together with an improved market and robust residual

values drove improved margin during H2.

We continue to focus on robust stock management and sourcing

good quality vehicles, both of which help to improve profitability.

The used car market remains of significant importance to our

business model and continues to represent a significant opportunity

for the Group. During the period we made several enhancements to

our business process's including unaccompanied test drives, a

number of online enhancements and contactless handover all of which

have helped mitigate the impact of lockdown restrictions and

provide a catalyst for permanent positive change.

Aftersales

Aftersales 2020 2019 Variance 2020 LFL 2019 LFL LFL variance

Revenue

GBPm 383.8 495.3 (22.5%) 378.0 470.0 (19.6%)

------ ------ --------- --------- --------- -------------

Gross margin

% 42.9% 42.8% 42.8% 42.2%

------ ------ --------- --------- --------- -------------

Aftersales is a key part of the Group and represented 40% (2019:

41.3%) of total gross profit. On a like-for-like basis aftersales

revenues were 19.6% down versus 2019. At the outset of lockdown,

the Group asked for volunteers from its technicians and parts teams

in order to maintain a presence at 41 aftersales locations

supporting key workers.

Our workshops remained fully operational throughout H2 operating

with upweighted COVID-19 secure protocols to protect both our

customers and colleagues. We implemented online service check-in

which has proved popular with customers and has helped to drive

productivity.

We continue to focus on increasing the penetration of service

plans. We now have 168,986 live service plan agreements, which is

up 5% on 2019. Service plan contracts are a strong retention tool

for the Group, creating a long lasting and sustainable relationship

with our customers.

We remain fully committed to our ongoing technician apprentice

scheme which has developed significantly over the past year.

Financial review

Financial performance

Despite operating against a backdrop of COVID-19 for the

majority of the year, the Board is pleased with the financial

performance of the business, recording an underlying profit before

tax* of GBP14.1m ahead of 2019 restated GBP4.0m and a profit before

tax of GBP2.0m (2019: restated loss of GBP45.7m).

The first half of the year was materially impacted by the

COVID-19 pandemic which led to the closure of the Group's

operations for a significant period. Despite this, restructuring,

strong cost control actions and the development of the Group's

omni-channel offering (including the launch of 'Click & Drive')

led to a resilient performance in the second half, underpinned by

significant outperformance of the retail UK new car market.

Revenue for the year was GBP3,699.9m which was 23.0% lower than

last year (restated GBP4,806.5m). Like-for-like* revenue declined

by 20.4% with revenue from new cars, used cars and aftersales all

impacted by the COVID-19 pandemic. In line with revenue, gross

profit decreased by GBP102.1m to GBP411.0m (2019: GBP513.1m). Gross

profit margin was higher than the prior year at 11.1% (2019: 10.7%)

largely as a result of strong used margins in the second half of

the year, driven by a buoyant market and robust residual

values.

Underlying net operating expenses at GBP368.0m (2019 restated:

GBP476.2m) were 22.7% below last year. The Group's Statement of

Consolidated Income includes the benefit of both a GBP34.9m receipt

from the Government's job retention scheme and GBP10.2m of rates

reductions under the Government's business rates holiday scheme.

Excluding these items, underlying net operating expenses were 14.6%

below last year as a result of ongoing focus and control of the

Group's cost base.

During the year, the Group's bank borrowings were based on a

floating rate linked to LIBOR. Net finance costs were slightly

below the prior year at GBP28.9m (2019: GBP32.9m). Given the

unprecedented COVID-19 situation, the Board made the decision to

make substantial drawings against the Group's revolving credit

facility and hold these sums in cash, creating an inefficient

liquidity position and increasing financing costs; however, this

was offset by lower interest cost on vehicle rental liabilities and

reduced stock levels.

Taxation

The Group's taxation charge for the year is GBP6.1m (2019:

credit of GBP3.9m) which is composite of a corporation tax credit

of GBP0.4m and a deferred tax charge of GBP6.5m. The Group's tax

charge is considerably higher this year as a result of a

significant increase in profits chargeable for taxation, capital

gains resulting from property disposals, and the revaluation of the

Group's deferred tax liabilities following the 11 March 2020 Budget

announcement that the standard rate of corporation tax would remain

at 19% instead of reducing to 17% from 1 April 2020. The current

tax recoverable recorded in the Group statement of financial

position has reduced from GBP9.8m to GBP1.1m following receipts

received from HMRC during the year.

*Alternative performance measures - see Note 15

Cash flow

The Group's net cash inflow from operating activities is

GBP37.8m (2019: restated GBP79.0m).

The prior year net cash inflow includes the benefit of increased

stocking funding in 2019 (from 81% in 2018 to 93% in 2019)

alongside a small delay in payments of trade and other payable

balances at the end of that year.

In 2020, we have seen the unwind of those 2019 year end actions

which did not repeat in 2020. We have also seen the continued focus

on working capital, in particular tighter controls around the

management of inventory and debtors. The year end Consolidated

Statement of Financial Position shows a significant year on year

reduction in inventory and debtors and we have also seen an

improvement in the ageing profiles. Stock funding at the balance

sheet date has remained consistent at 93%.

Property, plant and equipment capital expenditure totalled

GBP13.8m (2019: GBP45.8m) reflecting significantly lower spend as a

result of the COVID-19 pandemic as the Board took the decision to

delay and cancel certain initiatives in order to protect the cash

position of the Group.

The Group realised GBP18.0m from the disposal of freehold

properties during the year (2019: GBP17.6m) and continues to

benefit from its strong property portfolio. The net book value of

freehold and leasehold properties was GBP301m (equivalent to 77

pence per share) at the year-end.

Net debt* (excluding lease liabilities, vehicle rental

liabilities and stocking loans) at 31 December 2020 was GBP40.7m

(2019: GBP59.5m). This includes the benefit of GBP15.6m of deferred

VAT agreed under Government schemes.

Bank funding

At 31 December 2020, the Group had a revolving credit facility

(RCF) of GBP238m provided by five banks (The Bank of Ireland,

Barclays, HSBC, Lloyds and NatWest).

In May 2021, the Group agreed an amendment and extension to its

RCF, with the same banks. The amended RCF is for an initial GBP150m

and will expire on 30 September 2023. Under the amended facility,

interest is charged at a margin of between 3.25% and 4.25% (above

SONIA) based on the level of utilisation. The facility is subject

to quarterly covenant tests on leverage, interest cover and a

minimum EBITDA* per rolling twelve month period.

The Board has run a number of scenarios and stress tests in

order to test the appropriateness of these facilities and based on

the results of those tests, the Board supports the preparation of

the Annual Report & Accounts on a Going Concern basis (see

Basis of Preparation).

Dividends

As a result of the impact of the COVID-19 pandemic, the Board

previously communicated that it will not be recommending a

dividend for the year ended 31 December 2020.

The Board remains mindful of its relationships with, and

commitments to, all stakeholders and recognises the importance of

dividends to shareholders and will reinstate the payment of

dividends as soon as it believes that it is prudent to do so.

As noted in our 2019 Annual Report & Accounts, the Board has

become aware of an issue concerning technical compliance with the

2006 Act in relation to the payment of interim and final dividends

in 2013, 2014 and 2015. The effect of these irregularities is that

the interim and final dividends paid in 2013, 2014 and 2015 were

paid to shareholders at a time when the Company did not hold

adequate distributable reserves. However, there were sufficient

reserves held in subsidiaries of the Company which could have been

distributed to the Company in order to provide the Company with

adequate reserves.

To satisfy the steps required to rectify these irregularities,

the Company will put forward a resolution at the Company's

forthcoming General Meeting. The Company has put in place the

necessary controls and processes to ensure that a similar issue

will not reoccur.

Pension schemes

The Group has two defined benefit pension schemes, The Lookers

Pension Plan and The Benfield Motor Group Pension Plan. Both

schemes are closed to entry for new members and closed to future

accrual.

During June 2020 the former Dutton Forshaw Pension Plan trustees

resolved to transfer all remaining assets and liabilities to The

Lookers Pension Plan.

*Alternative performance measures - see Note 15

During the year the Group concluded its triennial valuation of

The Lookers Pension Plan and received approval from its lenders to

increase pension deficit payments to GBP12m plus expenses and PPF

levy, all subject to increases linked to CPI. The revised

contributions were effective from 1 July 2020.

The Group's triennial valuation of the Benfield Pension Plan was

concluded in February 2021 with a continuation of deficit

contributions of GBP0.3m plus expenses and PPF levy.

At 31 December 2020, the aggregate IAS 19 pension deficit is

GBP79.3m (31 December 2019: GBP55.7m). The year on year increase

arises as a result of the decrease in both corporate bond yields

and discount rate, which has been partly offset by an increase in

the schemes' asset values. The total actuarial loss on the Group's

defined benefit pension schemes in the year was GBP32.5m (2019:

gain of GBP7.1m).

Relatively small changes in the bases of valuation can have a

significant effect on the calculated deficit hence the movement in

the calculated deficit can be subject to high levels of

volatility.

Non-underlying items

The Group recorded net non-underlying costs of GBP12.1m during

the year. The Board has taken the view that each of the following

items relate to costs or income which are not incurred in the

normal course of business or due to their size, nature and

irregularity are not included in its assessment of financial

performance. Non-underlying items have been presented separately on

the face of the Statement of Total Comprehensive Income.

The principal items are as follows:

Restructuring costs and associated asset impairment

GBP12.5m.

During the year, the Board took decisive restructuring actions

to position the Group for a strong and sustainable future. This

included the identification of 12 sites (2019: 15) for either

closure, consolidation or refranchising. The Group now operates

from a portfolio of 150 dealerships.

The Board also undertook a review of the Group's operating model

in light of both its strategy and the structural changes taking

place across the industry. This led to 1,500 redundancies being

made. These costs are now complete.

Professional fees GBP9.2m

In our 2019 Annual Report & Accounts we detailed the

Accounts investigation. During the year, the Group incurred certain

professional fees in relation to procedures carried out by a number

of different advisory firms. These costs are now complete.

During 2020, and into 2021, the Group has continued to improve

its controls and governance and is making progress against the

remediation. To date the Group has:

-- Made progress in the formalisation of accounting policies,

processes and procedures, focussing initially on financial

reporting risk and judgemental areas

-- Restructured the Finance team and recruited a Group Financial Controller

-- Implemented a Financial Reporting attestation process for

senior financial and operational management

-- Continued to standardise the Group's Dealer Management System

with more dealerships now aligned to the Group's agreed

"blueprint."

Goodwill and intangible impairments GBP3.6m

In the first half of the year the Group made a non-cash

impairment charge of GBP2.6m against its Ford cash generating unit,

following a deterioration in market conditions. The Group also

fully impaired its Lomond brand in the second half of the year,

resulting in a noncash charge of GBP1.0m.

FCA provision GBP10.4m credit

In March 2021, the FCA advised the Board that it had decided to

close its investigation against Lookers Motor Group Ltd for the

possible mis-selling of regulated products between January 2016 and

June 2019. The FCA investigation was closed without applying any

sanction but noted several concerns relating to the historic

culture, systems and controls of the Group which the Board fully

accepted. The Group is satisfied that the FCA confirmation

represents an adjusting event after the balance sheet date as this

provides evidence that there was not an obligating event and have

therefore released the GBP10.4m provision - created in the 2019

Annual Report & Accounts - into non-underlying items in

2020.

Gain on property disposal GBP3.1m credit

Following the closure of 15 dealerships in 2019, and a further

12 this year, a number of freehold properties no longer required

within the Group have been disposed, generating a gain of

GBP3.1m.

Prior period adjustments - Group

(a) IFRS 16 leases

During the course of our year end procedures we identified a

number of leases which had been omitted in error from our IFRS 16

lease calculations. These omissions have a material impact on

balance sheets at 1 January 2019 and 31 December 2019. As a result,

and in line with IAS8, we have included this as a prior year

adjustment. The most significant impact of this adjustment on the

Group's 2019 Consolidated statement of financial position is an

increase in right of use assets and lease liabilities of GBP11.3m

and GBP12.8m respectively. Full details of this adjustment are set

out in Notes 1 and 11.

(b) Rental fleet vehicles

In addition, as part of our year-end procedures, we identified

that certain balances and transactions in the Group's Get Motoring

UK Limited subsidiary had been incorrectly treated in respect of

IFRS 16 in the Group's 20019 Annual Report & Accounts. Whilst

the impact of this is not material to the Group's Financial

Statements, the correct accounting treatment does impact the

classification and treatment of particular Financial Statement line

items and these have therefore been corrected. See Note 1 for

details.

Prior period adjustment - Company

Dividend receipts

In preparing subsidiary Financial Statements the Directors

identified a number of adjustments that had not been made in the

2019 Group Financial Statements and that impacted dividends paid by

these subsidiaries to Lookers plc in 2019 and prior. This has

required an adjustment to the Lookers plc Financial Statements. See

Note 1d.

Anna Bielby

Interim Chief Financial Officer

30 June 2021

Risk overview and management

Enterprise risk management framework

As with all organisations, Lookers is exposed to a wide range of

risks, both internal and external, as part of our on-going

activities. The identification and management of those risks is

integral to the achievement of our long-term goals which rely on

our ability to identify and control those things that can hurt us

and exploit opportunities that arise, both within our business and

the wider market. We identify risks and assess the effectiveness of

our control environment on an ongoing basis through robust risk

management processes and reporting. As a part of this, we undertake

horizon scanning to identify emerging risk, maintain ongoing

dialogue with the business, provide management information to the

Executive and the Board and keep up to date with developments in

the automotive sector and wider economy. To assist, we have

developed an Enterprise Risk Management Framework (ERMF) designed

to deliver a common language that helps us define and categorise

the risks that we face. It sets the high-level principles and

underpinning minimum requirements for the identification,

assessment, management and monitoring of each of those risk

categories in line with Lookers' defined risk appetite.

Three lines of defence

Lookers applies a "three lines of defence" governance model

across its business. The principal aim of this model is to ensure

that Lookers exercises ownership of risk in the first line of

business functions, and independent oversight and challenge of

those risks and their management by its second line departments

(Risk and Compliance). Internal Audit (the third line) are in place

to provide independent assurance to the Board of the effectiveness

of our controls. In summary the accountabilities between lines are

split as follows:

-- The first line of defence (the business) are accountable for

owning, taking and managing the risk

-- The second line of defence (Risk and Compliance) operate

independently of the first line. They do not own the risk but

instead independently oversee, advise and challenge the first line

activity

-- The third line of defence (Internal Audit) provide

independent assurance to the Board of the controls

Risk appetite framework

Our risk appetite framework defines the level of risk we are

willing to take across the different risk categories and allows us

to track mitigating action when our tolerance metrics suggest that

we are moving away from where we want to be. Risk appetite is key

for our decision-making process, including ongoing business

planning, new products approvals and business change

initiatives.

In setting the risk appetite, the Board outlines the "tone from

the top" and provides a basis for ongoing dialogue between

management and Board with respect to our current and evolving risk

profile, allowing strategic and financial decisions to be made on

an informed basis.

Financial reporting

The Executive Directors oversee the preparation of the Group's

annual corporate plan; the Board reviews and approves it and

monitors actual performance against it on a monthly basis. When

deemed appropriate, revised forecasts are prepared and presented

for Board review and approval. To ensure that information

consolidated into the Group's financial statements is in compliance

with relevant accounting standards and the Group's own accounting

policies, internal reporting data is reviewed regularly.

The Audit and Risk Committee reviews the appropriateness of the

Group's accounting policies each reporting period. The Audit and

Risk Committee considers reports from Executive Management,

Internal Audit, the Risk and Compliance teams and the Group's

external auditor, the application of IFRS and the reliability of

the Group's system of control over financial reporting.

During 2020 the Group's control environment has continued to

evolve, including internal controls over financial reporting. The

Financial Risk Policy and supporting Policy Standards have been

further developed. A review of the underpinning processes and

procedures has been undertaken and documented, including a

strengthened balance sheet reconciliation process and a dedicated

risk and control register. In addition, the Finance function has

been strengthened with an enhanced operating model introduced

across the period.

The Board continues to oversee a programme of work to further

enhance finance controls. These enhancements address the issues

previously identified in the Financial Review.

Controls have been designed to ensure that the Group's financial

reporting presents a true and fair reflection of the Group's

financial position. Many of these improvements have been

implemented although the process of further improving controls will

continue during 2021.

Principal risks and uncertainties

Appreciating that the operation of any business entails an

element of risk, the Board maintains a policy of continuous

identification, management and review of risks which may threaten

the achievement of our strategic objectives.

These risks are those that could cause the greatest damage if

not effectively identified, assessed and managed. The Board keeps

the Group's risk appetite under periodic review in light of

changing market conditions and the Group's performance and

strategic focus.

Directors' responsibilities statement

The Directors confirm to the best of their knowledge:

-- The Financial Statements have been prepared in accordance

with the applicable set of accounting standards and Article 4 of

the IAS Regulation and give a true and fair view of the assets,

liabilities, financial position and profit and loss of the Group

and Company.

-- The Annual Report & Accounts includes a fair review of

the development and performance of the business and the financial

position of the Group and Company, together with a description of

the principal risks and uncertainties that they face.

-- The Annual Report & Accounts, taken as a whole, are fair,

balanced and understandable and provide the information necessary

for shareholders to assess the Group's position and performance,

business model and strategy.

This responsibility statement was approved by the Board of

Directors and is signed on its behalf by:

Mark Raban

Chief Executive Officer

30 June 2021

Basis of preparation

The financial information presented in this preliminary

announcement is extracted from, and is consistent with, the Group's

audited financial statements for the year ended 31 December 2020.

The financial information set out below does not constitute the

Company's statutory financial statements for the periods ended 31

December 2020 or 31 December 2019 but is derived from those

financial statements. Statutory financial statements for 2020 will

be delivered following the Company's annual general meeting. The

auditors have reported on those financial statements; their report

was unqualified and did not contain a statement under section

498(2) or (3) of the Companies Act 2006.

The financial information in this announcement has been

extracted from the Group's Annual Report and Accounts for the year

ended 31 December 2020 and is prepared in accordance with

international accounting standards in conformity with the

requirements of the Companies Act 2006 and with International

Financial Reporting Standards (IFRS) adopted pursuant to Regulation

(EC) No 1606/2002 as it applies in the European Union. Whilst the

financial information included in this preliminary announcement has

been computed in accordance with IFRS, this announcement does not

itself contain sufficient information to comply with IFRS and the

financial information set out does not constitute the Company's

statutory accounts for the current or prior year.

Going concern

The Directors have considered the future prospects and

performance of the Group and have made an assessment of going

concern considering the Group's cash and liquidity position,

current performance and outlook, which assessed the restrictions

put in place by the UK Government to control the impact of the

COVID-19 pandemic, using the information available up to the date

of issue of the financial statements.

During the lockdown restrictions throughout 2020 and 2021,

management worked closely with its key OEM Brand Partners, who have

positively supported the business and are continuing to do so.

Management has continued to take action to protect the balance

sheet and cash flow including accepting UK Government support

measures including the Coronavirus Job Retention Scheme and the

Expanded Retail Discount 2020/21 for business rates in addition to

other self-help measures through a significant cost reduction

programme, the deferral of capital expenditure, identification of

property assets available for sale and cessation of the FY20

dividend.

Additionally, management has taken a number of longer term

actions to protect cash including continued investment in the

development of the Group's end-to-end online ordering capability

through the use of Click & Drive, a comprehensive review of

working capital management, and changed operational practices to

de-risk the intra-month cash requirements.

At the date of approval of the consolidated Financial

Statements, the UK is returning to some level of normality as

lockdown restrictions are eased, however the Directors are

cautiously monitoring the potential impact for future disruption.

The UK Government is very well progressed in the roll out of the

vaccination programme which should help the UK manage the future

impact from the pandemic.

Banking facilities and funding position

As at 31 December 2020 the Group had GBP238m of committed

revolving credit facilities due to expire on 31 March 2022. In

recognition of the trading uncertainty through 2020 the financial

covenants were renegotiated and included a suspension of the

interest cover ratio and replacement with EBITDA and Liquidity

covenants. The Group has satisfied each of those financial

covenants.

The Group's revolving credit facilities were successfully

renegotiated with its existing Banking Club in May 2021, for an

initial amount of GBP150m and with an extension to September 2023.

The profitability and cash generation of the Group has rebased the

size of facility required to support the ongoing working capital

needs of the Group following the restructuring of operations and

reduced footprint of the Group and closure of sites in 2020. The

amended facilities return to more normal covenant tests including

core leverage, interest cover and EBITDA testing on a quarterly

basis with effect from June 2021.

The Group has not made use of any borrowing under the COVID-19

Corporate Financing Facility or the Coronavirus Large Business

Interruption Loan Scheme.

In addition to the revolving credit facility, the Group has

stocking funding lines which were utilised at GBP210.0m as at 31

December 2020 (2019: GBP337.1m).

Assessment of the Group's financial position

The Group experienced significant disruption as a result of the

impact of the COVID-19 pandemic, the details of which are set out

in the Operating Review and the Financial Review.

The Directors have considered the potential impact of ongoing

measures to manage the impact of COVID-19 pandemic and considered

the possible medium term-risks on the macroeconomic impact the

restrictions could have on the UK economy across the period to June

2022. The Directors have also considered the potential disruption

to supply of new vehicles following the worldwide shortage of

semiconductor chips.

Management has modelled a number of adverse scenarios to assess

the potential impact that COVID-19 and possible stock shortages may

have on the Group's operations in addition to the scenarios

discussed in the Viability Statement. The Directors acknowledge

that there remains uncertainty regarding the timing of a full

return to the UK economic activity following the easing of

restrictions in the UK and the potential for some further

disruption to the UK economy. The Group has demonstrated

significant resilience to issues faced during 2020.

The business has adapted to a new omni-channel operating

platform and has shown great resilience to the issues faced in 2020

and 2021. This is underpinned by a strong balance sheet which has

been reinforced by the renegotiation of the core funding

facilities. The support received from OEM Brand Partners, the UK

Government and other key partners has contributed to a strong

financial position and places the Group in a strong position to

manage its way through other future potential disruptions.

The conclusion of a trade deal between the UK and the EU has

created more confidence with supply chains. The impact of Brexit

has thus far been immaterial and the Directors do not expect it to

cause any material impact to the supply chain or cause any issues

with access to skilled labour.

To support the assessment of the Group's ability to continue as

a going concern, the Directors have modelled a Base Case and three

downside scenarios as follows.

-- A medium-term downside scenario, where further lockdown

measures occur in quarter 4 of 2021 followed by a recession in the

first half of 2022 caused by macro-economic conditions.

-- A medium-term downside scenario, where potential stock

restrictions are caused by the impact of semiconductor chip

shortages. This sensitivity reduces volumes of new, used and fleet

sales from September 2021 to March 2022. This would be partly

offset by a reduction in operating costs. Normal trading

performance is expected to resume from April 2022. As this

potential issue continues to evolve, a second more severe

sensitivity was run to further test the Group's resilience. The

additional sensitivity reduces volumes of new and fleet volumes

further and extends the downturn out to June 2022. This is partly

offset by an increase in used volumes - though these are still

below the Base Case - and reflects both slightly stronger gross

margins and a modest reduction in operating costs.

-- A reverse stress test scenario, which is designed to breach

either liquidity or financial covenants. This scenario is driven

from Base Case and sensitises a reduction in vehicles sales volumes

and aftersales revenue only from April 2021. The scenario assumes a

constant reduction in aftersales revenues from April 2021 and

various reductions in vehicle volumes at increments over the period

to June 2022. It does not reflect any mitigating actions which the

Board could take.

In each of the scenarios the Directors have assumed that

property disposals between May 2021 and June 2022 are postponed and

therefore increase the net debt by the same value. Throughout 2020

and despite the impact of COVID-19, Management achieved several

surplus property disposals with a net profit to book value. Under

the base case and medium-term downside scenarios, the Group is

forecast to comply with the financial covenants set out in its

funding agreements and operate comfortably within its banking

facility limits. The Government has reacted to the impact of

COVID-19 by initiating demonstrable financial support to the

macro-economy and implemented a world leading roll out of the

vaccine.

The Group has equally reacted well to previous COVID-19

lockdowns as demonstrated by the performance in the four months to

April 2021, where the Group has consistently outperformed the

market.

The reverse stress test scenario models a decrease in sales

volumes and aftersales revenues not factoring in management taking

any significant mitigating actions. If the Group experienced a

significant reduction in aftersales or vehicle sales revenue, the

Board would take a series of actions to protect the business as

evidenced in 2020.

Based on the findings above, the Directors are confident in the

scenarios tested that there are no liquidity issues and that any

potential breaches in financial covenants can reasonably be

prevented or avoided through mitigating actions, as we have

demonstrated very well in 2020.

In view of the various sensitivities and additional stress

testing, the Board concludes that preparing the accounts on the

basis of Going Concern is appropriate.

Statement of Total Consolidated Comprehensive Income

For the year ended 31 December 2020 and

31 December 2019

Restated*

2020 2019

Note GBPm GBPm

Revenue 2 3,699.9 4,806.5

================================================== ===== ========== ==========

Cost of sales (3,288.9) (4,293.4)

================================================== ===== ========== ==========

Gross profit 411.0 513.1

================================================== ===== ========== ==========

Net operating expenses (380.1) (525.9)

================================================== ===== ========== ==========

Operating profit/(loss) 30.9 (12.8)

-------------------------------------------------- ----- ========== ==========

Underlying operating profit 43.0 36.9

Non-underlying items 3 (12.1) (49.7)

-------------------------------------------------- ----- ---------- ----------

Finance costs 4 (28.9) (32.9)

================================================== ===== ---------- ----------

Profit/(loss) before taxation 2.0 (45.7)

================================================== ===== ---------- ----------

Underlying profit before taxation 14.1 4.0

Non-underlying items 3 (12.1) (49.7)

-------------------------------------------------- ----- ---------- ----------

Tax (charge)/credit 5 (6.1) 3.9

================================================== ===== ========== ==========

Loss for the year (attributable to shareholders

of the Company) (4.1) (41.8)

================================================== ===== ---------- ----------

Exchange differences on translation of

foreign operation (may be recycled to profit

and loss)** 0.3 (0.4)

Actuarial (losses)/gains on pension scheme

obligations (not recycled to profit and

loss) (32.5) 7.1

================================================== ===== ========== ==========

Deferred tax on pension scheme obligations

(not recycled to profit and loss) 7.3 (1.2)

================================================== ===== ---------- ==========

Total other comprehensive (expense)/income

for the year (24.9) 5.5

================================================== ===== ========== ==========

Total comprehensive expense for the year

(attributable to shareholders of the Company) (29.0) (36.3)

================================================== ===== ========== ==========

Loss per share:

================================================== ===== ========== ==========

Basic loss per share (p) 7 (1.05) (10.74)

================================================== ===== ========== ==========

Diluted loss per share (p)*** 7 (1.05) (10.74)

================================================== ===== ========== ==========

*See Note 1 for details.

** In the year ended 31 December 2019 the exchange difference

loss of GBP0.4m was incorrectly disclosed directly in equity.

*** In the years ended 31 December 2020 and 31 December 2019

the basic and diluted earnings per share are equal as a result

of the Group incurring a loss for the year.

Consolidated and Company Statements

of Financial Position

As at 31 December 2019 and 31 December

2020

Group Restated Restated Company Restated Restated

2020 * 2019 * 2018 2020 * 2019 * 2018

Note GBPm GBPm GBPm GBPm GBPm GBPm

============================= ===== ======== ========= ========= ======== ========= =========

Non-current assets

===================================== ======== ========= ========= ======== ========= =========

Goodwill 8 79.3 81.9 111.7 - - -

============================== ===== ======== ========= ========= ======== ========= =========

Intangible assets 9 110.8 114.2 113.4 11.1 13.5 12.0

============================== ===== ======== ========= ========= ======== ========= =========

Property, plant

and equipment 10 399.9 429.2 416.8 0.7 0.8 0.9

============================== ===== ======== ========= ========= ======== ========= =========

Right of use assets 11 117.6 119.0 110.6 0.8 1.1 1.2

============================== ===== ======== ========= ========= ======== ========= =========

Investment in subsidiaries - - - 126.8 126.8 126.8

============================== ===== ======== ========= ========= ======== ========= =========

Deferred tax assets - - - 14.2 9.5 12.2

============================== ===== ======== ========= ========= ======== ========= =========

707.6 744.3 752.5 153.6 151.7 153.1

===================================== ======== ========= ========= ======== ========= =========

Current assets

===================================== ======== ========= ========= ======== ========= =========

Inventories 12 655.2 956.5 972.9 - - -

============================== ===== ======== ========= ========= ======== ========= =========

Trade and other

receivables 124.6 168.3 182.6 327.4 356.1 399.3

============================== ===== ======== ========= ========= ======== ========= =========

Current tax

receivable 1.1 9.8 - 3.4 11.7 8.8

============================== ===== ======== ========= ========= ======== ========= =========

Rental fleet vehicles 30.1 32.0 32.9 - - -

============================== ===== ======== ========= ========= ======== ========= =========

Cash and cash equivalents 243.0 150.3 152.8 0.1 17.4 19.2

============================== ===== ======== ========= ========= ======== ========= =========

Assets held for

sale 13.0 10.0 8.0 - - -

============================== ===== ======== ========= ========= ======== ========= =========

1,067.0 1,326.9 1,349.2 330.9 385.2 427.3

===================================== ======== ========= ========= ======== ========= =========

Total assets 1,774.6 2,071.2 2,101.7 484.5 536.9 580.4

===================================== ======== ========= ========= ======== ========= =========

Current liabilities

===================================== ======== ========= ========= ======== ========= =========

Bank loans and overdrafts 116.9 119.4 110.0 36.5 40.6 25.9

============================== ===== ======== ========= ========= ======== ========= =========

Trade and other

payables 911.8 1,261.5 1,220.4 61.1 149.2 139.1

============================== ===== ======== ========= ========= ======== ========= =========

Lease liabilities 19.1 20.1 19.8 0.5 0.7 0.6

========= ========= ======== ========= =========

Current tax payable - - 3.3 - - -

===================================== ======== ========= ========= ======== ========= =========

1,047.8 1,401.0 1,353.5 98.1 190.5 165.6

===================================== ======== ========= ========= ======== ========= =========

Net current assets/(liabilities) 19.2 (74.1) (4.3) 232.8 194.7 261.7

===================================== -------- --------- --------- ======== ========= =========

Non-current liabilities

===================================== ======== ========= ========= ======== ========= =========

Bank loans 166.8 90.4 128.7 158.4 81.4 118.7

============================== ===== ======== ========= ========= ======== ========= =========

Trade and other

payables 39.8 42.3 39.3 - - -

============================== ===== ======== ========= ========= ======== ========= =========

Lease liabilities 125.3 126.8 117.0 0.4 0.4 0.6

============================== ===== ======== ========= ========= ======== ========= =========

Provisions 13 - 10.4 - - - -

============================== ===== ======== ========= ========= ======== ========= =========

Pension scheme obligations 79.3 55.7 68.9 77.0 56.6 69.4

============================== ===== ======== ========= ========= ======== ========= =========

Deferred tax liabilities 33.2 34.0 33.0 - - -

============================== ===== ======== ========= ========= ======== ========= =========

444.4 359.6 386.9 235.8 138.4 188.7

===================================== ======== ========= ========= ======== ========= =========

Total liabilities 1,492.2 1,760.6 1,740.4 333.9 328.9 354.3

===================================== ======== ========= ========= ======== ========= =========

Net assets 282.4 310.6 361.3 150.6 208.0 226.1

===================================== ======== ========= ========= ======== ========= =========

Shareholders' equity

===================================== ======== ========= ========= ======== ========= =========

Ordinary share capital 19.5 19.5 19.4 19.5 19.5 19.4

============================== ===== ======== ========= ========= ======== ========= =========

Share premium 78.4 78.4 78.4 78.4 78.4 78.4

===================================== ======== ========= ========= ======== ========= =========

Capital redemption

reserve 15.1 15.1 15.1 15.1 15.1 15.1

============================== ===== ======== ========= ========= ======== ========= =========

Retained earnings 169.4 197.6 248.4 37.6 95.0 113.2

===================================== ======== ========= ========= ======== ========= =========

Total equity 282.4 310.6 361.3 150.6 208.0 226.1

===================================== ======== ========= ========= ======== ========= =========

The loss after tax for the Company was GBP33.9m (2019: restated

loss of GBP9.3m). The financial statements of Lookers plc, registered

no. 111876 were approved by the Directors on 30 June 2021.

Signed on behalf of the Board of Directors

M. D. Raban

Director

Consolidated Statement of Changes

in Equity

As at 1 January 2019, 31 December 2019 and 31 December

2020

Capital

Share Share redemption Retained Total

capital premium reserve earnings equity

Year ended 31 December 2019 Note GBPm GBPm GBPm GBPm GBPm

--------------------------------- ===== ========= ========= ============ ========== ========

As at 1 January 2019 19.4 78.4 15.1 249.0 361.9

========= ========= ============ ==========

Correction of errors* - - - (0.6) (0.6)

--------------------------------- ----- --------- --------- ------------ ---------- --------

As at 1 January 2019 (restated) 19.4 78.4 15.1 248.4 361.3

================================= ===== ========= ========= ============ ========== ========

Loss for the year (restated) - - - (41.8) (41.8)

================================= ===== ========= ========= ============ ========== ========

Total other comprehensive

income for the year - - - 5.5 5.5

--------------------------------- ----- --------

Total comprehensive expense

for the year (restated) - - - (36.3) (36.3)

========= ========= ============ ========== ========

New shares issued 0.1 - - - 0.1

================================= ===== ========= ========= ============ ========== ========

Share based compensation - - - 1.4 1.4

================================= ===== ========= ========= ============ ========== ========

Dividends paid 6 - - - (15.9) (15.9)

========== ========

As at 31 December 2019 19.5 78.4 15.1 197.6 310.6

================================= ===== ========= ========= ============ ========== ========

Year ended 31 December 2020

---------------------------------

As at 1 January 2020 19.5 78.4 15.1 197.6 310.6

================================= ===== ========= ========= ============ ========== ========

Loss for the year - - - (4.1) (4.1)

================================= ===== ========= ========= ============ ========== ========

Total other comprehensive

expense for the year - - - (24.9) (24.9)

--------------------------------- ----- --------- --------- ------------ ---------- --------

Total comprehensive expense

for the year - - - (29.0) (29.0)

===== ========= ========= ============ ========== ========

Share based compensation - - - 0.8 0.8

================================= ===== ========= ========= ============ ========== ========

As at 31 December 2020 19.5 78.4 15.1 169.4 282.4

================================= ===== ========= ========= ============ ========== ========

*Opening reserves at 1 January 2019 have been restated by GBP0.6m

and the loss for the year in the year ended 31 December 2019

has been restated by GBP0.2m in relation to corrections to lease

accounting entries in one of the Group's subsidiaries and following

further adjustments in relation to the adoption of IFRS 16.

Retained earnings include GBP16.5m (2019: GBP16.5m) of non-distributable

reserves relating to properties which had been revalued under

UK GAAP, but treated as deemed cost under IFRS.

Consolidated Statement of Cash Flows

For the year ended 31 December 2020

and 31 December 2019

2020 2019 (restated)

Note GBPm GBPm

===== ======== ================

Cash flows from operating activities

============================================== ===== ======== ================

(Loss) for the year (4.1) (41.8)

============================================== ===== ================

Tax charge/(credit) 6.1 (3.9)

============================================== ===== ================

Depreciation of property, plant and

equipment, rental fleet and right

of use assets 51.2 52.3

============================================== ===== ================

Profit on disposal of property, plant

and equipment (3.1) . (4.9)

============================================== ===== ================

Gain on lease surrenders (1.2) (0.4)

============================================== ===== ================

Gain on disposal of right of use asset

associated with rental fleet vehicles (1.9) (3.3)

============================================== ===== ================

Amortisation of intangible assets 4.8 6.1

============================================== ===== ================

Share based compensation 0.8 1.4

============================================== ===== ================

Impairment of property, plant and

equipment 5.0 4.3

============================================== ===== ================

Impairment of right of use assets 0.4 1.8

============================================== ===== ================

Impairment of intangible assets (underlying) - 0.4

============================================== ===== ================

Impairment of goodwill and intangible

assets (non-underlying) 3.6 30.4

============================================== ===== ================

Finance costs excluding pension related

finance costs and debt issue costs 4 27.3 30.6

============================================== ===== ================

Debt issue costs 4 0.5 0.4

============================================== ===== ================

Difference between pension charge

and cash contributions (8.9) (6.1)

============================================== ===== ================

Purchase of rental fleet vehicles (21.8) (17.4)

============================================== ===== ================

Purchase of right of use assets associated

with rental fleet vehicles (1.9) (3.3)

============================================== ===== ================

Purchase of vehicles for long term

leasing (27.8) (35.5)

============================================== ===== ================

Changes in provisions 13 (10.4) 10.4

============================================== ===== ================

Changes in inventories 355.1 57.4

============================================== ===== ================

Changes in receivables 43.4 14.7

============================================== ===== ================

Changes in payables (359.8) 25.3

============================================== ===== ================

Cash generated from operations 57.3 118.9

============================================== ===== -------- ----------------

Finance costs paid (21.2) (24.3)

============================================== ===== ================

Finance costs paid - finance leases (6.1) (6.3)

============================================== ===== ================

Tax refunded/(paid) 7.8 (9.3)

============================================== ===== ================

Net cash inflow from operating activities 37.8 79.0

============================================== ===== -------- ----------------

Cash flows from investing activities