Louis Vuitton, Dior Cushioned LVMH Sales in Luxury Slump

15 Ottobre 2020 - 7:56PM

Dow Jones News

By Matthew Dalton

LVMH Moet Hennessy Louis Vuitton SE said strong growth at its

biggest fashion brands buoyed revenue in the third quarter, partly

offsetting steep declines in other segments of the conglomerate's

luxury empire that have been slammed by the coronavirus

pandemic.

Revenue at the French conglomerate's fashion and leather goods

division, which includes Louis Vuitton and Dior, rose 12% compared

to a year ago. Sales of Hennessy Cognac held steady, driven by

strong consumption in the U.S.

But LVMH's other business fared badly, pulling down overall

revenue 7% to EUR11.96 billion ($13.99 billion). A dearth of

festive occasions hurt the conglomerate's champagne business, which

includes Dom Perignon and Moet & Chandon. A sharp drop in air

travel slammed DFS, LVMH's travel retail division.

And revenue at its watches and jewelry division was down 14%.

The decline could have implications for the legal battle that LVMH

is waging with Tiffany & Co. over its soured deal to buy the

U,S. jeweler. LVMH in court filings has argued that the pandemic

has been particularly damaging for Tiffany, causing a material

adverse change in the business that would allow the French

conglomerate to back out of the merger.

Tiffany, in an unexpected announcement Thursday before LVMH's

results, said its revenue fell "slightly" in August and September

compared to a year ago, and operating earnings rose 25%. Tiffany's

announcement was meant to refute LVMH's argument that the pandemic

has fundamentally damaged Tiffany's business, a person close to

Tiffany said.

"We are very pleased with the way the business has rebounded

following the first quarter and continues to rebound in the third

quarter, especially in Mainland China, and to recover in the United

States," Tiffany Chief Executive Alessandro Bogliolo said.

Jean Jacques Guiony, LVMH's chief financial officer, said the

conglomerate's watches and jewelry brands, including Bulgari and

Tag Heuer, suffered from Chinese and other Asian travellers being

stuck at home, where they are less likely to splurge than when on

trips abroad. Those brands aren't as strong among Western clients

as LVMH's big fashion brands, Mr. Guiony said.

"We lost a big chunk of the touristic business," he said. "We

didn't have the boost of the local client bases, which are less

well-developed than they are at Louis Vuitton and Dior."

Bulgari has been so successful in Asia, the Middle East and

Russia that the brand has focused less on cultivating clients in

Western Europe, Mr. Guiony said. "It's clear the current situation

means we need to do that as well," he said.

(END) Dow Jones Newswires

October 15, 2020 13:41 ET (17:41 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

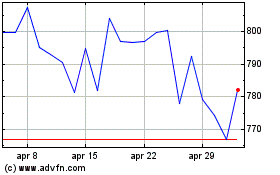

Grafico Azioni Lvmh Moet Hennessy Louis... (EU:MC)

Storico

Da Mar 2024 a Apr 2024

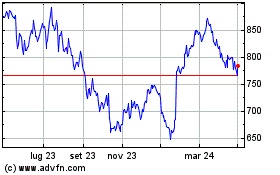

Grafico Azioni Lvmh Moet Hennessy Louis... (EU:MC)

Storico

Da Apr 2023 a Apr 2024