Lysol Maker Seeks to Ease Virus Concerns in Planes and Hotels -- WSJ

29 Luglio 2020 - 9:02AM

Dow Jones News

By Saabira Chaudhuri

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (July 29, 2020).

Lysol maker Reckitt Benckiser Group PLC is capitalizing on

booming interest in hygiene during the pandemic, launching a new

business selling its cleaning products and expertise to the travel

and hospitality industries.

The British company, which also makes Dettol soap, Finish

dishwasher tablets and Harpic toilet cleaner, said Tuesday the

preoccupation with cleaning had fueled a surge in second-quarter

sales. Now, it is trying to move quickly to position itself as a

hygiene expert and leverage Lysol's brand recognition with a new

professional-services business.

Companies across the hard-hit travel and hospitality industries,

struggling to woo anxious customers, have started touting their new

cleaning rituals as reassurance. Hilton Worldwide Holdings Inc.,

Delta Air Lines Inc. and Avis Budget Group Inc. are among those

that have partnered with Lysol in the U.S. to launch -- and

advertise -- cleaning programs. Outside the U.S., Reckitt has

struck similar partnerships with Uber Technologies Inc. in

Australia and Saudi Arabia's state-owned Saudia Airlines under the

Dettol brand.

"They come to brands like this to provide a stamp of approval,"

Reckitt Chief Executive Laxman Narasimhan said of the company's new

corporate customers. He declined to outline how big he thinks the

new professional-services business could grow.

For the second quarter, sales in Reckitt's hygiene arm rose

19.4% on a like-for-like basis from the year earlier. The gain was

driven by North America, where Lysol sales jumped over 70%.

The boom in demand for cleaning products -- also seen by rivals

Unilever PLC and Clorox Co. -- is a welcome boost for Reckitt,

which has struggled in recent years with volatile revenue growth,

narrowing margins and a series of one-off mishaps that led some

investors to question its business model. Now, the pandemic is

opening new windows of opportunity.

Mr. Narasimhan said Reckitt is investing in its hygiene

operations in once-ignored markets, including accelerating the

launch of Lysol in Brazil by three months. He expects demand for

Lysol and Dettol to remain higher than pre-pandemic levels and said

the company would spend an additional GBP100 million ($128.8

million) on expanding manufacturing capabilities.

"When behaviors are cemented for 60 days they do become embedded

in our daily lives," said Mr. Narasimhan.

Reckitt, like Unilever, has spent years trying to encourage

consumers to wash their hands and clean more. Earlier this month,

Reckitt said it would invest GBP25 million over several years to

create a public-health research institute to generate practical,

scientific research around hygiene intended to inform behavior

change.

The company also said Tuesday it would invest GBP100 million in

tapping new growth opportunities, including building out a sales

team to sell its disinfectants to more corporate customers. The

head of the company's North American hygiene business will switch

roles to lead the new professional-services business in

September.

Under the Delta deal, the U.S. airline will buy Lysol sprays and

wipes, as well as work with the cleaning brand to gather consumer

insights to help develop new disinfectants and protocols for use at

airports and on flights. The companies will start by focusing on

disinfecting airplane lavatories and plan to develop cleaning

routines for departure gates and airport lounges.

"The lavatory is a big source of concern for a lot of people,"

said Mr. Narasimhan, noting that lavatories are typically cleaned

before takeoff but often neglected during a flight.

Hilton has been publicizing a cleaning program it says it has

rolled out to 6,100 properties across 18 brands, intended to

demonstrate to guests that rooms, restaurants and gyms are being

thoroughly cleaned. Hilton's Chief Financial Officer Kevin Jacobs

last month said using Lysol was a way for the hotel chain to drive

customer loyalty and win market share. "The customer says, okay, I

like the way Hilton is doing this and so I'm going to preference

Hilton," he told an investor conference.

Mr. Narasimhan said Hilton is placing Lysol and Dettol cleaning

products at check-in desks and in rooms, and putting stickers on

bed sheets that say rooms have been cleaned according to standards

developed by Lysol.

Overall, Reckitt reported a first-half profit of GBP1.08

billion, up from GBP112 million a year earlier when results were

dragged down by a settlement with the Justice Department tied to

the company's former pharmaceuticals business. Net revenue for the

six months came in at GBP6.91 billion, up 10.8% from a year

earlier.

Reckitt's health arm -- which includes Mucinex cold medicine and

Nurofen painkillers -- reported second-quarter sales growth of 5%

on a like-for-like basis.

The company said it expects high-single-digit revenue growth for

the full year, an update on previous guidance that it expected

revenue to be better than the previous year.

However, some analysts cast doubt on whether the company can

continue its hot streak next year as it comes up against this

year's strong sales. "RB are having a great year there is no doubt,

but we expect longer term questions to resurface," said Jefferies

analyst Martin Deboo.

Write to Saabira Chaudhuri at saabira.chaudhuri@wsj.com

(END) Dow Jones Newswires

July 29, 2020 02:47 ET (06:47 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

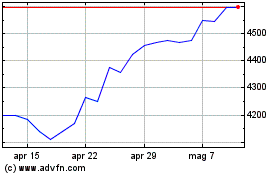

Grafico Azioni Reckitt Benckiser (LSE:RKT)

Storico

Da Mar 2024 a Apr 2024

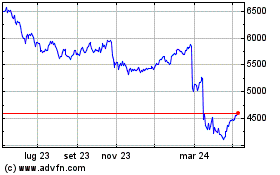

Grafico Azioni Reckitt Benckiser (LSE:RKT)

Storico

Da Apr 2023 a Apr 2024