TIDMMKS

RNS Number : 8041O

Marks & Spencer Group PLC

03 June 2020

Marks and Spencer Group plc (the "Company")

Annual Report and Financial Statements 2020

In compliance with Listing Rule 9.6.1, the Company announces

that the following documents have today been submitted to the UK

Listing Authority, and will shortly be available for inspection via

the National Storage Mechanism at

https://data.fca.org.uk/#/nsm/nationalstoragemechanism:

-- Annual Report and Financial Statements 2020;

-- Notice of Annual General Meeting of the Company, which will

be broadcast from Waterside House, 35 North Wharf Road, London W2

1NW at 11am on Friday 3 July 2020; and

-- Proxy forms for the 2020 Annual General Meeting.

In accordance with DTR 6.3.5(3) the Annual Report and Financial

Statements 2020 and the Notice of Annual General Meeting are

accessible on corporate.marksandspencer.com/investors .

A condensed set of Marks and Spencer Group plc financial

statements and information on important events that have occurred

during the year and their impact on the financial statements were

included in the Company's preliminary results announcement on 20

May 2020. That information together with the information set out

below which is extracted from the Annual Report and Financial

Statements constitute the requirements of DTR 6.3.5 which is to be

communicated via an RIS in unedited full text. This announcement is

not a substitute for reading the full Annual Report and Financial

Statements. Page and note references in the text below refer to

page numbers in the Annual Report and Financial Statements 2020. To

view the preliminary results announcement, visit the Company

website: corporate.marksandspencer.com/investors .

For further information, please contact:

Group Secretariat: +44 (0)20 3934 3043

Additional Information

Principal risks and uncertainties

Below are details of our principal risks and uncertainties and

the mitigating activities in place to address them. It is

recognised that the Group is exposed to risks wider than those

listed. However, we have disclosed those we believe are likely to

have the greatest impact on our business at this moment in time and

those that have been the subject of debate at recent Board or Audit

Committee meetings.

DESCRIPTION & CONTEXT MITIGATING ACTIVITIES

TRADING PERFORMANCE RECOVERY

A failure of our Food and/or * Continued to strengthen capabilities of our senior

Clothing & Home business to effectively leadership teams in both Food and Clothing & Home

and rapidly respond to the pressures through targeted recruitment.

of an increasingly competitive

and changing retail environment,

including the impact of Covid-19, * Established operating model consisting of a family of

would adversely impact customer accountable businesses who share M&S brand values,

experience, operational efficiency colleagues and support functions, technology and

and business performance. customer data.

M&S competes with a diverse range

of retailers - in both Food and

Clothing & Home - in an increasingly * Managing directors for each of these businesses who

challenged sector faced with have full accountability for their performance

continued cost and pricing pressures, including for marketing, supply chain, finance and

shifts in consumer behaviours technology.

and broader macroeconomic uncertainties.

Delivering the right product

ranges that appeal to our customers, * Individual Business Boards to enable executive

clear and simple pricing architecture oversight and effective governance of each business.

and availability are critical

to the growth of our business

In addition, Covid-19 has had, * Continued delivery against business-specific

and continues to have, a significant transformation plans incorporating discipline around

negative impact on our trading cost, prices, availability, value, ranges, broadening

performance in line with UK retail customer appeal and promotions across both

more widely. Managing the growth businesses.

in surplus stock resulting from

the lockdown is an area of business

focus. * Development, ongoing update and monitoring of

Delays in implementing the targeted business- specific planning for the business restore

transformational improvements, as future stages of the lockdown are communicated.

or the business recovery plans This includes development of a clear strategy to

in response to Covid-19, across manage the wide-ranging implications of the lockdown

the business could negatively period on all aspects of the Clothing & Home supply

impact business performance. chain and inventory management.

* Planned improvements to online trading by delivering

both the Ocado online launch in Food and our online

ambitions for Clothing & Home.

--------------------------------------------------------------

BUSINESS TRANSFORMATION

A failure to execute our business * Adoption of a 'Never the Same Again' approach to all

transformation and cultural change aspects of business operations and prioritisation of

initiatives with pace, consistency the most critical improvement initiatives.

and cross-business buy-in will

impede our ability to improve

operational efficiency and competitiveness. * Comprehensive review of all operational and capital

The business has continued to expenditure to allocate spending to those activities

deliver the range of projects aligned to the transformation agenda and stop others

underpinning the transformation, in view of Covid-19 priorities and recovery.

including:

* The reshaping, modernising and effective management

of a UK store estate that is fit for the future, with * Maintenance of programme governance principles for

the right stores in the right space, improved all ongoing projects.

integration between online and store sales and

shopping facilities expected by our target customer

groups. * Periodic independent audit reviews of key programme

delivery and reporting to the Audit Committee.

* Modernising our supply chain and logistics activities

to improve speed, operational effectiveness and * Maintaining momentum to deliver ongoing initiatives

availability and to reduce costs. to transform our supply chain capabilities in all

parts of the business. For example, in Food the

Vangarde supply chain programme has demonstrated

* Delivering our Digital First ambitions to improve improvements to food waste levels and availability.

customer experience, reduce costs and work smarter

across the business.

* Continued focus on the store estate transformation

with new initiatives like redevelopment of existing

In response to Covid-19, we will sites to make effective use of space, resetting

need to re-evaluate priorities rental rates with landlords and delivery of new

and their delivery, including format stores.

acceleration of initiatives to

respond to permanent changes

in customer behaviours or to

change our own working practices,

balancing delivery of the transformation

with strict cash management disciplines

and rapidly reacting to the consequences

of the pandemic.

A pause or delay to key components

of the business improvement programme

because of the virus response

or other reasons may delay delivery

of the transformation objectives.

--------------------------------------------------------------

LIQUIDITY AND FUNDING

Significantly reduced trading * Continued use of the existing committed facilities

over an extended and currently available to the business, including the GBP1.1bn

undetermined timeframe, combined revolving credit facility.

with an inability to effectively

manage expenditure against revised

targets, could impact the business's * Immediate measures implemented to manage cash and

ability to operate within and liquidity, including:

secure additional committed credit

facilities.

Availability of, and access to, * Freezing of discretionary spend

appropriate sources of funding

is required for core business

operations and the successful * Significant reduction in capital spending

and timely delivery of our transformation

plan. In addition, cash management

has additional complexity as * Dividend deferral

a consequence of the ongoing

trading restrictions during lockdown,

the associated reduction in cash * Temporary furlough of colleagues

generation and planning for the

impact of furloughing, deferral

of tax payments and other emergency * Enhanced controls over spending

measures.

Brexit adds a further dimension

to this risk because of the potential * Confirmation of our eligibility under the UK

impact on currency movements, government's CCFF scheme

corporate bond rates, changes

in credit regulations and the

extent of government support * Use of the business rates holiday, tax payment

of credit markets. deferral and other government support measures

An inability to maintain appropriate

short- and longer-term funding

to meet business needs (both * Formal agreement received from the syndicate of

operational and strategic), make lending banks to relax or waive covenant conditions

payments on debt and to effectively for our revolving credit facility.

manage associated risks, such

as significant fluctuations in

foreign currency or interest * Close monitoring and stress testing of projected cash

rate changes, may have an adverse and debt capacity, financial covenants and other

impact on business viability rating metrics.

and performance.

* Regular dialogue with the market and rating agencies.

* Review of counterparty credit risk and limits in line

with our risk appetite and treasury policy.

--------------------------------------------------------------

BREXIT

An inability to quickly identify * A cross-business working party is in place to

and effectively respond to the undertake scenario planning including financial and

challenges of a post-Brexit environment operational impact assessments and to consider and

could have a significant impact drive readiness requirements.

on performance across our business.

The potential implications of

the UK's exit from the European * Each of our family of businesses has undertaken a

Union are significant and include: risk assessment to prioritise and plan for the

* Deterioration in customer sentiment. operational changes they will need. Teams have

continued to progress planning during the current

pandemic lockdown.

* Operational complexity and cost due to restrictions

on the movement of goods and stricter border controls

(including the movement of goods between Great * Updates are provided to the Board and Audit Committee

Britain and Northern Ireland). outlining risks and actions being undertaken.

* Costs passed through from our suppliers. * We are engaged with the government and industry

bodies to represent M&S's views, including the UK

Border Development Group with access to the

* Continuity of supply and supplier viability. Department for Environment, Food & Rural Affairs

(Defra), HM Revenue & Customs (HMRC) and the Food

Standards Agency (FSA) to support operational

* Import and export duties. planning.

* Volatility in currency and corporate bond rates.

* Tightening of the labour market.

* Additional regulatory responsibilities and costs.

* Increased complexity and cost in our international

operations, including our franchise activities.

While an orderly exit following

the end of the transitional period

would allow business planning

to more effectively address the

consequences of change against

a defined timeframe, the level

of change required as part of

any deal is yet unclear. A no

deal outcome would have a more

immediate and negative impact.

The focus on the response to

Covid-19 and the possibility

that the government may not seek

an extension of the transitional

period may mean there is an increased

risk of a 'no deal' departure

and the consequential ability

to implement the necessary measures

on a timely basis.

--------------------------------------------------------------

FOOD ONLINE

A failure to effectively execute * M&S nominated directors are part of the Ocado Retail

the launch of M&S products for Board and participate in leadership forums.

Ocado Retail would significantly

impact the achievement of our

strategy to take our food online * The establishment and continued operation of a

in a profitable, scalable and dedicated M&S programme team, supported by senior

sustainable way. leadership, to oversee all aspects of project

The investment in Ocado Retail delivery including commercial agreements, product

is part of our strategy for improving range, and establishment of ongoing operating

our online reach and capability. processes.

To achieve this, we are committed

to providing M&S product ranges

and to have established new product * Joint working group in place with Ocado Group Plc and

development capabilities for Ocado Retail to establish the systems, processes and

Ocado Retail by the beginning ways of working to coordinate sourcing, product

of September 2020. development, product ranging, customer data and

Activities include: marketing.

* Finalisation of all commercial agreements with

suppliers.

* Regular remote communication continues under lockdown

with the Board, senior management and the delivery

* Delivery of a range of M&S products to allow a teams.

seamless transition for Ocado customers on launch.

* Establishing data and technology interfaces with

Ocado Retail.

* Developing operating procedures and ways of working

between the two businesses.

An inability to establish effective

operating protocols in advance

of the launch date, whether related

to the impact of Covid-19 or

other factors, could delay delivery

of the expected benefits from

our investment in Ocado Retail.

--------------------------------------------------------------

FOOD SAFETY & INTEGRITY

Failure to prevent or effectively * Oversight from Customer and Brand Protection

respond to a food safety incident, Committee.

or to maintain the integrity

of our products, could impact

business performance, customer * Food Safety Policy and Standards are in place, with

confidence and our brand. clear accountability set at all levels.

Food safety and integrity remain

vital for our business. We need

to manage the potential risks * Defined Terms of Trade, manufacturing standards,

to customer health and consumer specifications for "from farm to fork" and standard

confidence that face all food operating procedures (stores, support centre and

retailers. supply chain).

This includes considering how

external pressures on the food

industry and wider economic and * New food initiatives assessed for food safety risks.

environmental changes could impact

the availability and integrity

of our food, the ability to operate * Qualified and capable technical team, with continuing

all routine controls, our reputation professional development programme.

and shareholder value.

Many of these external pressures,

including the impact of Covid-19, * Store, supplier and depot audit programmes, including

inflationary costs, labour quality unannounced visits and raw material testing, adapted

and availability, increased regulatory to be managed remotely where site visits are not

scrutiny, animal disease, and possible.

the unknown impact of Brexit,

are, to a large degree, outside

our control but are nevertheless * Introduction of modified processes, including

monitored. enhanced monitoring of quality and customer

complaints, to mitigate risk during the Covid-19

lockdown and ongoing assessment of the need for

further change.

* Quarterly review of our control framework.

* Established processes for the development and legal

sign-off for product packaging.

* Documented and tested crisis management plan.

* Membership of the Food Industry Intelligence Network

at Board and Operating Committee level.

--------------------------------------------------------------

CORPORATE COMPLIANCE & RESPONSIBILITY

Failure to deliver against our * A Code of Conduct is in place and has recently been

legal, regulatory, social and reviewed and updated. This is underpinned by policies

environmental commitments would and procedures, including human rights, modern

undermine our reputation as a slavery, global sourcing, data protection,

responsible retailer, may result anti-bribery and corruption, health & safety, food

in legal exposure or regulatory safety, national minimum wage, equal pay, cyber and

sanctions, and could negatively data security. An annual self-assessment compliance

impact our ability to operate process is also in place.

and/or remain relevant to our

customers.

The increasingly broad and stringent * Immediate crisis response capability (via the Crisis

legal and regulatory framework Management team) when required on a reactive basis -

for retailers creates pressure more recently for Covid-19.

on both business performance

and market sentiment requiring

continual improvements in how * Mandatory induction briefings and annual training for

we operate as a business to maintain relevant colleagues on key regulations.

compliance.

More recently, the requirements

triggered by the Covid-19 o utbreak, * Oversight from committees and steering groups such as

including in relation to safety for fire, health and safety or food safety.

and social distancing, have in

a short time frame necessitated

immediate changes to operating * In-house regulatory legal team, including specialist

procedures in our distribution solicitors, which conducts 'horizon scanning' on new

network, stores and support centres. and emerging regulatory and legislative changes.

In addition, the expectations

of our customers and other stakeholders

(including regulators) are increasingly * Dedicated non-legal regulatory issue leaders and

demanding. The environmental advisers to drive compliance against key risk areas

impact of food, packaging and within the business. This includes, for example,

the sustainability of clothing GSCOP (Groceries Supply Code of Practice) compliance

are all increasingly relevant. in Food or ethical sourcing in Clothing & Home.

Speed in responding to evolving

expectations is vital to maintaining

a positive business perception. * Proactive engagement with regulators, legislators,

Non-compliance may result in trade bodies and policy makers.

fines, criminal prosecution for

M&S or colleagues, litigation,

additional investment to rectify * Simplified Plan A operating model with a lean central

breaches, disruption or cessation team responsible for setting the framework and

of business activity, as well establishing sustainability priorities in each of our

as have an impact on our reputation family of businesses.

and financial results.

* Published, monitored and reported commitments in

relation to environmental and social issues in line

with regulatory requirements.

* Established auditing and monitoring systems.

* Customer contact centre insight and analysis of live

social media issues.

--------------------------------------------------------------

BUSINESS CONTINUITY & RESILIENCE

Failures or resilience issues * A dedicated Business Continuity team.

at key business locations could

result in major business interruption.

In particular, a major incident * An established Group Crisis Management process -

at our Castle Donington e-commerce which was invoked and has operated throughout the

distribution centre may have Covid-19 outbreak.

a significant impact on our ability

to fulfil online orders. More

broadly, an inability to effectively * Business continuity plans, incorporating remote

respond to global events, such working requirements, are in place for key activities

as pandemic or supply chain disruption, across our operations, including offices, depots and

would significantly impact business IT sites. These were invoked and, where needed,

performance. refined during lockdown.

As our sole online Clothing &

Home fulfilment centre, the effective

operation of our Castle Donington * Group Incident Reporting & Management Procedures in

depot is vital. A major incident place and used to escalate incidents on site. These

leading to a sustained period also include critical third parties.

offline would impact sales and

potentially hinder the growth

of M&S.com. * Store and sourcing office business continuity

In addition to Castle Donington, assessments and visits, where appropriate.

the loss of other locations such

as the dedicated warehouses that

store beers, wines & spirits * Insurance cover to mitigate the impact of remediation

or frozen goods in the UK or and business interruption.

support facilities, such as for

IT, could impact business operations.

While the response to Covid-19 * Mechanisms to validate the existence of key supplier

has highlighted positives in arrangements.

the business's ability to continue

operating in extreme circumstances,

it has also underlined the risk * Ongoing contingency planning for Brexit.

associated with our global supply

chains. The reliance on China

and the interdependency of sourcing * Enhanced capabilities at Castle Donington to manage

locations, in addition to the technology failure.

concentration of supply from

individual countries such as

Bangladesh, highlight the potential * Engagement with external stakeholders including

impact of globally disruptive Retail Business Continuity Association and

events. Beyond supply chain, government-led initiatives.

the implications on trading both

in the UK and International are

also a risk. * Membership of the National Counter Terrorism

Information exchange.

--------------------------------------------------------------

INFORMATION SECURITY

Failure to adequately prevent * Dedicated Information Security function, comprising a

or respond to a data breach or multi-disciplinary operation of information security

cyber-attack could adversely specialists and support services and capabilities,

impact our reputation, result with a 24/7 Security Operation Centre.

in significant fines, business

disruption, loss of stakeholder

confidence, and/or loss of information * Continued focus on improving controls, policies, and

for our customers, employees procedures in line with our environment and threat

or business. landscape, including heightened areas of risk due to

The increasing sophistication Covid-19.

and frequency of cyber-attacks

in the retail industry, coupled

with the Data Protection Act * Maintained focus on scanning our threat environment.

(DPA), highlight the escalating

information security risk facing

all businesses. Our reliance * Established third-party assurance programme.

on a number of third parties

hosting critical services and

holding M&S and customer data * Focused security assurance, overall operational rigor

also means the information security and security hygiene around significant change

risk profile is changeable. activities.

This risk also increases as we

develop our digital capabilities.

For example our dependency on * Network of Data Protection Compliance Managers in

the availability of, and access priority business areas to oversee and address

to, insightful data across our compliance.

business and/or with the increasing

shift online.

In addition, the risk of a data * Mandatory information security and data protection

breach or misuse is impacted training for colleagues, including responsibilities

by Covid-19 as there is the potential for the use of personal data.

for:

* An increase in targeted phishing campaigns.

* Corporate Security team with a focus on improving the

physical security environment.

* New risks linked to working from home and the usage

of personal devices.

* Increased reliance on third parties supporting

critical support services.

--------------------------------------------------------------

TECHNOLOGY CAPABILITY

A failure to improve our technology * Delivery against our technology transformation

capabilities, reduce dependency programme continues and is underpinned with a defined

on legacy systems and enhance technology operating model, project governance

digital capability could limit principles and agile methodology.

our ability to keep pace with

customer expectations and competitors,

enable business transformation * Cross-channel technology investment strategy in place

and grow profitably. and aligned to the family of businesses, reviewed

The digital world continues to quarterly to track benefits realisation of core

evolve at an unrelenting pace, projects.

enabling competitive advantage,

influencing consumer behaviours

or expectations and increasing * Improvements to our IT infrastructure, increased

demands on IT infrastructure. bandwidth and deployment of a unified communication

As demonstrated during the Covid-19 and collaboration tool, which underpinned the rapid

lockdown, our business resilience move to remote working during the Covid-19 lockdown.

is increasingly dependent on

the reliability and effectiveness

of our technology infrastructure * Continued investment in in-store technology and

and capability. digital capabilities to enhance both customer and

We are clear on our aim to be colleague experience.

Digital First and continue to

plan and invest to support this

objective. * Prioritisation of technology initiatives which is

While a focus on improving the fully aligned with our operating and capital

existing IT infrastructure has expenditure targets.

begun to deliver improvements

in capability, flexibility and

cost efficiency, further work * Continued collaboration with our principal technology

is required to enable the business services partner, TCS, and other strategic

to move with pace to meet customer partnerships, such as Microsoft, to drive our Digital

and colleague needs. First ambition.

We also need to continue to develop

the skills and capabilities of

our colleagues in order to drive * Expansion of the Decoded programme and investment in

beneficial and effective use data analytics expertise to improve digital people

of the technological changes skills.

that are made.

* Investment in dedicated resource focused on

technology risk and assurance maturity and roll-out

of a structured IT control methodology.

--------------------------------------------------------------

THIRD-PARTY MANAGEMENT

An inability to successfully * Inclusion of third-party management risks as part of

manage and leverage our strategic the Crisis Management team oversight of the Covid-19

third-party relationships, or response.

a critical failure of a key supplier

or partner, could impact delivery

of our transformation initiatives, * Clear procurement and supplier management policies in

our ability to operate effectively place, including dedicated relationship partners for

and efficiently or, in some circumstances, strategic suppliers.

our brand and reputation.

Our business is dependent on

a range of significant third-party * Defined service level agreements and key performance

relationships that span products indicators for key contracts.

and services, franchise operations,

joint ventures, investments and

our banking and services partners. * Dedicated procurement and commercial teams.

A critical failure of a key supplier

or partner could have a significant

impact on operational activities, * Key supplier business contingency planning including

our transformation and/or customer targeted reviews by our Business Continuity team.

experience - any of which could

negatively impact operating profit.

The scale and impact of Covid-19, * Structured governance and business monitoring

both in the UK and internationally, processes for investments, other partnering and

has heightened the possibility franchise agreements.

of disruption or failure in the

important group of third-party

companies that form part of the * Integrated business planning processes to support

extended operations of our business. franchise and joint venture reviews.

* Regular review of franchise and joint venture markets

and new opportunities.

* Third-party self-assessment processes to confirm

compliance with expected standards and policies.

--------------------------------------------------------------

TALENT, CULTURE & CAPABILITY

An inability to maintain efficient * Investment in external hires to strengthen capability

processes and complete, accurate and address identified skills gaps.

people metrics could impact our

ability to effectively target

our resources and people agenda * Investment in internal talent through structured

to focus on attracting, engaging, identification of critical and senior roles.

developing and motivating colleagues

and developing skills for the

future. This could also impact * Leadership development programmes to enhance

the pace of operational and cultural leadership capability and colleague engagement.

transformation across the business.

The need to engage, motivate

and connect with our colleagues * Improved new starter experience to ensure effective

across a multi-generational, onboarding, engagement and retention of new

diverse workforce and drive Digital colleagues.

First skills and mindset is key

to delivering productivity and

supporting the transformation * A Business Involvement Group which is actively

of our business while driving involved in colleague engagement and representation

customer loyalty through a differentiated throughout the business, including at Board meetings.

service proposition.

An inability to maintain the

necessary change management capabilities * Development of a robust performance management system

could constrain our transformation that will measure achievement against business

objectives. This, combined with objectives and behaviours, with a clear link to

the cultural challenge of managing reward.

talent, performance and succession

could result in increased resource

management and development costs. * A total reward review, with benchmarking of all pay

and benefit components and transparency on fair pay,

including gender, ethnicity, disability and age.

* Creation of a network of external allies to champion

our inclusion and diversity agenda.

* Change management capability considered a specific

leadership skill requiring investment through

training, toolkits and methodology.

* Planned investment in an HR information system.

* Delivery of a digital-specific apprenticeship

programme driving digital literacy and capability

building.

--------------------------------------------------------------

BRAND, LOYALTY & CUSTOMER EXPERIENCE

An inability to evolve our brand * Chief Digital & Data Officer in post to head Insights

appeal, customer experience and and Loyalty programmes and the recently created

Sparks loyalty programme will Digital & Data team focusing on loyalty, data science,

impact our success in retaining digital product, customer growth and innovation.

and attracting customers and

expanding the business.

Consumer lifestyles and attitudes * Brand, marketing and product teams aligned with the

continue to evolve at pace in operating model to better address the specific needs

an increasingly diversified and of our family of businesses.

competitive retail environment.

A failure to anticipate and keep

up with customer expectations * Improved online search functionality, enhanced

would impact future trading performance. end-to-end journey across M&S.com and stores for

In addition, the uncertainty Click & Collect, and greater personalised digital

of the duration of Covid-19 and products and marketing.

its longer-term impact on consumer

behaviour, shopping habits and

spending power, is unknown, making * Investment in capability to measure customer

our ability to plan and rapidly experience through introduction of an end-to-end and

react more important than ever. multichannel net promoter score programme, supported

Evolving our Sparks programme by third-party expertise.

in a way that resonates with

our customers and helps inform

business decisions remains a * Completion of a review of our Sparks loyalty

key objective. Combined with programme to inform next steps.

coordinating improvements across

customer experience and personalisation

through meaningful measures of * Proactive monitoring of social media to observe and

customer experience, data-driven respond to trends in customer experience.

marketing strategies and embedding

Digital First behaviours, these

are key enablers to being a customer-centric * Initiatives launched in response to the Covid-19

business. lockdown to continue making product available safely

to customers, for example the range of M&S food boxes,

expansion of Mobile Pay Go payment facility,

introduction of M&S E-Gift Cards and shifting focus

to contactless home delivery.

* Targeted use of celebrity engagement and high-impact

sponsorship of ITV's 'Britain's Got Talent'.

--------------------------------------------------------------

The risks listed do not comprise all those associated with Marks

& Spencer and are not presented in any order of priority. In

addition to the risks disclosed, a wide range of lesser impacting

risks and uncertainties that Marks & Spencer is exposed to, or

could be exposed to in the near future, are actively monitored and

managed. These less material risks are kept in view in case their

likelihood or impact should show signs of increasing.

Further information on the financial risks we face and how they

are managed is provided on pages 152 to 162.

Directors' Responsibility Statement

The 2020 Annual Report contains the following statements

regarding responsibility for the financial statements in compliance

with DTR 4.1.12. Responsibility is for the full Annual Report and

Financial Statements 2020 and not the condensed statements required

to be set out in the Annual Financial Report announcement.

The directors are responsible for the maintenance and integrity

of the Company's website. Legislation in the UK governing the

preparation and dissemination of financial statements may differ

from legislation in other jurisdictions. Each of the directors,

whose names and functions are listed on pages 46 and 47 of the

Annual Report, confirm that, to the best of their knowledge:

- The Group financial statements, prepared in accordance with

the applicable set of accounting standards, give a true and fair

view of the assets, liabilities, financial position and profit or

loss of the Company and the undertakings included in the

consolidation taken as a whole.

- The Management Report includes a fair review of the

development and performance of the business and the position of the

Company and the undertakings included in the consolidation taken as

a whole, together with a description of the principal risks and

uncertainties that they face.

- The Annual Report, taken as a whole, is fair, balanced and

understandable, and provides the necessary information for

shareholders to assess the Group's performance, business model and

strategy.

The Directors of Marks and Spencer Group plc are listed in the

Group's 2020 Annual Report, and on the Group's website:

corporate.marksandspencer.com/investors.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

ACSKKNBKFBKKPAK

(END) Dow Jones Newswires

June 03, 2020 04:30 ET (08:30 GMT)

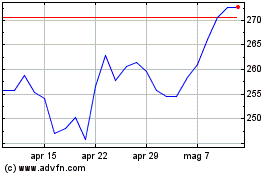

Grafico Azioni Marks And Spencer (LSE:MKS)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni Marks And Spencer (LSE:MKS)

Storico

Da Apr 2023 a Apr 2024