TIDMMKS

RNS Number : 3818W

Marks & Spencer Group PLC

18 August 2020

MARKS AND SPENCER GROUP PLC

M&S TRADING UPDATE AND STREAMLINING ANNOUNCEMENT

At the year-end M&S outlined a possible scenario for a

12-month Covid impacted trading period and set out a strengthened

liquidity and balance sheet platform for recovery. We also outlined

the 'Never the Same Again' programme for accelerating

transformation and capitalising on the learning from the crisis to

deliver three years change in one. Today we are updating the market

on revenue performance since year end and announcing further

proposed steps to accelerate change.

TRADING UPDATE

Overall the group year to date has performed ahead of the

scenario we announced at the year-end in revenue and cash. However

at this early stage there remains substantial uncertainty about

market conditions and the duration of social distancing measures,

and we are retaining a cautious approach to planning for the

balance of the year.

Food business showing good year on year growth

M&S Food sales have built steadily from the shifts in demand

and closure of travel locations at the outset of the crisis. In the

last 13 weeks total Food sales have increased 2.5%. In that same

period like for like sales excluding the impact of the closure of

hospitality and travel franchise units were up 10.6%, with an

improving trend as more locations recover and performance has

regained momentum as customers have bought back into our quality,

fresh food offer and investment in range and trusted value.

The transition to taking over the supply agreement with Ocado

Retail is on track for September and we are beginning to see the

benefits as planned in the form of trading terms and the launch of

over 500 new products in M&S stores from the expanded online

range created for the switchover.

We are making good progress in our 'Vangarde' supply chain

effectiveness programme working with our logistics partner GIST,

along with the new ambient food warehouse in Milton Keynes with our

partner XPO Logistics.

Clothing & Home significantly down but improving

Total revenue was down 38.5% in the last 13 weeks. In the 8

weeks since store re-opening total sales have been down 29.9% with

trends steadily improving. In those 8 weeks store sales were down

47.9% and online has continued to perform strongly up 39.2% on last

year.

The performance of store sales has varied widely across the

estate with some of the newer out of town stores trading close to

last year's level of sales overall in recent weeks but legacy town

centre stores and some shopping centres still heavily impacted by

social distancing and reduced footfall. Furthermore, with the

closure of many workplaces and lack of social gatherings, the

clothing sales mix has seen a substantial shift from office

dressing and formal wear into casual clothing and leisure wear.

Through upweighted promotional activity we have made good

progress in clearing surplus stock. As announced at the year-end we

have booked additional storage space to hibernate surplus good

stock for next year.

Online and digital accelerating

A central plank of our transformation strategy is to deliver a

much higher proportion of sales through digital channels and

relaunch our data and CRM platform under the Sparks banner. Online

Clothing & Home sales have performed strongly since the start

of the year with an additional 1.9m new customers. In the last 8

weeks, online sales have represented 41% of our total Clothing

& Home sales.

There has been a substantial change in delivery mix, with c. 68%

of orders delivered to home, compared with 29% the previous year.

Growth has been enabled by a robust performance from our Castle

Donington distribution centre, where the group has invested in

substantial additional capacity.

Following a successful relaunch in July, 8.2m customers are now

members of the new Sparks programme and over 800,000 have

downloaded the M&S App since launch.

International trends volatile

International sales have performed ahead of the Covid-19

scenario, primarily driven by strong online sales and an

improvement in franchise shipments in recent weeks, although it is

too early to know if this will be sustained. Trading in a number of

markets has been volatile with the re-imposition of local lockdowns

and closures affecting trade.

NEXT STEPS ON STREAMLINING THE BUSINESS

We are today announcing important proposals to further

streamline the business both at stores and management level.

As previously outlined Clothing & Home trading in the stores

remains well below last year, with online and home delivery strong.

It is clear that there has been a material shift in trade and

whilst it is too early to predict with precision where a new post

Covid sales mix will settle, we must act now to reflect this

change.

We have also learnt that we can work more flexibly and

productively with more colleagues multi-tasking and transitioning

between Food and Clothing & Home. The deployment of our leading

store technology package developed in partnership with Microsoft

has also enabled us to reduce layers of management and overheads in

the support office.

As a result we are today embarking on a multi-level consultation

programme which we anticipate will result in a reduction of c.

7,000 roles over the next 3 months. These will include departures

in our central support centre, in regional management, and in our

UK stores, reflecting the fact that the change has been felt

throughout the business.

We expect a significant proportion will be through voluntary

departures and early retirement. In line with our longstanding

value of treating our people well, we will now begin an extensive

programme of communication with colleagues.

Concurrently we expect to create a number of new jobs as we

invest in online fulfilment and the new ambient food warehouse and

reshape our store portfolio over the course of the year.

The cost of the programme including redundancies will be

reflected in a significant adjusting item to be included in the

group's half-year results. The streamlining programme is an

important step in delivering on our cost savings programme and

ensuring we emerge from the crisis with a lower cost base and a

stronger more resilient business.

Chief Executive Steve Rowe commented:

"In May we outlined our plans to learn from the crisis,

accelerate our transformation and deliver a stronger, more agile

business in a world in which some customer habits were changed

forever. Three months on and our Never the Same Again programme is

progressing; albeit the outlook is uncertain and we remain

cautious. As part of our Never The Same Again programme to embed

the positive changes in ways of working through the crisis, we are

today announcing proposals to further streamline store operations

and management structures. These proposals are an important step in

becoming a leaner, faster business set up to serve changing

customer needs and we are committed to supporting colleagues

through this time."

Group revenue: constant currency

8 weeks to

19 weeks to 13 weeks to 8 August

% change to LY 8 August 20(1) 8 August 20(1) 20(1)

------------------------------------------------ ---------------- ---------------- ----------

Clothing & Home -49.5 -38.5 -29.9

Food -1.1 2.5 2.5

International -31.9 -24.6 -19.9

Group -19.2 -13.2 -10.0

Clothing & Home.com 32.0 42.2 39.2

M&S.com 38.9 46.9 40.7

1. unaudited revenue for the:

- 19 week period from 29 March 2020 to 8 August 2020

- 13 week period from 10 May 2020 to 8 August 2020 (since last

reported)

- 8 week period from 13 June 2020 to 8 August 2020 (since

C&H space fully reopened)

This announcement contains inside information for the purposes

of Article 7 of EU Regulation 596/2014.

-Ends-

Statements made in this announcement that look forward in time

or that express management's beliefs, expectations or estimates

regarding future occurrences and prospects are "forward-looking

statements" within the meaning of the United States federal

securities laws. These forward-looking statements reflect Marks

& Spencer's current expectations concerning future events and

actual results may differ materially from current expectations or

historical results. Any forward-looking statements are subject to

various risks and uncertainties, including, but not limited to,

failure by Marks & Spencer to predict accurately customer

preferences; decline in the demand for products offered by Marks

& Spencer; competitive influences; changes in levels of store

traffic or consumer spending habits; effectiveness of Marks &

Spencer's brand awareness and marketing programmes; general

economic conditions or a downturn in the retail or financial

services industries; acts of war or terrorism worldwide; work

stoppages, slowdowns or strikes; and changes in financial and

equity markets. For further information regarding risks to Marks

& Spencer's business, please consult the risk management

section of the 2020 Annual Report (pages 33-43).

The forward-looking statements contained in this document speak

only as of the date of this announcement, and Marks & Spencer

does not undertake to update any forward-looking statement to

reflect events or circumstances after the date hereof or to reflect

the occurrence of unanticipated events.

For further information, please contact:

Investor Relations:

Fraser Ramzan: +44 (0) 20 3884 7080

Hannah Chambers: +44 (0) 20 3882 4714

Media enquiries:

Corporate Press Office: +44 (0) 20 8718 1919

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

UPDKZGMRLNLGGZM

(END) Dow Jones Newswires

August 18, 2020 02:00 ET (06:00 GMT)

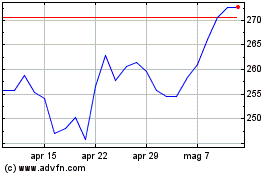

Grafico Azioni Marks And Spencer (LSE:MKS)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni Marks And Spencer (LSE:MKS)

Storico

Da Apr 2023 a Apr 2024