Maroc Telecom FY2020 Consolidated Results

CONSOLIDATED RESULTS AT 31 DECEMBER

2020

Operating results in line with objectives thanks to

strong performances at the

subsidiaries:

- 8.1% growth of the Group's customer base, to

nearly 73 million customers;

- Growth in the revenues of the Moov Africa

subsidiaries (+1.4% on a like-for-like

basis*), driven by Data Mobile and Mobile Money services;

- Sustained growth in Fixed Data in Morocco

(+13.2%);

- Increased profitability with an

adjusted EBITDA margin for the Group of 51.9%, an

improvement of +0.7 pt on a like-for-like

basis*.

Proposed dividend payment of MAD 3.5

billion, implying MAD 4.01 per share, representing a yield of

2.8%**.

Maroc Telecom Group outlook for 2021 at

constant scope and exchange rates:

- Decrease in revenues;

- Decrease in EBITDA;

- CAPEX of maximum 15% of revenues, excluding frequencies

and licences.

To mark the publication of this press release,

Mr Abdeslam Ahizoune, Chairman of the Management Board, stated:

« In 2020, the Maroc Telecom Group posted

operating results in line with objectives. Thanks to ongoing

efforts to control costs and multiple innovations, the Group has

maintained its margins, demonstrating thus its resilience and its

strong capacity to adapt to the conditions imposed by an

unprecedented health and economic crisis.

In Morocco, despite the effects of this crisis

and strong competitive pressure, the significant investments made

in Broadband support its leadership and its position as forerunner

operator. Internationally, the Group has chosen to bring together

its subsidiaries in Africa, under a common “Moov Africa” visual

identity, reflecting their good growth momentum .

The digitisation project launched by the Group

continues and has proved its effectiveness in front of the

constraints imposed by the pandemic. »

* The like-for-like basis illustrates the consolidation effects

of Moov Africa Chad and the use of a constant exchange rate

MAD/Ouguiya/Franc CFA** Based on the share price of

February,18th 2021 (MAD 145.30)

adjusted consolidated results* of the group

| (IFRS in

MAD million) |

Q4-2019 |

Q4-2020 |

Change |

Change on

like-for-like basis(1) |

2019 |

2020 |

Change |

Change on

like-for-like basis(1) |

|

Revenues |

9,209 |

9,271 |

+0.7% |

+0.4% |

36,517 |

36,769 |

+0.7% |

-0.8% |

| Adjusted

EBITDA |

4,525 |

4,740 |

+4.8% |

+4.6% |

18,922 |

19,100 |

+0.9% |

+0.5% |

|

Margin (%) |

49.1% |

51.1% |

+2.0 pt |

+2.1 pt |

51.8% |

51.9% |

+0.1 pt |

+0.7 pt |

| Adjusted

EBITA |

2,552 |

2,886 |

+13.1% |

+13.1% |

11,540 |

11,598 |

+0.5% |

+0.8% |

|

Margin (%) |

27.7% |

31.1% |

+3.4 pt |

+3.5 pt |

31.6% |

31.5% |

-0.1 pt |

+0.5 pt |

| Group

share of adjusted Net Income - |

1,382 |

1,475 |

+6.7% |

+6.7% |

6,029 |

6,001 |

-0.5% |

-0.4% |

|

Margin (%) |

15.0% |

15.9% |

+0.9 pt |

+0.9 pt |

16.5% |

16.3% |

-0.2 pt |

+0.1 pt |

|

CAPEX(2) |

2,184 |

1,417 |

-35.1% |

-34.9% |

6,788 |

3,448 |

-49.2% |

-50.6% |

| Of which

frequencies and licences |

102 |

124 |

|

|

1,418 |

135 |

|

|

|

CAPEX/revenues (excluding frequencies and licences) |

22.7% |

13.9% |

-8.7 pt |

-8.7 pt |

14.7% |

9.0% |

-5.7 pt |

-5.5 pt |

|

Adjusted CFFO |

4,185 |

4,498 |

+7.5% |

+7.4% |

13,352 |

15,719 |

+17.7% |

+17.8% |

| Net

debt |

17,350 |

17,619 |

+1.6% |

+2.4% |

17,350 |

17,619 |

+1.6% |

+2.4% |

|

Net debt/EBITDA(3) |

0.9x |

0.9x |

|

|

0.9x |

0.8x |

|

|

*The adjustments to the financial indicators are

detailed in Appendix 1.

► Customer

base

The Group's customer base grew by

8.1% in 2020, reaching nearly 73

million customers, due to the growth of the customer bases of the

Moov Africa subsidiaries and Fixed in Morocco.

►

Revenues

Maroc Telecom Group generated revenues(4) of MAD

36,769 million, up 0.7%

(-0.8% on a like-for-like basis(1)). The increase

in the revenues of the Moov Africa subsidiaries and Fixed Broadband

in Morocco offsets the slowdown in Mobile activities in Morocco,

heavily impacted by the competitive context.

In the fourth quarter alone and despite the

decrease in Mobile call termination rates in Morocco in December

2020, the Group's revenues increased by 0.7%

(+0.4% on a like-for-like basis(1)), thanks to the

sustained increase in the activities of the Moov Africa

subsidiaries and Fixed Broadband in Morocco.

► Earnings from

operations before depreciation and

amortization

At the end of December 2020, Maroc Telecom

Group's adjusted earnings from operations before depreciation and

amortization (EBITDA) reached MAD 19,100 million,

up 0.9% (+0.5% on a like-for-like

basis(1)). The adjusted EBITDA margin was 51.9%,

up 0.1 pt (+0.7

pt on a like-for-like basis(1)), thanks to

rigorous cost management.

► Earnings from

operations

At the end of 2020, Maroc Telecom Group’s

adjusted earnings from operations (EBITA)(5) amounted to MAD

11,598 million, up 0.8% on a

like-for-like basis(1), thanks to the increase in EBITDA. The

adjusted EBITA margin stood at 31.5%, up

0.5 pt on a like-for-like basis(1).

► Group share of Net

Income

The adjusted Group share of Net Income decreased

slightly by 0.4% on a like-for-like basis(1).

►

Investments

The capital expenditures(2) excluding

frequencies and licenses, down 38.3% over one

year, were adapted to the context of the health crisis and focused

on meeting strong demand for Fixed Internet access, extensions of

Data infrastructures, and quality of service. They represent

9.0% of revenues, a level in line with the

objective announced for the year.

► Cash

flow

Adjusted Cash Flow From Operations (CFFO)(6)

improved by +17.8% on a like-for-like basis(1),

reaching MAD 15,719 million mainly due to

the decrease in investments.

At 31 December 2020, Maroc Telecom Group’s

consolidated net debt(7) represented 0.8 times(3)

the Group's annual EBITDA.

► Highlights of the

fourth quarter

In Morocco, the ANRT is implementing a

multi-annual framework for Mobile and Fixed termination rates,

implying a 35% reduction in Mobile tariffs for

Maroc Telecom vs. 25% for Orange and

22% for Inwi, maintaining asymmetry.

In Mauritania, Mauritel obtained a 4G licence

for a total amount of MAD 124 million.

The new visual identity “Moov Africa” was

launched on 1 January 2021. The ten subsidiaries of the Maroc

Telecom Group (based in Mauritania, Burkina Faso, Gabon, Mali, Côte

d'Ivoire, Benin, Togo, Niger, Central African Republic and Chad)

are now united around a common visual identity.

►

Dividend

At the General Meeting of Shareholders of 30

April 2021, the Supervisory Board of Maroc Telecom will propose the

distribution of a dividend of MAD 4.01 per share,

representing a total amount of MAD 3.5

billion.

► Maroc Telecom Group

outlook for 2021 at constant scope and exchange

rates:

Based on recent market developments and insofar

as no new major exceptional event disrupts the Group's activity,

Maroc Telecom forecasts for 2021, at constant scope and exchange

rates:

- Decrease in revenues;

- Decrease in EBITDA;

- CAPEX of maximum 15% of revenues, excluding frequencies

and licences.

review

of the Group's activities

The adjustments to the "Morocco" and "International" financial

indicators are detailed in Appendix 1.

·Morocco

|

(IFRS in MAD million) |

Q4-2019 |

Q4-2020 |

Change |

2019 |

2020 |

Change |

|

|

Revenues |

5,378 |

5,152 |

-4.2% |

21,690 |

20,881 |

-3.7% |

|

|

Mobile |

3,557 |

3,219 |

-9.5% |

14,276 |

13,351 |

-6.5% |

|

|

Services |

3,523 |

3,084 |

-12.4% |

14,046 |

13,009 |

-7.4% |

|

|

Equipment |

35 |

135 |

ns |

230 |

342 |

+48.9% |

|

|

Fixed |

2,306 |

2,424 |

+5.1% |

9,261 |

9,517 |

+2.8% |

|

|

Of which Fixed Data* |

886 |

966 |

+9.1% |

3,186 |

3,608 |

+13.2% |

|

|

Elimination and other income |

-485 |

-491 |

|

-1,846 |

-1,987 |

|

|

| Adjusted

EBITDA |

2,948 |

2,979 |

+1.1% |

12,294 |

11,950 |

-2.8% |

|

|

Margin (%) |

54.8% |

57.8% |

+3.0 pt |

56.7% |

57.2% |

+0.5 pt |

|

| Adjusted

EBITA |

1,917 |

2,024 |

+5.6% |

8,294 |

8,079 |

-2.6% |

|

|

Margin (%) |

35.6% |

39.3% |

+3.6 pt |

38.2% |

38.7% |

+0.5 pt |

|

|

CAPEX(2) |

1,289 |

584 |

-54.7% |

3,022 |

1,466 |

-51.5% |

|

| Of which

frequencies and licences |

102 |

|

|

102 |

|

|

|

|

CAPEX/revenues (excluding frequencies and licences) |

22.1% |

11.3% |

-10.8 pt |

13.5% |

7.0% |

-6.4 pt |

|

|

Adjusted CFFO |

3,000 |

3,246 |

+8.2% |

9,425 |

10,300 |

+9.3% |

|

| Net

debt |

11,101 |

11,515 |

+3.7% |

11,101 |

11,515 |

+3.7% |

|

|

Net debt/EBITDA(3) |

0.9x |

0.9x |

|

0.8x |

0.9x |

|

|

*Fixed Data includes the Internet, TV on ADSL and Data services

to businesses

The Group's activities in Morocco generated

revenues down 3.7% compared with 2019, affected in

particular by the effects of the Covid-19 pandemic on Mobile

activities and partially offset by the solid momentum of Fixed and

Internet. This change was more marked in the fourth quarter of the

year due in particular to the fall in national call termination

prices, which has applied from December, 1st 2020.

At the end of 2020, the adjusted earnings from

operations before depreciation and amortisation (EBITDA) amounted

to MAD 11,950 million, down 2.8%

compared with 2019. The adjusted EBITDA margin increased by

0.5 pt to a high level of 57.2%,

thanks to the control of operating costs.

The adjusted earnings from operations (EBITA)(5)

reached MAD 8,079 million, down

2.6%. It represents an adjusted margin rate of

38.7%, up 0.5 pt.

Adjusted Cash Flow From Operations (CFFO)(6) in

Morocco increased by 9.3% to MAD

10,300 million due to efficient investment

management adapted to the context of the crisis.

Mobile

| |

Unit |

2019 |

2020 |

Change |

| |

|

|

|

|

| Customer base(8) |

(000) |

20,054 |

19,498 |

-2.8% |

| Prepaid |

(000) |

17,752 |

17,181 |

-3.2% |

| Postpaid |

(000) |

2,302 |

2,317 |

+0.6% |

| Of which Internet

3G/4G+(9) |

(000) |

11,789 |

11,060 |

-6.2% |

|

ARPU(10) |

(MAD/month) |

58.3 |

54.3 |

-6.9% |

At the end of 2020, the Mobile customer base(8)

totaled 19.5 million customers, down

2.8% over one year.

Mobile revenues fell by 6.5%

compared to the same period in 2019, to MAD 13,351

million impacted by the Covid-19 pandemic effects and the

competitive context.

The 2020 combined ARPU(10) stood at MAD

54.3, down 6.9% over one

year.

Fixed and Internet

| |

Unit |

2019 |

2020 |

Change |

| |

|

|

|

|

| Fixed

lines |

(000) |

1,882 |

2,008 |

+6.6% |

|

Broadband Access(11) |

(000) |

1,573 |

1,738 |

+10.4% |

The Fixed customer base maintained its good

momentum and increased by 6.6% to

2 million lines. The Broadband customer base now

has 1.7 million subscribers, up

10.4%.

The Fixed and Internet activities in Morocco

continue to improve their performance and generate revenues of MAD

9,517 million, up 2.8% compared

to 2019. This growth accelerated in the last three months of the

year, thanks to the enthusiasm for the FTTH offers and the ADSL

service.

Financial indicators

| (IFRS in MAD

million) |

Q4-2019 |

Q4-2020 |

Change |

Change on like-for-like basis(1) |

2019 |

2020 |

Change |

Change on like-for-like basis(1) |

|

Revenues |

4,102 |

4,367 |

+6.4% |

+5.8% |

16,095 |

16,883 |

+4.9% |

+1.4% |

|

Of which mobile services |

3,752 |

4,031 |

+7.4% |

+6.8% |

14,693 |

15,507 |

+5.5% |

+1.7% |

| Adjusted

EBITDA |

1,576 |

1,761 |

+11.7% |

+11.2% |

6,629 |

7,150 |

+7.9% |

+6.5% |

|

Margin (%) |

38.4% |

40.3% |

+1.9 pt |

+2.0 pt |

41.2% |

42.4% |

+1.2 pt |

+2.0 pt |

| Adjusted

EBITA |

635 |

861 |

+35.7% |

+35.7% |

3,246 |

3,520 |

+8.4% |

+9.6% |

|

Margin (%) |

15.5% |

19.7% |

+4.3 pt |

+4.4 pt |

20.2% |

20.8% |

+0.7 pt |

+1.6 pt |

|

CAPEX(2) |

895 |

832 |

-7.0% |

-6.3% |

3,766 |

1,982 |

-47.4% |

-50.0% |

| Of which

frequencies and licences |

|

124 |

|

|

1,316 |

135 |

|

|

|

CAPEX/revenues (excluding frequencies and licences) |

21.9% |

16.2% |

-5.7 pt |

-5.6 pt |

15.2% |

10.9% |

-4.3 pt |

-3.8 pt |

|

Adjusted CFFO |

1,185 |

1,252 |

+5.7% |

+5.3% |

3,927 |

5,419 |

+38.0% |

+38.4% |

| Net

debt |

8,748 |

7,517 |

-14.1% |

-12.3% |

8,748 |

7,517 |

-14.1% |

-12.3% |

|

Net debt/EBITDA(3) |

1.3x |

1.0x |

|

|

1.3x |

1.0x |

|

|

The Group's international activities recorded

revenues of MAD 16,883 million, up

1.4% on a like-for-like basis(1), explained by the

recovery in post-lockdown activities and the growth in Data Mobile

and Mobile Money services.

In 2020, the adjusted earnings from operations

before depreciation and amortisation (EBITDA) amounted to MAD

7,150 million, up 7.9%

(+6.5% on a like-for-like basis(1)). The adjusted

EBITDA margin was 42.4%, up 1.2

pt (+2.0 pt on a like-for-like basis(1)).

This performance comes from the improvement in the gross margin

rate and rigorous cost management.

During the same period, the adjusted earnings

from operations (EBITA)(5) improved by 8.4%

(+9.6% on a like-for-like basis(1)) to MAD

3,520 million, thanks to the increase in

EBITDA.

Adjusted Cash Flow From Operations (CFFO)(6)

from international activities improved by +38.4%

on a like-for-like basis(1) to MAD 5,419

million.

Operating indicators

| |

Unit |

2019 |

2020 |

Change |

| Mobile |

|

|

|

|

|

Customer base(8) |

(000) |

43,531 |

49,226 |

|

|

Mauritania |

|

2,470 |

2,641 |

+6.9% |

|

Burkina Faso |

|

8,546 |

9,388 |

+9.8% |

|

Gabon |

|

1,621 |

1,632 |

+0.6% |

|

Mali |

|

7,447 |

9,684 |

+30.0% |

|

Côte d’Ivoire |

|

8,975 |

10,050 |

+12.0% |

|

Benin |

|

4,377 |

4,682 |

+6.9% |

|

Togo |

|

3,030 |

3,380 |

+11.6% |

|

Niger |

|

2,922 |

3,005 |

+2.8% |

|

Central African Republic |

|

168 |

189 |

+12.0% |

|

Chad |

|

3,975 |

4,577 |

+15.2% |

| Fixed-Line |

|

|

|

|

| Customer

Base |

(000) |

325 |

337 |

|

|

Mauritania |

|

56 |

57 |

+0.9% |

|

Burkina Faso |

|

75 |

75 |

-0.3% |

|

Gabon |

|

22 |

25 |

+13.9% |

|

Mali |

|

171 |

180 |

+5.1% |

| Fixed-Line

Broadband |

|

|

|

|

| Customer

base(11) |

(000) |

116 |

131 |

|

|

Mauritania |

|

10 |

18 |

+82.7% |

|

Burkina Faso |

|

15 |

14 |

-2.2% |

|

Gabon |

|

18 |

22 |

+19.9% |

|

Mali |

|

73 |

77 |

+5.2% |

Notes:

(1) "Like-for-like" refers to the effects of

consolidating Moov Africa Chad as if it had taken place on January

1, 2019, and an unchanged MAD/Ouguiya/CFA franc exchange

rate.(2) CAPEX corresponds to purchases of tangible and intangible

assets recognized for the period.(3) The ratio Net Debt/EBITDA

excludes the impact of IFRS 16.(4) Maroc Telecom consolidates in

its financial statements Casanet and Moov Africa subsidiaries in

Mauritania, Burkina Faso, Gabon, Mali, Côte d’Ivoire, Benin, Togo,

Niger, Central African Republic and Chad since July 1, 2019. (6)

EBITA corresponds to EBIT before the amortization of intangible

assets acquired through business combinations, write-downs of

goodwill and other intangible assets acquired through business

combinations, and other income and expenses relating to financial

investment transactions and transactions with shareholders (except

when recognized directly in equity).(6) CFFO includes net cash flow

from operations before tax, as set out in the cash flow statement,

as well as the dividends received from companies accounted for by

the equity method and non-consolidated equity investments. CFFO

also includes net capital expenditure, which corresponds to net

uses of cash for acquisitions and disposals of tangible and

intangible assets.(7) Loans and other current and non-current

liabilities less cash and cash equivalents, including cash held in

escrow for bank loans.(8) The active customer base consists of

prepaid customers who have made or received a voice call (excluding

ERPT or Call-Center calls) or received an SMS/MMS or used Data

services (excluding ERPT services) during the past three months,

and postpaid customers who have not terminated their agreements.(9)

The active customer base for 3G and 4G+ Mobile Internet includes

holders of a postpaid subscription agreement (with or without a

voice offer) and holders of a prepaid Internet subscription

agreement who have made at least one top-up during the past three

months or whose top-up is still valid and who have used the service

during that period.(10) ARPU is defined as revenues (generated by

inbound and outbound calls and by data services) net of promotional

offers, excluding roaming and equipment sales, divided by the

average customer base for the period. In this instance, blended

ARPU covers both the prepaid and postpaid segments.(11) The

broadband customer base includes ADSL access, FTTH and leased lines

as well as the CDMA customer base in Mauritania, Burkina Faso and

Mali.

Important notice:Forward-looking statements.

This press release contains forward-looking statements regarding

Maroc Telecom’s financial position, income from operations,

strategy, and outlook, as well as the impact of certain

transactions. Although Maroc Telecom believes that these

forward-looking statements are based on reasonable assumptions,

they do not amount to guarantees for the company’s future

performance. The actual results may be very different from the

forward-looking statements, due to a number of risks and

uncertainties, both known and unknown. The majority of these risks

are beyond our control, namely the risks described in the public

documents filed by Maroc Telecom with the Moroccan Capital Markets

Authority (www.ammc.ma) and the French Financial Markets Authority

(www.amf-france.org), which are also available in French on

our website (www.iam.ma). This press release contains

forward-looking information that can only be assessed at its

publication date. Maroc Telecom does not undertake to supplement,

update, or alter these forward-looking statements as a result of

new information, future events, or for any other reason, subject to

the applicable regulations, and especially to Articles 2.19 et seq.

of the circular issued by the Moroccan Capital Markets Authority

and to Articles 223-1 et seq. of the French Financial Markets

Authority’s General Regulations.

Maroc Telecom is a full-service

telecommunications operator in Morocco and the leader in all of its

Fixed-Line, Mobile and Internet business sectors. It has expanded

internationally, and currently operates in 11 African countries.

Maroc Telecom is listed on both the Casablanca and Paris Stock

Exchanges, and its majority shareholders are Société de

Participation dans les Télécommunications (SPT*) (53%), and the

Kingdom of Morocco (22%).

* SPT is a company incorporated under

Moroccan law and controlled by Etisalat.

|

Contacts |

|

Investor

relationsrelations.investisseurs@iam.ma |

Press relationsrelations.presse@iam.ma |

Appendix 1: Transition from adjusted financial

indicators to published financial indicators

Adjusted EBITDA, adjusted EBITA, Group share of

adjusted Net Income, and adjusted CFFO are not strictly accounting

measures, and should be considered as additional information. They

are a better indicator of the Group's performance as they exclude

non-recurring items.

|

|

2019 |

2020 |

|

(in MAD million) |

Morocco |

International |

Group |

Morocco |

International |

Group |

|

Adjusted EBITDA |

12,294 |

6,629 |

18,922 |

11,950 |

7,150 |

19,100 |

|

Exceptional items: |

|

|

|

|

|

|

|

Dispute resolution |

|

|

|

+420 |

|

+420 |

|

Published EBITDA |

12,294 |

6,629 |

18,922 |

12,370 |

7,150 |

19,520 |

|

Adjusted EBITA |

8,294 |

3,246 |

11,540 |

8,079 |

3,520 |

11,598 |

|

Exceptional items:Dispute resolution |

|

|

|

|

|

|

|

Restructuring costs |

|

-9 |

-9 |

|

|

|

|

Dispute resolution |

|

|

|

+420 |

|

+420 |

|

ANRT fine |

-3,300 |

|

-3,300 |

|

|

|

|

Published EBITA |

4,994 |

3,237 |

8,231 |

8,499 |

3,520 |

12,018 |

|

Group share of adjusted Net Income |

|

|

6,029 |

|

|

6,001 |

|

Exceptional items: Restructuring costs |

|

|

|

|

|

|

|

Restructuring costs |

|

|

-4 |

|

|

|

|

Dispute resolution |

|

|

|

|

|

+469 |

|

COVID contributions |

|

|

|

|

|

-1,047 |

|

ANRT fine |

|

|

-3,300 |

|

|

|

|

Published net income – Group share |

|

|

2,726 |

|

|

5,423 |

|

Adjusted CFFO |

9,425 |

3,927 |

13,352 |

10,300 |

5,419 |

15,719 |

|

Exceptional items: Payment of licences |

|

|

|

|

|

|

|

Licences Payment |

-102 |

-1,835 |

-1,937 |

|

-143 |

-143 |

|

ANRT fine |

|

|

|

-3,300 |

|

-3,300 |

|

Published CFFO |

9,324 |

2,091 |

11,415 |

7,000 |

5,277 |

12,276 |

2020 CFFO was marked by the disbursement of MAD

3,300 million linked to the full payment of the

ANRT fine in Morocco as well as MAD 143 million

for licences obtained in Mauritania, Gabon and Togo.

2019 CFFO included the payment of MAD

1,937 million corresponding to the licences

obtained in Burkina Faso, Mali, Côte d’Ivoire and Togo as well as

the widening of the bandwidth spectrum in Morocco.

Appendix 2: Impact of the adoption of IFRS

16

As at end-December 2020, the impacts of this

standard on Maroc Telecom’s key indicators were as follows:

|

|

2020 |

|

(in MAD million) |

Morocco |

International |

Group |

|

Adjusted EBITDA |

+266 |

+292 |

+557 |

|

Adjusted EBITA |

+33 |

+29 |

+62 |

|

Group share of adjusted Net Income |

|

|

-17 |

|

Adjusted CFFO |

+266 |

+292 |

+557 |

|

Net Debt |

+838 |

+801 |

+1,639 |

Consolidated Statement of Financial

Position

|

ASSETS (in MAD million) |

2019 |

2020 |

| Goodwill |

9,201 |

9,315 |

| Other

intangible assets |

8,808 |

8,120 |

| Property, plant

and equipment |

31,037 |

28,319 |

| Right-of-use

asset |

1,630 |

1,592 |

| Equity

affiliates |

0 |

0 |

| Non-current

financial assets |

470 |

654 |

| Deferred tax

assets |

339 |

580 |

|

Non-current assets |

51,485 |

48,579 |

|

Inventories |

321 |

271 |

| Trade and other

receivables |

11,380 |

11,816 |

| Short-term

financial assets |

128 |

130 |

| Cash and cash

equivalents |

1,483 |

2,690 |

| Assets

available for sale |

54 |

54 |

| Current

assets |

13,365 |

14,960 |

| TOTAL

ASSETS |

64,851 |

63,540 |

| |

|

|

|

LIABILITIES (in MAD million) |

2019 |

2020 |

| Share

capital |

5,275 |

5,275 |

| Consolidated

reserves |

4,069 |

2,023 |

| Consolidated

net income for the period |

2,726 |

5,423 |

| Shareholders’

equity – Group share |

12,069 |

12,721 |

| Non-controlling

interests |

3,934 |

3,968 |

|

Shareholder’s equity |

16,003 |

16,688 |

| Non-current

provisions |

504 |

521 |

| Borrowings and

other long-term financial liabilities |

4,178 |

4,748 |

| Deferred tax

liabilities |

258 |

45 |

| Other

non-current liabilities |

0 |

0 |

|

Non-current liabilities |

4,939 |

5,314 |

| Trade

payables |

23,794 |

24,007 |

| Current tax

liabilities |

733 |

671 |

| Current

provisions |

4,634 |

1,247 |

| Borrowings and

other short-term financial liabilities |

14,748 |

15,612 |

| Current

liabilities |

43,908 |

41,538 |

| TOTAL

LIABILITIES |

64,851 |

63,540 |

Consolidated Income Statement

| (In MAD million) |

2019 |

2020 |

|

| |

|

Revenues |

36,517 |

36,769 |

|

| Cost of

purchases |

-5,670 |

-5,416 |

|

| Payroll

costs |

-3,098 |

-3,005 |

|

| Taxes,

royalties and dues |

-3,183 |

-3,344 |

|

| Other

operating income and expenses |

-5,610 |

-8,746 |

|

| Net

depreciation, amortization, and provisions |

-10,724 |

-4,240 |

|

|

Earnings from operations |

8,231 |

12,018 |

|

| Other income

and expenses from ordinary activities |

-11 |

-1,513 |

|

| Income from

equity affiliates |

0 |

0 |

|

| Income

from ordinary activities |

8,220 |

10,505 |

|

| Income from

cash and cash equivalents |

2 |

17 |

|

| Gross cost of

financial debt |

-756 |

-888 |

|

| Net cost of

financial debt |

-754 |

-871 |

|

| Other

financial income and expenses |

-38 |

26 |

|

|

Financial income |

-792 |

-844 |

|

| Income

tax |

-3,830 |

-3,372 |

|

| Net

Income |

3,598 |

6,289 |

|

| Translation

difference resulting from foreign business activities |

-226 |

134 |

|

| Other

comprehensive income and expenses |

43 |

-14 |

|

| Total

comprehensive income for the period |

3,415 |

6,409 |

|

| Net

Income |

3,598 |

6,289 |

|

| Earnings

attributable to equity holders of the parents |

2,726 |

5,423 |

|

|

Non-controlling interests |

873 |

866 |

|

| Earnings per

share |

2019 |

2020 |

|

| |

| Net

income attributable to equity holders of the parent (in MAD

million) |

2,726 |

5,423 |

|

| Number

of stocks at December 31 |

879,095,340 |

879,095,340 |

|

|

Net earnings per share (in MAD) |

3.10 |

6.17 |

|

|

Diluted net earnings per share (in MAD) |

3.10 |

6.17 |

|

Consolidated Cash Flow Statement

| (In MAD million) |

2019 |

2020 |

| Earnings from

operations |

8,231 |

12,018 |

| Depreciation,

amortization, and other restatements |

10,721 |

2,719 |

| Gross cash

flow from operating activities |

18,952 |

14,738 |

| Other changes in

net working capital requirement |

419 |

139 |

| Net cash

flow from operating activities before tax |

19,372 |

14,877 |

| Income tax

paid |

-4,091 |

-3,789 |

| Net cash

flow from operating activities (a) |

15,281 |

11,088 |

| Purchases of

property, plant and equipment and intangible assets |

-7,949 |

-4,141 |

| Purchases of

consolidated investments after acquired cash |

-1,096 |

0 |

| Increase in

financial assets |

-73 |

-249 |

| Disposals of

property, plant and equipment and intangible assets |

6 |

14 |

| Decrease in

financial assets |

287 |

144 |

| Dividends received

from non-consolidated equity investments |

6 |

14 |

| Net cash

flow used in investing activities (b) |

-8,819 |

-4,219 |

| Capital

increase |

0 |

0 |

| Dividends paid to

shareholders |

-6,003 |

-4,870 |

| Dividends paid by

subsidiaries to their non-controlling shareholders |

-838 |

-855 |

| Changes in

equity capital |

-6,841 |

-5,725 |

| Proceeds from

borrowings and increase in other long-term financial

liabilities |

2,270 |

2,307 |

| Proceeds from

borrowings and increase in other short-term financial

liabilities |

2,860 |

1,167 |

| Payments on

borrowings and decrease in other short-term financial

liabilities |

-4,548 |

-2,687 |

| Net interest

paid |

-473 |

-626 |

| Other cash items

relating to financing activities |

-13 |

-35 |

| Change in

borrowings and other financial liabilities |

96 |

125 |

|

|

|

|

| Net cash

flow used in financing activities (d) |

-6,744 |

-5,600 |

|

|

|

|

| Translation

adjustments and other non-cash items (g) |

65 |

-62 |

| Total cash flows

(a)+(b)+(d)+(g) |

-217 |

1,207 |

| Cash and

cash equivalents at beginning of period |

1,700 |

1,483 |

| Cash and

cash equivalents at end of period |

1,483 |

2,690 |

- Maroc Telecom_PR-FY2020_EN_VDEF

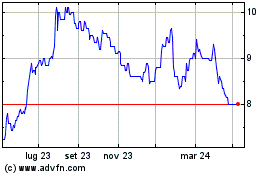

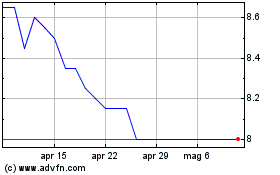

Grafico Azioni Maroc Telecom (EU:IAM)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni Maroc Telecom (EU:IAM)

Storico

Da Apr 2023 a Apr 2024