Meat Giant JBS's Owner Settles U.S. Corruption Charges -- Update

15 Ottobre 2020 - 12:03AM

Dow Jones News

By Luciana Magalhaes, Samantha Pearson and Jacob Bunge

SÃO PAULO -- Brazil's J&F Investimentos, which controls the

world's largest meatpacker, JBS SA, put an end to a long-running

legal dispute in the U.S. over bribes it paid in Brazil, agreeing

Wednesday to pay $128 million to settle the case.

J&F admitted in 2017 to paying about $150 million in bribes

to Brazilian politicians to secure cheap government funding to fuel

one of the most ambitious global acquisition sprees in Brazilian

corporate history. The affair landed its two major controllers, the

billionaire brothers Joesley and Wesley Batista, in jail for

several months.

J&F Investimentos, in a federal court in New York on

Wednesday, pleaded guilty to violating the U.S. Foreign Corrupt

Practices Act.

"As part of this scheme, executives at the highest levels of the

company used U.S. banks and real estate to pay tens of millions of

dollars in bribes to corrupt government officials in Brazil to

obtain hundreds of millions of dollars in financing for the company

and its affiliates," said Brian Rabbitt, acting assistant attorney

general of the Justice Department's criminal division.

JBS said in a letter addressed to shareholders Wednesday that it

and its controlling shareholder are committed to best corporate

practices and close cooperation with authorities in all

jurisdictions in which they operate. "The agreements announced

today represent an important step in their continuous efforts to

improve their compliance and corporate governance programs," JBS

said. A J&F spokesperson declined to comment.

JBS, which began as a family-owned slaughterhouse in the

Brazilian countryside, has invested billions of dollars in the U.S.

market, acquiring meatpacker Swift Foods and chicken producer

Pilgrim's Pride Corp.

Under the terms of Wednesday's agreement, the Justice Department

imposed a penalty of $256.5 million on São Paulo-based J&F, but

ordered it only to pay half of that to U.S. authorities to

compensate for fines already paid to Brazilian authorities.

The arrangement could free up the meatpacker to list its

international unit in the U.S., which it has been pursuing on and

off for the past few years, said Pedro Galdi, an analyst at

brokerage Mirae Asset.

To carry out bribes and other activities, the Justice Department

said, J&F executives used New York-based bank accounts to make

illicit payments and purchased a $1.5 million Manhattan apartment

that was used as a bribe. Prosecutors said executives of the firm

met in the U.S. to discuss and advance the scheme.

As part of the plea agreement, the Justice Department said,

J&F agreed to cooperate with the U.S. government in any ongoing

and future criminal investigations involving the firm and its

employees, and to boost its compliance program.

Both JBS and J&F are controlled by Brazil's Batista

family.

JBS wasn't part of Wednesday's plea agreement and won't bear any

liabilities arising from it, according to a statement from JBS. The

company's shares rallied more than 9% on Wednesday on São Paulo's

stock exchange.

JBS and controlling shareholders, however, reached an agreement

with the Securities and Exchange Commission on alleged violations

of U.S. securities laws by Pilgrim's Pride. As a result, JBS agreed

to pay roughly $27 million to the SEC.

Pilgrim's Pride, one of the largest U.S. poultry producers, said

late Tuesday it had agreed to a plea deal with the Justice

Department to resolve price-fixing charges related to poultry sales

and would pay a fine of $110.5 million.

In May 2017, J&F agreed to pay the equivalent of about $3.2

billion at the time to Brazilian authorities over 25 years to

settle the case in their home country. JBS executives admitted to

bribing almost 2,000 politicians, including the country's

then-president, Michel Temer, and his two predecessors. They have

all denied wrongdoing.

By signing the plea deal, brothers Joesley and Wesley Batista

avoided jail. The brothers, however, were later arrested on

accusations they committed insider trading by dumping the company's

shares and stockpiling U.S. dollars before the plea bargain became

public.

Marco Saravalle, an equity analyst, said many investors have

already priced in the company's legal troubles. "The important

thing about the company is that they have good operational assets

and the executives are motivated to produce results for

shareholders."

--Mengqi Sun contributed to this article.

Write to Luciana Magalhaes at Luciana.Magalhaes@wsj.com,

Samantha Pearson at samantha.pearson@wsj.com and Jacob Bunge at

jacob.bunge@wsj.com

(END) Dow Jones Newswires

October 14, 2020 17:48 ET (21:48 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

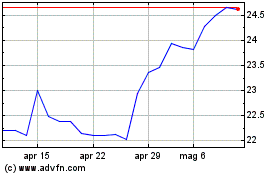

Grafico Azioni JBS ON (BOV:JBSS3)

Storico

Da Mar 2024 a Apr 2024

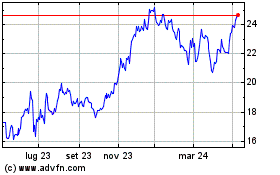

Grafico Azioni JBS ON (BOV:JBSS3)

Storico

Da Apr 2023 a Apr 2024