Regulatory News:

Mercialys (Paris:MERY):

- Solid balance sheet and limited contraction in values.

The loan to value ratio (LTV) is 38.3% excluding transfer taxes,

and 36.0% including transfer taxes. The portfolio value is Euro

3,186 million including transfer taxes, down -2.2% over six months.

The average appraisal yield rate came to 5.74% vs. 5.72% at

end-December 2020. The EPRA NDV is down -6.8% over six months to

Euro 17.17 per share, reflecting the adjustment of the portfolio

value, the impact of the fair value recognition of fixed-rate debt,

and the increase in the number of shares outstanding following the

partial payment of the dividend in shares

- Business close to 2019 levels and positive trend for

retailer sales. Footfall levels for Mercialys centers, between

the reopening of stores on May 19 and June 30, 2021, reached 91% of

the pre-crisis activity level from 2019. Retailer sales for May

came in +8.4% higher than 2020, while June’s figures are up +5.6%,

confirming the continued appeal of physical retail. Retailers are

returning to robust development trends based on limited rent

adjustments

- The rollout of the government support measures in the second

half of 2021 is expected to normalize the rent collection

levels. The gross collection rate1 for 2020 increased by Euro

7.0 million during the first half of 2021 to reach 88.3%, of which

Euro 4.1 million for the 2nd and 3rd quarters of 2020. The rate for

the first half of 2021 is 75.0%, negatively affected by the

government-ordered closures and the timeframes for the French

government to put in place the retailer support measures that it

has committed to following the compulsory closures linked to the

third lockdown. However, the French government has made a public

commitment to put in place support packages, in addition to the

solidarity fund, that will notably enable retailers that were

ordered to close to honor their rent payments. As a result, no

receivables were written off for the first half of 2021

- Funds from operations (FFO) at end-June 2021 reflect the

impacts of the health crisis, the refinancing operation carried out

in July 2020 and the asset sales completed in December 2020.

Invoiced rents are down -4.0% like-for-like to Euro 83.4 million,

including the impact of the relief granted to tenants for the 2020

closures and the impact of the government-ordered closures on

business in 2021. Funds from operations are down -11.6% to Euro

55.7 million, including the full-year impact of the July 2020

refinancing and the asset sales finalized in December 2020

- 2021 objectives: excluding the impacts of a further

deterioration in the health situation, including the potential

impacts of the measures relating to the “health pass” (reduced

footfall, further weakening of retailers, likely drop in variable

rents and the contribution from Casual Leasing, and increase in

additional operating expenses), Mercialys expects its funds from

operations (FFO) per share to be at least stable in 2021 compared

with 2020

Jun 30, 2020

Jun 30, 2021

Change %

Organic growth in invoiced rents including

indexation and Covid-19 impacts

-0.8%

-4.0%

-

Spread between the year-on-year change in

footfall2

for Mercialys centers vs. the CNCC index3

(year to end-June)

+640bp

+60bp

-

Year-on-year change in sales2 for

Mercialys retailers (month of June)

+0.6%

+5.6%

-

Funds from operations, FFO (€m)

63.0

55.7

-11.6%

ICR (EBITDA / net finance costs)

10.6x

5.6x

-

LTV (excluding transfer taxes)

41.1%

38.3%

-

LTV (including transfer taxes)

38.6%

36.0%

-

Portfolio value including transfer taxes

(€m)

3,522.6

3,185.6

-9.6%

EPRA NDV (€ per share)

19.90

17.17

-13.7%

I. Shopping centers significantly impacted

by measures to tackle the health crisis during the first half of

2021, but operations have bounced back strongly since

reopening

The first half of 2021 continued to be widely marked by the

effects of the health crisis linked to Covid-19, impacting the

activity of Mercialys’ shopping centers due to the measures set out

by the public authorities as part of efforts to tackle the

epidemic.

These measures were stricter for the shopping centers than those

in force during the first lockdown in 2020.

On the one hand, due to the very long period of

government-ordered closures affecting the centers, from January 31

to May 19, 2021, i.e. 3.5 months (compared with less than two

months during the first half of 2020). This closure period was

preceded by curfews, which had already had a major impact on store

footfall levels from January 2, 2021.

On the other hand, due to its scale, with stronger restrictions

than in 2020 concerning the scope of stores authorized to open and

the gradual ban on click and collect activities between January 31

and May 19, 2021. Only 36% of Mercialys’ rental base was able to

continue trading during the strict lockdown period in 2021 (i.e.

from April 3 to May 19), compared with 40% and 50% respectively

during the first and second lockdowns in 2020.

On May 19, 2021, the French government authorized the reopening

of “non-essential” stores. Mercialys’ shopping centers were able to

once again welcome members of the public across their entire retail

space (excluding indoor sit-down dining), in accordance with strict

health protocols and restrictions on minimum space ratios. Indoor

restaurants have been able to reopen since June 9, 2021, subject to

various health measures and minimum space ratios. These

restrictions on minimum space ratios were lifted on June 30, 2021

for venues open to the public, and France has not been subject to

any curfew measures since June 20, 2021.

As in 2020, a significant upturn was seen when “non-essential”

stores reopened, reflecting French consumers’ strong expectations

for a return to physical consumption at sites offering, through

this relationship’s inherent human contact, a wide selection of

products that are available immediately.

Mercialys’ very strong performance at this time also reflects

its commercial expertise, and notably illustrates its understanding

of the stakes involved with providing reassurance, visibility and a

welcoming environment for these reopening phases.

From May 19, 2021, the Company rolled out an extensive

communications plan in order to support a preferential return for

its end customers within its centers. In addition to communicating

on the high level of standards applied regarding health aspects,

Mercialys has shared a clear, identifiable message about opening

up, as well as the retail selection, the services available and the

human relationship provided by its sites.

Supporting this dynamic approach, the Company has also rolled

out a major operation through Prim’Prim’, its proprietary and 100%

digital loyalty program. Built around a drive-to-store approach

from May 19 to June 22, 2021, and a stronger volume of loyalty

cashbacks, adapted vouchers and a retailer challenge, this

operation has directly benefited the transformation rate and sales

for the 920 retailers in the 24 centers that are part of the

loyalty program. Mercialys has observed that, on average, more than

Euro 8 of sales are generated for each euro of vouchers spent at

its centers. The digitalization of the loyalty program also enables

the Company to collect and analyze transaction details, with Euro

2.5 million of sales generated for its retailers by Prim’Prim’

customers through this operation. Combined with the ramping up of

recruitment for loyalty program members during this period (+30%

more qualified contacts recorded since reopening), it is further

strengthening the increasingly fine-grained understanding of end

customers’ specific needs and habits, supporting the performance of

both Mercialys and its tenants.

II. The accounts at end-June 2021 reflect

the impact of the support measures for 2020 and the closures in

2021

Impacts of the support measures granted to tenants for the

two lockdowns from 2020 on the accounts at end-June 2021

The continued health crisis linked to Covid-19 in 2021 impacted

the operational indicators for the first half of 2021, as detailed

in Point III of this press release.

The retailer support measures put in place by Mercialys in

connection with the two lockdown phases in 2020 also had impacts on

the accounts at June 30, 2021.

On the one hand, Mercialys had set a maximum support budget of

Euro 13.5 million to help its tenants faced with the

economic impacts of the first lockdown in 2020 (March 15 -

May 11). Euro 9.4 million had been agreed by end-2020, with the

remaining Euro 4.1 million corresponding to negotiations that had

not been completed by the end of the year. The accounts at end-June

2021 reflect the progress made with these negotiations as

follows:

- Euro 1.7 million of new relief

granted and to be awarded, with 100% recognized in the accounts at

June 30, 2021 under invoiced rents. As these relief measures relate

to doubtful receivables covered by provisions in Mercialys’

accounts at end-December 2020, they have resulted in reversals of

provisions for doubtful receivables for the corresponding amounts.

As a result, these rent relief measures are neutral in terms of the

Company’s results. The balance of the Euro 13.5 million support

budget for the first lockdown, representing Euro 2.4 million, will

be subject to the same treatment if negotiations with the remaining

retailers are finalized;

- Euro 0.7 million impact for items

being spread in the accounts, recognized under invoiced rents, in

connection with the negotiations completed in 2020. For reference,

Euro 6.4 million of negotiations from 2020 were spread in the

accounts over the remaining term of the leases, with Euro 1.1

million already recognized in the accounts at end-December 2020.

The recognition of the remaining Euro 4.5 million will be spread

over the second half of 2021 and then 2022 to 2026, with Euro 0.7

million, Euro 1.4 million, Euro 1.3 million, Euro 0.6 million, Euro

0.3 million and Euro 0.1 million respectively.

On the other hand, negotiations have continued moving forward

with retailers in connection with the second lockdown in

2020 (October 30 - November 28):

- In line with the French government’s

recommendations, Mercialys had offered to waive part of their 2020

fourth-quarter rent for the retailers affected by the second

lockdown in 2020. The impact of this measure was estimated at

Euro 6.3 million and recognized in full in the accounts at

end-December 2020 under invoiced rents as provisions for relief to

be granted. During the first half of 2021, the negotiations with

retailers resulted in an effective amount of relief granted or to

be awarded of Euro 5.4 million, lower than initially estimated by

Mercialys. The reversal of provisions for relief to be granted

therefore led to Euro 0.9 million of net income under

invoiced rents at end-June 2021 for the section of these provisions

that were no longer applicable;

- As it was not in a position to quantify the

specific support measures for sit-down restaurants, Mercialys’

end-December 2020 accounts also included Euro 0.5 million of

provisions for the impairment of doubtful receivables associated

with this segment’s arrears for the month of November 2020. The

total amount of support granted within this framework during the

first half of 2021 came to Euro 0.4 million, once again resulting

in net income for the amount of the Euro 0.2 million

differential that was no longer applicable, when reversing the

provisions for the impairment of doubtful receivables;

- Lastly, a tax credit mechanism was

introduced by the French government in 2020 for the relief granted

by landlords in connection with the second lockdown, with various

restrictions for each type of tenant and requirements for tenants

to provide specific information. Mercialys had not recognized any

impact for this mechanism in its accounts at December 31, 2020. In

view of the aforementioned support measures put in place during the

first half of 2021 for the second lockdown in 2020, the Company

recorded Euro 0.5 million of income reflecting this tax

credit under net rental income in its accounts at June 30, 2021.

Further income is expected to be recorded over the coming months as

applications are received from tenants and rent relief is

awarded.

As the effects of the health crisis spread to 2021, they

are reflected in a slowdown in the normalization of the collection

rate for FY 2020. For reference, the residual risk concerning the

previous year was covered in the accounts at December 31, 2020 with

Euro 13.2 million of exceptional provisions recorded for arrears

relating to rent and charges from the second and third quarters of

2020 (therefore including the

Euro 4.1 million balance from the support budget not yet awarded

at the time in connection with the first lockdown).

During the first half of 2021, Mercialys continued moving

forward with negotiations with its retailers and its collection

actions for rent and charges billed in 2020, with retailers paying

Euro 4.1 million of rent and charges from the second and

third quarters of 2020. The resolution of these arrears made it

possible to generate income linked to the reversal of provisions

for the impairment of doubtful receivables concerning the Euro 13.2

million of exceptional provisions recorded at end-December 2020,

with Euro 3.7 million in the accounts at end-June 2021. This

amount is in addition to the accounting impacts mentioned

previously, reducing the remaining amount of the exceptional

provisions to Euro 7.8 million in the accounts at end-June

2021.

The collection rate for 2020 is broken down for each quarter in

the following table. It is presented based on the full amount of

rent and charges excluding tax billed to tenants (“gross” rate),

while also taking into account the amounts of rent relief already

granted or still to be awarded to retailers, in addition to

provisions for the impairment of doubtful receivables.

Gross collection rate

Collection rate including the

rent relief already granted or still to be awarded

Collection rate including the

rent relief already granted or still to be awarded and the

provisions for impairment of doubtful receivables

At Dec 31, 2020

At Jun 30, 2021

At Jun 30, 2021

At Jun 30, 2021

1st quarter of 2020

97.4%

97.8%

97.8%

99.0%

2nd quarter of 2020

63.9%

69.4%

84.0%

100.0%

3rd quarter of 2020

93.4%

95.5%

95.5%

100.0%

4th quarter of 2020

86.2%

90.1%

97.5%

98.9%

2020 full year

85.3%

88.3%

94.2%

99.5%

Since June 30, 2021, the closing date for these half-year

accounts, an additional Euro 0.6 million of rent and charges have

been collected, taking the total gross collection rate for 2020 up

to 88.6%.

No arrangements for landlords to provide rent relief in

connection with the government-ordered closures in 2021, as the

French government has made a commitment to support retailers to

cover their rent and charges

As mentioned above, the shopping center sector in France has

been significantly affected, since January 2021, by the government

measures relating to the health crisis. Meanwhile, the French

government has made a commitment to put in place support packages,

in addition to the solidarity fund and the mechanism covering fixed

costs, which should notably enable tenants that were ordered to

close to honor their rent payments. However, there have been delays

with rolling out these support measures, impacting the collection

rates for rent and charges for the first half of 2021. Considering

the public commitments made by the French government, Mercialys has

not determined any additional support measures relating to the

government-ordered closures for the first half of 2021.

The collection rate for the first half of 2021 is presented in

detail for each quarter in the following table. As Mercialys has

not granted any rent relief to its tenants for this period, this

represents a “gross” collection rate, as defined previously.

Gross collection rate

Residual arrears for rent and

charges excluding tax (€m)

At Jun 30, 2021

At Jun 30, 2021

1st quarter of 2021

81.0%

10.3

2nd quarter of 2021

68.6%

16.3

1st half of 2021

75.0%

26.6

Since June 30, 2021, the closing date for these half-year

accounts, an additional Euro 2.3 million of rent and charges have

been collected, taking the total collection rate for the first half

of 2021 up to 76.9%.

The overall impacts of the health crisis presented above can be

broken down as follows:

Impacts

Corresponding 2020

lockdown

Profit and loss

heading

Jun 30, 2020

Dec 31, 2020

Jun 30, 2021

Amount before potential

deferral (€m)

Treatment in profit and loss

(€m)

Amount before potential

deferral (€m)

Treatment in profit and loss

(€m)

Amount before potential

deferral (€m)

Treatment in profit and loss

(€m)

Negotiations finalized

1st

Invoiced rents / Provisions for

relief to be granted

-4.7

-1.2

-9.4

-4.1

-1.7

-2.4(1)

Negotiations finalized associated

with the documentation to be received from tenants

2nd

Invoiced rents / Provisions for

relief to be granted

na

na

-6.3

-6.3

+0.5

+0.5(2)

Subtotal

-4.7

-1.2

-15.7

-10.4

-1.2

-2.0

Arrears relating to the 2nd and

3rd quarters of 2020

1st

Provisions for doubtful

receivables

0.0

0.0

-13.2

-13.2

+5.4

+5.4(3)

Arrears for November 2020

relating to sit-down restaurants

2nd

Provisions for doubtful

receivables

na

na

-0.5

-0.5

+0.5

+0.5(4)

Subtotal

0.0

0.0

-13.7

-13.7

+5.9

+5.9

Tax credit

2nd

Net rental income

2nd lockdown not yet occurred

Positive impact not determined on

the reporting date

+0.5

+0.5(5)

TOTAL

-4.7

-1.2

-29.4

-24.1

+5.2

+4.5

(1) Euro -2.4 million comprising Euro -1.7

million for new relief granted for the first lockdown from 2020,

with 100% recognized in the accounts at June 30, 2021 and Euro -0.7

million for amounts spread in the accounts for the 2020

negotiations relating to the same lockdown; (2) Euro +0.5 million

comprising Euro -5.4 million for relief granted for the

negotiations concerning the second lockdown, Euro +6.3 million for

the reversal of provisions for relief to be granted as a result of

this (therefore generating Euro +0.9 million of net income for the

section that was no longer applicable) and Euro -0.4 million for

the relief granted and to be awarded for the month of November 2020

for sit-down restaurants; (3) Euro +5.4 million comprising Euro

+1.7 million for the reversal of provisions for doubtful

receivables resulting from the new relief granted for the first

lockdown in 2020, and Euro +3.7 million for the reversal of

provisions for doubtful receivables relating to the additional

collection for 2020; (4) Euro +0.5 million comprising Euro +0.5

million for the reversal of provisions for doubtful receivables

relating to rent for the month of November 2020 for sit-down

restaurants (therefore generating Euro +0.2 million of net income

for the section that was no longer applicable); (5) Euro +0.5

million comprising Euro +0.5 million for the tax credit recognized

to date in connection with the documentation to be provided by

retailers that have benefited from rent relief for the second

lockdown in 2020.

III. 2021 first-half business and

results

Footfall at Mercialys’ sites4 has bounced back very

strongly since the centers reopened on May 19, 2021, highlighting

French consumers’ attachment to their retailers and more generally

the appeal of physical retail. The number of visits recorded

between May 19 and June 30, 2021 at Mercialys centers reached 91%

of the pre-crisis level from 2019. During the first half of the

year, footfall contracted by -12.2% compared with the first half of

2020, outperforming the CNCC national index by 60bp, despite this

index benefiting from a favorable base effect as very large

shopping centers were closed during the first half of 2020 until

the start of July, whereas they were able to reopen on May 19 in

2021, at the same time as the other retail formats.

As a result of the many months when stores were closed, the

assessment of the change in retail sales over the first half

of 2021 is not relevant. Nevertheless, Mercialys has observed a

very good performance by retailers in its centers since stores were

able to reopen, with May 2021 showing average growth of +8.4%

compared with May 2020, even though stores remained closed for an

additional eight days in May 2021 versus May 2020. Compared with

June 2020, retailer sales for the month of June 2021 are up +5.6%.

For reference, retailer sales following the first lockdown in 2020

were already up +0.6% in June 2020 versus June 2019.

The analysis of the occupancy cost ratio5 is subject to

the same limitations as the sales analysis due to the periods when

stores were ordered to close. For reference, this ratio showed a

very moderate level of 10.4% at December 31, 2019.

The current financial vacancy rate6 was 4.0% for the

first half of 2021, slightly higher than the 3.8% recorded at

end-2020. The tenants who left sites during the first half of 2021

account for 100bp, while more than half of the units are already at

an advanced stage for reletting. Nevertheless, these departures

impacted organic growth during the first half of 2021 and are

presented under “Actions carried out on the portfolio” in the table

on page 8.

The health crisis has occurred in a context in which the retail

industry had already been weakened by the social protest movements

and reduced consumer interest in certain retailers, particularly in

the textiles sector. While this environment has led to pressure on

Mercialys’ rents, this has remained limited in relation to the

extreme nature of the economic and social situation faced, and does

not reflect any fundamental paradigm shift in the relationship

between retailers and landlords.

Mercialys recorded limited negative reversion of -6.5% on the

leases that were subject to renewals or relettings during the first

half of 2021, with a contraction of around Euro -0.7 million in the

Euro 8.6 million rental base represented by the 149 leases signed

(equivalent to 5% of the Company’s total rental base). These

results include the specific negotiations with the retailer

Camaïeu, which is one of the few chains in Mercialys’ portfolio to

have been subject to liquidation proceedings and a takeover by a

new investor. Excluding this specific situation, the reversion

generated during the first half of 2021 came to -5.4%.

Negotiations with the retailers are continuing to move forward

with a view to securing Mercialys’ rental flows, and cover a total

of 12.4% of the rental base to date. Taking into account all of the

lease renewals and relettings since January 1, 2021 to date, as

well as the advanced negotiations (approvals), Mercialys would

record a limited adjustment of Euro -1.2 million in its total

rental base, representing -0.7%.

Since the start of the health crisis, 669 lease amendments have

been signed, covering the relief measures granted in connection

with the two lockdowns in 2020. Around 5% of them resulted in a

negative impact on headline rent, showing that the vast majority of

retailers have not opened fundamental negotiations concerning rent

levels.

Moreover, in exchange for the relief granted in connection with

the two lockdowns in 2020, Mercialys has achieved an average

extension of 8.8 months for the firm term of leases across its

portfolio, helping secure its rent profile. This initiative to

ensure the sustainability of retailers within the centers, and

therefore the corresponding rental flows, has been able to move

forward by setting up early renewals, deferring three-year breaks,

or waiving the next three-year break.

As a result of these encouraging commercial trends, whereas at

the end of 2020 the leases expired or due to expire at December 31,

2021 represented 20.9% of the Group’s rental base, they are down to

just 10.9% of the Company’s total rental base to date, taking into

account all of the leases and the negotiations at an advanced

stage.

Invoiced rents came to Euro 83.4 million, down -8.1% on a

current basis and -4.0% like-for-like. These changes reflect the

following elements:

Year to end-June 2020

Year to end-June 2021

Indexation

+1.6 pp

Euro +1.5 million

+0.3 pp

Euro +0.2 million

Contribution by Casual Leasing

-0.8 pp

Euro -0.8 million

-0.4 pp

Euro -0.4 million

Contribution by variable rents

-0.1 pp

Euro -0.1 million

-0.8 pp

Euro -0.8 million

Actions carried out on the portfolio

-0.2 pp

Euro -0.2 million

-2.3 pp

Euro -2.1 million

Accounting impact of “Covid-19 rent

relief” granted to retailers for the 2020 lockdowns

-1.3 pp

Euro -1.2 million

-0.8 pp

Euro -0.7 million

Like-for-like growth

-0.8 pp

Euro -0.8 million

-4.0 pp

Euro -3.7 million

Asset acquisitions and sales

-2.3 pp

Euro -2.2 million

-4.0 pp

Euro -3.6 million

Other effects

-0.2 pp

Euro -0.2 million

-0.1 pp

Euro 0.0 million

Growth on a current basis

-3.3 pp

Euro -3.1 million

-8.1 pp

Euro -7.3 million

Rental revenues came to Euro 84.7 million, down -8.0%

from the first half of 2020, reflecting the contraction in invoiced

rents and the slight drop in lease rights and despecialization

indemnities.

Net rental income is down -1.9% to Euro 84.0 million.

This includes Euro +0.9 million and Euro +0.2 million of net income

linked to the reversal of provisions that were no longer applicable

following the negotiations completed in connection with the second

2020 lockdown, as well as Euro +0.5 million of income linked to the

tax credit recognized to date for these same negotiations. Further

income relating to the tax credit is expected to be recorded over

the coming months as applications are received from tenants and

rent relief is awarded.

EBITDA totaled Euro 76.3 million, down -2.3% compared

with June 30, 2020. The EBITDA margin came to 90.1% (vs. 74.8% at

December 31, 2020 and 84.9% at June 30, 2020).

The net financial expenses used to calculate FFO7

represent Euro 16.1 million, versus Euro 10.1 million at end-June

2020, reflecting the full-year impact of the bond issue carried out

in July 2020. This same impact is reflected in the real average

cost of drawn debt of 1.9%, compared with the 1.4% recorded for

the full year in 2020.

Other operating income and expenses (excluding capital gains

on disposals and impairments) came to Euro -0.2 million and

primarily include the impact of the ramping up of activities for

Ocitô and Cap Cowork.

Tax represents a Euro 0.4 million expense at end-June

2021 (Euro 1.2 million for the first half of 2020). This amount

corresponds primarily to a CVAE corporate value-added tax

expense.

The share of net income from equity associates and joint

ventures (excluding capital gains, amortization and

impairments) came to Euro 1.7 million at June 30, 2021,

compared with Euro 1.4 million at June 30, 2020. The change in this

share over the period reflects the assets sold and acquired by SCI

AMR at end-December 2020, and the dilution of Mercialys’ interest

in this company (from 39.9% to 25.0%), as well as the impact of

rent relief granted by associates in connection with the health

crisis.

Non-controlling interests (excluding capital gains,

amortization and impairments) came to Euro 5.3 million at June

30, 2021, virtually stable compared with the first half of 2020

(Euro 5.2 million).

Funds from operations (FFO7) are down -11.6% from June

30, 2020 to Euro 55.7 million, with Euro 0.60 per share8.

(In thousands of euros)

Jun 30, 2020

Jun 30, 2021

Change (%)

Invoiced rents

90,732

83,419

-8.1%

Lease rights and despecialization

indemnities

1,271

1,246

-2.0%

Rental revenues

92,003

84,665

-8.0%

Non-recovered service charges and property

tax and other net property expenses

(6,378)

(699)9

-89.0%

Net rental income

85,626

83,966

-1.9%

Management, administrative and other

activities income

1,698

1,292

-23.9%

Other income and expenses

(2,384)

(2,042)

-14.4%

Personnel expenses

(6,860)

(6,900)

+0.6%

EBITDA

78,079

76,317

-2.3%

EBITDA margin (% of rental revenues)

84.9%

90.1%

-

Net financial income (excluding

non-recurring items10)

(10,087)

(16,101)

+59.6%

Reversals of / (Allowances for)

provisions

1,272

(346)

na

Other operating income and expenses

(excluding capital gains on disposals and impairments)

(1,268)

(199)

-84.3%

Tax expenses

(1,215)

(423)

-65.2%

Share of net income from equity associates

and joint ventures (excluding capital gains, amortization and

impairments)

1,402

1,745

+24.5%

Non-controlling interests (excluding

capital gains, amortization and impairments)

(5,188)

(5,300)

+2.1%

FFO (Funds from operations)

62,993

55,694

-11.6%

FFO per share8 (Funds from operations

per share) - in euros

0.69

0.60

-12.1%

IV. Continuous improvement dynamics

supporting the digital ecosystem and site usage

Mercialys has always developed an agile approach to real estate

and retail, through its proven capacity to innovate and anticipate

trends, as well as a test and learn approach.

Ocito.net, its proprietary marketplace enabling consumers to buy

products online directly from their center’s retailers, is an

outstanding example of this approach. Launched in 2019 at a pilot

site, then extended nationwide in 2020, it has now been rolled out

across 30 centers and offers more than 40,000 products from 250

retailers.

By accelerating the diversification of the ways people consume

and proving the relevance of a unified retail vision, the health

crisis has contributed to the rapid change of scale achieved with

Ocitô. The intrinsic multimodal features of this service,

characterized by the in-store collection, drive-through, postal or

home delivery options available to end customers for their

products, have offered retailers an opportunity to adapt to a

context in which their activities have faced significant

disruption, helping them to generate sales and maintain links with

their customers.

In addition to its accelerated rollout, the gradual

strengthening of services (including express evening and weekend

deliveries), the technical and ergonomic changes made to enhance

the platform, and the various promotional and communication

operations aimed at end customers have been a valuable source of

information for Mercialys, supporting the volume of sales achieved

through the platform.

Capitalizing on this feedback, Mercialys has notably chosen to

focus its operational, human and promotional resources on the

centers with the highest volume of orders and therefore the best

potential for creating value. Moreover, the concentration of sales

on the retailers that are most involved in researching

complementary features to dovetail with their physical offering

highlights the importance of close collaboration between Mercialys

and its retailers using this service.

The Company is prioritizing close synergies with the retailers

that are most interested in Ocitô through specific support for ad

hoc requirements, such as the outlet operation carried out in June

2021, offering exclusive access through the platform to sales of

stock clearance items offered by seven stores from the Toulouse

shopping center. Generating an average spend of over Euro 30, these

fundamentally omnichannel commercial operations are proving to be

particularly relevant, supporting sales of stock that has become

counter-productive in store by occupying sales space at the expense

of new collections. This type of ad hoc campaign, aligned with the

needs of the retailers present in the centers, also helps them to

stand out within their catchment area.

This agile innovation approach is also illustrated by the

deployment of Mercialys’ multifunctionality strategy. The success

of the first two Cap Cowork spaces in particular, at the Grenoble

and Angers sites, with an average occupancy rate of 90% for their

closed offices, has provided strong insights into the coworking

market in regions where the structuring of these services is

relatively limited.

The typical Cap Cowork customer profile of professionals, very

small businesses and startups that can opt for the business address

service shows a clear preference for fixed, closed, individual

offices, rented for several months. In addition to contributing to

this service’s resilience despite the restrictive health context

over the first half of 2021, these features have been rapidly

incorporated into the projects for 2021. The solution’s

adaptability also benefits from work being carried out in just six

to eight weeks, and moderate investment levels of around Euro 0.7

million per site.

The extension of the Cap Cowork site in Angers, which opened in

July 2021, increased its total space by more than 200 sq.m. The

site can now welcome 54 customers, compared with 31 previously, and

offers considerably more individual closed office spaces than open

spaces compared with the initial design. The second project for

2021, which opened at the Toulouse shopping center, also in July,

offers 45 spaces spread over nearly 450 sq.m, with 90% closed

offices, and a large terrace with over 250 sq.m of space, further

strengthening this site’s appeal. Lastly, in the third quarter of

2021, Mercialys will inaugurate a new

Cap Cowork space in Nîmes, generating potential additional

rental income over 260 sq.m of space that was not initially

intended for letting (previous center management offices).

V. Project portfolio focused on creating

value and reconfiguring sites

In addition to the developments underway, Mercialys is looking

into a number of mixed-use reconfiguration projects for its sites,

aiming to build local service hubs that bring together diverse

sectors within which the Company has shown its expertise for

several years (coworking, healthcare centers, food courts,

last-mile logistics, leisure and education spaces, etc.). Part of a

far-reaching urban review, liaising with regional stakeholders,

these projects aim to further strengthen the sites’ anchoring

within their communities, while continuing to consolidate their

leading positions, transforming Mercialys’ centers into outstanding

living and socializing spaces.

At end-June 2021, Mercialys’ project portfolio represented Euro

474.6 million through to 2027, with Euro 32.1 million of additional

rental potential and an average target yield rate of 7.0%.

This portfolio, which concerns 31 sites out of the 51 shopping

centers and high-street assets owned by the Company, includes

retail space projects (redevelopments, extensions, retail parks),

dining and leisure projects, and tertiary activity projects

(housing, healthcare, coworking, etc.).

(In millions of euros)

Total investment

Investment still to be

committed

Target net rental

income

Target net yield on cost

(%)

Completion date

COMMITTED PROJECTS

27.0

24.9

0.811

na11

2021/2026

Dining and leisure

5.3

4.2

0.111

na11

2021/2022

Tertiary activities

21.7

20.7

0.711

na11

2021/2026

CONTROLLED PROJECTS

131.7

127.3

9.2

7.0%

2022/2024

Retail

86.9

82.7

6.1

7.0%

2022/2024

Tertiary activities

44.8

44.7

3.1

7.0%

2022/2023

IDENTIFIED PROJECTS

315.9

315.9

22.1

7.0%

2023/2027

Retail

88.5

88.5

6.2

7.0%

2023/2025

Dining and leisure

79.0

79.0

5.5

7.0%

2024

Tertiary activities

148.5

148.4

10.4

7.0%

2023/2027

TOTAL PROJECTS

474.6

468.1

32.112

7.0%12

2021/2027

- Committed projects: projects fully secured in terms of land

management, planning and related development permits - Controlled

projects: projects effectively under control in terms of land

management, with various points to be finalized for regulatory

urban planning (constructability), planning or administrative

permits - Identified projects: projects currently being structured,

in emergence phase

VI. Portfolio and financial

structure

EPRA Net Disposal Value (NDV) down -6.8% over six months and

-13.7% over 12 months

Mercialys’ portfolio value came to Euro 3,185.6 million

including transfer taxes, down -2.2% over six months and -9.6% over

12 months. Like-for-like13, it is down -2.2% over six months and

-4.5% over 12 months.

Excluding transfer taxes, the portfolio value came to Euro

2,996.6 million, down -2.3% over six months and -9.6% over 12

months. Like-for-like13, it is down -2.3% over six months and -4.5%

over 12 months.

At end-June 2021, Mercialys’ portfolio mainly comprised 51

shopping centers and high-street sites14, with 25 large regional

shopping centers and 26 leading local retail sites (neighborhood

shopping centers and city-center assets).

The average size of the 49 shopping centers (excluding the two

high-street retail assets) was nearly 16,600 sq.m at end-June 2021,

compared with 7,400 sq.m at end-2010. Their average value was Euro

64.4 million including transfer taxes in the first half of 2021,

compared with Euro 26.9 million in 2010.

The average appraisal yield rate was 5.74% at June 30,

2021, compared with 5.72% at December 31, 2020 and 5.49% at June

30, 2020.

The EPRA net asset value indicators are as follows:

EPRA NRV

EPRA NTA

EPRA NDV

Jun 30, 2021

Dec 31, 2020

Jun 30, 2020

Jun 30, 2021

Dec 31, 2020

Jun 30, 2020

Jun 30, 2021

Dec 31, 2020

Jun 30, 2020

€/share

20.32

21.18

22.00

18.26

19.04

19.6815

17.17

18.42

19.90

-4.1% over six months

-7,6% over 12 months

-4.1% over six months

-6.8% over six months

-7.2% over 12 months

-13.7% over 12 months

The EPRA Net Disposal Value (NDV) came to Euro 1,608.1

million at end-June 2021 vs. Euro 1,823.3 million at end-June 2020.

Per share, it represents Euro 17.1716, down -6.8% over six months

and -13.7% over 12 months, with this change taking into account the

May 2021 capital increase carried out in connection with the

partial payment of the dividend in shares.

The Euro -1.25 per share change16 for the first half of this

year takes into account the following impacts:

- dividend payment: Euro -0.42; - funds from operations (FFO):

Euro +0.5917; - change in unrealized capital gains (i.e. difference

between the net book value of assets on the balance sheet and their

appraisal value excluding transfer taxes): Euro -0.71, including a

yield effect for Euro -0.12, a rent effect for Euro -0.62 and other

effects18 for Euro +0.03; - change in fair value of fixed-rate

debt: Euro -0.49; - change in fair value of other items: Euro

+0.01; - the capital increase in connection with the option for the

2020 dividend to be paid in shares, as well as the change in

treasury shares: Euro -0.23.

Particularly solid financial structure despite the economic

and health crisis context

At end-June 2021, drawn debt represented Euro 1,449.5

million, made up of three bond issues and a private placement, with

a residual nominal amount of Euro 1,299.5 million, as well as

commercial paper, with Euro 150 million outstanding at end-June

2021.

At June 30, 2021, Mercialys had Euro 405 million of undrawn

financial resources, unchanged compared with December 31, 2020.

Mercialys also has a Euro 500 million commercial paper program,

with further issuing capacity of Euro 350 million, taking into

account the outstanding amount at June 30, 2021.

The real average cost of drawn debt for the first half of

2021 was 1.9%, up from the 2020 full-year figure of 1.4%, mainly

reflecting the impact of the bond refinancing operation carried out

in July 2020.

The average maturity of drawn debt was 3.6 years at

end-June 2021, compared with 3.5 years at end-December 2020 and 3.2

years at end-June 2020.

Mercialys has a healthy financial structure, with an LTV

ratio excluding transfer taxes19 of 38.3% at June 30, 2021

(compared with 38.1% at December 31, 2020 and 41.1% at June 30,

2020) and an LTV ratio including transfer taxes of 36.0% on

the same date (versus 35.8% at December 31, 2020 and 38.6% at June

30, 2020). The Company has maintained a very balanced financial

profile despite the effects of the economic and health crisis,

reflected in pressure on rent collection for 2020 and the first

half of 2021.

The ICR was 5.6x20 at June 30, 2021, compared with 5.0x

at December 31, 2020 and 10.6x at June 30, 2020, reflecting the

impacts of the health crisis on EBITDA and the impacts of the July

2020 bond refinancing on financial expenses.

On May 19, 2021, Standard & Poor’s confirmed its BBB /

negative outlook rating for Mercialys.

Alongside this, Mercialys has maintained a high level of

hedging for its debt, with a hedged or fixed-rate debt

position (including commercial paper) of 87% at end-June 2021,

compared with 92% at end-December 2020 and 82% at end-June

2020.

VII. 2021 outlook

The first half of 2021 was marked by a particularly long period

of government-ordered closures affecting shopping centers for more

than 3.5 months. However, the Company maintained its strong letting

trends, securing a sustained balance between providing support for

retailers, ensuring the sustainability of its rental flows and

moving forward with its collection efforts.

The context accompanying the reopening of stores since May 19,

2021 seems encouraging, and the forced savings built up by French

people during this health crisis period could be gradually freed up

to benefit consumption.

Nevertheless, there is still significant uncertainty surrounding

the coming months due to changes in the health situation, as well

as the potential enforcement of the “health pass” in shopping

centers. This decision to require visitors to show proof of full

vaccination, a negative PCR test or a recent Covid-19 infection

certificate at the entrance to sites will be entrusted by the

government from August 5, 2021 to prefects in the various French

departments, which may therefore lead to local applications of the

“health pass” on a case-by-case basis.

In this context, excluding the impacts of a further

deterioration in the health situation, including the potential

impacts of the measures relating to the “health pass” (reduced

footfall, further weakening of retailers, likely drop in variable

rents and the contribution from Casual Leasing, and increase in

additional operating expenses), Mercialys expects its funds from

operations (FFO) per share to be at least stable in 2021 compared

with 2020.

* * *

This press release is available on

www.mercialys.com A presentation of these results is also available

online, in the following section: Investors / News and Press

Releases / Presentations and Investor Days

About Mercialys Mercialys is one of France’s leading real

estate companies. It is specialized in the holding, management and

transformation of retail spaces, anticipating consumer trends, on

its own behalf and for third parties. At June 30, 2021, Mercialys

had a real estate portfolio valued at Euro 3.2 billion (including

transfer taxes). Its portfolio of 2,102 leases represents an

annualized rental base of Euro 169.8 million. Mercialys has been

listed on the stock market since October 12, 2005 (ticker: MERY)

and has “SIIC” real estate investment trust (REIT) tax status. Part

of the SBF 120 and Euronext Paris Compartment B, it had 93,886,501

shares outstanding at June 30, 2021.

IMPORTANT INFORMATION This press release contains certain

forward-looking statements regarding future events, trends,

projects or targets. These forward-looking statements are subject

to identified and unidentified risks and uncertainties that could

cause actual results to differ materially from the results

anticipated in the forward-looking statements. Please refer to

Mercialys’ Universal Registration Document available at

www.mercialys.com for the year ended December 31, 2020 for more

details regarding certain factors, risks and uncertainties that

could affect Mercialys’ business. Mercialys makes no undertaking in

any form to publish updates or adjustments to these forward-looking

statements, nor to report new information, new future events or any

other circumstances that might cause these statements to be

revised.

APPENDIX TO THE PRESS RELEASE FINANCIAL

STATEMENTS

Consolidated income statement

(In thousands of euros)

Jun 30, 2020

Jun 30, 2021

Rental revenues

92,003

84,665

Service charges and property tax

(30,429)

(30,148)

Service charges and tax reinvoiced to

tenants

26,953

25,929

Net property expenses

(2,901)

3,520

Net rental income

85,626

83,966

Management, administrative and other

activities income

1,698

1,292

Other income

53

221

Other expenses

(2,438)

(2,263)

Personnel expenses

(6,860)

(6,900)

Depreciation and amortization

(20,236)

(19,557)

Reversals of / (Allowances for)

provisions

1,272

(346)

Other operating income

3,541

790

Other operating expenses

(15,922)

(6,568)

Operating income

46,734

50,637

Income from cash and cash equivalents

46

162

Expenses from gross financial debt

(7,401)

(14,115)

(Expenses) / Income from net financial

debt

(7,355)

(13,953)

Other financial income

124

153

Other financial expenses

(1,463)

(1,619)

Net financial income

(8,693)

(15,419)

Tax expenses

(1,215)

(423)

Share of net income from equity associates

and joint ventures

775

1,091

Consolidated net income

37,599

35,886

attributable to non-controlling

interests

4,384

4,498

attributable to owners of the parent

33,215

31,388

Earnings per share21

Net income, attributable to owners of the

parent (in euro)

0.36

0.34

Diluted net income, attributable to owners

of the parent (in euro)

0.36

0.34

Consolidated statement of financial position

ASSETS (in thousands of euros)

Dec 31, 2020

Jun 30, 2021

Intangible assets

4,052

3,968

Property, plant and equipment other than

investment property

1,605

2,465

Investment property

2,050,907

2,031,973

Right-of-use assets

8,902

8,392

Investments in equity associates

38,918

38,412

Other non-current assets

73,865

61,796

Deferred tax assets

1,728

1,517

Non-current assets

2,179,976

2,148,523

Trade receivables

38,217

55,825

Other current assets

40,660

30,638

Cash and cash equivalents

464,611

287,958

Investment property held for sale

111

111

Current assets

543,599

374,533

Total assets

2,723,575

2,523,056

EQUITY AND LIABILITIES (in thousands of

euros)

Dec 31, 2020

Jun 30, 2021

Share capital

92,049

93,887

Additional paid-in capital, treasury

shares and other reserves

600,875

614,520

Equity, attributable to owners of the

parent

692,925

708,407

Non-controlling interests

202,193

201,266

Equity

895,118

909,673

Non-current provisions

1,207

1,224

Non-current financial liabilities

1,355,914

1,326,618

Deposits and guarantees

22,295

22,705

Non-current lease liabilities

8,655

8,071

Other non-current liabilities

15,311

10,404

Non-current liabilities

1,403,381

1,369,022

Trade payables

15,394

20,660

Current financial liabilities

348,553

166,677

Current lease liabilities

985

1,080

Current provisions

9,942

10,018

Other current liabilities

50,193

45,820

Current tax liabilities

9

106

Current liabilities

425,076

244,361

Total equity and liabilities

2,723,575

2,523,056

1 Collection rate calculated based on the full amount of rent

and charges excluding tax invoiced by Mercialys to its tenants 2

Mercialys’ large centers and main convenience shopping centers

based on a constant surface area, representing over 85% of the

value of the Company’s shopping centers 3 CNCC index - all centers,

comparable scope 4 Mercialys’ large centers and main convenience

shopping centers based on a constant surface area, representing

over 85% of the value of the Company’s shopping centers 5 Ratio

between rent, charges (included marketing funds) and invoiced work

(including tax) paid by retailers and their sales revenue

(including tax), excluding large food stores 6 The occupancy rate,

as with Mercialys’ vacancy rate, does not include agreements

relating to the Casual Leasing business 7 FFO: Funds From

Operations = Net income attributable to owners of the parent before

amortization, gains or losses on disposals net of associated fees,

any asset impairment and other non-recurring effects 8 Calculated

based on the undiluted average number of shares (basic), i.e.

92,136,487 shares 9 Of which, allocation and reversal of provisions

for the impairment of doubtful receivables linked in particular to

the health crisis 10act of hedging ineffectiveness, banking default

risk, bond redemption price, bond redemption costs, proceeds from

unwinding swaps and exceptional amortization relating to the

partial redemption of the 2023 issue 11the 2021 pipeline, the

investments to be committed, for the dining and leisure section,

correspond to an advance for work by Mercialys at the Annecy site,

which will be reimbursed to it in full, as well as the creation of

two restaurants in the parking area at the Angers site and a food

court at the Sainte-Marie site on Reunion Island. The tertiary

activities primarily include the Saint-Denis mixed-use urban

project, north of Paris, with an expected IRR of over 8%, as well

as coworking spaces 12 Excluding the impact of mixed-use

high-street projects, which could also generate property

development margins 13 Sites on a constant scope and a constant

surface area basis 14 Added to these are four geographically

dispersed assets with a total appraisal value including transfer

taxes of Euro 10.4 million 15 Value adjusted from Euro 19.72 per

share, as published in the 2020 Half-Year Financial Report, to Euro

19.68 per share, in order to more accurately reflect the new

methodology for calculating EPRA NTA 16 Calculation based on the

diluted number of shares at the end of the period, in accordance

with the EPRA methodology regarding NDV 17 Calculation based on the

diluted number of shares at the end of the period, as this concerns

the impact of FFO on the change in NDV per share 18 Including

impact of revaluation of assets outside of organic scope, equity

associates, maintenance capex and capital gains on asset disposals

19 LTV (Loan To Value): Net financial debt / (portfolio market

value excluding transfer taxes + market value of investments in

associates for Euro 55.9 million at June 30, 2021 and Euro 56.3

million at June 30, 2020, since the value of the portfolio held by

associates is not included in the appraisal value) 20 ICR (Interest

Coverage Ratio): EBITDA / net finance costs 21 Based on the

weighted average number of shares over the period adjusted for

treasury shares: - Undiluted weighted average number of shares for

the first half of 2021 = 92,136,487 shares - Fully diluted weighted

average number of shares for the first half of 2021 = 92,136,487

shares

View source

version on businesswire.com: https://www.businesswire.com/news/home/20210728005764/en/

Analysts / investors / media contact: Alexandre Leroy

Tel: +33 (0)1 82 82 75 63 Email: aleroy@mercialys.com

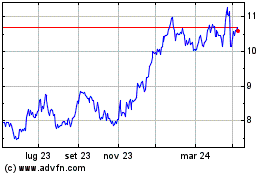

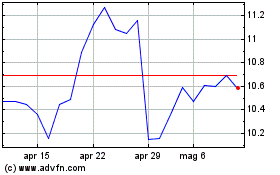

Grafico Azioni Mercialys (EU:MERY)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni Mercialys (EU:MERY)

Storico

Da Apr 2023 a Apr 2024