Michelin: First-half 2021: The Michelin Group reports sales of

€11.2 billion – up 19.6% – and segment operating income of €1.4

billion, representing 12.7% of sales. The Group raises its

full-year guidance.

Clermont-Ferrand, July 26, 2021- 5:45pm

COMPAGNIE GÉNÉRALE DES ÉTABLISSEMENTS

MICHELIN Financial

information for the six months

ended June 30, 2021

First-half

2021: The Michelin Group reports sales of €11.2 billion – up 19.6%

– and segment operating income of €1.4 billion, representing 12.7%

of sales.The Group raises its

full-year guidance.

- In an

environment shaped by an enduring health crisis, the robust market

recovery was tempered by major disruptions in the

global supply chain.

- In this

context, the commitment of Michelin teams helped

to deliver a 19.6% increase in sales and €1,421 million in segment

operating income for the period, with:

- a 22.8%

increase in tire volumes, adding €1,195 million to

SOI1 and reflecting market share

gains in every segment, especially 18-inch and larger tires, and a

4.6% increase in sales of non-tire

activities;

- a €126

million increase from the positive net price-mix/raw materials

effect. The 1.4% gain from responsive pricing management helped to

offset the rise in raw material procurement costs. In addition, the

mix effect added 1% to growth, thanks to the steady enhancement in

the product mix and a favorable market

mix;

- an

unfavorable currency effect, stemming primarily from the US

dollar’s weakness against the euro, which reduced SOI by €150

million.

- Free

cash flow before acquisitions totaled a positive €361 million,

lifted by the growth in EBITDA and the still lower than normal

inventory levels.

- Debt

remained unchanged for the period while equity increased, driving

an improvement in the Group's gearing to 26.7%.

Florent Menegaux, CEO, said: “As markets

continued to recover, the Michelin Group had a very good first

half. These solid results should not overshadow the persistent

impact of the health crisis, which is causing major disruptions,

particularly in the supply chain. I would therefore like to

personally thank the Michelin teams

for their unwavering commitment to enabling our Group to

sustain its leadership in our tire businesses and to continue

deploying our sustainable growth strategy.”

After recovering sharply in the first

half, global demand will not benefit from as favorable a base in

the second half of the year, when it will likely continue to be

impacted by global supply chain

disruptions. Passenger car and Light truck

tire markets are expected to expand by between 8% and 10% over the

year and Truck tire markets by between 6% and 8%. The Specialty

markets should deliver 10% to 12% growth

over the year.

Barring any new systemic effect from

Covid-192, Michelin plans to

strengthen its positions in the prevailing market environment.

Consequently, the Group is raising its objectives for the full

year, targeting segment operating income in excess of

€2.8 billion at constant exchange

rates (versus

> €2.5

billion as previously

announced) and structural free cash

flow3 of more than €1 billion

(versus around €1 billion).

|

(in € millions) |

First-half2021 |

First-half2020 |

|

Sales |

11,192 |

9,357 |

|

Segment operating income |

1,421 |

310 |

|

Segment operating margin |

12.7% |

3.3% |

|

Automotiveand related distribution |

13.1% |

-0.8% |

|

Road transportation and related distribution |

9.9% |

-1.3% |

|

Specialty businessesand related distribution |

14.8% |

14.7% |

|

Other operating income and expenses |

16 |

(133) |

|

Operating income |

1,437 |

177 |

|

Net income/(loss) |

1,032 |

(137) |

|

Earnings per share |

5.74 |

(0.75) |

|

Segment EBITDA |

2,277 |

1,192 |

|

Capital expenditure |

543 |

490 |

|

Net debt |

3,679 |

5,510 |

|

Gearing |

26.7% |

45% |

|

Provisions for post-employment benefit obligations |

3,408 |

3,858 |

|

Free cash flow1 |

346 |

(351) |

|

Free cash flow before acquisitions |

361 |

(310) |

|

Employees on payroll2 |

123,686 |

124,000 |

1 Free cash flow: net cash from operating activities less net

cash used in investing activities, adjusted for net cash flows

relating to cash management financial assets and borrowing

collaterals.

2 At period-end.

Market review

- Passenger car and Light truck tire

markets

|

First-half2021/2020(in number of tires) |

Western&CentralEurope* |

CIS |

North&

CentralAmerica |

South America |

China |

Asia(excluding

India & China) |

Africa/

India/ Middle East |

Total |

|

Original Equipment Replacement |

+26% +22% |

+38% +19% |

+36% +37% |

+57% +40% |

+22% +15% |

+17% +12% |

+48% +27% |

+27% +25% |

|

Second-quarter2021/2020(in number of

tires) |

Western&CentralEurope* |

CIS |

North&

CentralAmerica |

South America |

China |

Asia(excluding

India & China) |

Africa/

India/ Middle East |

Total |

|

Original Equipment Replacement |

+93% +45% |

+80% +52% |

+146% +74% |

+282% +89% |

-8% -2% |

+50% +21% |

+132% +81% |

+46% +46% |

* Including Turkey

In the first half of 2021, the global Original

Equipment and Replacement Passenger car and Light

truck tire market rebounded by 26% in number of tires

sold.

Worldwide unit sales of Original Equipment tires

rebounded by 27% in the first half of 2021. However, this sharp

market upturn from the low 2020 base was dampened by the impact of

semiconductor shortages on the global automotive industry, such

that OE demand ended the period still down 14% compared with

first-half 2019.After a first quarter shaped by a 78% upsurge in

Chinese demand off of favorable prior-year comparatives, the second

three months saw the European and North American markets increase

sharply, for the same reasons, by 93% and 146% respectively. In

China, however, supply chain issues caused demand to contract by 8%

over the quarter.The other regions (South America,

Africa/India/Middle East and Southeast Asia) also enjoyed, as

expected, a strong recovery in the second quarter.

The global Replacement market rebounded by 25%

in the first half, with a faster 46% gain in the second quarter

from much more favorable comparatives in Europe and the Americas,

at a time of sustained recovery in mobility and buying ahead of

price increases.In Western and

Central Europe, growth was stronger in

the Southern countries, which had experienced stricter lockdowns in

first-half 2020, with demand rising 30% in France, 51% in Spain and

28% in Italy, countries where restrictions on freedom of movement

remained in place until May 2021. Several dealers replenished their

inventories ahead of rising prices. In all, European tire demand

ended the period down slightly on 2019 levels.Tire demand in

North and Central America rose a steep 37% in the

first half, with a faster 74% gain in the second quarter led by

very favorable comparatives and the partial rebuilding of dealer

inventories. By the end of June, the Replacement market had climbed

back above 2019 levels.In South America,

Replacement demand ended the first half up 40% year on year, with

an 89% increase in the second quarter and particularly strong

growth in Brazil. By period-end, the South American market had made

up all of the shortfall since first-half 2019.In

China, after a particularly strong first quarter (up 38%

on highly favorable comparatives and inventory rebuilding), demand

was down a slight 2% year-on-year in the second three months,

reflecting the return to normal market conditions in the prior-year

period.In Southeast Asia, Replacement demand rose

by 12% over the first half, with a faster 21% gain in the second

quarter. In 2020, the market drop had not been as steep as in the

other regions. As of end-June 2021, demand was still below 2019

levels.In the Africa/India/Middle East region,

markets rebounded by 27% in the first half, with an 81% increase in

the second quarter led by the strong recovery in demand in India

(up 225%) and North Africa (up 87%). Replacement demand,

however, remained significantly below 2019 levels.

- Truck tire markets (radial and

bias)

|

First-half2021/2020(in number of

tires) |

Western&CentralEurope* |

CIS |

North&

CentralAmerica |

South America |

China |

Asia(excluding

India & China) |

Africa/

India/ Middle East |

Total |

|

Original Equipment Replacement |

+50% +27% |

+16% -5% |

+46% +35% |

+55% +29% |

+23% +28% |

+15% +9% |

+44% +16% |

+29% +22% |

|

Second-quarter2021/2020(in

number of tires) |

Western&CentralEurope* |

CIS |

North&

CentralAmerica |

South America |

China |

Asia(excluding

India & China) |

Africa/

India/ Middle East |

Total |

|

Original Equipment Replacement |

+98% +38% |

+19% +2% |

+119% +56% |

+117% +47% |

-11% +4% |

+45% +19% |

+127% +34% |

+12% +26% |

* Including Turkey

The number of new Truck tires

sold worldwide climbed a sharp 24% in the first half of 2021,

lifted by the global economic recovery and the resulting upturn in

freight demand.

The global Original Equipment Truck tire market,

as measured by the number of new tires sold, grew by 29% in the

first half of 2021.The first quarter delivered growth of 50%,

impelled by the 88% increase in Chinese demand ahead of

implementation of the China 6 emission standards.Growth slowed to

12% in the second three months, reflecting: - an 11% decline in

China, as trucking companies completed their fleet upgrades;-

strong growth in the other regions, off of very favorable

comparatives and in sharply rebounding economies. Global OE demand

rose significantly above first-half 2019 levels in first-half 2021,

led by the brisk growth in China, but remained below them in the

European and US markets.

Demand for Replacement Truck tires rose by 22%

over the first half, with a faster 26% gain in the second

quarter.In Western and Central

Europe, in an environment shaped by very favorable

economic conditions but also impacted by inventory rebuilding, the

Replacement market expanded by 27%, led by very high demand in the

Southern countries (up 48% in the Iberian Peninsula, 49% in Italy

and 31% in France). As a result, the market ended the period above

its 2019 levels. In North and Central America, the

Replacement market climbed 35% over the first six months, with a

faster 56% increase in the second quarter. Impelled by the economic

upturn in the region, this surge in growth lifted the market well

above its pre-crisis levels by the end of June.In South

America, the Replacement market ended the period up 29%,

as the 38% economic recovery-led gain in Brazil more than offset

the 11% decline in Argentina. Demand now exceeds 2019 levels.Demand

in Southeast Asia increased by 9% in the first

half, with a sharp acceleration to 19% in the second quarter.

Growth varied widely by country, from 18% in Thailand and 12% in

Indonesia to 7% in Japan and South Korea, and 3% in Australia. The

market remains significantly below its pre-crisis

levels.Replacement demand in the Africa/India/Middle East

region rose by 16%, led by a 27% increase in India, but

remained lower than in 2019.

- Specialty business markets

- Mining

tires: After getting off to a slow start in the first

quarter, the surface mining tire market is showing signs of fresh

momentum pointing to sustained demand in the second half.

-

Agricultural and Construction tires: The cyclical

rebound is continuing apace, particularly in Original Equipment

Agricultural, Construction and Materials Handling tires.

-

Two-wheel tires: Demand remains high in every

segment. These personal means of transportation, which still offer

a more sanitary alternative to public transport, are structurally

well suited to city travel, with demand being driven both by the

sustainable image of bicycles and the surging popularity of

recreational activities.

-

Aircraft tires: Demand for commercial aircraft

tires is flat in Europe, but has recovered in the Americas and

China, particularly from low-cost airlines.

-

Conveyor belts: The mining conveyor belt market

turned in a mixed performance, with demand stabilizing in Australia

due to sustained Chinese restrictions on Australian ore imports

while demand continued to expand in the services and engineering

segments. In North America, order intake was pretty low compared to

the recovery in the coal market and improving conditions in the

manufacturing industry.

-

Specialty polymers: Markets as a whole are

experiencing strong growth in demand, especially for precision

polymers, hydraulic seals and energy seals.

First-Half

2021 Net Sales and Earnings

Sales for the first six months of 2021 totaled

€11,192 million, an increase of 19.6% from the year-earlier period

that was attributable to the net impact of the following

factors:

- a robust 22.8%

upturn in tire volumes from favorable prior-year comparatives, as

higher demand lifted by the global economic recovery and dealer

inventory rebuilding overcame serious disruptions in the supply

chain;

- the 4.6% growth

in non-tire sales, as the recovery in Fenner’s operations and the

gains in fleet management services were dampened by the extremely

weak sales in the fine dining and travel segments due to the health

crisis;

- the positive

2.4% price-mix effect (0.9% in the first quarter and 4.5% in the

second). The €133 million positive price effect resulted from the

Group’s firm pricing discipline, with the rapid rollout of price

increases to offset rising raw materials and logistics costs. The

€96 million positive mix effect reflected (i) the sustained success

of the MICHELIN brand’s premium strategy, notably in the 18-inch

and larger segment; and (ii) the favorable impact of the relative

performances of (a) Replacement Passenger car and Light Truck tire

sales and (b) Original Equipment sales, which were impacted by the

semiconductor shortage. On the other hand, the mix effect was

attenuated by the relative performance of the various Specialty

segments, with in particular faster growth in Agricultural and

Construction tires than in Mining and Aircraft tires;

- the deeply

negative 5.9% currency effect, stemming from relative weakness of

the US dollar and the decline in the Turkish lira and the Argentine

peso against the euro;

- the lack of any

impact from changes in the scope of consolidation, after the

removal of the French Maps & Guides printing, publishing and

marketing assets, as of February 1, and of Solesis, in June, offset

the first-time consolidation of three recent acquisitions,

ConVeyBelt and Technobalt in the conveyor belt business and MAV

S.p.a in the precision polymer segment.

Segment operating income amounted to €1,421

million or 12.7% of sales, versus €310 million and 3.3% in

first-half 2020.

The change in segment operating income primarily

reflected:- a €1,195 million increase from the strong growth

in tire volumes sold and improved fixed cost absorption;- a robust

€229 million increase from the tire price-mix effect, led by

disciplined, responsive pricing management, sustained enhancement

of the product mix and a favorable business mix;- a €103 million

decrease from higher raw material prices and related transportation

costs;- a €103 million decrease from the increase in tire SG&A

expenses, which were exceptionally low in first-half 2020, but

which remain far lower than in first-half 2019;- a €24 million

decrease from the Group’s manufacturing and logistics performance,

as manufacturing performance gains were seriously impacted by the

sharp €45 million increase in logistics costs;- a €9 million

improvement in segment operating income from the non-tire

businesses;- a €56 million gain stemming primarily from the

year-on-year decline in Covid-19-related expenditure, including the

cost of purchasing and producing masks and hand sanitizer;- a €150

million decrease from the unfavorable currency effect.

Other operating income and

expenses amounted to a net income of €16 million,

corresponding to the €41 million amortization of intangible assets

acquired in business combinations, the €113 million disposal gain

on the Group’s investment in Solesis following the sale of a stake

to the Altaris fund, and restructuring costs.

In all, net income for the first half

came to €1,032 million.

Free cash flow ended the first half at €346

million, a €697 million improvement on the year-earlier period. The

increase was mainly attributable to the strong upturn in EBITDA

driven by the growth in volumes, less the outlays to partially

rebuild working capital. Gearing stood at 26.7% at June 30, 2021,

corresponding to net debt of €3,679 million, up €148 million

from December 31, 2020.

|

In € millions |

Sales |

Segment operatingincome |

Segment operatingmargin |

|

|

H1 2021 |

H1 2020 |

H1 2021 |

H1 2020 |

H1 2021 |

H1 2020 |

|

Automotive andrelated distribution |

5,562 |

4,394 |

730 |

(35) |

13.1% |

-0.8% |

|

Road transportation and related distribution |

2,897 |

2,411 |

286 |

(30) |

9.9% |

-1.3% |

|

Specialty businesses andrelated distribution |

2,733 |

2,552 |

405 |

375 |

14.8% |

14.7% |

|

Group |

11,192 |

9,357 |

1,421 |

310 |

12.7% |

3.3% |

-

Automotive and related

distribution

Sales in the Automotive and related distribution

segment rose by 26.6% to €5,562 million, from

€4,394 million in the first six months of 2020.

Segment operating income amounted to €730

million or 13.1% of sales, versus a loss of €35 million and

-0.8% in first-half 2020.

The year-on-year improvement was primarily led

by (i) the solid 28% increase in volumes, which drove market share

gains, particularly in the MICHELIN-branded 18-inch and larger

segment; and (ii) the favorable impact of the relative performances

of Replacement and OE tire sales, with the latter hit by the

shortage of auto semiconductors. Responsive pricing management

helped to offset the increase in raw material prices and related

transportation costs. Exchange rate movements had a negative impact

on the segment’s operating income.

- Road

transportation and related

distribution

Sales in the Road transportation and related

distribution segment amounted to €2,897 million in the first

half of 2021, a 20% increase from the €2,411 million reported for

the same period in 2020.

Segment operating income totaled €286 million or

9.9% of sales, versus a loss of €30 million and -1.3% in

first-half 2020.

With the upturn in global demand and a favorable

geographic mix, the segment enjoyed a 24% increase in tire volumes

sold over the period. The segment’s selective marketing strategy

and responsive pricing management helped to offset higher raw

material and related transportation costs. The Services &

Solutions business is stepping up the pace of growth, led by fleet

management solutions. Exchange rate movements had a negative impact

on the segment’s operating income.

-

Specialty businesses and related

distribution

Sales in the Specialty businesses and related

distribution segment rose by 7.1% over the period, to €2,733

million from €2,552 million in first-half 2020.

Segment operating income stood at €405 million

or 14.8% of sales, versus €375 million and 14.7% in first-half

2020.

From a less favorable base than the other two

segments, the Specialty businesses reported a 12% increase in tire

volumes, led by sales of Construction and Agricultural tires, which

resulted in a negative business mix. Rigorous price management on

non-indexed activities partially offset negative impact of raw

material clauses in first-half; from the second half of the year,

these clauses will turn favorable. The conveyor belt and high-tech

materials businesses continued to expand over the period. Exchange

rate movements had a negative impact on the segment’s operating

income.

“All

Sustainable” Michelin – First-Half 2021

Diversity and inclusion: One of

the ambitious objectives in the Group’s “All Sustainable” strategy

is to set the standard in diversity and inclusion. To track its

engagement in this area, Michelin has introduced a Diversities

& Inclusion Management Index (IMDI), with the goal of reaching

80/100 by 2030, compared with a base of 50/100 in 2019 and a score

of 62/100 at year-end 2020.The index will measure the Group’s

performance in embracing diversity and inclusion with

12 quantitative and qualitative indicators, organized into 5

categories: Gender balance, Identity, Multi-national management,

Disability, and Equal opportunity.

The Michelin Global Works

Council: Designed to foster open, constructive and

socially responsible dialogue at the international level, the

Michelin Global Works Council was set up by Michelin in 2020 with

the IndustriALL Global Union. It expresses the Group’s commitment

to creating a new forum for discussions with employee

representatives from most of its host countries, so as to

facilitate greater understanding of Michelin’s economic, social and

environmental challenges around the world and to improve, in every

host country, employee support during periods of business

transformation.

The Council’s first meeting, held on June 28 and

29, 2021, provided an opportunity to discuss the Group’s

sustainable growth vision, based on the right balance between

people, profit and planet.

Vigeo Eiris

non-financial rating: In 2021, MICHELIN was once

again awarded the highest A1+ ESG Rating by Vigeo Eiris (Moody’s),

with a five-point improvement in its overall score, to 73/100. This

ranked the Group at the top of the 39 companies rated in the

Automobile sector. According to Vigeo Eiris, Michelin “demonstrates

an advanced commitment and ability to integrate ESG factors into

its strategy, operations and risk management.” The Group also

earned a score of 100/100 for the rating’s “Environmental strategy”

aspects.

Value Balancing Alliance: In

late March, Michelin joined the Value Balancing Alliance (VBA), an

organization of multinational companies from a variety of

industries that is developing and testing a methodology capable of

translating environmental and social impacts into comparable

financial data.VBA is seeking to transform the way that companies

measure, assess and disclose information about the environmental,

human, social and financial value that they create for society. Its

goal is to provide every stakeholder with comprehensive, reliable

data to improve decision-making, business management and

performance assessment.

By participating in the alliance, Michelin can

work with companies from a variety of industries to lay the

groundwork for widespread implementation. The approach is fully in

line with the Group’s All Sustainable vision, based on the right

balance between personal fulfillment, business and financial

performance and safeguarding the planet. It will facilitate the

program underway since 2020 to assess the monetary value of the

economic, environmental and social impact of the Group’s operations

across the value chain.

Sustainable materials rate in

tires: In June, Michelin offered a further illustration of

its “All Sustainable” vision by unveiling a track tire with 46%

sustainable materials content. This very high percentage was

achieved by increasing the tire’s natural rubber content and using

recycled carbon black recovered from end-of-life tires. In this

way, Michelin is showcasing its ability to incorporate an

ever-higher proportion of sustainable materials into its products

without compromising on their performance. This latest milestone is

fully aligned with the Group’s commitment to using 100% sustainable

materials in all its tires by 2050.

First-Half

2021 Highlights

- January 6, 2021

- Michelin launches a simplification and competitiveness project to

support developments in its operations in France.

- January 18,

2021 - Michelin unveils the 2021 MICHELIN Guide France and its

Green Stars.

- February 8,

2021 - MICHELIN X® Multi™ Energy™ family of regional truck tires is

enhanced with two new fitments.

- February 9,

2021 - Thanks to its CAMSO TLH 732+ tire, CAMSO is optimizing

productivity for its construction industry customers.

- February 11,

2021 - Michelin signs a letter of commitment for maritime transport

with Neoline, a French shipowner relying mainly on sail propulsion.

The partnership is aligned with the Group’s commitment to reducing

the carbon footprint of its logistics operations by 15% in absolute

terms between 2018 and 2030.

- February 23,

2021 - In 2050, MICHELIN tires will be 100% sustainable. MICHELIN

is ambitiously committed to making its tires entirely from

renewable, recycled, biosourced or otherwise sustainable materials

by 2050, thanks to its powerful research & development

capabilities, materials technology expertise and open-innovation

strategy.

- February 24,

2021 - The Coalition for the Energy of the Future, of which

Michelin is a member, has announced seven projects to accelerate

the energy transition in transportation and across the entire

supply chain, with major milestones set to be reached in 2021.

- February 25,

2021 - Michelin launches the MICHELIN Pilot Sport EV, the first

tire in the Pilot Sport family purpose-engineered for electric

sports cars.

- March 10, 2021

- Michelin launches the new MICHELIN Wild Enduro Racing Line

mountain bike tire, which has already demonstrated its capabilities

with championship wins in some of the world’s most challenging

races.

- March 19, 2021

- Michelin partners with sennder, Europe’s leading digital freight

forwarder, to broaden its portfolio of fleet services that make

road freight more cost-effective and less carbon intensive.

- April 2021 -

With its two development projects underway with Safra and

Stellantis, and the construction of Europe’s largest hydrogen fuel

cell plant in Saint-Fons, France, Symbio (a Faurecia Michelin

Hydrogen Company) is helping to accelerate the transition to

hydrogen mobility.

- April 2, 2021 - BMW Group reaffirms

its trust in the Michelin Group with the development of two tires

specifically for the BMW M3 and M4: the MICHELIN Pilot Sport 4S and

the MICHELIN Pilot Sport Cup2 Connect.

- April 8, 2021 -

At the Group’s Capital Markets Day, Florent Menegaux presents

Michelin in Motion, the Group’s “All Sustainable” strategy for

2030, which is based on constantly seeking the right balance

between People, Profit and Planet.

- April 15, 2021

- Michelin and Altaris announce their intention to join forces to

speed the growth of Solesis, a Michelin subsidiary specializing in

biomaterials for the healthcare industry.

- April 15, 2021

- ProovStation, the European leader in automated inspection,

partners with Michelin to reduce the time and costs of tire

inspection, thanks to MICHELIN QuickScan technology.

- April 23, 2021

- By validating the use of Carbios’ enzymatic recycling technology

for PET4 plastic waste in Michelin tires, Michelin take a major

step towards developing 100% sustainable tires, one of Michelin’s

major goals for 2050.

- April 23, 2021

- Harley-Davidson and Michelin pursue their long-standing

collaboration with the MICHELIN Scorcher Adventure tire,

custom-designed for the Harley-Davidson Pan America™ 1250

motorcycle.

- April 29, 2021

- For the 2021 FIA World Endurance Championship campaign, Michelin

launches new tire lines developed entirely virtually for the

headlining Le Mans Hypercar class.

- April 30, 2021

- Michelin designs the MICHELIN X Incity EV Z tire, the first

MICHELIN range specifically engineered for electric buses.

- May 11, 2021 -

At the Blue Ocean Awards ceremony, Michelin presents its

International Mobility Award to Tarmac Technologies and SUN

Mobility, two startups that are contributing to the development of

mobility. The Award demonstrates the Group’s commitment to

leveraging open innovation to become a major player in connected

mobility.

- May 21, 2021 -

The Annual Meeting of Michelin shareholders is held behind closed

doors in compliance with French health rules. The event was an

opportunity for a number of people to pay tribute to Michel

Rollier, who stepped down as Chairman of the Supervisory Board. His

successor, Barbara Dalibard, was elected at the same-day meeting of

the Board.

- May 17, 2021 -

Camso earns recognition as a “Partner level supplier for 2020” in

the John Deere Achieving Excellence Program, in honor of its

dedication to providing products and services of outstanding

quality as well as its commitment to continuous improvement.

- May 19, 2021 -

The new MICHELIN Guide–Tablet Hotels app wins its first award, as

“Webby Honoree” in the “Apps and Software” category. The

distinction was presented at the Webby Awards, which honor

excellence on the Internet.

-

May 27, 2021 - The new MICHELIN TRAILXBIB tire, designed in

association with farmers in a number of countries, increases farm

yields thanks to the innovative MICHELIN Ultraflex technology.

- May 28, 2021 - AddUp, the joint

venture created by Michelin and Fives in 2016, takes metal 3D

printing to the next level with the development of a new generation

of machines with promising features for industry.

- June 1, 2021 - Movin’On’s

governance body now comprises 10 CEOs. Nine other chief

executives of leading global corporations have joined with Florent

Menegaux, President of Movin’On and Managing Chairman of the

Michelin Group, to set Movin’On’s strategic direction and deliver

actionable solutions to speed the transition to sustainable

mobility.

- June 1, 2021 - At the 2021 Movin’On

Summit, Michelin presents two innovations to accelerate the

development of sustainable mobility: the WISAMO project, an

automated, telescopic, inflatable wing sail system that will help

to decarbonize maritime shipping, and a high-performance racing

tire containing 46% sustainable materials. Both offer further

tangible, real-world proof of the Group’s determination to make

mobility increasingly sustainable.

- June 11, 2021 - Maude Portigliatti,

currently Senior Vice President, Advanced Research, is appointed

Executive Vice President, High Tech Materials.

- June 17, 2021 - KRISTAL.aero and

Michelin launch KRISTAL.air, a mobile app for everyone who flies

light aircraft. It not only expresses Michelin Aviation’s

commitment to fostering connected mobility, safe flying and closer

customer relationships, it is also compatible with the Group's “All

Sustainable” vision.

- June 23, 2021 - Michelin designs

the new MICHELIN X AGVEV, the first tire specifically engineered

for automatic guided vehicles (AGVs) operating in port facilities.

The MICHELIN X AGVEV is the first port tire that helps to cut

CO2 emissions and increase an electric vehicle’s battery life,

thanks to its very low rolling resistance.

- June 30, 2021 - Michelin launches

the new MICHELIN X® MULTI GRIP™ truck tire designed for

extreme winter conditions and wet roads. It also helps to make

overland shipping more sustainable, in particular by reducing CO2

emissions per kilometer driven.

- June 30, 2021 - Michelin launches

“WATEA by Michelin” to support its corporate customers in

transitioning to zero-emission mobility, based on an all-inclusive

monthly subscription and a palette of more than 80 services.

A full description of

first-half 2021 highlights may be found on the Michelin website:

http://www.michelin.com/en

Presentation and Conference

CallFirst-half 2021 results will be reviewed with analysts

and investors during a presentation today, Monday, July 26, 2021 at

6:30 p.m. CEST. The event will be in English, with simultaneous

interpreting in French.

WEBCASTThe

presentation will be webcast live on:

www.michelin.com/en/finance

CONFERENCE CALL Please

dial-in on one of the following numbers from 6:20 pm CEST:

|

In France (French) |

+33 (0)1 70 71 01 59 |

PIN code: 38844528# |

|

In France (English) |

+33 (0) 1 72 72 74 03 |

PIN code: 83809618# |

|

In the United Kingdom |

+44 (0) 207 194 3759 |

PIN code: 83809618# |

|

In North America |

(+1) (646) 722 4916 |

PIN code: 83809618# |

|

From anywhere else |

+44 (0) 207 194 3759 |

PIN code: 83809618# |

The presentation of financial information for

the six months ended June 30, 2021 (press release, presentation,

financial report) may also be viewed at http://www.michelin.com/en,

along with practical information concerning the conference

call.

Investor

calendar

- Financial information for

the nine months ended September 30, 2021: Monday,

October 25, 2021 after close of trading.

|

Investor RelationsÉdouard de

Peufeilhoux+33 (0) 6 89 71 93 73

edouard.de-peufeilhoux@michelin.comPierre Hassaïri+33 (0) 6 84 32

90 81pierre.hassairi@michelin.comFlavien Huet+33 (0) 7 77 85 04

82flavien.huet@michelin.com |

Media Relations +33 (0) 1 45 66 22

22groupe-michelin.service-de-presse@michelin.comIndividual

ShareholdersIsabelle Maizaud-Aucouturier+33 (0) 4 73 32 23

05isabelle.maizaud-aucouturier@michelin.comClémence Rodriguez+33

(0) 4 73 32 15 11clemence.daturi-rodriguez@michelin.com |

DISCLAIMERThis press

release is not an offer to purchase or a solicitation to recommend

the purchase of Michelin shares. To obtain more detailed

information on Michelin, please consult the documents filed in

France with Autorité des

Marchés Financiers, which are also

available from the www.michelin.com/eng

website.This press release may

contain a number of

forward-looking statements. Although the Company believes

that these statements are based on reasonable assumptions at the

time of publishing this document, they are by nature subject to

risks and contingencies liable to translate into a difference

between actual data and the forecasts made or inferred by these

statements. In accordance with EU

regulation no. 596/2014, we hereby inform you that this press

release may contain inside

information.

1SOI: Segment Operating Income2 Deeper supply chain disruptions

or tighter restrictions on freedom of movement that would result in

a significant drop in the tire markets.

3 Structural free cash flow corresponds to free

cash flow before acquisitions, adjusted for the impact of changes

in raw material prices on trade payables, trade receivables and

inventories.

4 Polyethylene terephthalate (PET) is a plastic

that is currently oil based, with its two monomers, ethylene glycol

and terephthalic acid, being derived from petroleum. It is the raw

material for one of the main polyester fibers used in tire

reinforcements.

- 20210726_Michelin_PR_2021 Half Year Results

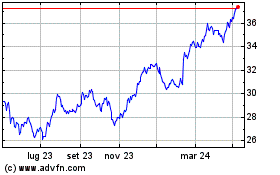

Grafico Azioni Michelin (EU:ML)

Storico

Da Mar 2024 a Apr 2024

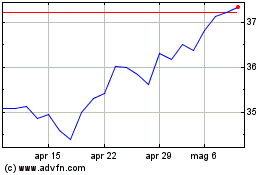

Grafico Azioni Michelin (EU:ML)

Storico

Da Apr 2023 a Apr 2024