Microsoft Earnings Jump on Pandemic-Driven Cloud, Videogaming Demand

26 Gennaio 2021 - 10:50PM

Dow Jones News

By Aaron Tilley

Microsoft Corp. posted record quarterly sales underpinned by

pandemic-fueled demand for videogaming and accelerated adoption of

its cloud-computing services.

The software giant Tuesday said fiscal second-quarter net income

rose more than 30% to $15.5 billion. Sales advanced 17% to $43.1

billion. Wall Street expected sales of $40.2 billion and net income

of $12.6 billion, according to FactSet.

The remote work era has been a boon for Microsoft. In addition

to its videogaming and cloud-computing products, the company has

seen strong sales for its Surface laptops as people bought devices

to work remotely and enable distance learning. And use of

Microsoft's Teams workplace collaboration software that includes

text chat and videoconferencing, and has been a priority for Chief

Executive Satya Nadella, has jumped during the pandemic. Microsoft

shares have risen more than 37% over the past year.

"What we have witnessed over the past year is the dawn of a

second wave of digital transformation sweeping every company and

every industry," Mr. Nadella said.

Microsoft shares rose more than 5% in after-hours trading.

Mr. Nadella's bet on cloud computing has been pivotal to

Microsoft's multiyear run of year-over-year sales increases. Sales

for the company's Azure cloud-services have expanded rapidly;

however, before the pandemic hit the pace of growth was slowing as

the business gained scale. The remote work era arrested that

decline. Azure sales increased 50% in the most recent quarter, up

from 48% expansion in the prior three-month period.

Azure became a bigger source of revenue for Microsoft than its

Windows operating system licenses in the September quarter, said

Brent Bracelin, an analyst at Piper Sandler. Microsoft doesn't

break out Azure revenue, but the company is the world's

second-largest cloud-computing vendor after Amazon.com Inc.

The role of videogaming in Microsoft's fortunes also has

increased under Mr. Nadella, in part fueled by acquisitions. The

company last year bought ZeniMax Media Inc., the parent company of

the popular Doom videogame franchise, for $7.5 billion. Xbox

content and services revenue increased 40% in the latest quarter,

aided by the November release of two new gaming consoles, Xbox

Series X and S, to battle Sony Corp.'s PlayStation 5.

For Microsoft, the consoles, a relatively low margin business,

are less important to its bottom line than hooking gamers on

subscription services for its games. But the company last week

misstepped when it tried to push through a price hike for some of

those services. Customers revolted, and the software giant reversed

course hours later.

The business software market, core to Microsoft, also is

becoming more heated. Business software vendor Salesforce.com Inc.

last month said it would spend around $27.7 billion to buy Slack

Technologies Inc., maker of a popular chat-based workplace

collaboration platform. With Slack, Salesforce is looking to more

aggressively go after a core business of Microsoft. The deal is

expected to close in the coming months.

-- For more WSJ Technology analysis, reviews, advice and

headlines, sign up for our weekly newsletter.

Write to Aaron Tilley at aaron.tilley@wsj.com

(END) Dow Jones Newswires

January 26, 2021 16:35 ET (21:35 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

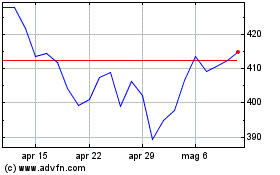

Grafico Azioni Microsoft (NASDAQ:MSFT)

Storico

Da Mar 2024 a Apr 2024

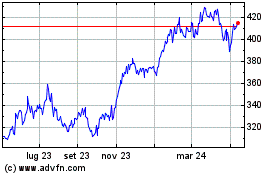

Grafico Azioni Microsoft (NASDAQ:MSFT)

Storico

Da Apr 2023 a Apr 2024